Class III Milk(CME) - gpvec

Class III Milk(CME) - gpvec

Class III Milk(CME) - gpvec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMMODITY PRODUCTS<br />

2008 Moore Research Report<br />

Seasonals • Charts • Strategies<br />

DAIRY

Welcome to the<br />

2008 MOORe HISTORICal<br />

DaIRY RePORT<br />

this comprehensive report provides historical daily charts, cash and basis charts,<br />

and seasonal strategies to help you trade.<br />

cme Group offers the following Dairy futures and options contracts: Butter, cash-settled Butter,<br />

Dry Whey, class IV milk, class <strong>III</strong> milk and Nonfat Dry milk. In addition to the moore historical<br />

Report, cme Group offers the following free trading tools for Dairy futures and options:<br />

• www.cmegroup.com/dairyquotes<br />

Free real-time price quotes on electronic Dairy futures and options complete with:<br />

– Best bids and offers<br />

– Daily trading activity<br />

– outright and spread markets<br />

• www.DailyDairyReport.com<br />

Free one-page daily e-mail commentary on the fundamental drivers of the dairy markets<br />

For more information on cme Group Dairy products,<br />

visit www.cmegroup.com/commodities or<br />

contact commodities@cmegroup.com.<br />

to begin trading Dairy futures and options on the cme Globex<br />

electronic trading platform, contact your broker directly.

For Your<br />

Information<br />

<strong>Class</strong> <strong>III</strong><br />

<strong>Milk</strong> Futures<br />

Basis<br />

& Cash<br />

Charts<br />

Page<br />

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2<br />

<strong>CME</strong> Futures, Options & Spot Call Specifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3<br />

How to Interpret Seasonal Pattern Charts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8<br />

Seasonal Section Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9<br />

Seasonal Patterns & Weekly Charts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10<br />

Seasonal & Spread Strategy Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .40<br />

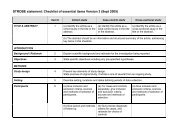

How to Interpret a Strategy Sheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .43<br />

Strategy Detail Tables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .43<br />

How to Interpret Average Volatility & Bull/Bear Charts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .70<br />

Volatility, Bull/Bear, Daily Section Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .71<br />

Historical Average Volatility Charts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .72<br />

Bull/Bear Charts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .75<br />

Historical Daily Futures Charts (<strong>Class</strong> <strong>III</strong> <strong>Milk</strong>) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .79<br />

Basis & Cash Section Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .93<br />

Cheese/<strong>Milk</strong> Basis Averages & Charts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .94<br />

Cash Market Seasonal Patterns . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .100<br />

Cash Market Weekly Charts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .101<br />

Cash Market Monthly Charts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .102<br />

(Charts current through December 2007.)<br />

Table of Contents<br />

Historical Dairy Report 2008 Edition<br />

NOTE: The <strong>CME</strong> <strong>Milk</strong> (<strong>Class</strong> <strong>III</strong>) contract<br />

replaced the BFP contract in January 2000.<br />

The Moore Research Center, Inc. (MRCI), located on 73 secluded<br />

acres outside Eugene, Oregon, is sought for its futures market analysis,<br />

combining many years of intensive computerized study and the<br />

experience of real-time trading. Our hardware and software both are<br />

constantly upgraded, giving MRCI the speed and depth of capability to<br />

study price movement that we believe are state-of-the-art for the industry.<br />

——————————————————————<br />

Copyright ©1989-2008. Moore Research Center, Inc. No part of this publication may be<br />

reproduced or transmitted in any form or by any means, electronic or mechanical, including<br />

photocopy, recording, facsimile, or any information storage and retrieval system,<br />

without written permission. Retransmission by fax or other means which results in the<br />

creation of an additional copy is unlawful.

Preface<br />

Knowledge is a foundation essential to making<br />

successful decisions. Does a prudent<br />

businessman market product/purchase raw material<br />

without first researching profit/cost potential? Does a<br />

successful futures trader/investor jump at a “hot tip” or a<br />

story in The Wall St. Journal? Or would one first seek<br />

some background—some history?<br />

The purpose of this publication is to quantify price<br />

history—both cash and futures—in the dairy market,<br />

offer it from a variety of relevant perspectives, and<br />

present it in a format useful to those whose commerce is<br />

substantially affected by fluctuations in prices for dairy<br />

products. The business executive and investor alike are<br />

encouraged to examine the following pages thoroughly,<br />

for seasonality can be a primary component of price<br />

movement in dairy products.<br />

Seasonal Patterns<br />

Nearly all markets—real estate, grain, cash butter,<br />

stock index futures—respond to various fundamental<br />

forces, many seasonal in nature. Such forces as weather,<br />

school calendars, and specific characteristics of futures<br />

contracts tend to recur and to influence, to one degree or<br />

another and in a more or less timely manner, certain<br />

markets every year. As any market responds to a series<br />

of these annually recurring factors, seasonal price<br />

patterns tend to evolve.<br />

Daily seasonal patterns are derived from and a<br />

composite of the historical daily price activity in the<br />

specific futures contract or cash market under<br />

consideration. The numerical index to the right of each<br />

seasonal pattern chart reflects the historical tendency for<br />

that market to reach its seasonal high (100) or low (0) at<br />

a given time.<br />

Weekly continuation charts, also contract-specific,<br />

are intended to illustrate historical relative value, turning<br />

points, and longer-term trends. Points on futures spread<br />

charts are plotted by subtracting the price of the secondnamed<br />

contract from that of the first.<br />

NOTE: The <strong>CME</strong> <strong>Milk</strong> (<strong>Class</strong> <strong>III</strong>) contract<br />

replaced the BFP contract in January 2000.<br />

Preface<br />

Windows of Opportunity<br />

From these seasonal patterns, one can derive a<br />

seasonal approach to both cash and futures markets that<br />

is designed to anticipate, enter, and capture recurrent<br />

price trends as they emerge and exit before they are<br />

“realized.” Within these patterns may exist certain<br />

“windows of opportunity” wherein well-defined<br />

seasonal tops, bottoms, and trends tend to appear.<br />

Moore Research Center, Inc. (MRCI) computer<br />

programs have analyzed trends that have recurred in the<br />

same direction during a similar period of time in at least<br />

80% of all years studied. The underlying theory<br />

assumes that causal fundamental factors specific to that<br />

time period must have existed and may be influential<br />

again, thus making each strategy of such historical<br />

reliability valid for trading considerations. However,<br />

that past performance is not necessarily indicative of<br />

future results.<br />

Even though these are potential strategies only and<br />

not recommendations, there is no mystery to them.<br />

They are merely presentations of quantified historical<br />

fact. However, if knowledge is essential to decisionmaking,<br />

then historically reliable strategies would seem<br />

to offer a starting point from which to take a reasoned<br />

approach to the dairy market.<br />

Commercial users/producers, then, may find seasonal<br />

analysis vital to managing cost/profit risks. The<br />

consistency implied by seasonality and its more reliable<br />

strategies can afford, to the business strategist planning<br />

into the future, greater confidence in purchasing raw<br />

material and/or marketing product.<br />

Price movement affects management decisions.<br />

Those with the knowledge to anticipate price movement<br />

more accurately also have the capacity to make<br />

successful decisions more consistently.<br />

2 HISTORICAL DAIRY REPORT

Chicago Mercantile Exchange has offered a variety of<br />

cash-settled dairy futures products since 1996. At present,<br />

these products consist of <strong>Class</strong> <strong>III</strong> and <strong>Class</strong> IV <strong>Milk</strong>, Nonfat<br />

Dry <strong>Milk</strong>, and Dry Whey futures and options contracts. In<br />

2005, <strong>CME</strong> listed a cash-settled butter futures contract<br />

(20,000 lbs) available for trade on Globex; in 2007, <strong>CME</strong><br />

made nearly all its cash-settled dairy futures and options<br />

contracts available for 23-hour trading on Globex. <strong>CME</strong> also<br />

trades a deliverable butter futures contract. In addition, <strong>CME</strong><br />

provides the location for a spot call (cash) dairy market where<br />

Cheese, Butter, and Nonfat Dry <strong>Milk</strong> are traded.<br />

Cash/Spot Market<br />

The Spot, or Cash, market is used for immediate<br />

inventory adjustments. This is a cash market that allows<br />

buyers and sellers to better manage production schedules and<br />

bottom lines with immediate sales or purchases of the<br />

products listed. Price discovery in this market is also used in<br />

conjunction with dairy information published by various<br />

government agencies to provide traders, hedgers, and<br />

speculators with trading possibilities.<br />

Trading<br />

Unit<br />

Contract<br />

Months<br />

Minimum<br />

Fluctuation<br />

Maximum<br />

Fluctuation<br />

Trading<br />

Hours<br />

Ticker<br />

Symbol<br />

Grade<br />

Dairy Futures and Options<br />

The futures are structured completely differently from<br />

the cash markets. All of <strong>CME</strong>’s dairy futures products,<br />

except butter, are cash-settled to the National Agricultural<br />

Statistical Service (NASS) monthly price. <strong>Class</strong> prices are<br />

based on formulas calculated by United States Department of<br />

Agriculture (USDA).<br />

Federal Order <strong>Class</strong> Prices<br />

Formulation of the Federal Order <strong>Class</strong> prices are<br />

derived from weighted averages of USDA-surveyed cheese,<br />

<strong>CME</strong> Dairy Futures, Options and Spot Call<br />

Contract Specifications: <strong>CME</strong> Spot Call Dairy Markets<br />

Cheese Butter Nonfat Dry <strong>Milk</strong><br />

40,000-44,000 lbs 40,000-44,000 lbs 42,000-45,000 lbs<br />

Daily Daily Daily<br />

$ 0.0025/lb $0.0025/lb $0.0025/lb<br />

$0.01/lb $0.01/lb $0.01/lb<br />

10:45AM to between<br />

10:47 and 11:01 AM<br />

Blocks: KB<br />

Barrels: RB<br />

Blocks: Grade A or better<br />

Barrels: Extra or better<br />

11:05AM to between<br />

11:07 and 11:21AM<br />

butter, nonfat dry milk, and whey prices for the month. The<br />

formulas for <strong>Class</strong> <strong>III</strong> and <strong>Class</strong> IV are as follow:<br />

<strong>Class</strong> <strong>III</strong> Price = (<strong>Class</strong> <strong>III</strong> Skim Price x .965) + (Butterfat Price x 3.5)<br />

<strong>Class</strong> <strong>III</strong> Skim Price = (Protein Price x 3.1) + (Other Solids Price x 5.9)<br />

Protein Price = ((Cheese Price - .1682) x 1.383) +<br />

((((Cheese Price - .1682) x 1.572) - Butterfat Price x .9) x 1.17)<br />

Other Solids Price = (Dry Whey Price - .1956) x 1.03<br />

Butterfat Price = (Butter Price - .1202) x 1.2<br />

<strong>Class</strong> IV Price = (<strong>Class</strong> IV Skim x .965) + (Butterfat Price x 3.5)<br />

<strong>Class</strong> IV Skim = Nonfat Solids Price x 9<br />

Nonfat Solids Price = (Nonfat Price - .1570) x .99<br />

Butterfat Price = (Butter Price - .1202) x 1.2<br />

What do these formulas tell us about the pricing of<br />

<strong>Class</strong> <strong>III</strong> and <strong>Class</strong> IV milk? Price movements in butter,<br />

cheese, whey, and<br />

<strong>Class</strong> <strong>III</strong> <strong>Class</strong> IV<br />

nonfat dry milk<br />

have an impact on Cheese 9.7¢ n/a<br />

the final price. As a Whey 6.0¢ n/a<br />

general rule, a one-<br />

Butter 0.5¢ 4.2¢<br />

cent change in dairy<br />

Nonfat Dry <strong>Milk</strong> n/a 8.6¢<br />

product prices has<br />

10:45AM to between<br />

10:47 and 11:01AM<br />

Grade AA Grade A: NM<br />

Extra Grade: NX<br />

Grade AA Grade A and Extra<br />

the following price impact on the<br />

class futures prices for milk.<br />

Monthly government<br />

numbers used to settle the <strong>Class</strong> <strong>III</strong><br />

and <strong>Class</strong> IV futures are released<br />

on the Friday before the 5th of the<br />

following month. If the 5th falls on<br />

Friday, data is then published on<br />

that Friday. Monthly data can be<br />

found on the USDA Web site or on<br />

a link at www.cmegroup.com.<br />

Examples of actual USDA<br />

monthly releases and last trading<br />

days for <strong>Class</strong> <strong>III</strong> and <strong>Class</strong> IV<br />

futures contracts are shown below.<br />

USDA Release Last Trading Day<br />

January 2/1/08 1/31/08<br />

February 2/29/08 2/28/08<br />

March 4/4/08 4/3/08<br />

April 5/2/08 5/1/08<br />

May 5/30/08 5/29/08<br />

June 7/3/08 7/2/08<br />

July 8/1/08 7/31/08<br />

August 9/5/08 9/4/08<br />

September 10/3/08 10/2/08<br />

October 10/31/08 10/30/08<br />

MOORE RESEARCH CENTER, INC. 3<br />

Dairy Futures, Options and Spot Call

Dairy Contract Specifications<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Futures<br />

<strong>Class</strong> <strong>III</strong> milk futures have been trading at <strong>CME</strong><br />

since 1996 in various forms. <strong>CME</strong> has adapted its<br />

futures contracts over time to keep up with the<br />

ever-changing government price support program for<br />

milk. Cash settlement was originally based on the<br />

Minnesota-Wisconsin (MW) price, then the Basic<br />

Formula Price (BFP), and currently the <strong>Class</strong> <strong>III</strong> milk<br />

price. <strong>Class</strong> <strong>III</strong> milk is also known by the industry as<br />

“cheese milk,” the milk used to produce American<br />

cheese.<br />

Contract Specifications: <strong>CME</strong> <strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Futures<br />

Futures Options<br />

on Futures<br />

Trading Unit 200,000 pounds Same as futures<br />

Contract Months<br />

24 consecutive<br />

calendar months<br />

Same as futures<br />

Months Listed All All<br />

Minimum<br />

Fluctuation<br />

$0.01 per cwt. $0.01 per cwt.,<br />

except Cab = $0.005<br />

Price Limits $0.75 per cwt. None<br />

Options Exercise n/a On any day that<br />

the option is traded<br />

Strike Price<br />

Intervals<br />

Termination<br />

of Trading<br />

Trading Hours<br />

RTH<br />

Trading Hours<br />

Globex<br />

Position Limits:<br />

Expiring<br />

contract month<br />

n/a $0.25<br />

Business day prior<br />

to USDA<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Price<br />

announcement<br />

9:05 a.m.<br />

to 1:10 pm<br />

(9:05 a.m. to 12:10<br />

p.m. on<br />

last trading day)<br />

Trading extends<br />

from Monday at<br />

9:05 a.m. Central<br />

Time (CT) through<br />

Friday at 1:30 p.m.<br />

with daily hourlong<br />

trading halts<br />

at 4:00 p.m.<br />

Ticker Symbols<br />

RTH / Globex DA / DC<br />

Same as futures<br />

9:05 a.m.<br />

to 1:12 p.m.<br />

(9:05 a.m. to<br />

12:10 p.m. on last trading<br />

day)<br />

same as Globex futures<br />

1500 contracts Aggregated with<br />

futures on an<br />

equivalent basis<br />

Calls: DA/DC<br />

Puts: DA/DC<br />

<strong>Class</strong> IV <strong>Milk</strong> Futures<br />

<strong>Class</strong> IV milk futures began trading in 2000 to<br />

complement the USDA’s component pricing system.<br />

<strong>Class</strong> IV milk is used to produce butter and nonfat dry<br />

milk.<br />

Contract Specifications: <strong>CME</strong> <strong>Class</strong> IV <strong>Milk</strong> Futures<br />

Futures Options on Futures<br />

Trading Unit 200,000 pounds Same as futures<br />

Contract Months<br />

24 consecutive<br />

calendar months<br />

Same as futures<br />

Months Listed All All<br />

Minimum<br />

Fluctuation<br />

$0.01 per cwt. $0.01 per cwt.,<br />

except Cab = $0.005<br />

Price Limits $0.75 per cwt. None<br />

Options Exercise n/a On any day that<br />

the option is traded<br />

Strike Price<br />

Intervals<br />

Termination of<br />

Trading<br />

Trading Hours<br />

Trading Hours<br />

Globex<br />

Position Limits:<br />

Expiring contract<br />

month<br />

Ticker Symbol:<br />

RTH/Globex<br />

n/a $0.25<br />

Business day prior to<br />

USDA <strong>Class</strong> IV <strong>Milk</strong><br />

Price announcement<br />

9:05 a.m to 1:10 p.m<br />

(9:05 a.m. - 12:10 p.m.<br />

on last trading day)<br />

Trading extends from<br />

Monday at 9:05 a.m.<br />

Central Time (CT)<br />

through Friday at 1:30<br />

p.m. with daily hourlong<br />

trading halts at<br />

4:00 p.m.<br />

Same as futures<br />

9:05 a.m. to 1:12 p.m.<br />

(9:05 a.m. - 12:10 p.m.<br />

on last trading day)<br />

same as Globex futures<br />

1500 contracts Aggregated<br />

with futures on<br />

an equivalent basis<br />

DK/GDK Calls: DK/GDK<br />

Puts: DK/GDK<br />

4 HISTORICAL DAIRY REPORT

Nonfat Dry <strong>Milk</strong> Futures<br />

Merchandisers, producers, processors, and<br />

speculators can now engage in price discovery and<br />

effectively manage price risk in Nonfat Dry <strong>Milk</strong>, a<br />

by-product derived from manufacturing butter. This<br />

product can be stored, used in various food sources,<br />

and/or reconstituted into milk. Futures complement<br />

<strong>CME</strong> Group’s overall dairy product complex, enabling<br />

users both to hedge and to trade milk against its major<br />

milk products.<br />

Contract Specifications: <strong>CME</strong> Nonfat Dry <strong>Milk</strong> Futures<br />

Futures Options on Futures<br />

Trading Unit 44,000 pounds<br />

Grade AA or Extra<br />

Same as futures<br />

Contract Months 24 months Same as futures<br />

Months Listed All Same as futures<br />

Minimum Fluctuation $0.00025 per pound $0.00025 per pound,<br />

except Cab = $0.000125<br />

Price Limits $0.025 per pound;<br />

expandable to $0.05 if<br />

contract nearest to<br />

expiration subject to<br />

daily price limit closes<br />

on the limit bid or offer<br />

None<br />

Options Exercise n/a Any day option is traded<br />

Strike Price Intervals n/a $0.02<br />

Termination of<br />

Trading<br />

Trading Hours<br />

RTH<br />

Trading Hours<br />

Globex<br />

Position Limits:<br />

Expiring month<br />

1st scale down<br />

Other contract<br />

months<br />

Ticker Symbol<br />

RTH / Globex<br />

Business day prior to<br />

USDA Nonfat Dry <strong>Milk</strong><br />

Price<br />

announcement<br />

9:05 a.m. to 1:10 p.m.<br />

(9:05 a.m. - 12:10 p.m.<br />

on last trading day)<br />

Trading extends from<br />

9:05 am Monday (CT)<br />

through 1:30 pm Friday<br />

with daily hour-long<br />

trading halts at 4:00 pm<br />

100 during the last 5<br />

days of trading<br />

1,000 in any contract<br />

month<br />

Same as futures<br />

9:05 a.m. to 1:12 p.m.<br />

(9:05 a.m. - 12:10 p.m.<br />

on last trading day)<br />

same as Globex futures<br />

Aggregated<br />

with futures on<br />

an equivalent basis<br />

NF / GNF Calls: NZ<br />

Puts: NZ<br />

Butter Futures<br />

Producers, consumers, merchandisers, and<br />

speculators can engage in price discovery and manage<br />

price risk for butter utilizing a physically delivered<br />

contract. Futures reflect cash market supply, demand,<br />

and cold-storage stocks.<br />

Contract Specifications: <strong>CME</strong> Butter Futures<br />

Futures (RTH) Options on Futures<br />

Trading Unit 40,000 pounds<br />

Grade AA<br />

Same as futures<br />

Contract Months 6 months Same as Futures<br />

Months Listed Mar, May, Jul,<br />

Sep, Oct, Dec<br />

Same as futures<br />

Minimum Fluctuation $0.00025 per pound $0.00025 per pound,<br />

Cab = $0.000125<br />

Price Limits $0.05 per pound;<br />

expandable to $0.10 if<br />

the contract nearest to<br />

expiration that is<br />

subject to daily price<br />

limit closes on the limit<br />

bid or offer<br />

None<br />

Options Exercise n/a Any day option traded.<br />

Strike Price Intervals n/a $0.02<br />

Termination of<br />

Trading<br />

Trading Hours<br />

Position Limits:<br />

Expiring Contract<br />

month<br />

1st scale down<br />

2nd scale down<br />

Other contract<br />

months<br />

The eighth-to-last<br />

business day of the<br />

month<br />

9:05 a.m. to 1:10 p.m.<br />

(9:05 a.m. - 12:10 p.m.<br />

on last trading day)<br />

150 at the close of<br />

business on the first<br />

business day following<br />

the first Friday of the<br />

contract month<br />

50 during the<br />

last 5 days of trading<br />

1,000 all months<br />

combined or 900<br />

in any contact month<br />

First Friday<br />

of the month<br />

9:05 a.m. to 1:12 p.m.<br />

(9:05 a.m. - 12:10 p.m.<br />

on last trading day)<br />

Aggregated<br />

with futures on<br />

an equivalent basis<br />

Ticker Symbol DB Calls: DB<br />

Puts: DB<br />

MOORE RESEARCH CENTER, INC. 5<br />

Dairy Contract Specifications

Dairy Contract Specifications<br />

Cash-settled Butter<br />

In September 2007, <strong>CME</strong> Group launched options<br />

on Cash-Settled Butter futures. Contract size at 20,000<br />

pounds is half the size of deliverable butter futures.<br />

Contract Specs: <strong>CME</strong> Cash-Settled Butter Futures (Globex Only)<br />

Trading Unit<br />

20,000 lbs<br />

Grade AA Butter<br />

Contract Listing 24 consecutive<br />

calendar months<br />

Minimum Fluctuation 1 point = $0.00025/lb<br />

= $5.00<br />

Price Limits $0.05 per pound,<br />

expanded to $0.10 after<br />

one-day limit move<br />

Termination of<br />

Trading<br />

Trading Hours<br />

Futures Options<br />

Business day preceding<br />

release date for USDA<br />

monthly price in the US<br />

for Butter<br />

Trading extends from<br />

Monday at 9:05 a.m.<br />

(CT) through Friday at<br />

1:30 p.m. with daily<br />

hour-long<br />

trading halts at 4:00 p.m.<br />

same as futures<br />

same as futures<br />

same as futures<br />

n/a<br />

same as futures<br />

same as futures<br />

Options Exercise n/a Any day option traded<br />

Strike Price Intervals n/a $0.02 per pound<br />

Ticker Symbol CB Puts/Calls: CB<br />

Dry Whey Futures<br />

Producers, consumers, merchandisers, and<br />

speculators can engage in price discovery and manage<br />

price risk for dry whey, which is a by-product from<br />

manufacturing cheese. Whey is the liquid that separates<br />

from milk in the process of cheese making. Dried whey,<br />

high in protein and low in fat, is used in a variety of<br />

foods such as crackers, breads, cereal, and commercial<br />

pastries. It is increasingly used in the popular energy<br />

and power bars as well as protein drinks and powders. It<br />

also has use as an animal feed.<br />

Contract Specs: <strong>CME</strong> Dry Whey Futures (Globex Only)<br />

Trading Unit<br />

Contract Listing<br />

Minimum Fluctuation<br />

Price Limits<br />

Termination of<br />

Trading<br />

Futures Options<br />

44,000 pounds<br />

Extra Grade<br />

24 consecutive<br />

calendar months<br />

1 point = $0.00025/lb =<br />

$11.00<br />

$0.04 per pound,<br />

except no limit in<br />

spot month during last<br />

5 trading days of month<br />

Business day preceding<br />

release date for USDA<br />

monthly price in the US<br />

for Butter<br />

same as futures<br />

same as futures<br />

same as futures, but also<br />

Cab $0.000125 = $5.50<br />

n/a<br />

same as futures<br />

Trading Hours Trading extends from<br />

Monday at 9:05 a.m.<br />

(CT) through Friday at<br />

1:30 p.m. with daily<br />

hour-long<br />

trading halts at 4:00 p.m.<br />

same as futures<br />

Options Exercise n/a Any day option traded<br />

Strike Price Intervals n/a $0.02 per pound<br />

Ticker Symbol DY Puts/Calls: DY<br />

6 HISTORICAL DAIRY REPORT

MOORE RESEARCH CENTER, INC. 7<br />

Personal Notes

How to Interpret Seasonal Pattern Charts<br />

Seasonal Pattern Chart Explanation<br />

ach chart consists of two aspects of a market’s seasonal pattern—the longest (up to 10 years) for which data<br />

Eexists (solid line) and its most recent 5-year (dotted line), December 2007 contracts inclusive. Thus, any evolution<br />

in the pattern may be perceived, as well as trends, tops, and bottoms coincident to both. The numerical index to the<br />

right measures the greatest historical tendency for the market to make a seasonal high (100) or low (0) at a given time.<br />

Besides illustrating the more obvious seasonal tops, seasonal bottoms, and seasonal trends, these patterns also<br />

suggest certain cause/effect phenomena which may present secondary opportunities. For instance, do smaller but<br />

well-defined breaks/rallies typically precede certain events, such as the Super Bowl or expiration of a lead contract?<br />

If so, does there exist an implied opportunity?<br />

9 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

January <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1999-2007)<br />

Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan<br />

How to Interpret Seasonal Average Charts<br />

utures markets are designed to enable those involved in the commerce of the underlying commodity to manage their<br />

Frisk of price fluctuation. Because commercial hedging is a purchase or sale in futures that temporarily<br />

substitutes for a similar transaction in the cash market, the relationship between cash and futures is of vital importance.<br />

Charts in the Basis section portray an averaged difference between a designated cash price and a designated<br />

futures contract price, commonly referred to as “basis.” Per industry standard, the daily futures closing price is<br />

subtracted from the underlying cash price to determine chart points and cash quotes of “$1.00 over” or “$0.05 under”<br />

futures—the fluctuation of cash around futures. Because futures prices are the reference against which cash quotes are<br />

made, futures prices are represented on the charts by the 0-line. [The chart itself consists of both a longer average (the<br />

solid line) and its most recent 5-year average (the dotted line).] From these charts, one may discern not only the<br />

degree to which basis typically widens/narrows at any given time of the year.<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

Cheddar Cheese Blocks - Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Average(98-07)<br />

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan<br />

8 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

3.50<br />

3.00<br />

2.50<br />

2.00<br />

1.50<br />

1.00<br />

0.50<br />

0.00

Page<br />

SEASONAL PATTERNS & WEEKLY CONTINUATIONS<br />

Jan, Feb, Mar, Apr . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10<br />

May, Jun, Jul, Aug . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12<br />

Sep, Oct, Nov, Dec . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14<br />

Jan vs: Feb, Mar, Apr, May . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .16<br />

Feb vs: Mar, Apr, May, Jun . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .18<br />

Mar vs: Apr, May, Jun, Jul . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .20<br />

Apr vs: May, Jun, Jul, Aug . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .22<br />

May vs: Jun, Jul, Aug, Sep . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .24<br />

Jun vs: Jul, Aug, Sep, Oct . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .26<br />

Jul vs: Aug, Sep, Oct, Nov . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .28<br />

Aug vs: Sep, Oct, Nov, Dec . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .30<br />

Sep vs: Oct, Nov, Dec, Jan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .32<br />

Oct vs: Nov, Dec, Jan, Feb . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .34<br />

Nov vs: Dec, Jan, Feb, Mar . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .36<br />

Dec vs: Jan, Feb, Mar, Apr . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .38<br />

STRATEGIES<br />

Seasonal Trade & Spreads Strategy Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .38<br />

Seasonal Strategy Detail Tables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .41<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong><br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong><br />

MOORE RESEARCH CENTER, INC. 9

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Seasonal Patterns<br />

9 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

9 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

9 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

9 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

January <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1999-2007)<br />

Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan<br />

February <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1999-2007)<br />

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb<br />

March <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1999-2007)<br />

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar<br />

April <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1999-2007)<br />

Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr<br />

10 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

19.00<br />

18.00<br />

17.00<br />

16.00<br />

15.00<br />

14.00<br />

13.00<br />

12.00<br />

11.00<br />

10.00<br />

9.00<br />

18.00<br />

17.00<br />

16.00<br />

15.00<br />

14.00<br />

13.00<br />

12.00<br />

11.00<br />

10.00<br />

9.00<br />

18.00<br />

17.00<br />

16.00<br />

15.00<br />

14.00<br />

13.00<br />

12.00<br />

11.00<br />

10.00<br />

9.00<br />

8.00<br />

20.00<br />

18.00<br />

16.00<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

Weekly Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Feb <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

MOORE RESEARCH CENTER, INC. 11<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Weeklies

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Seasonal Patterns<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

9 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

9 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1998-2007)<br />

Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May<br />

June <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1999-2007)<br />

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun<br />

July <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1999-2007)<br />

Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul<br />

August <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1998-2007)<br />

Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug<br />

12 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

22.00<br />

20.00<br />

18.00<br />

16.00<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

22.00<br />

20.00<br />

18.00<br />

16.00<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

24.00<br />

22.00<br />

20.00<br />

18.00<br />

16.00<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

22.00<br />

20.00<br />

18.00<br />

16.00<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

Weekly May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

MOORE RESEARCH CENTER, INC. 13<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Weeklies

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Seasonal Patterns<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

11 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

11 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

11 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

September <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1998-2007)<br />

Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep<br />

October <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1997-2007)<br />

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct<br />

November <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1997-2007)<br />

Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov<br />

December <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) Seasonal Patterns(1997-2007)<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec<br />

14 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

22.00<br />

20.00<br />

18.00<br />

16.00<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

22.00<br />

20.00<br />

18.00<br />

16.00<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

20.00<br />

18.00<br />

16.00<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

22.00<br />

20.00<br />

18.00<br />

16.00<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

Weekly Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Oct <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Nov <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Dec <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

MOORE RESEARCH CENTER, INC. 15<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Weeklies

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Seasonal Patterns: January<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Feb <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan<br />

Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan<br />

Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan<br />

Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan<br />

16 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

6.00<br />

4.00<br />

2.00<br />

0.00<br />

-2.00<br />

-4.00<br />

-6.00<br />

-8.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

-5.00<br />

-6.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

-5.00<br />

-6.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

-5.00<br />

-6.00<br />

Weekly Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Feb <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

MOORE RESEARCH CENTER, INC. 17<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Weeklies: January

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Seasonal Patterns: February<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

Feb <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb<br />

Feb <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb<br />

Feb <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb<br />

Feb <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb<br />

18 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

2.00<br />

1.50<br />

1.00<br />

0.50<br />

0.00<br />

-0.50<br />

-1.00<br />

-1.50<br />

-2.00<br />

2.50<br />

2.00<br />

1.50<br />

1.00<br />

0.50<br />

0.00<br />

-0.50<br />

-1.00<br />

-1.50<br />

-2.00<br />

-2.50<br />

-3.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

Weekly Feb <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Feb <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Feb <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Feb <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

MOORE RESEARCH CENTER, INC. 19<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Weeklies: February

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Seasonal Patterns: March<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar<br />

Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar<br />

Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar<br />

Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar<br />

20 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

-5.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

-5.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

2.00<br />

1.50<br />

1.00<br />

0.50<br />

0.00<br />

-0.50<br />

-1.00<br />

-1.50<br />

-2.00<br />

-2.50<br />

-3.00<br />

Weekly Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Mar <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

MOORE RESEARCH CENTER, INC. 21<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Weeklies: March

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Seasonal Patterns: April<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr<br />

Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr<br />

Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr<br />

Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr<br />

22 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

1.50<br />

1.00<br />

0.50<br />

0.00<br />

-0.50<br />

-1.00<br />

-1.50<br />

-2.00<br />

-2.50<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

Weekly Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Apr <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

MOORE RESEARCH CENTER, INC. 23<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Weeklies: April

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Seasonal Patterns: May<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May<br />

May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May<br />

May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May<br />

May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May<br />

24 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

7.00<br />

6.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

7.00<br />

6.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

7.00<br />

6.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

Weekly May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly May <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

MOORE RESEARCH CENTER, INC. 25<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Weeklies: May

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Seasonal Patterns: June<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun<br />

Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun<br />

Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun<br />

Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Oct <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun<br />

26 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

Weekly Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Jun <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Oct <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

MOORE RESEARCH CENTER, INC. 27<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Weeklies: June

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Seasonal Patterns: July<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

10 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul<br />

Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul<br />

Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Oct <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul<br />

Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Nov <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 10 Year Seasonal(98-07)<br />

Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul<br />

28 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

-4.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

Weekly Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Oct <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Jul <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Nov <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

MOORE RESEARCH CENTER, INC. 29<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Weeklies: July

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Seasonal Patterns: August<br />

11 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

11 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

11 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

11 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 11 Year Seasonal(97-07)<br />

Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug<br />

Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Oct <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 11 Year Seasonal(97-07)<br />

Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug<br />

Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Nov <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 11 Year Seasonal(97-07)<br />

Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug<br />

Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Dec <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 11 Year Seasonal(97-07)<br />

Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug<br />

30 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

1.50<br />

1.00<br />

0.50<br />

0.00<br />

-0.50<br />

-1.00<br />

-1.50<br />

-2.00<br />

2.50<br />

2.00<br />

1.50<br />

1.00<br />

0.50<br />

0.00<br />

-0.50<br />

-1.00<br />

-1.50<br />

-2.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

-1.00<br />

-2.00<br />

-3.00<br />

Weekly Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Oct <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Nov <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Weekly Aug <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Dec <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>)<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

MOORE RESEARCH CENTER, INC. 31<br />

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Weeklies: August

<strong>Class</strong> <strong>III</strong> <strong>Milk</strong> Spread Seasonal Patterns: September<br />

11 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

11 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

11 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

11 Year<br />

Pattern<br />

5 Year<br />

Pattern<br />

Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Oct <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 11 Year Seasonal(97-07)<br />

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep<br />

Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Nov <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 11 Year Seasonal(97-07)<br />

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep<br />

Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Dec <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 11 Year Seasonal(97-07)<br />

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep<br />

Sep <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) - Jan <strong>Class</strong> <strong>III</strong> <strong>Milk</strong>(<strong>CME</strong>) 11 Year Seasonal(97/98-07/08)<br />

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep<br />

32 HISTORICAL DAIRY REPORT<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0

3.50<br />

3.00<br />

2.50<br />

2.00<br />

1.50<br />

1.00<br />

0.50<br />

0.00<br />

-0.50<br />

-1.00<br />

4.00<br />

3.50<br />

3.00<br />

2.50<br />

2.00<br />

1.50<br />

1.00<br />

0.50<br />

0.00<br />

-0.50<br />