Lee Jackson - Final Thesis - Economics - Stanford University

Lee Jackson - Final Thesis - Economics - Stanford University

Lee Jackson - Final Thesis - Economics - Stanford University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

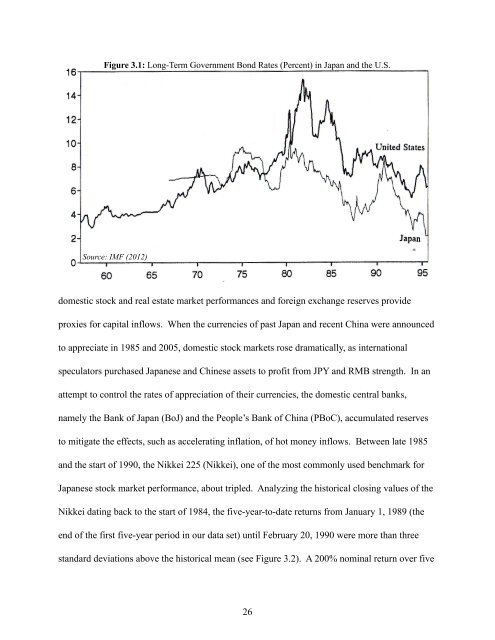

Figure 3.1: Long-Term Government Bond Rates (Percent) in Japan and the U.S.<br />

Source: IMF (2012)<br />

domestic stock and real estate market performances and foreign exchange reserves provide<br />

proxies for capital inflows. When the currencies of past Japan and recent China were announced<br />

to appreciate in 1985 and 2005, domestic stock markets rose dramatically, as international<br />

speculators purchased Japanese and Chinese assets to profit from JPY and RMB strength. In an<br />

attempt to control the rates of appreciation of their currencies, the domestic central banks,<br />

namely the Bank of Japan (BoJ) and the People’s Bank of China (PBoC), accumulated reserves<br />

to mitigate the effects, such as accelerating inflation, of hot money inflows. Between late 1985<br />

and the start of 1990, the Nikkei 225 (Nikkei), one of the most commonly used benchmark for<br />

Japanese stock market performance, about tripled. Analyzing the historical closing values of the<br />

Nikkei dating back to the start of 1984, the five-year-to-date returns from January 1, 1989 (the<br />

end of the first five-year period in our data set) until February 20, 1990 were more than three<br />

standard deviations above the historical mean (see Figure 3.2). A 200% nominal return over five<br />

26