SSG No 20 - Shipgaz

SSG No 20 - Shipgaz

SSG No 20 - Shipgaz

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Ventspils, while products are shipped<br />

through Vysotsk, St Petersburg, Tallinn,<br />

Riga, Ventspils, Klaipeda and Kaliningrad.<br />

The eight European Union countries and<br />

Russia, all bordering in the Baltic Sea, are<br />

concerned by the potential environmental<br />

impact by spills and by the sheer volume<br />

of traffic. That is why they are working<br />

together within HELCOM co-operation<br />

for protecting the Baltic Sea.<br />

aframax volatility<br />

The bulk of <strong>No</strong>rthern European crude<br />

exports are carried in aframax size vessels.<br />

Exports to the US and Canada are also<br />

shipped in VLCCs and suezmax tankers.<br />

However, the most important type of crude<br />

tanker in <strong>No</strong>rth Europe is the aframax,<br />

which, as we noted earlier, has experienced<br />

an extremely volatile market, particularly<br />

in the past twelve months.<br />

At present there is too much aframax<br />

tonnage around at approximately 74.0<br />

million DWT, hence the freight volatility,<br />

which has caused owners some grief of<br />

late. With the volatile market at least in the<br />

past 18 months, it is important to see the<br />

<strong>No</strong>rth European market as part of a whole<br />

Atlantic market, including the Caribbean,<br />

the Mediterranean and the Black Sea. The<br />

inter-play between the markets is interesting,<br />

and we can see a certain “slush-effect”,<br />

as tonnage interchanges between the areas.<br />

time to weed out tonnage<br />

The transport bank DVB says in its latest<br />

market outlook for aframaxes that there are<br />

plenty of single hull vessels, which are up<br />

to their fifth special survey. Owners might<br />

choose to scrap at more than USD 500<br />

per light weight ton, or even find alternative<br />

employment as conversion to FPSOs.<br />

The bank also believes that high oil prices<br />

might provide more employment as more<br />

marginal fields come into production. DVB<br />

highlights healthy, long-term prospects for<br />

aframaxes by forecasting a demand growth<br />

of between six and seven per cent because<br />

of increasing trade to <strong>No</strong>rth America and<br />

Europe. All in all, the bank expects demand<br />

to be 26 per cent higher by <strong>20</strong>10 compared<br />

with <strong>20</strong>06.<br />

net fleet growth<br />

DVB estimates that the aframax fleet will<br />

have a net growth of nine per cent next<br />

year and eleven per cent in <strong>20</strong>09, and<br />

admits that this is likely to weigh down the<br />

market, before the conditions improves<br />

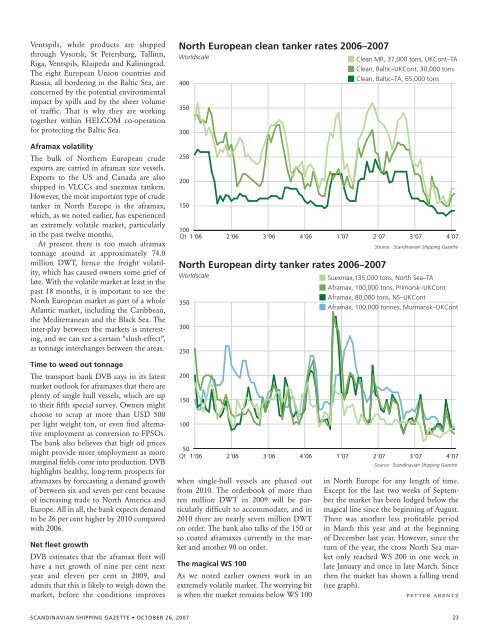

<strong>No</strong>rth European clean tanker rates <strong>20</strong>06–<strong>20</strong>07<br />

Worldscale � Clean MR, 37,000 tons, UKCont–TA<br />

� Clean, Baltic–UKCont, 30,000 tons<br />

� Clean, Baltic–TA, 65,000 tons<br />

400<br />

350<br />

300<br />

250<br />

<strong>20</strong>0<br />

150<br />

100<br />

Qt 1 ‘06<br />

2 ‘06<br />

when single-hull vessels are phased out<br />

from <strong>20</strong>10. The orderbook of more than<br />

ten million DWT in <strong>20</strong>09 will be particularly<br />

difficult to accommodate, and in<br />

<strong>20</strong>10 there are nearly seven million DWT<br />

on order. The bank also talks of the 150 or<br />

so coated aframaxes currently in the market<br />

and another 90 on order.<br />

the magical ws 100<br />

3 ‘06<br />

4 ‘06<br />

As we noted earlier owners work in an<br />

extremely volatile market. The worrying bit<br />

is when the market remains below WS 100<br />

1 ‘07<br />

2 ‘07<br />

<strong>No</strong>rth European dirty tanker rates <strong>20</strong>06–<strong>20</strong>07<br />

Worldscale<br />

350<br />

300<br />

250<br />

<strong>20</strong>0<br />

150<br />

100<br />

50<br />

Qt 1 ‘06<br />

2 ‘06<br />

3 ‘06<br />

4 ‘06<br />

1 ‘07<br />

3 ‘07<br />

4 ‘07<br />

Source: Scandinavian Shipping Gazette<br />

� Suexmax,135,000 tons, <strong>No</strong>rth Sea–TA<br />

� Aframax, 100,000 tons, Primorsk–UKCont<br />

� Aframax, 80,000 tons, NS–UKCont<br />

� Aframax, 100,000 tonnes, Murmansk–UKCont<br />

2 ‘07<br />

3 ‘07<br />

4 ‘07<br />

Source: Scandinavian Shipping Gazette<br />

in <strong>No</strong>rth Europe for any length of time.<br />

Except for the last two weeks of September<br />

the market has been lodged below the<br />

magical line since the beginning of August.<br />

There was another less profitable period<br />

in March this year and at the beginning<br />

of December last year. However, since the<br />

turn of the year, the cross <strong>No</strong>rth Sea market<br />

only reached WS <strong>20</strong>0 in one week in<br />

late January and once in late March. Since<br />

then the market has shown a falling trend<br />

(see graph).<br />

petter arentz<br />

SCAnDinAViAn SHiPPinG GAZETTE • OCTOBER 26, <strong>20</strong>07 23