Insurance-Linked Securities Report 2008 - Aon

Insurance-Linked Securities Report 2008 - Aon

Insurance-Linked Securities Report 2008 - Aon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Insurance</strong>-<strong>Linked</strong> <strong>Securities</strong> <strong>2008</strong><br />

20<br />

Reinsurers comprise 21 percent of the investor community today, and play an<br />

interesting role in the market. In addition to sponsoring transactions, some reinsurers<br />

also manage funds that invest in securities originated by themselves or by other<br />

sponsors. They may also accept risks either through reinsurance or investing in the<br />

ILS market. As an expert participant in the risk management and trading markets,<br />

reinsurers constantly strive to balance their risk portfolio. At the same time, they use<br />

their expertise in the market to maximize returns by buying and selling risk.<br />

Hedge funds and mutual funds, at 7 and 3 percent of the market, respectively, are<br />

similar to cat funds in specifically dedicating capital to catastrophe risk investments.<br />

Of course, hedge funds and mutual funds also participate in other markets,<br />

including equity and debt instruments. Although focused on managing risk and<br />

achieving diversification, these funds are primarily interested in meeting a high<br />

return threshold. In the current market, this causes some hedge funds to reserve<br />

capital for the future when returns may be higher.<br />

Despite the relatively few categories of catastrophe bond investors, no single<br />

group exerts disproportionate influence over the price or success of a particular<br />

transaction. At current volume levels, the market has proven efficient, at least<br />

from a theoretical perspective. This efficiency can be attributed to sponsors having<br />

alternative structures with which to manage risk and access capital, and investors<br />

having alternative uses of capital that offer different risk/return profiles. These<br />

alternatives can include traditional reinsurance and industry loss warranties (ILWs).<br />

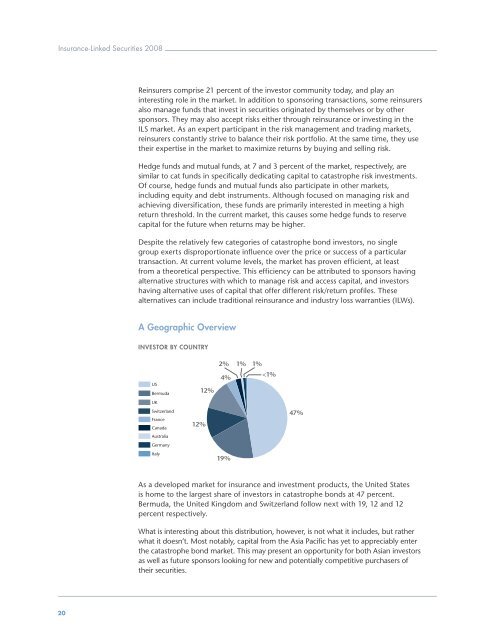

A Geographic Overview<br />

INVESTOR BY COUNTRY<br />

US<br />

Bermuda<br />

UK<br />

Switzerland<br />

France<br />

Canada<br />

Australia<br />

Germany<br />

Italy<br />

12%<br />

12%<br />

2%<br />

4%<br />

19%<br />

1%<br />

1%<br />