contents - BNP Paribas

contents - BNP Paribas

contents - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TRADING ACTIVITIES<br />

Operational risk control is based<br />

on several principles: accountability<br />

of the hierarchy, written procedures<br />

describing monitoring channels<br />

and audit trails, continuous<br />

rationalization of processing<br />

software, a system for reporting and<br />

handling incidents, and inspection<br />

assignments by the specialized audit<br />

departments. All of <strong>BNP</strong>’s banking<br />

and computer organization teams,<br />

from the Organization and<br />

Information Systems division<br />

(which plays a general role) to<br />

the Systems and Back Office<br />

Engineering departments of the<br />

International Banking and Finance<br />

division (in charge of organizing<br />

execution services), help ensure<br />

the security of procedures. These<br />

entities have undertaken a major<br />

quality certification program that<br />

is now in progress. As the<br />

foreseeable part of operational risk<br />

is to be considered as an expense,<br />

this program will enable <strong>BNP</strong> to<br />

look into the possibility of insurance<br />

coverage.<br />

Due to rapid changes occurring in<br />

the markets, continuous adjustments<br />

must be made to control systems,<br />

reporting procedures, and computer<br />

applications in order to put these<br />

principles into operation. <strong>BNP</strong><br />

develops new products and<br />

businesses taking operational risk<br />

into account.<br />

BUSINESS AND RESULTS OF <strong>BNP</strong>’S MAIN DOMESTIC SUBSIDIARIES<br />

BANQUE DE BRETAGNE<br />

This regional bank mainly serves<br />

Brittany (60 of its 66 offices), but<br />

also has branches in the neighboring<br />

départements of Loire Atlantique and<br />

Mayenne and in the greater Paris<br />

area. Its firm establishment in<br />

Brittany’s economic fabric, the<br />

permanence and competence of its<br />

staff, and its decision-making<br />

proximity earned it the title of<br />

“leading bank to SMCs in Brittany”<br />

(Dun & Bradstreet survey, published<br />

in the February 1998 issue of<br />

Challenge du Management). For the<br />

past several years, the bank has also<br />

been putting its business and<br />

revenues back into balance through<br />

a structured, offensive retail banking<br />

approach to individuals and selfemployed<br />

professionals.<br />

In 1997 Banque de Bretagne<br />

continued to innovate, launching<br />

the linked product Duo Jeune<br />

with Carte Plus. This event was a<br />

premiere in France involving<br />

Visa cards. It also updated its<br />

videotex services and Duo<br />

Sauvegarde (an IT vault for corporate<br />

clients). It offered individual<br />

customers a mortgage simulation<br />

tool and began to market a<br />

mortgage loan with rate cap. It<br />

strengthened its product offering by<br />

Model risk, arising from potential<br />

gaps between a price or risk<br />

model’s representation of reality<br />

and the actual situation, has now<br />

been integrated into operational<br />

risk. Starting in 1998 it will be<br />

covered by procedures aimed at<br />

making the following processes<br />

systematic:<br />

• evaluating the robustness of model<br />

calibrations, introducing new<br />

variables and extensions to cover<br />

new products,<br />

• implementing a research and<br />

maintenance program designed<br />

to detect drops in quality,<br />

incorporate the latest data, and<br />

handle computer system updates.<br />

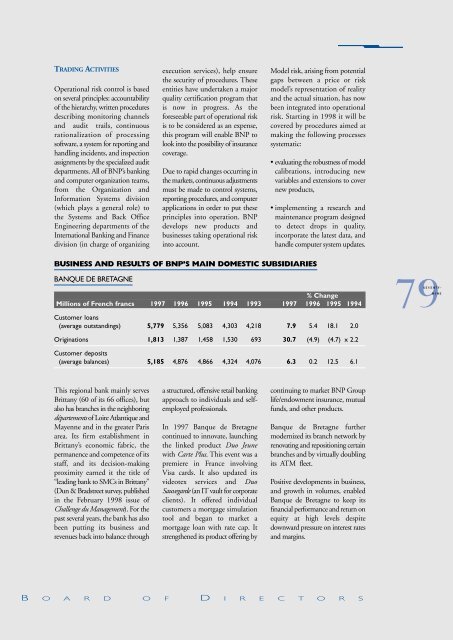

% Change<br />

Millions of French francs 1997 1996 1995 1994 1993 1997 1996 1995 1994<br />

Customer loans<br />

(average outstandings) 5,779 5,356 5,083 4,303 4,218 7.9 5.4 18.1 2.0<br />

Originations 1,813 1,387 1,458 1,530 693 30.7 (4.9) (4.7) x 2.2<br />

Customer deposits<br />

(average balances) 5,185 4,876 4,866 4,324 4,076 6.3 0.2 12.5 6.1<br />

continuing to market <strong>BNP</strong> Group<br />

life/endowment insurance, mutual<br />

funds, and other products.<br />

Banque de Bretagne further<br />

modernized its branch network by<br />

renovating and repositioning certain<br />

branches and by virtually doubling<br />

its ATM fleet.<br />

Positive developments in business,<br />

and growth in volumes, enabled<br />

Banque de Bretagne to keep its<br />

financial performance and return on<br />

equity at high levels despite<br />

downward pressure on interest rates<br />

and margins.<br />

B O A R D O F D I R E C T O R S<br />

79SEVENTY-<br />

NINE