SSG No 20 - Shipgaz

SSG No 20 - Shipgaz

SSG No 20 - Shipgaz

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

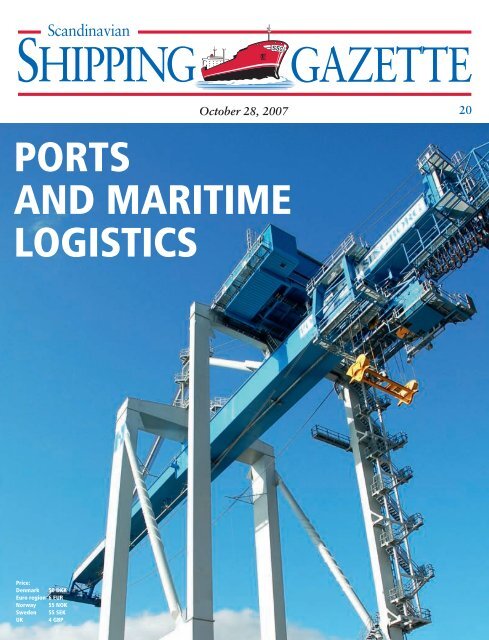

PORTS<br />

AND MARITIME<br />

LOGISTICS<br />

Price:<br />

Denmark 50 DKK<br />

Euro region 6 EUR<br />

<strong>No</strong>rway 55 NOK<br />

Sweden 55 SEK<br />

UK 4 GBP<br />

October 28, <strong>20</strong>07 <strong>20</strong>

Finnlines’ aim is to be the leading company in<br />

its field. For a company operating in the service<br />

sector, competent and enthusiastic employees<br />

are a key resource.<br />

A good, well-planned human resource<br />

policy serves to guarantee the enthusiasm and<br />

expertise of our personnel.<br />

A CAREER OPPORTUNITY<br />

WITH ROOM FOR MY<br />

PERSONALITY<br />

Employee satisfaction are one of the main values<br />

of Finnlines. We are constantly aiming<br />

to achieve this by being a reliable and motivating<br />

employer treating employees with<br />

fairness and equality, encouraging every<br />

employee to continuously develop his or her<br />

own competence and expertise.<br />

THE WAY TO GO IN SHIPPING<br />

The competence of our personnel is ensured<br />

through continuous training. One of the challenges<br />

for the future is to attract new, talented<br />

persons as Yourself.<br />

For further information on vacancies<br />

please contact our human resource offi cer at<br />

Finnlines Ship Management.<br />

FINNLINES PLC, PORKKALANKATU <strong>20</strong> A, FI-00180 HELSINKI, FINLAND,<br />

TELEPHONE: +358 (0)10 343 50, FAX: +358 (0)10 343 4242, EMAIL: SEAPERSONNELFIN@FINNLINES.FI<br />

FINNLINES SHIP MANAGEMENT AB, BOX 158, SE - <strong>20</strong>1 21 MALMÖ, SWEDEN,<br />

TELEPHONE: +46 (0)40-17 68 40, FAX: +46 (0)40-17 68 41 / 17 68 51, EMAIL: SEAPERSONNELSWE@FINNLINES.FI<br />

WWW.FINNLINES.FI

HEAD OFFICE<br />

P.O. Box 370, SE-401 25 Gothenburg, Sweden<br />

Phone +46-31-62 95 70, Fax +46-31-80 27 50<br />

E-mail: info@shipgaz.com<br />

editorial@shipgaz.com<br />

marketing@shipgaz.com<br />

Internet: www.shipgaz.com<br />

Rolf P. Nilsson, publisher and editor-in-chief<br />

Phone: +46-31-62 95 80<br />

Mobile: +46-708-49 95 80<br />

E-mail: rolf@shipgaz.com<br />

Lars Adrians, marketing manager<br />

Phone: +46-31-62 95 71<br />

Mobile: +46-702-22 92 92<br />

E-mail: lars@shipgaz.com<br />

BRANCH OFFICES<br />

Denmark<br />

Bent Mikkelsen, editor<br />

Smedegade 13, DK-6950 Ringkøbing, Denmark<br />

Phone: +45-9732 1333<br />

Mobile: +45-2424 1335<br />

E-mail: bent@shipgaz.com<br />

Estonia (Tallinn)<br />

Madli Vitismann, editor<br />

Mobile: +372-5038 088<br />

Phone & Fax: +372-646 13 18<br />

E-mail: madli@shipgaz.com<br />

Finland<br />

Pär-Henrik Sjöström, editor<br />

Malmgatan 5, FI-<strong>20</strong>100 ÅBO, Finland<br />

Phone: +358-2-242 62 50, Fax: +358-2-242 62 51<br />

Mobile: +358-400-82 71 13<br />

E-mail: par-henrik@shipgaz.com<br />

Stig-Johan Lundström, sales manager<br />

Ruissalontie 10 as 22 FI-<strong>20</strong><strong>20</strong>0 Turku, Finland<br />

Phone: +358-45 32 44 99, Fax: +358-50 855 558 21<br />

E-mail: stig-johan.lundstrom@marconwest.fi<br />

<strong>No</strong>rway<br />

Petter Arentz, editor<br />

P.O. Box 31, Teie, NO-3106 Tønsberg, <strong>No</strong>rway<br />

Phone: +47-33-40 12 00, Fax: +47-33-40 12 01<br />

Mobile: +47-90-99 06 37<br />

E-mail: petter@shipgaz.com<br />

Dag Bakka Jr, editor<br />

Strandgaten 223, NO-5004 Bergen, <strong>No</strong>rway<br />

Phone: +47-55-32 17 47<br />

Mobile: +47-414 56 807<br />

E-mail: dag@shipgaz.com<br />

Marit Eggen, marketing manager <strong>No</strong>rway<br />

Kilgata 9, NO-3217 Sandefjord, <strong>No</strong>rway<br />

Phone: +47-33-52 21 00, Fax: + 47-33 52 21 01,<br />

Mobile: +47-91-31 59 01<br />

E-mail: marit.eggen@shipgaz.com<br />

Odd-Einar Reseland, sales manager<br />

Sandakerveien 76 F, NO-0483 Oslo, <strong>No</strong>rway<br />

Phone: +47-22-09 69 10, Fax: +47-22-09 69 39<br />

Mobile: +47-47-33 29 96<br />

E-mail: odd.einar@shipgaz.com<br />

Poland<br />

Leszek Szymanski, correspondent<br />

Korzystno, ul. Truskawkowa 35, PL-78 132 Gryzbowo, Poland<br />

Phone: +48-94 354 04 84, Fax: +48-94 355 48 58<br />

Mobile: +48-602 579 6<strong>20</strong><br />

E-mail: leszek@shipgaz.com<br />

SUBSCRIPTION<br />

EUR 95/year. For further subscription details,<br />

please send an e-mail to subscribe@shipgaz.com<br />

or call +46-31-62 95 85<br />

www.shipgaz.com<br />

SCANDINAVIAN SHIPPING GAZETTE, OCOTBER 26, <strong>20</strong>07<br />

60<br />

IN THIS ISSUE<br />

18<br />

12 Intercultural communication<br />

improves safety<br />

14 The Danica White captain<br />

tells his story<br />

18 The Color Magic: A cruise vessel<br />

on a ferry route<br />

22 Aframax market steeped<br />

in over-supply<br />

REGULARS<br />

4 News Review<br />

9 SES Onboard<br />

11 Editorial<br />

72 Fleet News<br />

74 Technical News<br />

76 Finance & Insurance<br />

75 IT & Communications<br />

79 Market Reports<br />

FRONT PAGE PICTURE<br />

12<br />

14<br />

86 The precursors of the modern bulk<br />

carrier<br />

SPECIAL FEATURE<br />

Ports and Maritime Logistics<br />

25 In this issue we focus on ports and the equipment they use as<br />

important hubs in domestic and international trade. The ports are<br />

vital and stable elements in the economic relationship between<br />

<strong>No</strong>rthern European countries.<br />

34<br />

Much-wanted container crane on site in Port<br />

of Helsingborg. The crane weighs 765 tons,<br />

has a reach of 37 metres and a lifting capacity<br />

of 65 tons. Two fully loaded containers can<br />

be lifted at once. Another crane of the same<br />

kind is on order, with estimated delivery in<br />

April <strong>20</strong>08. This initiative is one stage in the<br />

establishment of Helsingborg as a container<br />

specialist.

neWs reVieW<br />

pOrt OperatOrS beCOme auSSieS<br />

UPM has sold its Finnish port operators<br />

Oy Rauma Stevedoring Ltd and<br />

Botnia Shipping Ltd to the Australian<br />

specialist infrastructure company Babcock<br />

Babcock & Brown Infrastructurelle<br />

(BBI) for EUR 90 million.<br />

Oy Rauma Stevedoring Ltd is a<br />

major port operator in Rauma, where<br />

UPM has a large paper mill. Botnia<br />

Shipping Ltd is based in Pietarsaari.<br />

UPM has signed a long-term logistics<br />

service contract with BBI. BBI now<br />

controls five European port companies<br />

with operating concessions in eleven<br />

ports throughout Europe.<br />

Århus Værft in Denmark.<br />

Still HOpe fOr ÅrHuS Værft<br />

There is a good chance that shipbuilding<br />

at Århus Værft will continue<br />

later on when things have cleared up.<br />

According to several press reports, it<br />

is the landowner at Århus, Olav de<br />

Linde, who wants to find new investors<br />

to continue the production of superyachts<br />

on the premises owned by Olav<br />

de Linde’s development company.<br />

He thinks that there is a market for<br />

the production of yachts in the luxury<br />

class. The Amande, which triggered the<br />

bankruptcy earlier this month, is a classic<br />

motor yacht with a steel hull delivered<br />

from Poland.<br />

Apart from building luxury yacht,<br />

Århus Værft also carried out repairs on<br />

both navy vessels and commercial vessels<br />

at its facility in Århus.<br />

G. erikSOn part Owner Of VeSSel<br />

Oy Langh Ship Ab has sold its drycargo<br />

vessel Christina to the new<br />

Mariehamn-based company Rederi Ab<br />

Tingö, which is partly owned by Rederiaktiebolaget<br />

Gustaf Erikson. The vessel<br />

will switch to the Gibraltar flag and<br />

will be renamed Tingö.<br />

bent mikkelsen<br />

Switch to distillates<br />

cut CO2 emissions<br />

<strong>SSG</strong>-GöTeborG. Intertanko argues for such<br />

a switch to distillate fuels (MDO) not only<br />

because it would reduce particulate matter,<br />

SOx and NOx, as is widely accepted, but it<br />

would also reduce total CO2 emissions.<br />

Using MDO would reduce fuel consumption,<br />

make onboard fuel processing<br />

redundant, reduce to a minimum the<br />

onboard energy consumption for waste<br />

treatment and significant CO2 production<br />

due SOx deposits in the ocean would be<br />

greatly reduced.<br />

These positive effects are greater then<br />

the negative effects of either higher energy<br />

consumption in de-sulphurisation at the<br />

refineries or manufacturing and operation<br />

of scrubbers onboard ships.<br />

“A switch to MDO from HFO would<br />

therefore at worst be CO2 neutral and,<br />

dependent upon assumptions, would in<br />

principle result in measurable net CO2<br />

Peter Wessel sold to MSC<br />

<strong>SSG</strong>-TønSberG. Color Line’s passenger/<br />

car ferry Peter Wessel, built 1981 at Landskrona,<br />

is sold to Italian operator Mediterranean<br />

Shipping Company (MSC) for delivery<br />

15 April to 9 May for EUR 25 million.<br />

The Peter Wessel, 29,704 gt, will make<br />

way for the SuperSpeed II on the route<br />

from Larvik to Hirtshals. The vessel has<br />

been servicing this route since 1984. Superspeed<br />

II, currently building at Aker Yards<br />

in Finland, is due to commence sailings in<br />

Mega Yacht 84 meter<br />

Looking for Cheif Engineer, 2:nd Engineer.<br />

Certificate STCW III/3, III/2, III/1<br />

color line<br />

reduction benefits.”, Intertanko writes in a<br />

recent report.<br />

In addition the tanker operators organisation<br />

says new refineries under construction<br />

and upgrading of existing ones will<br />

provide the extra capacities needed to meet<br />

the demand for MDO. An argument supported<br />

by a statement from Middle East<br />

Money & Ships saying that USD 1<strong>20</strong> billion<br />

are currently being invested in new<br />

refineries around the Gulf.<br />

As a warning to those who argues for the<br />

continuation of burning residuals onboard<br />

ships Intertanko says that because new<br />

refineries are set not to produce any residues,<br />

and even old refineries, as some in<br />

the USA, burn most of their residues in<br />

their own boilers:<br />

“It is therefore a matter of time until the<br />

oil industry will have insufficient residual<br />

fuel to supply the world commercial fleet.”<br />

the ferry Peter Wessel.<br />

May next year, one month late. The first<br />

fast ferry, Superspeed I, will service the<br />

route from Kristiansand to Hirtshals<br />

pOSitiVe tO mOre enVirOnmental meaSureS More of <strong>No</strong>rwegian owners’ tax bills<br />

could be converted into environmental measures. The <strong>No</strong>rwegian Ship owners’ Association<br />

(NSA) would welcome this switch to dampen the detrimental effects of the NOK<br />

14 billion back-tax bill. The total tax bill is around NOK 21 billion, based on book values,<br />

of which one third are allowed for environmental investments. At an official meeting<br />

recently NSA addressed its view to the parliament’s finance committee, concerning<br />

the environmental measures.<br />

More Information<br />

Email: info@technicalyachtsolutions.com<br />

Webbsite: www.technicalyachtsolutions.com<br />

scAnDinAViAn sHiPPinG GAZette • october 26, <strong>20</strong>07

ent mikkelsen<br />

lars christensen which will change name to servus 2 and become a Danish pilot cutter.<br />

the first private pilot service<br />

now established in denmark<br />

<strong>SSG</strong>-rinGkøbinG. The first private Danish<br />

pilot service has been established in<br />

Fredericia. Eight former pilots from the<br />

Fjord & Bælt pilotage district have formed<br />

their own company Danish Pilot Service<br />

A/S and are now offering pilot services to<br />

and from several Danish ports.<br />

The private initiative is, however, not<br />

allowed to offer transit pilotage through<br />

Danish waters. The company has an office<br />

in Fredericia and purchased boats. At the<br />

moment, Danish Pilot Service has three<br />

boats and a charter arrangement with the<br />

new supply boat Beltservice in Kalundborg.<br />

Business has so far been very good,<br />

according to the company, which has taken<br />

over most of the customers in the port of<br />

Fredericia from the state-owned pilot service.<br />

Danish Pilot Service A/S will soon also<br />

be working out of Skagen. The company<br />

has purchased a former <strong>No</strong>rwegian SAR<br />

vessel from <strong>No</strong>rsk selskab for skipbrudnes<br />

redning, the <strong>No</strong>rwegian Society for Sea<br />

Rescue.<br />

After minor upgrading and re-flagging<br />

to the Danish flag, the former Lars Christensen,<br />

built in 1972, will be re-named<br />

Servus 2 and stationed in Skagen both as<br />

a pilot boat and as the Skagen office for<br />

Danish Pilot Service. The Lars Christensen<br />

has arrived in Fredericia after having been<br />

laid up for in Vardø.<br />

Chief Engineer faces up to 15 years in prison<br />

<strong>SSG</strong>-GöTeborG. The former chief engineer<br />

of the roro-vessel Tanabata faces up<br />

to 15 years in prison and USD 750,000 in<br />

fines after being convicted on three counts.<br />

One count was conspiracy and two counts<br />

of making false statements.<br />

The chief had installed a, so called, magic<br />

pipe through which oily-water could be<br />

discharged over board without treatment<br />

in the oily-water separator. Sentencing has<br />

scAnDinAViAn sHiPPinG GAZette • october 26, <strong>20</strong>07<br />

been set on 10 January <strong>20</strong>08.<br />

The Tanabata was at the time operated<br />

by Pacific Gulf Marine (PGM). The company,<br />

which has previously pleaded guilty<br />

to discharges of oily-water from four of its<br />

vessels, was sentenced to pay USD 1 million<br />

in criminal fine and USD 500,000 in<br />

community service payments and to serve<br />

three years probation under the terms of<br />

an Environmental Compliance Program.<br />

neWs reVieW<br />

aker YardS wOrkS witH SrC Aker<br />

Yards Lifecycle Services and the Estonian<br />

SRC Group OÜ will start offering<br />

voyage repair services to shipping<br />

companies operating traffic to and<br />

from Finland. The services also include<br />

cruise vessels visiting the Baltic Sea<br />

during the summer season. The voyage<br />

repair service will be offered and managed<br />

by Aker Yards Lifecycle Services<br />

with managers and workers from SRC<br />

Group OÜ.<br />

tranSfenniCa inCreaSeS CallS<br />

At the end of October, Transfennica<br />

will add a third call per week at<br />

St. Petersburg. So far, the ro-ro vessel<br />

Pauline Russ has maintained the<br />

Lübeck–St. Petersburg service twice a<br />

week. The additional calls will be with<br />

Godby Shipping’s ro-ro vessel Midas,<br />

which has been chartered from UPM<br />

on a re-let until the end of the year.<br />

“The reason why we are expanding<br />

this service with another sailing is the<br />

increased market demand and we are<br />

very pleased with developments,” says<br />

Transfennica’s managing director, Dirk<br />

P. Witteveen, to <strong>SSG</strong>.<br />

According to Mr. Witteveen, the<br />

emphasis is still on northbound cargo,<br />

even if the southbound cargo volumes<br />

are also increasing.<br />

“There is still an imbalance in the<br />

service to St. Petersburg,” he informs.<br />

GOOd fiGureS in SwediSH pOrtS<br />

The ports in Sweden handled 93.2 million<br />

tons of cargo during the first six<br />

months this year, up 4.9 million tons<br />

compared to the corresponding period<br />

last year, according to offical statistics<br />

from SIKA/SCB. 13 million passengers<br />

travelled to or from Sweden by ferry,<br />

about the same number as during the<br />

first six months of <strong>20</strong>06.<br />

larGe Order bOOk at berGS Berg<br />

Propulsion will deliver 180 CP-propellers<br />

this year. The total value of the<br />

company’s order book is SEK 2.3 billion.<br />

Berg Propulsion has scheduled<br />

deliveries until <strong>20</strong>10. The favourable<br />

market has prompted the company to<br />

invest SEK 110 million in their Swedish<br />

activities, and about the same amount<br />

will be invested in Berg Propulsion’s<br />

production plant in Singapore, which<br />

is under construction.

VikinG line<br />

neWs reVieW<br />

new pOrt leGiSlatiOn in ruSSia<br />

The Russian Parliament has voted in<br />

favour of new port legislation, which,<br />

according to SeaNews.ru, defines the<br />

borders between ownership of land and<br />

property in the ports and the operation<br />

of ports and terminals.<br />

Land in ports may be privately, state<br />

or municipally owned but foreign private<br />

persons and legal entities may<br />

not own land in ports. The new port<br />

legislation also regulates lease levels<br />

for land in ports as well as leases and<br />

investment terms for state-owned infrastructure<br />

in ports.<br />

tHree CHarGed in wärtSilä CaSe<br />

After three and a half years of investigation,<br />

the Swedish National Economic<br />

Crimes Bureau has decided to<br />

file charges in a district court against<br />

Wärtsilä Sweden’s managing director<br />

and two of the company’s employees.<br />

They are charged with serious false<br />

certification, a crime that can lead to<br />

up to two years in prison. The case concerns<br />

around SEK 22 million (EUR 2.4<br />

million) in commissions paid to companies<br />

in the UK. All three charged are<br />

pleading not guilty.<br />

isabella is upgraded.<br />

VikinG line upGradinG itS fleet<br />

The car and passenger ferry Isabella is<br />

the second Viking Line vessel in which<br />

the public spaces have been extensively<br />

refitted. The Isabella returned in service<br />

at the end of September after a docking<br />

at Turku Repair Yard. The upgrading<br />

included rebuilding the taxfree shop<br />

and the à la carte restaurant.<br />

Over the next 12 months, Viking<br />

Line will invest a further EUR <strong>20</strong> million<br />

in upgrading public spaces, restaurants,<br />

shops and cabins on board its<br />

ships. The Mariella underwent such a<br />

refit last year and now it is turn of the<br />

Amorella and Gabriella.<br />

HAnnu lAAkso/seA-foto<br />

the ferry Vironia is to be sold.<br />

ro-ro service closed down<br />

between Sillamäe and kotka<br />

<strong>SSG</strong>-Tallinn. The ferry Vironia sailed on<br />

its last voyage between Sillamäe in Estonia<br />

and Kotka in Finland on 19 October.<br />

The service will be closed down after<br />

negotiations with Russia to be allowed to<br />

pass east of Hogland have failed. The move<br />

would have reduced the voyage time by<br />

two hours to four hours.<br />

Saaremaa Shipping Company’s managing<br />

director Tõnis Rihvk says to <strong>SSG</strong><br />

that the negotiations stranded already this<br />

spring and that any hopes of new negiotiations<br />

vanished when Russia announced<br />

<strong>SSG</strong>-kolobrzeG. The Ukrainian industrial<br />

group Donbas will purchase newly<br />

issued shares in Gdansk Shipyard for PLN<br />

400 million and thus take over control of<br />

the shipyard from the Polish state. Donbas<br />

already controls 5 per cent of the share<br />

capital in the shipyard and this will now<br />

increase to 80 per cent. The Polish competition<br />

authority will have to formally<br />

approve the agreement, dated 16 October,<br />

before it can come into force and this process<br />

could take several months.<br />

Two years ago, Donbas acquired the<br />

Polish steelworks Czestochowa, which is<br />

that they will build a radar station on Hogland.<br />

The vessel Vironia will be sold.<br />

Due to Vironia’s capacity, the service<br />

has been more of a ro-ro than a passenger<br />

service. Kari Juvas at Finnish Stella Lines<br />

says to <strong>SSG</strong> that his company is planning<br />

to start a service between Kotka, a port in<br />

<strong>No</strong>rthern Estonia, and Vyborg next year,<br />

but the new situation might speed up the<br />

planning work for an earlier traffic start.<br />

“Today, we have a different view, we are<br />

evaluating the situation to see how we will<br />

act” says Kari Juvas.<br />

Donbas to take over Gdansk Shipyard<br />

one of the largest suppliers of steel to the<br />

shipbuilding industry. Gdansk Shipyard<br />

will now increase its production by building<br />

other steel structures in addition to<br />

ships, e.g. windpower stations.<br />

Donbas’ Polish MD has already promised<br />

to repay all state subsidies granted to<br />

the shipyard in order to avoid implementing<br />

the reductions in capacity demanded<br />

by the EU.<br />

This year, the shipyard will launch seven<br />

ships and the same number next year and<br />

MD Andrzej Jaworski has promised that<br />

the yard will make a profit in <strong>20</strong>07.<br />

6 scAnDinAViAn sHiPPinG GAZette • october 26, <strong>20</strong>07

An efficient, reliable and low cost port<br />

in the southern part of the Oslo fjord<br />

www.larvik.havn.no

neWs reVieW<br />

naVY unable tO man new friGateS<br />

The <strong>No</strong>rwegian Navy may be unable to<br />

train enough sailors to man its new frigates.<br />

Two vessels of a series of five have<br />

so far been delivered, Fridtjof Nansen<br />

and Roald Amundsen. All the frigates<br />

are scheduled to be operational from<br />

year <strong>20</strong>10. The Office of the Auditor<br />

General (Riksrevisjonen) said bad planning<br />

and budget mismanagement in<br />

the Navy could threaten vessel efficiency.<br />

In a report the Auditor General talk<br />

of insufficient economic control in the<br />

armed forces and a lack of coherence<br />

between available personnel and tasks<br />

that needed to be executed.<br />

twO enGineerS SaCked The Chief<br />

Engineer and the 1st Engineer on A.<br />

P. Møller-Mærsk’s Estelle Mærsk have<br />

been sacked. They have been involved<br />

in criminal business selling several hundred<br />

tons of bunkers at the Chinese<br />

port of Yantian in a deal with criminal<br />

elements.<br />

car/passenger ferry fantaasia.<br />

kYStlink CHarterS fantaaSia<br />

Ferry company Kystlink has chartered<br />

Tallink car/passenger ferry Fantaasia<br />

for 3 months, with an option on a further<br />

3 months, to replace the Pride of<br />

Telemark, which is undergoing repairs<br />

at Cityvarvet in Göteborg. The Fantaasia<br />

will be docked in Göteborg for the<br />

necessary paintwork to commence sailing<br />

between Langesund, Strømstad and<br />

Hirtshals in the first or second week<br />

of <strong>No</strong>vember. Meanwhile, the steel<br />

repairs on the Pride of Telemark have<br />

now been completed and the vessel has<br />

been set to leave the dry-dock. Additional<br />

repairs of cables are also necessary<br />

and the vessel will not be ready to<br />

resume scheduled sailings for another<br />

three months.<br />

freDrik DAViDsson<br />

tAllink<br />

the ferry superstar was named at the italian shipyard fincantieri.<br />

Superstar is launched<br />

<strong>SSG</strong>-Tallinn. AS Tallink Group’s new fast<br />

ferry was launched and named October<br />

5 at the Italian shipyard Fincantieri. The<br />

ferry was named Superstar after the famous<br />

Estonian tennis player Kaia Kanepi.<br />

The Superstar has a capacity of 2 080<br />

passengers and 1 930 lane metres on its car<br />

deck. Its service speed is 27.5 knots. The<br />

ferry is part of the concept Tallink Shuttle,<br />

and will sail on the Tallin-Helsingfors<br />

route. The crossing will take less than two<br />

hours all the year round.<br />

The ferries Star and Superstar will<br />

replace Tallink’s former fast ferries, which<br />

were unable to sail in the Gulf of Finland<br />

during the winter.<br />

SHare purCHaSe SCHeme fOr HerninG SHippinG Herning Shipping A/S has<br />

launched a share purchase scheme for the employees for the first time. After 1 January,<br />

<strong>20</strong>08, it will be possible for a number of employees to buy shares in the company. The<br />

scheme will be offered to all sailing officers (the top four positions) as well as all working<br />

ashore in Denmark, France and Singapore or in shipyard site teams.<br />

Svitzer swaps tugs in Baltic operation<br />

<strong>SSG</strong>-rinGkøbinG. Svitzer A/S is about<br />

to change tugs in their barge train running<br />

from the Baltic area to shipyards in Stralsund<br />

and Odense.<br />

The Svitzer Munin, flying the Saint Vincent<br />

flag, will shortly be sold back to Sweden<br />

and reregistered to the Swedish flag.<br />

The tug will also get its old name Dynan<br />

back. Instead, Svitzer has sold the Per to<br />

Svitzer Limited and reregistered the tug,<br />

which will be sailed by the Lithuanian<br />

crew, to the Saint Vincent flag.<br />

The reason for the swap is that Svitzer<br />

Munin cannot sail to the port of Loksa as<br />

its draft is too deep. Svitzer has also chartered<br />

a sixth tug for its barge train operation.<br />

It is the Finnish tug Turva, with an<br />

Estonian crew, which sails between Loksa<br />

and Klaipeda with steel components for<br />

shipbuilding. The six tugs operating in the<br />

Baltic are the Bauge, Bure, Stevns Master,<br />

Stevns Icebird, Per and Turva.<br />

More news on page 77 ><br />

scAnDinAViAn sHiPPinG GAZette • october 26, <strong>20</strong>07

Safety<br />

Environment<br />

Security<br />

Editor: Cecilia Österman | Phone +46 31 62 95 88 | E-mail: cecilia@shipgaz.com | www.sesonboard.com<br />

Renewed search<br />

after perished fisherman<br />

An underwater search for the missing<br />

54-year old fisherman from the<br />

33-foot fishing vessel Skarbak was resumed<br />

towards the end of October, after Skarbak’s<br />

collision with the 16,000 DWT chemical<br />

tanker Doris. The Utkilen tanker cut<br />

the fishing vessel in half, as the Doris was<br />

unable to stop in time. At a public hearing<br />

after the accident it became apparent<br />

that the Doris had no lookout and did<br />

not use the radar, but that visibility was<br />

good. Sound recordings of the radio traffic<br />

between the two vessels show that there<br />

seems to have been some difference in<br />

opinion as to who should give way:<br />

Skarbak: “Are you going to slow down,<br />

you who are approaching us?”<br />

Doris: “Are you <strong>20</strong> foot, or are you 19? I<br />

think you should calm down a little bit.”<br />

Just minutes after this conversation the<br />

Doris slammed into the Skarbak and cut<br />

the fishing vessel in half. During the hearing<br />

the chemical tanker captain Trygve<br />

Southampton begins container scanning<br />

Southampton Container Terminals is<br />

first out in the US program for scanning<br />

all containers destined for the US, the<br />

Secure Freight Initiative (SFI), according to<br />

US Customs and Border Protection. Since<br />

October 12, all containers destined for<br />

US ports are scanned with non-intrusive<br />

equipment for the presence of radioactive<br />

material. Port Qasim in Pakistan – which<br />

like Southampton Container Terminals is<br />

owned by DP World – and Puerto Cortez<br />

in Honduras have also introduced container<br />

scanning.<br />

SCAnDinAviAn SHiPPinG GAZeTTe • oCToBeR 26, <strong>20</strong>07<br />

UTkilen<br />

The Utkilen-owned Doris.<br />

Bekken said that even though the Doris<br />

should have given way to the Skarbak to<br />

avoid the fatal collision, taking avoiding<br />

action would almost certainly have caused<br />

a collision. He accused the Skarbak of reckless<br />

action when the fishing vessel speeded<br />

up in the hope of getting across before<br />

the Doris passed. Although he admitted<br />

that the Skarbak had the right of way, he<br />

believe that the rule did not apply for the<br />

reason given, namely, that avoiding action<br />

would have led to a collision.<br />

At the largest port in the <strong>No</strong>rdic region,<br />

the Port of Göteborg, container scanning is<br />

not yet an issue.<br />

”As far as I know, this will come into<br />

force in <strong>20</strong>12 but we have not really begun<br />

discussing it yet”, says Tom Westman, head<br />

of Containerterminalen in the Port of<br />

Göteborg, although he is well aware that<br />

the port will ultimately have to introduce<br />

container scanning:<br />

”We handle a lot of exports to the US and<br />

if scanning becomes necessary, we will have<br />

to have it too”, says Tom Westman to <strong>SSG</strong>.<br />

SES Onboard<br />

The SES Onboard section<br />

focuses on Safety, Environment<br />

and Security issues of interest<br />

for ship operating professionals<br />

at sea and in shore-based<br />

organizations.<br />

One in three seamen sent home<br />

suffers from mental illness<br />

One in three repatriated seamen that<br />

require a medical escort, suffers from<br />

mental illness, writes the London P&I Club<br />

in its Stopploss Bulletin. It could be anxiety,<br />

depression or psycotic disorders that in<br />

extreme cases could be a danger to others<br />

onboard or constitue a suicide risk.<br />

The P&I Club advises all personnel<br />

onboard to consult WHO’s International<br />

Medical Guide for Ships and to seek advice<br />

by radio before administering the right<br />

medication, which the ships medical locker<br />

should contain.<br />

Piracy attacks increase again<br />

– Nigeria and Somalia worst hit<br />

According to<br />

IMB (International<br />

Maritime<br />

Bureau), robbery and<br />

piracy attacks against<br />

vessels increased 14<br />

per cent in the first<br />

nine months of <strong>20</strong>07 compared with the<br />

same period last year. The figures show that<br />

198 attacks have been reported worldwide<br />

so far this year. Somalia and Nigeria are<br />

the most afflicted countries with 26 attacks<br />

each. IMB warns that this trend may indicate<br />

that the decline in attacks since <strong>20</strong>04<br />

has now bottomed out.<br />

Tove SvenSSon<br />

Loss PRevention<br />

tooLbox<br />

in co-operation with<br />

More news, sources and links<br />

www.sesonboard.com

Build the<br />

requirements<br />

of the future into<br />

your fleet today.<br />

DNV serving the Maritime industry<br />

www.dnv.com<br />

It’s about leadership.<br />

“<strong>No</strong> one knows what the future holds.” Actually, in shipping we do know quite a bit. We know it will hold more regulations and more<br />

demands for environmentally sustainable and efficient operations – in short more challenges to deal with. Your vessels may be intended for 30<br />

to 40 years of operation. As a leading classification society, DNV is at the forefront of developments. We can help you build the requirements of<br />

the future into your fleet today, so you can go ahead – with confidence.<br />

Classification • Certification • Statutory Services • Maritime Consulting

Tax package born<br />

by horse-trading<br />

From time to time politicians<br />

do the wrong thing for the<br />

wrong reason. Sometimes<br />

politics gets in the way of<br />

reason and results tend to be<br />

unpredictable and often unintended. The<br />

new <strong>No</strong>rwegian tax package for shipping<br />

is a case in mind. It’s not at all surprising,<br />

bearing in mind that the current government<br />

is the most left wing ever in the<br />

country’s history.<br />

The minister of finance, Kristin Halvorsen,<br />

who is also the chairperson of<br />

the Socialist Left Party (Sosialistisk Venstreparti),<br />

is completely bent on cracking<br />

down on high earners, in this case the<br />

shipowners. Officially she says she needed<br />

the money to balance the budget, but<br />

it sounds hollow.<br />

Based on official figures, shipowning<br />

companies have to pay NOK 14 billion<br />

in deferred taxes calculated at book value.<br />

This is a two thirds of the total amount<br />

of NOK 21 billion as one third can be<br />

invested in a government environmental<br />

fund. The carrot is that when owners<br />

begin to pay their back-tax they will have<br />

the privilege to join a <strong>No</strong>rwegian tonnage<br />

tax system in line with that in the European<br />

Union. Those owning companies<br />

in the tax system choosing to leave the<br />

country will have to settle their tax bill in<br />

full before they leave and based on market<br />

value rather than book value.<br />

The back-tax payment and the introduction<br />

of a new tonnage tax system are all<br />

part of a new maritime strategy from<br />

the leftist government. The government<br />

wants lower NOx and CO2 emissions<br />

from <strong>No</strong>rwegian ships, but at the same<br />

time it deprives the owners of the funds<br />

to invest in new, environmentally friendly<br />

vessels. An example shows that NOK<br />

14 billion would buy <strong>20</strong>0 new gas-driven<br />

offshore vessels, which would reduce<br />

NOx emissions by 90 per cent and CO2<br />

by <strong>20</strong> per cent. This is only one of many<br />

inconsistencies in the new strategy.<br />

When the current government took<br />

office its program was and still is embedded<br />

in the so-called Soria Moria declaration.<br />

In this declaration shipping and<br />

maritime industry at large is a priority.<br />

Government agencies<br />

do not inspire innovation.<br />

Rather, they prevent it,<br />

at least in <strong>No</strong>rway.<br />

But alas, matters change and the threeparty<br />

government are now questioning<br />

the very basis for some of the strategies.<br />

For this is a government of the left and<br />

it relishes the fact that they control 65<br />

per cent of the Oslo Stock Exchange by<br />

value.<br />

The government has no coherent industrial<br />

policy for the maritime sector and<br />

frighteningly scant knowledge of the<br />

dynamics of this sector. They do not,<br />

apparently, see the connection between<br />

strong shipowning companies and the<br />

future of the maritime industry. We have<br />

noted this before; the shipowning companies<br />

are the maritime industry’s home<br />

market, where new products are developed<br />

and tested. Without this home market, the<br />

maritime industry will suffer.<br />

As expected the maritime industry<br />

– including the shipowners – is far from<br />

enthusiastic about the new maritime strategy,<br />

although everyone applauds the new<br />

tonnage tax regime. Otherwise there are<br />

only words like innovation, environmentally<br />

friendly shipping, funding through<br />

numerous government agencies etc. We<br />

have been here before and with this government<br />

we will be here for some considerable<br />

time.<br />

Government agencies do not inspire<br />

innovation. Rather, they prevent it, at<br />

least in <strong>No</strong>rway. The <strong>No</strong>rwegian maritime<br />

industry has been a success story for a<br />

good many years and the shipowning<br />

companies are an integral part of what is<br />

widely known as the maritime cluster. But<br />

since the advent of oil and gas in <strong>No</strong>rway<br />

the maritime cluster seems to have faded<br />

in importance. Most national politicians<br />

do not fully understand the marine sector<br />

and especially not shipping.<br />

Never have so many talked such nonsense.<br />

But the Labour Party has understood<br />

that <strong>No</strong>rwegian shipping must have<br />

operating conditions on par with their<br />

international competitors. However, the<br />

only way to get an EU style tonnage tax<br />

system accepted by the Socialist Left Party<br />

was to make shipowners settle deferred<br />

taxes in what must, surely, be the biggest<br />

political horse-trading in <strong>No</strong>rwegian history.<br />

The government will never admit to<br />

horse-trading, but there is always a price<br />

to pay for the Labour Party if it is to carry<br />

it’s two, smaller government partners<br />

along.<br />

<strong>No</strong>rwegian shipowners have long since<br />

waved goodbye to stable and predictable<br />

governments.<br />

p e t t e r a r e n t z<br />

Editor, <strong>No</strong>rway<br />

Phone: +47 33 40 12 00, E-mail: petter@shipgaz.com<br />

SCANDINAVIAN SHIPPING GAZETTE • OCTOBER 26, <strong>20</strong>07 11

Intercultural<br />

communication<br />

improves safety<br />

Seafarers have a long tradition of<br />

working in a global environment.<br />

It is estimated that 80 per cent of<br />

the world‘s merchant ships have a<br />

multilingual and multiethnic crew<br />

composition that interacts on an<br />

international scene with other parts<br />

of the shipping community. Onboard<br />

as well as onshore, they meet with<br />

pilots, agents and surveyors, to<br />

mention but a few.<br />

Several studies have examined<br />

the problems and potential solutions<br />

when facing an intercultural<br />

environment at work, but<br />

on a ship an additional dimension<br />

is added. <strong>No</strong>t only do the seafarers<br />

have to ensure good communication during<br />

working hours. The ship is also a learning<br />

environment and a social environment,<br />

where people eat and live together, often<br />

for long periods on end. For this reason<br />

communication is also an important tool<br />

in establishing social harmony onboard.<br />

Erik Hemming is a senior lecturer at the<br />

Åland Polytechnic and has educated seafarers<br />

in languages and culture for more than<br />

15 years. The Åland Polytechnic is in itself<br />

a cross-cultural institution with its mixed<br />

influences from Finland, Sweden and the<br />

island of Åland itself.<br />

– Intercultural communication is what<br />

makes the teamwork function on a ship,<br />

says Erik Hemming. It gives you a positive<br />

social environment, fewer problems and<br />

most certainly fewer accidents.<br />

Our culture can be called our mental<br />

programming. It is the personality of the<br />

group and “the way we do things here”.<br />

We constantly try to decode our sur-<br />

12 SCANDINAVIAN SHIPPING GAZETTE • OCTOBER 26, <strong>20</strong>07

TOVE SVENSSON<br />

roundings from our own assumptions<br />

and points of references from religion,<br />

history, climate and so on. The decoded<br />

message is then transferred to our way of<br />

being with regard to working methods,<br />

conflict solving, gender roles, games and<br />

food.<br />

– A culture clash is often the result of a<br />

misinterpreted decoding of the signal. And<br />

unfortunately, we often decode the signals<br />

as being negative, or perhaps neutral. Only<br />

rarely do we decode them in a positive way,<br />

says Erik Hemming.<br />

The difference in socio-material conditions<br />

for the crew, for instance working<br />

hours, cabin standard and other hygiene<br />

factors can sometimes act as a barrier to<br />

good communication.<br />

To avoid the sense of “us and them”<br />

onboard, Erik Hemming says it is important<br />

to do things together and communicate<br />

beyond the work-related order giving.<br />

In his opinion, this should come from<br />

higher ranks and down, since it is not as<br />

A.P. MøllER-MæRSk<br />

easy for the lower rank AB to knock on<br />

the chief mate’s cabin door and propose a<br />

mutual cup of coffee, as it would be the<br />

other way around.<br />

– By spending time together you learn<br />

to decode each other’s signals in a correct<br />

way. It is a matter of give and take. Anyway,<br />

it must be boring to spend a long time<br />

together on a ship and not communicate,<br />

says Erik Hemming.<br />

A door opener<br />

Another good example is learning at least<br />

a few phrases in the other language or languages<br />

spoken onboard. Just a few words<br />

can be a door opener and a source of many<br />

laughs.<br />

Poor communication between crew<br />

members from the same culture and<br />

speaking the same language can be a safety<br />

threat through misunderstandings and<br />

mistakes. It is only natural that the odds<br />

on miscommunication are increased when<br />

crew members are further hampered by<br />

cultural differences and speak English as<br />

a second language. According to a paper<br />

written by Robyn Pyne at the University<br />

of Plymouth and Thomas Koester at Force<br />

Technology in Denmark, failures in effective<br />

crew communication have played a<br />

central role in a number of maritime accidents.<br />

On the Sally Maersk a Polish repairman<br />

died from pneumonia when he was unable<br />

to communicate with the officer who was<br />

trying to treat him. His shipmates thought<br />

he was suffering from back pain after an<br />

earlier injury.<br />

Extreme example<br />

The bulk carrier Bright Field, which ran<br />

into a shopping complex in New Orleans<br />

in 1996, leaving 66 people injured,<br />

illustrates an extreme situation with a<br />

crew and a pilot from different cultures:<br />

American and Chinese. The word “no”<br />

is a very impolite word to the Chinese,<br />

A crewmember of the Sally Maersk died<br />

tragically due to problems of communication<br />

onboard.<br />

especially to an authority such as a pilot.<br />

Since the pilot was not able to understand<br />

the communication in Chinese between<br />

the engine room and the bridge, he was<br />

left unaware of the engine problems and<br />

could take no preventive action to mitigate<br />

the accident.<br />

It is no doubt difficult for seafarers that<br />

communicate in their native languages<br />

and perhaps simplified<br />

English in their day-today<br />

communication to<br />

suddenly muster a good<br />

command of a standard<br />

marine vocabulary<br />

according to the<br />

STCW convention,<br />

when an emergency<br />

situation occurs. Erik Hemming.<br />

What you can do is decide,<br />

if you want to be limiting<br />

or non-limiting in your<br />

communication, listening<br />

or non-listening.<br />

Pyne and Koester believe improved crew<br />

communication through training and education<br />

can reduce the risk of accidents as<br />

long as it is based on fundamental knowledge<br />

of the dynamics of crew interaction<br />

and communication.<br />

Leadership onboard necessitates crosscultural<br />

competency to revoke cultural<br />

differences in order to get the best out of<br />

a multicultural team. Less than ten per<br />

cent of our communication is verbal, the<br />

rest is non-verbal like in the quality of our<br />

voice, gestures, facial expressions and body<br />

language. It is the non-verbal communication<br />

that reflects a person’s thoughts and<br />

wishes.<br />

– We are mentally unaware of a large<br />

part of our communication and control<br />

may be two per cent. The rest is done without<br />

us thinking of it, says Erik Hemming<br />

and continues:<br />

– But what you can do is decide, if you<br />

want to be limiting or non-limiting in<br />

your communication, listening or nonlistening.<br />

You have the choice to open up<br />

professional communication.<br />

cecilia österman<br />

SCANDINAVIAN SHIPPING GAZETTE • OCTOBER 26, <strong>20</strong>07 13

The captain of the Danica White tells the story:<br />

A very special voyage<br />

Captain Niels Peter Nielsen was<br />

captain of the Danica White<br />

during the 82-day capture off<br />

the coast of the more or less<br />

lawless country Somalia in<br />

East Africa. <strong>SSG</strong> paid a visit to Captain<br />

Nielsen’s home in Denmark to hear his<br />

own words on the very special voyage.<br />

“The Danica White was held mainly by<br />

gentlemen soldiers off the coast of Somalia.<br />

Shortly after coming onboard they<br />

behaved nicely apart from some nasty<br />

hints of execution. They had their own<br />

cook, their own provisions and when we<br />

ran out of cigarettes, they even provided us<br />

with cigarettes from the stocks ashore”, the<br />

captain says.<br />

The voyage started at Sharjah, U.A.E,<br />

with a cargo of drilling equipment bound<br />

for Mombasa in Kenya. The Danica White<br />

was hi-jacked by a group of 15 persons on<br />

the open sea some 210 nautical miles off<br />

Somalia. Captain Nielsen was on the bridge<br />

that Friday morning, when there was suddenly<br />

a loud bang and later some voices<br />

talking fast. Within seconds a number of<br />

heavily armed and very young soldiers were<br />

in the wheelhouse demanding all valuables<br />

from the crew. They immediately altered<br />

course in order to reach the Somalia coast.<br />

”They were rather friendly when they<br />

realised that we did not make any resistance”,<br />

says Niels Nielsen. ”There was one<br />

English speaking person in the group, who<br />

was between <strong>20</strong> and 30 years old”. ”The<br />

youngest solider claimed to be 16 years<br />

old, but he looked more like 13.”<br />

First 24 hours<br />

The first 24 hours the Danica White,<br />

now with a crew of 15 plus the original<br />

five, steamed toward the shore without<br />

any interference. Late Saturday afternoon<br />

the American destroyer USS Carter Hall<br />

turned up on the horizon and began to call<br />

the ship.<br />

”I was instructed not to make any contact<br />

with the American warship”, explains<br />

Niels Nielsen. ”They have nothing to do<br />

with us in our waters”, said the leader<br />

of the hi-jacking group. The American<br />

destroyer sailed around the Danica White<br />

from 15:00 to about 21:00. During this<br />

time they constantly tried to contact the<br />

ship on the VHF, and ”alerted” the Danica<br />

White by firing warning shots over the bow<br />

and over the stern.<br />

”The hi-jackers became really afraid that<br />

they would be attacked and took their<br />

positions in the bridge-wings with the rest<br />

of the Danica White crew as shields, in<br />

case …”<br />

The youngest solider<br />

claimed to be 16 years<br />

old, but he looked<br />

more like 13.<br />

Niels Nielsen was worried even from his<br />

position in the wheelhouse. Luckily the US<br />

warship decided not to launch a boarding<br />

team. Instead they fired on the three boats<br />

used by the hi-jackers, at that moment<br />

being towed by the Danica White.<br />

Desperation<br />

”The efficient US guns managed to hit<br />

all three boats (one large and two smaller<br />

ones), and one of the ABs was ordered to<br />

cut the towing line. This changed the whole<br />

situation”, says Niels Nielsen. ”The hi-jackers’<br />

plan was that they would leave the ship<br />

at about <strong>20</strong> nautical miles from the shore<br />

with their loot, nothing more, according to<br />

their original plans and confirmed by their<br />

conversation during the days onboard.”<br />

The loss of three boats made the hi-jack-<br />

bent mikkelsen<br />

ers rather desperate as the boats were hired<br />

from somebody else, and now they had to<br />

cover the losses. So instead of leaving the<br />

Danica White they were forced to take the<br />

ship and claim a ransom to gain money to<br />

pay for the boats.<br />

The voyage for the hi-jackers seemed to<br />

be rather well-planned, as they arrived with<br />

their own cook and their own provisions.<br />

”The only inconvenience was that the<br />

Somali cook worked all day and only left<br />

the Danish cook some two-three hours per<br />

day for his cooking for the crew”. The two<br />

ABs on the Danica White soon became<br />

friendly with the Somalians and started<br />

eating their food. Niels Nielsen describes<br />

the Somalians as pigs in the sense that they<br />

never cleaned anything and after eating<br />

their supper on the aft deck it looked like<br />

a rice field.<br />

At anchor<br />

On Monday, the third day of the hi-jacking,<br />

the Danica White was anchored 1.7<br />

nautical miles off the coast of Somalia,<br />

some 26 nautical miles south of Kobyo,<br />

and just outside a private port.<br />

”The ship was equipped to be anchored<br />

with 110 tons of bunkers onboard as well<br />

as sufficient provision taken onboard at<br />

Sharjah, including <strong>20</strong>,000 cigarettes”, says<br />

Niels Nielsen. The same day a note of ransom<br />

was mailed to H. Folmer & Co, the<br />

managing owner of the Danica White, for<br />

a sum of USD 1.5 million. Then they started<br />

waiting for an answer.<br />

”The mate, the cook and the two ABs<br />

remained in their own cabins onboard,<br />

while I was more or less forced to bunk on<br />

the bridge”, says Niels Nielsen. ”My bedroom<br />

was not used, but my saloon accommodated<br />

five-six Somalians eating, smoking<br />

and chewing khat, which was brought<br />

onboard in large quantities after arrival on<br />

the coast”.<br />

The hi-jackers or soldiers from the<br />

Somalia Marines were onboard in a nineday<br />

turn.<br />

During the 82 day stay at anchor, the<br />

South West Monsoon started to pass the<br />

area. This forced captain Niels Nielsen to<br />

14 sCAnDinAViAn sHiPPinG GAZette • OCtObeR 26, <strong>20</strong>07<br />

bent mikkelsen

sCAnDinAViAn sHiPPinG GAZette • OCtObeR 26, <strong>20</strong>07 15

keep the main engine running in order<br />

to ease the pressure on the anchor chain.<br />

Also the two auxiliary engines were running<br />

during the stay. There was high consumption<br />

of fresh water, as the Somalian<br />

soldiers were very keen on taking showers.<br />

Three times the ship ran out of fresh water,<br />

but again the hi-jackers showed gentlemen<br />

style. On one occasion two tons of fresh<br />

water was delivered in <strong>20</strong> litre containers<br />

from the facilities ashore and sailed out in<br />

a small dingy. Later one of three trawlers<br />

lying (Somalia Marine’s fl eet) with a fresh<br />

water generator supplied nine tons of fresh<br />

water.<br />

During the fi rst month the temperature<br />

outside was ”only” 21–22° C, in August it<br />

was up to 25° C and with a lot of wind and<br />

Indian Ocean swell.<br />

Negotiations<br />

From day one at anchor there was contact<br />

from the hi-jackers with the offi ce in<br />

Copenhagen, where the Police had placed<br />

a negotiator to handle the talking with captain<br />

Niels Nielsen as middleman and interpreter<br />

between the offi ce in Copenhagen<br />

and the hi-jackers. The negotiations took a<br />

long time, as shipowner Jørgen Folmer was<br />

not willing to pay the full amount right<br />

away. Slowly and day-by-day the offer was<br />

raised a little to a fi nal sum in the neighbourhood<br />

of USD 750,000. The hi-jackers<br />

needed at least USD 570,000 to cover their<br />

losses.<br />

The fi nal offer was given on a Friday in<br />

August and accepted the following Monday,<br />

but it took nearly another ten days<br />

before the ship was released and the last<br />

soldiers left the vessel.<br />

Just before this happened, the soldiers<br />

took the last loot from the Danica White.<br />

The two TVs in the mess rooms, one of the<br />

ABs’ and the captain’s private computers<br />

and two portable air condition units were<br />

stolen as well as computers from the offshore<br />

mud lock stowed in a container on<br />

deck. The rest of the cargo, drilling pipes<br />

and oil-based mud in big bags, was never<br />

touched by the soldiers.<br />

Free at last<br />

”We had the best possible service during<br />

the fl ight back to Denmark from Djibouti<br />

and also during dinner at the best<br />

hotel in Djibouti. We looked forward to<br />

SPOS®<br />

“MASTER” THE WEATHER<br />

onboard weather routing<br />

over 1000 subscribers<br />

similar treatment in the future after leaving<br />

our ship … Ten seats on a private jet,<br />

a three course dinner, and wine was something<br />

highly appreciated after the days at<br />

anchor”, says Niels Nielsen.<br />

”We were met at sea by the French warship<br />

Brisson and called up by a Danish liaison<br />

offi cers as well as a civil servant from<br />

the Ministry of Foreign Affairs. We were in<br />

fact asked to leave the Danica White, which<br />

was sailed by a French crew and the Danish<br />

offi cer in order to give investigators an<br />

opportunity to take technical evidence for<br />

a future trail”, explains Niels Nielsen. ”We<br />

did not bother and were happy to enjoy<br />

the French hospitality onboard the Brisson”,<br />

the captain adds.<br />

”I must compliment the Government<br />

coverage to the families. H. Folmer & Co<br />

went to the police with all addresses to<br />

the next of kin and they, along with the<br />

Ministry of Foreign Affairs, took good<br />

care of the families. Meeting every week in<br />

Odense and daily telephone updates and<br />

all travel expenses paid, that is really good<br />

service for citizens”, Niels Nielsen says<br />

with a smile.<br />

bent mikkelsen<br />

...“We have found it extremely helpful in planning our voyage and more<br />

importantly staying out of bad weather areas”...<br />

...”on this voyage we used 87,4 metric tonnes of HFO less”...<br />

T: +31 317 399 800<br />

MeteoConsult<br />

A MeteoGroup Company<br />

www.SPOS.eu<br />

16 sCAnDinAViAn sHiPPinG GAZette • OCtObeR 26, <strong>20</strong>07

turku distribution centre

The Color Magic:<br />

A cruise vessel<br />

on a ferry route<br />

In mid-September Color Line’s<br />

successful cruise ferry Color Fantasy<br />

got an equal partner on the Oslo-Kiel<br />

service. The Color Magic is almost<br />

identical with her elder sister, but the<br />

design includes some modifications<br />

and improvements.<br />

The naming ceremony of Color<br />

Line’s latest newbuilding the<br />

Color Magic took place in<br />

Kiel on September 15. It was<br />

a spectacular event with the<br />

famous German actress Veronica Ferres<br />

as the godmother. Tens of thousands of<br />

people attended the “Mega-Party” on the<br />

quay; the party included a concert with<br />

the <strong>No</strong>rwegian pop group A-ha. According<br />

to Color Line, this NOK 15 million party<br />

was the largest single <strong>No</strong>rwegian marketing<br />

effort in Germany in <strong>20</strong>07.<br />

After the maiden voyage with invited<br />

guests the Color Magic entered regular<br />

service on September 18 on the Oslo–Kiel<br />

route.<br />

The Color Fantasy entered service on<br />

the Oslo–Kiel route in December <strong>20</strong>04.<br />

Described as a cruise vessel with a car deck,<br />

she set a new standard on the route and<br />

was extremely well received on the market.<br />

As she became even more successful<br />

than first expected Color Line decided to<br />

declare its option to build a sister vessel.<br />

The owner still has an option for a third<br />

vessel of this type.<br />

The NOK 15 million<br />

naming party was<br />

the largest single<br />

<strong>No</strong>rwegian marketing<br />

effort in Germany in <strong>20</strong>07.<br />

Ordered on May 27, <strong>20</strong>05, the hull of<br />

the vessel was built in Turku and launched<br />

on December 15 <strong>20</strong>06. After the launching<br />

the hull was towed to Rauma for completion.<br />

The Color Magic was delivered by<br />

Aker Yards Rauma shipyard on September<br />

6, <strong>20</strong>07.<br />

The Oscar Wilde<br />

On the Oslo–Kiel route the Color Magic<br />

replaced the Kronprins Harald, another<br />

Finnish-built ship, delivered in 1987. The<br />

Kronprins Harald, which also was purposebuilt<br />

for this route, was sold to Irish Ferries<br />

in January <strong>20</strong>07, but continued on charter<br />

to Color Line until the end of the summer.<br />

The COLOr MagIC<br />

Type: Cruise vessel/passenger & car ferry<br />

Builder: Aker Yards, Rauma, Finland<br />

Owner: Color Line AS, Oslo, <strong>No</strong>rway<br />

Yard <strong>No</strong>: 1355<br />

Delivered: 6 September, <strong>20</strong>07<br />

IMO <strong>No</strong>: 9349863<br />

Classification: Det <strong>No</strong>rske Veritas +1A1 Car<br />

Ferry A, ICE-1B (1A, except propeller blades<br />

1B), RP, E0, MCDK, pwdk, NAUT-OC, F-M,<br />

COMF-V(1) Pass & Crew, CLEAN, TMON<br />

L.o.a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 223.7 m<br />

L.p.p. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . <strong>20</strong>2.7 m<br />

Beam, mld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.0 m<br />

Beam, max . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41.4 m<br />

Depth, deck 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . .9.7 m<br />

Depth, deck 7 . . . . . . . . . . . . . . . . . . . . . . . . . . 21.9 m<br />

Draught, design . . . . . . . . . . . . . . . . . . . . . . . . .6.8 m<br />

GT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75,100<br />

DWT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,860 t<br />

Passengers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2,700<br />

Passenger cabins . . . . . . . . . . . . . . . . . . . . . . . .1,016<br />

Crew cabins . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .298<br />

Trailer capacity, lane m . . . . . . . . . . . . . . . . .1,265<br />

Cars, lane m . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1,190<br />

Machinery:<br />

Main engines . . . . . . . . . . . . . . .4 Wärtsilä 8L46B<br />

kW . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 x 7,800 kW<br />

at rpm . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .500<br />

Service speed, knots . . . . . . . . . . . . . . . . . . . . . . . 22<br />

She was delivered to her new owner on<br />

September 5 and will enter service between<br />

Ireland and France in late <strong>20</strong>07, renamed<br />

the Oscar Wilde.<br />

18 SCANDINAVIAN SHIPPING GAZETTE • OCTOBER 26, <strong>20</strong>07

Although they are near sisters, the Color<br />

Magic is not identical with the Color Fantasy.<br />

Based upon the experience from the<br />

operations with the Color Fantasy, there<br />

are many new features on the Color Magic.<br />

One of the most important is that there<br />

are 89 more cabins on the Color Magic, of<br />

which <strong>20</strong> are suites. The additional cabins<br />

are mainly located on deck 5, which on the<br />

Color Fantasy was designed as an exhibition<br />

space and additional car deck. On the<br />

Color Magic the aft part of deck 5 is used<br />

for crew areas.<br />

The demand for luxurious cabins turned<br />

out to be greater than originally expected<br />

when the Color Fantasy was put into<br />

service. The Color Magic has a total<br />

of 1,016 passenger cabins with 2,975<br />

beds. As many as 54 of the cabins are<br />

suites. The cabin modules are manufactured<br />

by Aker Yards Cabins.<br />

Spectacular promenade<br />

The size of the spa has<br />

been doubled on the<br />

Color Magic compared<br />

to the Color Fantasy.<br />

Also the Observation<br />

Lounge and the Show<br />

Lounge as well as the<br />

capacity of the conference<br />

areas are considerably<br />

larger on the younger<br />

sister.<br />

A main feature<br />

onboard the vessel is<br />

the 160-metre long,<br />

three-deck-high Magic<br />

Promenade. Lined with<br />

small bars, shops etc.,<br />

the promenade connects<br />

the panorama<br />

lifts and the stairs at<br />

each end of the ship.<br />

The embarkation of<br />

the passengers takes<br />

SCANDINAVIAN SHIPPING GAZETTE • OCTOBER 26, <strong>20</strong>07 19

place directly<br />

to the promenade.<br />

One of the main restaurants on<br />

the vessel is the Grand Buffet, seating more<br />

than 750 dinner guests. This buffet style<br />

restaurant is located in the forward part of<br />

deck 6. Another large restaurant on board<br />

is the Oceanic à la Carte Restaurant aft on<br />

deck 6 with a three-deck-high panorama<br />

window facing aft.<br />

The Magic Show Lounge in the forward<br />

part of the vessel spans through decks 6<br />

and 7. The terraced lounge is designed for<br />

both day and night activities, including full<br />

production shows and dancing.<br />

Trailers and cars<br />

Despite its cruise ship appearance,<br />

the Color Magic has<br />

also a car deck with 1,265 lane<br />

metres for trucks and trailers.<br />

The trailer lanes are 3.1 metres<br />

wide. For private cars there are<br />

also 1,190 lane metres on hoistable<br />

car decks. On deck 2 below<br />

the main car deck there is also a<br />

lower hold, which is partially<br />

used for the logistics of the ship<br />

when taking onboard stores etc.<br />

All ro-ro-equipment has been supplied by<br />

MacGregor.<br />

Propulsion is provided by four Wärtsilä<br />

8L46 medium speed engines with an<br />

output of 7,800 kW each at 500 rpm. The<br />

four Wärtsilä 6L26 auxiliary engines are<br />

connected to generators from ABB. The<br />

output of the auxiliary engines is 2,040 kW<br />

each at 1,000 rpm. The service speed of the<br />

vessel is 22 knots.<br />

The Color Magic has three bow thrusters<br />

of 2,<strong>20</strong>0 kW each and two stern thrusters<br />

of 1,000 kW each. Electrical power for<br />

the thrusters is generated by two 4,800 kW<br />

shaft generators during manoeuvring. The<br />

two CP propellers and the thrusters are<br />

supplied by Rolls Royce Kamewa.<br />

The integrated navigation system is<br />

delivered by Sperry Marine.<br />

pär-henrik sjöström<br />

<strong>20</strong> SCANDINAVIAN SHIPPING GAZETTE • OCTOBER 26, <strong>20</strong>07

Aframax market<br />

steeped in over-supply<br />

If and when VLCC tonnage begins<br />

liftings from Primorsk, a new era<br />

will dawn on the eastern half of the<br />

<strong>No</strong>rth European tanker market and it<br />

will affect the trading pattern in the<br />

whole area. Meanwhile, no doubt, aframax<br />

tonnage will continue to dominate the<br />

<strong>No</strong>rth European market for crude liftings.<br />

Nevertheless, these are worrying developments<br />

for hard-pressed aframax owners,<br />

operating in an extremely volatile market.<br />

In the past 18 months the cross <strong>No</strong>rth Sea<br />

rate has ranged from a top of WS 3<strong>20</strong> to a<br />

low of WS 80. Since the top in December<br />

last year, the development has been one of<br />

diminishing returns. With lower exports<br />

from <strong>No</strong>rway and the United Kingdom all<br />

eyes are on Russia and the increase in shipments<br />

through the Baltic and through the<br />

Barents Sea.<br />

Main push in the Baltic<br />

While plans for increased oil and product<br />

shipments in the north are rather vague<br />

and some years into the future, the prospects<br />

for more activity from oil terminals<br />

like Primorsk, the smaller Ust-Luga and the<br />

Lukoil oil and product terminal Vysotsk<br />

are fairly good. Generally the Russian central<br />

government has proposed to redirect<br />

oil volumes, that presently moves through<br />

Belarus to Baltic ports. Implementation<br />

means laying a 1,000 kilometres pipeline to<br />

circumvent Belarus and connecting on to<br />

Russia’s Baltic Pipeline System (BPS) with<br />

a 74 million tons annual capacity. Plans are<br />

now afoot to double the throughput of the<br />

BPS to around 150 million tons per year.<br />

To accommodate the increased capacity, oil<br />

terminals have to be expanded. Exports are<br />

currently well over 100 million tons annually<br />

at the Russian and Estonian terminals.<br />

According to Leningrad Oblast deputy<br />

governor Grigory Dvas the central government<br />

is considering two options; BPS<br />

capacity could be increased to 1<strong>20</strong> million<br />

or 150 million tons per annum. In either<br />

case, the export capacity of the terminals<br />

OECD EurOpE DEManD By prODuCt<br />

Lundqvist<br />

Rederierna’s<br />

aframax<br />

tanker the<br />

Thornbury<br />

on the river<br />

Elbe.<br />

needs to be expanded. Primorsk can only<br />

handle tankers with a maximum capacity<br />

of 1<strong>20</strong>,000 tons. In fact it can only load<br />

107,000 tons because of draft restrictions.<br />

The plan now is to deepen the channel at<br />

Primorsk to accommodate tankers with at<br />

least <strong>20</strong>0,000 tons capacity.<br />

A variety of crude and petroleum products<br />

are exported through a great many terminals.<br />

Russian crude is shipped through<br />

Primorsk, Vysotsk, Tallinn, Butinge and<br />

(million barrels per day) <strong>20</strong>06 <strong>20</strong>07 Mar ‘07 apr ‘07 May ‘07<br />

LPG & Ethane 0.96 0.93 0.99 0.94 0.95<br />

Naphtha 1.11 1.12 1.22 1.05 1.06<br />

Motor Gasoline 2.57 2.53 2.53 2.61 2.59<br />

Jet & Kerosene 1.28 1.30 1.<strong>20</strong> 1.23 1.28<br />

Gas/Diesel Oil 6.24 6.19 6.27 5.67 5.71<br />

Residual Fuel Oil 1.85 1.78 1.72 1.71 1.70<br />

Other Products 1.55 1.52 1.27 1.40 1.49<br />

Total Products 15.56 15.37 15.<strong>20</strong> 14.61 14.78<br />

EurOpE & Fsu Oil DEManD <strong>20</strong>06–<strong>20</strong>08<br />

Oil prODuCtiOn russia, uK anD nOrway<br />

PäR-HEnRik SjöSTRöm<br />

Source: IEA Oil Market Report<br />

(million barrels per day) <strong>20</strong>06 <strong>20</strong>07 <strong>20</strong>08 3 Qt ‘07 4 Qt ‘07<br />

Europe 16.3 16.1 16.5 16.4 16.6<br />

FSU 4.0 3.9 4.0 3.9 4.5<br />

Source: IEA Oil Market Report<br />

(million barrels per day) <strong>20</strong>06 <strong>20</strong>07 <strong>20</strong>08 May ‘07 Jun ‘07 Jul ‘07<br />

Russia 9.69 9.92 10.10 9.86 9.91 9.93<br />

United Kingdom 1.66 1.64 1.50 1.73 1.60 1.53<br />

<strong>No</strong>rway 2.78 2.51 2.37 2.46 2.17 2.48<br />

Source: IEA Oil Market Report<br />

22 SCAnDinAViAn SHiPPinG GAZETTE • OCTOBER 26, <strong>20</strong>07

Ventspils, while products are shipped<br />

through Vysotsk, St Petersburg, Tallinn,<br />

Riga, Ventspils, Klaipeda and Kaliningrad.<br />

The eight European Union countries and<br />

Russia, all bordering in the Baltic Sea, are<br />

concerned by the potential environmental<br />

impact by spills and by the sheer volume<br />

of traffic. That is why they are working<br />

together within HELCOM co-operation<br />

for protecting the Baltic Sea.<br />

aframax volatility<br />

The bulk of <strong>No</strong>rthern European crude<br />

exports are carried in aframax size vessels.<br />

Exports to the US and Canada are also<br />

shipped in VLCCs and suezmax tankers.<br />

However, the most important type of crude<br />

tanker in <strong>No</strong>rth Europe is the aframax,<br />

which, as we noted earlier, has experienced<br />

an extremely volatile market, particularly<br />

in the past twelve months.<br />

At present there is too much aframax<br />

tonnage around at approximately 74.0<br />

million DWT, hence the freight volatility,<br />

which has caused owners some grief of<br />

late. With the volatile market at least in the<br />

past 18 months, it is important to see the<br />

<strong>No</strong>rth European market as part of a whole<br />

Atlantic market, including the Caribbean,<br />

the Mediterranean and the Black Sea. The<br />

inter-play between the markets is interesting,<br />

and we can see a certain “slush-effect”,<br />

as tonnage interchanges between the areas.<br />

time to weed out tonnage<br />

The transport bank DVB says in its latest<br />

market outlook for aframaxes that there are<br />

plenty of single hull vessels, which are up<br />

to their fifth special survey. Owners might<br />

choose to scrap at more than USD 500<br />

per light weight ton, or even find alternative<br />

employment as conversion to FPSOs.<br />

The bank also believes that high oil prices<br />

might provide more employment as more<br />

marginal fields come into production. DVB<br />

highlights healthy, long-term prospects for<br />

aframaxes by forecasting a demand growth<br />

of between six and seven per cent because<br />

of increasing trade to <strong>No</strong>rth America and<br />

Europe. All in all, the bank expects demand<br />

to be 26 per cent higher by <strong>20</strong>10 compared<br />

with <strong>20</strong>06.<br />

net fleet growth<br />

DVB estimates that the aframax fleet will<br />

have a net growth of nine per cent next<br />

year and eleven per cent in <strong>20</strong>09, and<br />

admits that this is likely to weigh down the<br />

market, before the conditions improves<br />

<strong>No</strong>rth European clean tanker rates <strong>20</strong>06–<strong>20</strong>07<br />

Worldscale � Clean MR, 37,000 tons, UKCont–TA<br />

� Clean, Baltic–UKCont, 30,000 tons<br />

� Clean, Baltic–TA, 65,000 tons<br />

400<br />

350<br />

300<br />

250<br />

<strong>20</strong>0<br />

150<br />

100<br />

Qt 1 ‘06<br />

2 ‘06<br />

when single-hull vessels are phased out<br />

from <strong>20</strong>10. The orderbook of more than<br />

ten million DWT in <strong>20</strong>09 will be particularly<br />

difficult to accommodate, and in<br />