LGT Commodity Diversified Fund (USD) I1

LGT Commodity Diversified Fund (USD) I1

LGT Commodity Diversified Fund (USD) I1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>LGT</strong> <strong>Commodity</strong> <strong>Diversified</strong> <strong>Fund</strong> (<strong>USD</strong>) <strong>I1</strong><br />

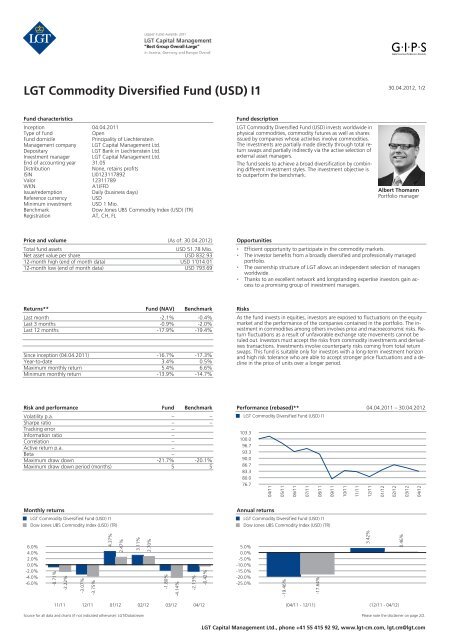

<strong>Fund</strong> characteristics<br />

Inception 04.04.2011<br />

Type of fund Open<br />

<strong>Fund</strong> domicile Principality of Liechtenstein<br />

Management company <strong>LGT</strong> Capital Management Ltd.<br />

Depositary <strong>LGT</strong> Bank in Liechtenstein Ltd.<br />

Investment manager <strong>LGT</strong> Capital Management Ltd.<br />

End of accounting year 31.05<br />

Distribution None, retains profits<br />

ISIN LI0123117892<br />

Valor 12311789<br />

WKN A1JFFD<br />

Issue/redemption Daily (business days)<br />

Reference currency <strong>USD</strong><br />

Minimum investment <strong>USD</strong> 1 Mio.<br />

Benchmark Dow Jones UBS <strong>Commodity</strong> Index (<strong>USD</strong>) (TR)<br />

Registration AT, CH, FL<br />

Price and volume (As of: 30.04.2012)<br />

Total fund assets <strong>USD</strong> 51.78 Mio.<br />

Net asset value per share <strong>USD</strong> 832.93<br />

12-month high (end of month data) <strong>USD</strong> 1'014.01<br />

12-month low (end of month data) <strong>USD</strong> 793.69<br />

Returns** <strong>Fund</strong> (NAV) Benchmark<br />

Last month -2.1% -0.4%<br />

Last 3 months -0.9% -2.0%<br />

Last 12 months -17.9% -19.4%<br />

Since inception (04.04.2011) -16.7% -17.3%<br />

Year-to-date 3.4% 0.5%<br />

Maximum monthly return 5.4% 6.6%<br />

Minimum monthly return -13.9% -14.7%<br />

Risk and performance <strong>Fund</strong> Benchmark<br />

Volatility p.a. – –<br />

Sharpe ratio – –<br />

Tracking error –<br />

Information ratio –<br />

Correlation –<br />

Active return p.a. –<br />

Beta –<br />

Maximum draw down -21.7% -20.1%<br />

Maximum draw down period (months) 5 5<br />

Monthly returns<br />

<strong>LGT</strong> <strong>Commodity</strong> <strong>Diversified</strong> <strong>Fund</strong> (<strong>USD</strong>) <strong>I1</strong><br />

Dow Jones UBS <strong>Commodity</strong> Index (<strong>USD</strong>) (TR)<br />

6.0%<br />

4.0%<br />

2.0%<br />

0.0%<br />

-2.0%<br />

-4.0%<br />

-6.0%<br />

-0.71%<br />

-2.22%<br />

-3.07%<br />

-3.75%<br />

4.37%<br />

2.47%<br />

11/11 12/11 01/12 02/12 03/12 04/12<br />

3.11%<br />

2.70%<br />

-1.80%<br />

-4.14%<br />

-2.13%<br />

-0.42%<br />

<strong>Fund</strong> description<br />

<strong>LGT</strong> <strong>Commodity</strong> <strong>Diversified</strong> <strong>Fund</strong> (<strong>USD</strong>) invests worldwide in<br />

physical commodities, commodity futures as well as shares<br />

issued by companies whose activities involve commodities.<br />

The investments are partially made directly through total return<br />

swaps and partially indirectly via the active selection of<br />

external asset managers.<br />

The fund seeks to achieve a broad diversification by combining<br />

different investment styles. The investment objective is<br />

to outperform the benchmark.<br />

Opportunities<br />

30.04.2012, 1/2<br />

Albert Thomann<br />

Portfolio manager<br />

▪ Efficient opportunity to participate in the commodity markets.<br />

▪ The investor benefits from a broadly diversified and professionally managed<br />

portfolio.<br />

▪ The ownership structure of <strong>LGT</strong> allows an independent selection of managers<br />

worldwide.<br />

▪ Thanks to an excellent network and longstanding expertise investors gain access<br />

to a promising group of investment managers.<br />

Risks<br />

As the fund invests in equities, investors are exposed to fluctuations on the equity<br />

market and the performance of the companies contained in the portfolio. The investment<br />

in commodities among others involves price and macroeconomic risks. Return<br />

fluctuations as a result of unfavorable exchange rate movements cannot be<br />

ruled out. Investors must accept the risks from commodity investtments and derivatives<br />

transactions. Investments involve counterparty risks coming from total return<br />

swaps. This fund is suitable only for investors with a long-term investment horizon<br />

and high risk tolerance who are able to accept stronger price fluctuations and a decline<br />

in the price of units over a longer period.<br />

Performance (rebased)** 04.04.2011 – 30.04.2012<br />

<strong>LGT</strong> <strong>Commodity</strong> <strong>Diversified</strong> <strong>Fund</strong> (<strong>USD</strong>) <strong>I1</strong><br />

103.3<br />

100.0<br />

96.7<br />

93.3<br />

90.0<br />

86.7<br />

83.3<br />

80.0<br />

76.7<br />

04/11<br />

Annual returns<br />

05/11<br />

06/11<br />

07/11<br />

08/11<br />

<strong>LGT</strong> <strong>Commodity</strong> <strong>Diversified</strong> <strong>Fund</strong> (<strong>USD</strong>) <strong>I1</strong><br />

Dow Jones UBS <strong>Commodity</strong> Index (<strong>USD</strong>) (TR)<br />

-19.46%<br />

-17.64%<br />

09/11<br />

10/11<br />

11/11<br />

12/11<br />

3.42%<br />

01/12<br />

02/12<br />

(04/11 - 12/11) (12/11 - 04/12)<br />

Source for all data and charts (if not indicated otherwise): <strong>LGT</strong>/Datastream Please note the disclaimer on page 2/2.<br />

5.0%<br />

0.0%<br />

-5.0%<br />

-10.0%<br />

-15.0%<br />

-20.0%<br />

-25.0%<br />

<strong>LGT</strong> Capital Management Ltd., phone +41 55 415 92 92, www.lgt-cm.com, lgt.cm@lgt.com<br />

0.46%<br />

03/12<br />

04/12

<strong>LGT</strong> <strong>Commodity</strong> <strong>Diversified</strong> <strong>Fund</strong> (<strong>USD</strong>) <strong>I1</strong><br />

<strong>Fund</strong> information<br />

Albert Thomann has been responsible for this portfolio since January 1, 2011.<br />

Fees and commissions<br />

Up-front fee maximum 4.00%<br />

Management fee p.a. 0.50%<br />

Operations fee p.a. 0.15%<br />

Asset allocation<br />

Settlement<br />

Energy Commodities<br />

Agricultur Commodities<br />

Industrial Metal Commodities<br />

Precious Metal Commodities<br />

Energy <strong>Commodity</strong> Producers<br />

Cash<br />

Agriculture Commodities Producers<br />

Industrial Metal Commodities Producers<br />

Precious Metal Commodities Producers<br />

Strategy asset allocation<br />

<strong>Commodity</strong> Futures & Physicals<br />

<strong>Commodity</strong> Alpha<br />

<strong>Commodity</strong> Equities<br />

Cash<br />

2.4%<br />

1.2%<br />

0.4%<br />

7.4%<br />

11.4%<br />

10.5%<br />

18.7%<br />

17.9%<br />

30.1%<br />

30.04.2012, 2/2<br />

0% 5% 10% 15% 20% 25% 30% 35% 40% 45%<br />

0% 10% 20% 30% 40% 50% 60% 70% 80% 90%<br />

7.4%<br />

14.5%<br />

24.4%<br />

78.1%<br />

Cut-off time daily (business days) 2 p.m. (t)<br />

Valuation on the following working day (t+1)<br />

Value date applied valuation +3 days (t+4)<br />

Source for all data and charts (if not indicated otherwise): <strong>LGT</strong>/Datastream<br />

Legal information<br />

* <strong>LGT</strong> <strong>Commodity</strong> <strong>Diversified</strong> <strong>Fund</strong> (<strong>USD</strong>) was approved as an investment undertaking for securities under Liechtenstein law on 31 August 2011. It is based on the identical investment<br />

policy as the <strong>LGT</strong> Multi Manager <strong>Commodity</strong> FoF (<strong>USD</strong>), the latter’s assets having been transferred to <strong>LGT</strong> <strong>Commodity</strong> <strong>Diversified</strong> <strong>Fund</strong> (<strong>USD</strong>) with effect from November<br />

30, 2011. This ensures a smooth transition and allows the fund's past performance to be transferred as well.<br />

Global Investment Performance Standards (GIPS)<br />

The firm in terms of the Global Investment Performance Standards (GIPS) contains all mutual funds managed according to the investment guidelines of <strong>LGT</strong> Capital Management<br />

Ltd. The firm is in compliance with the GIPS and verified as per 31.12.2010. A complete list and description of all of the firm's composites are available upon request. This fund<br />

is part of a composite. The composite return does not need to match the return of its individual components. The calculation of the risk measures within the segment "risk and performance"<br />

is based on monthly returns (gross of <strong>LGT</strong> management fees) with a rolling window of 36 months. Only exemption is the calculation of the maximum draw down, which<br />

is based on net of fees returns. GIPS® is a registered trademark of CFA Institute. CFA Institute has not been involved in the review or preparation of this report/advertisement.<br />

Representatives and paying agents<br />

The current full prospectus, the simplified prospectus and the current annual and semi-annual reports can be obtained free of charge from the fund administrator as well as under<br />

following addresses: Liechtenstein: <strong>LGT</strong> Bank in Liechtenstein Ltd., Herrengasse 12, FL-9490 Vaduz and as an electronic version at www.lafv.li; Representative, main distributor<br />

and paying agent for Switzerland: <strong>LGT</strong> Bank (Switzerland) Ltd., Lange Gasse 15, CH-4002 Basel; Paying agent in Austria: Erste Bank der österreichischen Sparkassen AG, Graben<br />

21, A-1010 Wien.<br />

Selling restrictions<br />

Where units are distributed outside Liechtenstein, the pertinent provisions in the respective country shall apply. The units have not been registered under the United States Securities<br />

Act 1933. With regard to distribution in the United States or to US citizens or persons resident in the United States, the restrictions detailed in the prospectus shall apply.<br />

Further information<br />

** A gain in value in the past provides no guarantee of positive performance in the future. The risk of price and foreign currency losses and of fluctuations in return as a result of<br />

unfavorable exchange rate movements cannot be ruled out. There is a possibility that investors will not recover the full amount they initially invested. Commissions and charges<br />

levied on the issuance and redemption of units are debited separately to each investor. They are therefore not taken into account in the performance shown here. This publication<br />

is an advertising message. It is for information purposes only and is not intended as an offer or recommendation to buy or sell any investment or other specific product. It is recommended<br />

that advice be obtained from a qualified expert.<br />

<strong>LGT</strong> Capital Management Ltd., phone +41 55 415 92 92, www.lgt-cm.com, lgt.cm@lgt.com