Report of Indian Institute of Public Administration ... - Ministry of Power

Report of Indian Institute of Public Administration ... - Ministry of Power

Report of Indian Institute of Public Administration ... - Ministry of Power

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FOREWORD<br />

Electricity is the most versatile form <strong>of</strong> energy and a strategic input providing a source <strong>of</strong><br />

livelihood for various segments <strong>of</strong> society. The power sector is a prime mover and an<br />

effective engine <strong>of</strong> economic growth. Sustaining India’s current turbo growth rate requires<br />

massive infusion <strong>of</strong> investments and predicated and sound policies for efficient power<br />

generation, transmission and distribution. Over the years, the SEBs had played a very vital<br />

and vibrant role in extending the outreach <strong>of</strong> electricity to even remote corners <strong>of</strong> the country.<br />

However, by the 1990s, the SEBs were found to be beset with unsustainable inefficiencies,<br />

unviable tariffs, high T&D losses, mounting subsidies, lack <strong>of</strong> adequate attention to the<br />

distribution segment, sub-optimal performance, wasteful practices and lackadaisical financial<br />

management. All these led to financial fragility <strong>of</strong> the entire sector.<br />

Due to the uninspiring financial position <strong>of</strong> the vertically integrated monolithic SEBs, the<br />

power sector was failing to attract the much-needed investments for its development. <strong>Power</strong><br />

sector reforms were necessitated to turn around the sector. Orissa was the first State to<br />

restructure its SEB and thereafter, 12 more States followed suit. Enactment <strong>of</strong> the Electricity<br />

Act, 2003, is doubtless a distinct watershed in the <strong>Indian</strong> power sector, as it introduced<br />

innovative concepts like power trading, Open Access, Appellate Tribunal, etc., and special<br />

provisions for the rural areas. The Act has made it mandatory for all the States to restructure<br />

their SEBs. Since, by now, sufficient experience was available to gauge the performance <strong>of</strong><br />

the restructured Utilities, the <strong>Ministry</strong> <strong>of</strong> <strong>Power</strong> felt it opportune to have the issue revisited<br />

and studied in depth, based on the hindsight and foresight warranted by the emerging<br />

challenges.<br />

With this end in view, MoP entrusted the <strong>Indian</strong> <strong>Institute</strong> <strong>of</strong> <strong>Public</strong> <strong>Administration</strong> with the<br />

task <strong>of</strong> undertaking a comprehensive study on ‘Impact <strong>of</strong> Restructuring <strong>of</strong> SEBs’. After<br />

wide consultations, IIPA drafted a team <strong>of</strong> experts with rich domain knowledge <strong>of</strong> the<br />

operational dynamics <strong>of</strong> the power sector. We acknowledge the outstanding work done by<br />

the members <strong>of</strong> the `Group <strong>of</strong> Experts’ at all stages <strong>of</strong> the Study. All <strong>of</strong> them carried an<br />

incisive State-specific review and helped in drafting <strong>of</strong> the National <strong>Report</strong> most diligently<br />

and objectively. All <strong>of</strong> them generously contributed their time and attention and completed<br />

their task most meticulously and methodically.<br />

The key findings <strong>of</strong> the Study are:<br />

• Restructuring is a necessary but not a sufficient condition for turnaround <strong>of</strong> the power<br />

sector. It is important to note that restructuring is only the beginning and not the end <strong>of</strong><br />

the process. It must be accompanied by continuous complementary efforts to enhance<br />

efficiency in the sector and improve the quality <strong>of</strong> service to consumers.<br />

• Strong and sustained political support during all phases <strong>of</strong> restructuring is the key. Taking<br />

the employees into confidence and enlisting their willing support and strengthening the

institution <strong>of</strong> Electricity Regulators are critical factors for success and sustainability <strong>of</strong><br />

power sector reforms.<br />

• Most <strong>of</strong> the GENCOs, TRANSCOs and some <strong>of</strong> the DISCOMs have now become<br />

financially viable. Consequently, they are able to attract additional investments and better<br />

technological and managerial interventions.<br />

• It has been noticed that most <strong>of</strong> the restructured Utilities are beaming positive trends in<br />

respect <strong>of</strong> key parameters wherever reasonable autonomy has been provided to them. The<br />

level <strong>of</strong> consumer satisfaction in these States is also significantly higher. Restructuring<br />

has brought in the required accountability in the power sector triggering improved<br />

performance. Such positive correlation needs to be further reinforced through welldesigned<br />

systems and adoption <strong>of</strong> best practices on a continuing basis.<br />

• Restructuring should not be misconstrued as privatisation. It requires demystification,<br />

aggressive education and creation <strong>of</strong> a strong constituency to preserve, promote and<br />

develop the essence <strong>of</strong> restructuring.<br />

We are thankful to Shri Sushilkumar Shindeji, Hon’ble Union Minister <strong>of</strong> <strong>Power</strong>, for very<br />

graciously agreeing to receive the <strong>Report</strong>. We are grateful to Shri R.V. Shahi, Secretary<br />

(<strong>Power</strong>), Government <strong>of</strong> India, who was always ready and willing for consultations and<br />

insightful views resulting in huge value addition to the <strong>Report</strong>. Shri A. K. Basu, Chairperson,<br />

CERC, was very kind to spare his valuable time along with his team <strong>of</strong> Chairpersons <strong>of</strong> the<br />

State Electricity Regulatory Commissions and enlighten us about the Regulatory issues<br />

pertaining to the power sector. Thanks are also due to Shri Ajay Shankar, Additional<br />

Secretary, Shri Rakesh Nath (Chairperson, CEA), Shri Mrutunjay Sahoo, JS&FA and Shri<br />

Alok Kumar, Director for their sterling support to the project. We are also beholden to the<br />

Trade Union representatives, led by Shri E. Balanandan, Chairman, NCCEEE for candidly<br />

sharing their views on employees’ issues with the Group <strong>of</strong> Experts. Thanks are also due to<br />

CEA, PFC, REC and MNES for their inputs and support. All the concerned State<br />

Governments and <strong>Power</strong> Utilities were positive and proactive and responded readily to the<br />

IIPA’s detailed questionnaire.<br />

It is fervently hoped that this <strong>Report</strong> would positively facilitate a heightened appreciation <strong>of</strong><br />

the issues and challenges confronting the power sector. It is our belief that the findings<br />

would trigger a rejuvenated power sector regime with well designed, and efficiently executed<br />

policy initiatives, enjoying fullest support <strong>of</strong> all the stakeholders. The key message emerging<br />

from the Study is: “If power sector wins, everybody wins”. To accomplish such a win-win<br />

situation, the time to act is here and now.<br />

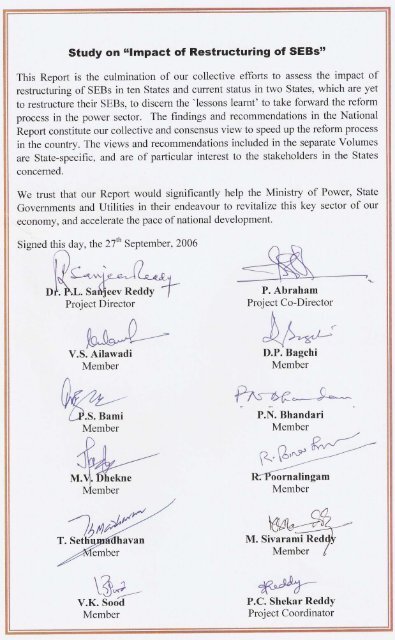

P. Abraham P. L. Sanjeev Reddy<br />

Project Co-Director Project Director

PREFACE<br />

The country has been registering 8 per cent GDP growth rate for the last few years and a<br />

target <strong>of</strong> more than 8 per cent GDP growth rate has been envisaged during the Eleventh Plan.<br />

To sustain this pace <strong>of</strong> growth, electricity generation also needs to grow commensurately.<br />

This would require an aggregate annual investment <strong>of</strong> at least Rs 1,00,000 crore in the power<br />

sector. It was felt by the <strong>Ministry</strong> <strong>of</strong> <strong>Power</strong> that the faster pace <strong>of</strong> reforms is the key to meet<br />

the ever-evolving challenges. <strong>Ministry</strong> <strong>of</strong> <strong>Power</strong> desired that a study be conducted on the<br />

impact <strong>of</strong> the restructuring exercise on the power sector to assess the performance gains,<br />

shortcomings, and difficulties, if any, in the entire reorganisation exercise, so as to introduce<br />

mid-course corrective measures.<br />

IIPA was entrusted with the instant Study because <strong>of</strong> its proven record <strong>of</strong> excellence, for over<br />

half a century, in the field <strong>of</strong> <strong>Public</strong> Service, Policy Making and Capacity Building. The<br />

Study is designed to bring out overall trends in the performance <strong>of</strong> the <strong>Power</strong> Sector, starting<br />

five years before reorganisation and thereafter. The purpose <strong>of</strong> the Study is to evolve the<br />

process <strong>of</strong> introducing appropriate policy interventions that will impact policy-making<br />

through better interaction and greater participation and involvement <strong>of</strong> the State Utilities, as<br />

well as all other Stakeholders.<br />

Some States had already restructured their SEBs even before the enactment <strong>of</strong> the Electricity<br />

Act, 2003, some have done so after its enactment and some other States are in the process <strong>of</strong><br />

doing so. In all, 12 States were selected for the Study based on the following criteria:<br />

• Almost all the States, which have restructured their SEBs: and<br />

• To draw a fair comparison and flag performance indicators between the restructured<br />

entities and the present SEBs, the top two performing SEBs in the country, namely those<br />

<strong>of</strong> Tamil Nadu and West Bengal, were also selected for the study.<br />

The instant Study, the first <strong>of</strong> its kind to be undertaken at the national level on the<br />

restructuring <strong>of</strong> SEBs, is unique in a number <strong>of</strong> aspects like:<br />

• `Group <strong>of</strong> Experts’ comprised <strong>of</strong> 10 members with wide-ranging experience and domain<br />

expertise in all important areas <strong>of</strong> the power sector;<br />

• 12 States were studied in depth. All the energy departments <strong>of</strong> these States have given<br />

their responses to detailed questionnaire <strong>of</strong> IIPA;<br />

• A detailed performance analysis <strong>of</strong> as many as 60 power Utilities, spread over all regions<br />

<strong>of</strong> the country was carried out;<br />

• Extensive consultations with all stakeholders including Employees’ Unions, Regulators<br />

and decision-makers, etc.;

• 360 0 feedback was obtained on the Draft <strong>Report</strong> from the concerned State Governments,<br />

power Utilities, etc.; and<br />

• The report runs into more than 1000 pages spread over four Volumes.<br />

A report <strong>of</strong> this magnitude is due to the contributions and support <strong>of</strong> a number <strong>of</strong> persons,<br />

who made very significant contributions in bringing the report to its present form.<br />

Dr. P.L. Sanjeev Reddy, IAS (R), Project Director and Shri P. Abraham, Project Co-Director<br />

steered the project right from its inception to its finalisation. Their deep knowledge and<br />

perceptive views helped in imparting a sense <strong>of</strong> direction and focus to the <strong>Report</strong>.<br />

<strong>Report</strong>s pertaining to the individual States were prepared by the respective Experts. From the<br />

findings <strong>of</strong> these <strong>Report</strong>s, the National <strong>Report</strong> was built by consensus. All the Experts went<br />

about their task most meticulously and systematically. Despite their onerous duties, they were<br />

always available with their insightful suggestions, for fine-tuning the <strong>Report</strong>.<br />

Sincere appreciation is also due to S/Shri K.M. Kapoor, P.S. Bhandari, Jaideep Lakhtakia,<br />

and Satish Kumar (<strong>of</strong> the <strong>Ministry</strong> <strong>of</strong> <strong>Power</strong>) who were very cooperative and provided all<br />

relevant data and inputs required from time to time. Shri A.K. Rajput, Deputy Director, CEA<br />

put in sustained efforts at all stages <strong>of</strong> preparation <strong>of</strong> the <strong>Report</strong> and helped in organising the<br />

inputs and data in a logical and systematic form.<br />

Valuable secretarial assistance was rendered by S/Shri B. Haridasan, Mehar Singh Bisht and<br />

Smt. Nirmala, who most willingly devoted long hours in organising, compiling, the copious<br />

data and inputs and painstakingly entering the same into the computer. Shri J.A. Rama<br />

Moorty, Project Officer, edited the entire <strong>Report</strong> and also provided administrative assistance.<br />

Shri Sunil Dutt, <strong>Public</strong>ations Officer, IIPA, rendered valuable editorial advice which helped<br />

in making the <strong>Report</strong> much more presentable. Thanks are also due to S/Shri G.K. Arora,<br />

Kishan Tanwar, Attar Singh, Bhuvan Chander and Islam Ali for the support rendered by them<br />

throughout the duration <strong>of</strong> the Project.<br />

Besides the above, there have been a number <strong>of</strong> persons who helped at various stages <strong>of</strong> the<br />

Project. Constraints <strong>of</strong> space preclude mentioning them by name. Their contributions are<br />

gratefully acknowledged.<br />

P.C. Shekar Reddy<br />

Project Coordinator

Performance <strong>of</strong> Generating Companies<br />

Annexure -XI<br />

S.No. Parameter 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06<br />

Andhra Pradesh - 1999-00<br />

1 Installed Capacity (MW)# 5210 5765 6208 6214 6255 6756 7238 7616 7787 8072 8860<br />

2 IC - State Sector (MW) 4974 5225 5475 5711 5726 5876 6179 6479 6639 6640 6939<br />

3 Gross Generation (MU)$ 21235 24074 25853 27896 30519 29930 28823 27217 26629 30868 --<br />

4 PLF (%) 77.40 78.30 82.00 76.80 83.20 86.30 86.30 88.50 86.20 89.60 --<br />

5 Plant Availability (%) 90.20 89.00 90.90 85.30 89.70 89.20 89.60 92.50 90.60 92.50 --<br />

6 Auxiliary Consump.(%)* 9.38 9.15 9.15 9.16 9.21 9.09 10.05 9.19 9.44 9.21 9.38<br />

7 Secondary Oil (ml/kWh) 3.45 2.52 1.39 1.34 1.15 0.78 1.33 1.00 0.70 0.49 0.57<br />

8 Heat Rate (kcal/kWh) 2721 2659 2579 2570 2547 2509 2514 2484 2493 2439 --<br />

Karnataka - 1999-00<br />

1 Installed Capacity (MW)# 3379 3385 3450 3973 4368 4465 4987 5197 5367 5935 6529<br />

2 KPCL 3027 3027 3228 3474 3868 3943 4063 4350 4365 4530 4640<br />

3 Gross Generation (KPCL) 14289 11929 15929 15970 19540 19493 18878 18141 19178 19822 --<br />

4 PLF (%) 67.70 70.20 75.20 81.60 82.30 81.30 81.10 79.92 88.40 83.30 --<br />

5 Plant Availability (%) 83.60 86.20 88.70 90.70 87.40 87.60 -- -- -- -- --<br />

6 Auxiliary Consump. (%)* 9.75 10.64 8.26 8.20 8.16 7.97 8.52 8.44 8.58 8.82 8.79<br />

7 Secondary Oil (ml/kWh) 1.18 0.78 0.77 1.30 2.41 -- 1.05 0.70 0.50 0.69 0.73<br />

8 Heat Rate (kcal/kWh) 2437 2630 2548 2540 2488 2498 2496 2529 2576<br />

Haryana - 1999-00<br />

1 Installed Capacity (MW)# 1780 1780 1780 1780 1780 1990 1990 1990 1990 2546 2560<br />

2 IC - State Sector (MW) 1780 1780 1780 1780 1780 1990 1990 1990 1990 2539 2553<br />

3 Gross Generation (MU)$ 7262 7627 7331 8302 7969 7238 8454 9783 10865 9847 --<br />

4 PLF (%) 42.82 47.66 49.17 49.24 53.24 49.73 60.80 66.44 74.91 69.46 66.77<br />

5 Plant Availability (%) 62.20 68.80 70.30 65.20 80.23 72.37 67.71 80.83 69.31 78.11 --<br />

6 Auxiliary Consump.(%)* 11.74 12.75 12.12 11.98 11.65 11.74 11.11 9.27 9.77 10.48 9.76<br />

7 Secondary Oil (ml/kWh) 17.72 18.60 13.33 12.84 7.08 5.54 3.35 3.40 4.50 3.47 3.73<br />

8 Heat Rate (kcal/kWh) -- -- -- -- 3378 3505 3432 3365 3318 3287 3.73<br />

A-1

S.No. Parameter 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06<br />

Orissa - 1996-97<br />

1 Installed Capacity (MW)# 1692 1693 1693 1698 1998 2298 2298 2304 2301 2320 2345<br />

2 IC - State Sector (MW) 1692 1692 1692 1697 1998 2297 2297 2303 2299 2320 2345<br />

3 Gross Generation (MU)$ 2670 5946 5840 6358 7916 7802 9265 5882 9119 10308 --<br />

4 PLF (%) 67.00 69.40 65.30 76.20 85.60 81.58 70.64 71.24 81.60 86.04 --<br />

5 Plant Availability (%) 81.00 84.10 83.70 88.50 90.34 87.89 79.23 89.16 87.44 89.06 --<br />

6 Auxiliary Consump.(%)* 10.01 11.57 11.65 10.23 10.25 10.59 10.68 -- 9.38 9.47 9.65<br />

7 Secondary Oil (ml/kWh) 3.53 5.00 4.28 1.68 1.31 2.13 1.52 1.70 -- 0.76 0.65<br />

8 Heat Rate (kcal/kWh) -- -- -- 2478 2447 2355 2296 2430 2465 2437 --<br />

Madhya Pradesh- 2002-03<br />

1 Installed Capacity (MW)# 3864 3873 3878 4094 4353 4373 3008 3100 3112 3324 3795<br />

2 IC - State Sector (MW) 3864 3864 3866 4076 4331 4351 2986 3078 3076 3275 3745<br />

3 Gross Generation (MU)$ 17599 18410 19441 20552 21812 21439 14010 15452 15802 15907 --<br />

4 PLF (%) 58.70 62.30 66.00 67.20 69.40 66.70 72.20 72.20 70.00 71.78 --<br />

5 Plant Availability (%) 77.10 76.40 77.40 78.40 77.80 78.32 76.75 87.34 86.73 86.62 --<br />

6 Auxiliary Consump.(%)* 10.33 9.83 9.89 9.68 9.81 10.31 9.24 8.96 9.34 9.71 9.65<br />

7 Secondary Oil (ml/kWh) 8.14 5.14 3.26 2.86 2.01 2.70 2.02 2.80 2.30 1.96 3.08<br />

8 Heat Rate (kcal/kWh) 3005 3015 2909 2919 2855 3013 3160 3018 3102 3118 --<br />

Rajasthan - 2000-01<br />

1 Installed Capacity (MW)# 1985 1985 1985 2235 2487 2489 3001 3077 3681 3814 3866<br />

2 IC - State Sector (MW) 1985 1985 1985 2235 2485 2485 2985 3067 3509 3549 3776<br />

3 Gross Generation (MU)$ 9929 10386 10853 11964 12638 13311 14161 17146 18599 20668 --<br />

4 PLF (%) 73.70 75.60 80.50 78.10 82.30 85.00 85.00 85.00 82.00 85.00 --<br />

5 Plant Availability (%) 77.40 80.30 89.30 83.20 86.50 87.80 -- -- -- -- --<br />

6 Auxiliary Consump.(%)* 10.48 10.21 10.32 10.29 10.08 9.43 9.41 9.44 9.66 9.40 9.10<br />

7 Secondary Oil (ml/kWh) 3.01 2.79 1.73 1.30 1.15 1.56 0.94 0.50 0.70 0.74 0.62<br />

A-2

S.No. Parameter<br />

Uttar Pradesh - 1999-00<br />

1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06<br />

1 Installed Capacity (MW)# 6069 6059 6169 6085 5613 5613 4659 4626 4621 4706 4924<br />

2 IC - State Sector (MW) 6069 6059 6169 6079 5607 5607 4659 4626 4621 4621 4810<br />

3 Gross Generation (MU)$ 22827 23637 23790 24938 23598 24888 22633 22377 22836 20911 --<br />

4 PLF (%) 47.30 49.10 48.80 48.90 49.80 57.19 59.76 58.40 57.70 57.50 --<br />

5 Plant Availability (%) 60.40 62.70 63.10 61.30 64.30 64.89 72.07 74.03 73.28 -- --<br />

6 Auxiliary Consump.(%)* 9.64 9.75 10.22 9.86 10.05 10.14 10.55 10.10 9.85 9.92 10.08<br />

7 Secondary Oil (ml/kWh)<br />

All India<br />

5.30 3.86 4.70 5.84 11.12 6.97 2.33 2.20 4.90 1.14 5.00<br />

1 Installed Capacity (MW)# 83294 85795 89102 93294 97884 101626 105046 107877 112684 118426 124287<br />

2 IC - State Sector (MW) 55646 53737 55467 56870 58493 60850 65875 63711 67380 69161 --<br />

3 Gross Generation (MU) 379877 395889 421747 448544 481055 501204 517439 532693 565102 594456 617382<br />

4 Gross Gen. State Sector 235798 235359 243725 256546 268641 270788 290245 282405 304648 315365 --<br />

5 PLF (%) 63.00 64.40 64.70 64.60 67.30 69.00 69.97 72.34 72.96 74.82 73.71<br />

6 PLF (%)-State Sector 58.00 60.30 60.90 60.80 63.70 65.60 66.62 68.93 68.80 69.77 --<br />

7 Plant Availability (%) 77.80 79.13 78.78 78.88 79.89 79.84 79.91 81.83 81.93 82.93 81.78<br />

8 Auxiliary Consump.(%)* 9.14 9.14 9.36 9.17 8.92 8.80 8.72 8.53 9.05 8.57 8.44<br />

9 Secondary Oil (ml/kWh) 4.53 4.36 3.45 3.50 3.59 2.76 2.70 -- 2.30 1.37 1.77<br />

* Auxiliary consumption (%) is in respect <strong>of</strong> thermal plants<br />

# Installed Generating Capacity (Utilities Only)<br />

$ State Sector<br />

(Source : CEA)<br />

Note: Figures <strong>of</strong> PLF, Plant Availability, Auxiliary Consumption, Secondary Oil Consumption and Heat Rate are in respect <strong>of</strong> Thermal <strong>Power</strong> Plants.<br />

A-3

Performance <strong>of</strong> Transmission Companies<br />

Annexure-XII<br />

Parameter<br />

Andhra Pradesh (1999-2000)*<br />

1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

Total Length <strong>of</strong> Transmission Lines (ckt km) 17847 18354 20073 20700 20700 22070 24888 28968 26143 27406<br />

Transmission Losses (%)<br />

Karnataka (1999-2000)*<br />

8.98 8.94 8.18 7.55 6.11 4.91<br />

Total Length <strong>of</strong> Transmission Lines (ckt km) 16990 17173 18890 19467 20473 21377 22302 22302 22302 24860<br />

Transmission Losses (%)<br />

Haryana (1999-2000)*<br />

6.55 4.89 4.18<br />

Total Length <strong>of</strong> Transmission Lines (ckt km) 4470 4828 4152 4395 4458 4458 5312 5460 5897 6731<br />

Transmission Losses (%)<br />

Orissa (1996-97)*<br />

6.78 7.17 6.78 7.18 5.67<br />

Total Length <strong>of</strong> Transmission Lines (ckt km) 7726 8271 8249 6418 6418 7918 7918 8907 9139 9139<br />

Transmission Losses (%)<br />

Madhya Pradesh (2002-03)*<br />

5.00 5.17 5.11 4.15 3.92<br />

Total Length <strong>of</strong> Transmission Lines (ckt km) 21111 21916 22942 21476 21970 24060 24060 17605 18011 19310<br />

Transmission Losses (%)<br />

Rajasthan (2000-01)*<br />

8.25 8.17 8.20 7.93 6.12 5.62<br />

Total Length <strong>of</strong> Transmission Lines (ckt km) 14371 15328 16466 16651 16898 17339 18075 18634 19065 19881<br />

Transmission Losses (%)<br />

Uttar Pradesh (1999-2000)*<br />

4.10 4.17 3.68 4.72 4.59<br />

Total Length <strong>of</strong> Transmission Lines (ckt km) 21202 23193 21587 22361 22546 22546 23984 23981 24107 25085<br />

Transmission Losses (%)<br />

All India<br />

5.50 5.50 5.50 5.92 5.67 4.97<br />

Total Length <strong>of</strong> Transmission Lines (ckt km) 302653 316297 330514 338799 346963 359524 379194 396934 402100 416479<br />

* Year <strong>of</strong> Restructuring <strong>of</strong> SEB<br />

(Source : CEA)<br />

A-4

Voltage<br />

Level<br />

400 kV<br />

220 kV<br />

Annexure -XII(A)<br />

Yearwise Targets Vs. Achievements IX and X Plans for Transmission Lines<br />

State 1997-98 1998-99 1999-2000 2000-01 2001-02 Total 9th Plan 2002-03 2003-04 2004-05 2005-06<br />

(ckt.km.)<br />

2006-07<br />

Utility P* A# P A P A P A P A P A P A P A P A P A P A<br />

Haryana 0 0 0 0 0 0 0 0 0<br />

Rajasthan 162 162 0 0 0 0 0 0 0 0 162 162 0 0 327 329 0 0 210 0 250<br />

UP 391 197 260 293 480 475 5 158 1 1 1137 1124 0 0 0 0 0 0 140 675 20<br />

Gujarat 41 16 137 120 191 207 42 1 60 0 471 344 64 49 16 13 0 0 150 66 155<br />

MP 100 10 100 215 198 200 0 0 222 101 620 526 150 21 338 245 254 241 0 0 0<br />

Maharashtra 145 187 204 120 330 660 412 307 203 40 1294 1314 31 43 131 118 20 9 0 11 211<br />

AP 0 0 50 0 487 656 234 190 585 997 1356 1843 168 130 520 136 536 310 60 337 44<br />

Karnataka 50 134 155 136 226 218 530 548 0 0 961 1036 3 0 0 0 0 0 0 0 0<br />

Orissa 0 0 0 0 212 0 212 155 57 24 481 179 200 137 40 32 95 141 0 2 39<br />

W. Bengal 0 0 0 0 290 290 0 0 22 0 312 290 22 0 22 22 0 0 0 49 660<br />

Total (SS) 963 706 980 884 2488 2720 1495 1419 1150 1163 7076 6892<br />

Total<br />

(All India)<br />

2990 2767 3004 3262 3128 3336 1973 2091 1780 1780 12875 13236<br />

Haryana 186 152 110 43 137 131 164 153 55 28 652 507 75 72 278 282 129 320 300 306 308<br />

Rajasthan 234 232 314 278 304 162 204 161 153 401 1209 1234 55 181 226 208 394 606 390 658 381<br />

UP 39 0 89 95 93 36 226 52 111 60 558 243 17 58 228 317 59 12 180 221 392<br />

Gujarat 278 311 371 567 160 277 463 360 317 236 1589 1751 234 198 675 633 103 79 210 98 361<br />

MP 104 38 170 170 50 46 330 217 120 119 774 590 100 88 9 10 40 18 205 205 189<br />

Maharashtra 347 644 179 285 185 247 391 426 366 358 1468 1960 216 295 445 442 343 184 175 162 384<br />

AP 326 323 229 184 495 945 372 452 538 840 1960 2744 593 804 310 177 163 123 180 46 222<br />

Karnataka 212 271 85 42 381 332 530 595 499 524 1707 1564 323 86 265 369 336 283 130 130 211<br />

Tamilnadu 44 89 99 266 175 171 539 502 374 313 1231 1341 266 375 205 206 303 203 120 143 166<br />

Orissa 147 135 24 0 218 0 530 342 400 216 1319 693 466 340 75 211 260 289 105 150 279<br />

W. Bengal 24 0 30 0 12 530 190 73 408 99 664 702 132 78 153 251 30 10 90 95 88<br />

Assam 0 0 0 0 0 0 5 25 25<br />

Total (SS) 2406 2569 2514 2701 2884 3141 4669 3364 4132 3495 16605 15270<br />

Total<br />

(All India)<br />

2824 2914 3210 3330 3553 3932 5058 3674 4240 3543 18885 17393<br />

Length <strong>of</strong> Transmission Lines (State Sector) Plan during 2006-07 to 2011-12 (ckt.km.)<br />

(Source : CEA)<br />

State<br />

Voltage<br />

Level (kV)<br />

2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 * P-Planned<br />

400 234 900 1032 686 740 # A- Achievement<br />

AP<br />

220 502.69 1355.88 333 706.99 152<br />

132 360 420 240 240 180<br />

220 224 32 470 85 536<br />

Karnataka 110 20 90 51 60<br />

66 160 40 40 10 170<br />

400 0 100 100 100 200<br />

Haryana 220 22 210 180 180 180 240<br />

132 21 223 300 360 330 330<br />

400 180 430 695 0 0 1080<br />

Rajasthan 220 472 738 307 0 0 594<br />

UP<br />

132<br />

220<br />

132<br />

375<br />

168.5<br />

80.27<br />

0<br />

0<br />

261<br />

0<br />

60<br />

159<br />

0<br />

144<br />

181<br />

0<br />

80<br />

100<br />

0<br />

520<br />

350<br />

A-5

Yearwise Targets Vs. Achievements IX and X Plans for Sub-Stations<br />

Annexure-XII(B)<br />

Voltage State 1997-98 1998-99 1999-2000 2000-01 2001-02 Total 9th Plan 2002-03 2003-04 2004-05 2005-06<br />

(ckt.km.)<br />

2006-07<br />

Level Utility P* A# P A P A P A P A P A P A P A P A P A P A<br />

Haryana 0 0 0 0 0 0 0 0 0<br />

Rajasthan 0 0 0 0 0 0 315 315 630 315 945 630 630 315 945 315 945 630 0 315 0<br />

UP 630 0 630 945 755 440 630 0 945 945 3590 2330 0 0 0 0 315 0 630 945 630<br />

Gujarat 0 0 315 315 945 1445 1130 315 815 815 3205 2890 0 0 0 0 0 0 0 315 630<br />

MP 315 630 0 0 0 0 0 0 0 0 315 630 0 0 0 0 0 315 0 630 0<br />

Maharashtra 315 315 630 315 315 1260 630 630 630 0 2520 2520 0 630 1945 1445 500 500 315 0 420<br />

AP 0 0 0 0 945 0 1260 945 630 945 2835 1890 0 0 0 0 315 0 630 1575 630<br />

400 kV Karnataka 0 0 0 0 0 0 0 0 815 500 815 500 315 0 630 1130 0 0 0 500 630<br />

Tamilnadu 0 400 0 0 0 315 315 0 630<br />

Orissa 630 0 0 0 630 0 0 630 0<br />

W. Bengal 0 0 0 0 630 630 0 0 0 0 630 630 0 0 630 0 0 0 735 0 315<br />

Assam 0 0 0 0 0 0 0 0 0<br />

Total (SS) 1890 1260 2205 2205 3905 3775 4280 2520 4780 3520 17060 13280<br />

Total<br />

(All India)<br />

3150 2205 2205 2835 6990 6230 5855 4095 6355 5095 24555 20460<br />

Haryana 250 100 450 150 400 250 200 300 200 100 1500 900 400 400 800 955 600 810 600 450 850<br />

Rajasthan 200 400 200 200 250 400 400 1000 300 400 1450 2400 0 250 490 550 300 420 300 900 100<br />

UP 200 0 200 700 100 200 200 100 1080 460 1780 1460 160 240 100 820 300 660 320 460 460<br />

Gujarat 500 450 600 1300 300 950 650 450 400 550 2450 3700 350 250 600 500 400 1150 0 400 500<br />

MP 320 320 160 125 160 285 320 320 0 0 960 1050 0 160 160 320 640 1120 640 680 480<br />

Maharashtra 450 1075 150 400 350 845 650 1920 325 450 1925 4690 275 775 700 1425 675 1745 475 855 525<br />

AP 600 831.5 450 350 500 1000 400 550 500 300 2450 3032 632 1100 600 732 300 100 200 200 400<br />

220 kV Karnataka 500 1050 500 800 400 900 300 300 300 200 2000 3250 600 500 200 600 200 500 500 400 500<br />

Tamilnadu 150 250 300 450 475 600 700 1195 410 450 2035 2945 150 50 100 200 300 100 400 700 300<br />

Orissa 300 60 200 100 250 200 300 320 200 0 1250 680 600 120 0 0 400 200 200 140 400<br />

W. Bengal 160 0 160 0 640 640 960 0 0 0 960 960 320 160 1280 1120 800 640 600 160 320<br />

Assam 0 0 0 0 100 0 75 0 75 0 250 0 25 0 0 0 25 37 275 250 225<br />

Total (SS) 5360 6017 4690 5435 5335 8060 6045 8155 5310 4220 27640 31887<br />

Total<br />

(All India)<br />

5410 6017 4840 5485 5435 8210 6195 8155 5410 4320 27290 32187<br />

* P-Planned # A- Achievement<br />

(Source : CEA)<br />

A-6

Transmission Sub-Station Capacity Addition (State Sector) during 1997-98 to 2011-12<br />

Annexure-XII(C)<br />

State Voltage (kV) Capacity 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12<br />

400<br />

MVA<br />

Number<br />

945<br />

2<br />

945<br />

3<br />

1575<br />

4<br />

2520<br />

4<br />

630<br />

1<br />

AP 220<br />

MVA<br />

Number<br />

831.5<br />

9<br />

350<br />

5<br />

1000<br />

9<br />

550<br />

7<br />

300<br />

3<br />

1100<br />

11<br />

731.5<br />

8<br />

100<br />

1<br />

200<br />

1<br />

1600<br />

8<br />

1400<br />

7<br />

1000<br />

5<br />

800<br />

4<br />

600<br />

3<br />

132<br />

MVA<br />

Number<br />

192<br />

6<br />

280<br />

7<br />

160<br />

4<br />

160<br />

4<br />

120<br />

3<br />

400<br />

MVA<br />

Number<br />

630<br />

1<br />

630<br />

1<br />

630<br />

1<br />

1260<br />

2<br />

Haryana 220<br />

MVA<br />

Number<br />

100<br />

2<br />

150<br />

2<br />

250<br />

3<br />

300<br />

4<br />

100<br />

1<br />

400<br />

4<br />

955<br />

10<br />

810<br />

9<br />

450<br />

5<br />

200<br />

1<br />

200<br />

1<br />

800<br />

4<br />

800<br />

4<br />

1000<br />

5<br />

1600<br />

8<br />

132<br />

MVA<br />

Number<br />

148<br />

7<br />

352<br />

11<br />

384<br />

12<br />

480<br />

15<br />

416<br />

13<br />

448<br />

14<br />

400<br />

MVA<br />

Number<br />

500<br />

1<br />

1130<br />

3<br />

500<br />

1<br />

500<br />

1<br />

630<br />

1<br />

1630<br />

2<br />

Karnataka<br />

220<br />

110<br />

MVA<br />

Number<br />

MVA<br />

Number<br />

1050<br />

8<br />

800<br />

8<br />

1100<br />

10<br />

300<br />

3<br />

200<br />

2<br />

500<br />

4<br />

600<br />

5<br />

500<br />

5<br />

400<br />

3<br />

1200<br />

6<br />

260<br />

13<br />

600<br />

3<br />

280<br />

15<br />

1000<br />

6<br />

180<br />

9<br />

800<br />

4<br />

150<br />

8<br />

1800<br />

9<br />

100<br />

5<br />

66<br />

MVA<br />

Number<br />

786.8<br />

29<br />

412.8<br />

19<br />

256.4<br />

8<br />

1600<br />

8<br />

100<br />

5<br />

MP<br />

400<br />

220<br />

MVA<br />

Number<br />

MVA<br />

Number<br />

630<br />

2<br />

320<br />

2<br />

125<br />

1<br />

285<br />

2<br />

320<br />

2<br />

160<br />

1<br />

320<br />

2<br />

315<br />

1<br />

1120<br />

7<br />

630<br />

2<br />

680<br />

5<br />

Orissa<br />

400<br />

220<br />

MVA<br />

Number<br />

MVA<br />

Number<br />

60<br />

1<br />

100<br />

1<br />

200<br />

2<br />

320<br />

1<br />

120<br />

2<br />

200<br />

2<br />

630<br />

2<br />

140<br />

2<br />

400<br />

MVA<br />

Number<br />

315<br />

1<br />

315<br />

1<br />

315<br />

1<br />

315<br />

1<br />

630<br />

2<br />

315<br />

1<br />

945<br />

3<br />

Rajasthan 220<br />

MVA<br />

Number<br />

400<br />

4<br />

200<br />

3<br />

400<br />

4<br />

1000<br />

10<br />

400<br />

4<br />

250<br />

3<br />

550<br />

6<br />

300<br />

3<br />

900<br />

11<br />

300<br />

3<br />

500<br />

5<br />

100<br />

1<br />

800<br />

8<br />

132<br />

MVA<br />

Number<br />

300<br />

15<br />

400<br />

MVA<br />

Number<br />

315<br />

1<br />

630<br />

2<br />

440<br />

2<br />

945<br />

2<br />

945<br />

3<br />

UP 220<br />

MVA<br />

Number<br />

700<br />

7<br />

200<br />

2<br />

100<br />

1<br />

460<br />

7<br />

240<br />

3<br />

820<br />

11<br />

660<br />

7<br />

460<br />

7<br />

780<br />

5<br />

200<br />

1<br />

860<br />

4<br />

120<br />

1<br />

1180<br />

4<br />

132<br />

MVA<br />

Number<br />

120<br />

6<br />

280<br />

10<br />

80<br />

4<br />

40<br />

2<br />

100<br />

2<br />

120<br />

2<br />

All India<br />

400<br />

220<br />

MVA<br />

Number<br />

MVA<br />

Number<br />

8210 7655<br />

90<br />

2205<br />

6<br />

4220<br />

49<br />

3520<br />

9<br />

5315<br />

62<br />

1345<br />

5<br />

8372<br />

88<br />

3205<br />

9<br />

8662<br />

93<br />

1760<br />

5<br />

6995<br />

79<br />

5540<br />

16<br />

(Source : CEA)<br />

A-7

Performance <strong>of</strong> Distribution Companies<br />

Annexure-XIII<br />

Parameter<br />

Andhra Pradesh (1999-2000)<br />

1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

Length <strong>of</strong> 33 kV Lines (ckt km) 25,114 25,782 26,549 27,906 27,906 31,972 32,655 46,787 32,732 33,580<br />

Length <strong>of</strong> 11 kV Lines (ckt km) 156,798 157,639 158,617 162,329 162,329 170,045 176,859 284,435 186,988 202,568<br />

Distribution Lines upto 500 Volts 407,653 412,511 384,315 464,769 464,769 447,933 448,949 645,409 447,428 486,237<br />

Ratio LT to HT (upto 11 kV) 2.60 2.62 2.42 2.86 2.86 2.63 2.54 2.27 2.39 2.40<br />

HT Lines (ckt km)/1000 sq km 570.07 573.13 576.68 590.18 590.18 618.23 643.01 1034.12 679.83 736.48<br />

LT Lines (ckt km)/1000 sq km 1482.11 1499.77 1397.26 1689.76 1689.76 1628.55 1632.25 2346.52 1626.72 1767.81<br />

No. <strong>of</strong> Distribution Transformers 146215 146215 146215 172014 177344 177344 177344 264962 331508 405997<br />

Aggregate Capacity <strong>of</strong> DTs (kVA)<br />

DTs Failure Rate (%)<br />

11121738 11121738 11121738 10259123 10765846 10765846 107658 19253256 20774972 22495826<br />

- Central Distribution Co. 23.73 16.27 11.87 9.48<br />

- Northern Distribution Co. 25.03 32.9 24.42 18.83 15.81 11.72<br />

- Eastern Distribution Co. 28 20 13.87 9.48 7.25<br />

Karnataka (1999-2000)<br />

14.16 9.26 8.45 7.01<br />

Length <strong>of</strong> 33 kV Lines (ckt km) 5175 5175 6016 6189 6381 6655 6864 6864 6878 7242<br />

Length <strong>of</strong> 11 kV Lines (ckt km) 113597 113674 120015 120010 120010 130578 136682 137533 162501 170961<br />

Distribution Lines upto 500 Volts 312054 312933 451220 465678 351241 359964 367690 370702 405958 417605<br />

Ratio LT to HT (upto 11 kV) 2.75 2.75 3.76 3.88 2.93 2.76 2.69 2.70 2.50 2.44<br />

HT Lines (ckt km)/1000 sq km 592.30 592.70 625.76 625.74 625.74 680.84 712.66 717.10 847.29 891.40<br />

LT Lines (ckt km)/1000 sq km 1627.06 1631.64 2352.68 2428.06 1831.38 1876.87 1917.15 1932.85 2116.68 2177.41<br />

No. <strong>of</strong> Distribution Transformers 102117 102117 102117 114893 139170 148099 158212 158212 125799 214442<br />

Aggregate Capacity <strong>of</strong> DTs (kVA) 6493215 6493215 6493215 7547142 12012274 12861815 13618012 13618012 11142573 18773263<br />

A-8

Parameter 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

Haryana (1999-2000)<br />

Length <strong>of</strong> 33 kV Lines (ckt km) 4288 4357 3386 3386 4473 4473 4473 3718 3866 3966<br />

Length <strong>of</strong> 11 kV Lines (ckt km) 53159 53816 54240 54240 55765 55765 55765 59048 59729 65638<br />

Distribution Lines upto 500 Volts 102639 103266 103878 103878 105749 105749 105749 107695 107969 111150<br />

Ratio LT to HT (upto 11 kV) 1.93 1.92 1.92 1.92 1.90 1.90 1.90 1.82 1.81 1.69<br />

HT Lines (ckt km)/1000 sq km 1202.42 1217.28 1226.87 1226.87 1261.37 1261.37 1261.37 1335.63 1351.03 1484.69<br />

LT Lines (ckt km)/1000 sq km 2321.62 2335.81 2349.65 2349.65 2391.97 2391.97 2391.97 2435.99 2442.19 2514.14<br />

No. <strong>of</strong> Distribution Transformers 93356 93356 99938 103678 103678 103678 103678 124809 133425 146810<br />

Aggregate Capacity <strong>of</strong> DTs (kVA) 6317560 6317560 6822865 7272612 7272612 7272612 7272612 8939692 9535301 10306617<br />

DTs Failure Rate (%)<br />

Orissa (1996-97)*<br />

33.00 27.80 25.73 20.19 16.56 15.68 16.15 16.30<br />

Length <strong>of</strong> 33 kV Lines (ckt km) 9,841 9,841 9,440 9,440 9,440 10,209 10,209 10,199 - 11,026<br />

Length <strong>of</strong> 11 kV Lines (ckt km) 48,551 48,401 50,141 50,141 50,141 61,293 61,293 61,293 27,180 61,920<br />

Distribution Lines upto 500 Volts 51,510 51,459 58,755 58,755 58,755 58,755 58,755 58,755 58,755 58,755<br />

Ratio LT to HT (upto 11 kV) 1.06 1.06 1.17 1.17 1.17 1.19 0.96 0.96 - 0.95<br />

HT Lines (ckt km)/1000 sq km 311.80 310.84 322.02 322.02 322.02 393.64 393.64 393.64 174.56 397.66<br />

LT Lines (ckt km)/1000 sq km 330.81 330.48 377.34 377.34 377.34 466.81 377.34 377.34 377.34 377.34<br />

No. <strong>of</strong> Distribution Transformers 22,938 22,938 22,938 31,290 31,290 31,290 31,290 31,290 22,181 34,424<br />

Aggregate Capacity <strong>of</strong> DTs (kVA)<br />

DTs Failure Rate (%)<br />

1,660,364 1,660,364 1,660,364 4,837,950 4,837,950 4,837,950 4,837,950 4,837,950 1,847,571 2,643,156<br />

- NESCO 17.00 15.00 14.00 13.00 11.00 15.00<br />

- WESCO 18.57 19.50 20.49 18.65 16.91<br />

A-9

Parameter 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

Madhya Pradesh (2002-03)*<br />

Length <strong>of</strong> 33 kV Lines (ckt km) 34,160 32,745 33,932 34,460 34,940 35,300 35,300 29,535 29,804 30,790<br />

Length <strong>of</strong> 11 kV Lines (ckt km) 189,984 190,303 191,737 194,884 195,821 194,383 153,688 174,073 170,613 174,571<br />

Distribution Lines upto 500 Volts 350,659 354,331 353,874 362,762 367,793 371,227 344,060 369,406 364,329 369,756<br />

Ratio LT to HT (upto 11 kV) 1.85 1.86 1.85 1.86 1.88 1.91 2.24 2.12 2.14 2.12<br />

HT Lines (ckt km)/1000 sq km 428.43 429.15 432.39 439.48 441.60 438.35 498.58 564.71 553.49 566.33<br />

LT Lines (ckt km)/1000 sq km 790.77 799.05 798.02 818.06 829.41 837.15 1116.17 1198.40 1181.93 1199.53<br />

No. <strong>of</strong> Distribution Transformers 157,466 225,313 236,543 249,003 249,003 249,003 249,003 168,980 173,888 307,952<br />

Aggregate Capacity <strong>of</strong> DTs (kVA) 11,630,648 11,820,877 12,410,070 14,149,999 14,149,999 14,149,999 14,149,999 14,595,914 15,411,238 28,047,304<br />

DTs Failure Rate (%)<br />

Rajasthan (2000-01)*<br />

14.1 14.56 18.13 20.37 24.14 22.88<br />

Length <strong>of</strong> 33 kV Lines (ckt km) 21,105 21,105 23,180 24,477 25,393 25,773 25,773 27,720 23,228 29,781<br />

Length <strong>of</strong> 11 kV Lines (ckt km) 127,102 130,725 138,928 145,265 150,652 157,490 157,504 165,417 173,881 184,994<br />

Distribution Lines upto 500 Volts 179,022 183,154 192,178 198,618 205,116 216,360 216,360 221,317 225,550 232,820<br />

Ratio LT to HT (upto 11 kV) 1.41 1.40 1.38 1.37 1.36 1.37 1.37 1.34 1.30 1.26<br />

HT Lines (ckt km)/1000 sq km 371.38 381.97 405.94 424.45 440.19 460.17 460.22 483.35 508.07 540.54<br />

LT Lines (ckt km)/1000 sq km 523.09 535.16 561.53 580.35 599.33 632.19 632.19 646.67 659.04 680.28<br />

No. <strong>of</strong> Distribution Transformers 127,176 127,176 164,826 181,048 196,396 201,680 201,680 229,563 257,052 303,700<br />

Aggregate Capacity <strong>of</strong> DTs (kVA) 7,351,708 7,351,708 8,837,219 9,514,466 10,062,377 10,321,565 10,321,565 11,420,254 12,189,328 13,956,805<br />

DTs Failure Rate (%) 13.43 13.49 15.01 17.55<br />

A-10

Parameter 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

Uttar Pradesh (1999-00)*<br />

Length <strong>of</strong> 33 kV Lines (ckt km) 24,376 24,376 25,325 25,941 25,971 25,971 27,743 28,407 29,286 29,159<br />

Length <strong>of</strong> 11 kV Lines (ckt km) 184,571 185,142 192,481 196,310 194,622 194,622 196,782 199,303 202,238 206,823<br />

Distribution Lines upto 500 Volts 220,022 223,549 230,332 234,256 232,460 232,460 232,460 236,945 238,786 239,342<br />

Ratio LT to HT (upto 11 kV) 1.19 1.21 1.20 1.19 1.19 1.19 1.18 1.19 1.18 1.16<br />

HT Lines (ckt km)/1000 sq km 626.92 628.86 653.79 666.79 661.06 661.06 816.76 827.22 839.41 858.44<br />

LT Lines (ckt km)/1000 sq km 747.33 759.31 782.35 795.68 789.58 789.58 964.84 983.46 991.10 993.41<br />

No. <strong>of</strong> Distribution Transformers 276,448 276,448 304,011 315,146 315,146 315,146 315,146 315,146 354,402 354,708<br />

Aggregate Capacity <strong>of</strong> DTs (kVA) 14,594,258 14,594,258 16,854,422 17,518,011 17,518,011 17,518,011 17,518,011 17,518,011 19,448,081 19,556,036<br />

DTs Failure Rate (%)<br />

All India<br />

20 20 20<br />

Length <strong>of</strong> 33 kV Lines (ckt km) 181,452 182,348 193,099 198,578 195,740 205,004 218,027 233,729 213,883 229,166<br />

Length <strong>of</strong> 11 kV Lines (ckt km) 1,523,749 1,533,518 1,593,105 1,634,840 1,660,453 1,711,619 1,753,331 1,936,689 1,869,371 1,971,722<br />

Distribution Lines upto 500 Volts 3,081,842 3,108,830 3,405,788 3,538,189 3,525,121 3,574,500 3,679,596 3,985,909 3,859,504 3,953,456<br />

Ratio LT to HT (upto 11 kV) 2.02 2.03 2.14 2.16 2.12 2.09 2.10 2.06 2.06 2.01<br />

HT Lines (ckt km)/1000 sq km 463.53 466.51 484.63 497.33 505.12 520.69 533.37 589.15 568.67 599.81<br />

LT Lines (ckt km)/1000 sq km 937.52 945.73 1036.06 1076.34 1072.36 1087.39 1119.36 1212.54 1174.09 1202.67<br />

No. <strong>of</strong> Distribution Transformers 1,642,664 1,694,711 1,869,024 1,999,989 2,089,009 2,140,153 2,207,340 2,364,709 2,492,274 2,916,588<br />

Aggregate Capacity <strong>of</strong> DTs (kVA) 135,852,203 124,602,352 154,171,507 141,973,942 179,930,696 169,119,362 176,025,524 196,685,931 206,667,870 236,070,385<br />

* Year <strong>of</strong> Restructuring <strong>of</strong> SEB (Source: CEA)<br />

A-11

Percentage Transformation, Transmission and Distribution Losses<br />

(including Energy Unaccounted for) in States/Union Territories (UTs)<br />

Annexure-XIV<br />

STATES/UTs 1990-91 1991-92 1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

1 Haryana 27.49 26.79 26.78 25.00 30.80 32.39 32.77 34.04 35.33 38.28 39.82 39.22 37.65 32.07 32.11<br />

2 Himachal 20.96 19.81 19.98 18.80 19.17 16.41 18.42 20.22 26.35 22.76 23.38 25.55 21.16 22.76 28.9<br />

3 J&K 42.96 50.08 48.13 46.37 50.07 49.03 49.97 51.34 47.97 45.04 45.39 48.85 45.55 45.54 41.08<br />

4 Punjab 19.26 21.75 19.61 19.70 17.19 18.32 18.95 18.79 17.98 18.32 26.58 27.70 24.42 25.96 25.42<br />

5 Rajasthan 25.76 23.07 22.71 24.85 24.65 29.29 25.88 26.42 29.41 30.33 29.76 43.06 42.61 43.74 44.68<br />

6 UP 27.13 26.13 24.68 24.37 21.87 22.75 25.06 26.47 30.28 40.37 36.94 37.62 34.16 35.17 34.39<br />

7 Uttaranchal 32.39 25.17 49.23 39.3<br />

8 Chandigarh 23.72 29.64 26.21 27.27 28.44 33.72 21.88 22.38 22.48 24.70 25.41 24.97 24.06 39.06 30.37<br />

9 Delhi 24.93 24.66 24.02 32.54 35.08 49.57 49.64 48.51 50.54 46.67 44.27 43.97 45.82 43.66 45.4<br />

10 BBMB 4.43 4.33 3.52 3.64 4.05 3.85 3.12 3.84 4.47 4.14 4.32 4.81 5.20 1.22 0.98<br />

11 Gujarat 23.44 23.56 22.20 20.81 20.87 21.03 21.42 24.41 25.34 25.34 28.14 26.87 28.52 24.20 30.43<br />

12 MP 17.98 25.82 22.52 21.78 20.75 19.27 20.59 20.94 21.05 33.67 46.07 44.55 43.31 41.44 41.3<br />

13 Chhattisgarh 33.75 37.86 42.55 28.06<br />

14 Maharashtra 18.26 18.61 18.51 17.83 17.47 18.21 17.72 18.04 17.82 29.20 33.81 37.28 34.01 34.12 32.4<br />

15 D&N Haveli 17.69 19.66 17.98 12.64 11.35 9.31 8.80 12.90 15.37 31.69 39.84 27.22 40.26 15.10 16.00<br />

16 Goa 24.97 23.78 21.85 24.50 26.87 26.06 23.50 31.02 30.40 27.56 28.70 25.18 40.26 45.05 35.97<br />

17 Daman&Diu 16.85 15.9 15.67 22.34 16.30 12.80 8.15 14.69 21.83 11.33 11.38 7.52 14.95 16.88 15.56<br />

18 AP 22.93 20.25 20.65 20.21 18.05 19.58 33.09 32.28 33.56 37.65 36.63 26.81 30.11 27.73 23.96<br />

19 Karnataka 20.17 19.93 19.62 19.49 19.35 19.15 18.86 19.06 30.57 37.31 34.93 33.83 24.57 23.29 26.08<br />

20 Kerala 22.36 22.47 22.77 20.52 20.81 21.48 21.37 19.12 17.69 17.76 18.44 32.21 27.45 21.63 22.48<br />

21 Tamilnadu 17.98 18.44 17.30 16.99 17.12 16.13 17.22 17.06 16.75 17.01 15.72 16.06 17.31 17.16 19.28<br />

22 Lakshadweep 18.62 17.43 18.72 16.99 17.84 17.23 15.11 15.70 12.78 10.13 6.71 10.94 11.29 11.85 10.20<br />

23 Pondicherry 19.2 18 15.31 15.80 15.00 16.54 17.38 13.56 10.44 12.25 7.93 12.00 21.10 11.60 18.15<br />

A-12

STATES/UTs 1990-91 1991-92 1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

24 Bihar 16.47 18.31 17.15 15.12 15.28 12.62 18.16 11.01 16.53 15.46 17.86 51.70 37.98 36.66 38.88<br />

25 Jharkhand 26.39 21.19 25.35 19.62<br />

26 Orissa 25.77 25.3 25.87 23.07 23.66 25.63 50.38 49.79 43.20 44.26 44.91 47.34 45.36 57.09 44.02<br />

27 Sikkim 24.53 25.89 22.55 22.60 21.22 16.47 29.24 22.87 12.44 12.07 24.98 31.73 54.85 54.99 50.49<br />

28 West Bengal 17.69 19.72 17.53 15.96 19.45 19.98 20.62 20.35 22.89 26.33 29.44 31.67 25.93 31.01 28.54<br />

29 A & N 19.83 21.66 23.62 23.71 22.38 19.25 19.15 20.59 20.03 16.52 17.49 29.20 19.78 25.95 12.63<br />

30 DVC 2.61 2.3 1.99 1.33 0.64 2.15 1.98 1.21 2.56 2.48 4.75 3.63 3.34 2.69 2.69<br />

31 Assam 24.1 22.66 21.41 22.44 24.18 27.60 25.97 27.32 38.72 38.96 40.71 42.78 38.30 39.31 51.76<br />

32 Manipur 28.02 24.43 22.35 23.92 25.30 24.85 22.95 21.09 59.55 62.06 58.49 62.35 63.66 65.18 70.61<br />

33 Meghalaya 11.56 11.65 11.62 17.89 19.03 12.66 19.48 12.13 19.93 27.38 20.97 22.66 21.92 16.73 28.35<br />

34 Nagaland 26.08 23.14 27.26 33.45 36.12 35.17 26.81 29.79 26.52 32.32 24.60 52.32 56.71 55.00 48.26<br />

35 Tripura 29.59 31.96 30.64 30.53 31.96 30.86 30.11 31.11 26.82 29.63 43.89 40.38 40.64 46.44 59.54<br />

36 Arunachal Pr. 19.99 28.2 32.32 42.04 45.30 37.12 32.62 34.10 30.60 47.12 34.41 53.58 38.95 47.54 42.96<br />

37 Mizoram 29.63 34.95 29.04 31.89 29.76 25.18 34.35 46.84 44.79 47.63 45.42 49.77 46.91 55.54 66.14<br />

All India 22.89 22.83 21.80 21.41 21.13 22.27 24.53 24.79 26.45 30.93 32.86 33.98 32.54 32.53 31.25<br />

(Source : CEA)<br />

A-13

Commercial Pr<strong>of</strong>it/Loss (without Subsidy) <strong>of</strong> State <strong>Power</strong> Utilities<br />

Annexure - XV(A)<br />

States 1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01<br />

(Rs crore)<br />

2001-02 2002-03 2003-04 2004-05<br />

Andhra Pradesh -4 -23 -981 -1255 -939 -1376 -2679 -3117 -2559 -2948 -1232 -1579 -1194<br />

Assam -205 -197 -255 -261 -244 -439 -322 -214 -379 -696 -776 -656 -1081<br />

Bihar -280 -190 -189 -211 -442 -495 -605 -511 -670 -896 -966 -987 -1122<br />

Chhattisgarh 204 643 561 370<br />

Delhi -207 - 0 -578 -626 -760 -1039 -1103 -1055 -1092 -803 -1781 -812<br />

Gujarat -519 -493 -550 -1003 -952 -1364 -2039 -3778 -3920 -3146 -2267 -3031 -2125<br />

Haryana -404 -507 -468 -554 -635 -765 -704 -1247 -1960 -948 -803 -785 -1449<br />

Himachal Pradesh 2 -51 19 11 -19 -33 -88 -206 -92 -107 -52 -46 -37<br />

Jammu & Kashmir -225 -293 -347 -363 -507 -661 -835 -793 -990 -703 -1089 -989 -1080<br />

Jharkhand -255 -462 -730 -1183<br />

Karnataka -19 -2 -164 -502 -652 -322 -847 -975 -1675 -1870 -1599 -1315 -1107<br />

Kerala -65 -75 -129 -183 -208 -199 -411 -646 -1129 -1254 -935 -916 -239<br />

Madhya Pradesh -493 -377 -594 -602 -464 -1058 -2655 -3151 -3264 -1703 -835 -667 -764<br />

Maharashtra 162 189 276 -408 -92 -11 160 -1479 -1404 -540 -255 -549 -804<br />

Meghalaya -8 -3 -21 -20 -15 -26 -50 -53 -44 -34 -52 64 -9<br />

Orissa -85 -196 -136 -231 -375 -392 -538 -187 -216 -261 -944 193 303<br />

Punjab -626 -693 -681 -644 -603 -943 -1354 -2113 -1477 -1868 -1386 -663 -1520<br />

Rajasthan -260 -415 -412 -430 -498 -640 -1331 -1899 615 -1324 -1739 -1777 -2037<br />

Tamil Nadu -258 -302 -2 -77 -257 -296 -741 -1442 -1447 -5174 -2100 -1360 -2030<br />

Uttar Pradesh -808 -1202 -1152 -1136 -3378 -3692 -3692 -2596 -2534 -2518 -2374 -2116 -3624<br />

Uttranchal -26 23 -40 -179<br />

West Bengal -258 -231 -339 -322 -398 -492 -1089 -842 -1059 -1706 -914 -296 -275<br />

All India -4560 -5060 -6125 -8770 -11305 -13963 -20860 -26353 -25259 -29331 -21193 -19722 -22129<br />

(Source : Planning Commission and PFC)<br />

A-14

Commercial Pr<strong>of</strong>it/Loss (with Subsidy) <strong>of</strong> State <strong>Power</strong> Utilities<br />

Annexure-XV(B)<br />

States<br />

(Rs crore)<br />

1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

Andhra Pradesh -4 -23 -37 4 -89 -1376 -130 -53 -932 284 855 1467 1231<br />

Assam -205 -197 -255 -261 -244 -439 -322 -214 -379 -549 -587 -631 -907<br />

Bihar -280 -190 -189 -211 -442 -495 -605 -511 -670 -1167 -1456 -1511 -1606<br />

Delhi -207 NA NA -578 -626 -760 -1039 -1103 -1055 -- -881 -1609 -584<br />

Gujarat 100 92 106 108 111 119 -366 -2501 -2604 188 101 -343 649<br />

Haryana -368 -447 -13 46 7 -32 -340 -835 -1548 -919 -5 187 -392<br />

Himachal Pradesh 2 -51 19 11 -19 -33 -88 -206 -92 -120 -98 83 -58<br />

Jammu & Kashmir -225 -293 -347 -363 -507 -661 -835 -793 -990 50 -1112 -996 -1032<br />

Karnataka 32 34 43 51 54 58 67 76 76 213 103 412 621<br />

Kerala -65 -75 -120 -130 -176 -199 -205 -181 -348 -682 138 -211 -117<br />

Madhya Pradesh -113 38 -80 -8 -163 -812 -2534 -2718 -2800 -2197 11 1015 -296<br />

Maharashtra 162 189 276 222 166 295 515 605 -1404 -451 -368 415 2209<br />

Meghalaya -2 4 -14 -12 -7 -17 -41 -43 -34 -24 -55 65 -23<br />

Orissa 26 30 25 27 -363 -386 -538 -187 -212 36 -475 422 464<br />

Punjab -626 -693 -681 -644 -603 -943 -1354 -1709 -1477 -1415 -40 1528 1315<br />

Rajasthan 22 10 77 81 63 65 -134 -133 615 -1581 -626 -412 -578<br />

Tamil Nadu 92 226 348 339 330 274 335 -1192 -1197 -4457 700 -494 -139<br />

West Bengal -258 -158 -242 -240 -343 -402 -1040 -793 -1009 -1181 -94 183 713<br />

Uttar Pradesh -808 -1202 85 381 -1821 -1853 -1853 -2596 -1734 -1395 -295 -1004 -3557<br />

All India -2725 -2706 -998 -1178 -4674 -7598 -10509 -15088 -17794 -16725 -4846 -2268 -3438<br />

(Source : Planning Commission and PFC)<br />

A-15

Rs crore<br />

30000<br />

25000<br />

20000<br />

15000<br />

10000<br />

5000<br />

0<br />

Losses <strong>of</strong> State <strong>Power</strong> Utilities (without Subsidy)<br />

All State<br />

Utiltiies<br />

Group-1<br />

States<br />

Annexure-XV(C)<br />

1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

All State Utilities 4560 5060 6125 8770 11305 13963 20860 26353 25259 29252 20887 19465 21998<br />

Group-1 States excluding UP 1472 1519 2756 4152 4188 5311 9793 11680 10114 8689 7932 7751 7239<br />

Other States excluding UP 2280 2339 2217 3482 3738 4960 7375 12078 12611 15397 10581 9598 11135<br />

(Source : Planning Commission and PFC)<br />

A-16

Rs crore<br />

45000<br />

40000<br />

35000<br />

30000<br />

25000<br />

20000<br />

15000<br />

10000<br />

5000<br />

0<br />

Losses <strong>of</strong> State <strong>Power</strong> Utilities (without Subsidy)<br />

Business as usual continues vs. Effect <strong>of</strong> Reforms and Restructuring<br />

Annexure-XV(D)<br />

All State Utilities 4560 5060 6125 8770 11305 13963 20860 26353 25259 29252 20887 19465 21998 21334 20808<br />

Group-1 States<br />

excluding UP<br />

All SEBs/ Utilities-<br />

Business as usual continues<br />

Group-1 excluding UP -<br />

Business as usual continues<br />

Business as<br />

usual<br />

all SEBs<br />

Business<br />

as usual<br />

Group-1<br />

Reduction in<br />

Losses for<br />

Group-1<br />

1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07<br />

1472 1519 2756 4152 4188 5311 9793 11680 10114 8689 7932 7751 7239 6499 5867<br />

29252 31940 34993 38046 41098 44151<br />

11680 11566 13000 14435 15870 17305 18740 20174<br />

(Source : Planning Commission and PFC)<br />

A-17

Rs crore<br />

5000<br />

0<br />

-5000<br />

-10000<br />

-15000<br />

-20000<br />

Cash Pr<strong>of</strong>it/Loss <strong>of</strong> State <strong>Power</strong> Utilities (with Subsidy)<br />

All State<br />

Utilities<br />

Group-1<br />

States<br />

Other<br />

States<br />

Annexure-XV(E)<br />

1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

All State Utilities -2725 -2706 -998 -1178 -4674 -7598 -10509 -15088 -17794 -16725 -4846 -2268 -3438<br />

Group-1 States (excluding UP) -613 -357 15 -377 -1118 -3243 -4649 -4953 -5856 -4164 -1018 1482 466<br />

Other States excluding UP -1305 -1147 -1098 -1181 -1735 -2502 -4006 -7539 -10203 -11166 -3533 -2746 -347<br />

(Source : Planning Commission and PFC)<br />

A-18

Rs crore<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

% <strong>of</strong> Losses <strong>of</strong> Group 1 States<br />

excluding UP compared to all<br />

the states (excluding UP)<br />

0<br />

Percentage <strong>of</strong> Losses <strong>of</strong> Group-1 States (excluding UP)<br />

compared to all the States (excluding UP)<br />

Effect <strong>of</strong><br />

Restructuring<br />

Annexure-XV(F)<br />

1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

55 54 53 52 57 49 45 36 43 45 39<br />

(Source : Planning Commission and PFC)<br />

A-19

Annexure-XV(G)<br />

Commercial losses <strong>of</strong> State <strong>Power</strong> Utilities as a Percentage <strong>of</strong> Revenue (sale <strong>of</strong> power)<br />

States 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

Andhra Pradesh -54.85 -28.57 -34.48 -64.27 -68.95 -42.57 -49.86 -16.66 -20.56 -13.93<br />

Assam -71.23 -60.57 -108.39 -70.77 -38.45 -56.30 -110.30 -115.99 -81.59 -124.68<br />

Bihar -18.07 -34.78 -33.63 -42.68 -28.44 -33.70 -99.12 -106.39 -104.22 -113.91<br />

Chhatishgarh 11.28 27.96 22.56 15.19<br />

Delhi -37.05 -35.16 -34.21 -48.12 -46.25 -38.82 -33.61 -47.91 -17.46<br />

Gujarat -30.69 -22.79 -27.67 -37.20 -67.93 -58.00 -44.54 -29.77 -36.89 -24.26<br />

Haryana -47.70 -45.15 -46.04 -37.99 -65.33 -87.11 -34.96 -27.59 -24.23 -42.90<br />

Himachal Pradesh 3.64 -5.41 -7.62 -18.20 -36.49 -13.95 -16.72 -6.87 -4.67 -3.04<br />

Jammu & Kashmir -655.83 -819.47 -700.08 -834.18 -381.34 -440.20 -244.17 -180.15 -199.26<br />

Jharkand -27.60 -44.55 -68.93 -106.67<br />

Karnataka -27.54 -30.52 -12.14 -30.32 -29.58 -44.64 -42.01 -35.62 -22.26 -16.95<br />

Kerala -26.61 -30.98 -20.84 -34.39 -39.77 -55.79 -64.44 -37.69 -33.24 -8.19<br />

Madhya Pradesh -18.17 -11.11 -25.22 -56.25 -56.39 -52.45 -47.07 -19.44 -13.74 -14.89<br />

Maharashtra -5.80 -1.08 -0.12 1.61 -14.10 -12.45 -4.49 -2.05 -4.15 -5.72<br />

Meghalaya -36.50 -26.56 -36.73 -75.10 -65.76 -45.56 -35.79 -42.28 40.76 -4.04<br />

Orissa -25.40 -32.71 -28.85 -36.93 -11.54 -12.14 -15.66 -50.16 9.74 14.13<br />

Punjab -31.30 -24.78 -33.91 -40.96 -59.49 -37.21 -41.85 -26.76 -11.20 -25.97<br />

Rajasthan -21.71 -20.97 -21.57 -40.12 -50.16 15.44 -34.39 -43.29 -42.92 -44.89<br />

Tamil Nadu -1.88 -5.79 -5.65 -13.26 -23.24 -19.40 -65.40 -22.93 -12.54 -18.23<br />

UP(<strong>Power</strong> corp.) -30.87 -87.38 -79.32 -79.32 -46.83 -38.72 -40.06 -39.63 -53.75 -55.82<br />

Uttranchal -10.12 3.44 -4.23 -23.96<br />

West Bengal -24.17 -27.89 -27.22 -59.69 -40.27 -47.36 -72.97 -34.93 -7.75 -6.80<br />

All State Utilities -23.63 -25.71 -27.35 -37.90 -42.93 -35.77 -41.69 -26.20 -22.04 -22.60<br />

(Source : Planning Commission and PFC)<br />

A-20

Percentage<br />

Commercial Losses <strong>of</strong> State <strong>Power</strong> Utilities as a Percentage <strong>of</strong> Revenue (Sale <strong>of</strong> <strong>Power</strong>)<br />

60.00<br />

50.00<br />

40.00<br />

30.00<br />

20.00<br />

10.00<br />

0.00<br />

All State<br />

Utilities<br />

Group-1<br />

States<br />

Annexure-XV(H)<br />

1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

All State Utilities 23.63 25.71 27.35 37.90 42.93 35.77 41.69 26.20 22.04 22.60<br />

Group-1 States 31.85 25.69 27.90 47.84 50.55 37.87 45.68 29.06 24.46 20.20<br />

Other States 19.18 25.73 27.03 32.02 38.33 34.49 39.85 24.74 20.72 23.93<br />

Other<br />

States<br />

(Source: Planning Commission and PFC)<br />

A-21

% to<br />

Amount<br />

Revenue Amount<br />

% to<br />

Revenue Amount<br />

% to<br />

Revenue Amount<br />

% to<br />

Revenue Amount<br />

% to<br />

Revenue Amount<br />

Subsidy Booked & Subsidy Received and Percentage <strong>of</strong> Subsidy Booked & Received to Total Revenue<br />

(For Utilities selling directly to consumers) (Rs crore)<br />

2000-01<br />

2001-02<br />

2002-03<br />

Sl.<br />

No.<br />

State<br />

Subsidy Booked Subsidy Received Subsidy Booked Subsidy Received Subsidy Booked Subsidy Received<br />

% to<br />

Revenue<br />

1 Andhra Pradesh 2936 61.4 2788 58.30 2437 41.2 2437 41.2 1509 20.41 1509 20.41<br />

2 Haryana 820 36.44 820 36.44 763 28.13 763 28.13 829 28.49 829 28.49<br />

3 Karnataka 1821 50.27 708 19.54 2211 49.67 1872 42.05 1333 29.69 1240 27.62<br />

4 Madhya Pradesh - - - - 543 15.01 543 15.01 668 15.55 851 19.81<br />

5 Orissa 0 0 0 0 0 0 0 0 0 0 0 0<br />

6 Rajasthan - - - - 1324 34.39 286 7.43 1047 26.06 278 6.92<br />

7 Uttar Pradesh 240 3.85 240 3.85 862 13.72 862 13.72 849 14.17 849 14.17<br />

8 Assam 52 8.45 0 0 52 8.29 0 0 80 11.97 80 11.97<br />

9 Gujarat 2021 33.22 2021 33.22 2579 36.51 2579 36.51 1,805 23.70 1,527 20.05<br />

10 Maharashtra -373 -3.2 -373 -3.20 0 0 0 0 0 0 0 0<br />

11 Tamil Nadu 1693 22.8 250 3.37 323 4.01 323 4.01 2,212 24.15 2,212 24.15<br />

12 West Bengal 215 10.22 50 2.38 239 10.23 100 4.28 0 0 0 0<br />

All India 12183 17.25 14541 20.67 9563 13.59 12,907 15.96 11,577 14.32<br />

% to<br />

Amount<br />

Revenue Amount<br />

% to<br />

Revenue Amount<br />

% to<br />

Revenue Amount<br />

2003-04<br />

2004-05<br />

Sl.<br />

No.<br />

State<br />

Subsidy Booked Subsidy Received Subsidy Booked Subsidy Received<br />

% to<br />

Revenue<br />

1 Andhra Pradesh 1515 19.73 1515 19.73 1303 15.20 1303 15.20<br />

2 Haryana 1026 31.67 924 28.52 1102 32.62 1102 32.62<br />

3 Karnataka 1529 25.88 1172 19.84 1569 24.02 1400 21.43<br />

4 Madhya Pradesh 818 16.85 1,049 21.61 817 15.93 817 15.93<br />

5 ORISSA 0 0 0 0 0 0 14 0.65<br />

6 Rajasthan 1060 25.60 534 12.90 1298 28.60 690 15.20<br />

7 Uttar Pradesh 0 0 0 0 693 10.67 693 10.67<br />

8 Assam 0 0 0 0 70 8.04 70 8.04<br />

9 Gujarat 1,101 13.40 2,017 24.55 1,101 12.56 2,026 23.11<br />

10 Maharashtra 0 0 0 0 1 0.01 1 0.01<br />

11 Tamil Nadu 250 2.30 250 2.30 925 8.30 925 8.30<br />

12 West Bengal 0 0 0 0 0 0 0 0<br />

All India 9,905 11.07 10,101 11.29 10956 11.19 11,693 11.94<br />

(Source : PFC)<br />

Annexure-XV(I)<br />

A-22

Percentage<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

Percentage <strong>of</strong> Energy Shortage (Group-1 States)<br />

Annexure-XVI(A)<br />

1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06<br />

Andhra Pradesh 9 7 8 9 7 3 1 1<br />

Delhi 2 3 5 3 2 1 1 2<br />

Haryana 2 2 3 2 3 5 6 9<br />

Karnataka 13 8 9 13 10 14 4 1<br />

Madhya Pradesh 6 7 12 15 16 13 14 14<br />

Orissa -3 -3 -3 0 2 2 1 1<br />

Rajasthan 3 5 4 1 2 1 1 4<br />

Uttar Pradesh 15 10 17 13 20<br />

India 6 5 8 8 9 7 7 8<br />

India<br />

(Source : MoP)<br />

A-25

Percentage<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

India<br />

Percentage <strong>of</strong> Peak Shortage (Group-1 States)<br />

Annexure-XVI(B)<br />

1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06<br />

Andhra Pradesh 9 12 15 20 19 11 2 2<br />

Delhi 8 12 13 8 9 3 2 3<br />

Haryana 8 0 3 3 3 5 10 9<br />

Karnataka 16 16 13 17 22 12 5 10<br />

Madhya Pradesh 25 30 25 13 14 22 19 22<br />

Orissa 2 5 -2 7 6 7 0 2<br />

Rajasthan 4 0 3 1 2 0 8 14<br />

Uttar Pradesh 15 9 14 17 20<br />

India 13 14 12 13 13 12 12 12<br />

(Source : MoP)<br />

A-26

Per Capita Consumption <strong>of</strong> Electricity (kWh per year)<br />

Anneure-XVII<br />

States 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05<br />

Andhra Pradesh<br />

(1999-2000)*<br />

345.70 391.00 405.33 433.96 433.14 699.74 672.64 718.84 764.75<br />

Karnataka<br />

(1999-2000)*<br />

340.14 387.09 350.64 367.02 411.74 638.03 611.16 642.26 660.04<br />

Haryana<br />

(1999-2000)*<br />

503.78 488.02 502.41 530.20 544.31 924.37 997.08 923.83 950.69<br />

Orissa<br />

(1996-97)*<br />

308.90 308.18 321.16 334.28 342.89 550.02 470.18 695.42 735.49<br />

Madhya Pradesh<br />

(2002-03)*<br />

366.95 377.51 398.17 353.13 294.82 495.48 520.35 474.78 515.50<br />

Rajasthan<br />

(2000-01)*<br />

301.23 314.34 330.28 339.51 349.54 517.41 566.14 539.62 583.32<br />

Uttar Pradesh<br />

(1999-2000)*<br />

196.56 199.53 198.79 179.06 191.08 311.28 316.13 299.63 308.83<br />

ALL INDIA 334.26 348.50 360.01 364.45 366.12 559.18 566.69 592.00 612.50<br />

(Source : CEA)<br />

* Year <strong>of</strong> Restructuring <strong>of</strong> SEB<br />

Note : From 2001-02 onwards the figures refer to annual per capita consumption <strong>of</strong> electricity<br />

as per new definition adopted.<br />

A-27

Percentage<br />

70.00<br />

60.00<br />

50.00<br />

40.00<br />

30.00<br />

20.00<br />

10.00<br />

0.00<br />

-10.00<br />

Presentage <strong>of</strong> Subsidy Booked to Total Revenue<br />

States<br />

Annexure-XV(J)<br />

AP Haryana Karnataka MP Orissa Rajasthan UP Assam Gujarat Maharashtra Tamilnadu West Bengal All India<br />

2000-01 61.40 36.44 50.27 0.00 3.85 8.45 33.22 -3.20 22.80 10.22 17.25<br />

2001-02 41.20 28.13 49.67 15.01 0.00 34.39 13.72 8.29 36.51 0.00 4.01 10.23 20.67<br />

2002-03 20.41 28.49 29.69 15.55 0.00 26.06 14.17 11.97 23.70 0.00 24.15 0.00 15.96<br />

2003-04 19.73 31.67 25.88 16.85 0.00 25.60 0.00 0.00 13.40 0.00 2.30 0.00 11.07<br />

2004-05 15.20 32.62 24.02 15.93 0.00 28.60 10.67 8.04 12.56 0.01 8.30 0.00 11.19<br />

(Source : PFC)<br />

A-23

Percentage<br />

70.00<br />

60.00<br />

50.00<br />

40.00<br />

30.00<br />

20.00<br />

10.00<br />

0.00<br />

-10.00<br />

Presentage <strong>of</strong> Subsidy Received<br />

to Total Revenue<br />

States<br />

Annexure-XV(K)<br />

AP Haryana Karnataka MP Orissa Rajasthan UP Assam Gujarat Maharashtra Tamilnadu West Bengal All India<br />

2000-01 58.30 36.44 19.54 0.00 3.85 0.00 33.22 -3.20 3.37 2.38<br />

2001-02 41.20 28.13 42.05 15.01 0.00 7.43 13.72 0.00 36.51 0.00 4.01 4.28 13.59<br />

2002-03 20.41 28.49 27.62 19.81 0.00 6.92 14.17 11.97 20.05 0.00 24.15 0.00 14.32<br />

2003-04 19.73 28.52 19.84 21.61 0.00 12.90 0.00 0.00 24.55 0.00 2.30 0.00 11.29<br />

2004-05 15.20 32.62 21.43 15.93 0.65 15.20 10.67 8.04 23.11 0.01 8.30 0.00 11.94<br />

A-24

Introduction to Volume-II<br />

Study on ‘Impact <strong>of</strong> Restructuring <strong>of</strong> SEBs’<br />

Synopsis <strong>of</strong> Volume-I <strong>of</strong> the <strong>Report</strong> has been presented in this<br />

Volume. It primarily contains the operative portion <strong>of</strong> the<br />

National <strong>Report</strong>, i.e., Recommendations and Way Forward.<br />

This Volume has been specifically prepared to serve as a ready<br />

reference and to ensure wider dissemination. For any<br />

clarifications, please refer to Volume-I.

CONTENTS<br />

Executive Summary............................................................................................ 1<br />

A. Background ......................................................................................................... 1<br />

B. Overview <strong>of</strong> the Sector ....................................................................................... 3<br />

C. Restructuring Models and Progress.................................................................. 3<br />

D. Outcome <strong>of</strong> Restructuring <strong>of</strong> the <strong>Power</strong> Sector ............................................... 5<br />

E. Regulatory Commissions.................................................................................... 6<br />

F. Rural Electrification........................................................................................... 6<br />

G. Other Findings .................................................................................................... 7<br />

H. Findings and Recommendations ....................................................................... 7<br />

Chapter-1<br />

Recommendations............................................................................................... 9<br />

6.1 Political Commitment and Support .................................................................. 9<br />

6.2 Detailed Policy Statements............................................................................... 10<br />

6.3 Communication Strategy ................................................................................. 10<br />

6.4 Consultancy Support........................................................................................ 11<br />

6.5 Human Resources Development Issues .......................................................... 12<br />

6.6 Financial Restructuring Plans......................................................................... 13<br />

6.7 Managing the Reforms Process ....................................................................... 13<br />

6.8 Role <strong>of</strong> the Electricity Regulatory Commissions ........................................... 13<br />

6.9 Establishing a <strong>Power</strong> Sector Reform Fund .................................................... 15<br />

6.10 Access to Central Institutional Funds by Privatised Utilities....................... 15<br />

6.11 Reconstitution <strong>of</strong> the Board <strong>of</strong> Directors........................................................ 16<br />

6.12 Memoranda <strong>of</strong> Agreements ............................................................................. 16<br />

6.13 Better Management Practices.......................................................................... 16<br />

6.14 Capacity Building and Developing Management Cadres ............................. 17<br />

6.15 Centre for Manpower Planning and Development........................................ 17<br />

6.16 Accountability and Corporate Governance ................................................... 18<br />

6.17 Participation <strong>of</strong> Civil Society Organisations .................................................. 18<br />

6.18 Citizens’ Charter .............................................................................................. 19<br />

6.19 Universal Metering <strong>of</strong> Service Connections ................................................... 19<br />

6.20 State Government Initiatives and Support to Prevent Theft ....................... 19<br />

6.21 Energy Accounting and Auditing.................................................................... 20<br />

6.22 Reducing Cross-Subsidies................................................................................ 21<br />

6.23 Fostering Competition Through Open Access............................................... 22<br />

6.24 Data Management Systems.............................................................................. 23<br />

6.25 Adoption <strong>of</strong> Information Technology in <strong>Power</strong> Sector ................................. 23<br />

6.26 Outsourcing <strong>of</strong> Works/Services....................................................................... 23<br />

6.27 Encouragement to Non-Conventional Energy Sources................................. 24<br />

6.28 Rural Electrification......................................................................................... 24<br />

6.29 State-Level Planning and Coordination ......................................................... 25<br />

Chapter - 2<br />

Way Forward .................................................................................................... 26<br />

7.1 Steps to be Taken by the <strong>Ministry</strong> <strong>of</strong> <strong>Power</strong> .................................................. 26<br />

7.2 Steps to be Taken by the State Governments................................................. 29<br />

7.3 Steps Suggested for Implementation by the Utilities..................................... 31

A. BACKGROUND<br />

EXECUTIVE SUMMARY<br />

A1 The pre-eminent role <strong>of</strong> ‘electricity’ in the growth <strong>of</strong> a nation’s economy is<br />

well-established. To sustain the envisaged GDP growth rate <strong>of</strong> more than eight<br />

per cent, electricity generation has also to grow at about the same rate. The<br />

Tenth Five Year Plan aims at a generating capacity addition <strong>of</strong> 41,110 MW.<br />

However, the achievement is likely to be about 75 per cent <strong>of</strong> the target. The<br />

total installed generating capacity in the country at the end <strong>of</strong> 2005-06 was<br />

1,24,287 MW. Though India ranks fifth in the world in terms <strong>of</strong> electricity<br />

generated, the annual per capita consumption is a miniscule, 631.5 kWh (2005-<br />

06 provisional figure), one <strong>of</strong> the lowest in the world. The world average <strong>of</strong><br />

annual per capita consumption in 2003 was 2,429 kWh.<br />

A2 The current Five Year Plan emphasises the need for power sector reforms<br />

through ‘restructuring’ <strong>of</strong> the State Electricity Boards (SEBs), by establishing<br />

regulatory mechanisms, and by effecting overall improvement <strong>of</strong> the physical<br />

and financial attributes <strong>of</strong> the SEBs. The enactment <strong>of</strong> the Electricity Act, 2003<br />

(EA, 2003) was a milestone in the development <strong>of</strong> the power sector, and aims<br />

at, inter-alia, supply <strong>of</strong> electricity to all citizens at reasonable tariff, provision<br />

<strong>of</strong> transparent subsidies, establishment <strong>of</strong> Electricity Regulatory Commissions<br />

and Appellate Tribunal, and promotion <strong>of</strong> policies conducive to the growth <strong>of</strong><br />

the electricity sector. The EA, 2003 has, in particular, made ‘restructuring’ <strong>of</strong><br />

SEBs, on functional basis, mandatory.<br />

A3 SEBs have been in existence for over 40 to 50 years, and have had several<br />

achievements to their credit. However, on the whole, SEBs had become<br />

unviable and unpr<strong>of</strong>itable, with heavy accumulated losses and liabilities. They<br />

were blamed for poor service delivery, mainly due to inefficient planning and<br />

sluggish execution <strong>of</strong> capital works, inadequate maintenance, low generation<br />

[low Plant Load Factor (PLF)], high Transmission and Distribution (T&D)<br />

Losses, erratic supply to consumers, and perennial financial losses. Such inept<br />

and consistently sub-optimal performance on all fronts by the SEBs in general<br />

convinced the planners and policy-makers about the need to reorganise the<br />

SEBs into smaller, viable, uni-functional Utilities, with clearly defined<br />

jurisdictions and tasks, as part <strong>of</strong> the power sector reforms. This hypothesis<br />

followed the realisation that the earlier attempts at reforming the generation<br />

segment <strong>of</strong> the electricity value chain had not achieved the desired results; and<br />

reforming the distribution segment was considered essential for improving the