Depec-Bradesco Economic Highlights - Economia em Dia

Depec-Bradesco Economic Highlights - Economia em Dia

Depec-Bradesco Economic Highlights - Economia em Dia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Macroeconomic Research Department<br />

<strong>Depec</strong>-<strong>Bradesco</strong> <strong>Economic</strong><br />

<strong>Highlights</strong><br />

Year IX Number 8 - February, 25 2011<br />

The decision to raise interest rates by 50 bps at next week’s Copom<br />

meeting is undoubtedly the right call in light of the deceleration in<br />

economic activity that is already underway<br />

The 50 bps interest rate hike that the Copom is likely<br />

to impl<strong>em</strong>ent next week is part of a coordinated<br />

economic policy action – which includes a marked<br />

reduction in the growth of public spending as well<br />

as macro-prudential measures – in order to bring<br />

infl ation to the center of the target over the course of<br />

2012. In our view, this economic policy strategy, the<br />

deceleration that is already underway in economic<br />

activity and the fact that part of the deterioration<br />

in infl ation and in infl ation expectations is due to<br />

commodity shocks – to be accommodated in the<br />

infl ation band – are more than enough to justify an<br />

increase of at most 50 bps at this meeting, followed<br />

by the possibility of another 50 bps hike at April’s<br />

meeting, if necessary.<br />

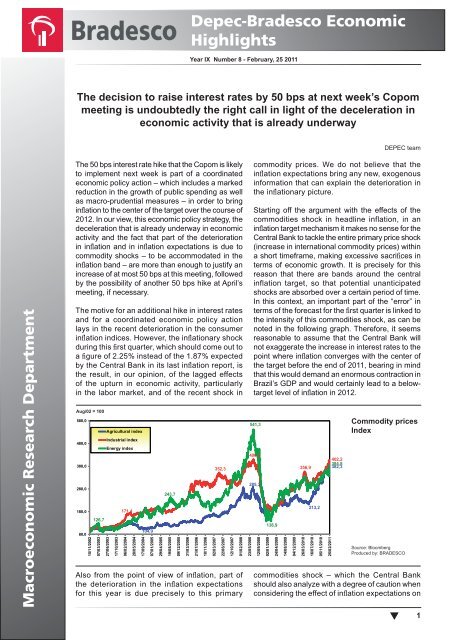

The motive for an additional hike in interest rates<br />

and for a coordinated economic policy action<br />

lays in the recent deterioration in the consumer<br />

infl ation indices. However, the infl ationary shock<br />

during this fi rst quarter, which should come out to<br />

a fi gure of 2.25% instead of the 1.87% expected<br />

by the Central Bank in its last infl ation report, is<br />

the result, in our opinion, of the lagged effects<br />

of the upturn in economic activity, particularly<br />

in the labor market, and of the recent shock in<br />

Aug/02 = 100<br />

580,0<br />

480,0<br />

380,0<br />

280,0<br />

180,0<br />

80,0<br />

15/11/2002<br />

126,7<br />

07/03/2003<br />

Agricultural index<br />

Industrial index<br />

Energy index<br />

27/06/2003<br />

17/10/2003<br />

171,4<br />

06/02/2004<br />

28/05/2004<br />

104,9<br />

17/09/2004<br />

07/01/2005<br />

29/04/2005<br />

243,7<br />

352,3<br />

Also from the point of view of infl ation, part of<br />

the deterioration in the infl ation expectations<br />

for this year is due precisely to this primary<br />

19/08/2005<br />

09/12/2005<br />

31/03/2006<br />

21/07/2006<br />

10/11/2006<br />

02/03/2007<br />

22/06/2007<br />

12/10/2007<br />

01/02/2008<br />

23/05/2008<br />

DEPEC team<br />

commodity prices. We do not believe that the<br />

infl ation expectations bring any new, exogenous<br />

information that can explain the deterioration in<br />

the infl ationary picture.<br />

Starting off the argument with the effects of the<br />

commodities shock in headline inflation, in an<br />

infl ation target mechanism it makes no sense for the<br />

Central Bank to tackle the entire primary price shock<br />

(increase in international commodity prices) within<br />

a short timeframe, making excessive sacrifi ces in<br />

terms of economic growth. It is precisely for this<br />

reason that there are bands around the central<br />

inflation target, so that potential unanticipated<br />

shocks are absorbed over a certain period of time.<br />

In this context, an important part of the “error” in<br />

terms of the forecast for the fi rst quarter is linked to<br />

the intensity of this commodities shock, as can be<br />

noted in the following graph. Therefore, it se<strong>em</strong>s<br />

reasonable to assume that the Central Bank will<br />

not exaggerate the increase in interest rates to the<br />

point where infl ation converges with the center of<br />

the target before the end of 2011, bearing in mind<br />

that this would d<strong>em</strong>and an enormous contraction in<br />

Brazil’s GDP and would certainly lead to a belowtarget<br />

level of infl ation in 2012.<br />

541,3<br />

406,0<br />

285,3<br />

12/09/2008<br />

138,9<br />

02/01/2009<br />

24/04/2009<br />

14/08/2009<br />

04/12/2009<br />

356,9<br />

26/03/2010<br />

213,2<br />

16/07/2010<br />

05/11/2010<br />

25/02/2011<br />

402,2<br />

384,8<br />

382,3<br />

Commodity prices<br />

Index<br />

Source: Bloomberg<br />

Produced by: BRADESCO<br />

commodities shock – which the Central Bank<br />

should also analyze with a degree of caution when<br />

considering the effect of infl ation expectations on<br />

1

<strong>Depec</strong>-Bradeso <strong>Economic</strong> <strong>Highlights</strong><br />

the projected infl ation in their model. Hypothetically,<br />

let’s imagine a situation where infl ation is in the center<br />

of the target at the start of a year and that, solely<br />

on account of an external shock, both infl ation and<br />

infl ation expectations point to a higher-than-target<br />

value. In this case, it makes no sense to assume<br />

that there are two vectors pushing infl ation up: one<br />

from the external shock which leads to an increase<br />

in current infl ation and another from an “exogenous”<br />

deterioration in expectations. Expectations have<br />

worsened fundamentally because of the shock and<br />

not on account of any other factor. Therefore, to say<br />

8,5%<br />

6,5%<br />

4,5%<br />

2,5%<br />

5,2%<br />

7,2%<br />

8,1%<br />

5,5%<br />

4,4%<br />

3,0%<br />

mar/04<br />

mai/04<br />

jul/04<br />

set/04<br />

nov/04<br />

jan/05<br />

mar/05<br />

mai/05<br />

jul/05<br />

set/05<br />

nov/05<br />

jan/06<br />

mar/06<br />

mai/06<br />

jul/06<br />

set/06<br />

nov/06<br />

jan/07<br />

mar/07<br />

mai/07<br />

jul/07<br />

set/07<br />

nov/07<br />

jan/08<br />

mar/08<br />

mai/08<br />

jul/08<br />

set/08<br />

nov/08<br />

jan/09<br />

mar/09<br />

mai/09<br />

jul/09<br />

set/09<br />

nov/09<br />

jan/10<br />

mar/10<br />

mai/10<br />

jul/10<br />

set/10<br />

nov/10<br />

jan/11<br />

With regard to the infl ation cores, our diagnosis is that<br />

the acceleration seen over the last few months is the<br />

lagged refl ex of last year’s growth in economic activity,<br />

particularly in the labor market. It’s like taking a look in<br />

the rear-view mirror: the infl ation that we are experiencing<br />

right now is the result of the marked level of economic<br />

activity that was registered in previous quarters. As<br />

5,6%<br />

5,1%<br />

that the deterioration in infl ation expectations would<br />

be an additional risk factor is wrong, and is the same<br />

as counting the same shock twice. As a result, in our<br />

opinion, the deterioration in the infl ation expectations<br />

for 2011 is suffering to a marked degree from this<br />

“double counting” effect due to the pronounced<br />

correlation between infl ation expectations and current<br />

infl ation, infl uenced by the commodities shock. In<br />

addition to this pronounced correlation with current<br />

infl ation, as can be observed in the following graph,<br />

the predictive power of infl ation expectations at times<br />

of external shocks se<strong>em</strong>s even smaller.<br />

6,4%<br />

IPCA<br />

Expectations 12 months forward<br />

4,0%<br />

5,3%<br />

4,5%<br />

5,9%<br />

5,5%<br />

IPCA infl ation<br />

and infl ation<br />

expectations 12<br />

months ahead,<br />

synchronized 2004<br />

- 2011<br />

Source: IBGE, BC<br />

Produced by: BRADESCO<br />

can be noted in the following table, among the main<br />

determinants of the underlying infl ation, the it<strong>em</strong>s that<br />

most draw attention are the earnings of households and<br />

the labor market. What is expected regarding this aspect<br />

is that the Central Bank will adjust its instruments in order<br />

to bring economic growth to below potential, and in our<br />

opinion, this is what is currently being done.<br />

July 2008 February 2011<br />

Expectation for the current year 6.50% 5.79%<br />

Change in 6 months (bps) 213 88<br />

Expectation for the next year 4.98% 4.78%<br />

Change in 6 months (bps) 94 28<br />

Infl ation for the previous year 4.46% 5.91%<br />

Gap (6 month average) 2.14% 0.52%<br />

Commodities in reais (variation over 6 months) 17.68% 16.29%<br />

Un<strong>em</strong>ployment Rate (6 month average) 7.93% 6.46%<br />

Real Earnings (annualized 6 month variation) 4.42% 8.19%<br />

Domestic Absorption (annualized 2 quarters variation) 9.93% 7.35%<br />

Even before the start of the monetary tightening cycle<br />

that is currently in progress, economic activity had<br />

already been giving signs that growth, in the margin, is<br />

below potential and the fi gures for the labor market point<br />

unmistakably in this direction, as can be observed in the<br />

graphs below. Growth in engag<strong>em</strong>ent and in earnings<br />

dropped from a fi gure close to 1.0% at the end of last<br />

Comparison between<br />

indicators which are<br />

signifi cant for infl ation<br />

during monetary tightening<br />

cycles<br />

2008 - 2011<br />

Source: IBGE, BC<br />

Produced by: BRADESCO<br />

year to a slightly negative fi gure at the start of this<br />

year, while engag<strong>em</strong>ent recently slowed down from a<br />

monthly rate of slightly more than 1.0% to a fi gure of<br />

less than 0.5%. Brazilian industrial production has been<br />

showing stability since the second last quarter of last<br />

year, retail sector sales are showing the fi rst signs of<br />

deceleration and apparent consumption of machinery<br />

DEPEC<br />

2

<strong>Depec</strong>-Bradeso <strong>Economic</strong> <strong>Highlights</strong><br />

and equipment, which is a proxy for investments, has<br />

been slowing down. The output gap as measured by<br />

the IBC-Br index se<strong>em</strong>s to be converging on stability<br />

and, in a more comprehensive way, since the second<br />

half of last year Brazilian GDP growth has certainly<br />

been below potential 1 . Therefore, we see no reason for<br />

1,8%<br />

1,2%<br />

0,6%<br />

0,35%<br />

0,0%<br />

-0,04%<br />

-0,6%<br />

-1,2%<br />

Growth in<br />

engag<strong>em</strong>ent: growth<br />

in the margin and in<br />

the 3-month moving<br />

average<br />

4,9%<br />

3,5%<br />

2,1%<br />

0,91%<br />

0,75%<br />

0,7%<br />

-0,7%<br />

-2,1%<br />

-2,09%<br />

-3,5%<br />

-4,9%<br />

-6,3%<br />

nominal<br />

real<br />

Neutral level<br />

0,21%<br />

0,78%<br />

-0,96%<br />

1,31%<br />

-0,14%<br />

1,35%<br />

0,04%<br />

-1,65%<br />

0,66%<br />

1,10%<br />

-0,42%<br />

1,55%<br />

1,39%<br />

-0,54%<br />

1,59%<br />

-0,84%<br />

0,69%<br />

0,30%<br />

3,95%<br />

3,00%<br />

-4,79%<br />

excessively speeding up or extending the interest rate<br />

cycle at the very moment in which economic activity is<br />

already showing signs of slowing down, which will be<br />

reinforced by the effects of the fi scal measures aimed at<br />

reducing the rate of growth in spending and the macroprudential<br />

measures that are underway.<br />

1,98%<br />

out/03<br />

dez/03<br />

fev/04<br />

abr/04<br />

jun/04<br />

ago/04<br />

out/04<br />

dez/04<br />

fev/05<br />

abr/05<br />

jun/05<br />

ago/05<br />

out/05<br />

dez/05<br />

fev/06<br />

abr/06<br />

jun/06<br />

ago/06<br />

out/06<br />

dez/06<br />

fev/07<br />

abr/07<br />

jun/07<br />

ago/07<br />

out/07<br />

dez/07<br />

fev/08<br />

abr/08<br />

jun/08<br />

ago/08<br />

out/08<br />

dez/08<br />

fev/09<br />

abr/09<br />

jun/09<br />

ago/09<br />

out/09<br />

dez/09<br />

fev/10<br />

abr/10<br />

jun/10<br />

ago/10<br />

out/10<br />

dez/10<br />

-0,08%<br />

-0,59%<br />

3-month interpolated<br />

average variation<br />

(seasonally<br />

adjusted) of nominal<br />

and real earnings<br />

Output gap calculated<br />

based on the IBC-Br<br />

(using an HP fi lter)<br />

1 Brazilian GDP has been growing at an annualized rate of less than 3% since the third quarter of 2010 if we take into account our projections for the<br />

current quarter and the previous quarter.<br />

-0,16%<br />

1,31%<br />

0,35%<br />

1,50%<br />

1,10%<br />

jan/07<br />

fev/07<br />

mar/07<br />

abr/07<br />

mai/07<br />

jun/07<br />

jul/07<br />

ago/07<br />

set/07<br />

out/07<br />

nov/07<br />

dez/07<br />

jan/08<br />

fev/08<br />

mar/08<br />

abr/08<br />

mai/08<br />

jun/08<br />

jul/08<br />

ago/08<br />

set/08<br />

out/08<br />

nov/08<br />

dez/08<br />

jan/09<br />

fev/09<br />

mar/09<br />

abr/09<br />

mai/09<br />

jun/09<br />

jul/09<br />

ago/09<br />

set/09<br />

out/09<br />

nov/09<br />

dez/09<br />

jan/10<br />

fev/10<br />

mar/10<br />

abr/10<br />

mai/10<br />

jun/10<br />

jul/10<br />

ago/10<br />

set/10<br />

out/10<br />

nov/10<br />

dez/10<br />

jan/11<br />

fev/11<br />

Source: IBGE<br />

Produced by: BRADESCO<br />

2,0%<br />

1,5%<br />

1,0% 0,89%<br />

0,5%<br />

0,0%<br />

-0,5%<br />

-1,0%<br />

0,14%<br />

0,65%<br />

0,58%<br />

0,35%<br />

0,05%<br />

-0,23%<br />

0,87%<br />

0,17%<br />

0,02%<br />

-0,64%<br />

Monthly variation<br />

3 month moving average<br />

0,07%<br />

-0,05%<br />

-0,20%<br />

-0,36%<br />

0,12% 0,22%<br />

0,92%<br />

0,28%<br />

0,00%<br />

-0,11%<br />

0,22%<br />

-0,39%<br />

0,92%<br />

0,81%<br />

0,53%<br />

0,43%<br />

0,23%<br />

0,08%<br />

Source: IBGE<br />

Produced by: BRADESCO<br />

-0,57%<br />

0,69%<br />

-0,10%<br />

0,33%<br />

0,23%<br />

jan/08<br />

fev/08<br />

mar/08<br />

abr/08<br />

mai/08<br />

jun/08<br />

jul/08<br />

ago/08<br />

set/08<br />

out/08<br />

nov/08<br />

dez/08<br />

jan/09<br />

fev/09<br />

mar/09<br />

abr/09<br />

mai/09<br />

jun/09<br />

jul/09<br />

ago/09<br />

set/09<br />

out/09<br />

nov/09<br />

dez/09<br />

jan/10<br />

fev/10<br />

mar/10<br />

abr/10<br />

mai/10<br />

jun/10<br />

jul/10<br />

ago/10<br />

set/10<br />

out/10<br />

nov/10<br />

dez/10<br />

jan/11<br />

Source: Bacen<br />

Produced by: BRADESCO<br />

DEPEC<br />

0,03%<br />

-0,15%<br />

0,34%<br />

3

<strong>Depec</strong>-Bradeso <strong>Economic</strong> <strong>Highlights</strong><br />

If the pace of economic activity over the next few months<br />

is still incompatible with the convergence of the infl ation<br />

cores onto the center of the target, another signifi cant<br />

question that the Central Bank will have to deal with will<br />

relate to the instruments to be utilized in order to bring<br />

about convergence. An important part of the diagnosis<br />

of the current deceleration of economic activity is due<br />

to the interpretation that the increase in imports and the<br />

“weakness” of exports of manufactured goods is acting<br />

like a brake upon GDP growth, channeling overseas<br />

the excess domestic d<strong>em</strong>and 2 . This diagnosis, coupled<br />

with the unusual circumstances in the manner which<br />

monetary policy is being impl<strong>em</strong>ented in the world mean<br />

that the traditional usage of interest rates by the Central<br />

Bank may be less intense in the present monetary<br />

tightening cycle, in case a greater-than-presentlyexpected<br />

increase is required. This is because of the<br />

fact that the increase in interest rates has an impact<br />

on the FX rate, making it appreciate even more during<br />

a time of excess global liquidity.<br />

8,0%<br />

6,9%<br />

7,0%<br />

6,0% 5,8%<br />

5,0%<br />

4,0%<br />

3,0%<br />

2,0%<br />

1,0%<br />

0,0%<br />

-1,0%<br />

-2,0%<br />

4,1% 3,8%<br />

3,4%<br />

2,3% 2,0% 1,8%1,6% 1,5% 1,4% 1,3% 1,2%<br />

1,0% 1,0%<br />

If the Brazilian Central Bank is one of the only ones to<br />

excessively raise interest rates in this global context in<br />

which the interest rates of the developed countries are<br />

extr<strong>em</strong>ely low – and operating by means of quantitative<br />

mechanisms – and the <strong>em</strong>erging economies are making<br />

greater use of macro-prudential measures than of<br />

interest rates, then Brazil’s FX could perhaps register<br />

an excessive appreciation. Such an appreciation in<br />

the real would aggravate the economy’s external<br />

competitiveness 3 . The signs given off by the present<br />

administration suggest that this is an important th<strong>em</strong>e<br />

for the economic policymakers and, therefore, the side<br />

effects of raising interest rates cannot be overlooked<br />

in this economic policy framework. As a result, any<br />

aggressive action in terms of raising interest rates in this<br />

phase, in addition to not being justifi ed on account of the<br />

slowing down in economic activity, does not se<strong>em</strong> very<br />

likely in our opinion, as it would aggravate the external<br />

leak and intensify the deceleration in economic activity<br />

that is already underway.<br />

0,4% 0,2% 0,2% 0,2%<br />

Venezuela<br />

Serbia<br />

Romania<br />

Estonia<br />

Greece<br />

Uruguay<br />

Indonesia<br />

U K<br />

Portugal<br />

Thailand<br />

Singapore<br />

Malta<br />

Brazil<br />

Spain<br />

Belgium<br />

Colombia<br />

Slovakia<br />

Poland<br />

India<br />

Korea<br />

Lux<strong>em</strong>burg<br />

Hungary<br />

Finland<br />

China<br />

Austria<br />

Mexico<br />

South Africa<br />

Euro Zone<br />

Canada<br />

Italy<br />

Slovenia<br />

France<br />

Holland<br />

Germany<br />

Australia<br />

Cyprus<br />

Sweden<br />

Ireland<br />

Czech Republic<br />

USA<br />

Peru<br />

Philippines<br />

Chile<br />

Therefore, in our opinion, the Copom will raise interest<br />

rates by 50 bps at this meeting and will wait to see the<br />

results of this monetary policy action combined with<br />

the macro-prudential, fi scal and para-fi scal measures.<br />

In addition to being effective, it se<strong>em</strong>s to us that these<br />

actions will be come on top of a deceleration that is<br />

already underway in the factor that has been the main<br />

vector of infl ationary acceleration over the last few<br />

months, namely the labor market. As a result of this,<br />

in our opinion there is no justifi cation for any more<br />

-0,3%<br />

-1,0%<br />

Comparison<br />

between the<br />

12-month infl ation<br />

differential<br />

(headline) and each<br />

country’s infl ation<br />

target<br />

Source: CEIC<br />

Produced by: BRADESCO<br />

pronounced acceleration in the intensity or total size<br />

of the interest rate cycle, at the very moment in which<br />

the vectors that govern infl ation are pointing to a much<br />

more favorable outlook for the cores.<br />

Summing up, we are not underestimating the infl ationary<br />

phenomenon and we recognize that inflation is a<br />

challenge that faces Brazil as well as dozens of other<br />

countries. However, the already clear endogenous<br />

or induced signs of deceleration lead us to believe<br />

2 Nor can we fail to take into account that part of the deceleration that is already being seen in the economy may be the result of the increase in interest<br />

rates that the Central Bank impl<strong>em</strong>ented during the fi rst half of last year, the <strong>em</strong>pirical results of which were expected to be seen at the end of that year.<br />

Although the transmission channels of that interest rate increase are not clear – after all, interest rates on credit continued to drop, the level of confi dence<br />

of businessmen and consumers was not affected – it is possible that the appreciation in the real FX rate that followed and households’ consumption and<br />

savings decisions have meant that the increase in interest rates was transmitted to economic activity. Incidentally, the interest rate that matters to the<br />

economy is the real swap rate and this has been increasing since the middle of 2009 by roughly 2.0 p.p. during the period, which leads us to believe that,<br />

in effect, part of the economic activity adjustment may have come through this channel.<br />

3 This appreciation would certainly help to reduce infl ation, and the increase in interest rates would eventually lead to a decrease in the country’s external<br />

defi cit at a later time, on account of the moderating effect on domestic d<strong>em</strong>and. However, initially the effect would be to aggravate the loss of competitiveness.<br />

DEPEC<br />

4

<strong>Depec</strong>-Bradeso <strong>Economic</strong> <strong>Highlights</strong><br />

that this is not the moment to step up the pace of<br />

monetary tightening. In addition to this, depending upon<br />

developments in relation to the crisis in North African<br />

and Middle Eastern countries, we have to consider<br />

Team<br />

Octavio de Barros - Macroeconomic Research Director<br />

Marcelo Cirne de Toledo / Fernando Honorato Barbosa<br />

the possibility of an impact on the level of economic<br />

activity in the developed countries, which may be<br />

signifi cant and which could have obvious infl ationary<br />

consequences.<br />

Global economics: Fabiana D’Atri / Daniel Valladares Weeks / Daniela Cunha de Lima /Igor Velecico / Thomas Henrique Schreurs Pires /<br />

Matheus Ribeiro Machado<br />

Brazil: Robson Rodrigues Pereira / Andréa Bastos Damico / Ana Paula Almeida / Ellen Regina Steter / Myriã Bast / Renata Rodovalho Gonçalves<br />

Brazilian sectors: Regina Helena Couto Silva / Priscila Pacheco Trigo / Rita de Cassia Milani<br />

Proprietary survey: Fernando Freitas / Ana Maria Bonomi Barufi / Leandro Câmara Negrão<br />

Internships: Laura Pinto Gonçalves / Felipe Cardoso D´Avila / Mirella P. Amaro Hirakawa / Wellington Barbosa Nunes / Daiane Cristina Montanari<br />

DEPEC - BRADESCO does not accept responsibility for any actions/decisions that may be taken based on the information provided in its publications and projections. All the<br />

data and opinions contained in these information bulletins is carefully checked and drawn up by fully qualifi ed professionals, but it should not be used, under any hypothesis, as<br />

the basis, support, guidance or norm for any document, valuations, judgments or decision taking, whether of a formal or informal nature. Therefore, we <strong>em</strong>phasize that all the<br />

consequences and responsibility for using any data or analysis contained in this publication is assumed exclusively by the user, ex<strong>em</strong>pting BRADESCO from all responsibility<br />

for any actions resulting from the usage of this material. We all point out that access to this information implies acceptance in full of this term of responsibility and usage.<br />

DEPEC<br />

5