Rules, Regulations and Transaction Costs in Transition Bulgaria

Rules, Regulations and Transaction Costs in Transition Bulgaria

Rules, Regulations and Transaction Costs in Transition Bulgaria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

For the same reasons, only 34.2% of the entrepreneurs <strong>in</strong>terviewed have used loans <strong>in</strong> carry<strong>in</strong>g on their bus<strong>in</strong>ess.<br />

The actual percentage is highest <strong>in</strong> the production sector - 50%, followed by trade - 30%, <strong>and</strong> services - 22.2%.<br />

Small enterprises resort to loans twice more often than micro-firms.<br />

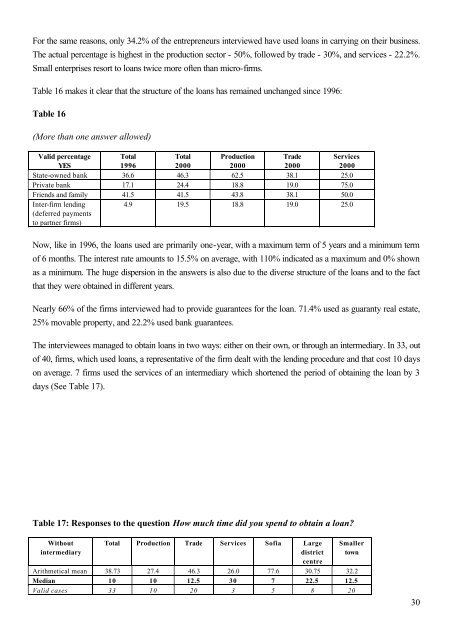

Table 16 makes it clear that the structure of the loans has rema<strong>in</strong>ed unchanged s<strong>in</strong>ce 1996:<br />

Table 16<br />

(More than one answer allowed)<br />

Valid percentage Total<br />

Total Production Trade Services<br />

YES<br />

1996<br />

2000<br />

2000<br />

2000<br />

2000<br />

State-owned bank 36.6 46.3 62.5 38.1 25.0<br />

Private bank 17.1 24.4 18.8 19.0 75.0<br />

Friends <strong>and</strong> family 41.5 41.5 43.8 38.1 50.0<br />

Inter-firm lend<strong>in</strong>g<br />

(deferred payments<br />

to partner firms)<br />

4.9 19.5 18.8 19.0 25.0<br />

Now, like <strong>in</strong> 1996, the loans used are primarily one-year, with a maximum term of 5 years <strong>and</strong> a m<strong>in</strong>imum term<br />

of 6 months. The <strong>in</strong>terest rate amounts to 15.5% on average, with 110% <strong>in</strong>dicated as a maximum <strong>and</strong> 0% shown<br />

as a m<strong>in</strong>imum. The huge dispersion <strong>in</strong> the answers is also due to the diverse structure of the loans <strong>and</strong> to the fact<br />

that they were obta<strong>in</strong>ed <strong>in</strong> different years.<br />

Nearly 66% of the firms <strong>in</strong>terviewed had to provide guarantees for the loan. 71.4% used as guaranty real estate,<br />

25% movable property, <strong>and</strong> 22.2% used bank guarantees.<br />

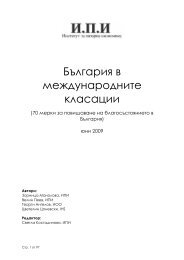

The <strong>in</strong>terviewees managed to obta<strong>in</strong> loans <strong>in</strong> two ways: either on their own, or through an <strong>in</strong>termediary. In 33, out<br />

of 40, firms, which used loans, a representative of the firm dealt with the lend<strong>in</strong>g procedure <strong>and</strong> that cost 10 days<br />

on average. 7 firms used the services of an <strong>in</strong>termediary which shortened the period of obta<strong>in</strong><strong>in</strong>g the loan by 3<br />

days (See Table 17).<br />

Table 17: Responses to the question How much time did you spend to obta<strong>in</strong> a loan?<br />

Without<br />

<strong>in</strong>termediary<br />

Total Production Trade Services Sofia Large<br />

district<br />

centre<br />

Smaller<br />

town<br />

Arithmetical mean 38.73 27.4 46.3 26.0 77.6 30.75 32.2<br />

Median 10 10 12.5 30 7 22.5 12.5<br />

Valid cases 33 10 20 3 5 8 20<br />

30