contents - BNP Paribas

contents - BNP Paribas

contents - BNP Paribas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

76<br />

SEVENTY-<br />

SIX<br />

MARKET RISK<br />

<strong>BNP</strong> measures its market risks in<br />

terms of RNP, which is defined as<br />

sensitivity (of a position, portfolio,<br />

book, etc.) to very large assumed<br />

innovations in market prices. <strong>BNP</strong>’s<br />

current in-house RNP model uses<br />

five years of underlying data to<br />

estimate the impact of these adverse<br />

market fluctuations on the Group’s<br />

interest rate, foreign exchange, and<br />

equity positions over a five-day<br />

holding period, assuming a 95%<br />

confidence level. It also examines<br />

the underlying data of the previous<br />

12 months to determine whether<br />

volatility, measured according to<br />

the same criteria, has not varied in<br />

even greater proportions.<br />

Since adverse market price<br />

changes are very large, they relate<br />

to the one or two most extreme<br />

fluctuations in very broad risk<br />

factors (e.g., short- and long-term<br />

interest rates; euro-zone<br />

currencies, other freely floating<br />

currencies, and centrally<br />

administered currencies), which<br />

apply to each class of risk.<br />

RNP limits for interest rate,<br />

foreign exchange, and equity<br />

positions and for each currency<br />

are applied to each book and<br />

trader at each decision-making<br />

center. Each site is also given<br />

volume position limits, which<br />

are easier to monitor on a daily<br />

basis. Additional rules for<br />

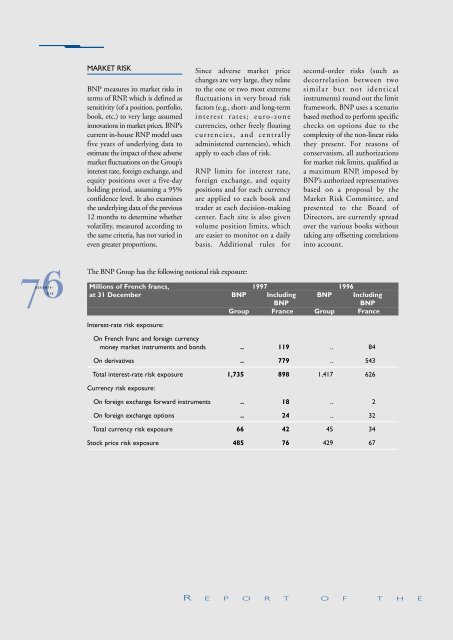

The <strong>BNP</strong> Group has the following notional risk exposure:<br />

second-order risks (such as<br />

decorrelation between two<br />

similar but not identical<br />

instruments) round out the limit<br />

framework. <strong>BNP</strong> uses a scenario<br />

based method to perform specific<br />

checks on options due to the<br />

complexity of the non-linear risks<br />

they present. For reasons of<br />

conservatism, all authorizations<br />

for market risk limits, qualified as<br />

a maximum RNP, imposed by<br />

<strong>BNP</strong>’s authorized representatives<br />

based on a proposal by the<br />

Market Risk Committee, and<br />

presented to the Board of<br />

Directors, are currently spread<br />

over the various books without<br />

taking any offsetting correlations<br />

into account.<br />

Millions of French francs, 1997 1996<br />

at 31 December <strong>BNP</strong> Including <strong>BNP</strong> Including<br />

<strong>BNP</strong> <strong>BNP</strong><br />

Group France Group France<br />

Interest-rate risk exposure:<br />

On French franc and foreign currency<br />

money market instruments and bonds .. 119 .. 84<br />

On derivatives .. 779 .. 543<br />

Total interest-rate risk exposure 1,735 898 1,417 626<br />

Currency risk exposure:<br />

On foreign exchange forward instruments .. 18 .. 2<br />

On foreign exchange options .. 24 .. 32<br />

Total currency risk exposure 66 42 45 34<br />

Stock price risk exposure 485 76 429 67<br />

R E P O R T O F T H E