Prospectus - SBM Offshore

Prospectus - SBM Offshore

Prospectus - SBM Offshore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

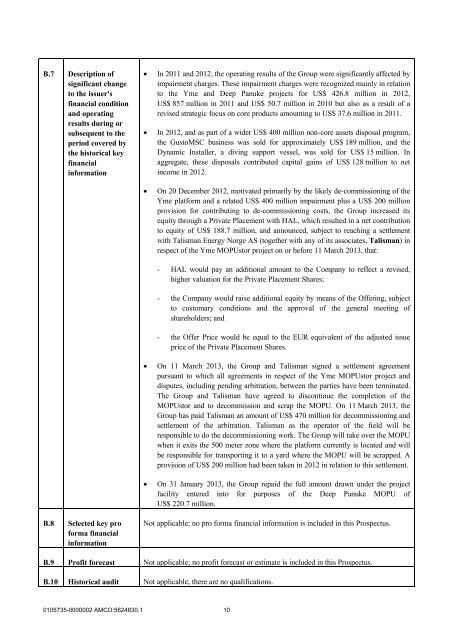

B.7 Description of<br />

significant change<br />

to the issuer's<br />

financial condition<br />

and operating<br />

results during or<br />

subsequent to the<br />

period covered by<br />

the historical key<br />

financial<br />

information<br />

B.8 Selected key pro<br />

forma financial<br />

information<br />

0105735-0000002 AMCO:5624830.1 10<br />

· In 2011 and 2012, the operating results of the Group were significantly affected by<br />

impairment charges. These impairment charges were recognized mainly in relation<br />

to the Yme and Deep Panuke projects for US$ 426.8 million in 2012,<br />

US$ 857 million in 2011 and US$ 50.7 million in 2010 but also as a result of a<br />

revised strategic focus on core products amounting to US$ 37.6 million in 2011.<br />

· In 2012, and as part of a wider US$ 400 million non-core assets disposal program,<br />

the GustoMSC business was sold for approximately US$ 189 million, and the<br />

Dynamic Installer, a diving support vessel, was sold for US$ 15 million. In<br />

aggregate, these disposals contributed capital gains of US$ 128 million to net<br />

income in 2012.<br />

· On 20 December 2012, motivated primarily by the likely de-commissioning of the<br />

Yme platform and a related US$ 400 million impairment plus a US$ 200 million<br />

provision for contributing to de-commissioning costs, the Group increased its<br />

equity through a Private Placement with HAL, which resulted in a net contribution<br />

to equity of US$ 188.7 million, and announced, subject to reaching a settlement<br />

with Talisman Energy Norge AS (together with any of its associates, Talisman) in<br />

respect of the Yme MOPUstor project on or before 11 March 2013, that:<br />

- HAL would pay an additional amount to the Company to reflect a revised,<br />

higher valuation for the Private Placement Shares;<br />

- the Company would raise additional equity by means of the Offering, subject<br />

to customary conditions and the approval of the general meeting of<br />

shareholders; and<br />

- the Offer Price would be equal to the EUR equivalent of the adjusted issue<br />

price of the Private Placement Shares.<br />

· On 11 March 2013, the Group and Talisman signed a settlement agreement<br />

pursuant to which all agreements in respect of the Yme MOPUstor project and<br />

disputes, including pending arbitration, between the parties have been terminated.<br />

The Group and Talisman have agreed to discontinue the completion of the<br />

MOPUstor and to decommission and scrap the MOPU. On 11 March 2013, the<br />

Group has paid Talisman an amount of US$ 470 million for decommissioning and<br />

settlement of the arbitration. Talisman as the operator of the field will be<br />

responsible to do the decommissioning work. The Group will take over the MOPU<br />

when it exits the 500 meter zone where the platform currently is located and will<br />

be responsible for transporting it to a yard where the MOPU will be scrapped. A<br />

provision of US$ 200 million had been taken in 2012 in relation to this settlement.<br />

· On 31 January 2013, the Group repaid the full amount drawn under the project<br />

facility entered into for purposes of the Deep Panuke MOPU of<br />

US$ 220.7 million.<br />

Not applicable; no pro forma financial information is included in this <strong>Prospectus</strong>.<br />

B.9 Profit forecast Not applicable; no profit forecast or estimate is included in this <strong>Prospectus</strong>.<br />

B.10 Historical audit Not applicable, there are no qualifications.