case comment - ITMA

case comment - ITMA

case comment - ITMA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

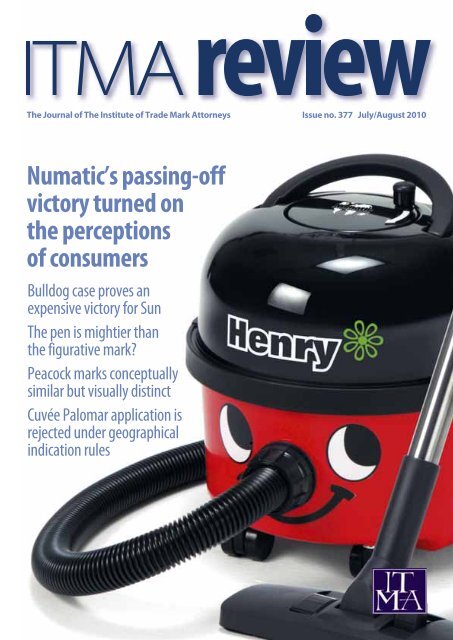

The Journal of The Institute of Trade Mark Attorneys<br />

Numatic’s passing-off<br />

victory turned on<br />

the perceptions<br />

of consumers<br />

Bulldog <strong>case</strong> proves an<br />

expensive victory for Sun<br />

The pen is mightier than<br />

the figurative mark?<br />

Peacock marks conceptually<br />

similar but visually distinct<br />

Cuvée Palomar application is<br />

rejected under geographical<br />

indication rules<br />

Issue no. 377 July/August 2010

<strong>ITMA</strong> business<br />

Public relations: Mama Mia!<br />

here we go again . . . . . . . . . . . . . . . . . .2<br />

Chief Executive’s Bulletin:<br />

gearing up for summer? . . . . . . . . . . .5<br />

Northern Seminar 24 June 2010 . . .6<br />

Presentation by the Legal Services<br />

Board on Alternative Business<br />

Structures . . . . . . . . . . . . . . . . . . . . . . . . . . .8<br />

<strong>ITMA</strong> Summer Reception,<br />

8 July 2010 . . . . . . . . . . . . . . . . . . . . . . .10<br />

Book review<br />

Practical, but not quite there<br />

in practice . . . . . . . . . . . . . . . . . . . . . . . .12<br />

Case <strong>comment</strong><br />

Bulldog <strong>case</strong> proves an expensive<br />

victory for Sun . . . . . . . . . . . . . . . . . . .13<br />

The pen is mightier than the<br />

figurative mark? . . . . . . . . . . . . . . . . . .14<br />

Unibanco: late submission<br />

meant OHIM did not consider<br />

‘uni’ prefix evidence . . . . . . . . . . . . . .16<br />

Kremezin encroaches on<br />

Krenosin’s development . . . . . . . . .17<br />

Golden Toast registration goes<br />

up in smoke after ‘descriptive’<br />

decision . . . . . . . . . . . . . . . . . . . . . . . . . .18<br />

Hypnotizer and Hpnotiq at<br />

higher end of similarity scale . . . . .20<br />

Court of Appeal applies ECJ’s<br />

guidance reluctantly . . . . . . . . . . . . .22<br />

Firstrung bad faith verdict . . . . . . . .23<br />

General Court decision means<br />

game over in trade mark<br />

invalidity action . . . . . . . . . . . . . . . . . .24<br />

Intelligent Sensor fails . . . . . . . . . . . .25<br />

Peacock marks conceptually<br />

similar but visually distinct . . . . . . .26<br />

Numatic’s passing-off victory<br />

turned on the perceptions of<br />

consumers . . . . . . . . . . . . . . . . . . . . . . .28<br />

Rioja regulators toast vinegar<br />

label decision . . . . . . . . . . . . . . . . . . . .30<br />

Cuvée Palomar application is<br />

rejected under geographical<br />

indication rules . . . . . . . . . . . . . . . . . . .32<br />

International<br />

Malaysia: first user has stronger<br />

claim to Jost . . . . . . . . . . . . . . . . . . . . .34<br />

CONTENTS<br />

Noticeboard<br />

Who’s who in <strong>ITMA</strong> . . . . . . . . . . . . . . . .35<br />

And finally...<br />

Chris Gibson, 1943-2010 . . . . . . . . . .36<br />

Forthcoming events 2010 . . . . . . . .36<br />

Cover picture: the new Henry ‘Flower’<br />

model, courtesy of Numatic International.<br />

The views expressed in the articles in the<br />

Review are personal to the authors and we<br />

make no representations nor warranties<br />

of any kind about the accuracy of the<br />

information contained in the articles.<br />

<strong>ITMA</strong> Review copy deadlines<br />

Contributions to the Review must be<br />

received by the 12th of the month for<br />

publication in the following month’s<br />

issue, including whenever possible highresolution<br />

images of authors and relevant<br />

graphics. These are best sent as separate<br />

files rather than embedded in Word<br />

documents. Illustrations or photos often<br />

add interest and aid understanding of the<br />

issues covered in articles. Please email<br />

material to Kelly Robson, Editor, at<br />

kellyrobson@btinternet.com and Tania<br />

Clarke at tclarke@withersrogers.com<br />

The Institute of Trade<br />

Mark Attorneys<br />

5th Floor<br />

Outer Temple<br />

222-225 Strand<br />

London WC2R 1BA<br />

Tel: 020 7101 6090<br />

Fax: 020 7101 6099<br />

Web: www.itma.org.uk<br />

© 2010<br />

<strong>ITMA</strong> BUSINESS<br />

Media watch<br />

<strong>ITMA</strong> BUSINESS<br />

PUBLIC<br />

RELATIONS<br />

Mama Mia!<br />

here we<br />

go again...<br />

Three very famous brands feature<br />

in this month’s review of the press.<br />

Firstly, a <strong>case</strong> that is just about to<br />

embark as I pen this column, so the<br />

situation may well have moved on<br />

by the time you are reading this. Sir<br />

Stellios – no surname required – is<br />

fighting the company he formed,<br />

EASYJET, over the ancillary services<br />

that the airline can offer. The dispute<br />

centres on an agreement drawn up<br />

when the airline floated on the<br />

London Stock Exchange in 2000 and<br />

the Independent used the story to<br />

highlight previous <strong>case</strong>s including<br />

APPLE and BUDWEISER. I suspect<br />

this story will “fly” for a while!<br />

The second “iconic” brand to feature<br />

is HARRODS who attracted much<br />

media interest when they threatened<br />

legal action against a small cafe in<br />

Witham, Essex, over the stylised use<br />

of HOLLANDS in the name Hollands<br />

Cafe Lounge which Harrods claim is<br />

too similar to the Harrods stylised<br />

logo. Again, stories of small<br />

companies receiving legal notices<br />

from large companies are often<br />

newsworthy, regardless of who is<br />

in the right.<br />

The third “big name” to feature in this<br />

round-up is the band ABBA, which<br />

has decided to take action against 15<br />

ABBA tribute groups who all include<br />

the name ABBA in their names.<br />

Apparently there are over 40 ABBA<br />

2 <strong>ITMA</strong> Review July/August 2010

tribute groups in the UK alone and<br />

the quality of some has prompted<br />

Universal Music in Sweden to take<br />

action. I’m sure you can all think of<br />

puns to describe the action but one<br />

line comes to my mind – “Mama Mia,<br />

here we go again ... ” Sorry!<br />

The last story I picked up didn’t<br />

feature a famous brand but it did<br />

have a famous personality behind<br />

the story – Tony Benn – who, the<br />

Daily Mail reported at length, had<br />

“invented” a method of taking the<br />

strain while waiting for trains, planes<br />

and other forms of transport. His<br />

SEATCASE has just had approval<br />

from the Furniture Industry Research<br />

Association (FIRA) which he could<br />

take to market. As you all know, he<br />

should check whether anyone is<br />

already using SEATCASE and I have to<br />

report that there is already a company<br />

out there with a UK registration for<br />

luggage. His earlier invention of<br />

Backbencher for a similar application<br />

might serve him better though I’m<br />

sure a good attorney will plead his<br />

<strong>case</strong> with whatever name he goes<br />

with – and get some decent publicity<br />

into the bargain.<br />

Incidentally, one of our members<br />

who helped out at one of our<br />

Business Advice Open Days has<br />

come across a useful search facility,<br />

www.tmview.europa.eu/tmview,<br />

which includes data from official trade<br />

mark offices who have signed up.<br />

Currently eight offices (including the<br />

UK), OHIM and WIPO have signed up<br />

and they aim to cover the whole EU.<br />

It may be worth a look.<br />

As for our own efforts, we issued<br />

a press release announcing the<br />

new Nottingham Law School skillsbased<br />

qualification, which offers a<br />

transitional course from this October<br />

and, subject to validation, a full<br />

Certificate in Trade Mark Practice<br />

in 2011. The press release also<br />

announced the <strong>ITMA</strong> Litigator<br />

Certificate and <strong>ITMA</strong> Advocacy<br />

Certificate, which allows trade mark<br />

attorneys to practice litigation and<br />

appear as advocates before the<br />

Patents County Court.<br />

As usual we issued local press<br />

releases announcing our presence at<br />

the Business Advice Open Days. BBC<br />

Radio Oxford took up our offer of<br />

an interview and Janice Trebble of<br />

July/August 2010<br />

<strong>ITMA</strong> BUSINESS<br />

Saunders and Dolleymore gave an<br />

eight-minute live interview on their<br />

breakfast show on the morning of the<br />

exhibition. With excerpts repeated<br />

on the news headlines, this was a<br />

fantastic piece of free publicity for us;<br />

all for the price of a stamp and a little<br />

bit of effort. We put a link to her<br />

interview on the <strong>ITMA</strong> website,<br />

although we could only do this for<br />

one week without hitting copyright<br />

issues.<br />

Finally under Media Watch, we have<br />

written another two articles: one for<br />

the UK Science Parks Journal – which<br />

invite us to write for them every year,<br />

so we must be doing something right<br />

– and a new request from Financier<br />

Worldwide, which claims to have<br />

a readership of 90,000 over 42<br />

countries. These, again, are always<br />

useful sources of free publicity for<br />

<strong>ITMA</strong> and the profession.<br />

Business Advice Open Days<br />

My thanks go to Kieron Taylor of<br />

Swindell and Pearson and Rob<br />

Furneaux of Rouse & Co for their<br />

assistance at the Coventry Advice Day<br />

and to Natalie Brindle of Harrison IP<br />

and to Sam Bristow and Jeni Casey of<br />

Walker Morris who are due to help<br />

out in Llandudno and Sunderland<br />

respectively to complete the summer<br />

term of exhibitions.<br />

Liaison with IPO<br />

Kieron Taylor is also due to present<br />

an IPO Masterclass in Coventry on<br />

29 July on behalf of <strong>ITMA</strong> in a<br />

joint presentation with a CIPA<br />

representative. These Masterclasses<br />

are aimed at business advisers who<br />

complete a two-and-a-half-day<br />

course developed by the IPO in<br />

partnership with Coventry University<br />

and the British Library. The main<br />

purpose of Kieron’s presentation is to<br />

explain what attorneys do and to<br />

emphasise that professional advice is<br />

available and that advisers need to<br />

know where to draw the line between<br />

information and advice. A little<br />

knowledge is sometimes a very<br />

dangerous thing and, while these<br />

courses have been developed by<br />

others, it is important that we make<br />

an input to demonstrate the added<br />

value of using <strong>ITMA</strong> members.<br />

Similarly, <strong>ITMA</strong> members attend IPO<br />

branding seminars. Gareth Jenkins of<br />

Wynne-Jones, Laine & James made<br />

the <strong>ITMA</strong> presentation in Cardiff on<br />

29 June and was supported by other<br />

members of his firm, as well as<br />

attorneys from other firms in the<br />

region who provided one-to-one<br />

sessions for the audience. My thanks<br />

go to all those members who<br />

volunteered and I would urge<br />

everyone to keep a lookout for events<br />

occurring in their region as they<br />

provide an invaluable platform to<br />

demonstrate the professionalism of<br />

Institute members. The <strong>ITMA</strong> office<br />

tries to ensure all members in the<br />

regions where these occur are<br />

notified but it is always worth keeping<br />

an eye out for news of them on the<br />

IPO website.<br />

Liaison with Business Link<br />

For some time we have been<br />

conscious that we need to do more<br />

with other government departments<br />

and agencies to ensure the messages<br />

about trade marks and the value of<br />

the trade mark attorney profession<br />

are foremost in the minds of those<br />

people advising business. <strong>ITMA</strong> Chief<br />

Executive Keven Bader and I as PR<br />

Manager met with the Theme<br />

Manager for Exploit Your Ideas<br />

and Grow Your Business of<br />

businesslink.gov.uk to discuss how<br />

the Institute can ensure the<br />

information on their website is<br />

accurate in respect of trade marks and<br />

to improve the links from their site to<br />

ours. We have agreed to be what is<br />

termed a secondary Proxy Approver<br />

for content, on an ad hoc basis, so<br />

that at least content will be accurate.<br />

With a bit of luck we should also be<br />

able to raise the profile of the Institute<br />

with links and our logo on the<br />

businesslink.gov website.<br />

We have also been in touch with<br />

the Theme Manager for Starting Up<br />

and already drawn his attention to<br />

the importance to business of<br />

recognising that registering company<br />

names at Companies House does not<br />

cover trade mark registration. These<br />

are long term projects for the PR &<br />

Communications Committee to take<br />

forward and we will be considering<br />

what other activities we can<br />

undertake that will result in a better<br />

service for business, such as how we<br />

can also influence content on the<br />

other main government portal<br />

direct.gov.uk.<br />

<strong>ITMA</strong> Review 3

<strong>ITMA</strong> BUSINESS<br />

Below are examples of the savings<br />

members made by using IP Benefits<br />

Plus in the last quarter.<br />

It is certainly worth looking at<br />

the offers, some of which are<br />

highlighted in the Public Relations<br />

column, and is yet another example<br />

of the advantages of being an <strong>ITMA</strong><br />

member.<br />

To access IP Benefits go to the<br />

members section of the <strong>ITMA</strong><br />

website, click on Members Home<br />

IP Benefits<br />

This month the IP Benefits Team at<br />

Parliament Hill has asked us to<br />

highlight the following deals:<br />

Beautiful flowers and gifts at<br />

amazing discounted prices<br />

delivered direct to your door.<br />

Exclusive 10% discount, from<br />

Flowers Direct.<br />

CDs from as little as £7.49 with<br />

free worldwide delivery from CD<br />

WOW. DVDs and games are also<br />

discounted.<br />

CDs from as little as £6.49 with<br />

free worldwide delivery from<br />

Bang CD.<br />

You can now save up to 75% on<br />

work and leisure magazines by<br />

subscribing through the Magazine<br />

Group – and postage is free.<br />

Pay less than half price on shirts<br />

and accessories from TM Lewin.<br />

Up to 20% discount on family days<br />

out with Merlin Attractions. Alton<br />

Towers, Chessington World of<br />

Adventures, The London<br />

Dungeon and many more are<br />

covered with these discounts.<br />

The Gourmet Society has teamed<br />

up with over 3,000 leading<br />

restaurants across the country<br />

to offer some fantastic discounts.<br />

Enjoy 2-for-1 meals or 25% off<br />

your bill – including drinks – at<br />

<strong>ITMA</strong> BUSINESS<br />

(top left) and then click on the IP<br />

Benefits graphic.<br />

One member saved £200.40<br />

with Old English Inns.<br />

Mr V saved £183.42 with<br />

HotelStayUK.<br />

Mr A saved £58.38 with Holiday<br />

Autos.<br />

One member saved £152.64<br />

with Buying Support Agency.<br />

One member saved £36.33 with<br />

CottageStayUK.<br />

a wide variety of participating<br />

establishments, from Michelinstarred<br />

establishments to awardwinning<br />

independents and<br />

famous names like Pizza Express,<br />

Café Rouge, Loch Fyne, The<br />

Living Room and Prezzo.<br />

Members can now take advantage<br />

of an exclusive 7.5% discount on<br />

the SayShopping Pass – the multiretailer<br />

gift voucher that can be<br />

spent in some of the UK's biggest<br />

and best shopping, activity,<br />

entertainment and dining outlets.<br />

This versatile voucher covers over<br />

12,000 UK outlets including Comet,<br />

Debenhams, JJB Sports, Boots and<br />

River Island, making it a suitable<br />

gift for any occasion. Many people<br />

also use the vouchers to save<br />

money on their own retail<br />

expenditure: if you buy, for<br />

example, £100 of vouchers, you’ll<br />

only pay £92.50 plus delivery.<br />

For more information on how to<br />

obtain these discounts and special<br />

offers members should access the<br />

IP Benefits website from the <strong>ITMA</strong><br />

website members’ area; click on<br />

Members Home (top of the list on<br />

the left hand side) and then click on<br />

the IP Benefits graphic – see also the<br />

box at the end of the Review which<br />

gives examples of savings made by<br />

members using the scheme.<br />

Ken Storey, PR Manager,<br />

ken.storey@btinternet.com<br />

“...we need to do<br />

more with other<br />

government<br />

departments and<br />

agencies to ensure<br />

the messages about<br />

trade marks and the<br />

value of the trade<br />

mark attorney<br />

profession are<br />

foremost in the<br />

minds of those<br />

people advising<br />

business.”<br />

4 <strong>ITMA</strong> Review July/August 2010

<strong>ITMA</strong> BUSINESS<br />

July/August 2010<br />

<strong>ITMA</strong> BUSINESS<br />

Chief Executive’s Bulletin:<br />

gearing up for summer?<br />

As you all gear up for the holiday season and a well-earned<br />

break, I thought it best to provide an update on recent matters<br />

that are of interest to you and the Institute. Emailed to members<br />

on 23 June.<br />

In this bulletin you will find<br />

information on:<br />

Hearings before the IPO<br />

Membership subscriptions<br />

<strong>ITMA</strong> survey<br />

Accommodation update<br />

<strong>ITMA</strong> Staff news<br />

Hearings before the IPO<br />

Have you had any problems<br />

conducting ex-parte and/or interpartes<br />

hearings before the IPO via the<br />

telephone or video link service?<br />

<strong>ITMA</strong> continue to be in dialogue with<br />

the IPO regarding the use of these<br />

services and the perceived desire by<br />

the IPO for all hearings to be<br />

conducted via one of these methods<br />

rather than face-to-face. We are of the<br />

view that there are occasions where a<br />

face-to-face hearing might be more<br />

appropriate (and indeed necessary)<br />

than the preferred methods, for<br />

example in <strong>case</strong>s where cross<br />

examination takes place. We feel that<br />

the choice should not be removed<br />

from the attorney/client. The IPO have<br />

been receptive to our <strong>comment</strong>s and<br />

would welcome evidence to support<br />

out requests.<br />

In order to assist the IPO, we are<br />

asking you as members to provide<br />

examples of where the use of the<br />

telephone or video link has been<br />

detrimental and caused problems,<br />

both from a technical perspective, ie<br />

technology not working, and from a<br />

logistic/handling perspective. Not<br />

necessarily just because you lost that<br />

particular <strong>case</strong>! If you have any<br />

examples or have thoughts that you<br />

would like to share, please email me<br />

at keven@itma.org.uk.<br />

Membership subscriptions<br />

The <strong>ITMA</strong> Office has been working<br />

hard to chase for outstanding<br />

renewal subscriptions. We are<br />

grateful for all those that have<br />

renewed their membership for 2010.<br />

At the end of June, we will be lapsing<br />

all membership subscriptions where a<br />

renewal fee for 2010 has not been<br />

paid. This will result in all the benefits<br />

of being a member of <strong>ITMA</strong> being<br />

removed and even worse, you will<br />

not receive any more of my bulletins!<br />

If you are in any doubts about<br />

whether your renewal has been<br />

paid, please check with the Office to<br />

ensure that you remain a valid<br />

member.<br />

For 2011 we will be looking at<br />

the option of paying renewal<br />

subscriptions by Direct Debit. For<br />

those individuals whose firm pays<br />

for membership, this will also be a<br />

function available for your firm to use.<br />

We believe a Direct Debit system will<br />

make the whole renewal process<br />

much more efficient for both you<br />

and the <strong>ITMA</strong> office and further<br />

information on the set up of this<br />

will be sent in due course.<br />

<strong>ITMA</strong> membership survey<br />

In my last bulletin I mentioned that<br />

it has been agreed in principle that<br />

<strong>ITMA</strong> should canvas the membership<br />

to obtain important information<br />

about the trade mark profession and<br />

membership of <strong>ITMA</strong>. We will be<br />

sending out a separate email with<br />

information about the online survey.<br />

The survey is short (only ten<br />

questions) and we really would like<br />

everyone to submit a response to<br />

help shape the Institute for the future.<br />

Accommodation<br />

Having been in the new HQ for a<br />

couple of months, we now consider<br />

ourselves ‘settled in’ and the<br />

relocation project complete.<br />

We would like to thank Thorne-<br />

Hiley Property consultants<br />

(www.thornehiley.co.uk) who helped<br />

in all aspects of the move. Their<br />

expertise, clear advice and friendly<br />

approach took away much of the<br />

pressure and ensured that we found<br />

our new home, completing the<br />

project on time and within budget.<br />

<strong>ITMA</strong> Staff<br />

As you are probably aware, last year<br />

Margaret Tyler reduced her working<br />

hours as she approached retirement.<br />

Margaret has now confirmed that she<br />

would like to fully retire and her last<br />

day will be 20 August 2010.<br />

This is a huge moment in the history<br />

of <strong>ITMA</strong>, as Margaret has provided<br />

well over 20 years of service and has<br />

been instrumental in building the<br />

Institute during her time. I for one will<br />

be very sorry to see Margaret leave,<br />

having helped me settle into my role.<br />

There will be numerous opportunities<br />

to thank Margaret, but I would like to<br />

take this particular one to thank her<br />

publicly for everything that she has<br />

done for the Institute. We will be<br />

looking to mark the occasion<br />

accordingly (probably with a party)<br />

and further information will be made<br />

available as we have the details.<br />

If you are heading off on your<br />

summer holidays soon, have a<br />

wonderful break.<br />

Until the next time...<br />

Keven Bader, Chief Executive,<br />

keven@itma.org.uk<br />

<strong>ITMA</strong> Review 5

<strong>ITMA</strong> BUSINESS<br />

Northern<br />

Seminar<br />

24 June 2010<br />

Radisson BLU Hotel, Leeds<br />

Rowena Bercow<br />

The meeting began with <strong>ITMA</strong><br />

President Maggie Ramage reminding<br />

us that external regulation of our<br />

profession became compulsory once<br />

the Legal Services Act 2007 had been<br />

passed and that as of the beginning of<br />

this year we are regulated by IPREG, a<br />

board set up jointly with CIPA for that<br />

purpose, which is itself overseen by the<br />

Legal Ombudsman.<br />

IPREG consists of three patent<br />

attorneys, three trade mark attorneys<br />

and three lay members. These are<br />

divided into three committees to deal<br />

with the necessary matters for<br />

regulation; namely, Education and<br />

Qualifications, Internal/External<br />

Governance and Conduct and<br />

Discipline. There is an overriding<br />

objective to be transparent to the<br />

public and IPREG has worked hard to<br />

come up with a code of conduct. The<br />

relative cost of regulation is higher<br />

than for solicitors and IPREG has tried<br />

to arrive at something workable.<br />

IPREG Update<br />

Next, Penny Nicholls, an IPREG<br />

member, talked about how the board<br />

was operating. The backgrounds of<br />

the lay members are Rosalind Burford<br />

(education), Philip Portwood (local<br />

government) and Danny Keenan<br />

(medical council). The whole board<br />

meets every two months but the<br />

committees meet more frequently. The<br />

chief executive is Ann Wright, who is a<br />

part-time solicitor. They are trying not<br />

to be too interventionist but want to<br />

keep lines of communication open and<br />

<strong>ITMA</strong> BUSINESS<br />

are taking soundings about potential<br />

issues arising. They do not want to<br />

impose expensive rules.<br />

Insurance<br />

One issue which had come up<br />

concerned insurance. There was<br />

confusion between the relevant rules<br />

and guidance. Rule 17 of the Code of<br />

Practice requires that the level of<br />

insurance is commensurate with the<br />

practice, whereas the guideline<br />

suggests £1 million. In practice the<br />

actual amount will not have to be<br />

given on the application for<br />

registration, and is for the practitioner<br />

to decide, but IPREG has authority to<br />

obtain details from the insurers.<br />

Complaints handling<br />

Responsibility for complaints is<br />

currently being transferred from <strong>ITMA</strong>.<br />

Trade mark practitioners must have<br />

a procedure for complaints and<br />

must include that in the terms of<br />

engagement for new clients. That<br />

should probably consist of a reference<br />

to IPREG, mentioning the name of the<br />

chief executive. Complaints relating<br />

to conduct will be dealt with by a<br />

separate disciplinary board which will<br />

have two lay members and one<br />

professional member (drawn from a<br />

panel). Complaints will initially be<br />

sifted by IPREG board members to<br />

reject claims that are vexatious or<br />

with no grounds.<br />

The Legal Ombudsman will be<br />

operational in October and will deal<br />

with complaints in relation to service.<br />

Education, qualifications and CPD<br />

There is a commitment to promoting<br />

diversity amongst members of the<br />

profession imposed by the legislation.<br />

However, educational standards could<br />

not be compromised.<br />

Continuing professional development<br />

involves self-certification. CIPA and<br />

<strong>ITMA</strong> can decide how many hours can<br />

be claimed for its events. Events<br />

organised by other bodies in the legal<br />

profession also count. For individual<br />

study and in-house activity it is<br />

necessary to describe how it was<br />

worthwhile.<br />

Entity registration<br />

Entities have to be registered as well<br />

as individuals. There is a fee for each<br />

entity and an additional fee for each<br />

registered or other professional. An<br />

entity will be bound for the acts and<br />

omissions of its other professionals.<br />

Legal Services Board<br />

IPREG is regulated by the Legal<br />

Services Board, to which it pays an<br />

annual fee. That is the same board that<br />

regulates barristers, solicitors, notaries,<br />

etc. IPREG can compete to regulate<br />

other business and is interested in<br />

doing that with regard to Alternative<br />

Business Structures.<br />

The Legal Ombudsman<br />

There followed a short presentation<br />

by Gary Garland, Deputy Chief<br />

Ombudsman of the Legal<br />

Ombudsman. He is barrister with<br />

experience in the war crimes tribunal<br />

at the Hague, among other things.<br />

Office for Legal Complaints - Procedure<br />

This is the same as the Legal<br />

Ombudsman. It provides the<br />

complaints handling service for all<br />

seven branches of the legal profession.<br />

A customer must try to resolve the<br />

matter with the practitioner first.<br />

Practitioners must have a procedure<br />

for dealing with complaints and when<br />

responding to a client must advise<br />

that they have recourse to the Legal<br />

Ombudsman. Time runs from that<br />

response for the customer to pursue<br />

the matter (six months).<br />

The office examines the complaint to<br />

try to find a resolution and, if that is not<br />

possible, will make a decision which is<br />

binding on the professional. They can<br />

award up to £30,000.<br />

There is a right of appeal by the<br />

client to the High Court, but for the<br />

professional a decision can only be<br />

challenged by means of a judicial<br />

review. Complying with the<br />

Ombudsman’s decision is a defence<br />

to litigation.<br />

Guidance for Practitioners<br />

It is compulsory to respond to<br />

complaint correspondence from a<br />

customer; it would be considered<br />

professional misconduct not to. When<br />

responding, it is suggested to be<br />

realistic, pragmatic and businesslike<br />

and to use contrition when responding<br />

to a complaint.<br />

There is a statutory obligation to tell a<br />

client who to contact if they disagree,<br />

which triggers the six-month period for<br />

the client to pursue the matter.<br />

Publication<br />

No policy had been agreed with regard<br />

the publication of decisions on<br />

6 <strong>ITMA</strong> Review July/August 2010

complaints. The Legal Services Act<br />

does not allow the complainant to be<br />

identified, but the professional can be<br />

named at discretion. Protagonists will<br />

probably be kept anonymous except in<br />

the <strong>case</strong> of overriding public interest,<br />

for example theft or fraud.<br />

Intellectual Property Office<br />

After a break for refreshment, Oliver<br />

Morris, one of the principal hearing<br />

officers, gave a presentation in respect<br />

of hot topics including the first two<br />

substantive decisions to be issued by<br />

the Company Names Tribunal: MB<br />

Inspection Ltd v HI-ROPE LTD [2010]<br />

RPC 18 and Zurich Insurance Company<br />

v Zurich Investments Ltd BL O/197/10<br />

The Company Names Tribunal<br />

Decisions on these first two <strong>case</strong>s were<br />

made by a panel of three adjudicators.<br />

Only a small proportion of <strong>case</strong>s so far<br />

have been defended. If there is no<br />

reply to the tribunal from the owner of<br />

the company name objected to, a<br />

simple default decision is likely to be<br />

issued.<br />

The decisions deal with matters as<br />

a sequence of steps, deciding first<br />

whether the complainant has the<br />

requisite goodwill, next whether the<br />

respective names are the same or<br />

similar (depending upon whether<br />

both have been pleaded) and then<br />

considering any defences that the<br />

respondent may have put forward<br />

under section 69(4) of the Companies<br />

Act 2006.<br />

Some useful guidance has already<br />

resulted from the first two decisions<br />

with regard to goodwill and identity<br />

and similarity of names.<br />

With regard to the requirement for<br />

goodwill, it was decided that goodwill<br />

in the traditional sense was sufficient<br />

(as per Muller & Co’s Margarine Ltd<br />

[1901] AC217).<br />

Concerning sameness and similarity of<br />

names, in the <strong>case</strong> of “HI ROPE”, the<br />

only difference between the names in<br />

issue was the designation “Ltd”. As a<br />

company name must be identified by<br />

a reference to the designation of the<br />

nature of the company (with certain<br />

exceptions) and as an undertaking<br />

cannot trade by reference to a<br />

company name under which it is not<br />

incorporated, the defence was found<br />

to be virtually redundant if the name<br />

upon which the complainant relied<br />

had to include the company<br />

designation. It was decided that the<br />

July/August 2010<br />

<strong>ITMA</strong> BUSINESS<br />

names should be regarded as the same<br />

if the only difference that arises is from<br />

the company designation.<br />

In “Zurich” the names to be compared<br />

were Zurich and Zurich Investments<br />

Ltd. The complainant had claimed<br />

both that the company name was the<br />

same and that it was, in the alternative,<br />

similar. Upon examining the <strong>case</strong>-law it<br />

was decided that the names were not<br />

the same even though the difference<br />

between them resided in a descriptive<br />

term (cf Reed v Reed [2004] EWCA Civ<br />

159) but that they were similar. It was<br />

noted that it was not necessary to<br />

factor in any goods or services when<br />

considering similarity because a<br />

company can operate in any area.<br />

Defences<br />

In HI-ROPE, section 69(4)e, that the<br />

complainant would not be adversely<br />

affected to any significant extent,<br />

was claimed. That was unsuccessful,<br />

despite submissions that the<br />

respective businesses of industrial rope<br />

access, and walking holidays, were<br />

different so that there would be no<br />

adverse affect. It was held that a<br />

company name can be used in any<br />

field of activity but, in any event, there<br />

was a potential overlap because a<br />

walking business might use ropes,<br />

which, in turn, could compromise the<br />

complainant’s safety reputation.<br />

In Zurich, section 69(4)b, that the<br />

company had operated or was<br />

planning to do so, was claimed. Again,<br />

that was unsuccessful despite evidence<br />

that the company name had been held<br />

in succession by three different but<br />

associated companies of which one,<br />

but not the current one, had traded. It<br />

was held that the company that had<br />

traded could not be taken to be the<br />

company in issue because the former<br />

was a separate legal entity, and also<br />

there was no evidence of substantial<br />

start-up costs (which are specifically<br />

mentioned in the provision) for the<br />

complained of company.<br />

In both <strong>case</strong>s, section 69(4)d, that<br />

registration had been made in good<br />

faith, was claimed. The defence failed<br />

in HI-ROPE as there was little to show<br />

any good faith such as evidence<br />

relating to the genesis of the name or<br />

evidence of business plans etc.<br />

However the good faith defence<br />

succeeded for Zurich Investments<br />

because it was relevant to consider the<br />

activities of the earlier two companies<br />

dating back to 1989 as this could<br />

inform as to the motivation in the<br />

registration of the company name<br />

complained of. Taking this into<br />

account, and the overall circumstances,<br />

good faith was found.<br />

In conclusion the complainant<br />

succeeded in HI- ROPE, but not in<br />

Zurich. It should be noted that at the<br />

time of going to print the Zurich<br />

decision is still subject to appeal.<br />

Firecraft<br />

Following the Firecraft <strong>case</strong>, in which<br />

the decision of the office on passingoff<br />

enabled a successful applicant for<br />

invalidation to obtain summary<br />

judgment in the High Court, it had<br />

been decided that in future all such<br />

decisions will only be made after a<br />

hearing.<br />

Section 5(3) TMA 1994<br />

The Office would like more detail on<br />

Notices of Opposition of objections on<br />

the basis of this provision, which seems<br />

to be used routinely as a make-weight<br />

ground, for instance with reference to<br />

the detriment identified in L’Oreal v<br />

Bellure[2010] EWCA Civ 535. It has<br />

formulated additional questions for<br />

the Form TM7 to that end which have<br />

been submitted to <strong>ITMA</strong> for their<br />

<strong>comment</strong>s.<br />

Case-management conferences<br />

There had been an increase in <strong>case</strong>management<br />

conferences and the<br />

Office would like to encourage them.<br />

General View on Regulation<br />

The afternoon was concluded by<br />

<strong>comment</strong>s from Michael Harrison, who<br />

is both an <strong>ITMA</strong> and a CIPA member,<br />

on the new regulatory regime.<br />

He said that it had been seen as an<br />

opportunity to come within the same<br />

scope as lawyers and to show<br />

transparency and a commitment to<br />

consumer interests and to promote<br />

best practice. So far the cost seemed to<br />

be relatively low (not much more than<br />

previously) and the regulation fairly<br />

light-touch. As far as ongoing costs<br />

were concerned, the levies should<br />

reflect the complaint levels which were<br />

not expected to be high. The CPD<br />

provisions appeared to be reasonable<br />

and it was particularly good that those<br />

could cover both professions. It has<br />

certainly improved our credibility.<br />

Rowena Bercow,<br />

rowenabercow@gmail.com<br />

<strong>ITMA</strong> Review 7

<strong>ITMA</strong> BUSINESS<br />

<strong>ITMA</strong> BUSINESS<br />

Presentation by the Legal Services Board<br />

on Alternative Business Structures<br />

On 6 June CIPA and <strong>ITMA</strong><br />

with IPReg hosted the Legal<br />

Services Board “Road Show” on<br />

Alternative Business Structures.<br />

The presentation was given by<br />

Chris Kenny, Chief Executive<br />

of the Legal Services Board,<br />

and he was joined by his<br />

colleague Fran Gillo Director<br />

of Regulatory Practice, for the<br />

question and answer session.<br />

The event was chaired by Michael<br />

Heap, Chairman of IPReg.<br />

A large number of the attorney<br />

profession attended representing<br />

both the large and smaller firms.<br />

There were a number of key themes<br />

in the presentation.<br />

The external environment has<br />

changed with new technology<br />

and changed consumer<br />

expectations and the legal<br />

regulatory framework needs to<br />

catch up to give commercial<br />

flexibility to legal services<br />

providers.<br />

Business excellence and creativity<br />

is as important as legal excellence.<br />

We are already seeing a shift from<br />

individual towards entity-based<br />

regulation and ABS is a part of<br />

that shift.<br />

The timeline was announced by the<br />

Legal Services Board in March this<br />

year. Prospective ABS can apply for<br />

licence from mid-2011 and open for<br />

trading from October 2011. There will<br />

be transitional arrangements for<br />

entities that are currently “ABS like”<br />

until 6 October 2012, following which<br />

they must be licensed.<br />

After the formal presentation there<br />

8 <strong>ITMA</strong> Review<br />

was a wide reaching question and<br />

answer session. Because of the quite<br />

forensic but very pertinent nature of<br />

some of the questions, the Legal<br />

Service Board have written up the<br />

questions and their answers and<br />

these are set out at the end of this<br />

article.<br />

IPReg has issued its own<br />

questionnaire about ABS and are very<br />

grateful to those who have replied.<br />

This will inform, although not<br />

determine, whether CIPA and <strong>ITMA</strong><br />

with IPReg wish to make an<br />

application to be a Licensing<br />

Authority.<br />

The responses will be collated and a<br />

summary will be posted on the IPReg<br />

website.<br />

At the time of going to press, the<br />

Solicitors Regulation Authority and<br />

the Council of Licenced Conveyancers<br />

have both confirmed that they will be<br />

making applications.<br />

The LSB section of the IPReg website<br />

contains useful material on ABS and<br />

we will be updating this section<br />

regularly.<br />

Finally, a question was raised about<br />

complaints handling and the new<br />

Legal Services Board requirement.<br />

IPReg are urgently working on this<br />

and will be sending information out<br />

as soon as possible. However you can<br />

access the Legal Services Board<br />

documentation via their section on<br />

the IPReg website.<br />

Ann Wright, IPReg Chief Executive<br />

Q & A s<br />

1. LSB’s desire is for a level playing field<br />

between ABS and non-ABS, but<br />

there are key tests for ABS<br />

(eg on fitness to own and<br />

requirements for a Head of Legal<br />

Practice (HoLP) and Head of<br />

Finance and Administration<br />

(HoFA)) that are more onerous than<br />

those for non-ABS.<br />

It is true that there are<br />

requirements set out in the Legal<br />

Services Act (LSA) that apply only<br />

to ABS. Where this is the <strong>case</strong>, we<br />

have tried to ensure that these are<br />

implemented in a pragmatic way.<br />

So, for example, we have said that<br />

we consider that the qualifications<br />

and experience of a HoLP are,<br />

broadly, matters for the ABS to<br />

decide rather than the regulator.<br />

Where tests do currently exist<br />

(such as a requirement for criminal<br />

records checks, or disclosure of<br />

being declared bankrupt), they<br />

should not be any more onerous<br />

for ABS than for non-ABS. There<br />

may be some aspects of ABS<br />

regulation that Approved<br />

Regulators (ARs) consider should<br />

be copied across into non-ABS<br />

regulation. In such <strong>case</strong>s we<br />

would expect the AR to have<br />

evidence to justify any additional<br />

requirements.<br />

2. ABS may raise issues about legal<br />

professional privilege for intellectual<br />

property attorneys. In the current<br />

framework, for an MDP privilege<br />

rests with the entity. Are there<br />

similar protections for ABS? This is<br />

particularly an issue for those<br />

firms that deal with the USA.<br />

Legal professional privilege is<br />

covered in LSA s190. However we<br />

recognise that this is an important<br />

issue and we will work with IPReg,<br />

CIPA and <strong>ITMA</strong> to identify whether<br />

there are gaps/differences and<br />

how these could be addressed.<br />

3. Will the change in regulating for<br />

outcomes be able to deal<br />

appropriately with different ABS<br />

structures – for example a sole<br />

July/August 2010

practitioner whose spouse is a<br />

shareholder, compared to a large<br />

corporation?<br />

For both ABS and non-ABS, in<br />

order to implement outcomes<br />

regulation successfully, ARs/LAs<br />

will have to adopt a risk based<br />

approach. This would mean that<br />

the AR/LA would be aware of the<br />

risks posed by a sole practitioner<br />

compared to a large corporation<br />

and would adapt a proportionate<br />

approach to each one.<br />

4. IPReg as a possible Licensing<br />

Authority for ABS:<br />

IPReg may not have the resources to<br />

be able to check fully the owners of<br />

a complex corporate structure<br />

LSB anticipates that there will be<br />

some types of ABS that a LA is not<br />

competent to regulate. Although<br />

the LSB can become a LA we hope<br />

that we will not need to. If it<br />

appears that IPReg is not going to<br />

be a LA, there would need to be<br />

discussions between it and<br />

existing LAs to see which one<br />

appeared competent to regulate<br />

intellectual property attorneys<br />

and whether any changes needed<br />

to be made to regulatory<br />

arrangements. Alternatively it may<br />

be possible to set up outsourcing<br />

arrangements to carry out the<br />

required checks.<br />

LSB would expect LAs to put<br />

the onus to provide sufficient<br />

information on the ABS licence<br />

applicant, although there would<br />

need to be some checks carried<br />

out to ensure that the information<br />

was correct.<br />

Licence application fees can be<br />

structured so that they are cost<br />

reflective – so those whose<br />

applications required substantial<br />

resources to check would pay<br />

more than those with<br />

straightforward applications.<br />

Can there be a joint application<br />

from CIPA/<strong>ITMA</strong> to avoid the need<br />

to pay two application fees, since<br />

regulation will be carried out by<br />

IPReg?<br />

LSB will check the application<br />

rules.<br />

<strong>ITMA</strong> BUSINESS<br />

Will the costs of regulating ABS be<br />

borne by ABS or smeared across all<br />

those regulated?<br />

This is for the AR/LA to decide. As<br />

a general principle, it is preferable<br />

for costs to be able to be allocated<br />

as accurately and transparently as<br />

possible.<br />

Currently IPReg does not have<br />

sufficient information to be able to<br />

assess the likely demand for ABS<br />

licences from those it regulates or<br />

new entrants.<br />

We understand that IPReg has<br />

started to gather information<br />

about the entities it regulates. This<br />

should help it to assess which are<br />

likely to need an ABS licence.<br />

5. If a TMA/PA LLP is owned by a<br />

limited company provides services<br />

to it, but the reserved activity is only<br />

provided by the LLP, is the limited<br />

company an ABS?<br />

A - Who the licensee is will always<br />

depend on the precise<br />

circumstances. But even if the<br />

limited company is not the<br />

licensee (and the LLP is), the<br />

owners of the limited company<br />

would need to pass a fit and<br />

proper person test.<br />

6. There will be a wide range of ABS –<br />

what are the boundaries of<br />

regulation?<br />

We agree that this is an important<br />

issue. The SRA is facilitating a<br />

working group that includes all<br />

the ARs as well as other regulatory<br />

bodies such as the FSA and the<br />

accountancy bodies to discuss<br />

how to deal with regulatory<br />

overlaps in the least burdensome<br />

way possible. The LSB will also be<br />

looking more widely at where<br />

regulation now bites and whether<br />

it provides appropriate levels of<br />

consumer protection.<br />

7. Question for IPReg – it would be<br />

very helpful for some guidance<br />

about where the reserved legal<br />

activities are actually carried out by<br />

intellectual property attorneys.<br />

Legal Services Board<br />

9 June 2010<br />

“The SRA is facilitating<br />

a working group that<br />

includes all the ARs as<br />

well as other regulatory<br />

bodies such as the FSA<br />

and the accountancy<br />

bodies to discuss how<br />

to deal with regulatory<br />

overlaps in the least<br />

burdensome way<br />

possible. The LSB will<br />

also be looking more<br />

widely at where<br />

regulation now bites<br />

and whether it provides<br />

appropriate levels of<br />

consumer protection.”<br />

July/August 2010 <strong>ITMA</strong> Review 9

<strong>ITMA</strong> BUSINESS<br />

<strong>ITMA</strong> Summer<br />

Reception<br />

8 July 2010<br />

Westminster Boating Centre.<br />

Pictures by Stewart Rayment.<br />

Rachel Gillard-Jones and Michael Keogh (BP)<br />

Manish Joshi (Joshi & Welch), Haakon Vold-Aunebakk<br />

and Spencer Burgess (Eccora)<br />

10 <strong>ITMA</strong> Review<br />

<strong>ITMA</strong> BUSINESS<br />

George Apaya (BBC Worldwide),<br />

Anusha Arunasalam (Boult Wade Tennant).<br />

Daniel Sullivan, Duncan Welch, Anna Claudia<br />

Turchetto, Rachel Harrison, Manish Joshi (all<br />

Joshi & Welch); Rear: Bob Boad (Joshi & Welch),<br />

Mary Bagnall (Mayer Brown International),<br />

Donald Pennant (Akzo Nobel)<br />

Florian Treub and Triona Desmond,<br />

(Hammonds), Jeremy Dickerson (Burges<br />

Salmon), Lianne Bulger (Hammonds)<br />

July/August 2010

Lianne Bulger (Hammonds), Akosua<br />

Mensah (Formula One Management)<br />

<strong>ITMA</strong> BUSINESS<br />

Mark Finn (EMW Picton Howell),<br />

Giovanni Visintini (BP), Ian Wood<br />

(Mayer Brown International)<br />

Declan Cushley (Browne Jacobson), Jeremy Dickerson (Burges Salmon),<br />

Hilde Vold-Aunebakk (Acapo AS), Emma Tuck and Mark Daniels (Browne Jacobson)<br />

Matthew Stokes, David Sheppard, Dipthi<br />

Bryant and Robert Davey (Thomson Reuters)<br />

July/August 2010 <strong>ITMA</strong> Review 11

BOOK REVIEW<br />

How many markets are there<br />

for trade mark books? There is<br />

the higher-end market, served<br />

by the bound encyclopaedia<br />

and loose-leaf tomes that fill<br />

shelves and exude gravitas.<br />

There are the thinner academic<br />

books that display that the<br />

reader is interested in the<br />

underlying principles, the<br />

history and the economic<br />

justifications for trade<br />

mark law.<br />

Then there is the middle ground. The<br />

middle ground is troublesome. I can<br />

imagine the author must question<br />

how far to go – what subjects stay in,<br />

which are omitted and how much<br />

detail does one give? Is it intended to<br />

address the dryness of some of the<br />

practitioner texts, perhaps making a<br />

reference text which is easy to read<br />

and which begins not from the <strong>case</strong>s,<br />

but from the principle? Is it a text<br />

which covers most of what a<br />

practitioner will face, leaving more<br />

difficult questions to the specialist<br />

practitioner texts?<br />

A Practical Approach to Trade Mark<br />

Law is a book in the middle ground.<br />

At £44.95 it is substantially cheaper<br />

than many other texts, and in its<br />

writing it is clear that its intentions<br />

are not to compete with Kerly. It<br />

describes itself as “providing a<br />

comprehensive overview of the<br />

subject complete with clear, practical<br />

advice and tips on issues likely to<br />

arise in practice”. It also says it is “an<br />

excellent resource for those new to<br />

the law, where the expert overview<br />

and clear layout promote clarity and<br />

ease of use”. I think it is half right.<br />

BOOK REVIEW<br />

Practical, but not quite there in practice<br />

A Practical Approach to Trade Mark Law (4th Ed). Michaels and Norris. Published March 2010, £44.95<br />

Oxford University Press. Reviewed by Aaron Wood.<br />

It is certainly easy to use, and the text<br />

provides a clear introduction to all of<br />

the essential aspects of trade mark<br />

law. If it were to have included a<br />

chapter explaining how everything<br />

fits together – questions of validity,<br />

infringement, defences and the like –<br />

then it would be an outstanding text<br />

to give to someone new to the<br />

profession. What it does particularly<br />

well is to give a few sentences of<br />

explanation to the <strong>case</strong>s it mentions,<br />

something which is missing from a<br />

number of other texts, whose method<br />

is simply to cite. By leading readers on<br />

a journey with these <strong>case</strong>s, the text<br />

is rendered memorable. It is to be<br />

regretted that barristers are taught<br />

the foundations of outstanding public<br />

speaking, including the importance<br />

of story-telling, yet so few barristers<br />

extend this to their written work.<br />

Where the text does fall down,<br />

unfortunately, is in depth. The writing<br />

extends to 234 pages (by way of<br />

comparison, the chapter on passingoff<br />

alone in Kerly extends to 125<br />

pages). Most texts on trade marks<br />

give scant regard to collective and<br />

certification marks – this text gives a<br />

mere six paragraphs. Brevity is<br />

something to be admired where it<br />

can be done well. There is much skill<br />

in explaining something in fewer<br />

words. In being brief, however, it is<br />

easy to omit or be inaccurate. I think<br />

this has happened in this work.<br />

In the chapter relating to<br />

assignments, for example, it is said<br />

that an assignment must be in writing<br />

and must be signed by the assignor or<br />

their personal representative. Given<br />

that this book addresses both UK and<br />

CTM law and practice, I think that this<br />

is a dangerous omission. How easy<br />

would it be to take that paragraph<br />

on trust, and later find that the<br />

assignment of the CTMs was not<br />

valid? Likewise, the explanation of<br />

the difference between “capable of<br />

distinguishing” and “distinctive” was<br />

not well expressed, and overlooks<br />

the quite clear <strong>comment</strong>s in the<br />

POSTKANTOOR <strong>case</strong>. The text<br />

also makes a misleading mess of<br />

explaining how the notification<br />

system at the UKIPO works. Having<br />

tried to explain this to a client, I can<br />

profess that it is somewhat akin to<br />

explaining the offside rule to an<br />

Amazonian pygmy, but it should<br />

be possible to explain it.<br />

That is not to say that this book does<br />

not treat some subjects well. I was<br />

particularly pleased with the section<br />

on remedies, the section explaining<br />

the interaction between s10(6)<br />

and the Comparative Advertising<br />

Directive and the section on<br />

exhaustion of rights in the context of<br />

rebranding and re-boxing. This brings<br />

me back to my first paragraph, and<br />

the question of where this book lies<br />

in the market – who should buy it? I<br />

would recommend it to new trainees,<br />

as its length is not off-putting. A new<br />

trainee could easily grasp many of the<br />

overarching concepts in trade mark<br />

law over a short period of time thanks<br />

to the storytelling style of this book.<br />

Would I use it as the sole manual in<br />

my practice? No, but I don’t think that<br />

this was the intention of the authors.<br />

I would, however, consider lending it<br />

to a more experienced trainee who<br />

had a “blind-spot” – some area of<br />

trade mark law where the law is<br />

difficult to understand because of<br />

the many strands. I think that the<br />

explanations in this book would<br />

generally serve as a good starting<br />

place for further study.<br />

Aaron Wood, Wood Trade Marks,<br />

aaron@woodtmd.com<br />

12 <strong>ITMA</strong> Review July/August 2010

CASE COMMENT<br />

Geoff Weller<br />

Summary<br />

This was the Appointed Person<br />

decision on the costs to be awarded<br />

following the unsuccessful appeal by<br />

Red Bull GmbH in their opposition<br />

to the trade mark application for<br />

BULLDOG by Sun Ltd. The appeal was<br />

reported in the May issue of the <strong>ITMA</strong><br />

Review. In that decision Ms Michaels<br />

had indicated Sun (which was not<br />

legally represented) was entitled to a<br />

contribution towards its costs in the<br />

appeal. In this decision Ms Michaels<br />

was presented with a five-figure costs<br />

claim by Sun which, on application of<br />

the principles of cost awards at the<br />

Registry in general and in particular<br />

for unrepresented parties, came<br />

down to just £367.50.<br />

Decision<br />

Ms Michaels noted that costs before<br />

the Registry and Appointed Person<br />

are intended to make a contribution<br />

to the costs of the action not to<br />

compensate for the expense the party<br />

has been put to. In most <strong>case</strong>s, which<br />

do not qualify for “off the scale”<br />

awards, the award is according to the<br />

“modest” published scale which it is<br />

generally accepted is unlikely to ever<br />

July/August 2010<br />

CASE COMMENT<br />

Bulldog <strong>case</strong> proves an<br />

expensive victory for Sun<br />

Appointed Person decision O-108-10 of Amanda Michaels on<br />

31 March 2010 in the matter of UK tm application no 2442910<br />

BULLDOG in class 32 by Sun Mark Ltd and opposition no 95303<br />

thereto by Red Bull GmbH. Geoff Weller reports...<br />

reflect the actual costs incurred.<br />

Ms Michaels noted the <strong>case</strong> law<br />

guidance for when the party to be<br />

awarded costs was not professionally<br />

represented, which is to apply by<br />

analogy the principles of the High<br />

Court as set out in particular in the<br />

Civil Procedure Rules 48.6. Essentially<br />

this says an unrepresented party can<br />

only ever get two thirds of what a<br />

represented party can get and the<br />

amount will depend on whether he<br />

can prove a financial loss. If can not<br />

then the amount he can get is the<br />

amount calculated for the reasonable<br />

time spent doing the work at the<br />

fixed rate of £9.25 an hour.<br />

Sun claimed a total of £14,000 as<br />

costs in the appeal alone. Ms<br />

Michaels, noting this was not a <strong>case</strong><br />

with reasons to award off the scale,<br />

felt that this claim was both at a rate<br />

unsupported by evidence – rates<br />

claimed were up to £250 per hour,<br />

and at an amount of time that was<br />

not objectively reasonable for this<br />

<strong>case</strong> – 74 man hours. As no actual<br />

financial loss was shown by Sun in<br />

evidence, she awarded an amount<br />

based on time she considered would<br />

have reasonably be spent on doing<br />

the work in this appeal and hearing<br />

(30 hours preparation plus four hours<br />

per person to attend the hearing) and<br />

on the £9.25 per hour rate. This came<br />

to £367.50 to be added on top of the<br />

£1,650 awarded by the hearing officer<br />

(whose decision had been upheld in<br />

the appeal).<br />

Comment<br />

This decision is a reminder to all that<br />

costs awards in <strong>case</strong>s at the Registry<br />

are, as a policy, contributory and not<br />

compensatory. Parties involved in or<br />

considering matters before the<br />

Registry must bear in mind the actual<br />

costs expended on <strong>case</strong>s will almost<br />

always far exceed the scale even for<br />

unrepresented parties. This <strong>case</strong><br />

gives a factual example of the time<br />

considered reasonable on a particular<br />

<strong>case</strong> and how that then translates into<br />

a financial award. I suggest this <strong>case</strong><br />

also makes it imperative that an<br />

unrepresented party document<br />

carefully the loss to their business<br />

whilst dealing with the action so as<br />

to give themselves the best possible<br />

position with the modest cost<br />

award envelope.<br />

Geoff Weller, IPULSE,<br />

gweller@ipulseip.com<br />

<strong>ITMA</strong> Review 13

CASE COMMENT<br />

CASE COMMENT<br />

The pen is mightier than<br />

the figurative mark?<br />

Beifa Group Co Ltd v OHIM (defendant) & Schwan-Stabilo Schwanhaüßer<br />

(intervener), Case T-148/08. Almost five years after Beifa’s Community<br />

registered design for a highlighter pen prompted an objection by<br />

Schwan-Stabilo, judgment of the General Court came down on<br />

12 May 2010. Arguably the most arresting aspect of the decision is<br />

the result itself, but there’s more to this <strong>case</strong> than meets the eye,<br />

says Ben Longstaff.<br />

What happens if you register a<br />

Community design for a product, and<br />

a competitor objects that your design<br />

is too much like one or more of their<br />

registered trade marks for the same<br />

product? It shouldn’t be too difficult<br />

to sort out, or at least you might hope<br />

not. Yet after just such unremarkable<br />

beginnings, this seemingly simple<br />

dispute over highlighter pens has<br />

become the first Community<br />

registered design appeal to reach<br />

judgment in the General Court.<br />

Beifa’s registration (no 352315-0007,<br />

published on 26 July 2005) was for<br />

a highlighter pen. The following<br />

summer, Stabilo succeeded in<br />

invalidating the registration under Art<br />

25(1)(e) of the Community Design<br />

Regulation (6/2002), which refers to<br />

earlier rights arising out of either<br />

national or Community law. In this<br />

<strong>case</strong> Stabilo relied on its rights under<br />

national law – the Markengesetz,<br />

which is Germany’s implementation<br />

of the Trade Mark Directive.<br />

The Stabilo trade mark in question<br />

showed a figurative drawing of a<br />

highlighter pen, with, it must be said,<br />

at least some resemblance to the<br />

Beifa design (see German trade<br />

mark 300454708).<br />

Beifa’s appeal from the Cancellation<br />

Division was dismissed at OHIM in<br />

January 2008. The Third Board of<br />

Appeal found that use of the sign<br />

would breach Stabilo’s rights under<br />

the Markengesetz, despite certain<br />

differences between the design and<br />

the mark. Consequently there was<br />

no need to consider Stabilo’s other<br />

evidence on invalidity (this conclusion<br />

was to have a crucial bearing on the<br />

outcome). Beifa then took its <strong>case</strong> to<br />

14 <strong>ITMA</strong> Review<br />

the General Court, arguing that the<br />

decision should be annulled and sent<br />

back to the Cancellation Division to<br />

hear the remaining points.<br />

Beifa made three particular pleas on<br />

the substance:<br />

1) Art 25(1)(e) should be restricted<br />

to designs identical to the earlier<br />

mark;<br />

2) Beifa was entitled to request proof<br />

of use of the earlier mark; and<br />

3) Art 25(1)(e) had been incorrectly<br />

applied, since there had not been<br />

a proper assessment of the<br />

likelihood of confusion<br />

Perhaps unsurprisingly, Beifa lost on<br />

the first point. The General Court held<br />

that there was no reason to interpret<br />

Art 25(1)(e) so restrictively – that<br />

would prevent trade mark owners<br />

objecting to all but identical signs,<br />

and would be at odds with the recitals<br />

to the designs Regulation.<br />

The second point provided at least a<br />

technical victory for Beifa. The court<br />

ruled that the company was certainly<br />

entitled to rely on the proof-of-use<br />

provisions in the Markengesetz,<br />

despite the fact that there are no<br />

equivalent entitlements in the<br />

Regulation. This suggests that Art<br />

25(1)(e) imports not just earlier rights<br />

arising under the national law, but<br />

also any corresponding limitations<br />

that qualify those rights.<br />

The catch was the General Court’s<br />

next finding: the correct time to ask<br />

for proof of use of the mark was<br />

during the period for preliminary<br />

observations by the proprietor.<br />

Unfortunately for Beifa, this request<br />

was therefore way out of time.<br />

Ben Longstaff<br />

The third of Beifa’s pleas created a<br />

lengthy discussion in the judgment.<br />

The appellant’s argument was<br />

that OHIM had not undertaken an<br />

assessment of the likelihood of<br />

confusion on the part of the relevant<br />

public. Again, the court turned to the<br />

national law relied on by Stabilo, the<br />

Markengesetz, which does indeed<br />

require a likelihood of confusion, in<br />

line with Art 5(1)(b) of the Trade<br />

Mark Directive. The correct test was<br />

therefore to apply the <strong>case</strong> law<br />

derived from that article – global<br />

assessment, overall impression and<br />

so on.<br />

The court duly identified the relevant<br />

public and the nature of the visual<br />

comparison to be made in this <strong>case</strong><br />

(conceptual and aural considerations<br />

being largely impossible for the shape<br />

of pens), apparently endorsing the<br />

approach taken by the Board at<br />

OHIM. In fact it all appeared to look<br />

very promising for Stabilo, until the<br />

issue of the mark itself came under<br />

scrutiny.<br />

Here things veered badly off course<br />

for the trade mark proprietor.<br />

The General Court noted that the<br />

Cancellation Division’s judgment had<br />

referred to the “three-dimensional<br />

shape” of the earlier trade mark. It also<br />

noted that the parties all agreed that<br />

the mark was in reality a figurative<br />

mark, as recorded in the minutes.<br />

The “inescapable conclusion” of this<br />

paradox was that the comparison<br />

made by the Cancellation Division<br />

was between the design and some<br />

other, unidentified three-dimensional<br />

mark. The suggestion was that the<br />

rogue mark might well have been a<br />

German 3D mark that Stabilo had<br />

July/August 2010

elied on at an earlier stage. This error<br />

in law was fatal to the outcome, and<br />

since it had not been corrected by the<br />

Board of Appeal, the decision had to<br />

be annulled.<br />

OHIM and Stabilo argued that it was<br />

enough that the earlier mark was<br />

similar to a different sign, which was<br />

in turn similar to the design – a sort of<br />

chain of similarity. As one might<br />

expect, the General Court had little<br />

time for that argument, stating that<br />

there is no presumption that similarity<br />

will hold by extension via an<br />

intermediate sign. The comparison<br />

must be with the exact sign relied on.<br />

Moreover, to hold otherwise would<br />

require the court to make fresh<br />

findings of fact on similarity, and the<br />

court had already made quite clear<br />

that it was not able to rule on the<br />

merits of issues not already<br />

discussed below.<br />

The outcome of all this was that<br />

Stabilo’s earlier wins were overturned,<br />

restoring Beifa’s registered<br />

Community design. In a further<br />

unfortunate twist for Stabilo, the<br />

court held that even though the<br />

respondent had no less than four<br />

other grounds for challenging the<br />

registration, these had not been<br />

considered by the Board of Appeal,<br />

and so could not be looked at by<br />

the General Court.<br />

For reasons best known to Stabilo,<br />

it had not sought to have the <strong>case</strong><br />

remitted to the Cancellation Division<br />

for hearing its other arguments in the<br />

event of Beifa winning the appeal. In<br />

contrast, Beifa had sought hearing of<br />

those other arguments, presumably<br />

expecting that this would be the<br />

normal course of events, so the<br />

appellant must have been rather<br />

relieved when the court held that it’s<br />

interests were “sufficiently<br />

safeguarded by annulment of the<br />

contested decision” without needing<br />

to give Stabilo the chance to run<br />

further arguments. Whether<br />

Stabilo’s interests have been equally<br />

safeguarded is presumably<br />

something its lawyers are exploring.<br />

The judgment also produced a couple<br />

of jurisdictional and procedural<br />

points. Notably, the court rejected<br />

OHIM’s argument that remitting the<br />

<strong>case</strong> to the Cancellation Division<br />

would amount to the General Court<br />

giving an order to OHIM, which it had<br />

CASE COMMENT<br />

no jurisdiction to do. The court held<br />

that all it would be doing in such a<br />

situation is making a decision that<br />

Board of Appeal ought to have taken,<br />

and it noted that OHIM was bound to<br />

do whatever was necessary to comply<br />

with its judgments.<br />

The court further held that although<br />

new pleas in law are not admissible<br />

on appeal as a general rule, a party<br />

can bring a plea that amplifies or is<br />

closely connected with a plea<br />

previously put forward, whether<br />

directly or by implication.<br />

Where does all this leave trade mark<br />

proprietors? The judgment certainly<br />

seems to strengthen the position of<br />

Community designs as against<br />

figurative marks. It also emphasises<br />

the need to make absolutely clear<br />

that a 3D mark is being registered<br />

as such rather than just a figurative<br />

image (see for example rule 3.4 of the<br />

Implementing Regulation 2868/95,<br />

as amended). Even so, the judgment<br />

also emphasised that the relevant<br />

public will perceive threedimensional<br />

marks differently to<br />

figurative marks, presumably<br />

referring to the lower inherent<br />

distinctiveness of shape marks.<br />

It may not seem a heartwarming<br />

judgment for trade mark owners,<br />

but clearly a great deal turned on<br />

the elementary error of making the<br />

comparison with the wrong mark.<br />

It sounds as though relying on the<br />

interloping mark, whatever it may<br />

have been, would have been a much<br />

better bet for Stabilo (OHIM seemed<br />

to think so), and of course it is also<br />

possible that Stabilo could have<br />

romped home on its other<br />

arguments.<br />

That doesn’t make the General Court<br />

ruling wrong, however. Rather, it<br />

highlights the potential inefficiency<br />

and uncertainty that can result from<br />

not deciding on all the issues at first<br />

instance, but instead allowing a single<br />

issue to determine the outcome as<br />

far as the General Court. As such, this<br />

decision probably says much more<br />

about the importance of well<br />

structured litigation than it does<br />

about the inherent strength of trade<br />

mark rights.<br />