Lee Jackson - Final Thesis - Economics - Stanford University

Lee Jackson - Final Thesis - Economics - Stanford University

Lee Jackson - Final Thesis - Economics - Stanford University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

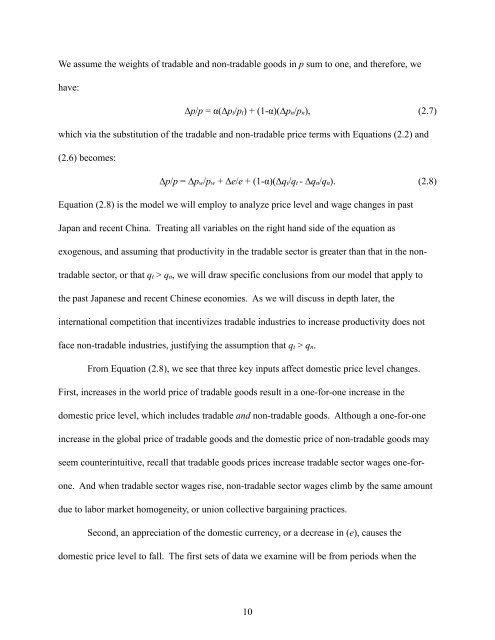

We assume the weights of tradable and non-tradable goods in p sum to one, and therefore, we<br />

have:<br />

∆p/p = α(∆pt/pt) + (1-α)(∆pn/pn),<br />

which via the substitution of the tradable and non-tradable price terms with Equations (2.2) and<br />

(2.6) becomes:<br />

∆p/p = ∆pw/pw + ∆e/e + (1-α)(∆qt/qt - ∆qn/qn).<br />

Equation (2.8) is the model we will employ to analyze price level and wage changes in past<br />

Japan and recent China. Treating all variables on the right hand side of the equation as<br />

exogenous, and assuming that productivity in the tradable sector is greater than that in the non-<br />

tradable sector, or that qt > qn, we will draw specific conclusions from our model that apply to<br />

the past Japanese and recent Chinese economies. As we will discuss in depth later, the<br />

international competition that incentivizes tradable industries to increase productivity does not<br />

face non-tradable industries, justifying the assumption that qt > qn.<br />

From Equation (2.8), we see that three key inputs affect domestic price level changes.<br />

First, increases in the world price of tradable goods result in a one-for-one increase in the<br />

domestic price level, which includes tradable and non-tradable goods. Although a one-for-one<br />

increase in the global price of tradable goods and the domestic price of non-tradable goods may<br />

seem counterintuitive, recall that tradable goods prices increase tradable sector wages one-for-<br />

one. And when tradable sector wages rise, non-tradable sector wages climb by the same amount<br />

due to labor market homogeneity, or union collective bargaining practices.<br />

Second, an appreciation of the domestic currency, or a decrease in (e), causes the<br />

domestic price level to fall. The first sets of data we examine will be from periods when the<br />

10<br />

(2.7)<br />

(2.8)