Corporate Governance further improved. Management structure ...

Corporate Governance further improved. Management structure ...

Corporate Governance further improved. Management structure ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

S+Bi Annual Report 2011 CoRpoRAte GoveRnAnCe<br />

Group <strong>structure</strong> and shareholders | Capital <strong>structure</strong><br />

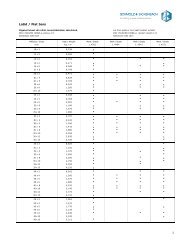

As decided on 15 April 2011, in 2011 a <strong>further</strong> capital increase of CHF 45 937 500 took place by the issue of 13 125 000<br />

registered shares with a nominal value of CHF 3.50 per share. In the transaction, 4 231 044 shares were paid for in cash<br />

and 8 893 956 shares were offset against part of the hybrid capital that was outstanding on 31 December 2010. the<br />

remainder of the hybrid capital was repaid with part of the cash proceeds from the capital increase.<br />

2.4 Shares and participation certificates<br />

As at 31 December 2011, the share capital consisted of 118 125 000 registered shares with a par value of CHF 3.50 per<br />

share. the Company held no treasury shares at yearend or during the course of the year. each share entitles the holder to<br />

one vote. voting rights may only be exercised if the shareholder is registered in the Company‘s share register by the correct<br />

time as a shareholder with the right to vote. Registered shares are not securitised and are held in collective custody by SIX<br />

SAG AG. Shareholders are not entitled to request a printed copy of share certificates. every shareholder can, however, at<br />

any time request to receive from the Company certification of the shares in their ownership.<br />

S+Bi AG has not issued any participation certificates.<br />

2.5 Dividend rights certificates<br />

S+Bi AG has not issued any dividend right certificates.<br />

2.6 restrictions on transferability and nominee registration<br />

Certificated shares can be physically deposited with a depositary; paperless shares can be entered in the principal register<br />

of a depositary and credited to a securities account (creation of intermediated securities). Intermediated securities can only<br />

be disposed of, or given as security, according to the Swiss Federal Law on Intermediated Securities. paperless securities<br />

that do not qualify as intermediated securities can only be transferred by cession. For such cession to be valid, it must be<br />

notified to the company.<br />

In accordance with the Articles of Incorporation, persons acquiring registered shares may upon request be entered without<br />

restriction in the share register as a shareholder with voting rights if they expressly declare that they acquired the registered<br />

shares in their own name and on their own account. If no such declaration is made, nominees are registered with voting<br />

rights up to a maximum of 2% of the share capital. Beyond this limit, nominees with registered shares are registered with<br />

voting rights only if they provide a written declaration that they are prepared to disclose the addresses and shareholdings<br />

of persons on whose account they hold 0.5% or more of the outstanding share capital.<br />

except for the nominee clause there are no restrictions on transfer, nor are there any statutory privileges, so no derogations<br />

had to be granted in 2011. Revocation or amendment of these stipulations requires the agreement of at least two thirds of<br />

the represented votes and the absolute majority of the represented nominal share values.<br />

2.7 Convertible bonds and options<br />

As at 31 December 2011, the Company had no convertible bonds or options outstanding.<br />

SUCCeSSfUL<br />

CapitaL inCreaSe<br />

57