Corporate Governance further improved. Management structure ...

Corporate Governance further improved. Management structure ...

Corporate Governance further improved. Management structure ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

56<br />

www.six-swiss-exchange.com/shares/<br />

companies/major_share holders_en.html<br />

S+Bi Holding AG and GeBUKA AG are parties to a shareholder agreement, under which the voting<br />

rights of the shares subject to the agreement are exercised uniformly. In addition to mutual purchasing and preemption rights,<br />

this shareholder agreement also governs representation on the Board of Directors of the Company, under the terms of which<br />

S+Bi Holding AG and GeBUKA AG may nominate an agreed number of members of the Board of<br />

Directors for the Company, with GeBUKA AG entitled to at least one seat and S+Bi Holding AG<br />

entitled to nominate the Chairman.<br />

During the business year, there were changes in the significant shareholders, which were notified to the Company as well as<br />

to the Disclosure office of SIX Swiss exchange AG. these can be inspected on the Internet.<br />

1.3 Cross-holdings<br />

the Company has no crossholdings with significant shareholders or other related companies.<br />

2 Capital <strong>structure</strong><br />

2.1 Capital<br />

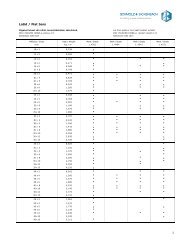

Share capital<br />

As at 31 December 2011, the ordinary share capital of S+Bi AG amounted to CHF 413 437 500,<br />

divided into 118 125 000 registered shares with a nominal value of CHF 3.50 per share. All registered shares are fully paid<br />

up and there are no additional depositary obligations on the part of shareholders.<br />

Under the terms of the Articles of Incorporation, the General Meeting may at any time convert existing registered shares<br />

into bearer shares.<br />

2.2 authorised and conditional capital in particular<br />

the Company has authorised share capital of CHF 87 500 000, corresponding to 21.16% of the current share capital.<br />

In accordance with Art. 3b of the Articles of Incorporation, the Board of Directors is authorised to increase the share capital<br />

up to a maximum of CHF 87 500 000 at any time up to 15 April 2013, by issuing up to 25 000 000 bearer or registered<br />

shares to be fully paid up with a par value of CHF 3.50 per share. Capital increases by means of a firm underwriting, or<br />

increases in instalments, are permitted. the amount to be issued, the date of dividend entitlement, and the type of deposits<br />

are determined by the Board of Directors. the Board of Directors is authorised to exclude shareholders from subscription<br />

rights related to the acquisition of companies, business units or holdings and to assign such rights to third parties.<br />

newly acquired registered shares are subject to the restrictions on transfer in accordance with Art. 4 of the Articles of<br />

Incorporation.<br />

the Company has no conditional capital.<br />

2.3 Changes in capital<br />

there were no changes in the share capital in 2008 or 2009. As decided on 28 october 2010, in 2010 the share capital was<br />

reduced and simultaneously increased. the nominal value of the former 30 000 000 shares was first reduced from CHF 10<br />

to CHF 3.50 per share. the amount of the reduction was transferred to reserves. the share capital was simultaneously increased<br />

by more than the amount of the reduction by the issue of 75 000 000 shares with a nominal value of CHF 3.50 per<br />

share. As a result, as at 31 December 2010 the share capital of the Company comprised 105 000 000 registered shares<br />

with a nominal value of CHF 3.50 per share.