?ytl land? or - Announcements - Bursa Malaysia

?ytl land? or - Announcements - Bursa Malaysia

?ytl land? or - Announcements - Bursa Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

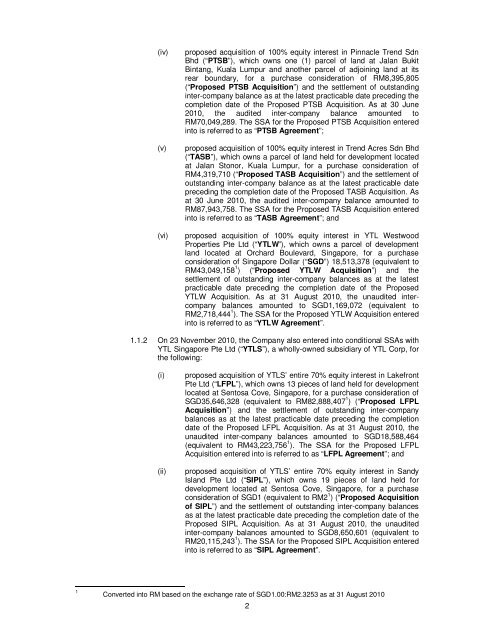

(iv) proposed acquisition of 100% equity interest in Pinnacle Trend Sdn<br />

Bhd (“PTSB”), which owns one (1) parcel of <strong>land</strong> at Jalan Bukit<br />

Bintang, Kuala Lumpur and another parcel of adjoining <strong>land</strong> at its<br />

rear boundary, f<strong>or</strong> a purchase consideration of RM8,395,805<br />

(“Proposed PTSB Acquisition”) and the settlement of outstanding<br />

inter-company balance as at the latest practicable date preceding the<br />

completion date of the Proposed PTSB Acquisition. As at 30 June<br />

2010, the audited inter-company balance amounted to<br />

RM70,049,289. The SSA f<strong>or</strong> the Proposed PTSB Acquisition entered<br />

into is referred to as “PTSB Agreement”;<br />

(v) proposed acquisition of 100% equity interest in Trend Acres Sdn Bhd<br />

(“TASB”), which owns a parcel of <strong>land</strong> held f<strong>or</strong> development located<br />

at Jalan Ston<strong>or</strong>, Kuala Lumpur, f<strong>or</strong> a purchase consideration of<br />

RM4,319,710 (“Proposed TASB Acquisition”) and the settlement of<br />

outstanding inter-company balance as at the latest practicable date<br />

preceding the completion date of the Proposed TASB Acquisition. As<br />

at 30 June 2010, the audited inter-company balance amounted to<br />

RM87,943,758. The SSA f<strong>or</strong> the Proposed TASB Acquisition entered<br />

into is referred to as “TASB Agreement”; and<br />

(vi) proposed acquisition of 100% equity interest in YTL Westwood<br />

Properties Pte Ltd (“YTLW”), which owns a parcel of development<br />

<strong>land</strong> located at Orchard Boulevard, Singap<strong>or</strong>e, f<strong>or</strong> a purchase<br />

consideration of Singap<strong>or</strong>e Dollar (“SGD”) 18,513,378 (equivalent to<br />

RM43,049,158 1 ) (“Proposed YTLW Acquisition”) and the<br />

settlement of outstanding inter-company balances as at the latest<br />

practicable date preceding the completion date of the Proposed<br />

YTLW Acquisition. As at 31 August 2010, the unaudited intercompany<br />

balances amounted to SGD1,169,072 (equivalent to<br />

RM2,718,444 1 ). The SSA f<strong>or</strong> the Proposed YTLW Acquisition entered<br />

into is referred to as “YTLW Agreement”.<br />

1.1.2 On 23 November 2010, the Company also entered into conditional SSAs with<br />

YTL Singap<strong>or</strong>e Pte Ltd (“YTLS”), a wholly-owned subsidiary of YTL C<strong>or</strong>p, f<strong>or</strong><br />

the following:<br />

(i) proposed acquisition of YTLS’ entire 70% equity interest in Lakefront<br />

Pte Ltd (“LFPL”), which owns 13 pieces of <strong>land</strong> held f<strong>or</strong> development<br />

located at Sentosa Cove, Singap<strong>or</strong>e, f<strong>or</strong> a purchase consideration of<br />

SGD35,646,328 (equivalent to RM82,888,407 1 ) (“Proposed LFPL<br />

Acquisition”) and the settlement of outstanding inter-company<br />

balances as at the latest practicable date preceding the completion<br />

date of the Proposed LFPL Acquisition. As at 31 August 2010, the<br />

unaudited inter-company balances amounted to SGD18,588,464<br />

(equivalent to RM43,223,756 1 ). The SSA f<strong>or</strong> the Proposed LFPL<br />

Acquisition entered into is referred to as “LFPL Agreement”; and<br />

(ii) proposed acquisition of YTLS’ entire 70% equity interest in Sandy<br />

Is<strong>land</strong> Pte Ltd (“SIPL”), which owns 19 pieces of <strong>land</strong> held f<strong>or</strong><br />

development located at Sentosa Cove, Singap<strong>or</strong>e, f<strong>or</strong> a purchase<br />

consideration of SGD1 (equivalent to RM2 1 ) (“Proposed Acquisition<br />

of SIPL”) and the settlement of outstanding inter-company balances<br />

as at the latest practicable date preceding the completion date of the<br />

Proposed SIPL Acquisition. As at 31 August 2010, the unaudited<br />

inter-company balances amounted to SGD8,650,601 (equivalent to<br />

RM20,115,243 1 ). The SSA f<strong>or</strong> the Proposed SIPL Acquisition entered<br />

into is referred to as “SIPL Agreement”.<br />

1 Converted into RM based on the exchange rate of SGD1.00:RM2.3253 as at 31 August 2010<br />

2