SSG No 4 - Shipgaz

SSG No 4 - Shipgaz

SSG No 4 - Shipgaz

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Price:<br />

Denmark 50 DKK<br />

Euro region 6 EUR<br />

<strong>No</strong>rway 55 NOK<br />

Sweden 55 SEK<br />

UK 4 GBP<br />

February 23, 2007 4<br />

IT & COMMUNICATIONS<br />

VILLY LARSEN:<br />

I regret my behaviour<br />

Master Mariner<br />

or Master CRIMINAL?<br />

LATEST IT makes Dover Strait passage safer<br />

Baltice – Internet aid for WINTER NAVIGATION<br />

3D – the NEXT GENERATION of nautical charts

Finnlines’ aim is to be the leading company in<br />

its field. For a company operating in the service<br />

sector, competent and enthusiastic employees<br />

are a key resource.<br />

A good, well-planned human resource<br />

policy serves to guarantee the enthusiasm and<br />

expertise of our personnel.<br />

A CAREER OPPORTUNITY<br />

WITH ROOM FOR MY<br />

PERSONALITY<br />

Employee satisfaction are one of the main values<br />

of Finnlines. We are constantly aiming<br />

to achieve this by being a reliable and motivating<br />

employer treating employees with<br />

fairness and equality, encouraging every<br />

employee to continuously develop his or her<br />

own competence and expertise.<br />

THE WAY TO GO IN SHIPPING<br />

The competence of our personnel is ensured<br />

through continuous training. One of the challenges<br />

for the future is to attract new, talented<br />

persons as Yourself.<br />

For further information on vacancies<br />

please contact our human resource offi cer at<br />

Finnlines Ship Management.<br />

FINNLINES PLC, PORKKALANKATU 20 A, FI-00180 HELSINKI, FINLAND,<br />

TELEPHONE: +358 (0)10 343 50, FAX: +358 (0)10 343 4242, EMAIL: SEAPERSONNELFIN@FINNLINES.FI<br />

FINNLINES SHIP MANAGEMENT AB, BOX 158, SE - 201 21 MALMÖ, SWEDEN,<br />

TELEPHONE: +46 (0)40-17 68 40, FAX: +46 (0)40-17 68 41 / 17 68 51, EMAIL: SEAPERSONNELSWE@FINNLINES.FI<br />

WWW.FINNLINES.FI

HEAD OFFICE<br />

P.O. Box 370, SE-401 25 Gothenburg, Sweden<br />

Phone +46-31-62 95 70, Fax +46-31-80 27 50<br />

E-mail: info@shipgaz.com<br />

editorial@shipgaz.com<br />

marketing@shipgaz.com<br />

Internet: www.shipgaz.com<br />

Rolf P. Nilsson, publisher and editor-in-chief<br />

Phone: +46-31-62 95 80<br />

Mobile: +46-708-49 95 80<br />

E-mail: rolf@shipgaz.com<br />

Lars Adrians, marketing manager<br />

Phone: +46-31-62 95 71<br />

Mobile: +46-702-22 92 92<br />

E-mail: lars@shipgaz.com<br />

BRANCH OFFICES<br />

Denmark<br />

Bent Mikkelsen, editor<br />

Smedegade 13, DK-6950 Ringkøbing, Denmark<br />

Phone: +45-9732 1333<br />

Mobile: +45-2424 1335<br />

E-mail: bent@shipgaz.com<br />

Estonia (Tallinn)<br />

Madli Vitismann, editor<br />

Mobile: +372-5038 088<br />

Phone & Fax: +372-646 13 18<br />

E-mail: madli@shipgaz.com<br />

Finland<br />

Pär-Henrik Sjöström, editor<br />

Malmgatan 5, FI-20100 ÅBO, Finland<br />

Phone: +358-2-242 62 50, Fax: +358-2-242 62 51<br />

Mobile: +358-400-82 71 13<br />

E-mail: par-henrik@shipgaz.com<br />

Stig-Johan Lundström, sales manager<br />

Ruissalontie 10 as 22 FI-20200 Turku, Finland<br />

Phone: +358 45 32 44 99, Fax: +358 50 855 558 21<br />

E-mail: stig-johan.lundstrom@marconwest.fi<br />

<strong>No</strong>rway<br />

Petter Arentz, editor<br />

P.O. Box 31, Teie, NO-3106 Tønsberg, <strong>No</strong>rway<br />

Phone: +47-33-40 12 00, Fax: +47-33-40 12 01<br />

Mobile: +47-90-99 06 37<br />

E-mail: petter@shipgaz.com<br />

Dag Bakka Jr, editor<br />

Strandgaten 223, NO-5004 Bergen, <strong>No</strong>rway<br />

Phone: +47-55-32 17 47<br />

Mobile: +47-414 56 807<br />

E-mail: dag@shipgaz.com<br />

Marit Eggen, marketing manager <strong>No</strong>rway<br />

Søndre Vøra 20, NO-3234 Sandefjord, <strong>No</strong>rway<br />

Phone: +47-33-45 36 55, Fax: +47-33-47 30 33<br />

Mobile: +47-913-15 901<br />

E-mail: marit.eggen@shipgaz.com<br />

Odd-Einar Reseland, sales manager<br />

Sandakerveien 76 F, NO-0483 Oslo, <strong>No</strong>rway<br />

Phone: +47 22 09 69 10, Fax: +47 22 09 69 39<br />

Mobile: +47 47 33 29 96<br />

E-mail: odd.einar@shipgaz.com<br />

Poland<br />

Leszek Szymanski, correspondent<br />

Korzystno, ul. Truskawkowa 35, PL-78 132 Gryzbowo, Poland<br />

Phone: +48 94 354 04 84, Fax: +48 94 355 48 58<br />

Mobile: +48 602 579 620<br />

E-mail: leszek@shipgaz.com<br />

SUBSCRIPTION<br />

EUR 95/year. For further subscription details,<br />

please send an e-mail to subscribe@shipgaz.com<br />

or call +46-31-62 95 85<br />

www.shipgaz.com<br />

SCANDINAVIAN SHIPPING GAZETTE, FEBRUARY 23, 2007<br />

22<br />

34<br />

IN THIS ISSUE<br />

12<br />

12 Villy Larsen: I regret my behaviour<br />

16 Inherent problems in Baltic Rim<br />

economies<br />

40<br />

REGULARS<br />

4 News Review<br />

8 SES Onboard<br />

11 Editorial<br />

42 Technical News<br />

43 Fleet News<br />

44 Finance & Insurance<br />

48 Market Reports<br />

SPECIAL FEATURE<br />

IT & Communications<br />

19 We look at vessel traffic control, the high-tech bridge, AIS<br />

as used by Danish pilots, simulated ice navigation and new<br />

3D navigational charts. All of this and more are vital to an<br />

efficient fleet operation. But, as we show, it is a challenge.<br />

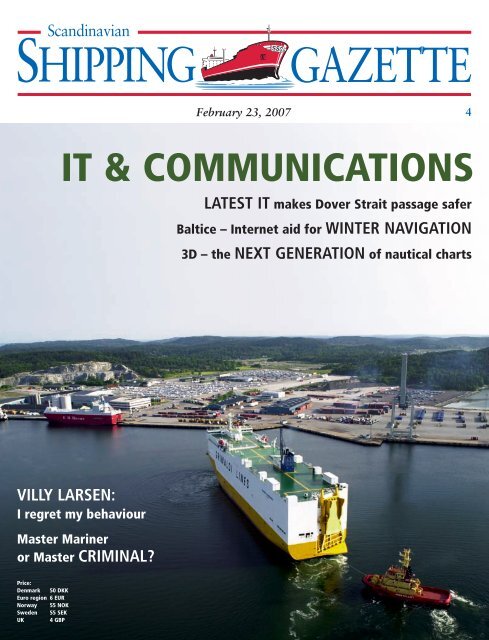

FRONT PAGE PICTURE<br />

20<br />

Grimaldi Lines is the leading ro-ro<br />

multipurpose carrier in its trading areas.<br />

Grimaldi Lines provides regular services<br />

between <strong>No</strong>rth Europe, the Mediterranean,<br />

West Africa, the East Coast of<br />

South America and Intramediterranean.<br />

The new generation of ro-ro multipurpose<br />

vessels of the Grimaldi Group is<br />

highly technological and provides for<br />

reliable and high quality services.

NEWS REVIEW<br />

FREDRIKSEN BUYS INTO STX John<br />

Fredriksen has, through his private<br />

investment company Greenwich Holding,<br />

bought a 9.7 per cent stake in the<br />

big South Korean STX Corporation for<br />

USD 60 million. Among the corporation’s<br />

companies is STX Pan Ocean.<br />

Fredriksen has previously invested in<br />

South Korean companies like Hyundai<br />

Merchant Marine and Hanjin, both<br />

short-term, profitable investments.<br />

RUSSIA SUPPORTS SHIPBUILDING Aid<br />

for the development of shipbuilding<br />

will, according to SeaNews.ru, amount<br />

to RUB 48 billion (EUR 1.39 billion)<br />

in the period 2007–2009, of which<br />

RUB 29.5 billion (EUR 856 million)<br />

will come from the national budget.<br />

The Russian strategy, which is currently<br />

being discussed in the Duma,<br />

the Russian parliament, also involves<br />

aid measures in the form of reductions<br />

in or exemption from taxes and<br />

charges on both equipment and facilities.<br />

CONSAFE ORDERS NEW RIGS Consafe<br />

Invest AB in Sweden and Yantai Raffles<br />

Shipyard Ltd in China have signed a<br />

letter of intent to build two 30,000 ton<br />

semisubmersible service and crane vessels<br />

of a new Yantai design. An option<br />

on an additional two vessels is also<br />

included.<br />

The first rig, the SSCB Safe Lifter,<br />

will be ready for delivery within 18<br />

months and the second, the SSCB Safe<br />

Carrier, within 28 months. The total<br />

order value, exkluding optional rigs, is<br />

USD 300 million.<br />

MORE CAR CARRIERS FOR MAERSK<br />

A.P. Møller-Mærsk has signed up for<br />

more car carriers for the new pool with<br />

Höegh Autoliners. The group has<br />

signed an agreement with the Chinese<br />

Xiamen Shipbuilding Corporation for<br />

the four units with a capacity of around<br />

5,000 cars. Each ship has a price of<br />

USD 58 million. The Maersk group has<br />

also secured an option on four more<br />

sister vessels.<br />

The contract will secure A.P. Møller-<br />

Mærsk Group’s position as one of the<br />

largest individual clients of the Chinese<br />

shipyard with a portfolio of container<br />

carriers, VLCCs, chemical tankers, supply<br />

ships and now car carriers.<br />

PORT OF GÖTEBORG<br />

The container terminal in Port of Göteborg.<br />

Port of Göteborg launches<br />

new investment program<br />

ssg-göteborg. The Port of Göteborg<br />

recently concluded a SEK 1.7 billion (EUR<br />

190 million) investment program and is<br />

now about to launch a new programme.<br />

Up until 2010, SEK 1.5 billion (EUR 160<br />

million) will be ploughed into facilities<br />

such as buildings, outdoor storage areas,<br />

ssg-tønsberg. Over 1.1 million cruise<br />

guests visited <strong>No</strong>rway in the last year, or 20<br />

per cent more than the previous year.<br />

Bergen remains the biggest cruise city in<br />

<strong>No</strong>rway with 249 cruise ship calls and<br />

218,185 passengers, 4 calls and 28,130 passengers<br />

more than in 2005. The second<br />

largest cruise city in <strong>No</strong>rway is Oslo with<br />

160 calls and 206,233 passengers, up 15<br />

ramps, cranes and adjustments for storage<br />

and parking. Last year, the port had a<br />

turnover of SEK 1.5 billion (EUR 160 million),<br />

up 15 per cent compared to 2005. Its<br />

pre-tax profit was SEK 157 million (EUR<br />

17.2 million), about the same as for the<br />

previous year.<br />

New <strong>No</strong>rdic Master’s programme<br />

ssg-göteborg. Five <strong>No</strong>rdic academies<br />

launches a new Master’s Programme for<br />

mariners who preferably has worked a couple<br />

of years after their graduation. The programme<br />

is a two-year continuation and<br />

offers three directions, management, logistics<br />

and survey and technical operation. It<br />

will be possible to combine this education<br />

with continued work aboard ships and stu-<br />

dents on the “<strong>No</strong>rdic Master in Maritime<br />

management”, the official name of the programme,<br />

will take courses on Chalmers<br />

University of Technology in Sweden,<br />

Kalmar Maritime Academy in Sweden,<br />

Åland Polytechnic, Sydväst Maritime in<br />

Åbo and Vestfold University Collage in<br />

<strong>No</strong>rway, all five schools who are partners in<br />

this cooperation.<br />

Cruise guests to <strong>No</strong>rway up 20 per cent<br />

calls and 20,133 passengers compared with<br />

the previous year. Geiranger had 155 cruise<br />

ships visiting, carrying 139,409 passengers,<br />

or one vessel less and 9,052 fewer passengers<br />

than in 2005. Two new areas have<br />

joined the list with places in <strong>No</strong>rway to call<br />

at. Olden had 58 ship visits and 51,521<br />

passengers and Molde-Åndalsnes had 53<br />

calls and 32,304 passengers.<br />

4 SCANDINAVIAN SHIPPING GAZETTE • FEBRUARY 23, 2007

D/S “<strong>No</strong>rden” sells ships<br />

and gives shares to the staff<br />

ssg-ringkøbing. D/S “<strong>No</strong>rden” has<br />

reported a profit of USD 64.4 million after<br />

the sale of five vessels over a couple of<br />

months. The nice profit has made the<br />

company decide to give all the employees<br />

with more than one year of employment<br />

four shares in the company, which means<br />

a total of 668 shares with a quoted value of<br />

DKK 3.23 million.<br />

The sale of vessels is two handymax bulk<br />

carriers currently under construction in<br />

China for delivery in late 2007 and early<br />

2008. The first is 50 per cent owned by<br />

“<strong>No</strong>rden”. Both are sold with a nice profit<br />

and taken back on charter for periods that<br />

could go up to five years.<br />

Furthermore, the bulkcarriers <strong>No</strong>rd-Spirit<br />

and the <strong>No</strong>rd-Phoenix and the product<br />

tanker <strong>No</strong>rdeuropa is sold off. The tanker<br />

continues sailing in the <strong>No</strong>rient Pool.<br />

TWO APM PORTS IN BOMB-SCANNING TEST Two of Maersk Line’s ports are being used<br />

in a bomb scanning test of containers bound for American ports. Container operators are<br />

expecting delays and bottlenecks in conjunction with the scanning. Eight ports worldwide<br />

have been set up to work with a container scanner. They are Port Qasim, Pakistan, which<br />

along with Salalah, Oman, is run by APM Terminals, and Southampton, UK, Puerto<br />

Cordes, Honduras, the Gamman terminal in Busan, South Korea, and Singapore.<br />

Trafigura made settlement with Ivory<br />

Coast after Probo Koala scandal<br />

ssg-tallinn. The three men imprisoned in<br />

Abidjan, Ivory Coast, since last September<br />

– following the hazardous waste scandal<br />

involving the Probo Koala – have been<br />

released.<br />

The men were released after an agreement<br />

had been reached between the Ivory<br />

Coast President’s office and the shipping<br />

company Trafigura, where the men were<br />

employed.<br />

The size of the settlement is EUR 152<br />

million and will cover the cost of cleaning<br />

up as well as, according to information, the<br />

cost of a new hospital. The Ivory Coast will<br />

also pay compensation to the victims and<br />

waive all claims, both now and in the<br />

future. Trafigura says that long-term collab-<br />

oration with the Ivory Coast will be established.<br />

Trafigura and Prime Marine Management,<br />

owner of the Probo Koala, both<br />

deny responsibility for the scandal and say<br />

that the agreement, in relation to the circumstances<br />

of the accident, is very fair. The<br />

agreement states that both companies are<br />

innocent.<br />

Greenpeace, which saw to it that the vessel<br />

was detained in Estonia so that an<br />

investigation into the scandal could be initiated,<br />

criticises the agreement. The organisation<br />

says that the victims will not receive<br />

any help from their government, which has<br />

promised to renounce all future claims<br />

against Trafigura.<br />

ADVOKATFIRMAN<br />

MORSSING & NYCANDER<br />

Est. 1880<br />

MARITIME LAW • LOGISTICS & MULTIMODAL • MARINE INSURANCE<br />

ADMIRALTY & CASUALTY • PURCHASE & SALE • SHIP FINANCING<br />

Box 3299, 103 66, STOCKHOLM, Sweden, Tel: +46 8 58705100 (24-hour service), E-mail: info@mna.se, Fax: +46 8 58705120<br />

www.morssingnycander.se<br />

NEWS REVIEW<br />

BOLIN BUYS UGELSTADS REDERI The<br />

Swede Mons Bolin and his Greek business<br />

partner Gabriel Petridis have<br />

bought S. Ugelstads Rederi in Ålesund<br />

for NOK 730 million through their<br />

Greek-British holding company Aries<br />

Energy Corporation. The shipping company<br />

has a fleet of five platform supply<br />

vessels (PSV) and had been owned by<br />

Peter Lorange for the past 19 years. Aries<br />

Energy now plans to order more PSVs<br />

to be marketed by S. Ugelstads Rederi.<br />

GO-AHEAD FOR ADSTEAM PURCHASE<br />

SvitzerWijsmuller has been given the<br />

final approval for the takeover of<br />

Adsteam. The last hurdle was the<br />

British Competition Commission,<br />

which made its last request on February<br />

9 before giving approval. SvitzerWijsmuller<br />

will have to sell off its towing<br />

activities in Liverpool, where Svitzer-<br />

Wijsmuller is already competing with<br />

Adsteam. The demand from the Competition<br />

Commission does not change<br />

the Adsteam board’s recommendation<br />

to sell the company to SvitzerWijsmuller,<br />

which after the takeover will<br />

have a market of 12 per cent, with nearly<br />

500 tugs on most continents.<br />

ATTICA LEAVES THE BALTIC Attica<br />

Group has discontinued its Nystad–<br />

Rostock ro-ro service. The ro-ro carrier<br />

<strong>No</strong>rdia was withdrawn from the service<br />

at the end of last year and the other vessel,<br />

the Marin, sailed on her last voyage<br />

in the service at the end of January. This<br />

means that the Greek shipping group<br />

has no shipping operations left in the<br />

Baltic. The Marin is now sailing between<br />

Patras and Venice, complementing the<br />

four Superfast ferries and the Blue Star<br />

ferry, all deployed in the Adriatic.<br />

SCANDINAVIAN SHIPPING GAZETTE • FEBRUARY 23, 2007 5

NEWS REVIEW<br />

NEW PIPELINE TO PRIMORSK The<br />

Russian oil company Transneft has<br />

announced that the plans for a pipeline<br />

from Unecha on the Belorussian border<br />

to Primorsk have now been completed<br />

and that construction will begin<br />

on 12 February. The Baltic Pipeline<br />

System will have a capacity of 150 million<br />

tons of crude oil per year. The terminal<br />

in Primorsk will be enlarged so<br />

that it can handle an additional 50 million<br />

tons of crude oil per year.<br />

STRONG GROWTH IN GDYNIA The<br />

Port of Gdynia reported a sharp<br />

upswing in the volume of goods handled<br />

in 2006 – up 16 per cent to 14.2<br />

million tons. This means that Gdynia<br />

accounts for a quarter of all goods handled<br />

by Polish ports. This is the highest<br />

volume of goods since 1979, a record<br />

year in the history of the port when<br />

14.4 million tons of goods were handled.<br />

The <strong>No</strong>rdatlantic.<br />

SUPER PROFIT ON TANKER SALE D/S<br />

“<strong>No</strong>rden” has announced the sale of<br />

the crude oil tanker <strong>No</strong>rdatlantic to a<br />

German buyer for takeover in March,<br />

this year. “<strong>No</strong>rden” also reported a<br />

profit of USD 30.1 million on the sale.<br />

This means that the <strong>No</strong>rdatlantic has<br />

been a real golden egg for the Copenhagen-based<br />

company.<br />

The tanker was delivered from Sumitomo<br />

Group in Japan in 2001 for a<br />

sum of USD 35.0 million. Since then<br />

the tanker has been very profitable with<br />

a steady five-year time charter at a level<br />

of USD 23,500 with operating costs<br />

around USD 14,000. The tanker has<br />

been sold to a German K/G for USD<br />

59.5 million or close to double the<br />

price paid in 2001.<br />

BENT MIKKELSEN<br />

Cars at CMP.<br />

Profit and volumes up for CMP<br />

ssg-ringkøbing. Copenhagen Malmö Port<br />

(CMP) had a good year in 2006. The cargo<br />

volume handled grew 10 per cent. The profit<br />

went up 16 per cent and the turnover<br />

reach an all-time high of SEK 649 million.<br />

The profit was SEK 93 million compared<br />

with SEK 80 million in 2005. The growth<br />

in imports of new cars was particularly high<br />

with an increase of 30 per cent to 440,000<br />

units during 2006. Furthermore, there was<br />

15 per cent a growth in the ferry traffic<br />

from Malmö to Travemünde. Container<br />

traffic increased 13 per cent to 175,000<br />

TEUs over the quayside and, finally, the<br />

number of cruise passengers increased 7 per<br />

HKSOA and ICS disagree on sulphur fuel<br />

ssg-göteborg. Hong Kong Shipowners<br />

Association (HKSOA) makes it very clear<br />

that their organisation does not agree with<br />

the ICS statement that global shipping is not<br />

able to switch to low sulphur fuel. ICS suggested<br />

in their statement that they represented<br />

the view of the whole shipping industry.<br />

“We see the ICS opinions as being an<br />

ICS position, and that others in the industry<br />

have other opinions”, says managing<br />

director Arthur Bowring to <strong>SSG</strong>.<br />

HKSOA says shipping should be proactive<br />

in its work to reduce emissions and the<br />

only way forward is switching over to low<br />

cent to a total of 458,000. The total cargo<br />

volume amounted to 16.6 million tons or<br />

1.4 million tons more than 2005.<br />

Investments<br />

A number of investments in both ports are<br />

in the pipeline for the years ahead. An<br />

extra pier for tankers will be built at<br />

Prøvestenen in Copenhagen and the<br />

approach to the oil terminal in Malmö will<br />

be widened. CMP is planning new cruiseship<br />

quays in Copenhagen and a new ferry<br />

and container terminal in Malmö. A combi-terminal<br />

in Malmö is also being planned<br />

together with a logistics park.<br />

sulphur fuel. The organisation also wants a<br />

global limit, without borders or zones, of<br />

maximum one per cent sulphur content in<br />

fuel.<br />

“HKSOA does not support the use of<br />

scrubbers or any other technology that<br />

would permit continued use of residual<br />

fuel in ship’s engines. Ships have incinerated<br />

the waste products of refineries for long<br />

enough, and shipowners and their crews<br />

would now welcome a move towards the<br />

use of clean fuels that do not need extensive<br />

treatment before use”, HKSOA writes<br />

in a statement.<br />

6 SCANDINAVIAN SHIPPING GAZETTE • FEBRUARY 23, 2007<br />

BENT MIKKELSEN

Best ever result for Statoil<br />

ssg-tønsberg. <strong>No</strong>rwegian oil company<br />

Statoil, soon to merge with Hydro, has<br />

announced record net income of NOK<br />

40.6 billion for last year compared with<br />

NOK 30.7 billion in 2005. Total oil and<br />

gas production in 2006 was 1,135,000 barrels<br />

of oil equivalent (boe) per day, compared<br />

to 1,169,000 boe per day in 2005. In<br />

the fourth quarter of 2006, total oil and gas<br />

production amounted to 1,153,000 boe per<br />

day, compared to 1,232,000 boe per day in<br />

the fourth quarter of 2005.<br />

Statoil’s figure of 1,140,000 boe per day<br />

for production in 2006 was based on an oil<br />

price of USD 60 per bbl. A realised oil<br />

price of USD 60 per bbl would have resulted<br />

in an estimated production of 1,139,000<br />

boe per day. The difference from the<br />

reported production is due to production<br />

sharing agreements (PSA) effects. The Statoil<br />

chief executive, Helge Lund says:<br />

“The annual income for 2006 is the best<br />

ever for Statoil. We maintained strong earnings<br />

and competitive returns, despite temporarily<br />

lower production overall. Through<br />

the acquisition of two deepwater portfolios<br />

in the Gulf of Mexico (GoM) from<br />

Anadarko and Plains and the subsequent<br />

divestment of the retail operation in Ireland<br />

we have further upgraded our portfolio.”<br />

Redress for Destination Gotland,<br />

Rikstrafiken loses arbitration<br />

ssg-göteborg. The Swedish National<br />

Public Transport Agency, Rikstrafiken, has<br />

lost a dispute with Destination Gotland<br />

and an arbitration tribunal has ordered it<br />

to pay out approx. SEK 300 million for<br />

2004 to 2006, which Rikstrafiken had<br />

retained.<br />

The dispute concerned how the traffic<br />

agreement should be interpreted, including<br />

whether money should be paid out even if<br />

fuel consumption was lower than calculat-<br />

ed. The arbitration tribunal has determined<br />

that the money must be paid out and that<br />

it was permissible for the money to be used<br />

for other investments. In addition to the<br />

money Rikstrafiken has refused to pay out,<br />

it will also have to pay all legal expenses.<br />

“We have to be self-critical and acknowledge<br />

that the State quite simple hasn’t handled<br />

this agreement in a correct manner”,<br />

says Staffan Widlert, director-general of<br />

Rikstrafiken, in a press release.<br />

EU COMMISSION APPROVES INVESTMENT IN PORT OF MUUGA The EU Commission<br />

has decided that the financing of the expansion of the eastern part of the Port of Muuga<br />

cannot be regarded as state aid because Port of Tallinn is a state-owned company. The Port<br />

of Muuga is the largest of five ports in the port company and the EUR 116 million investment<br />

in the expansion will have to be earned or borrowed by the port company itself.<br />

<strong>No</strong>rway to implement<br />

ballast water convention<br />

ssg-tønsberg. This year <strong>No</strong>rway will<br />

implement strict controls on ballast water<br />

management by applying the standards set<br />

down in the IMO convention on ballast<br />

water. Wikborg Rein, <strong>No</strong>rway’s leading<br />

maritime law firm, warns against introducing<br />

the convention before it comes into<br />

force internationally. The move has considerable<br />

commercial and operational implications<br />

for vessels calling at <strong>No</strong>rwegian<br />

ports, who will now be required to adhere<br />

to a ballast water plan, keep a strict log of<br />

ballast water management, and will only be<br />

allowed to discharge clean ballast, which<br />

has been exchanged at sea in accordance<br />

with the convention. The convention<br />

requires ships to conduct ballast water<br />

exchange at least 200 nautical miles from<br />

the nearest land, in at least 200 metres<br />

depth of water and in accordance with<br />

guidelines issued by IMO. If it is not possible<br />

to conduct water ballast exchange as<br />

described, it shall be carried out as far from<br />

the nearest land as possible, at least 50 nautical<br />

miles from the nearest land and in<br />

water at least 200 metres deep.<br />

NEWS REVIEW<br />

ST PETERBURG CHANNEL WIDENED<br />

SeaNews.ru reports that the 27 nautical<br />

mile long channel to St Petersburg will<br />

be widened to 140 metres and dredged<br />

to a depth of 13 metres. As a result of<br />

this, it is estimated that goods turnover<br />

in the port could increase 25 per cent. In<br />

the future, the channel will be widened<br />

to 150–160 metres. The investment is<br />

estimated to be in the region of RUB 25<br />

billion (about EUR 725 million).<br />

Wind working on the installation of<br />

wind turbines on the Horn Revpowerplant.<br />

DBB BUYS SALVAGE EQUIPMENT Dansk<br />

Bjergning & Bugsering (DBB) has<br />

acquired a self-elevation crane platform<br />

fitted with propulsion and classed as a<br />

ship. The jack-up platform will be used<br />

in future salvage operations along with<br />

the floating crane Samson. The new<br />

piece of equipment is currently named<br />

Wind, flies the Luxembourg flag and is<br />

owned by a Belgian group. The “ship”<br />

is docking in Belgium at the moment<br />

and will soon be taken to DBB’s base<br />

port, Aarhus, for preparations to install<br />

a 1,000 ton crane permanently.<br />

GREEN REEFERS DOWN LAST YEAR<br />

Bergen-based Green Reefers’ operating<br />

results for last year were down to USD<br />

16.2 million from USD 25.7 million a<br />

year earlier. The company has now sold<br />

the 99,000 cbm fish carrier the Green<br />

Frio, built in 1979, and when the vessel<br />

is delivered Green Reefers will control<br />

46 vessels, including four time-chartered<br />

and two bareboat-chartered ships.<br />

Last year was one of expansion for<br />

Green Reefers. In the last quarter,<br />

Green Reefers bought 20 reefers for<br />

around USD 176 million.<br />

More news on page 46 ><br />

SCANDINAVIAN SHIPPING GAZETTE • FEBRUARY 23, 2007 7<br />

BENT MIKKELSEN

Safety<br />

Environment<br />

Security<br />

Editor: Cecilia Österman | Phone +46 31 62 95 88 | E-mail: cecilia@shipgaz.com | www.sesonboard.com<br />

Less fire fighting<br />

with good safety culture<br />

An internal report has uncovered<br />

serious deficiencies in a Swedish<br />

nuclear power plant and a discussion<br />

about safety culture is in full swing.<br />

Safety culture as a concept was first<br />

introduced after the Chernobyl disaster,<br />

but is now used in all sorts of<br />

industries, shipping included. With<br />

all right, since a ship is a safety-critical<br />

environment and a healthy organisation<br />

is a prerequisite to gain result in<br />

the preventive safety work.<br />

Human error is often claimed to<br />

be the reason for accidents. In most<br />

cases it is implied that human error<br />

is restricted to the crew and does not<br />

extend beyond the ships personnel.<br />

This is unfortunate, since attitudes<br />

and behaviours are outcomes, not<br />

something that appears out of thin air.<br />

In the report from the Forsmark<br />

nuclear power plant, the authors state<br />

that the degradation of the safety<br />

culture in all probability is due to the<br />

focus on increased production. And<br />

that is not particularly unique. Time is<br />

money and sometimes, it seems, it is<br />

more accepted to do the wrong thing<br />

and redo it, if the perception is that<br />

the shortcut saves money.<br />

We devote our time to constant fire<br />

fighting instead of developing and<br />

maintaining the good work. Fire fighting<br />

is all right when you are with the<br />

brigade. The rest of us should use our<br />

time to make a change.<br />

c e c i l i a ö s t e r m a n<br />

cecilia@shipgaz.com<br />

Bad ergonomics behind<br />

rescue helicopter crash<br />

The Swedish National Investigation<br />

Board has now published their investigation<br />

of the fatal crash with a Swedish<br />

navy helicopter during a maritime rescue<br />

drill on the Swedish West Coast in <strong>No</strong>vember<br />

2003. Six people died in the crash.<br />

Thorough investigation has not been<br />

able to disclose any technical faults with<br />

the crashed helicopter. Instead the report<br />

points to several deficiencies when it comes<br />

to man–machine interaction and also a lack<br />

of risk analysis regarding the organisational<br />

changes that has taken place during the<br />

past years in the Swedish Armed Forces.<br />

Insecure and frustrated<br />

The report states that several important<br />

instruments, control handles and switches<br />

were designed or placed in a way that accidental<br />

misunderstanding or mishandling<br />

could not be excluded. On some helicopters<br />

of the same type, a plastic stripe had<br />

even been placed over the radar altitude<br />

switch to prevent errors. Interviews with<br />

helicopter pilots also reveal that the per-<br />

GÖSTA BOLANDER, FBB<br />

SES Onboard<br />

The SES Onboard section<br />

focuses on Safety, Environment<br />

and Security issues of interest<br />

for ship operating professionals<br />

at sea and in shore-based<br />

organizations.<br />

HKP10 Super Puma, a helicopter of the same<br />

type that crashed in 2003.<br />

sonnel felt insecure, frustrated and strained<br />

in connection with the repeated organisational<br />

changes. According to the report,<br />

during changes in an organisation, particularly<br />

at merges, it is extremely important to<br />

maintain a positive safety culture and the<br />

company’s crew resource management.<br />

In the summary, the report also recommends<br />

that the Swedish Civil Aviation<br />

Authority introduce a routine that guarantees<br />

that a rescue helicopter with a winch<br />

is available to send to any accident scene<br />

where it might de be required.<br />

AGREEMENT ON AIR AND SEA RESCUE Estonian minister of the interior Kalle<br />

Laanet and Swedish Minister for Communications Åsa Torstensson signed a cooperation<br />

agreement on air and sea rescue on February 5. The agreement defines the two<br />

countries’ areas for search and rescue as well as responsible authorities. It also covers the<br />

exchange of information between the two parties as well as assistance and joint exercises.<br />

Estonia has a similar agreement with Finland and is preparing an agreement with Latvia.<br />

A discussion forum has been launched on SES Onboard.<br />

Join the forum for Safety, Environment and Security issues at<br />

www.sesonboard.com<br />

THE SCANDINAVIAN SHIPPING GAZETTE • FEBRUARI 23, 2007

Captain Schröder released<br />

On February 8 the German captain<br />

Wolfgang Schröder was released after<br />

four months in an American high security<br />

prison. Schröder was master of the containership<br />

Zim Mexico III that was involved in<br />

a fatal accident in the port of Mobile, Alabama<br />

in March last year. The bow thruster<br />

failed during manoeuvring and the ship’s<br />

bow struck a gantry crane, which crashed<br />

to the ground hitting an electrician, who<br />

died from the injuries. Schröder was arrested<br />

and charged with misconduct and was<br />

found guilty. Schröder admitted in court<br />

that he knew the bow thruster had failed<br />

before. Neither he nor the port pilot insisted<br />

on a tug being in assistance.<br />

THE SCANDINAVIAN SHIPPING GAZETTE • FEBRUARI 23, 2007<br />

Schröder was facing a prison term of<br />

up to two years but was set free on time<br />

already served and had to leave the US<br />

within 72 hours. The vessels operator, Rickmers<br />

Reederei of Germany, has agreed to<br />

pay a USD 350,000 fine.<br />

There has been a number of noticed<br />

arrests and incarcerations of masters over<br />

the recent years. Captain Larsen, who is<br />

portrayed on page 12, and also Captain<br />

Mangouras of the Prestige, Captain Spiropoulos<br />

of the Erika, and Salvage Master Pappas<br />

held in Karachi over the Tasman Spirit<br />

grounding. The Erika trial is scheduled to<br />

start on February 12 and is expected to last<br />

until June.<br />

Research on Fast Rescue Boat system<br />

The final report of the research and<br />

development project REBUS was<br />

presented on January 26. The project has<br />

run since 2003 with the aim to develop a<br />

new Fast Rescue Boat system (FRB). The<br />

FRB concept was introduced in 2000 as a<br />

result of lessons learned during the sinking<br />

of the Estonia but unfortunately a lot of<br />

incidents and accidents have been reported<br />

from FRB operations.<br />

In the REBUS system the manual handling<br />

of painter line and lifting wire has been<br />

eliminated, and the FRB is driven into a<br />

dock with automatic locking devices. The<br />

pendulum problems with a FRB hanging<br />

at a high hull side have been reduced by<br />

the means of a guider along the ships side.<br />

The system was first tested at SSPA’s<br />

USCG has revealed a number of<br />

falsified oil record books and magic<br />

pipes, resulting in both heavy fines and<br />

imprisonment. Heavy lift operator Pacific-<br />

Gulf Marine was fined USD 1 million after<br />

admitting that the company’s entire fleet<br />

have discharged hundreds of thousands of<br />

litres of oily water bypassing the oily water<br />

separator (OWS) with a magic pipe.<br />

A USD 750,000 fine was imposed on the<br />

Greek owners of the bulk carrier Irika after<br />

a similar charge, but here the ships second<br />

engineer is rewarded USD 250,000 for blowing<br />

the whistle. The engineer slipped some<br />

photographs of a magic pipe in operation<br />

seakeeping and manoeuvring basin in<br />

Göteborg and later a prototype was tested<br />

onboard Stena Danica during the autumn<br />

of 2006.<br />

The REBUS project also recommends<br />

that FRB operators wear personal protective<br />

equipment, such as a dry rescue suit,<br />

lifejacket and helmet, and that they be<br />

equipped with a portable, watertight VHF<br />

unit with a headset. A new type of lifejacket,<br />

dedicated for the FRB operators, has<br />

been developed within REBUS. This lifejacket<br />

is certified and under production.<br />

Vinnova and the Swedish Maritime<br />

Administration financed the project with a<br />

total budget of EUR 1.9 million.<br />

For more information, please see<br />

www.sesonboard.com<br />

Magic pipe led to fines and prison<br />

to the inspectors during an inspection.<br />

Owners of another Greek bulk carrier,<br />

the Irene E.M., were hit with a USD 1.25<br />

million fine for carrying a false oil record<br />

book and bypassing the inoperable OWS<br />

on a regular basis for several months. USD<br />

250,000 of the fine goes to a marine environment<br />

project in Delaware Bay.<br />

A similar charge resulted in the Korean<br />

chief engineer being sentenced to five<br />

months in prison and the second engineer<br />

to three years’ probation. The ship’s operator,<br />

Sun Ace Shipping Co, was handed a<br />

USD 500,000 fine in addition to a threeyear<br />

restriction on trading to the US.<br />

New MARPOL<br />

checklist<br />

Lloyd’s Register and UK P&I officials<br />

believe port state control (PSC)<br />

inspectors will increasingly crack down on<br />

offences involving air pollution, garbage<br />

disposal and ballast management. To help<br />

masters and owners to comply with MAR-<br />

POL and reduce the risk of PSC detentions,<br />

Lloyd’s Register and the UK P&I<br />

Club has jointly published a checklist. The<br />

checklist highlights seven areas where operational<br />

deficiencies are frequently found:<br />

oil from machinery spaces, retention of<br />

oil onboard, discharge violation, inconsistent<br />

oil record book entries, garbage management,<br />

cargo residues and shipboard<br />

oil pollution emergency plans (SOPEP).<br />

Although not directly linked to MARPOL,<br />

an appendix on ballast water management<br />

is also included.<br />

In 2005, Lloyd’s Register also published<br />

a pre-port arrival PSC checklist to support<br />

owners and masters. The checklist covers<br />

the most common items for detention,<br />

such as fire pumps, lifeboats, engine room<br />

cleanliness and certificates for masters and<br />

officers.<br />

For more information, please see<br />

www.sesonboard.com<br />

Loss Prevention<br />

tooLBox<br />

in co-operation with<br />

MORE NEwS, SOURCES AND lINkS<br />

www.sesonboard.com

BOOKIT<br />

BOOKIT<br />

A RESERVATIONS SYSTEM<br />

20<br />

WITH YEARS<br />

OF EXPERIENCE<br />

Hogia Ferry Systems AB<br />

Vallonvägen 1 B,<br />

FIN-65610 Korsholm, Finland<br />

Tel. +358-6-319 2800<br />

Fax +358-6-319 2899<br />

bookit@hogia.fi bookit.hogia.fi<br />

www.mpl.fi

Political expediency<br />

will override dithering shipping<br />

Political expediency has totally<br />

overtaken international shipping<br />

organisations’ efforts to<br />

reduce ship emissions. In fact, if<br />

the International Chamber of<br />

Shipping (ICS), representing national ship<br />

owners’ associations, and Baltic and International<br />

Maritime Council (BIMCO) do<br />

not stop dithering they could risk being left<br />

out of further proceedings.<br />

ICS has, typically, asked for more time<br />

to find a consensus among member organisations<br />

instead of taking a lead. And they<br />

are talking of sulphur limits to allow alternative<br />

compliance measures and looking<br />

for a net environmental benefit. It is much<br />

to late for this sort of approach and it may<br />

result in shipping getting a worse deal<br />

than if they had taken a more proactive<br />

and sensible approach. With the recent<br />

United Nation report on global warming<br />

and climate changes, politicians will want<br />

to see a different approach.<br />

Sometimes it is worth a reminder that the<br />

IMO agreed MARPOL Annex VI (a separate<br />

treaty), dealing with air emissions from<br />

ships, in 1997. On May 18, 2004, MAR-<br />

POL Annex VI was ratified by the 15th<br />

nation, bringing the total percentage of the<br />

world’s merchant shipping tonnage to<br />

54.57. Annex VI went into effect on May<br />

19, 2005. It sets limits on SOx and NOx<br />

emissions from ships, and prohibits the<br />

Denmark’s largest<br />

single taxpayer<br />

When you are the largest single taxpayer<br />

in a country, you might expect some interest<br />

when you open your mouth to say<br />

something about a new tax proposal. This<br />

is what happened when the Danish government<br />

opened a new proposal for taxation<br />

of companies.<br />

The A.P. Møller-Mærsk chief executive<br />

Jess Søderberg took a rare opportunity to<br />

speak up in public and said that the A.P.<br />

Møller-Mærsk Group might consider moving<br />

its headquarters and main functions to<br />

intentional emission of ozone depleting<br />

substances such as chlorofluorocarbons;<br />

sets a global limit on the maximum allowable<br />

sulphur content of fuel oil used in<br />

shipping to 4.5 per cent by mass, and calls<br />

for the IMO to monitor the worldwide<br />

average sulphur content of shipping fuel. It<br />

also establishes specific “SOx Emission<br />

Control Areas” with more stringent controls<br />

on SOx emissions (1.5 per cent by<br />

mass) and finally prohibits onboard incineration<br />

for ships carrying certain products.<br />

It is no good pretending otherwise, shipping<br />

is a major air polluter. In order to safeguard<br />

an already tarnished image, it needs<br />

to embrace bright ideas, i.e. for ships to<br />

switch to distillate fuel, in this case marine<br />

diesel. The suggestion was first floated by<br />

the international independent tanker organisation<br />

Intertanko and is supported by the<br />

Hong Kong Shipowners’ Association. But<br />

beyond that there is little apparent support<br />

despite the merits of using distillate fuel;<br />

cleaner air and less dangerous pollution in<br />

case of accidents at sea.<br />

But because most of the international<br />

shipping organisations are by nature reactive<br />

rather than proactive, they will never<br />

be ahead of time. By choosing distillate<br />

fuel, shipping would clean up their act<br />

decisively and be able to meet future more<br />

stringent limits. Defeatist talk by the ICS<br />

that refineries cannot deliver the necessary<br />

a foreign country if the proposal would<br />

stay as it appeared in the first draft. It<br />

would affect the Group considerably and<br />

would drain the company of a large sum<br />

of money, much more than the DKK 13.5<br />

billion the company paid in taxes in 2006<br />

as the largest single taxpayer in Denmark.<br />

The prime minister was quick to reply,<br />

saying that the government had no intention<br />

of driving large, healthy companies<br />

out of the country. The purpose of the<br />

new proposal is to come down on the<br />

equity foundations, which purchase Danish<br />

companies and fill them with debts so<br />

EDITORIAL<br />

Defeatist talk by the ICS<br />

that refineries cannot deliver<br />

the necessary quantities<br />

is less than helpful.<br />

quantities is less than helpful. We all know<br />

that there will be sufficient volumes when<br />

demand is present. Such is the market,<br />

and ICS knows it. All ICS will say about<br />

the use of distillate fuel is that they have<br />

no objection to some ship owners making<br />

the switch. Shipping is clearly split on support<br />

of distillate fuels. Many owners look<br />

for a lead from ICS and BIMCO, but are<br />

not getting it. Rather, these organisations<br />

are doing their best to confuse the issue<br />

and thereby fritting<br />

away an opportunity<br />

to show<br />

courage and<br />

take the lead. It<br />

is a pity.<br />

petter arentz<br />

Editor, <strong>No</strong>rway<br />

Phone: +47 33 40 12 00, E-mail: petter@shipgaz.com<br />

that they do not pay any tax at all. Naturally<br />

the usual crowd has been in view in<br />

the media saying that a multinational<br />

company should not have political influence<br />

and just pay their taxes, but it is<br />

rather natural to have a say when you pay<br />

for the music or part of the music.<br />

It will be interesting to see what the<br />

government and the Minister for Fiscal<br />

Affairs will do to avoid the anger of A.P.<br />

Møller-Mærsk and hit the equity funds,<br />

because they cannot make a proposal for<br />

equity funds with exemption for A.P.<br />

Møller-Mærsk, the largest privately owned<br />

shipping company in the world.<br />

SCANDINAVIAN SHIPPING GAZETTE • FEBRUARY 23, 2007 11

Villy Larsen:<br />

I regret my<br />

behaviour<br />

The words come from captain<br />

Villy Larsen, who in September<br />

2006 experienced a nightmare<br />

off the American east coast,<br />

while captain on the Danish<br />

coaster Danica White, bound for the military<br />

harbour of Sunny Point close to<br />

Wilmington to take on military cargo for<br />

Greece and Saudi Arabia.<br />

“I would have done it otherwise, surely”,<br />

says Villy Larsen. “Being in prison with an<br />

almost unknown future was a real nightmare.<br />

I was not sure that I would come out<br />

at all, and sometimes got the impression<br />

“I deeply regret asserting my rights under the ISPS code. It<br />

was not worth spending 104 days in a US jail. That is not<br />

something I wish for anyone, not even my worst enemy!”<br />

that everyone wanted to forget about me<br />

while I was locked away in a dark prison.”<br />

It all started when a US Coast Guard<br />

boarding party with nine persons approached<br />

the Danica White some three<br />

nautical miles off the coast for an inspection.<br />

BENT MIKKELSEN<br />

“They wanted the crew to stay in the<br />

mess room, while the officer in charge and<br />

his deputy came on to the bridge”, explains<br />

Villy Larsen. “The officer in charge showed<br />

his ID, while the deputy did not have one.<br />

This is against the rules, and it is also<br />

against the rules for our ship to have any<br />

unknown persons onboard.”<br />

The officer in charge insisted on vouching<br />

for the deputy. Then a long discussion<br />

started with the officer in charge, who also<br />

insisted on keeping the crew in the mess<br />

room during an inspection of the cabins.<br />

Again captain Villy Larsen stood up and<br />

12 SCANDINAVIAN SHIPPING GAZETTE • FEBRUARY 23, 2007

Engine Protection Partner AS<br />

Schaller Automation’s Oil Mist Detector systems<br />

P.O. Box 2668 Møhlenpris,<br />

NO-5836 Bergen, <strong>No</strong>rway<br />

Phone: +47 55 30 19 00<br />

Fax: +47 55 30 19 01<br />

www.epp.no<br />

insisted that the persons living in each cabin<br />

should be present during the inspection.<br />

This was agreed upon. The next hurdle was<br />

inspection of the cargo hold. The USCG<br />

officer in charge insisted on having the<br />

hatch opened instead of using the access at<br />

each end. Villy Larsen refused to open the<br />

hatch as it can only be done with the derricks<br />

lifted, which for safety reasons he did<br />

not want to do in swell, three nautical<br />

miles off the coast.<br />

“I think there was some bad chemistry<br />

between the officer in charge and me right<br />

from the beginning”, says Villy Larsen, and<br />

continues with explanation of the “attack”<br />

on the coastguard dingy:<br />

“When the party left I had to speed up<br />

the vessel a little in order to be able to steer<br />

it. The dingy touched the side of the ship,<br />

but with no damage at all.”<br />

When the “collision” occurred the Danica<br />

White was drifting at 1.2 knots.<br />

<strong>No</strong>t enough food in the prison<br />

A few days later an inspection of the cargo<br />

hold was conducted while lying at a safe<br />

anchorage without any problems, and<br />

there were no signs of authorities or trouble<br />

when the ship was taken to the quayside<br />

and lay there a whole weekend.<br />

“The office in Copenhagen, the charterers<br />

and USGC had worked out a scheme to<br />

send over a new captain to the ship and he<br />

was on board during the approach to Sunny<br />

Point”, says Villy Larsen. “After a quiet<br />

weekend I was told to come down to the<br />

quayside and was arrested. I was taken to<br />

the immigration authorities and then to a<br />

judge and put in jail with the words that it<br />

would all take about a couple of weeks,<br />

maximum a month.”<br />

“Coming into the prison was a very<br />

strange experience”, says Villy Larsen. “It<br />

TIMELINE<br />

Aug 27: Danica White approaches Cape Fear<br />

River. USCG Boarding party on board<br />

Aug 28: Anchored off Delaware River. New<br />

inspection<br />

Sept 4: Danica White alongside at the<br />

quayside at Sunny Point<br />

Sept 7: Villy Larsen arrested. Appeared for a<br />

judge in Wilmington. Given a public defence<br />

lawyer. Wife (cook) Lone Larsen flies back to<br />

Denmark.<br />

Sept 14: Transferred to Raleigh Prison<br />

Sept 28: Transferred to Smithfield Prison<br />

<strong>No</strong>v 27: Appeared for a judge in Wilmington.<br />

Transferred to Wilmington Prison<br />

Dec 18: Released and put on airplane directly<br />

to London<br />

was a non-smoking area as the state of<br />

South Carolina buys prison cells from private<br />

prison operators and non-smokers are<br />

better paid than smokers, so they insist on<br />

non-smoking. That was tough for me, as I<br />

usually smoke 20–30 cigarettes per day.<br />

Also in prisons the amount of food is not<br />

enough for everyone, so there are fights.<br />

Lights are on 24 hours a day, so you learn<br />

to sleep with the lights on. The only cigarette<br />

I smoked during the 104 days was on<br />

my birthday, <strong>No</strong>vember 16, when I purchased<br />

one cigarette at a price equal to<br />

DKK 90 on the inside black market.”<br />

After 14 days in Wilmington he was<br />

transferred to the capital city of South Carolina,<br />

Raleigh, and jailed there for another<br />

14 days before going to the prison in<br />

Smithfield. There he was put in a one-person-cell<br />

with another inmate.<br />

“Two persons living in a cell measuring<br />

2 × 2 metres with one bed and one mattress<br />

on the floor and with a combined toilet<br />

and washing facility in the cell and lights<br />

Schaller Automation’s repair and service department<br />

– come directly to us, save time & money!<br />

➢ repair centre – max 2 days repair time<br />

➢ main stock for spare parts – 1 day delivery time<br />

➢ sales of new and reconditioned VISATRON O.M.D.<br />

➢ open 24 hours/7 days a week<br />

➢ exchange unit service for all VISATRON systems<br />

➢ overhaul and service of the following system series:<br />

VN /79, VN /82, VN /87 & VN /93<br />

SCANDINAVIAN SHIPPING GAZETTE • FEBRUARY 23, 2007 13

Villy Larsen’s passport shows an entry stamp<br />

for prosecution.<br />

on 24 hours a day. It was a real change of<br />

lifestyle for me. I was used to working from<br />

six am to late at night every day onboard<br />

the ship, reading, talking and taking care of<br />

the engine as well as the whole ship. <strong>No</strong>w I<br />

had nothing to do at all. <strong>No</strong>thing whatso-<br />

ever. <strong>No</strong> reading stuff, and the only TV on<br />

was the TV shop in the dayroom in the<br />

prison. And no smoking!”<br />

Assault with deadly weapon<br />

On <strong>No</strong>vember 27, Villy Larsen was brought<br />

to a court in Wilmington, where the prosecutor<br />

and his own lawyer insisted on a<br />

release, but the judge wanted a declaration<br />

from the US Home Land Security saying<br />

that they did not have any claims on Villy<br />

Larsen. So it was back to jail. The paper<br />

from Home Land Security was provided<br />

on December 18 and the same day Villy<br />

Larsen was escorted to the airport and sent<br />

on a plane to London. Then the original<br />

charge – assault nine times with a deadly<br />

weapon (read: the ship) giving a fine of<br />

USD 240,000 and twenty years in prison –<br />

was boiled down to time served plus a fine<br />

of USD 100 for abusive language and inexpedient<br />

manoeuvring.<br />

<strong>No</strong> roses for the employer<br />

“I must praise my union Maritime Leaders<br />

to the absolute highest level”, says Villy<br />

Larsen. “From the very first days they did<br />

everything possible to help me. They pro-<br />

THE INTERNATIONAL CONFERENCE ON<br />

COMPUTER APPLICATIONS IN SHIPBUILDING (ICCAS 2007)<br />

18-20 September 2007, Portsmouth, UK<br />

vided me with a lawyer and paid that for<br />

me and furthermore, they provided me<br />

with money to buy extra food in the<br />

prison. There you get a jail account to<br />

which they transferred money on a weekly<br />

basis. On the home front they also took<br />

mental care of my wife Lone, who was sent<br />

home from Wilmington without knowing<br />

anything about my fate.”<br />

“On the other hand, there is no reason<br />

for roses to my company H. Folmer & Co,<br />

who did nothing to free me from jail. I<br />

think they kept a low profile in order to<br />

keep the profitable charters out of South<br />

Carolina. Neither was there any help when<br />

Lone called the Ministry of Foreign Affairs.<br />

This is your own problem, was the answer<br />

she got from a telephone call.”<br />

Villy Larsen and his wife took off at the<br />

end of January for Namibia to sign on to<br />

the sister ship Danica Brown for trading<br />

between Namibia and the Congo River in<br />

Africa.<br />

“Africa is much easier to work in. With a<br />

couple of cartons of cigarettes most problems<br />

can be solved there and then”,<br />

explains Villy Larsen.<br />

bent mikkelsen<br />

ICCAS 2007 will be the 13th International Conference on Computer Applications in Shipbuilding. The 2007 conference will be held in Portsmouth, UK, on 18-20 September 2007.<br />

The conference will review operational experience from existing computer applications in the design and build of ships and offshore structures. It will also examine the advances in<br />

Information Technology which have contributed to increased productivity in both shipbuilding and maritime operations; including increasing co-operative working between shipyards,<br />

marine equipment and system manufacturers, engineering partners and shipping companies.<br />

The conference will cover the full range of topics related to computer applications and abstracts are invited on:<br />

• Concept design, tendering, initial design, general arrangement, cost and work estimation, hull form, hydrodynamic analysis and basic structural<br />

design, risk based design<br />

Detailed and production design<br />

Structure, machinery, hull and outfitting design<br />

Parts manufacturing and assembly<br />

Prefabrication, shop automation, robotics, assembly, simulations and accuracy control<br />

Material management<br />

Material control, supply chain management, Logistics and e-solutions<br />

Inspection and maintenance<br />

Life-cycle maintenance, parts and systems reliability, inspection standards and Risk management.<br />

Knowledge Management and Innovation Management<br />

Authors should focus their papers on advances made in information and communication technology with respect to methods, tools, standards and organisational adaptations in the<br />

different application sectors of the shipbuilding industry. A reflection on the potential impact of the innovation described to productivity improvements is appreciated.<br />

The conference will attract a large international audience and provide a forum and means of professional development for all parties interested in computer applications in<br />

shipbuilding.<br />

Key dates and up to date information will be displayed on the website at: www.rina.org.uk/events<br />

BENT MIKKELSEN<br />

The Royal Institution of Naval Architects<br />

If you would like to submit an abstract or require further information, please contact:<br />

Conference Department, RINA, 10 Upper Belgrave Street, London SW1X 8BQ.<br />

Tel +44 (0)7201 2401, Fax +44 (0)20 7259 5912 or by Email: conference@rina.org.uk<br />

14 SCANDINAVIAN SHIPPING GAZETTE • FEBRUARY 23, 2007

Master Mariner<br />

or Master Criminal?<br />

Mark Twain once wrote “sailing is like<br />

being in jail, but with the added<br />

opportunity of drowning”. Captain<br />

Larsen has tried the correctness of<br />

that statement the hard way, and<br />

unfortunately, his encounter with the<br />

American Department of Justice is not<br />

an isolated experience.<br />

❯<br />

Over the past years, developments<br />

show a trend where a criminal charge<br />

against the individual seafarer has become<br />

the prosecutor’s tool of choice in order to<br />

attend to safety, security and environmental<br />

issues. Accidents, especially those<br />

involving oil spill, result in not only liability,<br />

but also in criminal investigation. It is<br />

widely accepted that any deliberate actions<br />

that result in pollution, injury to life,<br />

industry and the environment should be<br />

taken seriously, but in many cases, a criminal<br />

investigation is initiated even if an<br />

error in navigation or management of the<br />

vessel caused the incident. According to<br />

those who advocate this, the aim is to discourage<br />

others as well as punish the wrongdoer.<br />

In his interview, captain Larsen criticizes<br />

Birgitta Hed of the Swedish Club.<br />

the owners of the Danica White for the<br />

meagre assistance in his precarious situation,<br />

and instead praises his union, the<br />

Maritime Leaders, for all their efforts.<br />

Since the P&I does not cover costs and<br />

fines deriving from a criminal charge, an<br />

experience like captain Larsen’s can be a<br />

costly occurrence for all involved.<br />

Birgitta Hed, Deputy Area Manager at<br />

the Swedish Club, therefore stresses the<br />

importance of a contingency plan for the<br />

ship owner on how to handle criminal<br />

investigations, so that all functions<br />

involved – the owner, management and<br />

crew – are aware of their rights and obligations<br />

and how to avoid additional charges<br />

of obstruction of justice.<br />

Rewarding the whistle blower<br />

A policy well known to all employees will<br />

also serve another purpose. Birgitta Hed<br />

relates to the American authorities’ campaign,<br />

where a “whistle blower” is entitled<br />

to a percentage of the fine imposed if they<br />

tell their side of the story. A well informed<br />

crew that feel the support of their employer<br />

will less likely end up as a hostile witness<br />

in a crime investigation, but instead work<br />

with the company in improving routines<br />

and preventing accidents.<br />

A fully implemented Safety Management<br />

System (SMS) is the backbone in loss<br />

prevention at sea and can of course be<br />

helpful in any investigation. However,<br />

when prosecutors exploit the information<br />

from incident reports to nail the crew or, as<br />

in some cases, the shore based Designated<br />

Person (DP), there may be a risk that the<br />

already scarce reporting is curbed even<br />

more. The focus shifts from lessons to be<br />

learned to finding fault and a scapegoat;<br />

the opposite of what International Safety<br />

Management sought to achieve. There<br />

have also been cases where people, on the<br />

advice of their lawyers, entirely refuse to<br />

speak to investigators of an incident, thus<br />

comprising truth and transparency.<br />

Birgitta Hed believes this trend is clearly<br />

counterproductive and that it may result in<br />

suppressed incident reporting, among other<br />

things.<br />

Similarly, Peter Jodin, who is Safety<br />

Manager at Wallenius Marine, thinks that<br />

people onboard will think both once and<br />

twice before reporting accidents and near<br />

misses. Wallenius Marine has not had an<br />

We will not leave any<br />

of our boys or girls behind.<br />

incident like this yet but Captain Jodin<br />

feels confident they know how to react<br />

when and if it happens.<br />

“We will not leave any of our boys or<br />

girls behind”, says Peter Jodin.<br />

If ever in the situation, Wallenius<br />

Marine will set their P&I and local agent to<br />

work to arrange with legal assistance. Even<br />

if in the end the P&I will not cover the<br />

charges, the person accused is innocent<br />

until proven guilty and will get all necessary<br />

assistance.<br />

Written policy on the way<br />

At Transatlantic, they are equally prepared<br />

for the worst. A written policy is on its way<br />

out to the ships and the issue was recently<br />

discussed at a conference with the company’s<br />

senior officers and engineers. The concept<br />

is the same.<br />

“Transatlantic will immediately contact<br />

our insurance companies and use their<br />

expertise to arrange for legal assistance and<br />

to raise a possible bail”, says Lars Holmberg,<br />

Technical Manager at Transatlantic.<br />

Experience has shown that both guilty<br />

and innocent seafarers are caught in criminal<br />

investigations, often with great harm<br />

done, both personally and economically,<br />

before a decision is made. With today’s<br />

shortage of quality seafarers, the trend to<br />

criminalize the seafarer may possibly act as<br />

a deterrent to those interested in a seagoing<br />

career. Who wants to take up the<br />

challenge of becoming the company’s DP<br />

or accept the position as captain or chief<br />

engineer, if the risk at stake involves<br />

prison?<br />

cecilia österman<br />

SCANDINAVIAN SHIPPING GAZETTE • FEBRUARY 23, 2007 15

Inherent<br />

problems<br />

in Baltic Rim<br />

economies<br />

Skyscrapers crowd the modern parts of Tallinn.<br />

Given the expected global<br />

downturn this year, the Baltic<br />

Rim countries – Estonia,<br />

Latvia, Lithuania and Poland<br />

– will be hard put to retain<br />

their astonishing growth rate at or around 10<br />

per cent, which is not far off that of China.<br />

When we wrote about the economic<br />

developments in these countries a year ago<br />

we commented that there are inherent risks<br />

with strong economic growth, the most<br />

important being inflation, which is not<br />

under control in any of these countries.<br />

Estonia and Lithuania wanted to join the<br />

European Monetary Union (EMU) last<br />

year but were rejected because of too high<br />

inflation. New applications will be forthcoming<br />

with the view to join in 2009. That<br />

would be realistic for all except Poland,<br />

which could only realistically hope to join<br />

in 2013, according to <strong>No</strong>rdea’s latest Baltic<br />

Rim Outlook. It is ironic that the reason<br />

why Estonia and Lithuania wanted to join<br />

the EMU was to retain inflation.<br />

EU deemed too rigid<br />

Maybe the European Union was too rigid<br />

when it rejected Estonia’s and Lithuania’s<br />

EMU application. Niels Mygind, writing<br />

in Baltic Rim Economies, said that “after<br />

the fall of the command economies they<br />

(the countries) needed deep restructuring<br />

from a system based on bureaucratic directives<br />

to a new market system where customers’<br />

demand and market based costs<br />

completely changed what and how companies<br />

should produce. Quite fast companies<br />

cut away unprofitable production, but it<br />

took several years to build up the new production<br />

structure with new technology,<br />

products and markets. Therefore the gross<br />

domestic product (GDP) fell in the first<br />

MADLI VITISMANN<br />

years and bottomed out around 1994”.<br />

By all accounts, these countries have<br />

gone a very long way in a relatively short<br />

time, from early 1990s, trying to catch up.<br />

There are bound to be problems when you<br />

cut the odd economic corner.<br />

Highest GDP in Estonia<br />

Estonia had its highest GDP growth ever<br />

last year with just above 12 per cent, 1.0<br />

per cent higher than China, and higher<br />

than any of the other Baltic Rim countries.<br />

Baltic Rim Outlook claims the Estonian<br />

GDP growth has peaked and that growth<br />

will revert to single digit this year. However,<br />

there are other potential shocks latent<br />

in the economy, the most potent being<br />

real estate prices, which now seem to have<br />

peaked.<br />

More important is that lending in general<br />

is down on 2005 and this weakening trend<br />

16 SCANDINAVIAN SHIPPING GAZETTE • FEBRUARY 23, 2007

Consumer prices year-on-year<br />

Per cent<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

‘04<br />

Source: <strong>No</strong>rdea<br />

‘05<br />

‘06*<br />

■ Poland<br />

■ Lithuania<br />

■ Latvia<br />

■ Estonia<br />

‘07*<br />

‘08*<br />

in credit growth should stop the economy<br />

from over-heating.<br />

However, there is still a question mark<br />

concerning corporate lending. As it is, the<br />

Estonian economy remains stretched to its<br />

limit. With unemployment historically low<br />

at around 5.5 per cent this year, there is<br />

very little slack left except that the government<br />

could try to reduce structural unemployment,<br />

i. e. the mismatch between<br />

workers looking for job and the vacancies<br />

available. It is surely a case of available<br />

skills not matching demand.<br />

Over-heating abating<br />

<strong>No</strong>t surprising Lithuania’s economy is at or<br />

near a boiling point. On current evidence<br />

and with real estate prices stabilising, the<br />

danger should be over for now. <strong>No</strong>rdea<br />

Unemployment rate<br />

Per cent<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

‘04<br />

‘05<br />

‘06*<br />

■ Poland<br />

■ Lithuania<br />

■ Latvia<br />

■ Estonia<br />

notes that there has not been any largescale<br />

loss of competitiveness, mainly<br />

thanks to lower inflation, than in the other<br />

Baltic Rim countries.<br />

Since the membership in the European<br />

Union in 2004, emigration from Lithuania<br />

has been quite big and the labour force has<br />

shrunk by 30,000 people in two years to<br />

the end of 2006. Shortage of labour has<br />

forced wage claims up into double figures,<br />

especially since late 2005.<br />

A loose fiscal policy has also added<br />

demand pressure. Tax cuts from 33 to 27<br />

per cent and plans for a further cut to 24<br />

per cent has fed into a stronger than expected<br />

GDP growth. And now there is even talk<br />

of cutting income tax to 20 per cent.<br />

If they can balance this potential increase<br />

in private demand finely against available<br />

supply in the economy, Lithuania could be<br />

in a position to sustain those tax cuts.<br />

Too strong growth<br />

Latvia experienced very strong growth in the<br />

past two years, but it may already have<br />

peaked simply because growth rates in<br />

excess of 10 per cent was not sustainable.<br />

There is an added problem with the black<br />

economy, which the authorities say they are<br />

fighting with all available means. Meanwhile<br />

all lot of attention is attached to real<br />

estate prices, which any believe are too high.<br />

<strong>No</strong>rdea indicates that the real estate market<br />

could outpace the whole Latvian economy,<br />

like it has done in the past two years.<br />

Many economists are looking for signs<br />

of an economic correction, but are unsure<br />

of what could trigger it. Higher cost of<br />

SCANDINAVIAN SHIPPING GAZETTE • FEBRUARY 23, 2007 17<br />

‘07*<br />

‘08*<br />

Gross domestic product<br />

Per cent<br />

How many dollars per ton are you losing today?<br />

15<br />

13<br />

11<br />

9<br />

7<br />

5<br />

3<br />

‘04<br />

‘05<br />

‘06*<br />

■ Poland<br />

■ Lithuania<br />

■ Latvia<br />

■ Estonia<br />

Keep wondering where your company is leaking money? We believe that in many cases the leak can<br />

be traced back to the bunker purchase department and the lack of information traders have at their<br />

disposal when deciding on what and when to buy bunkers. Can you honestly say that the bunker<br />

traders at your company have the right risk management tools? Visit www.mabux.com and we will<br />

tell you all you need to know to spend less and save more money when buying bunkers.<br />

Visit www.mabux.com<br />

Get a 14 day free trial<br />

‘07*<br />

‘08*<br />

* Estimates

Old City Harbour in Tallinn, Estonia. Cranes for newbuildings are all over.<br />

money is always a way out, but Latvia does<br />

not want to increase interests because that<br />

would delay a possible entry into the European<br />

Monetary Union (EMU). A tight<br />

labour market adds to the problem of stabilising<br />

the economy.<br />

Domestic demand strengthens Poland<br />

Continued high unemployment and rising<br />

wage pressure is a contradiction in terms if<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

there ever was one, but they are both vital<br />

elements in Poland’s economic development.<br />

After low growth in the economy in<br />

2005 the rate is now picking up to close to<br />

5.5 per cent last year. A general comment<br />

about the Polish economy is that both the<br />

private and the corporate sector seem to be<br />

in good shape. A key could be that the<br />

economy is increasingly reliant on domestic<br />

demand. This will make the economy<br />

<br />

<br />

<br />

<br />

<br />

more resilient, especially if the global economy<br />

should slow down.<br />

It is also important to note that there is a<br />

big element of structural unemployment.<br />

Perhaps the most important development<br />

in the Polish economy is that investment is<br />

picking up quite considerably. Admittedly<br />

most of the increase has been in the financial<br />

sector and in the public sector.<br />

Polish companies experience high profitability<br />

and access to relatively cheap<br />

funding. Poland has also been quite successful<br />

in containing inflation, which is<br />

expected to remain the lowest of the Baltic<br />

Rim area for some time. The problem now<br />

is how to handle the potentially nasty<br />