TEXCHEM RESOURCES BHD. - Announcements - Bursa Malaysia

TEXCHEM RESOURCES BHD. - Announcements - Bursa Malaysia

TEXCHEM RESOURCES BHD. - Announcements - Bursa Malaysia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

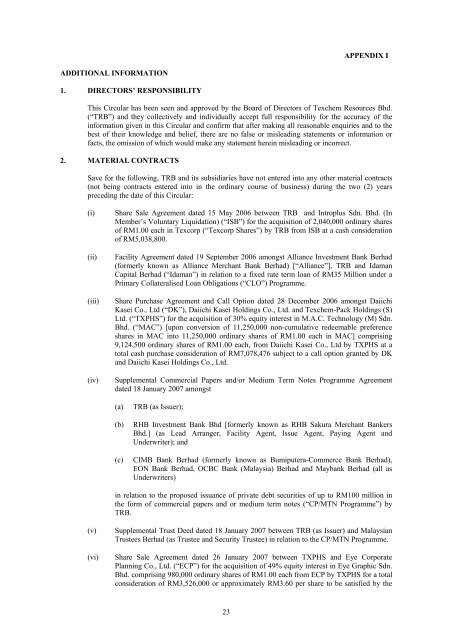

ADDITIONAL INFORMATION<br />

1. DIRECTORS’ RESPONSIBILITY<br />

23<br />

APPENDIX I<br />

This Circular has been seen and approved by the Board of Directors of Texchem Resources Bhd.<br />

(“TRB”) and they collectively and individually accept full responsibility for the accuracy of the<br />

information given in this Circular and confirm that after making all reasonable enquiries and to the<br />

best of their knowledge and belief, there are no false or misleading statements or information or<br />

facts, the omission of which would make any statement herein misleading or incorrect.<br />

2. MATERIAL CONTRACTS<br />

Save for the following, TRB and its subsidiaries have not entered into any other material contracts<br />

(not being contracts entered into in the ordinary course of business) during the two (2) years<br />

preceding the date of this Circular:<br />

(i) Share Sale Agreement dated 15 May 2006 between TRB and Introplus Sdn. Bhd. (In<br />

Member’s Voluntary Liquidation) (“ISB”) for the acquisition of 2,040,000 ordinary shares<br />

of RM1.00 each in Texcorp (“Texcorp Shares”) by TRB from ISB at a cash consideration<br />

of RM5,038,800.<br />

(ii) Facility Agreement dated 19 September 2006 amongst Alliance Investment Bank Berhad<br />

(formerly known as Alliance Merchant Bank Berhad) [“Alliance”], TRB and Idaman<br />

Capital Berhad (“Idaman”) in relation to a fixed rate term loan of RM35 Million under a<br />

Primary Collateralised Loan Obligations (“CLO”) Programme.<br />

(iii) Share Purchase Agreement and Call Option dated 28 December 2006 amongst Daiichi<br />

Kasei Co., Ltd (“DK”), Daiichi Kasei Holdings Co., Ltd. and Texchem-Pack Holdings (S)<br />

Ltd. (“TXPHS”) for the acquisition of 30% equity interest in M.A.C. Technology (M) Sdn.<br />

Bhd. (“MAC”) [upon conversion of 11,250,000 non-cumulative redeemable preference<br />

shares in MAC into 11,250,000 ordinary shares of RM1.00 each in MAC] comprising<br />

9,124,500 ordinary shares of RM1.00 each, from Daiichi Kasei Co., Ltd by TXPHS at a<br />

total cash purchase consideration of RM7,078,476 subject to a call option granted by DK<br />

and Daiichi Kasei Holdings Co., Ltd.<br />

(iv) Supplemental Commercial Papers and/or Medium Term Notes Programme Agreement<br />

dated 18 January 2007 amongst<br />

(a) TRB (as Issuer);<br />

(b) RHB Investment Bank Bhd [formerly known as RHB Sakura Merchant Bankers<br />

Bhd.] (as Lead Arranger, Facility Agent, Issue Agent, Paying Agent and<br />

Underwriter); and<br />

(c) CIMB Bank Berhad (formerly known as Bumiputera-Commerce Bank Berhad),<br />

EON Bank Berhad, OCBC Bank (<strong>Malaysia</strong>) Berhad and Maybank Berhad (all as<br />

Underwriters)<br />

in relation to the proposed issuance of private debt securities of up to RM100 million in<br />

the form of commercial papers and or medium term notes (“CP/MTN Programme”) by<br />

TRB.<br />

(v) Supplemental Trust Deed dated 18 January 2007 between TRB (as Issuer) and <strong>Malaysia</strong>n<br />

Trustees Berhad (as Trustee and Security Trustee) in relation to the CP/MTN Programme.<br />

(vi) Share Sale Agreement dated 26 January 2007 between TXPHS and Eye Corporate<br />

Planning Co., Ltd. (“ECP”) for the acquisition of 49% equity interest in Eye Graphic Sdn.<br />

Bhd. comprising 980,000 ordinary shares of RM1.00 each from ECP by TXPHS for a total<br />

consideration of RM3,526,000 or approximately RM3.60 per share to be satisfied by the