Income Dynamics, Economic Rents and the Financialization of the ...

Income Dynamics, Economic Rents and the Financialization of the ...

Income Dynamics, Economic Rents and the Financialization of the ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

%Pr<strong>of</strong>its<br />

10 20 30 40<br />

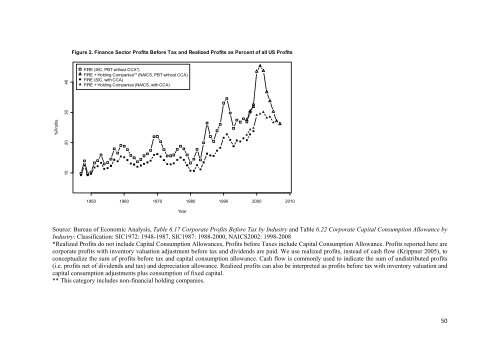

Figure 2. Finance Sector Pr<strong>of</strong>its Before Tax <strong>and</strong> Realized Pr<strong>of</strong>its as Percent <strong>of</strong> all US Pr<strong>of</strong>its<br />

FIRE (SIC, PBT without CCA*)<br />

FIRE + Holding Companies** (NAICS, PBT without CCA)<br />

FIRE (SIC, with CCA)<br />

FIRE + Holding Companies (NAICS, with CCA)<br />

1950 1960 1970 1980 1990 2000 2010<br />

Year<br />

Source: Bureau <strong>of</strong> <strong>Economic</strong> Analysis, Table 6.17 Corporate Pr<strong>of</strong>its Before Tax by Industry <strong>and</strong> Table 6.22 Corporate Capital Consumption Allowance by<br />

Industry: Classification: SIC1972: 1948-1987, SIC1987: 1988-2000, NAICS2002: 1998-2008<br />

*Realized Pr<strong>of</strong>its do not include Capital Consumption Allowances, Pr<strong>of</strong>its before Taxes include Capital Consumption Allowance. Pr<strong>of</strong>its reported here are<br />

corporate pr<strong>of</strong>its with inventory valuation adjustment before tax <strong>and</strong> dividends are paid. We use realized pr<strong>of</strong>its, instead <strong>of</strong> cash flow (Krippner 2005), to<br />

conceptualize <strong>the</strong> sum <strong>of</strong> pr<strong>of</strong>its before tax <strong>and</strong> capital consumption allowance. Cash flow is commonly used to indicate <strong>the</strong> sum <strong>of</strong> undistributed pr<strong>of</strong>its<br />

(i.e. pr<strong>of</strong>its net <strong>of</strong> dividends <strong>and</strong> tax) <strong>and</strong> depreciation allowance. Realized pr<strong>of</strong>its can also be interpreted as pr<strong>of</strong>its before tax with inventory valuation <strong>and</strong><br />

capital consumption adjustments plus consumption <strong>of</strong> fixed capital.<br />

** This category includes non-financial holding companies.<br />

50