ideas On Financial, Estate And gift Planning For - Cleveland Clinic

ideas On Financial, Estate And gift Planning For - Cleveland Clinic

ideas On Financial, Estate And gift Planning For - Cleveland Clinic

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4<br />

the spirit of giving<br />

Philanthropy is defined as the effort or inclination to increase the<br />

well-being of mankind, as by charitable aid or donations.<br />

While there is a whole spectrum of <strong>gift</strong> planning options<br />

(see chart, “comparison of <strong>gift</strong> categories” p.6), one creative way<br />

to be philanthropic is to establish a deferred-payment <strong>gift</strong> annuity.<br />

for rose mary kubik, recipient of the george W. crile, sr. award, philanthropy<br />

extends to cleveland clinic and beyond, to her nieces and nephews in the form of<br />

deferred-payment <strong>gift</strong> annuities. a deferred-payment <strong>gift</strong> annuity may also be your<br />

<strong>gift</strong> vehicle of choice if your objective is to secure a dependable income for your<br />

future, or the future of a loved one.<br />

the deferred-payment <strong>gift</strong> annuity is a popular twist on the charitable <strong>gift</strong><br />

annuity. the term “<strong>gift</strong> annuity” describes a plan under which we provide<br />

guaranteed annual payments to you in exchange for your <strong>gift</strong>. Our approved<br />

payout rates are calculated with just this type of exchange in mind – to ensure<br />

the maximum payment to you.<br />

the deferred-payment part of such plans is what makes them so appealing to<br />

people who want to invest resources now to compound for the future. it is the<br />

only charitable plan that allows you to build a stream of very high income that<br />

begins at a date of your choice and is guaranteed for life – instead of taking<br />

payments now.<br />

Favorable Tax Treatment<br />

Several tax bonuses go along with the high return you receive<br />

in this plan. When you begin taking your payments (for example,<br />

upon retirement), a portion of every payment is treated as a taxfree<br />

return of principal. You also receive a significant charitable<br />

income-tax deduction right away, as soon as you transfer some<br />

assets into the plan.<br />

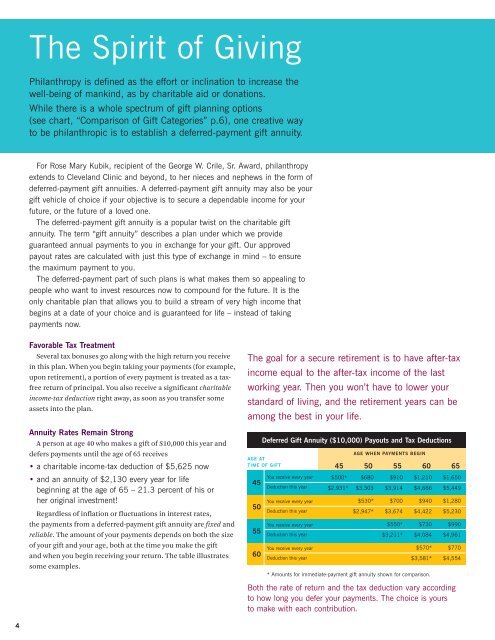

Annuity Rates Remain strong<br />

A person at age 40 who makes a <strong>gift</strong> of $10,000 this year and<br />

defers payments until the age of 65 receives<br />

• a charitable income-tax deduction of $5,625 now<br />

• and an annuity of $2,130 every year for life<br />

beginning at the age of 65 – 21.3 percent of his or<br />

her original investment!<br />

Regardless of inflation or fluctuations in interest rates,<br />

the payments from a deferred-payment <strong>gift</strong> annuity are fixed and<br />

reliable. The amount of your payments depends on both the size<br />

of your <strong>gift</strong> and your age, both at the time you make the <strong>gift</strong><br />

and when you begin receiving your return. The table illustrates<br />

some examples.<br />

the goal for a secure retirement is to have after-tax<br />

income equal to the after-tax income of the last<br />

working year. then you won’t have to lower your<br />

standard of living, and the retirement years can be<br />

among the best in your life.<br />

45<br />

Deferred Gift Annuity ($10,000) Payouts and Tax Deductions<br />

AGe AT<br />

Time oF GiFT<br />

50<br />

55<br />

60<br />

you receive every year<br />

deduction this year<br />

you receive every year<br />

deduction this year<br />

you receive every year<br />

deduction this year<br />

you receive every year<br />

deduction this year<br />

AGe wHeN PAymeNTs BeGiN<br />

45 50 55 60 65<br />

$500* $680 $910 $1,210 $1,650<br />

$2,931* $3,303 $3,914 $4,686 $5,449<br />

$530* $700 $940 $1,280<br />

$2,947* $3,674 $4,422 $5,230<br />

$550* $730 $990<br />

$3,211* $4,084 $4,961<br />

* amounts for immediate-payment <strong>gift</strong> annuity shown for comparison.<br />

$570* $770<br />

$3,581* $4,554<br />

Both the rate of return and the tax deduction vary according<br />

to how long you defer your payments. the choice is yours<br />

to make with each contribution.