Evolution of Amortizing Asset Securitization - Securitization.Net

Evolution of Amortizing Asset Securitization - Securitization.Net

Evolution of Amortizing Asset Securitization - Securitization.Net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

New issue<br />

volumes and<br />

spreads reflect<br />

investor<br />

sentiment<br />

Revolving<br />

pools <strong>of</strong><br />

short-term<br />

assets are<br />

easily<br />

structured to<br />

fund in the<br />

semi-annual<br />

pay bullet<br />

ABS<br />

market…<br />

…and their<br />

desirability is<br />

reflected in<br />

tight spreads<br />

2<br />

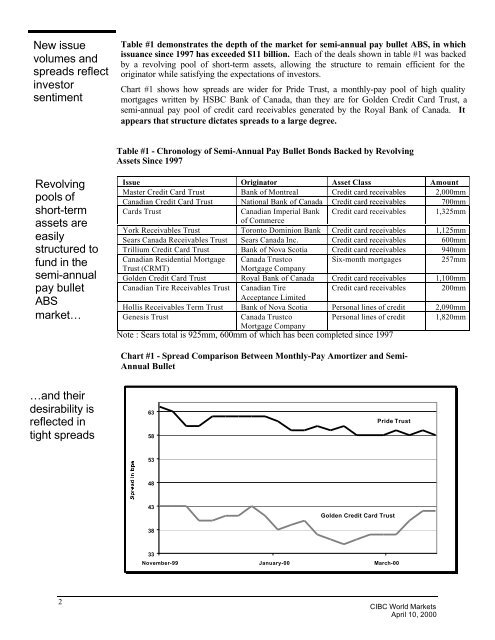

Table #1 demonstrates the depth <strong>of</strong> the market for semi-annual pay bullet ABS, in which<br />

issuance since 1997 has exceeded $11 billion. Each <strong>of</strong> the deals shown in table #1 was backed<br />

by a revolving pool <strong>of</strong> short-term assets, allowing the structure to remain efficient for the<br />

originator while satisfying the expectations <strong>of</strong> investors.<br />

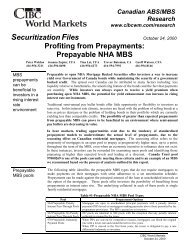

Chart #1 shows how spreads are wider for Pride Trust, a monthly-pay pool <strong>of</strong> high quality<br />

mortgages written by HSBC Bank <strong>of</strong> Canada, than they are for Golden Credit Card Trust, a<br />

semi-annual pay pool <strong>of</strong> credit card receivables generated by the Royal Bank <strong>of</strong> Canada. It<br />

appears that structure dictates spreads to a large degree.<br />

Table #1 - Chronology <strong>of</strong> Semi-Annual Pay Bullet Bonds Backed by Revolving<br />

<strong>Asset</strong>s Since 1997<br />

Issue Originator <strong>Asset</strong> Class Amount<br />

Master Credit Card Trust Bank <strong>of</strong> Montreal Credit card receivables 2,000mm<br />

Canadian Credit Card Trust National Bank <strong>of</strong> Canada Credit card receivables 700mm<br />

Cards Trust Canadian Imperial Bank Credit card receivables 1,325mm<br />

<strong>of</strong> Commerce<br />

York Receivables Trust Toronto Dominion Bank Credit card receivables 1,125mm<br />

Sears Canada Receivables Trust Sears Canada Inc. Credit card receivables 600mm<br />

Trillium Credit Card Trust Bank <strong>of</strong> Nova Scotia Credit card receivables 940mm<br />

Canadian Residential Mortgage Canada Trustco<br />

Six-month mortgages 257mm<br />

Trust (CRMT)<br />

Mortgage Company<br />

Golden Credit Card Trust Royal Bank <strong>of</strong> Canada Credit card receivables 1,100mm<br />

Canadian Tire Receivables Trust Canadian Tire<br />

Acceptance Limited<br />

Credit card receivables 200mm<br />

Hollis Receivables Term Trust Bank <strong>of</strong> Nova Scotia Personal lines <strong>of</strong> credit 2,090mm<br />

Genesis Trust Canada Trustco<br />

Mortgage Company<br />

Personal lines <strong>of</strong> credit 1,820mm<br />

Note : Sears total is 925mm, 600mm <strong>of</strong> which has been completed since 1997<br />

Chart #1 - Spread Comparison Between Monthly-Pay Amortizer and Semi-<br />

Annual Bullet<br />

63<br />

58<br />

53<br />

48<br />

43<br />

38<br />

33<br />

Pride Trust<br />

Golden Credit Card Trust<br />

November-99 January-00 March-00<br />

CIBC World Markets<br />

April 10, 2000