Résumé/CV (PDF) - College of Liberal Arts and Education ...

Résumé/CV (PDF) - College of Liberal Arts and Education ...

Résumé/CV (PDF) - College of Liberal Arts and Education ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

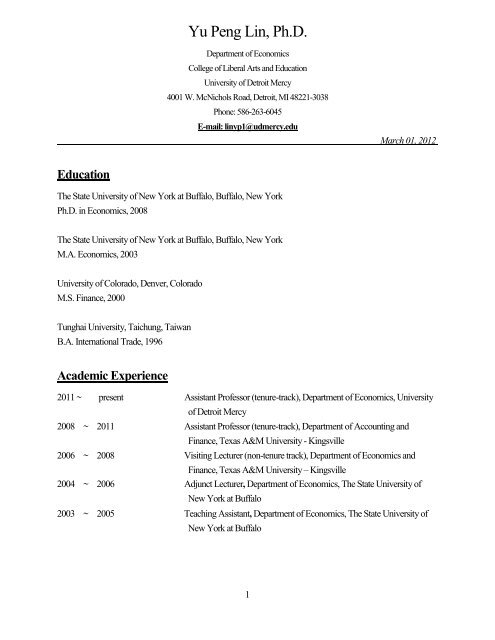

<strong>Education</strong><br />

Yu Peng Lin, Ph.D.<br />

Department <strong>of</strong> Economics<br />

<strong>College</strong> <strong>of</strong> <strong>Liberal</strong> <strong>Arts</strong> <strong>and</strong> <strong>Education</strong><br />

University <strong>of</strong> Detroit Mercy<br />

4001 W. McNichols Road, Detroit, MI 48221-3038<br />

Phone: 586-263-6045<br />

E-mail: linyp1@udmercy.edu<br />

The State University <strong>of</strong> New York at Buffalo, Buffalo, New York<br />

Ph.D. in Economics, 2008<br />

The State University <strong>of</strong> New York at Buffalo, Buffalo, New York<br />

M.A. Economics, 2003<br />

University <strong>of</strong> Colorado, Denver, Colorado<br />

M.S. Finance, 2000<br />

Tunghai University, Taichung, Taiwan<br />

B.A. International Trade, 1996<br />

Academic Experience<br />

1<br />

March 01, 2012<br />

2011 ~ present Assistant Pr<strong>of</strong>essor (tenure-track), Department <strong>of</strong> Economics, University<br />

<strong>of</strong> Detroit Mercy<br />

2008 ~ 2011 Assistant Pr<strong>of</strong>essor (tenure-track), Department <strong>of</strong> Accounting <strong>and</strong><br />

Finance, Texas A&M University - Kingsville<br />

2006 ~ 2008 Visiting Lecturer (non-tenure track), Department <strong>of</strong> Economics <strong>and</strong><br />

Finance, Texas A&M University – Kingsville<br />

2004 ~ 2006 Adjunct Lecturer, Department <strong>of</strong> Economics, The State University <strong>of</strong><br />

New York at Buffalo<br />

2003 ~ 2005 Teaching Assistant, Department <strong>of</strong> Economics, The State University <strong>of</strong><br />

New York at Buffalo

Teaching<br />

Teaching Interest Microeconomics (principle <strong>and</strong> advanced), Macroeconomics (principle <strong>and</strong><br />

Hybrid (seated <strong>and</strong> online)<br />

advanced) , Financial Economics; Econometrics; Quantitative Methods;<br />

Money <strong>and</strong> Capital Markets; Managerial Economics.<br />

Courses Macroeconomics, Microeconomics, Managerial Economics, <strong>and</strong> Corporate<br />

Developed <strong>and</strong> Taught Finance, Financial Management; Financial Economics; Designed <strong>and</strong><br />

<strong>of</strong>fered in Blackboard.<br />

Distance <strong>Education</strong> TTVN classes <strong>of</strong>fered in the Texas A&M University – Kingsville <strong>and</strong><br />

University Service<br />

televised at TAMUK – System Center at San Antonio.<br />

Blackboard (WebCT) based.<br />

2011 ~ present Program Review Committee (undergraduate programs)<br />

Summer, 2010 Coordinator <strong>and</strong> Leading Faculty - <strong>College</strong> <strong>of</strong> Business Administration<br />

Study Abroad Program in Taiwan<br />

2008 ~ 2011 Academic advisor <strong>of</strong> the Taiwanese Student Association at Texas A&M<br />

University – Kingsville<br />

2010 ~ 2011 Committee on Evaluation <strong>of</strong> Administrators<br />

2008 ~ 2010 University Honor Council<br />

2009 ~ 2010 University Graduate Council<br />

2007 ~ 2010 Faculty Senate<br />

2008 ~ 2009 Committee on Committees (Faculty Senate)<br />

2009 ~ 2010 Executive Committee (Faculty Senate)<br />

2008 ~ 2009 University Research Council<br />

Work Experience<br />

2000 ~ 2001 China Motor Corporation, Treasury department, Taiwan<br />

- Senior Financial Analyst<br />

1996 ~ 1998 The Central Insurance Corporation<br />

Pr<strong>of</strong>essional Certificate<br />

- Junior Risk Analyst<br />

2

Who’s Who in America, Marquis, 2011<br />

Virtual Instructor Certificate, Texas A&M University, 2008<br />

Pr<strong>of</strong>essional Service<br />

Reviewer: Administrative Issues Journal<br />

Reviewer: Southwest Academy <strong>of</strong> Management 2011 conference<br />

Reviewer: Academy <strong>of</strong> Management 2011 <strong>and</strong> 2012 meeting<br />

Pr<strong>of</strong>essional Membership<br />

American Economic Association<br />

Academy <strong>of</strong> Economics <strong>and</strong> Finance<br />

International Academy <strong>of</strong> Business <strong>and</strong> Economics<br />

Midwest Economic Association<br />

Southern Economic Association<br />

Personal Skills<br />

Language: English, M<strong>and</strong>arin (Chinese)<br />

Computer: STATA, LIMDEP, SAS, MS Office<br />

Research Interest<br />

Financial Economics; Applied Microeconomics; Applied Econometrics; Industrial Organization; Industrial<br />

Relations; Labor Economics.<br />

Referred Journal Publications <strong>and</strong> Conference Proceedings<br />

Lin, Yu Peng (with Ryan D. Rhoades), “The Nature <strong>and</strong> Scope <strong>of</strong> Top Manager Compensation in the Ranch<br />

Industry”. International Journal <strong>of</strong> Management Studies. forthcoming, June, 2012. (International Journal <strong>of</strong><br />

Management Studies is an academic journal associated with the Texas Southern University <strong>and</strong> listed in<br />

Cabell’s Directories)<br />

Lin, Yu Peng (with James Sesil), “The Impact <strong>of</strong> Employee Stock Option Adoption <strong>and</strong> Incidence on<br />

Productivity: Evidence from U.S. Panel Data”, Industrial Relations, Vol.50 (3), July, 2011<br />

(SSCI; Econlit; Industrial Relations is an academic journal associated with UC-Berkeley)<br />

Lin, Yu Peng (with James Sesil), “Do Broad-Based Stock Options Promote Organization Capital?”, British<br />

3

Journal <strong>of</strong> Industrial Relations, Vol. 49(S2), July, 2011<br />

(SSCI; Econlit; British Journal <strong>of</strong> Industrial Relations is an academic journal associated with London School<br />

<strong>of</strong> Economics)<br />

Lin, Yu Peng, “Broad-Based Stock Options: Adopters vs. Non-adopters”, Journal <strong>of</strong> Applied Business <strong>and</strong><br />

Economics, June 2009<br />

(Cabell’s Directory)<br />

Lin, Yu Peng (with James Sesil), “Broad-Based Stock Options Program, Organization Capital, <strong>and</strong> Employee<br />

Productivity”, Best paper <strong>of</strong> the 2009 “Challenges <strong>of</strong> Globalizing Financial Systems” conference <strong>and</strong><br />

published in the conference proceedings., Jordan, 2009<br />

Lin, Yu Peng (with James Sesil), “Broad-Based Stock Options Program, Organization Capital, <strong>and</strong> Firm<br />

Performance”, Best paper <strong>of</strong> the 2007 Academy <strong>of</strong> Management annual meeting <strong>and</strong> published in the<br />

conference proceedings.<br />

Lin, Yu Peng (with James Sesil), the research results <strong>of</strong> “The Impact <strong>of</strong> Executive <strong>and</strong> Broad-Based Stock<br />

Option Adoption on Productivity – Evidence from U.S. Panel Data”, 2007, appears on the Connecting<br />

Research to HR Practices, SHRM Foundation<br />

<strong>College</strong>-level Textbooks<br />

Lin, Yu Peng, Business Statistics <strong>and</strong> Econometrics, Kendall Hunt Publishing, manuscript, 2012<br />

Lin, Yu Peng, Time Value <strong>of</strong> Money: A Key in Finance, Kendall Hunt Publishing, 2010<br />

Lin, Yu Peng, An Application Guide to Macroeconomic Policy, Kendall Hunt Publishing, 2009<br />

Working Papers<br />

Lin, Yu Peng, “What Drives Employee Stock Options Program? Safeguarding Human Capital <strong>and</strong> Recruiting<br />

Wanted-skill”, under review by the Review <strong>of</strong> Financial Economics (The Review <strong>of</strong> Financial Economics is an<br />

academic journal associated with the University <strong>of</strong> New Orleans <strong>and</strong> listed in SSCI, EconLit, <strong>and</strong> Cabell’s<br />

Directories).<br />

Lin, Yu Peng (with James Sesil <strong>and</strong> Maya Kroumova), “The Impact <strong>of</strong> Broad-Based Stock Options on Firm<br />

Performance: Does Firm Size Matter?”, under review by Industrial <strong>and</strong> Labor Relations Review (SSCI;<br />

EconLit; Industrial <strong>and</strong> Labor Relations Review is an academic journal associated with Cornell University),<br />

2011<br />

4

Lin, Yu Peng, “Managerial Compensation <strong>and</strong> Firm Survival”, working paper<br />

Lin, Yu Peng, “Broad-Based Stock Options Program <strong>and</strong> Production Efficiency: The Question <strong>of</strong><br />

Self-Selection”, working paper<br />

Lin, Yu Peng, “Employee Stock Options Compensation: A Survey”, working paper<br />

Lin, Yu Peng, “CEO Compensation: An International Comparison”, working paper<br />

Lin, Yu Peng (with Ryan D. Rhoades), “Top Manager Compensation <strong>and</strong> Firm Performance: New Evidence<br />

from the Ranch Industry”, working paper<br />

Lin, Yu Peng (with James Sesil <strong>and</strong> Steven Director), “Stock Option Adoption <strong>and</strong> Irrational Exuberance: The<br />

Impact on Pr<strong>of</strong>itability”, working paper<br />

Funding <strong>and</strong> Rewards<br />

Mark Diamond Research Fund at the State University <strong>of</strong> New York at Buffalo, 2005~2006<br />

HP Catalyst Initiative – “Developing STEM-preneur through Engineering Innovation H<strong>and</strong>s-on Projects” (HP<br />

Grant ID: 5607862) with Jin Kai, Hua Li, <strong>and</strong> Stanley Leja. 2011, amount: $150,000.<br />

Conference Presentations<br />

Lin, Yu Peng, “The Nature <strong>and</strong> Scope <strong>of</strong> Top Manager Compensation in the Ranch Industry”, International Academy <strong>of</strong><br />

Business <strong>and</strong> Academy (IABE) winter conference, Key West, FL, March 9~11, 2012<br />

Lin, Yu Peng, “What Drives Employee Stock Options Program? Safeguarding Human Capital <strong>and</strong> Recruiting<br />

Wanted-skill”, The Western Economics Association International (WEAI) annual conference, Portl<strong>and</strong>, OR,<br />

June 30, 2010<br />

Lin, Yu Peng, “The Impact <strong>of</strong> Broad Based <strong>and</strong> Executive Stock Option Adoption”, Southern Economic<br />

Association (SEA) annual meeting, San Antonio, TX, November 21, 2009<br />

Lin, Yu Peng, “Broad-Based Stock Options Program, Organizational Capital, <strong>and</strong> Employee Productivity”<br />

(with James Sesil), Midwest Economics Association (WEA) annual meeting, Clevel<strong>and</strong>, OH, March 20, 2009<br />

Lin, Yu Peng, “Broad-Based Stock Options Program: Adopters vs. Non-adopters”, International Academy <strong>of</strong><br />

Business <strong>and</strong> Economics (IABE) annual conference, Las Vegas, NV, October 19, 2008<br />

5

Lin, Yu Peng, “Broad-Based Stock Options Program <strong>and</strong> Production Efficiency: The Question <strong>of</strong><br />

Self-Selection”, Midwest Economics Association (WEA) annual meeting, Chicago, IL, March 14, 2008<br />

Lin, Yu Peng, “Broad-Based Stock Options Program, Organization Capital, <strong>and</strong> Firm Performance” (with<br />

James Sesil), Academy <strong>of</strong> Management (AOM) annual meeting, Philadelphia, PA, August 06, 2007<br />

Lin, Yu Peng, “Broad-Based Stock Options Program <strong>and</strong> Productivity: An Implication <strong>of</strong> Capital-Skill<br />

Complementarity”, Midwest Economics Association (MEA) annual meeting, Minneapolis, MN, March 24,<br />

2007<br />

Lin, Yu Peng, “Stock Option Adoption <strong>and</strong> Irrational Exuberance: The Impact on Pr<strong>of</strong>itability” (with James<br />

Sesil <strong>and</strong> Steven Director), Business Research Consortium <strong>of</strong> Western New York , Canisius <strong>College</strong>, Buffalo,<br />

New York, April, 2006<br />

6