Market Share Leaders - Advertising Age

Market Share Leaders - Advertising Age

Market Share Leaders - Advertising Age

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

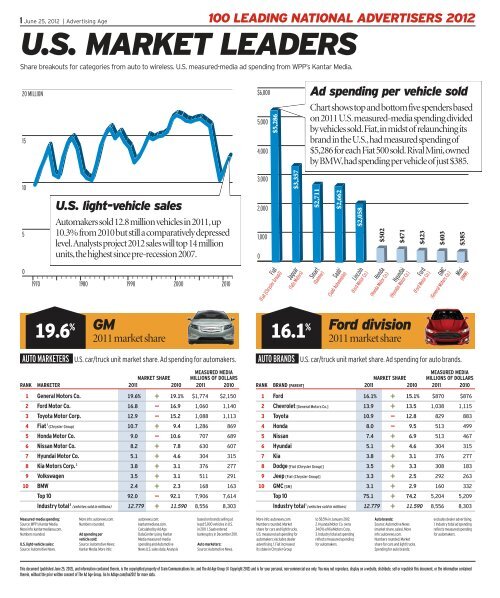

1 June 25, 2012 | <strong>Advertising</strong> <strong>Age</strong><br />

U.S. MARKET LEADERS<br />

<strong>Share</strong> breakouts for categories from auto to wireless. U.S. measured-media ad spending from WPP’s Kantar Media.<br />

20 MILLION<br />

15<br />

10<br />

5<br />

0<br />

1970<br />

AUTO MARKETERSN U.S. car/truck unit market share. Ad spending for automakers.<br />

MARKET SHARE<br />

MEASURED MEDIA<br />

MILLIONS OF DOLLARS<br />

RANK MARKETER 2011 2010 2011 2010<br />

1<br />

2<br />

General Motors Co.<br />

Ford Motor Co.<br />

19.6%<br />

16.8<br />

+<br />

-<br />

19.1%<br />

16.9<br />

$1,774<br />

1,060<br />

$2,150<br />

1,140<br />

3 Toyota Motor Corp. 12.9 - 15.2 1,088 1,113<br />

4 Fiat 1 (Chrysler Group) 10.7 + 9.4 1,286 869<br />

5 Honda Motor Co. 9.0 - 10.6 707 689<br />

6 Nissan Motor Co. 8.2 + 7.8 630 607<br />

7 Hyundai Motor Co. 5.1 + 4.6 304 315<br />

8 Kia Motors Corp. 2<br />

3.8 + 3.1 376 277<br />

9 Volkswagen 3.5 + 3.1 511 291<br />

10 BMW 2.4 + 2.3 168 163<br />

Top 10 92.0 - 92.1 7,906 7,614<br />

Industry total 3 (vehicles sold in millions) 12.779 + 11.590 8,556 8,303<br />

Measured-media spending:<br />

Source: WPP’s Kantar Media.<br />

More info: kantarmediana.com.<br />

Numbers rounded.<br />

U.S. light-vehicle sales:<br />

Source: Automotive News.<br />

U.S. light-vehicle sales<br />

Automakers sold 12.8 million vehicles in 2011,up<br />

10.3% from 2010 but still a comparatively depressed<br />

level.Analysts project 2012 sales will top 14 million<br />

units,the highest since pre-recession 2007.<br />

1980<br />

More info: autonews.com.<br />

Numbers rounded.<br />

Ad spending per<br />

vehicle sold:<br />

Source: Automotive News;<br />

Kantar Media. More info:<br />

1990<br />

2000<br />

autonews.com;<br />

kantarmediana.com.<br />

Calculated by Ad <strong>Age</strong><br />

DataCenter using Kantar<br />

Media measured-media<br />

spending and Automotive<br />

News U.S. sales data. Analysis<br />

100 LEADING NATIONAL ADVERTISERS 2012<br />

2010<br />

based on brands selling at<br />

least 5,000 vehicles in U.S.<br />

in 2011. 1. Saab entered<br />

bankruptcy in December 2011.<br />

Auto marketers:<br />

Source: Automotive News.<br />

Fiat<br />

(Fiat [Chrysler Group])<br />

19.6 % Ford division<br />

16.1 %<br />

GM<br />

2011 market share<br />

$6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

$5,286<br />

Jaguar<br />

$3,357<br />

(Tata Motors)<br />

AUTO BRANDSN U.S. car/truck unit market share. Ad spending for auto brands.<br />

MARKET SHARE<br />

MEASURED MEDIA<br />

MILLIONS OF DOLLARS<br />

RANK BRAND [PARENT] 2011 2010 2011 2010<br />

1<br />

2<br />

Ford<br />

Chevrolet [General Motors Co.]<br />

16.1%<br />

13.9<br />

+<br />

+<br />

15.1%<br />

13.5<br />

$870<br />

1,038<br />

$876<br />

1,115<br />

3 Toyota 10.9 - 12.8 829 883<br />

4 Honda 8.0 - 9.5 513 499<br />

5 Nissan 7.4 + 6.9 513 467<br />

6 Hyundai 5.1 + 4.6 304 315<br />

7 Kia 3.8 + 3.1 376 277<br />

8 Dodge [Fiat (Chrysler Group)] 3.5 + 3.3 308 183<br />

9 Jeep [Fiat (Chrysler Group)] 3.3 + 2.5 292 263<br />

10 GMC [GM] 3.1 + 2.9 160 332<br />

Top 10 75.1 + 74.2 5,204 5,209<br />

Industry total 1 (vehicles sold in millions) 12.779 + 11.590 8,556 8,303<br />

More info: autonews.com.<br />

Numbers rounded. <strong>Market</strong><br />

share for cars and light trucks.<br />

U.S. measured ad spending for<br />

automakers; excludes dealer<br />

advertising. 1. Fiat increased<br />

its stake in Chrysler Group<br />

Ad spending per vehicle sold<br />

Chart shows top and bottom five spenders based<br />

on 2011 U.S.measured-media spending divided<br />

by vehicles sold.Fiat,in midst of relaunching its<br />

brand in the U.S.,had measured spending of<br />

$5,286 for each Fiat 500 sold.Rival Mini,owned<br />

by BMW,had spending per vehicle of just $385.<br />

Smart<br />

$2,711<br />

(Daimler)<br />

$2,662<br />

Saab 1<br />

(Saab Automobile)<br />

Lincoln<br />

to 58.5% in January 2012.<br />

2. Hyundai Motor Co. owns<br />

34.0% of Kia Motors Corp.<br />

3. Industry total ad spending<br />

reflects measured spending<br />

for automakers.<br />

$2,058<br />

(Ford Motor Co.)<br />

Honda<br />

$502<br />

(Honda Motor Co.)<br />

$471<br />

2011 market share<br />

Hyundai<br />

(Hyundai Motor Co.)<br />

Auto brands:<br />

Source: Automotive News<br />

(market share, sales). More<br />

info: autonews.com.<br />

Numbers rounded. <strong>Market</strong><br />

share for cars and light trucks.<br />

Spending for auto brands;<br />

$423<br />

Ford<br />

(Ford Motor Co.)<br />

$403<br />

GMC<br />

(General Motors Co.)<br />

$385<br />

Mini<br />

(BMW)<br />

excludes dealer advertising.<br />

1. Industry total ad spending<br />

reflects measured spending<br />

for automakers.<br />

This document (published June 25, 2012), and information contained therein, is the copyrighted property of Crain Communications Inc. and The Ad <strong>Age</strong> Group (© Copyright 2012) and is for your personal, non-commercial use only. You may not reproduce, display on a website, distribute, sell or republish this document, or the information contained<br />

therein, without the prior written consent of The Ad <strong>Age</strong> Group. Go to Ad<strong>Age</strong>.com/lna2012 for more data.

2 June 25, 2012 | <strong>Advertising</strong> <strong>Age</strong><br />

Largest personal-care advertisers<br />

Based on 2011 U.S.measured-media ad spending.Total U.S.<br />

personal-care ad spending: $6.5 billion.Procter & Gamble,the<br />

nation’s (and world’s) top advertiser,accounted for 27.6% of that.<br />

U.S. AD SPENDING ($ MILLIONS)<br />

All other $1,339<br />

Kao Corp. $129<br />

GlaxoSmithKline<br />

$137<br />

Kimberly-Clark<br />

Corp. $151<br />

Revlon $159<br />

Coty $258<br />

Estée Lauder Cos. $271<br />

Unilever $462<br />

2.0%<br />

2.1%<br />

2.3%<br />

2.4%<br />

4.0%<br />

4.2%<br />

20.5% 27.6%<br />

Total<br />

$6,527<br />

7.1% 7.5%<br />

20.4%<br />

PERSONAL-CARE BRANDSN Most-advertised personal-care brands.<br />

Procter & Gamble Co. $1,798<br />

L’Oréal $1,330<br />

Johnson & Johnson $492<br />

MEASURED MEDIA<br />

SHARE OF ADVERTISING MILLIONS OF DOLLARS<br />

RANK BRAND [PARENT] 2011 2010 2011 2010<br />

1 L’Oréal Paris [L’Oréal] 7.6% + 7.1% $496 $439<br />

2 Olay [Procter & Gamble Co.] 4.8 - 5.0 313 306<br />

3 CoverGirl [P&G] 4.7 + 3.9 305 242<br />

4 Maybelline New York [L’Oréal] 4.6 + 4.1 300 256<br />

5 Garnier [L’Oréal] 4.0 + 3.7 263 228<br />

6 Crest [P&G] 3.5 + 2.8 229 173<br />

7 Dove [Unilever] 2.9 - 3.4 187 209<br />

8 Gillette [P&G] 2.8 - 3.2 186 196<br />

9 Pantene [P&G] 2.1 - 2.4 140 147<br />

10 Neutrogena [Johnson & Johnson] 2.0 = 2.0 133 124<br />

Top 10 39.1 + 37.6 2,551 2,320<br />

Total category ad spending 100.0 = 100.0 6,527 6,173<br />

U.S. AD SPENDING ($ MILLIONS)<br />

Henkel $13<br />

Sun Products Corp. $41<br />

Energizer Holdings $65<br />

Koch Industries $125<br />

Kimberly-Clark<br />

Corp. $129<br />

Church & Dwight Co.<br />

$151<br />

Reckitt Benckiser $181<br />

6.6%<br />

6.8%<br />

7.9%<br />

All other $131<br />

0.7%<br />

2.2%<br />

3.4%<br />

9.6%<br />

6.9%<br />

Total<br />

$1,897<br />

10.2%<br />

11.2%<br />

34.5%<br />

Procter & Gamble Co. $655<br />

L'Oréal Paris<br />

7.6 Brand’s share of ad spending<br />

% Clorox<br />

6.2 Brand’s share of ad spending<br />

%<br />

Measured-media spending:<br />

Source: WPP’s Kantar Media.<br />

More info: kantarmediana.com.<br />

Numbers rounded.<br />

Personal-care advertisers:<br />

Source: Ad <strong>Age</strong> DataCenter<br />

analysis of Kantar Media U.S.<br />

measured-media spending.<br />

Numbers rounded. <strong>Share</strong><br />

shown is company’s share of<br />

U.S. personal-care measuredmedia<br />

spending. Total<br />

spending and share<br />

calculations based on ad<br />

spending for Kantar Media’s<br />

industry classifications for<br />

Cosmetics & Beauty Aids<br />

(D100); Personal Hygiene &<br />

Health (D200); Hair Products &<br />

Accessories (D300); and Men’s<br />

Toiletries, Hygienic Goods &<br />

Skin Care (D400).<br />

Personal-care brands:<br />

Source: Ad <strong>Age</strong> DataCenter<br />

analysis of Kantar Media U.S.<br />

measured-media spending.<br />

Numbers rounded. <strong>Share</strong> of<br />

advertising and industry total<br />

100 LEADING NATIONAL ADVERTISERS 2012<br />

category ad spending based<br />

on Kantar Media’s industry<br />

classifications for Cosmetics &<br />

Beauty Aids (D100); Personal<br />

Hygiene & Health (D200); Hair<br />

Products & Accessories (D300);<br />

and Men’s Toiletries, Hygienic<br />

Goods & Skin Care (D400).<br />

Largest household-product advertisers<br />

Based on 2011 U.S.measured-media ad spending.Total U.S.<br />

household-product ad spending:$1.9 billion.P&G accounted<br />

for more than one-third of total spending.<br />

HOUSEHOLD-PRODUCT BRANDSN Most-advertised household products.<br />

SC Johnson $213<br />

Clorox Co. $193<br />

MEASURED MEDIA<br />

SHARE OF ADVERTISING MILLIONS OF DOLLARS<br />

RANK BRAND [PARENT] 2011 2010 2011 2010<br />

1 Clorox [Clorox Co.] 6.2% + 6.0% $117 $141<br />

2 Febreze [Procter & Gamble Co.] 6.0 + 5.6 114 131<br />

3 Tide [P&G] 5.3 - 7.5 100 177<br />

4 Glade [SC Johnson] 5.0 - 5.7 94 133<br />

5 Charmin [P&G] 4.2 + 3.0 80 71<br />

6 OxiClean [Church & Dwight Co.] 4.0 + 2.9 76 67<br />

7 Bounty [P&G] 3.9 + 3.3 73 77<br />

8 Energizer [Energizer Holdings] 3.4 + 2.5 65 60<br />

9 Lysol [Reckitt Benckiser] 3.1 - 3.2 59 75<br />

10 Arm & Hammer [Church & Dwight] 2.7 + 2.3 52 54<br />

Top 10 43.7 + 41.8 830 985<br />

Total category ad spending 100.0 = 100.0 1,897 2,356<br />

Household-product<br />

advertisers:<br />

Source: Ad <strong>Age</strong> DataCenter<br />

analysis of Kantar Media U.S.<br />

measured-media spending.<br />

Numbers rounded. <strong>Share</strong><br />

shown is company’s share of<br />

U.S. personal-care measuredmedia<br />

spending. Total<br />

spending and share<br />

calculations based on ad<br />

spending for Kantar Media’s<br />

industry classifications for<br />

Household Supplies (H300);<br />

and Household Soaps,<br />

Cleansers & Polishes (H400).<br />

Household-product brands:<br />

Source: Ad <strong>Age</strong> DataCenter<br />

analysis of Kantar Media U.S.<br />

measured-media spending.<br />

Numbers rounded. <strong>Share</strong> of<br />

advertising and industry total<br />

category ad spending based<br />

on Kantar Media’s industry<br />

classifications for Household<br />

Supplies (H300); and<br />

Household Soaps, Cleansers<br />

& Polishes (H400).

3 June 25, 2012 | <strong>Advertising</strong> <strong>Age</strong><br />

2.0<br />

1.0<br />

0.5<br />

0<br />

U.S. box office<br />

The number of movie tickets sold in the U.S.last year slumped<br />

to the lowest level seen since 1995.This marked the second<br />

consecutive year of declining ticket sales and box-office gross.<br />

Number of tickets sold (billions)<br />

No. 1 film:<br />

“Toy Story”<br />

1995<br />

MOVIE STUDIOSN <strong>Share</strong> of U.S. box-office gross sales for movie-studio companies.<br />

MEASURED MEDIA<br />

MARKET SHARE MILLIONS OF DOLLARS<br />

RANK MARKETER (SELECTED STUDIOS) 2011 2010 2011 2010<br />

1 Viacom (Paramount, MTV, Nickelodeon) 19.3% + 16.4% $484 $453<br />

2 Time Warner (Warner Bros., New Line) 17.9 - 18.2 741 693<br />

3<br />

4<br />

Sony Corp. (Columbia, Sony, TriStar)<br />

Walt Disney Co. (Disney, Marvel, Pixar)<br />

13.4<br />

12.2<br />

+<br />

-<br />

12.7<br />

14.0<br />

546<br />

363<br />

467<br />

342<br />

5 Comcast Corp. 1 (Universal, Focus Features) 11.5 + 9.1 586 492<br />

6<br />

7<br />

News Corp. (Twentieth Century Fox)<br />

Summit Entertainment<br />

11.1 - 15.5 362 441<br />

2<br />

4.0 - 5.0 144 127<br />

8 Weinstein Co. 2.9 + 0.8 152 32<br />

9 Relativity Media 2.2 + 0.1 132 26<br />

10 Lions Gate Entertainment 3 (Lionsgate) 1.8 - 4.9 93 199<br />

Top 10 96.4 - 96.6 3,603 3,272<br />

Industry total (box office, $ in billions) $10.174 - $10.565 3,812 3,562<br />

100 LEADING NATIONAL ADVERTISERS 2012<br />

Viacom<br />

19.3 2011 market share<br />

% Lipitor<br />

2.4 2011 market share<br />

%<br />

Measured-media spending:<br />

Source: WPP’s Kantar Media.<br />

More info: kantarmediana.com.<br />

Numbers rounded.<br />

U.S. box office:<br />

Source: Box Office Mojo. More<br />

info: boxofficemojo.com.<br />

2000<br />

No. 1 film:<br />

“Spider-Man”<br />

Movie studios:<br />

Source: Box Office Mojo. More<br />

info: boxofficemojo.com.<br />

Measured-media spending for<br />

movies excludes spending for<br />

DVDs. Numbers rounded.<br />

1. Comcast in January 2011<br />

bought 51% stake in<br />

2005<br />

Box-office gross sales ($ in billions)<br />

NBC Universal. 2. Lions Gate<br />

in January 2012 bought<br />

Summit Entertainment, known<br />

for its “Twilight Saga” series.<br />

3. Excluding Summit<br />

Entertainment.<br />

$12<br />

No. 1 film: “Harry Potter and<br />

the Deathly Hollows - Part 2” 6<br />

2010<br />

9<br />

3<br />

0<br />

World’s largest<br />

pharmaceutical marketers:<br />

Source: IMS Health. More info:<br />

imshealth.com.<br />

Numbers rounded. World<br />

figures include prescription<br />

and certain over-the-counter<br />

sales. U.S. figures are<br />

World’s largest pharma marketers<br />

Based on worldwide dollar sales.The United States,home<br />

to 4.5% of the world’s population,last year accounted for<br />

37.4% of the industry’s worldwide drug sales.<br />

SALES IN $ BILLIONS U.S.<br />

WORLD<br />

Pfizer, USA $25.1<br />

$56.4<br />

Novartis, Switzerland $19.2<br />

$51.6<br />

Merck & Co., USA $19.3<br />

$40.1<br />

Sanofi, France $11.8<br />

$39.5<br />

AstraZeneca, U.K. $19.9<br />

$37.0<br />

Roche, Switzerland $14.5<br />

$34.9<br />

GlaxoSmithKline, U.K. $14.2<br />

$34.5<br />

Johnson & Johnson, USA $12.1<br />

$27.7<br />

Abbott Laboratories, USA $11.5<br />

$25.9<br />

Teva, Israel $15.1<br />

$23.9<br />

PRESCRIPTION DRUGSN Best-selling drugs. <strong>Market</strong> share based on U.S. dollar sales.<br />

MEASURED MEDIA<br />

MARKET SHARE MILLIONS OF DOLLARS<br />

RANK BRAND [PARENT, POTENTIAL GENERIC COMPETITION] 2011 2010 2011 2010<br />

1 Lipitor [Pfizer, Nov. 2011] 2.41% + 2.37% $244 $272<br />

2 Plavix [Bristol-Myers Squibb/Sanofi, May 2012] 2.13 + 1.98 51 127<br />

3 Nexium [AstraZeneca, May 2014] 1.94 - 2.04 18 17<br />

4 Abilify [Bristol-Myers Squibb/Otsuka, April 2015] 1.63 + 1.49 126 156<br />

5 Advair Diskus [GlaxoSmithKline, NA] 1.44 - 1.52 137 200<br />

5 Seroquel [AstraZeneca, March 2012] 1.44 + 1.43 81 80<br />

5 Singulair [Merck, Aug. 2012] 1.44 + 1.33 73 95<br />

8 Crestor [AstraZeneca, July 2016] 1.38 + 1.23 1 70<br />

9 Cymbalta [Eli Lilly & Co., Dec. 2013] 1.16 + 1.04 100 152<br />

10 Humira 1 [Abbott Laboratories, Dec. 2016] 1.09 + 0.94 94 34<br />

Top 10 16.04 + 15.36 923 1,204<br />

Industry total (U.S. drug sales, $ in billions) $319.9 + $308.6 4,339 4,450<br />

prescription drugs including<br />

insulin.<br />

Prescription drugs:<br />

Source: IMS Health (market<br />

share); Medco Health<br />

Solutions (estimated dates for<br />

potential generic competition;<br />

data as of January 2012).<br />

More info: imshealth.com;<br />

medcohealth.com.<br />

Numbers rounded. 1. Tied for<br />

10th place with Enbrel<br />

(Amgen/Pfizer) and Remicade<br />

(Johnson & Johnson).

4 June 25, 2012 | <strong>Advertising</strong> <strong>Age</strong><br />

Verizon<br />

31.6 2011 market share<br />

% Coke<br />

14.7 2011 market share<br />

%<br />

WIRELESSN U.S. market share for wireless-service providers.<br />

MARKET SHARE<br />

MEASURED MEDIA<br />

MILLIONS OF DOLLARS<br />

RANK CARRIER [PARENT] 2011 2010 2011 2010<br />

1 Verizon Wireless 1<br />

2 AT&T<br />

31.6% + 31.3% $1,327 $1,553<br />

2<br />

26.3 - 26.6 1,410 1,562<br />

3 Sprint Nextel 3<br />

15.6 - 16.1 881 973<br />

4 T-Mobile 2 5<br />

[Deutsche Telekom]<br />

TracFone [America Movil]<br />

9.5 - 12.2 517 582<br />

4<br />

7.1 + 6.0 99 50<br />

6 MetroPCS Communications 3.2 + 2.8 117 104<br />

7 U.S. Cellular [Telephone and Data Systems] 2.1 - 2.2 92 98<br />

8 Cricket [Leap Wireless International] 1.9 + 1.8 67 86<br />

Top 8 97.3 - 99.0 4,510 5,008<br />

All other 2.8 + 0.9 506 448<br />

Industry total (subscribers in millions) 331.6 + 311.0 5,016 5,456<br />

100 LEADING NATIONAL ADVERTISERS 2012<br />

46.9 % 25.3 % A-B InBev<br />

AmEx<br />

2011 market share<br />

2011 market share<br />

BEER MARKETERSN <strong>Market</strong> share based on U.S. shipment volume (barrels).<br />

MARKET SHARE<br />

MEASURED MEDIA<br />

MILLIONS OF DOLLARS<br />

RANK MARKETER [PARENT] (DIVISION) 2011 2010 2011 2010<br />

1 Anheuser-Busch InBev 46.9% - 47.7% $513 $558<br />

2 MillerCoors 1 [SABMiller] 28.4 - 28.8 402 396<br />

3 Crown Imports 2<br />

5.7 + 5.3 94 78<br />

4 Heineken 3.8 - 3.9 125 123<br />

5 Pabst Brewing Co. 2.7 = 2.7 2 3<br />

6 North American Breweries 1.3 + 1.2 3 3<br />

7 Diageo (Guinness) 1.2 = 1.2 26 27<br />

8 D.G. Yuengling & Son 1.2 + 1.0 4 2<br />

9 Boston Beer Co. 1.2 + 1.1 31 33<br />

10 Mark Anthony Group (Mike’s Hard Lemonade) 0.7 + 0.6 12 10<br />

Top 10 93.0 - 93.5 1,210 1,235<br />

Industry total(barrels in millions 3 ) 210.2 - 213.2 1,220 1,242<br />

Measured-media spending:<br />

Source: WPP’s Kantar Media.<br />

More info: kantarmediana.com.<br />

Numbers rounded.<br />

Beer marketers:<br />

Source: Beer <strong>Market</strong>er’s<br />

Insights (U.S. market share,<br />

U.S. industry sales). More info:<br />

beerinsights.com.<br />

Numbers rounded. Measured<br />

spending for marketers’ beer<br />

brands. 1. Joint venture.<br />

SABMiller has 58% stake;<br />

Molson Coors has 42%.<br />

2. Grupo Modelo and<br />

Constellation Brands<br />

joint venture; A-B InBev as of<br />

year-end 2011 owned 50.35%<br />

direct and indirect equity<br />

interest in Modelo.<br />

3. Beer barrel = 31 gallons.<br />

Wireless:<br />

Source: ComScore MobiLens<br />

(market share); CTIA (year-end<br />

subscribers in millions). More<br />

info: comscore.com; ctia.org.<br />

Numbers rounded. U.S. network<br />

operator market share based<br />

on subscribers (age 13+) for<br />

three months ended December<br />

2011 and three months ended<br />

December 2010 from<br />

ComScore. 1. Verizon<br />

Communications owns 55%;<br />

Vodafone Group owns 45%.<br />

2. AT&T in March 2011 agreed to<br />

buy T-Mobile USA from<br />

Deutsche Telekom; AT&T in<br />

December 2011 terminated the<br />

deal. 3. Includes prepaid brands<br />

(Boost, Virgin Mobile USA);<br />

excludes Clearwire, in which<br />

Sprint Nextel has a minority<br />

economic interest. 4. Ad<br />

spending for America Movil;<br />

bulk of spending for TracFone<br />

and Straight Talk (TracFone’s<br />

Walmart offering).<br />

CREDIT CARDSN <strong>Share</strong> of general-purpose cards based on purchase volume.<br />

MARKET SHARE<br />

MEASURED MEDIA<br />

MILLIONS OF DOLLARS<br />

RANK MARKETER [PARENT] 2011 2010 2011 2010<br />

1 American Express 1<br />

25.3% + 24.6% $316 $521<br />

2<br />

3<br />

Chase [JPMorgan Chase]<br />

Bank of America<br />

18.1 + 17.7 424 359<br />

1<br />

12.1 - 12.7 138 89<br />

4 Citigroup 1<br />

9.5 - 10.3 228 37<br />

5 Capital One 5.6 + 5.3 261 200<br />

6 Discover 1<br />

4.9 = 4.9 142 155<br />

7 U.S. Bank [U.S. Bancorp] 4.0 + 3.9 5 7<br />

8 Wells Fargo 2.7 + 2.6 0 0<br />

9 HSBC 1<br />

1.6 = 1.6 8 16<br />

10 USAA 1<br />

1.5 = 1.5 1 0<br />

Top 10 85.4 + 85.2 1,522 1,386<br />

Industry total (purchase volume, $ in trillions) $2.050 + $1.870 2,196 1,761<br />

BEVERAGESN <strong>Share</strong> based on U.S. sales volume for nonalcoholic beverages.<br />

MARKET SHARE<br />

MEASURED MEDIA<br />

MILLIONS OF DOLLARS<br />

RANK BRAND [PARENT] 2011 2010 2011 2010<br />

1<br />

2<br />

Coke [Coca-Cola Co.]<br />

Pepsi [PepsiCo]<br />

14.7%<br />

7.8<br />

-<br />

-<br />

15.0%<br />

8.3<br />

$232<br />

196<br />

$265<br />

148<br />

3 Mountain Dew [PepsiCo] 4.6 = 4.6 24 21<br />

4 Dr Pepper [Dr Pepper Snapple Group] 4.1 = 4.1 88 103<br />

5 Gatorade 1 [PepsiCo] 3.5 + 3.2 106 112<br />

6 Sprite [Coca-Cola Co.] 2.9 - 3.0 9 17<br />

7 Nestlé Pure Life [Nestlé] 2.8 = 2.8 19 15<br />

8 Poland Spring [Nestlé] 2.2 = 2.2 6 5<br />

9 Tropicana [PepsiCo] 2.0 - 2.1 48 31<br />

10 Dasani [Coca-Cola Co.] 1.7 + 1.6 6 4<br />

Top 10 46.1 - 47.0 735 722<br />

Industry total (gallons in billions) 29.542 + 29.280 1,639 1,526<br />

Credit cards:<br />

Source: The Nilson Report.<br />

More info: nilsonreport.com.<br />

<strong>Market</strong> share of generalpurpose<br />

credit cards based on<br />

total purchase volume in<br />

dollars for U.S. credit-card<br />

issuers. Numbers rounded.<br />

Excludes cash advances.<br />

Industry total measuredmedia<br />

spending on credit<br />

cards for credit-card issuers;<br />

excludes MasterCard Inc. and<br />

Visa Inc., whose customers<br />

are banks that issue cards.<br />

Measured-media spending<br />

shown is for companies’ credit<br />

cards. (Spending shown does<br />

not include direct mail, a key<br />

discipline for this category.)<br />

Visa had U.S. measured-media<br />

spending of $150.7 million in<br />

2011 and $204.7 million in 2010.<br />

MasterCard had U.S.<br />

measured-media spending<br />

of $118.7 million in 2011 and<br />

$124.6 million in 2010.<br />

1. American Express market<br />

share excludes AmEx cards<br />

issued by third parties.<br />

Discover market share<br />

excludes Discover cards<br />

issued by third parties. BofA,<br />

Citi, HSBC and USAA include<br />

their AmEx-branded cards.<br />

HSBC includes its Discoverbranded<br />

cards.<br />

Beverages:<br />

Source: Beverage <strong>Market</strong>ing<br />

Corp. More info:<br />

beveragemarketing.com.<br />

Numbers rounded. <strong>Market</strong><br />

share data for refreshment<br />

beverages based on U.S. sales<br />

volume in gallons. Brand<br />

includes all trademark volume<br />

(Coke, for example, includes<br />

Coca-Cola, Diet Coke and<br />

caffeine-free Coca-Cola).<br />

1. Includes G2.

5 June 25, 2012 | <strong>Advertising</strong> <strong>Age</strong><br />

RETAILN Nation’s 10 largest retail advertisers, with share of total U.S. retail sales.<br />

MEASURED MEDIA<br />

SHARE OF U.S. RETAIL SALES MILLIONS OF DOLLARS<br />

RANK MARKETER 2011 2010 2011 2010<br />

1 Macy’s 1.0% = 1.0% $835 $888<br />

2 Target Corp. 2.5 - 2.6 694 649<br />

3 Sears Holdings Corp. 1.3 - 1.5 677 700<br />

4 Walmart Stores 11.6 - 11.9 673 902<br />

5 Home Depot 2.3 = 2.3 487 447<br />

6 J.C. Penney Co. 0.6 - 0.7 444 413<br />

7 Best Buy Co. 1.4 = 1.4 371 282<br />

8 Lowe’s Cos. 1.8 = 1.8 344 389<br />

9 Kohl’s Corp. 0.7 = 0.7 331 340<br />

10 Gap Inc. 0.4 = 0.4 300 322<br />

Top 10 23.9 - 24.4 5,156 5,332<br />

Industry total (U.S. sales, $ in trillions 1 ) $2.759 + $2.611 15,849 15,577<br />

100 LEADING NATIONAL ADVERTISERS 2012<br />

Macy’s<br />

1.0 <strong>Share</strong> of U.S.retail sales<br />

% McDonald’s<br />

9.2 2011 market share<br />

%<br />

Measured-media spending:<br />

Source: WPP’s Kantar Media.<br />

More info: kantarmediana.com.<br />

Numbers rounded.<br />

Retail:<br />

Source: Census Bureau<br />

(U.S. retail sales).<br />

More info: census.gov.<br />

Numbers rounded. 1. Industry<br />

total (U.S. sales) is U.S. retail<br />

sales excluding motor-vehicle<br />

and parts dealers, gas stations<br />

and fuel dealers.<br />

Restaurants:<br />

Source: 2012 Technomic Top<br />

500 Chain Restaurant Report<br />

(sales used to calculate<br />

market share). More info:<br />

technomic.com.<br />

Numbers rounded.<br />

Systemwide sales is<br />

franchised plus companyowned<br />

restaurants. 1. <strong>Share</strong><br />

based on estimated sales.<br />

RESTAURANTSN <strong>Market</strong> share based on U.S. systemwide sales.<br />

MEASURED MEDIA<br />

MARKET SHARE MILLIONS OF DOLLARS<br />

RANK CHAIN [PARENT] 2011 2010 2011 2010<br />

1 McDonald’s [McDonald’s Corp.] 9.23% + 8.97% $963 $886<br />

2 Subway [Doctor’s Associates] 3.08 + 2.94 475 429<br />

3 Starbucks 1 [Starbucks Corp.] 2.63 + 2.51 98 94<br />

4 Wendy’s 1 [Wendy’s Co.] 2.30 - 2.31 273 281<br />

5 Burger King 1 [Burger King Holdings] 2.27 - 2.41 300 300<br />

6 Taco Bell 1 [Yum Brands] 1.84 - 1.91 251 275<br />

7 Dunkin’ Donuts[Dunkin’ Brands] 1.60 + 1.56 120 115<br />

8 Pizza Hut 1 [Yum] 1.46 - 1.50 220 217<br />

9 KFC 1 [Yum] 1.22 - 1.30 200 206<br />

10 Applebee’s[DineEquity] 1.19 - 1.20 156 146<br />

Top 10 26.81 + 26.60 3,055 2,950<br />

Industry total (sales, $ in billions) $370.2 + $361.1 5,795 5,548