Class III Milk(CME) - gpvec

Class III Milk(CME) - gpvec

Class III Milk(CME) - gpvec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

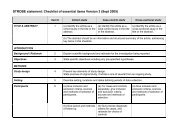

How to Interpret Seasonal Pattern Charts<br />

Seasonal Pattern Chart Explanation<br />

ach chart consists of two aspects of a market’s seasonal pattern—the longest (up to 10 years) for which data<br />

Eexists (solid line) and its most recent 5-year (dotted line), December 2007 contracts inclusive. Thus, any evolution<br />

in the pattern may be perceived, as well as trends, tops, and bottoms coincident to both. The numerical index to the<br />

right measures the greatest historical tendency for the market to make a seasonal high (100) or low (0) at a given time.<br />

Besides illustrating the more obvious seasonal tops, seasonal bottoms, and seasonal trends, these patterns also<br />

suggest certain cause/effect phenomena which may present secondary opportunities. For instance, do smaller but<br />

well-defined breaks/rallies typically precede certain events, such as the Super Bowl or expiration of a lead contract?<br />

If so, does there exist an implied opportunity?<br />

9 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

January <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1999-2007)<br />

Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan<br />

How to Interpret Seasonal Average Charts<br />

utures markets are designed to enable those involved in the commerce of the underlying commodity to manage their<br />

Frisk of price fluctuation. Because commercial hedging is a purchase or sale in futures that temporarily<br />

substitutes for a similar transaction in the cash market, the relationship between cash and futures is of vital importance.<br />

Charts in the Basis section portray an averaged difference between a designated cash price and a designated<br />

futures contract price, commonly referred to as “basis.” Per industry standard, the daily futures closing price is<br />

subtracted from the underlying cash price to determine chart points and cash quotes of “$1.00 over” or “$0.05 under”<br />

futures—the fluctuation of cash around futures. Because futures prices are the reference against which cash quotes are<br />

made, futures prices are represented on the charts by the 0-line. [The chart itself consists of both a longer average (the<br />

solid line) and its most recent 5-year average (the dotted line).] From these charts, one may discern not only the<br />

degree to which basis typically widens/narrows at any given time of the year.<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

Cheddar Cheese Blocks - Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Average(98-07)<br />

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan<br />

8 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

3.50<br />

3.00<br />

2.50<br />

2.00<br />

1.50<br />

1.00<br />

0.50<br />

0.00