Income Dynamics, Economic Rents and the Financialization of the ...

Income Dynamics, Economic Rents and the Financialization of the ...

Income Dynamics, Economic Rents and the Financialization of the ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

a real estate bubble fueled by low interest rates <strong>and</strong> rising housing prices. The finance sector fur-<br />

<strong>the</strong>r inflated this bubble through <strong>the</strong> aggressive marketing <strong>of</strong> sub-prime mortgages to feed <strong>the</strong>ir<br />

pr<strong>of</strong>itable business in mortgage backed securities. 12 In a particularly thorough analysis <strong>of</strong> this set<br />

<strong>of</strong> events Fligstein <strong>and</strong> Goldstein (2010) show that this market was created by a limited set <strong>of</strong><br />

financial institutions participating in all aspects <strong>of</strong> <strong>the</strong> process, with collusion from <strong>the</strong> rating<br />

agencies that valued risky securities as AAA investments <strong>and</strong> a set <strong>of</strong> federal regulators who<br />

deeply believed that financial markets were efficient <strong>and</strong> self-regulating. Their analysis is impor-<br />

tant in revealing <strong>the</strong> actor-network structure that produced <strong>the</strong> unstable financial market that, at<br />

least temporarily, brought <strong>the</strong> period <strong>of</strong> financialization to a halt.<br />

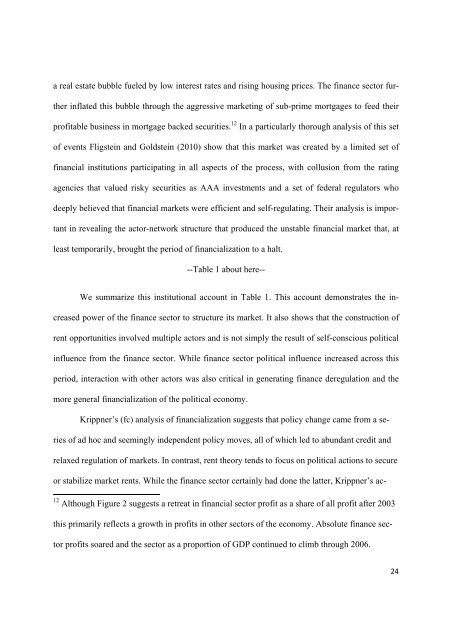

--Table 1 about here--<br />

We summarize this institutional account in Table 1. This account demonstrates <strong>the</strong> in-<br />

creased power <strong>of</strong> <strong>the</strong> finance sector to structure its market. It also shows that <strong>the</strong> construction <strong>of</strong><br />

rent opportunities involved multiple actors <strong>and</strong> is not simply <strong>the</strong> result <strong>of</strong> self-conscious political<br />

influence from <strong>the</strong> finance sector. While finance sector political influence increased across this<br />

period, interaction with o<strong>the</strong>r actors was also critical in generating finance deregulation <strong>and</strong> <strong>the</strong><br />

more general financialization <strong>of</strong> <strong>the</strong> political economy.<br />

Krippner’s (fc) analysis <strong>of</strong> financialization suggests that policy change came from a se-<br />

ries <strong>of</strong> ad hoc <strong>and</strong> seemingly independent policy moves, all <strong>of</strong> which led to abundant credit <strong>and</strong><br />

relaxed regulation <strong>of</strong> markets. In contrast, rent <strong>the</strong>ory tends to focus on political actions to secure<br />

or stabilize market rents. While <strong>the</strong> finance sector certainly had done <strong>the</strong> latter, Krippner’s ac-<br />

12 Although Figure 2 suggests a retreat in financial sector pr<strong>of</strong>it as a share <strong>of</strong> all pr<strong>of</strong>it after 2003<br />

this primarily reflects a growth in pr<strong>of</strong>its in o<strong>the</strong>r sectors <strong>of</strong> <strong>the</strong> economy. Absolute finance sec-<br />

tor pr<strong>of</strong>its soared <strong>and</strong> <strong>the</strong> sector as a proportion <strong>of</strong> GDP continued to climb through 2006.<br />

24