standard loan purchase and sale agreement - FCI Exchange

standard loan purchase and sale agreement - FCI Exchange

standard loan purchase and sale agreement - FCI Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

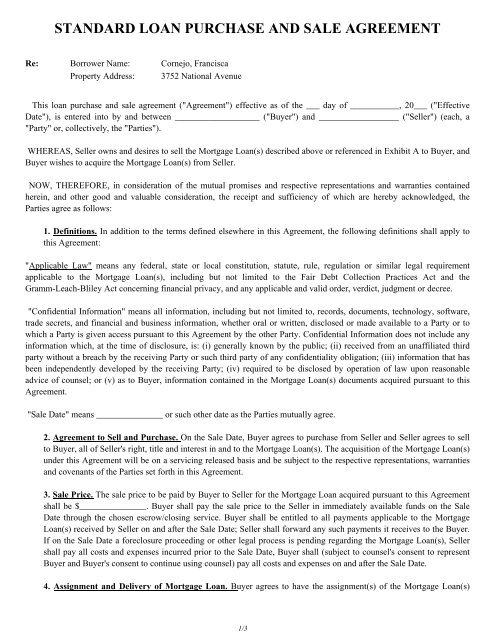

STANDARD LOAN PURCHASE AND SALE AGREEMENT<br />

Re: Borrower Name: Cornejo, Francisca<br />

Property Address: 3752 National Avenue<br />

This <strong>loan</strong> <strong>purchase</strong> <strong>and</strong> <strong>sale</strong> <strong>agreement</strong> ("Agreement") effective as of the ___ day of ___________, 20___ ("Effective<br />

Date"), is entered into by <strong>and</strong> between ___________________ ("Buyer") <strong>and</strong> __________________ ("Seller") (each, a<br />

"Party" or, collectively, the "Parties").<br />

WHEREAS, Seller owns <strong>and</strong> desires to sell the Mortgage Loan(s) described above or referenced in Exhibit A to Buyer, <strong>and</strong><br />

Buyer wishes to acquire the Mortgage Loan(s) from Seller.<br />

NOW, THEREFORE, in consideration of the mutual promises <strong>and</strong> respective representations <strong>and</strong> warranties contained<br />

herein, <strong>and</strong> other good <strong>and</strong> valuable consideration, the receipt <strong>and</strong> sufficiency of which are hereby acknowledged, the<br />

Parties agree as follows:<br />

1. Definitions. In addition to the terms defined elsewhere in this Agreement, the following definitions shall apply to<br />

this Agreement:<br />

"Applicable Law" means any federal, state or local constitution, statute, rule, regulation or similar legal requirement<br />

applicable to the Mortgage Loan(s), including but not limited to the Fair Debt Collection Practices Act <strong>and</strong> the<br />

Gramm-Leach-Bliley Act concerning financial privacy, <strong>and</strong> any applicable <strong>and</strong> valid order, verdict, judgment or decree.<br />

"Confidential Information" means all information, including but not limited to, records, documents, technology, software,<br />

trade secrets, <strong>and</strong> financial <strong>and</strong> business information, whether oral or written, disclosed or made available to a Party or to<br />

which a Party is given access pursuant to this Agreement by the other Party. Confidential Information does not include any<br />

information which, at the time of disclosure, is: (i) generally known by the public; (ii) received from an unaffiliated third<br />

party without a breach by the receiving Party or such third party of any confidentiality obligation; (iii) information that has<br />

been independently developed by the receiving Party; (iv) required to be disclosed by operation of law upon reasonable<br />

advice of counsel; or (v) as to Buyer, information contained in the Mortgage Loan(s) documents acquired pursuant to this<br />

Agreement.<br />

"Sale Date" means _______________ or such other date as the Parties mutually agree.<br />

2. Agreement to Sell <strong>and</strong> Purchase. On the Sale Date, Buyer agrees to <strong>purchase</strong> from Seller <strong>and</strong> Seller agrees to sell<br />

to Buyer, all of Seller's right, title <strong>and</strong> interest in <strong>and</strong> to the Mortgage Loan(s). The acquisition of the Mortgage Loan(s)<br />

under this Agreement will be on a servicing released basis <strong>and</strong> be subject to the respective representations, warranties<br />

<strong>and</strong> covenants of the Parties set forth in this Agreement.<br />

3. Sale Price. The <strong>sale</strong> price to be paid by Buyer to Seller for the Mortgage Loan acquired pursuant to this Agreement<br />

shall be $_______________. Buyer shall pay the <strong>sale</strong> price to the Seller in immediately available funds on the Sale<br />

Date through the chosen escrow/closing service. Buyer shall be entitled to all payments applicable to the Mortgage<br />

Loan(s) received by Seller on <strong>and</strong> after the Sale Date; Seller shall forward any such payments it receives to the Buyer.<br />

If on the Sale Date a foreclosure proceeding or other legal process is pending regarding the Mortgage Loan(s), Seller<br />

shall pay all costs <strong>and</strong> expenses incurred prior to the Sale Date, Buyer shall (subject to counsel's consent to represent<br />

Buyer <strong>and</strong> Buyer's consent to continue using counsel) pay all costs <strong>and</strong> expenses on <strong>and</strong> after the Sale Date.<br />

4. Assignment <strong>and</strong> Delivery of Mortgage Loan. Buyer agrees to have the assignment(s) of the Mortgage Loan(s)<br />

1/3

prepared as required. Seller shall provide Buyer with all collateral files, <strong>and</strong> information which may contain notes,<br />

deeds <strong>and</strong> original notarized assignment no later than 14 days from <strong>purchase</strong> date. Seller shall send RESPA "goodbye"<br />

letters to Obligators in accordance with applicable law within 5 days of <strong>purchase</strong> closing <strong>and</strong> send or email within 2<br />

days copies to Buyer or Buyer's designated servicer. Buyer or their designated servicer shall send RESPA "welcome"<br />

letters to Obligators in accordance with applicable law. As of the transfer date, all rights, Obligations, Liabilities <strong>and</strong><br />

responsibilities with respect to the servicing of the Mortgage Loans shall pass to Buyer or Buyer's designated servicer.<br />

The seller shall have no obligation to perform any servicing activities with respect to the Mortgage Loan(s) after the<br />

Sale Date, except those required by law. Buyer shall pay any recording fees or similar expenses due <strong>and</strong> payable on<br />

account of the assignments contemplated in this section 4. Seller shall further cooperate with Buyer should Buyer need<br />

any other document or other items executed <strong>and</strong> delivered to Buyer in connection with the <strong>sale</strong> of the Mortgage<br />

Loan(s).<br />

5. Servicing. Servicing of the Mortgage Loan(s) will be transferred from the Seller to the Buyer or their designated<br />

servicer as soon as reasonably practical after the Sale Date, in accordance with Seller's usual procedures. In accordance<br />

with Applicable Law, Seller <strong>and</strong> Buyer shall respectively provide the borrower of the Mortgage Loan(s) with any<br />

required notice of transfer of servicing rights <strong>and</strong> notice of Buyer's acquisition of the Mortgage Loan(s).<br />

6. Seller Representations <strong>and</strong> Warranties. Seller represents <strong>and</strong> warrants to Buyer that Seller is the owner of the<br />

Mortgage Loan(s), has the right to transfer <strong>and</strong> sell the Mortgage Loan(s) to Buyer, that the lien position presented is<br />

correct (for example the Mortgage Loan is a 1st position or in 2nd position), that, if the Seller originated the Mortgage<br />

Loan, that all Applicable Laws were followed in the origination of the Mortgage Loan or if Seller was assigned the<br />

Mortgage Loan, that to the best of Seller's knowledge all Applicable Laws were followed in connection with the<br />

origination of the Mortgage Loan. Seller agrees to buy back any <strong>loan</strong> listed in attached Exhibit A for 30 days after<br />

<strong>purchase</strong> date, found not to be a valid deed of trust or mortgage as of the date of <strong>purchase</strong>, for full prorated <strong>purchase</strong><br />

price. EXCEPT AS SPECIFICALLY SET FORTH IN THIS SECTION 6, SELLER MAKES NO OTHER<br />

REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, REGARDING THE MORTGAGE LOAN. THE<br />

MORTGAGE LOAN IS BEING SOLD TO BUYER "WITHOUT RECOURSE", EXCEPT AS SPECIFICALLY SET<br />

FORTH HEREIN.<br />

7. Buyer Representations <strong>and</strong> Warranties. Buyer represents <strong>and</strong> warrants to Seller that Buyer is duly organized,<br />

validly existing <strong>and</strong> in good st<strong>and</strong>ing under the laws of Buyer's state of formation. Buyer has the power <strong>and</strong> all<br />

licenses, permits, authorizations <strong>and</strong> approvals (governmental, corporate or otherwise) necessary to carry on its<br />

business <strong>and</strong> perform its obligations under this Agreement, if needed. Buyer is in compliance with all Applicable Laws<br />

relating to this Agreement, including being duly licensed, if needed, to acquire <strong>and</strong>/or service Mortgage Loans in each<br />

state in which such license is required. The execution or performance of this Agreement by Buyer will not violate<br />

Buyer's formation documents or any material contract or other instrument to which it is a party or by which it is bound<br />

<strong>and</strong> will not violate any outst<strong>and</strong>ing judgment, order, injunction, law, rule or regulation to which it is subject. Buyer<br />

will perform all acts under this Agreement, <strong>and</strong> will own <strong>and</strong> service the Mortgage Loan(s) hereafter, in strict<br />

compliance with all Applicable Law.<br />

8. Confidentiality. Except as expressly provided in this Section 8 or with the other Party's prior written consent, both<br />

Parties agree to hold all Confidential Information of the other Party in confidence. Confidential Information shall be<br />

deemed the exclusive property of the disclosing Party. Neither Party, during the term <strong>and</strong> after termination of this<br />

Agreement, shall disclose any Confidential Information of the other Party to any person (other than its own directors,<br />

officers, employees, agents <strong>and</strong> contractors who must have such information for the performance of a Party's<br />

obligations under this Agreement) or use any Confidential Information for purposes other than those contemplated by<br />

this Agreement. The Parties agree that monetary damages for breach of the obligations under this Section 8 may not be<br />

adequate <strong>and</strong> that the non-disclosing Party shall be entitled to injunctive relief with respect to a breach thereof.<br />

2/3

9. Relationship of Parties. The Parties acknowledge <strong>and</strong> agree that the <strong>purchase</strong> <strong>and</strong> <strong>sale</strong> of the Mortgage Loans was<br />

negotiated as an arms-length transaction <strong>and</strong> nothing in this Agreement is to be construed to constitute the Parties as<br />

employer/employee, franchiser/franchisee, agent/principal, partners, joint ventures, co-owners or otherwise as<br />

participants in a joint or common undertaking.<br />

10. Modification of Agreement. This Agreement contains the entire <strong>agreement</strong> between the parties relating to the<br />

Mortgage Loan; there are no other <strong>agreement</strong>s express or implied. Buyer specifically acknowledges that it has not<br />

<strong>purchase</strong>d the Mortgage Loan(s) in reliance on any other representation or statement of Seller or Seller's<br />

representatives not contained in this Agreement. Only an instrument in writing signed by the Parties may modify this<br />

Agreement.<br />

11. Governing Law. This Agreement shall be construed in accordance with <strong>and</strong> governed by the laws of the State of<br />

California. The Parties agree to submit to the jurisdiction of California courts sitting in the County of Orange.<br />

12. Indemnification. In addition to the re<strong>purchase</strong> obligations set forth in paragraph 6, supra:<br />

a. Buyer agrees to indemnify, defend <strong>and</strong> hold Seller harmless from <strong>and</strong> against any <strong>and</strong> all claims, suits, actions,<br />

liability, losses, expenses (including reasonable attorney's fees), or damages (collectively "Damages") which may<br />

hereafter arise, which Seller may sustain arising out of any breach of Buyer's warranties, representations, or<br />

covenants as set forth in this Agreement.<br />

b. Seller agrees to indemnify, defend <strong>and</strong> hold Buyer harmless from <strong>and</strong> against any <strong>and</strong> all claims, suits, actions,<br />

liability, losses, expenses (including reasonable attorney's fees), or damages (collectively "Damages") which may<br />

hereafter arise, which Buyer may sustain due to or arising out of any breach of Seller's representations, warranties,<br />

or covenants as set forth in this Agreement.<br />

13. No Waivers; Remedies Cumulative; Survival. The waiver of any breach of this Agreement shall not be construed<br />

to be a waiver of any other or subsequent breach. All remedies afforded by this Agreement for a breach hereof shall be<br />

cumulative; that is, in addition to all other remedies provided for herein or by law or in equity. The provisions of<br />

Sections 6, 7, 8, 12 <strong>and</strong> 13 shall survive <strong>sale</strong> <strong>and</strong> transfer of the Mortgage Loan(s) to Buyer <strong>and</strong> any termination of this<br />

Agreement.<br />

14. Notice. Except as otherwise provided herein, all notices required under this Agreement shall be in writing <strong>and</strong><br />

delivered personally or by facsimile or by overnight delivery service or by first class mail, postage prepaid, to each<br />

party at the address listed below. Either party may change the notice address by notifying the other party in writing.<br />

Notices shall be deemed received upon receipt, electronic confirmation of delivery as to facsimile notices, or 3 days<br />

after deposit in the U. S. Mail, whichever is applicable.<br />

Executed as of the Effective Date.<br />

Buyer Seller<br />

Company: _____________________ Company:<br />

Contact Person: _____________________ Contact Person:<br />

Address: _____________________ Address: 950 S. Jay Circle<br />

_____________________<br />

Phone: _____________________ Phone: 714-307-1182<br />

Email: _____________________ Email: danaoson@gmail.com<br />

Signature: _____________________ Signature: _____________________<br />

Name: _____________________ Name: O'Son, Dana<br />

3/3