Scandinavian Shipping Gazette 8

Scandinavian Shipping Gazette 8

Scandinavian Shipping Gazette 8

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8<br />

Ro-ro<br />

Technology<br />

Are you working 91<br />

hours a week? page 12<br />

Bore + ConRo =<br />

RoFlex page 44<br />

When to order ro-ro on<br />

a builder’s market page 60<br />

April 18 2008, 7 €

Finnlines’ aim is to be the leading company in<br />

its fi eld. For a company operating in the service<br />

sector, competent and enthusiastic employees<br />

are a key resource.<br />

A good, well-planned human resource<br />

policy serves to guarantee the enthusiasm and<br />

expertise of our personnel.<br />

A CAREER OPPORTUNITY<br />

WITH ROOM FOR MY<br />

PERSONALITY<br />

Employee satisfaction are one of the main values<br />

of Finnlines. We are constantly aiming<br />

to achieve this by being a reliable and motivating<br />

employer treating employees with<br />

fairness and equality, encouraging every<br />

employee to continuously develop his or her<br />

own competence and expertise.<br />

THE WAY TO GO IN SHIPPING<br />

The competence of our personnel is ensured<br />

through continuous training. One of the challenges<br />

for the future is to attract new, talented<br />

persons as Yourself.<br />

For further information on vacancies<br />

please contact our human resource offi cer at<br />

Finnlines Ship Management.<br />

FINNLINES PLC, PORKKALANKATU 20 A, FI-00180 HELSINKI, FINLAND,<br />

TELEPHONE: +358 (0)10 343 50, FAX: +358 (0)10 343 4242, EMAIL: SEAPERSONNELFIN@FINNLINES.COM<br />

FINNLINES SHIP MANAGEMENT AB, BOX 158, SE - 201 21 MALMÖ, SWEDEN,<br />

TELEPHONE: +46 (0)40-17 68 40, FAX: +46 (0)40-17 68 41 / 17 68 51, EMAIL: SEAPERSONNELSWE@FINNLINES.COM<br />

WWW.FINNLINES.COM

HEAD OFFICE<br />

P.O. Box 370, SE-401 25 Gothenburg, Sweden<br />

Phone +46-31-62 95 70, Fax +46-31-80 27 50<br />

E-mail: info@shipgaz.com<br />

editorial@shipgaz.com<br />

marketing@shipgaz.com<br />

Internet: www.shipgaz.com<br />

Rolf P. Nilsson, publisher and editor-in-chief<br />

Phone: +46-31-62 95 80<br />

Mobile: +46-708-49 95 80<br />

E-mail: rolf@shipgaz.com<br />

Lars Adrians, marketing manager<br />

Phone: +46-31-62 95 71<br />

Mobile: +46-702-22 92 92<br />

E-mail: lars@shipgaz.com<br />

BRANCH OFFICES<br />

Denmark<br />

Bent Mikkelsen, editor<br />

Smedegade 13, DK-6950 Ringkøbing, Denmark<br />

Phone: +45-9732 1333<br />

Mobile: +45-2424 1335<br />

E-mail: bent@shipgaz.com<br />

Estonia (Tallinn)<br />

Madli Vitismann, editor<br />

Mobile: +372-5038 088<br />

Phone & Fax: +372-646 13 18<br />

E-mail: madli@shipgaz.com<br />

Finland<br />

Pär-Henrik Sjöström, editor<br />

Malmgatan 5, FI-20100 ÅBO, Finland<br />

Phone: +358-2-242 62 50, Fax: +358-2-242 62 51<br />

Mobile: +358-400-82 71 13<br />

E-mail: par-henrik@shipgaz.com<br />

Stig-Johan Lundström, sales manager<br />

Ruissalontie 10 as 22 FI-20200 Turku, Finland<br />

Phone: +358-45 32 44 99, Fax: +358-50 855 558 21<br />

E-mail: stig-johan.lundstrom@marconwest.fi<br />

Norway<br />

Petter Arentz, editor<br />

Gamleveien 9, NO-3121 Nøtterøy, Norway<br />

Phone: +47-33-40 12 00<br />

Mobile: +47-90-99 06 37<br />

E-mail: petter@shipgaz.com<br />

Dag Bakka Jr, editor<br />

Strandgaten 223, NO-5004 Bergen, Norway<br />

Phone: +47-55-32 17 47<br />

Mobile: +47-414 56 807<br />

E-mail: dag@shipgaz.com<br />

Marit Eggen, marketing manager Norway<br />

Kilgata 9, NO-3217 Sandefjord, Norway<br />

Phone: +47-33-52 21 00, Fax: +47-33 52 21 01,<br />

Mobile: +47-91-31 59 01<br />

E-mail: marit.eggen@shipgaz.com<br />

Odd-Einar Reseland, sales manager<br />

Sandakerveien 76 F, NO-0483 Oslo, Norway<br />

Phone: +47-22-09 69 10, Fax: +47-22-09 69 39<br />

Mobile: +47-47-33 29 96<br />

E-mail: odd.einar@shipgaz.com<br />

Poland<br />

Leszek Szymanski, correspondent<br />

Korzystno, ul. Truskawkowa 35, PL-78 132 Gryzbowo, Poland<br />

Phone: +48-94 354 04 84, Fax: +48-94 355 48 58<br />

Mobile: +48-602 579 620<br />

E-mail: leszek@shipgaz.com<br />

SUBSCRIPTION<br />

EUR 80 plus delivery per year. For further subscription details,<br />

please see www.shipgaz.com/subscription<br />

or call +46(0)770-457 114<br />

SCANDINAVIAN SHIPPING GAZETTE, APRIL 18, 2008<br />

IN THIS ISSUE<br />

12 Long hours on watch<br />

60<br />

32 72<br />

15 The first China ro-ro to DFDS<br />

18 Bore – New business areas<br />

complementing ro-ro<br />

SPECIAL FEATURE<br />

Ro-ro Technology<br />

21 During several decades ro-ro<br />

has been the foremost cargo<br />

handling method in Scandinavia<br />

regarding short-sea shipments<br />

of general cargo. In this issue of<br />

SSG we take a look at the state<br />

of ro-ro today in Scandinavia.<br />

REGULARS<br />

4 News Review<br />

11 Editorial<br />

72 Fleet News<br />

73 Technical News<br />

74 IT & Communications<br />

75 Market Reports<br />

82 The battleship duel off Nordkap<br />

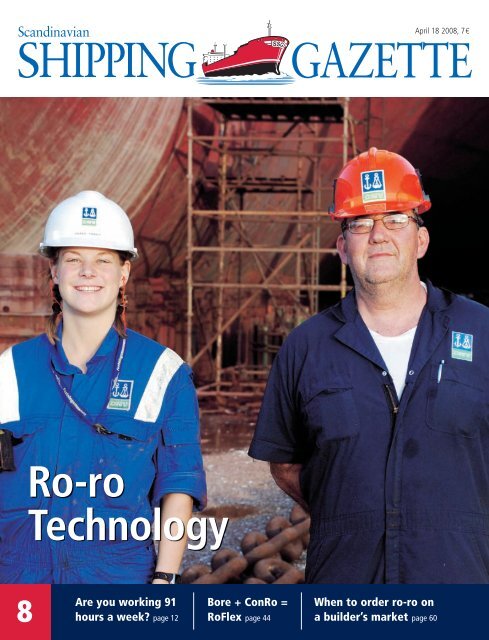

FRONT PAGE PICTURE<br />

36<br />

22<br />

Det Norske Veritas (DNV) is an independent<br />

foundation established 1864<br />

with the objective to safeguarding life,<br />

property and the environment. With<br />

8,000 employees in more than 100<br />

countries, DNV’s global network is linked<br />

by efficient information technology.<br />

DNV’s prime assets in risk managing are<br />

the creativity, knowledge and expertise<br />

of the employees. Read more about DNV<br />

on www.dnv.com and on page 35.

TALLINk<br />

NEWS REVIEW<br />

SjaaStad haS decided to reSign<br />

Bjørn Sjaastad, CEO of Frontline<br />

Management AS, is to resign. Sjaastad<br />

has decided for family reasons to move<br />

back to his home in Bergen. Bjørn<br />

Sjaastad is expected to leave the company<br />

before the end of June.<br />

The board of Frontline will immediately<br />

start the recruitment process in<br />

order to find a new CEO.<br />

LLoyd’S poSted record reSuLt<br />

The insurance market Lloyd’s reports<br />

a GBP 3.8 billion profit for 2007, of<br />

which around GBP 2 billion was from<br />

investment returns. The combined ratio<br />

was 84 per cent and total written premiums<br />

reached GBP 16.4 billion. The<br />

marine insurance portfolio generated<br />

GBP 1,226 million and provided GBP<br />

127 million to the overall result with a<br />

combined ratio of 95 per cent.<br />

The Superstar.<br />

taLLink´S SuperStar deLivered<br />

Fincantieris’ Ancona Shipyard has delivered<br />

the Tallink ferry Superstar, the<br />

ship will be deployed in the Tallinn-<br />

Helsinki service from 21 April. The<br />

Superstar has a capacity of 2,080 passengers,<br />

a cargo capacity of 1,930 lane<br />

metres and a speed of 27.5 knot.<br />

The vessel will complement the Tallink<br />

Shuttle service and offer fast trips<br />

all the year round. Tallink ordered the<br />

Superstar in 2005 at a price of was EUR<br />

120 million.<br />

Sea containerS Ltd SoLd ShareS<br />

Silja Line’s former owner, SeaContainers<br />

Ltd., has sold 50 per cent of Sea<br />

Containers Finland Oy to Greek Eugenides<br />

Group.<br />

Sea Containers Finland Oy operates<br />

the fast ferries Superseacat Three and<br />

Superseacat Four in the Tallinn-Helsinki<br />

service and owns the subsidiary<br />

SuperSeaCat OÜ in Tallinn.<br />

imo agree to reduce<br />

ship emissions<br />

ssg-göteborg. IMO’s MEPC meeting<br />

held in London has been hailed as a success<br />

after the delegates agreed on several<br />

regulations on ship emissions.<br />

From 2010, the sulphur content in ship’s<br />

fuel burned in SECAs will be lowered to<br />

1.0 per cent. In 2012, the global cap on<br />

sulphur content will be lowered from 4.5<br />

per cent to 3.5 per cent. Three years later,<br />

the limits for SECAs will be lowered again<br />

down to 0.1 per cent sulphur content and<br />

in 2020, the global cap will be set at 0.5<br />

per cent. In 2018, the measures will be<br />

reviewed to see if the market has been able<br />

to cope with the demand for cleaner fuel.<br />

MEPC does not say that the fuel must<br />

necessarily be destilled.<br />

When it comes to NOx reductions, the<br />

limit is set at emissions of 17 g/kW for<br />

engines installed prior to 1 January, 2011,<br />

engines installed thereafter get a 14.4 g/<br />

kW limit and engines installed on or after<br />

1 January, 2016 must have NOx emission<br />

levels reduced to 3.4 g/kW when operating<br />

in a SECA but outside the 14.4 limit still<br />

applies.<br />

The delegates also agreed to hold a<br />

meeting in Norway during the summer to<br />

address issues concerning greenhouse gas<br />

emissions. All the MEPC 57 agreements<br />

are to be adopted at the MEPC 58, which<br />

meets in October.<br />

The proposals have been widely hailed<br />

as a positive step for the environment as<br />

well as IMO, which from time to time is<br />

criticized for<br />

being to slow<br />

and ineffective.<br />

The steps proposed<br />

at MEPC 57<br />

are considered<br />

progressive.<br />

“it will certainly<br />

be one<br />

of IMO’s finest<br />

hours when<br />

this happens six<br />

months from<br />

now”, said IMO<br />

Secretary-General<br />

Mr Efthimos<br />

Mr Efthimos E.<br />

Mitropoulos<br />

E. Mitropoulos at the closing of the meeting.<br />

The European Commission’s permanent<br />

representative at IMO, Martin Koopmans,<br />

has been indicating that the measures will<br />

be enough to keep the EU from drawing<br />

up its own regulations, if the proposals<br />

really are adopted in October.<br />

The only negative comment seen so far<br />

comes from the European Community<br />

Shipowners’ Association, which, according<br />

to Lloyds List, says the lower SOx emission<br />

levels applied in SECA may affect short<br />

sea shipping negatively since SECAs exist<br />

where short sea shipping exists and the low<br />

sulphur fuel will be more expensive which<br />

might push trade from the sea to the roads<br />

and trucks – an issue ECSA says the EU<br />

must deal with.<br />

Former maerSk boSS new head oF wiSta, The former head of communication<br />

at A. P. Møller-Mærsk, Jette Clausen, has been elected chairman of the board of WISTA<br />

Denmark. She is taking over the position from Marianne Sørensen, who declined<br />

re-election after six years on the post. The board now consists of Vivi Johansen,<br />

Søfartsstyrelsen, Marlika Virrankoski-Poilsen, Clipper Group, Birgitte Sølgaard, MAQS<br />

Law Firm and Nina Lomborg, D/S Torm.<br />

Lauritzen Kosan buys more LPG’s in Korea<br />

ssg-ringkøbing. Lauritzen Kosan enlarges<br />

its portfolio of ethylene carriers from<br />

Korean shipyards. Recently Lauritzen<br />

Kosan has purchased three ethylene carriers<br />

from a Greek company for delivery in<br />

2010 from the Korean shipbuilder Hyundai<br />

Heavy Industries. The Hyundai trio will<br />

4 SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008<br />

IMO<br />

be larger than the current series of 12 new<br />

ships under construction at Sekwang Heavy<br />

Industries. The Hyundai ships will be on<br />

9,000 cbm compared to the 8,000 on the<br />

Sekwang-series. The total number of new<br />

ethylene carriers in the Lauritzen Kosan<br />

fleet will be 15 units already in 2010.

no strike on swedish<br />

vessels – agreement reached<br />

SSG-GöteborG. The Swedish Shipowners’<br />

Employers’ Association and the two Swedish<br />

ship officers’ trade unions have signed<br />

a new collective bargaining agreement<br />

covering the period 1 January 2008 to 31<br />

January 2011.<br />

As a consequence, all notices of strike<br />

and lockout actions have been withdrawn.<br />

SSG-rinGkøbinG. The Canadian shipping<br />

company Algoma Tankers will continue to<br />

sail under Danish flag with their tanker<br />

Algoma Hansa after the recent take over.<br />

Until a week ago the ship was sailing under<br />

its previous name Amalienborg (named<br />

after the royal Danish castle) under a bareboatcharter<br />

for Danish Dannebrog Rederi.<br />

Our strength - your benefit!<br />

The new agreement includes a wage<br />

increase by 5.3 per cent from 1 February<br />

this year, 5.0 per cent next year and 4.0 per<br />

cent from 1 February 2010.<br />

In addition, officers on tankers and dry<br />

cargo vessels above 3,000 gt will receive an<br />

increment of 4.5 per cent and 2.5 per cent<br />

respectively.<br />

Canadian tanker under Danish flag<br />

However the Canadian buyer decided to<br />

continue to sail under Danish flag with<br />

Rungsted as homeport. Algoma Tankers<br />

purchased the sister ship Aggersborg in<br />

2005, but re-flagged the ship to Canadian<br />

flag under the name Algosea. In 1998 the<br />

vessels were the first tankers to be built by<br />

a US shipyard for foreign account.<br />

Rosella to replace Ålandsfärjan<br />

SSG-åbo. Viking Line will transfer the<br />

ferry Rosella to the Mariehamn – Kapellskär<br />

service. On her present route between<br />

Helsinki and Tallinn, the Rosella will be<br />

replaced by the newbuilding Viking XPRS<br />

at the end of April.<br />

The Rosella will be deployed in the service<br />

across the Åland Sea at the end of<br />

May after a refit.<br />

She will replace the much smaller ferry<br />

Ålandsfärjan, which has been trading on<br />

the route since spring, 1987. This will not<br />

become a permanent traffic arrangement<br />

for the Mariehamn – Kapellskär service, as<br />

Viking Line has the purpose-built newbuilding<br />

Viking ADCC under construction in<br />

PäR-HENRIk SjöSTRöM<br />

The Ålandsfärjan.<br />

Spain for delivery in summer, 2009.<br />

Viking Line’s Managing Director Nils-<br />

Erik Eklund told SSG that the Ålandsfärjan<br />

is no longer needed in the fleet and will<br />

be up for sale.<br />

LOADMASTER®, LEVELMASTER®,<br />

SHIPMASTER®, TYFON®<br />

& Sonic cleaning tool<br />

POLARJET®<br />

Tank Cleaning Machines<br />

The MSC Napoli.<br />

Removal of final steRn section<br />

The removal of the final stern section<br />

of the MSC Napoli started on 10 April.<br />

Clean-up contractors will be in place<br />

throughout the five-month removal<br />

operation. The hull of the MSC Napoli<br />

was cracked in a storm off the coast<br />

of Cornwall on January 18, 2007. The<br />

crew of 26 were airlifted to safety and<br />

the vessel was deliberately grounded<br />

because it was feared she could sink.<br />

The salvage work havs been extensive,<br />

in August, last year, the bow section of<br />

the container vessel was salvaged and<br />

transported to the shipyard Harland<br />

and Wolff for recycling<br />

stRike at Polish Bct called off<br />

The strike at Baltic Container Terminal,<br />

BCT, in Gdynia has been called<br />

off after 13 days. The final negotiations<br />

on Tuesday 1 April lasted 13 hours. No<br />

one is willing to go into the details of<br />

the compromise reached. The employees’<br />

main demand was a salary increase<br />

of 17 per cent of their basic salary. The<br />

board was only willing to agree to 13<br />

per cent.<br />

The strike started on 20 March.<br />

During the strike, container vessels<br />

were rerouted to other ports and terminals.<br />

LNG and Boiler Automation<br />

Please visit us at: www.kockumsonics.com, www.polarmarine.se, www.texon.se<br />

annons.indd 1 07-10-01 17.33.20<br />

SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008 5<br />

THE BRITISH MCA<br />

NEWS REVIEW

CoLoR LINE<br />

NEWS REVIEW<br />

camiLLo eitzen in carrier deaL<br />

Camillo Eitzen & Co ASA has reached<br />

an agreement in principle for the sale<br />

of two bulk carriers, the 53,100 DWT<br />

Sibulk Innovation, built in 2004 and<br />

the 55,700 DWT Sibulk Quality, built<br />

in 2005.<br />

The vessels will be delivered in July<br />

2008 to an undisclosed buyer. The total<br />

price for the two vessels is USD 145.5<br />

million.<br />

mærSk veSSeLS to uS SubSidiary<br />

A. P. Møller-Mærsk is about to sell two<br />

container feeder carriers to its US subsidiary<br />

Maersk Inc in Norfolk, Virginia.<br />

The two vessels are the Agnete Mærsk<br />

and the Christian Mærsk. The Agnete<br />

Mærsk has a capacity of 1,092 TEUs.<br />

The Christian Mærsk has a capacity of<br />

1,500 TEUs. It is expected that both<br />

vessels, under US flag, will be deployed<br />

in the Middle East feeder service<br />

Trouble again for Superspeed 1.<br />

new probLemS For SuperSpeed 1<br />

Color Line has been forced to reduce<br />

the number of passengers booked on<br />

their new ferry the SuperSpeed 1, Norwegian<br />

media report. The reason is that<br />

more passengers than there are seats<br />

have been booked on the vessel resulting<br />

in passengers having to spend the<br />

trip sitting on the floor.<br />

The problems for the vessel, which<br />

could not be delivered on time, this<br />

winter are thus continuing.<br />

kotka reached one miLLion tonS<br />

The Port of Kotka recorded a goods<br />

volume of more than one million tons<br />

in March. This is the first time that<br />

goods turnover in the port has exceeded<br />

one million tons in a single month.<br />

maritime safety<br />

laws turned down<br />

ssg-göteborg. The European Council<br />

turned down, by a broad majority, two<br />

directives concerning safety at sea.<br />

The flag state directive that seeks to<br />

make IMO (International Maritime Organization)<br />

flag state rules obligatory and the<br />

civil liability directive that aims to increase<br />

liability for shipowners and regulate compensation<br />

payments gained support from<br />

few member states during the Transport<br />

Council meeting on 7 April.<br />

The Slovenian EU presidency said<br />

that due to the weak support, there is no<br />

point in continuing the work on the EU<br />

Commission’s text.<br />

”The flag state directive was turned down<br />

because the Member States do not want to<br />

give the EU Commission and the EU more<br />

competence in this subject. They want to<br />

ssg-göteborg. Christer Schoug has been<br />

appointed by Royal Caribbean Cruises as<br />

vice president of newbuildings.<br />

Schoug is currently the managing director<br />

of Stena Ro-Ro and deputy managing<br />

director of Stena Rederi.<br />

The VP of newbuildings is a new post<br />

in the RCL organisation and Schoug will<br />

lead construction and design of new cru-<br />

handle this through IMO instead. The<br />

Member States say they will apply IMO`s<br />

voluntary flag state audit scheme and work<br />

within IMO to make it compulsory instead<br />

of making binding EU rules out of<br />

IMO’s flag state audit scheme as the EU<br />

Commission wants and the directive suggests”,<br />

says Christopher Frisk, the Swedish<br />

Shipowner’s Association’s representative in<br />

Brussels, to SSG.<br />

”CLD was turned down because the<br />

Member States do not see any added<br />

value in the proposal. In principle, it only<br />

duplicates existing IMO regulations and<br />

moreover introduces some additions that<br />

nobody wants. Instead, the Member States<br />

promised to ratify the 1996 protocol of the<br />

LLMC Convention and implement these<br />

regulations in full.<br />

Schoug to Royal Caribbean Cruises<br />

ssg-göteborg. 22 per cent of all dry<br />

bulk carriers in the current world orderbook<br />

have been ordered at shipyards that<br />

up til last year never had delivered a ship.<br />

The analyst company Worldyards estimates<br />

that the total dry bulk orderbook stands at<br />

211.7 million DWT, of which 48 million<br />

tons have been ordered at the new shipyards.<br />

In addition, tankers of 13 million<br />

DWT, are expected to be converted to dry<br />

ise vessels for all the<br />

RCL brands: Royal<br />

Caribbean International,<br />

Celebrity Cruises,<br />

Pullmantur, Azamara<br />

Cruises and CDF<br />

Croisières de France.<br />

Christer Schoug.<br />

The RCL group has a<br />

fleet of 37 vessels and seven on order.<br />

Every fifth bulker ordered at non-existing yard<br />

bulk carriers. The uncertainty regarding<br />

the new shipyard’s capacity and reliability<br />

in combination with the current financial<br />

turbulence, up to half of the orderbook<br />

is still seeking financing, triggers expectations<br />

that many ordered vessels will be significantly<br />

delayed or not delivered at all.<br />

According to estimates in the market, this<br />

could be the case for 20-30 per cent of the<br />

current orders.<br />

SCAVANGE AIRCOOLERS and HEAT EXCHANGERS<br />

for all major makes of diesel engines.<br />

Åkerivägen 8, S-152 42 SÖDERTÄLJE, Sverige<br />

Tel: 08-550 858 80, -550 858 81 | Fax: 08-550 809 71<br />

E-mail: scancool.sales@swipnet.se<br />

6 SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008

PäR-HENRIk SjöSTRöM<br />

The Birka Express.<br />

Finnlines extends time charter<br />

of birka cargo vessels<br />

ssg-åbo. Birka Cargo’s largest ro-ro vessels<br />

Birka Express (8,843 DWT), Birka Carrier<br />

(8,853 DWT) and Birka Trader (8,853<br />

DWT) will continue on their time charter<br />

with Finnlines until the end of 2012.<br />

ssg-ringkøbing. The grounding of the<br />

crude oil tanker Minerva Concert in the<br />

Hatter Barn Channel on May 14, 2007, was<br />

caused by lack of attention by the pilot,<br />

the captain, the second officer on duty and<br />

by the lack of communication between<br />

them on the voyage from Fredericia to<br />

Rotterdam via Grenå with 81,268 tons of<br />

crude oil on board.<br />

The pilot, who had a pilot-trainee attending,<br />

did not discuss the voyage plan with<br />

the captain when deciding to sail in the<br />

Hatter Barn Channel as the draft was 12.5<br />

The present charter has thus been extended<br />

four years. For the moment, Finnlines<br />

also has Birka Cargo’s smaller series of roro<br />

vessels Birka Transporter, Birka Exporter<br />

och Birka Shipper on time charter.<br />

man b&w paSSeS 60 miLLion japaneSe horSeS mark Japan’s Mitsui Engineering<br />

& Shipbuilding Co. Ltd. (MES) has delivered licence-made MAN B&W engines with a<br />

combined out-put of 60 million horsepowers. According to MAN B&W, this is a world<br />

record for a single brand. MES signed its first licence agreement with Burmeister & Wain<br />

in 1926. Today MES has a production capacity of five million horsepowers per year.<br />

Lack of attention caused<br />

oil tanker grounding<br />

metres. During the voyage the pilot and his<br />

trainee talked in Danish without telling the<br />

officer on watch about the change in the<br />

voyage plan. After some hours, the tanker<br />

ran aground just on the wrong side of buoy<br />

19. The pilot claimed that the ship’s gyro<br />

conpass had a deviation of +5°, but several<br />

expert teams investigating the instruments<br />

in the four days of the salvage operation<br />

did not discover any failures.<br />

The ship was lightered and sailed to a<br />

dry dock in Hamburg, where it stayed from<br />

late May to August 25, 2007.<br />

INTERIOR<br />

INSULATION<br />

VENTILATION<br />

PIPING<br />

ELECTRICAL<br />

SCANMARINE<br />

GROUP OF SWEDEN AB<br />

WWW.SCANMARINE.SE<br />

Bäringe 1B, Annexet<br />

SE-241 95 Billinge, Sweden<br />

NEWS REVIEW<br />

Phone: +46 (0)413-54 40 00<br />

Fax: +46 (0)413-54 41 10<br />

E-mail: scanmarine@scanmarine.se<br />

SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008 7

SEADRILL<br />

NEWS REVIEW<br />

The West Sirius.<br />

two driLLing rigS to SeadriLL<br />

Seadrill has taken delivery of two<br />

deepwater drilling rigs, the West Phoenix<br />

and the West Sirius, from Samsung<br />

Shipyard in South Korea and<br />

Jurong Shipyard in Singapore, respectively.<br />

Both units have secured long-term<br />

contracts.<br />

The West Sirius is contracted by<br />

Devon Energy Corporation for four<br />

years in the Gulf of Mexico while the<br />

West Phoenix has a three-year contract<br />

with Total Norge for deployment in<br />

the North Atlantic region. The drilling<br />

rigs have a water depth capability up to<br />

3,000 metres.<br />

uS carnivaL backS on FueL FeeS<br />

The Florida Attorney General has<br />

reached a settlement with six cruise<br />

lines over the imposition of a retroactively<br />

imposed fuel surcharge on cruise<br />

passengers. Carnival and its five subsidiary<br />

cruise lines have agreed to refund<br />

approximately USD 40 million to<br />

consumers nationwide who were charged<br />

the fuel surcharge after they had<br />

booked their cruises. Other affected<br />

cruise lines are Holland America, Princess,<br />

Costa, Cunard and Seabourne.<br />

HEMPASIL<br />

- let your fuel take you further<br />

HEMPASIL is documented to reduce<br />

fuel consumption by 10.6%<br />

HEMPEL<br />

www.hempel.dk<br />

50 plans to<br />

strenghten dutch<br />

maritime sector<br />

ssg-göteborg. The Dutch Cabinet<br />

has approved a policy letter filed by state<br />

secretary Tineke Huizingas, which aims to<br />

strengthen the country’s maritime sector.<br />

The letter includes some 50 concrete<br />

plans aimed at reducing environmental<br />

impact from shipping, improving maritime<br />

safety, increasing the competitiveness of<br />

the national shipping industry and promoting<br />

carreers in shipping.<br />

Among the proposals are environmentally<br />

differentiated port dues, funding for<br />

environmental courses in maritime education<br />

programs and measures to increase<br />

safety at sea where the target will be lowered<br />

from 25 accidents per year to 20. To<br />

lighten the administrative burden for com-<br />

panies, inspection authorities will increase<br />

co-operation. Inspections will be risk-based<br />

and shipowners who fullfil their obligations<br />

will be less inconvenienced by inspections.<br />

Some inspection tasks will be transferred<br />

to the market.<br />

The Dutch maritime sector employs<br />

27,000 people and has a direct value added<br />

of about EUR 1.6 billion per year. To<br />

improve this, the tonnage tax and rates for<br />

ship management will be lowered.<br />

The Dutch maritime sector is suffering<br />

from recruitment problems. Huizingas<br />

wants to see improved collaboration in<br />

nautical education and is prepared to offer<br />

subsidies for introductory work placements.<br />

new Service From grenå to turku The Port of Grenå will be connected with Turku<br />

in Finland via a direct liner service. Norwegian Nor Lines will call Grenå en route from<br />

Norway to Finland. The Danish broker Franck & Tobisen has identified the necessary<br />

conditions for the call at Grenå.<br />

Göteborg in global climate project<br />

ssg-göteborg. The port of Göteborg has<br />

joined forces with 13 of the world’s largest<br />

ports, including Rotterdam, in an initiative<br />

to reduce ship’s emissions and combat climate<br />

change.<br />

In July, the ports plan to sign a climate<br />

declaration and Göteborg will provide a<br />

part of the declaration concerning shore<br />

connections for electricity.<br />

According to the port company, shore<br />

ssg-åbo. The Bourbon Dolphin was built<br />

to all rules and regulations and the Norwegian<br />

commission has not proposed any<br />

changes in the current design regulations,<br />

says Ulstein Verft in its first comment on<br />

the report filed by the Royal Commission<br />

to the Norwegian government.<br />

Ulstein Verft claims that the vessel was<br />

exposed to stresses it was not designed for.<br />

connections for all vessels calling at the roro<br />

terminal would reduce CO2 emissions<br />

from shipping by ten per cent if the shoresupplied<br />

electricity was generated free of<br />

CO2 emissions. At the same time, emissions<br />

of SOx and NOx would decrease by<br />

95 per cent.<br />

Among the ports involved in the project<br />

are Shanghai, Rotterdam, Los Angeles,<br />

Dubai and Santos.<br />

Ulstein Verft comments Dolphin report<br />

According to the shipbuilder, the commission<br />

has carried out a thorough job and the<br />

report is extensive. Ulstein claims, however,<br />

that the shipyard has fulfilled all requirements<br />

on information and communication<br />

of stability criteria for the vessel. An<br />

approved stability manual was delivered<br />

and a load calculator for stability calculations<br />

was installed on the ship.<br />

8 SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008<br />

Hempasil 58x58.indd 1 19-03-2008 11:42:50

Sævik turned down on<br />

aker yard egm<br />

ssg-göteborg. At an extraordinary general<br />

meeting, a majority of the shareholders<br />

in Aker Yards rejected the proposal by Per<br />

Sævik’s Havyard Invest to elect four new<br />

members and replace two standing members<br />

of the company board. Sævik controls<br />

ten per cent of the shares. Sævik was supported<br />

by about 35.8 million shares but<br />

a majority of 49.5 million shares voted<br />

against the proposal. South Korean shipbuilder<br />

STX controls a stake of around<br />

40 per cent of the shares. This is currently<br />

under investigation by the EU competition<br />

authority and the shipbuilder’s voting right<br />

was initially suspended pending the EU<br />

decision. The suspension was, however,<br />

lifted provided that STX voted against the<br />

proposed reshuffle of the board.<br />

Melchiors gets new Brussels job<br />

ssg-ringkøbing.Carsten Melchiors, the<br />

former Secretary General of Bimco, was<br />

not unemployed for a long time.<br />

Carsten Melchiors has now been appointed<br />

as the permanent representative in the<br />

European Union for the International<br />

Association of Classification Societies<br />

(IACS).<br />

IACS will shortly open an office in<br />

Brussels, where Melchiors will be based in<br />

The best investment for your vessel - Puts your diesel ahead<br />

We also carry out the work, in-situ or in our workshops<br />

Worldwide sales and service network<br />

For 2-stroke & 4-stroke engines<br />

Valve seat grinding/machining<br />

Valve spindle grinding<br />

Cylinder liner honing<br />

Sealing surfaces grinding/machining<br />

Portable lathes for various purposes<br />

Special machines for workshops<br />

order to work as a lobbyist towards the EU<br />

administration. IACS permanent secretary<br />

Richard Leslie says in a statement that his<br />

is delighted to get someone who knows all<br />

the stakeholders in the industry and is so<br />

well-connected in the EU.<br />

Carsten Melchiors worked at A. P. Møller-Mærsk,<br />

J. Lauritzen, Elite <strong>Shipping</strong><br />

and the Maritime Development Center of<br />

Europe before joining Bimco.<br />

For diesel engine<br />

maintenance<br />

www.chris-marine.com<br />

SSpa SupportS eStonia theory<br />

Swedish SSPA and three other European<br />

research organisations support in<br />

general the original commissions theory<br />

on how the Estonia sank. Through<br />

model testing and computer simulations<br />

the researchers have been able<br />

to confirm how the Estonia could list,<br />

turn up side down and eventually sink<br />

in the manner commission said it did.<br />

The final report will be published 5<br />

May.<br />

rtL oFFer car tranSit via riga<br />

Russian Transport Lines (RTL) will<br />

remove the bottleneck for the transit<br />

of cars to Russia by using Riga, the<br />

Latvian business newspaper Bizness &<br />

Baltija writes.<br />

The Russian company has invested<br />

EUR 800,000 in its terminal RTL Euro<br />

on seven hectares of land in Freeport<br />

of Riga and will invest further EUR 1<br />

million in order to expand the terminal<br />

by an additional 10 hectares, which will<br />

give it an annual capacity of 100,000<br />

cars.<br />

Chris-Marine ® Head Offi ce<br />

and Subsidiaries<br />

NEWS REVIEW<br />

SWEDEN<br />

Chris-Marine AB<br />

Tel: +46 - 40 671 2600<br />

Fax: +46 - 40 671 2699<br />

info@chris-marine.com<br />

NORWAY<br />

Chris-Marine Norge A/S<br />

Tel: +47 - 3279 8590<br />

Fax: +47 - 3279 8509<br />

steinar.olsgard@chris-marine.com<br />

SINGAPORE<br />

Chris-Marine (S) Pte. Ltd.<br />

Tel: +65 - 6268 8611<br />

Fax: +65 - 6264 3932<br />

chrism@chris-marine.com.sg<br />

P.R. OF CHINA<br />

Chris-Marine Rep Offi ce Shanghai<br />

Tel: +86 - 21 5465 3756<br />

Fax: +86 - 21 6415 2081<br />

lanny.chen@chris-marine.com<br />

RUSSIA<br />

Chris-Marine Rep Offi ce St. Petersburg<br />

Tel: +7 - 812 3292 599<br />

Fax: +7 - 812 3292 597<br />

andrey.egerev@chris-marine.com<br />

INDIA<br />

Chris-Marine Rep Offi ce India<br />

Tel: +91 - 712 645 1155<br />

sunil.vaidya@chris-marine.com<br />

GREECE<br />

CM Hellas Ltd.<br />

Tel: +30 - 210 4826 060<br />

costas.sohoritis@chris-marine.com<br />

SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008 9

A question of ownership<br />

Finnish shipbuilding has made headlines<br />

during the last months. Unfortunately<br />

the interest of the press<br />

has not concerned the excellent ships<br />

delivered – it has mainly focused on the<br />

newbuildings not handed over in time.<br />

Aker Yards presented a poor result for<br />

2007 and states that the losses have mainly<br />

been generated by ferries built in Finland.<br />

Many of the deliveries have been seriously<br />

delayed due to different problems.<br />

According to Aker Yards the operations in<br />

Finland are suffering from a high pressure<br />

on subcontractors: “A stretched suppliers’<br />

market causes delays, and a number of<br />

deliveries from suppliers are still suffering<br />

from unacceptable quality,” they state.<br />

Building a technically advanced ship is<br />

a complex chain of subprojects, which are<br />

managed by a large number of different<br />

companies. The trick is to manage such a<br />

conglomerate of projects. In the end, the<br />

shipyard alone is responsible for the ship<br />

owner receiving exactly the ship ordered<br />

at the right time. Integrating external<br />

workforce in the shipbuilding process is<br />

indeed an extremely demanding task to<br />

administrate, and in this field the Finnish<br />

shipyards have probably come further<br />

than anybody else in the world.<br />

Today panicking is the typical reaction<br />

if there is even a slight disturbance in the<br />

financial performance of a company. Losses<br />

are simply unacceptable to the share<br />

holders in all branches.<br />

The losses generated by Aker Yards<br />

Finnish shipyards will not be the last of<br />

their kind in shipbuilding. Investors in<br />

shipbuilding simply have to live with the<br />

fact that the market goes up and down<br />

and that the fierce competition sometimes<br />

makes it necessary to take orders at small<br />

margins.<br />

Aker Yards is one of the leading builders<br />

of large cruise vessels in the world<br />

– perhaps the best of the best. Regarding<br />

both hardware and human resources, Aker<br />

Yards’ Finnish shipyards form the core of<br />

the most advanced shipbuilding cluster<br />

in the world regarding large cruise vessels.<br />

The shipyard in Turku specializes in<br />

building Post-Panamax cruise vessels. The<br />

project management and building of such<br />

gigantic ships is the ultimate challenge<br />

within shipbuilding and Aker Yards has<br />

done excellent so far. As the builder of the<br />

largest cruise vessels, the Turku shipyard<br />

is one of the most efficient and modern<br />

plants in the whole world.<br />

Finland also has a unique network of<br />

suppliers of the most prestigious components<br />

and systems. Finally, Finland has<br />

probably the leading know-how not only<br />

in building, but also in designing ultralarge<br />

cruise ships.<br />

Still, something has of course to be<br />

done about the losses. Perhaps it is not<br />

optimal to maintain three separately located<br />

shipbuilding sites? Perhaps the shipyards<br />

and the subcontractors should have<br />

even closer relations, leading to creative<br />

ideas how to mutually master the increasing<br />

costs? Perhaps they do not really<br />

understand the simple fact that they both<br />

need each other to exist in the long run?<br />

A crucial question is if the current situation<br />

is related to the shipbuilding process<br />

at all. What if this is an ownership-related<br />

issue? Maybe the current ownership structure<br />

is not at all ideal for a shipyard?<br />

In October last year, the Korean shipbuilding<br />

group STX acquired a 39.2 per<br />

cent ownership stake in Aker Yards. The<br />

EU competition authorities are told to be<br />

currently evaluating the acquisition of the<br />

shares.<br />

The Koreans have still not revealed<br />

their intentions with this deal. However,<br />

it has been interpreted as a shortcut into<br />

the cruise ship market and this has created<br />

concern on high levels in Europe. Is this<br />

the final countdown for the crown jewel<br />

of European shipbuilding, the building of<br />

cruise ships?<br />

Indeed, it is alarming if the Korean shipbuilding<br />

industry slips into the last European<br />

bastion of shipbuilding through the<br />

back door. But what are their real intentions?<br />

Either they believe that it is possible<br />

to continue with shipbuilding in Finland<br />

or they want to drain the know-how and<br />

move it to their own country.<br />

Mr Martin Saarikangas, the man who<br />

soon twenty years ago saved the Finnish<br />

shipbuilding industry, has declared to the<br />

press that there would now be a golden<br />

pär-henrik sjöström<br />

Editor, Finland<br />

Phone: +358 2 242 62 50,<br />

E-mail: par-henrik@shipgaz.com<br />

EDITORIAL<br />

opportunity for Finnish investors to regain<br />

control over the shipyards in Finland.<br />

However, the interest for shipbuilding<br />

seems to be non-existent among Finnish<br />

investors. Why do we not believe in Finnish<br />

shipbuilding in Finland if the investors<br />

in Korea believe in it?<br />

It is possible that the most serious threat<br />

to Finnish shipbuilding is not at all the<br />

Koreans, but the lack of a genuine interest<br />

in building ships among its owners.<br />

It is of utmost importance that the<br />

building of high-tech vessels like cruise<br />

ships stays in Finland. But it cannot be<br />

achieved by government decrees about<br />

forced marriages between the shipyards in<br />

Finland, France and Italy.<br />

The current shipyards of Aker Yards<br />

Cruise & Ferries unit have the critical mass<br />

and they definitively have the know-how<br />

needed to continue to stand upon their<br />

own feet.<br />

They also have a world-wide reputation<br />

as reliable and safe partners to cooperate<br />

with. The recent difficulties regarding<br />

ferries have changed nothing of this. The<br />

delivery times of the cruise vessels have<br />

not been delayed at all. The attitude of the<br />

Finnish shipbuilders is still the same – the<br />

goal is always to deliver a ship fulfilling all<br />

specifications, including the delivery time.<br />

There will be a stable demand for new<br />

cruise ships also in the future. A significant<br />

part of these vessels will be built in<br />

Finland. Hopefully the owners of Aker<br />

Yards understand the true value of their<br />

Finnish assets instead of just focusing at<br />

the latest financial report.<br />

SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008 11

JöRGEN SPRåNG<br />

Long hours on watch<br />

The working hours for masters and watch keeping officers on small<br />

vessels have escalated and frequently exceed 91 hours per week.<br />

Research student and Captain Fredrik Hjorth at Kalmar Merchant Marine<br />

Academy has studied how safety at sea is affected by the working<br />

conditions on board.<br />

The study has been performed on eleven<br />

smaller vessels flying various flags operating<br />

along the coast in the Baltic Sea. The<br />

study is part of a larger safety management<br />

research project and the objective was to<br />

investigate tasks, rest and working hours on<br />

vessels with only two navigational officers<br />

on board. Fredrik Hjorth has interviewed<br />

masters, officers and other crew members<br />

as well as personnel managers, designated<br />

persons and representatives for the administration<br />

and the union.<br />

“It is important to get a comprehensive<br />

picture. A ship can be seen as a sociotechnical<br />

system, where maritime safety<br />

and the working environment are depend-<br />

ent on all sides of the system working<br />

together”, says Fredrik Hjorth.<br />

“When needed, there must be back-up<br />

available from colleagues on board or from<br />

the land organization. Otherwise it doesn’t<br />

matter how well educated and trained you<br />

are.”<br />

The right crew<br />

The social interaction and well-being is<br />

very important on board any ship and perhaps<br />

even more so on smaller vessels with<br />

restricted space for recreation and small<br />

public rooms. On a ship with only five to<br />

seven people it is vital that you find the<br />

right crew members.<br />

“It is a question of both getting the job<br />

done and ensure the well-being on board.<br />

With a small crew there is no room for<br />

on-the-job training. Everybody must have<br />

certain experience and more or less know<br />

what to do from day one. At the same<br />

time it is important that the crew function<br />

together socially.”<br />

Furthermore, Fredrik Hjorth has studied<br />

accident reports and compared the journals<br />

for working hours with the log books<br />

on board the visited ships.<br />

In 2004 the Marine Accident Investigation<br />

Branch (MAIB) investigated 652 accidents<br />

on vessels with only two navigational<br />

officers. MAIB came to the conclusion that<br />

12 SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008

Seen to the number of ABs<br />

on board and the tasks<br />

they have to perform,<br />

we wouldn’t even get food<br />

if they had to stand<br />

watch at night.<br />

the workload on the crew is so heavy that<br />

it is difficult for them to fulfil their duties<br />

and still get enough rest and that this often<br />

leads to accidents.<br />

Swedish, Dutch and Japanese studies<br />

also point to the fact that most collisions<br />

and groundings that occur at night are due<br />

to fatigued operators, often in combination<br />

with lack of sufficient lookout.<br />

Research shows that it is difficult for the<br />

officers to recuperate on board and that<br />

this might lead to a chronic state of fatigue<br />

that can have adverse effects on health and<br />

well-being.<br />

But the small number of crew also<br />

implies other safety aspects than fatigue. A<br />

lot of work on board has to be carried out<br />

single-handed, sometimes in the dark and<br />

on a slippery deck, where no one can see if<br />

you get injured or fall overboard.<br />

No lookouts<br />

Another aspect is the lack of proper lookout.<br />

According to the STCW, watch keeping<br />

is to be done with two persons on the<br />

bridge. Exceptions can be and frequently<br />

are made for certain circumstances but<br />

only in daylight.<br />

However, none of the participating ships<br />

in the study had a lookout to accompany<br />

the officer on watch at night. A decision<br />

enforced by the necessity, but also the will<br />

of the crew, to operate the ship with a small<br />

crew and at the same time keep the vessel<br />

in good shape. In the report, a master is<br />

quoted:<br />

“Seen to the number of ABs on board<br />

and the tasks they have to perform, we<br />

wouldn’t even get food if they had to stand<br />

watch at night.”<br />

The many working hours often result<br />

in violations of the regulations regarding<br />

work-time and rest period. Fredrik Hjorth<br />

says that the crew often feel that they have<br />

to adjust their working time records in<br />

order to comply with the regulations and<br />

quotes an officer as saying:<br />

“I tried to fill in my real working hours<br />

once, but the master lashed out and told<br />

me that he would never sign that since it<br />

did not comply with the regulations. Since<br />

then I never write anything else than cutand-dried<br />

records.”<br />

Another example from the report is<br />

a comparison between the records and<br />

the ship’s log book indicating that only<br />

two persons were working, when the ship<br />

moored in port. The rest of the crew were<br />

apparently sleeping.<br />

Supposedly, this adjustment of work<br />

hour records is known amongst the Administrations,<br />

but they choose not to act on it.<br />

Paperwork<br />

A growing part of the workload in contemporary<br />

shipping is administrative work.<br />

A task that the officer on watch is not<br />

allowed to do during watch, according to<br />

regulations.<br />

“ISM, ISPS, operational administration<br />

and environmental issues like garbage handling,<br />

all involve a lot of paper work and<br />

somebody must take care of it”, says Fredrik<br />

Hjorth.<br />

The remaining question is when and by<br />

whom. If all the administrative duties are<br />

to be performed off the normal watch, it<br />

would mean an average of 1–2 hour longer<br />

days, naturally with an equally shorter time<br />

for sleep.<br />

Solutions suggested in the report include<br />

increasing the number of crew on board<br />

or moving tasks from the ship to the land<br />

organisation.<br />

When the results were presented, the<br />

report got a lot of attention in the media<br />

from various stakeholders. The media light<br />

was largely on the touching up of the working<br />

hour records and the seafarers, feeling<br />

that this is done with the tacit acceptance<br />

of the authorities.<br />

The author of the report thinks the limelight<br />

should be pointed elsewhere;<br />

“The focus should really be on the crew<br />

and the pressure they take upon themselves<br />

in order to make everything work and their<br />

professional pride and will to do a good<br />

job.”<br />

cecilia österman<br />

SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008 13

BENT MIkkELSEN<br />

The first<br />

China ro-ro<br />

to DFDS<br />

The Tor Corona is the first of four sisters going to DFDS Tor Line.<br />

The Tor Corona is the very first<br />

Chinese ro-ro vessel in the DFDS<br />

Tor Line fleet, but it was ordered<br />

and owned by an experienced ro-ro<br />

provider: the London-based Norbulk<br />

<strong>Shipping</strong>.<br />

The company, which has a <strong>Scandinavian</strong><br />

background, has previously built six roros<br />

in China for Finnlines charter. The<br />

Tor Corona is the first of four units that<br />

will sail for DFDS Tor Line on long-term<br />

timecharter. The business with Norbulk<br />

<strong>Shipping</strong> has been extended to a purchase<br />

of two of the China ro-ros, the Finnmaster<br />

and the Finnreel. The other four units from<br />

the first series have been sold to the charter<br />

Finnlines, leaving Norbulk shipping with<br />

only the Tor Corona and its sister the Tor<br />

Hafnia (delivery in March 2008) and the<br />

two remaining sisters, which are due for<br />

delivery in August and October this year,<br />

in the fleet.<br />

“This, however, eases up on the manning<br />

BENT MIkkELSEN<br />

Two Swedish captains have command of Tor<br />

Corona. Here is Eibert Fransson.<br />

situation. It means that we can man the new<br />

ships much more easily, as it is so tough to<br />

attract new crew members like in the rest<br />

of the shipping community”, explains captain<br />

Eibert Fransson, Tor Corona.<br />

Scottish manning<br />

The manning and technical management<br />

of the Tor Corona are handled by the Scottish<br />

division of Norbulk <strong>Shipping</strong>.<br />

The inauguration of the Tor Corona is a<br />

Tor CoroNa<br />

Type: ro-ro<br />

Builder: Jinling Shipyard, Nanjing<br />

owner: Seatreasure Ltd, London (Norbulk<br />

<strong>Shipping</strong>, Glasgow)<br />

Newbuilding no. 05-0402<br />

Class: Lloyds + 100A1, ro-ro, Ice Class 1A,<br />

Solas II p. 54 + LMC, NAV1, UMS,*IWS, SCM.<br />

IMo no. 9357597<br />

Loa 187.1 m<br />

Lpp 169.8 m<br />

Width 26.5 m<br />

Draft 6.9 m<br />

Depth to weather deck 21.6 m<br />

GT 25,654<br />

NT 7,696<br />

DWT 11,322<br />

Drivers 12<br />

Lane metres 3,455<br />

Tank top 470 m<br />

Main deck 1,043 m<br />

Upper deck 1,168 m<br />

Top deck 774 m<br />

Reefer plugs 75<br />

Machinery:<br />

Main engines 2 MAN type L48/60<br />

kW 9,450<br />

Speed 20.0 knots<br />

Bow thruster 2x1,100 kW<br />

14 SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008

eal boost to the Baltic Bridge service running<br />

from Klaipeda in Lithuania to Copenhagen<br />

and Fredericia, calling twice weekly.<br />

The Tor Corona calls Copenhagen on the<br />

way from Klaipeda to Fredericia and again<br />

on the leg from Fredericia to Klaipeda. The<br />

capacity is up about 40 per cent compared<br />

to the previous vessels on the service.<br />

This is by far the easiest<br />

way to handle trailers<br />

and lorries on board.<br />

“It is a clear signal to the market that<br />

DFDS Tor Line will serve all our customers<br />

in the best possible way”, says Christian V.<br />

Petersen, head of DFDS Tor Line’s office<br />

in Fredericia.<br />

The Baltic Bridge is a highly interesting<br />

service with a lot of potential for the<br />

future, but also a service working with a<br />

volatile market. The Russian market is still<br />

the biggest for the ro-ro service and political<br />

changes and legal steps are still kind<br />

of dark horses in the background for the<br />

exporter’s everyday work in transport and<br />

manufacturing.<br />

Four decks<br />

Tor Corona is a four-deck ro-ro vessel with<br />

direct access to all decks. There is no elevator,<br />

but it is possible to drive directly to<br />

the tank top deck, the main deck and on a<br />

special ramp to the weather deck and again<br />

from there to the upper deck.<br />

“This is by far the easiest way to handle<br />

trailers and lorries on board”, says captain<br />

Eibert Fransson. “Elevators are extremely<br />

slow, not that time is a factor on this service,<br />

but driving is much easier.”<br />

The quay access goes via two ramps.<br />

There is a main ramp to the main deck and<br />

a smaller ramp to the weather deck. On the<br />

tank top deck and the main deck the height<br />

allows cargo of up to 5.5 metres, while<br />

it is 4.7 and 4.9 on the two upper decks.<br />

Naturally the weather deck will provide<br />

an unlimited height, but the access to the<br />

deck only allows 4.9 metres.<br />

The total capacity of the ship is 3,455<br />

lane metres, which equals 230 trailers, each<br />

14 metres long. The vessel is not fitted<br />

for container handling, except for those<br />

onboard trailers or mafis.<br />

The driveways on the Tor Corona are the<br />

first to be equipped with a special asphalt<br />

BENT MIkkELSEN<br />

BENT MIkkELSEN<br />

BENT MIkkELSEN<br />

The ramps aft give access to the main deck and the second deck.<br />

The special asphalt cover on the ramps prevents the lorries from skidding.<br />

The spacious main deck.<br />

SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008 15

BENT MIkkELSEN<br />

The Tor Corona’s top deck.<br />

to prevent vehicles from skidding on the<br />

ramps.<br />

“The asphalt is something new instead<br />

of the previous steel net, which was welded<br />

on. The steel net had a limited time<br />

before it was worn out, but as yet we have<br />

no experience of this asphalt” says Eibert<br />

Fransson.<br />

China<br />

The Tor Corona is a product of the Chinese<br />

shipyard Jinling Shipyard in Nanjing,<br />

which delivered the previous six ro-ros for<br />

Norbulk.<br />

“I think they have done a very fine job.<br />

The Chinese have learned a lot from the<br />

last couple of years building ships for foreign<br />

accounts”, says Eibert Fransson.<br />

“Naturally there are some smaller details<br />

that aren’t really good, but it’s not on vital<br />

parts of the ship. In our mess room we have<br />

problems with chairs and tables. The very<br />

nice handmade chairs are six centimetres<br />

too low and our table is four centimetres<br />

too high, which gives a rather odd position<br />

for eating. But this is something that can<br />

be fixed rather easily by a local carpenter”,<br />

he adds.<br />

The standard of the accommodation as<br />

well as the passenger department is high<br />

with handmade leather furniture and<br />

handmade wooden cabinets. The ship has<br />

a drivers’ department with twelve single<br />

cabins with private bath and toilet. Also<br />

BENT MIkkELSEN<br />

each cabin is equipped with a refrigerator.<br />

The passenger department also has its own<br />

mess room and dayroom with a large TV<br />

screen for the entertainment of the drivers<br />

on the crossing. The majority of the passengers<br />

on board are truck drivers from<br />

Lithuania and the Baltic states.<br />

The Tor Corona is manned with a Swedish<br />

captain and Latvian crew (at present 17<br />

persons) ranging from the Chief Engineer<br />

to the ABs hired for lashing the trailers<br />

on board (which is part of the time charter).<br />

The crew is compiled by taking some<br />

of the crew members from the Finnlines<br />

ships, which then are complemented with<br />

some new members of the crew.<br />

“I think it has gone smoothly. Some of<br />

the faces are familiar and others I’m starting<br />

to learn”, explains captain Eibert Fransson.<br />

Engine room<br />

The ship is powered by two MAN engines<br />

with an output of 9,450 kW, giving the<br />

ship a maximum speed of 20 knots, which<br />

is only needed on one of the weekly crossings.<br />

The other crossing is usually done<br />

at a lower and more fuel economical<br />

speed. At 20 knots the ship burns 75 tons<br />

of heavy fuel, while the consumption is<br />

reduced to only 31 tons at a speed of 15<br />

knots.<br />

The engine room is spacious with a lot<br />

of room for repair tasks and with good<br />

workshop facilities. The auxiliary engines<br />

in a separate, specially insulated space gives<br />

a very healthy engine room while lying in<br />

Fredericia from 6 a.m. to 9 p.m. with the<br />

main engines stopped.<br />

The ship is built to Lloyd’s Ice Class 1A<br />

and is able to sail the Baltic area in winter<br />

time, even though Klaipeda is mentioned<br />

as the only guaranteed ice free port in the<br />

Baltic area.<br />

bent mikkelsen<br />

Even though the Tor Corona is built in China, the components are mainly European.<br />

16 SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008

Boks Oslo<br />

First class cars deserve<br />

first class travel conditions.<br />

A VOYAGE on one of our ships will be for reasons of necessity, not for pleasure.<br />

Even so, we still do everything within our power to ensure a comfortable<br />

passage for all concerned.<br />

For us, the cars we carry are not simply vehicles. Each one is someone’s brand<br />

new car. That’s our attitude, and that’s the way the crews on our ships have<br />

been trained to think.<br />

Which is why the vehicles we carry on our ships are treated more like<br />

passengers than cars. And with us, everyone travels first class.<br />

WORLDWIDE RO/RO THE FLEXIBLE WAY<br />

www.hoegh.com

JoACHIm SJöSTRöm<br />

Ro-Ro TECHNoLoGY<br />

Bore’s ro-ro vessel Estraden in a gale on the North Sea. Bore is one of the pioneers within ro-ro shipping and operates<br />

a fleet of 22 ships, including ro-ro vessels, car carriers, dry cargo vessels and an ice strengthened bulk carrier.<br />

Bore – New business areas<br />

complementing ro-ro<br />

When acquiring Bror Husell Chartering<br />

and Engship, the Finnish shipping<br />

company Bore was primarily looking<br />

for expansion in the ro-ro sector. As an<br />

extra bonus Bore got two interesting<br />

new business areas.<br />

Entering the fast growing market for car<br />

shipments was the primary objective<br />

when the Finnish shipping company Bore<br />

acquired the two shipping companies<br />

Bror Husell Chartering Ltd and Rederi Ab<br />

Engship in 2005 and 2006 respectively.<br />

Bror Husell Chartering had recently<br />

carried out a conversion of its ro-ro vessel<br />

Transgard, now renamed Auto Baltic, into<br />

a car carrier and entered into a long-term<br />

charter with UECC. Rederi Ab Engship<br />

had similar plans for its two sister vessels<br />

Heralden (now Auto Bay) and Serenaden<br />

(Auto Bank), and these plans were also<br />

later carried through by Bore.<br />

“Already before the acquisitions of<br />

Bror Husell Chartering and Engship we<br />

had been in contact with the UECC<br />

about car shipments, but at that time we<br />

lacked suitable vessels,” Thomas Franck,<br />

Senior Executive Vice President of Bore,<br />

explains.<br />

Bore is more than a 100-year-old shipping<br />

company and it is a part of the family-owned<br />

Rettig Group. At the end of the<br />

1970’s Bore decided to concentrate on<br />

18 SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008

o-ro shipping and closed down its other<br />

shipping activities, including one third<br />

in the Silja Line ferry company. Bore was<br />

the first shipping company in Finland to<br />

order a ro-ro vessel in the mid 1960’s,<br />

which makes Bore one of the ro-ro pioneers<br />

also in a European perspective.<br />

Today Bore is one of Finland’s largest<br />

privately-owned shipping companies,<br />

with a fleet of 22 vessels.<br />

New areas<br />

The acquisition of the Åland-based shipping<br />

company Bror Husell Chartering Ltd<br />

included not only two ro-ro vessels but<br />

also a business area called Contracts of<br />

Affreightment (CoA).<br />

We prefer to call<br />

the small container vessels<br />

multi-purpose vessels …<br />

“We did not have any experience at all<br />

of contract shipments with conventional<br />

cargo vessels, but we became interested<br />

in this segment as Bror Husell Chartering’s<br />

former Managing Director Jhonny<br />

Husell continued to lead this unit in our<br />

employment as our Executive Vice President<br />

Commercial,” Mr Franck says. “It is<br />

about industrial shipping, which generates<br />

much closer customer relations than when<br />

operating as a TC-actor, so we decided to<br />

go for it.”<br />

Rederi Ab Engship added further two<br />

new segments to Bore – small container<br />

feeder vessels and bulk shipments.<br />

“We prefer to call the small container<br />

vessels multi-purpose vessels as they are<br />

also employed in other types of traffic,”<br />

Mr Franck clarifies. “Indeed, we had been<br />

active in container shipping for three years<br />

through our company RML, but these vessels<br />

were sold before the company expanded.”<br />

Bore came into the container business<br />

when there was a weak market for ro-ro<br />

shipping at the beginning of the millennium.<br />

The intention was to expand within<br />

the container segment, but the booming<br />

traffic on the Baltic Sea led to strongly<br />

increasing newbuilding prices, and the<br />

intended order was never carried through.<br />

Bore sold its container vessels and acquired<br />

the two shipping companies instead.<br />

“Then suddenly we were involved in sev-<br />

PäR-HENRIk SJöSTRöm<br />

PäR-HENRIk SJöSTRöm<br />

Thomas Franck, Senior Executive Vice President of Bore, has launched a tonnage renewal<br />

program within the shipping company. He thinks that it is crucial to maintain a critical mass in<br />

the fleet.<br />

originally built for Rederi Ab Engship in 1997, Bore’s ro-ro vessel Heralden was converted into<br />

the car carrier Auto Bay in China in 2007. She is on long term charter to UECC.<br />

eral new market segments, and we had to<br />

decide what to do with them,” Mr Franck<br />

explains.<br />

Close relations<br />

The least interesting of them was the container<br />

business. Bore knew it quite well and<br />

the vessels were rather small. The increase<br />

of container feeder tonnage in the Baltic<br />

Sea increased the competition and kept the<br />

freight rates low.<br />

“Our small container vessels were not<br />

competitive enough and last autumn we<br />

Ro-Ro TECHNoLoGY<br />

sold two of them. We bought two newer<br />

dry cargo vessels for the CoA-business<br />

instead. We see growth potential within<br />

this segment, and we want to expand<br />

together with our customers,” Mr Franck<br />

says.<br />

He says that the close customer relations<br />

within CoA make it possible to develop<br />

the business in a different way than when<br />

operating on a time charter basis.<br />

“We are large enough to be able to offer<br />

our partners a variety of solutions. We<br />

are for example investigating the possible<br />

SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008 19

JoACHIm SJöSTRöm<br />

Ro-Ro TECHNoLoGY<br />

Bore’s dry cargo vessels employed in the contract trade (CoA) are operated from the office in<br />

mariehamn. The Nordgard is one of the four “compass-vessels” in the fleet, here pictured in<br />

the kiel Canal on a voyage from Finland with a deck cargo of sawn wood.<br />

advantages of replacing lo-lo with ro-ro to<br />

gain more optimised transport solutions<br />

for some of our customers in the CoA segment.”<br />

Mr Franck stresses the importance of a<br />

constantly ongoing renewal process of the<br />

fleet. Modern and competitive vessels are<br />

a precondition for being able to offer the<br />

right transport solutions to the customer.<br />

“The average age of the vessels in our<br />

fleet is now about 15 years. By replacing<br />

older vessels with newbuildings or newer<br />

second-hand vessels the age is going to<br />

decrease further.”<br />

A renewal of the fleet by simply selling<br />

out older vessels without replacing them is<br />

not in the line with Bore’s business idea.<br />

New situation<br />

The philosophy advocated by Mr Franck is<br />

to maintain a critical mass with a fleet of at<br />

least 20 vessels.<br />

This is a huge difference compared with<br />

the situation before the acquisitions of<br />

Bror Husell Chartering and Engship when<br />

Bore had just four ro-ro vessels.<br />

“Now we are active in many sectors but<br />

primarily focusing on ro-ro, car shipments<br />

and CoA. The bulk segment is also interesting<br />

for us as there is a limited supply of<br />

ice-strengthened tonnage. We have investigated<br />

the possibilities to order newbuildings<br />

or buy second-hand vessels, but due to<br />

the current price situation we have decided<br />

to renew the tank top on our bulk carrier<br />

Bravaden and receive a 30-year-classing for<br />

life extension.”<br />

pär-henrik sjöström<br />

e<br />

� Shipowners<br />

� Modern RoRo-projects<br />

� In-House-Management<br />

Dag Engström Rederi AB<br />

PO Box 115<br />

SE 453 23 Lysekil Sweden<br />

E-mail: dag@engstromshipping.se<br />

Tfn +46 523 18940<br />

Fax +46 523 14943<br />

20 SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008

SCANDINAVIAN SHIPPING GAZETTE • XXXXX XX, 2008 21<br />

Pär-Henrik SjöStröm<br />

Ro-ro<br />

Technology<br />

editor: Pär-Henrik Sjöström<br />

Growing demand for an ageing fleet 22<br />

ro-ro rules in <strong>Scandinavian</strong> short sea shipping 26<br />

Global ro-ro: Growing in niches 30<br />

Göteborg – the capital of ro-ro 32<br />

Larger and faster ships in the future 36<br />

ACL on the go with the fourth generation 40<br />

Bore + Conro = roFlex 44<br />

Polsteam expands on ferry tonnage 46<br />

FSG stands firm as ro-ro market gets tougher 48<br />

Seatruck orders four Flensburger ro-ros 52<br />

misana and misida: tailor-made but still flexible 54<br />

esbjerg – working ro-ro since the bacon revolution 58<br />

Looking for the perfect time to order 60<br />

Shortsea XML focusing the main obstacles 64<br />

nordic Ferry Service takes over more services 66<br />

Sandwich plate on kapella car deck 70

RO-RO TECHNOLOGY<br />

Growing demand<br />

for an ageing fl eet<br />

Growing demand, an ageing fl eet and the entry of private equity investors<br />

are signs indicating a positive future for the ro-ro industry and an accelerated<br />

newbuilding activity as soon as opportunities arrive, that is when there are<br />

shipyard slots available at affordable costs.<br />

2007 became a year when ro-ro owners<br />

experienced continuously rising time-charter<br />

rates. This was true also for the smaller<br />

ro-ros of less than 1,200 lane metres.<br />

According to shipbrokers BRS in Paris,<br />

the average time charter rate for a 900-lane<br />

metre, 14-knots ro-ro reached around EUR<br />

6,500 per day last year, while the average<br />

rate for the largest vessels, above 3,000<br />

lane metres and with a speed of 21 knots,<br />

reached circa EUR 19,500 per day.<br />

Rates are at historically high levels and<br />

so are ship prices, which can be seen in<br />

the table supplied by shipbrokers Brax<br />

<strong>Shipping</strong> in Göteborg. The activity on the<br />

second-hand market was intense for the second<br />

consecutive year with 44 sale and purchase<br />

deals registered in 2007, or 40 per cent<br />

up on 2006. According to BRS, there are<br />

mainly two causes behind this activity; the<br />

high newbuilding prices and the late delivery<br />

times for those vessels already ordered.<br />

ageing fl eet<br />

The ro-ro fl eet is ageing. After the fi rst years<br />

of the 1980s, there was a sharp drop in<br />

newbuilding orders, and new ordering did<br />

not gather speed again until the middle of<br />

the 1990s. BRS statistics show that 33 per<br />

cent of the existing fl eet of 557 vessels will<br />

be 30 years or older by the end of 2009.<br />

A glance at the current order book shows<br />

that owners are focusing at larger units,<br />

which is not surprising bearing in mind<br />

the current newbuilding prices, and there<br />

are very few orders for vessels of less than<br />

1,800 lane metres.<br />

The current upswing in rates for smaller<br />

vessels is likely caused by the general<br />

increase in demand and the lack of supply<br />

of larger units. The few orders for small roros<br />

show that this segment in the long run<br />

faces extinction, with the exception for tailor-made<br />

vessels built for routes where port<br />

capacities and fairways puts restrictions on<br />

vessels sizes.<br />

With few exceptions, as Epic <strong>Shipping</strong>’s<br />

orders last year for three ro-paxes and six<br />

ro-ros, the current order book consists of<br />

vessels ordered by liner operators.<br />

consolidation<br />

Last year was a year of consolidation in the<br />

ro-ro industry. In Northern/North-western<br />

Europe, Rederiaktiebolaget Eckerö took<br />

control of Birka Line, Cobelfret acquired<br />

Ferryways and a consortia bought Scandlines.<br />

In the latter deal, a new type of<br />

player emerged in the ro-ro market as the<br />

private equity groups Allianz Capital Partners<br />

and 3i Group bought 40 per cent each<br />

of the former Danish/German state-owned<br />

ferry operator, with the remaining 20 per<br />

cent acquired by Deutsche Seereederei.<br />

Other private equity players entering the<br />

ro-ro market were Kohlberg Kravis Roberts<br />

22 SCANDINAVIAN SHIPPING GAZETTE • APRIL 18, 2008<br />

JOACHIM SJÖSTRÖM<br />

& Co and Marfi n Investment Group.<br />

The interest in ro-ro from these groups<br />

indicates a positive outlook for the industry.<br />

Demand is growing, but this has to be<br />

met by increased capacity at the same time<br />

as the replacement need in an ageing fl eet<br />

is growing. BRS warns that if newbuilding<br />

prices do not fall or charter rates increase<br />

substantially there might be a critical<br />

shortage of mid-sized tonnage. This could

threaten the existence and development of<br />

routes and even lead to changes to alternative<br />

transport modes.<br />

With the exception of ro-ro specialist<br />

shipyards as Flensburger Schiffbau, J. J. Sietas,<br />

Aker Yards and Jinling, the interest for<br />

building ro-ros has been lukewarm in the<br />

shipbuilding industry.<br />

A potential ordering spree may also lead<br />

to an increased interest for scrapping and<br />

recycling of old ro-ro vessels, a business<br />

that has been rather rare in recent history.<br />

”We know that this is coming, the question<br />

is when”, says Martin Kärrhage at Brax<br />

<strong>Shipping</strong>.<br />

Intense ordering<br />

2007 was an intense ordering year in the<br />

car carrier business. According to shipbrokers<br />