Case Studies - Affordable Housing Regulatory ... - City of Alexandria

Case Studies - Affordable Housing Regulatory ... - City of Alexandria

Case Studies - Affordable Housing Regulatory ... - City of Alexandria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

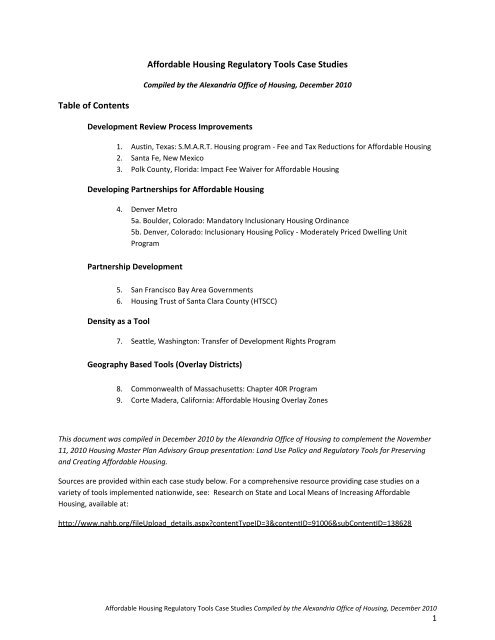

Table <strong>of</strong> Contents<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong><br />

Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

Development Review Process Improvements<br />

1. Austin, Texas: S.M.A.R.T. <strong>Housing</strong> program ‐ Fee and Tax Reductions for <strong>Affordable</strong> <strong>Housing</strong><br />

2. Santa Fe, New Mexico<br />

3. Polk County, Florida: Impact Fee Waiver for <strong>Affordable</strong> <strong>Housing</strong><br />

Developing Partnerships for <strong>Affordable</strong> <strong>Housing</strong><br />

4. Denver Metro<br />

5a. Boulder, Colorado: Mandatory Inclusionary <strong>Housing</strong> Ordinance<br />

5b. Denver, Colorado: Inclusionary <strong>Housing</strong> Policy ‐ Moderately Priced Dwelling Unit<br />

Program<br />

Partnership Development<br />

5. San Francisco Bay Area Governments<br />

6. <strong>Housing</strong> Trust <strong>of</strong> Santa Clara County (HTSCC)<br />

Density as a Tool<br />

7. Seattle, Washington: Transfer <strong>of</strong> Development Rights Program<br />

Geography Based Tools (Overlay Districts)<br />

8. Commonwealth <strong>of</strong> Massachusetts: Chapter 40R Program<br />

9. Corte Madera, California: <strong>Affordable</strong> <strong>Housing</strong> Overlay Zones<br />

This document was compiled in December 2010 by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong> to complement the November<br />

11, 2010 <strong>Housing</strong> Master Plan Advisory Group presentation: Land Use Policy and <strong>Regulatory</strong> Tools for Preserving<br />

and Creating <strong>Affordable</strong> <strong>Housing</strong>.<br />

Sources are provided within each case study below. For a comprehensive resource providing case studies on a<br />

variety <strong>of</strong> tools implemented nationwide, see: Research on State and Local Means <strong>of</strong> Increasing <strong>Affordable</strong><br />

<strong>Housing</strong>, available at:<br />

http://www.nahb.org/fileUpload_details.aspx?contentTypeID=3&contentID=91006&subContentID=138628<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong> Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

1

1. Austin Texas ‐ Development Review Process Improvements<br />

Sources:<br />

http://www.ci.austin.tx.us/auditor/au01303.htm, http://www.ci.austin.tx.us/auditor/downloads/au01303.pdf,<br />

http://www.lakecountyfl.gov/pdfs/2025/SMART_<strong>Housing</strong>.pdf<br />

Overview<br />

In April 2000, Austin city council passed a resolution creating the S.M.A.R.T. <strong>Housing</strong> program in order to moderate<br />

the trends that made much <strong>of</strong> the local real estate unaffordable for low and medium income families. The Program<br />

provides a set <strong>of</strong> criteria to be met by developers <strong>of</strong> reasonably priced housing to serve families with incomes <strong>of</strong> 80<br />

percent or below the area median family income (MFI) in order to receive <strong>City</strong> incentives. Incentives <strong>of</strong>fered to<br />

developers include land development fee waivers and expedited development review.<br />

How does it work?<br />

The S.M.A.R.T <strong>Housing</strong> projects must be safe, mixed income, affordable, reasonably priced, and transit oriented. In<br />

addition, the projects must be energy efficient. Developers who agree to make a portion <strong>of</strong> their developments<br />

reasonably priced and comply with the other program requirements will be eligible to receive full or partial fee<br />

waivers. Specifically, the S.M.A.R.T. <strong>Housing</strong> resolution provides for the waiver <strong>of</strong> thirty types <strong>of</strong> development<br />

related fees, including land development fees (zoning, subdivision, site plan); building permit and inspection fees;<br />

subdivision construction inspection fees; and water and wastewater capital recovery (impact) fees.<br />

After developers submit an application consisting <strong>of</strong> preliminary project plans, the S.M.A.R.T. <strong>Housing</strong> program<br />

manager reviews the plans for compliance with the program requirements. If the preliminary plans indicate<br />

compliance with the established criteria, the program manager approves and certifies the plan and submits the<br />

plan through the expedited development review process. Staff walks applicants through major issues early and<br />

identifies “gotcha issues.” A review team reviews the plans within 14 working days. The review team reviews<br />

corrected plans, if any, within seven working days and the applicant is required to submit revisions for rejected<br />

plans within seven working days.<br />

Results<br />

Since 2005, more than 4,900 S.M.A.R.T. <strong>Housing</strong> units have been completed, and nearly 80% <strong>of</strong> these have been<br />

affordable to families at or below 80% <strong>of</strong> the Median Family Income (MFI). In 2004, 21% <strong>of</strong> all building permits<br />

issued for single family residences in Austin were S.M.A.R.T. Houses. That year alone, nearly 600 new homes were<br />

built in the Austin area under the auspices <strong>of</strong> S.M.A.R.T. <strong>Housing</strong>. As <strong>of</strong> 2002, fees waived under the Program<br />

totaled approximately $1,214,000.<br />

Challenges<br />

S.M.A.R.T <strong>Housing</strong> program challenges include: promoting too much demand to allow full fee waivers without<br />

impacting utility rates; maintaining longer term affordability without decreasing building; serving lower income<br />

residents without increasing the concentration <strong>of</strong> poverty in traditionally low‐income neighborhoods; amending<br />

local accessibility requirements that exceed national standards without “watering down” the goal <strong>of</strong> increased<br />

accessibility for people with disabilities; and recognizing that the goals <strong>of</strong> increasing density and tax base may<br />

conflict with goals <strong>of</strong> increasing housing affordability and mitigating gentrification.<br />

Applicability to <strong>Alexandria</strong><br />

Implementing an affordable housing policy that would expedite the development review process and provide<br />

developer incentives such as fee waivers could increase the affordable housing stock in the <strong>City</strong> <strong>of</strong> <strong>Alexandria</strong>.<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong> Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

2

Although implementing such policy would not need state enabling legislation, resources to support a fee waiver<br />

program should be evaluated.<br />

2. Santa Fe, New Mexico: Fee and Tax Reductions for <strong>Affordable</strong> <strong>Housing</strong><br />

Sources<br />

http://www.santafenm.gov/index.aspx?NID=642<br />

http://www.tbrpc.org/resource_center/pdfs/housing/Santa_Fe_NM_AH.PDF<br />

Overview<br />

The <strong>City</strong> <strong>of</strong> Santa Fe, New Mexico has adopted several policies that expedite permitting as well as waive, reimburse<br />

or reduce various fees for affordable housing projects. Fees that were waived for the development <strong>of</strong> affordable<br />

housing include building permit, impact, and utility expansion fees.<br />

How does it work?<br />

The <strong>City</strong> <strong>of</strong> Santa Fe, New Mexico accelerated the permitting process for projects that include at least 25 percent<br />

affordable housing. In addition, the city passed the following ordinances relating to fees for affordable housing<br />

projects.<br />

Resolution No. 1994‐96 waives standard building permit fees for nonpr<strong>of</strong>it affordable housing developers.<br />

It also reimburses these fees to for‐pr<strong>of</strong>it builders after the developer certifies that the sales price, size <strong>of</strong><br />

the unit, size <strong>of</strong> the household and household incomes meet affordable standards.<br />

Section 14‐95.4 SFCC 1987 (Capital Impact Fee) exempts affordable housing from capital development<br />

impact fees for nonpr<strong>of</strong>it affordable housing developers and reimburses for pr<strong>of</strong>it developers after the<br />

developer certifies that the sales price, size <strong>of</strong> the unit, size <strong>of</strong> the household and household incomes<br />

meet affordable standards.<br />

Section 14‐96.8B SFCC 1987 (Inclusionary Zoning Ordinance) waives plan submittal fees for annexation,<br />

rezoning or subdivisions for low‐priced housing developments (those providing no less than 75%<br />

affordable units) and waives building permit fees for low price units (those affordable to households<br />

earning less than 80% <strong>of</strong> median area income).<br />

Ordinance No. 2000‐01 reduces the utility expansion charge for meter service for a low priced dwelling<br />

unit (those affordable to households earning less than 80% <strong>of</strong> median income) to $800 (compared to the<br />

standard charge <strong>of</strong> $2,000).<br />

Results<br />

By the early 1990s, three quarters <strong>of</strong> Santa Fe’s residents could not afford a median priced home, and housing<br />

costs were 40% above the national average. Expedited permitting, along with the reduction in administration and<br />

impact fees and other zoning & planning tools, have helped make nearly 16% <strong>of</strong> all new homes built in Santa Fe<br />

during the last decade affordable for working families.<br />

Applicability to <strong>Alexandria</strong><br />

The manner in which every city administers the development process is different and some <strong>of</strong> the fees charged by<br />

the <strong>City</strong> <strong>of</strong> Santa Fe may not be charged by the <strong>City</strong> <strong>of</strong> <strong>Alexandria</strong> and vice versa. However, implementing policies<br />

and procedures that waive fees and expedite the review process are options that could be available to the <strong>City</strong> <strong>of</strong><br />

<strong>Alexandria</strong>. The <strong>City</strong> must evaluate these options and determine the impact that waiving fees can have on<br />

competing priorities. The city would not need state enabling legislation to implement this program.<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong> Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

3

3. Polk County, Florida: Impact Fee Waiver for <strong>Affordable</strong> <strong>Housing</strong><br />

Source:<br />

http://www.lakelandgov.net/commdev/planning/files/F362ADA2867D4808B3D28B21D9C89A09.pdf<br />

Overview<br />

Polk County, Florida charges impact fees to help cover the cost <strong>of</strong> new development. These fees help to defray the<br />

cost <strong>of</strong> new infrastructure including roads, water and sewer lines, recreation facilities, and even schools. In order<br />

to encourage the development <strong>of</strong> affordable housing, the county provides waivers and reductions to these fees.<br />

How does it work?<br />

There are several steps to Polk County’s impact fee waiver and reduction process. First, the developer pays the full<br />

impact fee when applying for the permit for the affordable housing project. Upon sale <strong>of</strong> a housing unit to a<br />

qualified buyer, the County reimburses the full portion <strong>of</strong> the impact fee for buyers at or below 80 percent <strong>of</strong> area<br />

median income and half <strong>of</strong> the impact fee for buyers between 80 percent and 120 percent <strong>of</strong> the area median<br />

income. The County requires the impact fee waivers to be repaid by the homeowner if the house is sold within<br />

seven years, and it places a lien on the property to enforce this repayment requirement. The fee waivers and<br />

reductions are also available to commercial property owners who rent units to qualified income groups. In order<br />

to retain this waiver, commercial property owners must certify annually that the units are occupied by income<br />

eligible renters.<br />

Polk County first introduced impact fee waivers in 1990, and the fee waivers granted are funded from general<br />

revenues, gas taxes, and other sources <strong>of</strong> revenue. In order to limit the financial impact that the waivers might<br />

have on the county budget, the county sets a maximum annual waiver cap <strong>of</strong> $250,000 across all projects. If the<br />

cap is reached, a developer may appeal to the appropriate commission for fee waivers that would exceed the cap.<br />

Results<br />

As <strong>of</strong> 2008, only nonpr<strong>of</strong>it organizations have taken advantage <strong>of</strong> the impact fee waiver ordinance. According to<br />

Jeff Bagwell, the executive director <strong>of</strong> a local non‐pr<strong>of</strong>it, the impact fee waiver alone is not enough to make<br />

homeownership affordable to moderate‐income families in the county.<br />

Challenges<br />

The county has found that the impact fee alone is not enough to encourage the development <strong>of</strong> affordable<br />

housing by the development community. In addition, many developers have been hesitant to use this tool due to<br />

the lack <strong>of</strong> clarity surrounding the details <strong>of</strong> the impact fee waiver. Therefore, educating the development<br />

community and ensuring clarity <strong>of</strong> the fee waiver is important to the future success <strong>of</strong> the program.<br />

Applicability to <strong>Alexandria</strong><br />

The <strong>City</strong> <strong>of</strong> <strong>Alexandria</strong> does not charge specific impact fees for development projects. However, developers are<br />

required to address infrastructure issues through the <strong>City</strong>’s permitting process. Allowing for the reduction in fees<br />

in exchange for affordable housing would be a tool available to the <strong>City</strong>, but the impact to competing priorities<br />

would need to be considered. The city would not need state enabling legislation to implement this program.<br />

4. Denver Metropolitan Area – Partnership Development<br />

Facing high land costs, rising home prices, and the typical metropolitan problems <strong>of</strong> sprawl, a jobs‐housing<br />

mismatch, and traffic congestion—communities in the Metro Denver area have implemented local policies that<br />

create affordable housing in order to positively impact these interconnected problems. The Metro Denver<br />

experience shows that any municipality can take local action to successfully address the need for more affordable<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong> Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

4

housing. And, in the process, a municipality can help to address the broader quality <strong>of</strong> life issues that affect its<br />

citizens and the citizens across the region. The examples below show how two <strong>of</strong> the four cities created significant<br />

affordable housing using inclusionary zoning. Details <strong>of</strong> the programs may differ, but the concept is the same.<br />

4a. Boulder, Colorado<br />

Source:<br />

http://www.bpichicago.org/documents/Denver_Report.pdf<br />

Overview<br />

In 2000, in response to rapidly rising housing costs and the ineffectiveness <strong>of</strong> a voluntary inclusionary housing<br />

program, the <strong>City</strong> <strong>of</strong> Boulder passed a mandatory inclusionary housing ordinance. The new program requires 20%<br />

<strong>of</strong> housing in new developments to be priced affordably for low‐income households (households earning less than<br />

80% <strong>of</strong> the area median income). The comprehensive mandatory ordinance covers all residential developments<br />

regardless <strong>of</strong> size (with the exception <strong>of</strong> developments <strong>of</strong> a single lot with one owner and total floor area <strong>of</strong> less<br />

than 1,600 feet).<br />

How does it work?<br />

If the development has four or fewer units, the developer must create one affordable unit on‐site, one affordable<br />

unit <strong>of</strong>f‐site, dedicate land for one affordable unit, or pay a fee <strong>of</strong> roughly $18,000 to Boulder’s <strong>Affordable</strong> <strong>Housing</strong><br />

Trust Fund. The only cost <strong>of</strong>fset provided to the developer is a waiver <strong>of</strong> development excise taxes. However, for<br />

developments that provide more than 20% affordable units, the developer can also receive subsidy funds for land<br />

use review and building permit fees.<br />

Results<br />

Since 2000, the <strong>City</strong> <strong>of</strong> Boulder constructed 380 affordable homes, including condominiums, townhomes, and<br />

single‐family homes. While market‐rate units in the developments continued to sell for between $390,000 and<br />

$430,000, the affordable units were priced between $112,000 and $185,000. Ninety‐eight percent <strong>of</strong> people who<br />

moved into the affordable units already lived or worked in Boulder, and they included teachers, nurses and other<br />

service sector workers. The <strong>City</strong> collected $1.5 million in fee‐in‐lieu payments from roughly 50 developments.<br />

Payments are deposited in an affordable housing fund, which has subsidized the creation <strong>of</strong> about 80 affordable<br />

units each year.<br />

Challenges<br />

The current inclusionary zoning ordinance has both a direct and an indirect effect on the market price <strong>of</strong> housing in<br />

Boulder. The direct effect is that developers must make up the incremental cost <strong>of</strong> constructing permanently<br />

affordable dwellings. Some <strong>of</strong> these costs are passed on to Boulder‘s homebuyers. The indirect effect is that house<br />

prices for all housing consumers increase as the <strong>City</strong> takes existing dwellings out <strong>of</strong> the housing stock and<br />

dedicates them to permanent affordable units. Furthermore, the existing program for permanent affordable<br />

owner‐occupied housing accelerates the rate <strong>of</strong> depreciation in the stock <strong>of</strong> owner‐occupied housing because it<br />

does not allow homeowners to earn a return on their maintenance and repair expenditures.<br />

Applicability to <strong>Alexandria</strong><br />

The mandatory zoning approach to affordable housing has proven to be a very effective means <strong>of</strong> increasing the<br />

number affordable housing units in many localities and could be a very effective tool to produce more affordable<br />

housing in the <strong>City</strong> <strong>of</strong> <strong>Alexandria</strong>. However, this tool would need state enabling legislation to be implemented.<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong> Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

5

4b. <strong>City</strong> <strong>of</strong> Denver<br />

Sources:<br />

http://www.bpichicago.org/documents/Denver_Report.pdf<br />

www.realtor.org/smart_growth.nsf/docfiles/winter07proscons.pdf/$FILE/winter07proscons.pdf<br />

http://www.milehigh.com/resources/custom/pdf/housing/2004_Final_IHO_Report.pdf<br />

Overview<br />

To address the growing affordability crisis, in 2002, the <strong>City</strong> <strong>of</strong> Denver passed an inclusionary housing policy called<br />

the Moderately Priced Dwelling Unit program. The policy requires all new owner occupied developments <strong>of</strong> more<br />

than 30 units to include 10% <strong>of</strong> the units as affordable. As <strong>of</strong> 2005, the ordinance—coupled with the rezoning <strong>of</strong><br />

large‐scale redevelopments and proactive planning for affordable housing—resulted in the creation <strong>of</strong> 3,395<br />

affordable homes in Denver.<br />

How does it work?<br />

The policy is voluntary for rental developments, and it does not apply to condo conversions. The owner‐occupied<br />

units must be affordable to households earning less than 80% <strong>of</strong> area median income. A developer who provides<br />

the affordable units will receive a 10% density bonus (except for developments in certain zoning districts, planned<br />

unit developments, or districts where no residential use is permitted). The developer may also receive a subsidy <strong>of</strong><br />

$5,000 to $10,000 per affordable unit (up to 50% <strong>of</strong> the total units), a reduction in the number <strong>of</strong> required parking<br />

spaces per unit, and an expedited permitting process. Instead <strong>of</strong> building the affordable units on‐site, a developer<br />

may pay a fee <strong>of</strong> 50% <strong>of</strong> the price per affordable unit not built into the trust fund. The developer may build the<br />

affordable units <strong>of</strong>f‐site if she or he builds more affordable units than would have been required in the market‐rate<br />

development. The MPDUs must remain affordable for at least 15 years after they are first sold.<br />

Results<br />

As <strong>of</strong> 2002, development was continuing apace and 3,395 affordable homes were built. The <strong>City</strong> planned to review<br />

its “fee‐in‐lieu‐<strong>of</strong> housing” payment program that was established to provide developers an option to pay a fee<br />

instead <strong>of</strong> providing a moderate price dwelling unit (MPDU). From constitutional arguments to price and rent<br />

control prohibitions, inclusionary housing proponents frequently have to overcome legal challenges from a<br />

development community that is <strong>of</strong>ten fervent in its opposition. In addition, some challenges faced in Denver as <strong>of</strong><br />

2004 include: on‐going management and monitoring <strong>of</strong> the housing inventory being created by the requirement<br />

for the entire affordability period <strong>of</strong> each unit; maintaining adequate funding for the rebate incentive (the program<br />

relies upon a nominal amount <strong>of</strong> projects electing the cash‐in‐lieu option to provide income to support payment <strong>of</strong><br />

the rebates), enhancing the incentive package to keep pace with developer concerns (the use <strong>of</strong> current incentives<br />

needs to be reviewed, with developer input, to ensure that they are effectively assisting in providing affordability<br />

to their projects), and ensuring that unit production assisted by the program is consistent with the targeted needs<br />

<strong>of</strong> households.<br />

Applicability to <strong>Alexandria</strong><br />

Establishing a voluntary zoning or incentive zoning policy enables local governments to provide density bonuses<br />

and other incentives to developers, in exchange for delivery <strong>of</strong> public benefits such as affordable housing. While<br />

such a tool can help produce more affordable housing in the <strong>City</strong> <strong>of</strong> <strong>Alexandria</strong>, it would need state enabling<br />

legislation to be implemented.<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong> Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

6

5. San Francisco Bay Area ‐ Partnership Development<br />

Sources:<br />

http://www.bayareavision.org/initiatives/equitabledevelopment.html#sf<br />

http://www.abag.ca.gov/planning/housingneeds/pdf/resources/A_Place_to_Call_Home_2007.pdf<br />

http://www.abag.ca.gov/housing‐top.html<br />

http://www.sjhousing.org/report/edec/Ecdc/6‐23‐08/<strong>Housing</strong>_Element.pdf<br />

The Association <strong>of</strong> Bay Area Governments (ABAG), a regional land use planning agency for the nine‐county San<br />

Francisco Bay Area, is very involved in trying to increase the range <strong>of</strong> housing choices in the region. One <strong>of</strong> the<br />

initiatives recently completed is the Regional <strong>Housing</strong> Needs Allocation (RHNA). RHNA is a state mandated process<br />

for determining how many housing units, including affordable units, each community must plan to accommodate.<br />

Working with local governments, ABAG developed an allocation methodology for assigning units, by income<br />

category, to each city and county in the nine‐county Bay Area. This allocation <strong>of</strong> need shows local governments the<br />

total number <strong>of</strong> housing units, by affordability, for which they must plan in their <strong>Housing</strong> Elements (a plan that<br />

ensures that local governments adequately plan to meet the housing needs <strong>of</strong> all people within the community—<br />

regardless <strong>of</strong> their income) for the period. Allocations for each jurisdiction are published in the annual housing<br />

report.<br />

How does it work?<br />

The regional housing need is determined by estimating the existing and projected need for housing. Both are<br />

determined through estimates <strong>of</strong> existing and projected household growth. Household growth is dependent on<br />

total net births, migration and household formation rates ‐ how many new households are formed each year, e.g.,<br />

young adults move out <strong>of</strong> their parent’s home into homes <strong>of</strong> their own.<br />

Results<br />

The 2006 projected regional need for the Bay Area was 230,743 housing units.<br />

Challenges<br />

The RHNA presents both opportunities and challenges for the region. To meet the RHNA goal, cities have<br />

developed housing policies, implemented land use regulations, and/or inventoried housing opportunity sites in<br />

order to facilitate housing production. While some cities have proactively planned for residential uses in their<br />

General Plan and have met some <strong>of</strong> its goals, it is a challenge for the homebuilding industry to construct units at a<br />

high enough level <strong>of</strong> production for all income categories in order to meet the cities’ RHNA goal. Construction <strong>of</strong><br />

homes, according RHNA goals, is especially challenging given the slowdown in the housing market and in the<br />

overall economy. Banks have tightened their lending practices, making conditions difficult for consumers to obtain<br />

mortgages and potentially for developers to obtain construction loans. Raw material and construction costs have<br />

increased significantly in the last few years, creating challenges to develop housing projects that are financially<br />

feasible, especially for affordable housing developments<br />

Applicability to <strong>Alexandria</strong><br />

While a regional program has the potential to address housing and related issues (such as congestion/traffic) by<br />

requiring jurisdictions to produce a range <strong>of</strong> housing for all income levels, there are significant challenges to<br />

establishing such a program for the DC Metro area. While the Council <strong>of</strong> Governments (COG) does currently serve<br />

as the regional coordinating organization, the area it covers spans three states and many jurisdictions. In addition,<br />

local jurisdictions in Virginia are not currently allowed to require affordable housing, and would therefore require<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong> Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

7

state enabling legislation to be implemented. This program appears to be <strong>of</strong> limited value in structuring a program<br />

for <strong>Alexandria</strong>.<br />

6. <strong>Housing</strong> Trust Santa Clara County (HTSCC)<br />

Source:<br />

http://www.housingtrustscc.org/about‐us/index.php<br />

How it Works<br />

In the 1990's, the high cost <strong>of</strong> housing in Silicon Valley had skyrocketed. Individuals and families were impacted, as<br />

well as business owners, who complained <strong>of</strong> recruiting and retention problems. Led by the Santa Clara County<br />

Board <strong>of</strong> Supervisors, what is now the Silicon Valley Leadership Group, affordable housing activists, local<br />

businesses and foundations organized to create something groundbreaking: a non‐pr<strong>of</strong>it <strong>Housing</strong> Trust, supported<br />

by voluntary contributions, devoted to addressing the full range <strong>of</strong> affordable housing needs from increasing<br />

homeownership and preventing homelessness to increasing the supply <strong>of</strong> rental and permanent housing. Within<br />

two years HTSCC had exceeded its goal <strong>of</strong> raising $20 million from a range <strong>of</strong> sources, including: The Santa Clara<br />

County Board <strong>of</strong> Supervisors, Intel, Adobe Systems, Cisco Systems, Applied Materials, Solectron and homebuilder<br />

KB Homes, and all cities and towns in Santa Clara County.<br />

Results<br />

Today, scores <strong>of</strong> Silicon Valley employers, employer foundations, state and federal housing agencies and private<br />

citizens have contributed to the shared goal to increase affordable housing options. HTSCC has raised more than<br />

$40 million to invest more than $32 million to create thousands <strong>of</strong> housing opportunities for Silicon Valley's<br />

workforce, families, seniors and special needs individuals by making loans and grants to developers increasing the<br />

supply <strong>of</strong> affordable housing, assisting first‐time homebuyers, preventing homelessness and stabilizing<br />

neighborhoods, and leveraged over $1.7 billion to create more than 7,800 housing opportunities. Of those served,<br />

83% had household incomes below 80% <strong>of</strong> the Area Medium Income (AMI).<br />

First‐Time Homebuyer Program<br />

Total Invested: over $14.7 million<br />

Total Leveraged: over $693 million<br />

New Homeowners Created: 2,089<br />

Developer Loan Program<br />

Total Invested: $7.8 million<br />

Total Leveraged: $467 million<br />

Families Helped: 1,643<br />

Homelessness Prevention Program<br />

Total Invested: nearly $10.4 million<br />

Families and Individuals Assisted with <strong>Housing</strong>: nearly 4,110<br />

Applicability to <strong>Alexandria</strong><br />

A housing trust fund leveraging public and private funds would certainly be applicable in <strong>Alexandria</strong>. The challenge<br />

is that while <strong>Alexandria</strong> does have significantly high housing costs, like Silicon Valley, it might not likely have the<br />

same level <strong>of</strong> potential corporate participation or corporate interest, and may not have the political/public<br />

constituency to build an organization <strong>of</strong> this scale. However it could be explored at a smaller scale, and/or on a<br />

regional level.<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong> Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

8

7. Seattle Washington Transfer <strong>of</strong> Development Rights Program<br />

Source:<br />

http://www.seattle.gov/housing/incentives/TDRbonus.htm<br />

http://www.housingpolicy.org/toolbox/strategy/policies/diverse_housing_types.html?tierid=45<br />

Overview<br />

The <strong>City</strong> <strong>of</strong> Seattle Washington adopted a Transferable Development Rights (TDR) Program in 1985. This program<br />

allows commercial developers who want more density than allowed under zoning rules to purchase unused<br />

density from owners <strong>of</strong> downtown properties with affordable housing, landmark buildings, or major open space.<br />

This program sets up a framework in which developers can purchase additional development rights instead <strong>of</strong><br />

going through various administrative processes that allow them to increase the density on their project.<br />

How does it work?<br />

The <strong>City</strong> designated sending and receiving areas within the downtown portions <strong>of</strong> the <strong>City</strong>. The receiving areas are<br />

places where additional development is desired and the sending areas include affordable housing units that <strong>City</strong><br />

wishes to preserve. Commercial developers who own property in the designated receiving areas can negotiate<br />

and purchase unused density from property owners in the sending area. Additionally, the <strong>City</strong> <strong>of</strong> Seattle purchases<br />

unused density from the owners <strong>of</strong> certified TDR sites and places that density in a TDR bank. All transactions,<br />

whether private or through the <strong>City</strong>, require execution and recording <strong>of</strong> a TDR Agreement between the owner <strong>of</strong><br />

the TDR site and the <strong>City</strong>. The TDR is validly transferred by Statutory Warranty Deed and is recognized by the<br />

courts as real property. In return for the ability to sell the unused square footage on their property, owners <strong>of</strong><br />

certified TDRs are required to preserve the housing located there as affordable for a period <strong>of</strong> 50 years, typically to<br />

residents at or below 50% percent <strong>of</strong> the area median income. In addition, the money that property owners<br />

receive from the sale <strong>of</strong> a TDR is used to rehabilitate the property and increase its useful life.<br />

Results<br />

Seattle’s TDR and bonus programs have contributed over $14 million <strong>of</strong> funding for affordable housing projects in<br />

downtown. In return, this funding has helped to preserve over 900 units <strong>of</strong> affordable housing in 14 downtown<br />

projects. Of the 900 units, 491 units are affordable to households up to 30% <strong>of</strong> median income and 342 units are<br />

affordable to households up to 50% <strong>of</strong> median income. In light <strong>of</strong> the newly adopted emphasis <strong>of</strong> the FAR system<br />

on housing, these two programs are projected to contribute an additional $14 million toward the preservation and<br />

production <strong>of</strong> affordable housing in downtown in the next 10 years.<br />

Challenges<br />

One <strong>of</strong> the identified challenges <strong>of</strong> this program is the willingness to allow commercial developers to buy<br />

additional property rights. In order to create a market for TDRs, the local government must be willing to make<br />

developers purchase additional development rights instead <strong>of</strong> simply awarding them through an administrative<br />

process. Furthermore, local governments must be willing to allow the extra development potential without<br />

demanding several other additional requirements. Another challenge is creating the market for the TDRs. Seattle<br />

created this market by buying many <strong>of</strong> the development rights during the beginning <strong>of</strong> the years <strong>of</strong> the project<br />

which requires capital.<br />

Applicability to <strong>Alexandria</strong><br />

This tool could be applicable to the <strong>City</strong> <strong>of</strong> <strong>Alexandria</strong> because, like Seattle, <strong>Alexandria</strong> has high land cost. The high<br />

land costs create an atmosphere in which higher densities are desirable among commercial developers hence<br />

helping to create a market for the TDRs. However, this tool does require strong political and community support<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong> Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

9

to uphold the zoning by right issues and higher densities in various portions <strong>of</strong> the city, and the city would need to<br />

adopt a more entrepreneurial approach to land use in helping facilitate TDR negotiations. State enabling legislation<br />

would not be needed to implement this program.<br />

8. Commonwealth <strong>of</strong> Massachusetts Chapter 40R Program<br />

Source:<br />

http://www.mass.gov/envir/smart_growth_toolkit/pages/mod‐40R.html<br />

Overview<br />

Massachusetts’ Chapter 40R program encourages communities to create dense residential or mixed‐use smart<br />

growth zoning districts located near transit stations, in areas <strong>of</strong> concentrated development such as existing city<br />

and town centers, and in other highly suitable locations. In addition, Chapter 40R districts are required to include a<br />

high percentage <strong>of</strong> affordable housing.<br />

How does it work?<br />

The Chapter 40R Program encourages communities to establish development overlay zones in smart growth<br />

locations by <strong>of</strong>fering financial incentives to the local governments ($3,000 per housing unit). In order to receive the<br />

financial incentives, a local government must adopt an overlay zone that meets the location and procedural<br />

processes established by the statute. The overlay zones are then approved by the states and the financial<br />

incentives are paid once housing units are built.<br />

In addition to the location criteria, the overlay zones must meet a number <strong>of</strong> procedural criteria in order to receive<br />

approval from the state. The overlay zone must allow residential densities <strong>of</strong> at least 8 to 20 units an acre by right,<br />

<strong>of</strong>fer developers a more certain approval process including making allowable uses by right, establish a maximum<br />

120 day period for project approvals, and allow denials only for non‐compliance with the bylaw or design<br />

standards. In order to be an approved Chapter 40R district eligible for the financial incentives, at least 20 percent<br />

<strong>of</strong> the housing built within the overlay zone must be affordable.<br />

Results<br />

This state law was enacted in 2005 and as <strong>of</strong> August 2009 27 districts have been approved that will allow for the<br />

construction <strong>of</strong> 9,780 housing units, 2,100 <strong>of</strong> which must be affordable. Of the 27 districts, 17 have given plan<br />

approval for a total <strong>of</strong> 3,214 units <strong>of</strong> which at least 830 will be affordable and 347 have been built. The success <strong>of</strong><br />

these districts has sparked additional interest and it is estimated that about 20 communities are reported to be<br />

planning or considering creating districts Chapter 40R Districts.<br />

Challenges<br />

One <strong>of</strong> the challenges that has been identified is the time and expense it takes to set up a district. Planners<br />

interviewed on the Chapter 40R program suggest it took on average more than a year to go through the planning,<br />

public hearing, application, local and state approval process. In addition, it is estimated that the cost to set up a<br />

district was $35,000 – $65,000.<br />

Applicability to <strong>Alexandria</strong><br />

Since the Chapter 40R Program is a state program administrated by the State <strong>of</strong> Massachusetts, there are certain<br />

portions that would not be applicable to the <strong>City</strong> <strong>of</strong> <strong>Alexandria</strong>. For example, the <strong>City</strong> is not going to receive a<br />

financial incentive from the state to set up a district as described in this program. However, the procedural<br />

requirements such as approval deadlines and development densities allowable by right with certain geographic<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong> Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

10

oundaries could be implemented within the <strong>City</strong> <strong>of</strong> <strong>Alexandria</strong>. The city would not need enabling legislation to<br />

implement the procedural requirements associated with this program.<br />

9. Corte Madera, CA <strong>Affordable</strong> <strong>Housing</strong> Overlay Zones<br />

Source:<br />

http://www.kennedycommission.org/documents/HE_Toolbox_000.pdf<br />

http://www.snrpc.org/Workforce<strong>Housing</strong>/Development/<strong>Affordable</strong><strong>Housing</strong>OverlayZoning.pdf<br />

Overview<br />

The town <strong>of</strong> Corte Madera, CA has established a number <strong>of</strong> overlay zones in its zoning code that address the<br />

development <strong>of</strong> affordable housing. The zoning code includes the following zones: an optional affordable housing<br />

zone, two exclusive affordable housing zones, and a mixed use affordable housing overlay zone.<br />

How does it work?<br />

The Town <strong>of</strong> Corte Madera, CA includes two overlay zones that require that 100 percent <strong>of</strong> the housing built within<br />

the specific area is affordable, and two overlay zones that allow a number <strong>of</strong> incentives if affordable housing is<br />

provided. The exclusive affordable overlay zones are old and abandoned industrial and commercial sites that<br />

currently do not allow residential development. The exclusive overlay zone allows the site to redeveloped with<br />

residential development, but only if 100 percent <strong>of</strong> the units are deemed affordable. These zones ensure that the<br />

identified sites are preserved for affordable housing and encourage for‐pr<strong>of</strong>it/nonpr<strong>of</strong>it/ public partnerships in<br />

order to access public financing for maximum affordability and quality. The two optional affordable housing<br />

overlay zones allow incentives such as increased density by right and reduction in fees if specific amounts <strong>of</strong><br />

affordable housing are provided.<br />

Applicability to <strong>Alexandria</strong><br />

The <strong>City</strong> <strong>of</strong> <strong>Alexandria</strong> has very few abandoned sites that do not contain substantial market value; therefore, it<br />

would be very difficult to implement “exclusive affordable housing overlay zones” at such sites. In addition,<br />

creating overlay zones that require certain percentages <strong>of</strong> affordable housing without providing additional<br />

incentives would require state enabling legislation. However, the city could implement overlay zones that provide<br />

additional incentives in return for certain percentages <strong>of</strong> affordable housing that would be more in line with the<br />

<strong>Alexandria</strong> market and would not require state enabling legislation.<br />

<strong>Affordable</strong> <strong>Housing</strong> <strong>Regulatory</strong> Tools <strong>Case</strong> <strong>Studies</strong> Compiled by the <strong>Alexandria</strong> Office <strong>of</strong> <strong>Housing</strong>, December 2010<br />

11