Distributor Top 40 - Advertising Specialty Institute

Distributor Top 40 - Advertising Specialty Institute

Distributor Top 40 - Advertising Specialty Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SOI<br />

2008 To p <strong>40</strong> Di s T r i bu Tor s<br />

<strong>Distributor</strong> <strong>Top</strong> <strong>40</strong><br />

(Last year’s rank in parentheses)<br />

2<br />

1<br />

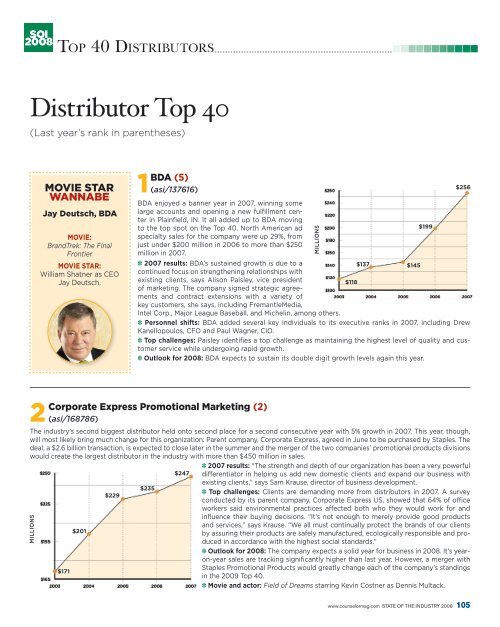

BDA (5)<br />

(asi/137616)<br />

BDA enjoyed a banner year in 2007, winning some<br />

large accounts and opening a new fulfillment center<br />

in Plainfield, IN. It all added up to BDA moving<br />

to the top spot on the <strong>Top</strong> <strong>40</strong>. North American ad<br />

specialty sales for the company were up 29%, from<br />

just under $200 million in 2006 to more than $250<br />

million in 2007.<br />

✽ 2007 results: BDA’s sustained growth is due to a<br />

continued focus on strengthening relationships with<br />

$137 $145<br />

existing clients, says Alison Paisley, vice president<br />

of marketing. The company signed strategic agreements<br />

and contract extensions with a variety of<br />

key customers, she says, including FremantleMedia,<br />

Intel Corp., Major League Baseball, and Michelin, among others.<br />

$118<br />

✽ Personnel shifts: BDA added several key individuals to its executive ranks in 2007, including Drew<br />

Kanellopoulos, CFO and Paul Wagner, CIO.<br />

✽ <strong>Top</strong> challenges: Paisley identifies a top challenge as maintaining the highest level of quality and customer<br />

service while undergoing rapid growth.<br />

✽ Outlook for 2008: BDA expects to sustain its double digit growth levels again this year.<br />

Corporate Express Promotional Marketing (2)<br />

(asi/168786)<br />

The industry’s second biggest distributor held onto second place for a second consecutive year with 5% growth in 2007. This year, though,<br />

will most likely bring much change for this organization: Parent company, Corporate Express, agreed in June to be purchased by Staples. The<br />

deal, a $2.6 billion transaction, is expected to close later in the summer and the merger of the two companies’ promotional products divisions<br />

would create the largest distributor in the industry with more than $450 million in sales.<br />

✽ 2007 results: “The strength and depth of our organization has been a very powerful<br />

$247 differentiator in helping us add new domestic clients and expand our business with<br />

existing clients,” says Sam Krause, director of business development.<br />

$229<br />

$235<br />

✽ <strong>Top</strong> challenges: Clients are demanding more from distributors in 2007. A survey<br />

conducted by its parent company, Corporate Express US, showed that 64% of office<br />

workers said environmental practices affected both who they would work for and<br />

influence their buying decisions. “It’s not enough to merely provide good products<br />

and services,” says Krause. “We all must continually protect the brands of our clients<br />

$201<br />

by assuring their products are safely manufactured, ecologically responsible and produced<br />

in accordance with the highest social standards.”<br />

✽ Outlook for 2008: The company expects a solid year for business in 2008. It’s yearon-year<br />

sales are tracking significantly higher than last year. However, a merger with<br />

$171<br />

Staples Promotional Products would greatly change each of the company’s standings<br />

in the 2009 <strong>Top</strong> <strong>40</strong>.<br />

✽ Movie and actor: Field of Dreams starring Kevin Costner as Dennis Multack.<br />

MilliOns<br />

MoviE stAr<br />

wAnnABE<br />

Jay Deutsch, BDA<br />

MOvie:<br />

BrandTrek: The Final<br />

Frontier<br />

MOvie sTar:<br />

William Shatner as CEO<br />

Jay Deutsch.<br />

MilliOns<br />

$199<br />

$256<br />

www.counselormag.com STATE OF THE INDUSTRY 2008 105

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

Proforma (3)<br />

3 (asi/300094)<br />

$2<strong>40</strong> Proforma saw a 5% sales increase in 2007, reaching<br />

$2<strong>40</strong> million.<br />

$228<br />

✽ 2007 results: “Proforma’s sales were up in 2007<br />

for a number of reasons,” says Greg Muzzillo, company<br />

founder and co-CEO. He cites a 110% growth of<br />

$202<br />

e-commerce sales (more than 5% of total sales volume),<br />

attributable to Proforma’s continuing commitment<br />

to develop and sell technology integrating print,<br />

promotional products and business documents.<br />

$161<br />

✽ new in 2007: Proforma became the exclusive<br />

distributor for RR Donnelly’s smaller and mid-sized<br />

accounts in 2007 and added several other major<br />

$1<strong>40</strong><br />

accounts, including Coca-Cola, Labatt, AT&T and<br />

NASCAR.<br />

✽ <strong>Top</strong> challenges: “In 2007 one of our biggest<br />

challenges and focuses was increasing the strength of the Proforma brand,” Muzzillo says. “We worked<br />

through in-depth research and creative execution to produce some exciting new tools and programs.”<br />

✽ Outlook for 2008: Muzzillo says that overall, Proforma is on track to reach the $<strong>40</strong>0 million mark with<br />

its second highest billing month ever in April 2008.<br />

MilliOns<br />

staples Promotional Products (6)<br />

4 (asi/334634)<br />

This division of office products retail giant Staples was formed last year when the company<br />

acquired <strong>Top</strong> <strong>40</strong> distributor American Identity. On its own, American Identity had<br />

ranked as the sixth-largest industry distributor in 2006.<br />

✽ 2007 results: With the two companies’ combined efforts in the ad specialty market,<br />

2007 saw an increase from American Identity’s sole results in 2006 of 13%, to total sales<br />

of $215 million.<br />

✽ Outlook for 2008: Staples should shoot up the <strong>Top</strong> <strong>40</strong> list even further next year, after<br />

it completes its acquisition of Corporate Express, the parent company of the second-largest<br />

ad specialty distributor Corporate Express Promotional Marketing. The combination<br />

with Corporate Express would create the largest distributor in the industry – by far. The<br />

two companies’ combined industry sales for 2007 would be more than $460 million.<br />

Group ii<br />

5 Communications/iMs (4)<br />

(asi/215310)<br />

IMS is counting on a new focus on<br />

integrated sales, as well as its product<br />

development expertise, to offset a difficult<br />

economy and decreased revenues<br />

from the company’s large corporate clients.<br />

The revenue dip caused the firm to<br />

lose one spot, from 4 to 5 on this year’s<br />

<strong>Top</strong> <strong>40</strong>.<br />

✽ 2007 results: Last year’s sales dip of<br />

nearly 10% is reflective of transitional<br />

times for key clients, says Kathy Evans,<br />

marketing department manager. “I think<br />

it’s mostly just the industry we work<br />

MilliOns<br />

106 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

$158<br />

$177<br />

MilliOns<br />

$180 $180 $180<br />

Muzzillo<br />

says that<br />

overall,<br />

Proforma is<br />

on track to<br />

reach the<br />

$<strong>40</strong>0 million<br />

mark.<br />

$191<br />

$215<br />

with. Wells Fargo is one of our biggest clients, and we know it’s<br />

tough in the banking industry right now,” she says.<br />

✽ new in 2007: The company has put a new focus on building<br />

an integrated sales force, embodied in<br />

weekly conferences where different sales<br />

$222<br />

groups sit down together to share ideas.<br />

“We work more as a team this year than<br />

we’ve ever done,” Evans says.<br />

$202<br />

<strong>Top</strong> challenges: “To try to keep our sales<br />

up and find new avenues,” Evans says.<br />

$185<br />

✽ Outlook for 2008: Evans says this year<br />

will probably be as challenging as last<br />

year. The company is being aggressive<br />

in showing new products, but “people<br />

are asking for cutbacks. Unit sales aren’t<br />

necessarily down but prices are down.<br />

Clients are demanding it.”

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

Geiger (7)<br />

6 (asi/202900)<br />

Geiger saw a 7% increase in sales in 2007, largely thanks to acquisitions it closed the previous year, and the<br />

results helped to move the company up one spot to number six on this year’s <strong>Top</strong> <strong>40</strong>.<br />

✽ 2007 results: The distributor’s revenues increased from $172.5 million in 2006 to $184.1 million in<br />

2007. Lo-an Lantz, executive vice president of Geiger, attributes the growth to a couple of factors. “One<br />

was an increase in corporate program sales and<br />

the second reason was because of revenues as a<br />

$184 result of acquisition,” she says. “Program sales are<br />

strong. This suggests that even though the econ-<br />

$173<br />

omy continues to be soft, large firms are continuing<br />

to promote their brands.”<br />

MilliOns<br />

108 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

✽ new in 2007: “In addition to the increased interest<br />

in eco-friendly, and ‘safe products,’ we saw a<br />

shift in how clients evaluate our capabilities,” Lantz<br />

says. “The need for integrated Web sites as a deliverable<br />

for clients is not new, the emphasis on the<br />

appearance of client integrated Web sites is. Clients<br />

are drawing conclusions regarding our creativity<br />

and capabilities from the appearance and<br />

functionality of Web sites.”<br />

✽ <strong>Top</strong> challenges: “This year, we are focusing on balance,”<br />

Lantz says. “We’re shifting resources to areas of revenue generation, educating our buyers on the<br />

importance of product safety and brand management, and assisting our sales partners in growing their business.”<br />

✽ Outlook for 2008: Lantz believes this could be a soft year for Geiger and the industry. “While some market segments are up,” she says,<br />

“the impact of the mortgage crisis and property devaluation has had an impact on other former growth markets.”<br />

7<br />

Cintas (8)<br />

(asi/162167)<br />

The Cincinnati-based company is looking to a number of moves to drive growth, including strategic<br />

purchases and redirecting sales resources to follow demand, according to executives Bill Gale,<br />

senior vice president, and Mike Thompson, vice president and treasurer.<br />

✽ 2007 results: While Cintas saw North American ad specialty sales increase 8% last year, a slowing<br />

economy impacted the company’s direct sale uniform business toward the end of 2007, Thompson<br />

told industry analysts in a March corporate earnings call. “During challenging economic conditions,<br />

these direct sale businesses tend to move with greater volatility than our rental business, as many<br />

of the direct sale customers will delay purchasing during economic downturns,” he says.<br />

✽ new in 2007: Significant in 2007 was the company’s expansion into the international market<br />

with the purchase of a small document management business in the Netherlands. Cintas has<br />

also been reallocating sales resources in its uniforms and fire protection segments to focus on<br />

growth markets.<br />

✽ Personnel shifts: As of presstime, Cintas<br />

$171 was in search of a new executive to take<br />

over its promotional products division,<br />

after Jim Stutz announced his move to<br />

$155<br />

$158<br />

become executive vice president at Halo/<br />

Lee Wayne.<br />

✽ <strong>Top</strong> challenges: Thompson cites energy<br />

$149<br />

costs as a major challenge for the company,<br />

due to an increase in delivery fuel prices<br />

and greater seasonal usage of natural gas.<br />

✽ Outlook for 2008: A combination of<br />

$135<br />

lower revenues and increased energy costs<br />

should point to single-digit growth this<br />

year, Gale told analysts.<br />

MilliOns<br />

$121<br />

$125<br />

$138<br />

MoviE stAr<br />

wAnnABE<br />

Gene Geiger,<br />

Geiger<br />

MOvie:<br />

Indiana Jones and the<br />

Kingdom of the Crystal<br />

Skull<br />

MOvie sTar:<br />

Harrison Ford as<br />

Gene Geiger<br />

8%<br />

increase in<br />

Cintas’<br />

north<br />

american<br />

ad specialty<br />

sales from<br />

last year

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

MilliOns<br />

national Pen Company (11)<br />

8 (asi/2810<strong>40</strong>)<br />

National Pen Company moved up three spots into the top 10 this year, after its acquisition early last year of<br />

fellow <strong>Top</strong> <strong>40</strong> distributor Atlas Pen.<br />

✽ 2007 results: “We showed some slight increases due to expansion in the area of Internet sales and product<br />

expansion in paper goods – calendars and holiday cards,” says company CEO Richard Schulte. The company’s<br />

overall North American ad specialty sales show a 23% increase over 2006.<br />

$93<br />

$110<br />

$114<br />

$130<br />

$160<br />

✽ new in 2007: Schulte reports the biggest change last<br />

year was innovation in the way the company approaches<br />

the marketplace. “We had pretty much approached the<br />

market as telesales, Internet and mail,” he says. “For the<br />

first time we brought a lot of focus to integrating our<br />

approach.”<br />

✽ Personnel shifts: National Pen brought in a completely<br />

new senior management team in 2007, Schulte reports<br />

(Schulte himself came on as CEO in late 2006). Sean<br />

Clough is executive vice president of sales and marketing;<br />

Alan Honeycutt is executive vice president of<br />

human resources; Ed Fares is the company’s new CIO;<br />

Terry Quinn is executive vice president of operations;<br />

and Ted Heininger is CFO.<br />

✽ <strong>Top</strong> challenges: “I would say the upgrade of our Oracle system platform was a big challenge,” Schulte says. “Postage increases also impacted<br />

us last year – sample mailings is where we really felt it. We had to do reengineering of packages to adhere to postal standards and avoid some of<br />

the postage increase.”<br />

✽ Outlook for 2008: Schulte expects the company to be ahead of last year, but won’t yet identify a growth percentage.<br />

MoviE stAr<br />

wAnnABE<br />

richard schulte,<br />

national Pen Company<br />

MOvie:<br />

At the Edge of a Rising<br />

Summit<br />

MOvie sTar:<br />

Denzel Washington<br />

as Schulte<br />

www.counselormag.com STATE OF THE INDUSTRY 2008 111

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

4imprint (12)<br />

9 (asi/197045)<br />

MilliOns<br />

N/A<br />

$73<br />

$83<br />

$111.6<br />

$145.35<br />

112 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

It was the second consecutive year of greater<br />

than 30% revenue growth for the Oshkosh, WIbased<br />

distributor. And, as the largest online seller<br />

of promotional products, 4imprint extended its<br />

reach with additional catalogs to enhance its<br />

offerings.<br />

✽ 2007 results: 4imprint is one of the fastestgrowing<br />

distributors on the <strong>Top</strong> <strong>40</strong> this year, as<br />

its North American ad specialty sales increased<br />

from $111.6 million in 2006 to $145.35 million last<br />

year. “Our sales increase was driven by further<br />

development of our catalog/internet based business<br />

model, with an emphasis on new product<br />

and service offerings,” says company CFO David<br />

Seekings.<br />

✽ <strong>Top</strong> challenges: The company’s strategy continues to focus on developing “great offers that resonate<br />

with our customers in tougher economic times,” Seekings says. “If we can get this challenge right, we<br />

remain optimistic about our growth prospects in 2008.”<br />

Halo/Lee wayne (10)<br />

10 (asi/356000)<br />

Halo/Lee Wayne, in a year that it was acquired by public equity firm Compass Equity,<br />

increased its revenues from $131 million in 2006 to $145 million in 2007. The distributor<br />

also continued its acquisition spree this year, as it purchased fellow <strong>Top</strong> <strong>40</strong> company<br />

Goldman Promotions in April.<br />

✽ 2007 results: Halo grew its sales by 11.5% in 2007,<br />

MoviE stAr<br />

wAnnABE<br />

Marc simon,<br />

Halo/Lee wayne<br />

MOvie:<br />

A Few Good (Sales) Men<br />

MOvie sTar:<br />

Tom Cruise as Simon<br />

and CEO Marc Simon attributes the results to both<br />

acquisitions and organic growth. “Our continued<br />

growth derives from our culture of high performance,<br />

efficient and accurate support,” he says. “The<br />

result is a combination of successful acquisitions and<br />

recruiting along with gains in organic growth.”<br />

✽ new in 2007: Simon says the company introduced<br />

enhancements to its order management software,<br />

created new marketing material to help its account<br />

executives promote their business and developed a<br />

year-long sales training series of weekly webinars.<br />

✽ <strong>Top</strong> challenges: “The primary challenge we faced last year was customers’ growing sensitivity to product<br />

liability, and how to position ourselves to reduce their exposure and ours,” Simon says.<br />

✽ Outlook for 2008: Bookings so far this year are strong compared to 2007, Simon says, and he expects<br />

the company will realize “substantial revenue increases from our recent recruiting success and our acquisition<br />

of Goldman Promotions.”<br />

‘‘ The primary challenge we faced last<br />

year was customers’ growing sensitivity<br />

to product liability.<br />

’’<br />

– MARC SIMON, HALO/LEE WAyNE (ASI/35600)<br />

MilliOns<br />

$186<br />

$207<br />

MoviE stAr<br />

wAnnABE<br />

Kevin Lyons-tarr,<br />

4imprint<br />

MOvie:<br />

Back To The Future<br />

MOvie sTar:<br />

Michael J. Fox<br />

as President Lyons-Tarr<br />

$106<br />

$131<br />

$145

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

11<br />

12<br />

MilliOns<br />

Adventures in <strong>Advertising</strong> (9)<br />

(asi/109480)<br />

Adventures in <strong>Advertising</strong> experienced a slight dip in sales in 2007, from $135 million<br />

in 2006 to $133 million last year. “Actually, after three years of strong sales growth<br />

and no new franchise sales, we were pleased to see sales plateau at such a high<br />

level,” says David Woods, CEO of AIA. “As in all sales organizations, there is always<br />

some attrition.”<br />

MoviE stAr<br />

wAnnABE<br />

David woods,<br />

Adventures in<br />

<strong>Advertising</strong><br />

MOvie:<br />

Built to Last<br />

MOvie sTar:<br />

Tom Hanks starring as<br />

Woods.<br />

tic toc (13)<br />

(asi/158990)<br />

$86<br />

$95<br />

$96.2<br />

$99.1<br />

114 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

✽ 2007 results: Woods says that the 1.5% drop in<br />

$128<br />

revenues last year was expected, as the company<br />

hadn’t recruited new franchise owners over the<br />

previous two years. “By not being able to sell franchises<br />

for three years, we expected our momentum<br />

would slow down temporarily,” he says. “We<br />

$119<br />

also continue to selectively prune out low margin<br />

N/A<br />

and unprofitable business.”<br />

✽ new in 2007: AIA tried to focus its 2007 efforts<br />

on initiatives to help its franchise owners and support its sales affiliates. “We have added additional<br />

resources in field management, internal customer support and IT,” Woods says. “We announced an<br />

investment of more than $2 million to transform our operating platform. Our focus is continuing to invest<br />

in the best people and systems to support our long term growth and success.”<br />

✽ <strong>Top</strong> challenges: “Sales development is a major initiative for AIA, and it is always challenging to find the<br />

best people,” Woods says. “Thus far in 2008, we have experienced the best recruiting results in several<br />

years, maintaining very high selection standards. Product safety issues and potential price increases<br />

require constant vigilance.”<br />

✽ Outlook for 2008: “The year got off to a slow but steady start, and there have been signs of improvement<br />

recently,” Woods says. “We expect it will be at least 12 to 18 months before we see strong growth<br />

in the overall economy again.”<br />

$105<br />

Tic Toc has focused recently on expanding its relationships<br />

with key clients, as well as penetrating<br />

new international markets. Last year, the moves<br />

lead to a 6% increase in sales from $99 million in<br />

2006 to $105 million in 2007.<br />

✽ 2007 results: CEO Paul Gittemeier chalks the<br />

company’s revenue jump in North American sales<br />

up to increased business from a couple of large<br />

clients, and the addition of a new client in late<br />

2006 that has since become the company’s largest<br />

customer.<br />

✽ new in 2007: Tic Toc expanded its operations<br />

outside the U.S. last year with the addition of several<br />

new international clients, Gittemeier reports.<br />

✽ <strong>Top</strong> challenges: “The devaluation of the dollar<br />

coupled with the petroleum price increases have caused our costs to rise because much of what we sell<br />

is manufactured outside the USA and is made of plastic, a petroleum derivative,” Gittemeier says. In addition,<br />

there is the impact on the industry from recent reports of harmful chemicals in common plastic products.<br />

“Although we’ve been clean as a whistle and have very stringent material and safety testing protocols, the fallout from the ’07 global<br />

plastic content and lead paint issues has caused our clients to be hyper-aware of potential problems,” he says, while stressing that none of<br />

these problems have directly affected Tic Toc.<br />

✽ Outlook for 2008: Gittemeier reports “some very nice increases” in sales this year.<br />

MilliOns<br />

$135<br />

MoviE stAr<br />

wAnnABE<br />

Paul Gittemeier,<br />

tic toc<br />

$133<br />

MOvie:<br />

The Imagination Company<br />

MOvie sTar:<br />

Paul Newman as Gittemeier.

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

13<br />

workflow one (26)<br />

(asi/333647)<br />

Of all the big movers on this year’s chart, no company could beat Workflow One’s tremendous 50%<br />

growth from last year, which took the company from number 26 with $60 million in 2006, all the way to<br />

number 13 with $90 million in 2007. The move was not wholly unexpected given the comments from Dan<br />

Welborne, vice president of the promotional product division, who predicted in last year’s report there<br />

would be monumental growth in 2007.<br />

MilliOns<br />

$29<br />

$38<br />

$42<br />

$60<br />

116 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

$90<br />

✽ 2007 results: “WorkflowOne has become more<br />

mature in the process of selling and supporting the<br />

business of promotional products,” Welborne says.<br />

✽ new in 2007: The company added a number<br />

of divisional directors in 2007 that were responsible<br />

for building sales plans and working with the<br />

local offices. Divisional vice presidents also more<br />

aggressively promoted promotional products in<br />

their sales regions.<br />

✽ <strong>Top</strong> challenges: “The biggest challenge in 2007<br />

was internal communication and strategy relative<br />

to adding this line of business to everyone’s traditional<br />

business,” says Welborne. “We had to show<br />

clients they could be even more successful through<br />

promotional products. For 2008, it’s more of the<br />

MoviE stAr<br />

wAnnABE<br />

Greg Mosher,<br />

workflow one<br />

MOvie:<br />

Mission Possible<br />

MOvie sTar:<br />

Marlon Brando as CEO<br />

Mosher<br />

same. We must continue to push ourselves internally to be the best.”<br />

✽ Outlook for 2008: Expect another big move in 2008: Welborne says the ad specialty division of his company is already more than 30%<br />

ahead in year-over-year revenue.<br />

asi 78065 ppai 143980<br />

So much more than picnic<br />

www.PicnicPromotions.com<br />

Since 1982<br />

outdoor, tailgating, totes, coolers, wine, entertaining, tools, garden...

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

14<br />

15<br />

American solutions for Business (18)<br />

(asi/120075)<br />

ASB’s secret to success is remaining customer-focused, according to founder and president Larry Zavadil.<br />

This means looking after the needs of its three customers – sales associates, end-users and vendors – rather<br />

than becoming too operations-centric.<br />

MilliOns<br />

Banyan incentives (14)<br />

(asi/342382)<br />

The ever tight-lipped Banyan Incentives declined to give its sales for a fifth year<br />

in a row, so the company’s standing is based on a Counselor estimate. Despite<br />

another year of projected flat growth, the company was able to hold onto the<br />

number 14 spot on the list.<br />

✽ 2007 results: President Paul Griffiths, though, did give some insight about the<br />

company’s performance last year: “The continued cost increases from Asia have<br />

been a challenge,” he says. “With oil and plastics going up along with metals, it’s<br />

hitting us both in materials and labor. Costs are going up quicker than we are able<br />

to pass it on to the customer and some are balking. I think that’s going to push<br />

through the next two years quite honestly.”<br />

✽ new in 2007: Online sales have become huge for Banyan, which for years has<br />

depended on its direct marketing and telesales. The company expects online sales<br />

to remain strong, so it has been investing in its Web site and adding functionality.<br />

✽ <strong>Top</strong> challenges: Like many industry companies, safety has become a major concern<br />

as has the general cost of doing business. Staying on top of both issues while<br />

retaining low prices is increasingly difficult, Griffiths says. “In the competitive market it’s hard to pass all those costs on. The result is we<br />

end up tightening what we can spend to promote ourselves to grow the business.”<br />

✽ Outlook for 2008: “We plan on making further investments in this industry in the next couple of years,” Griffiths says, “and we continue<br />

to grow the business.”<br />

✽ Movie: The Never-Ending Story<br />

$49<br />

$55<br />

$67<br />

$78<br />

$88<br />

✽ 2007 results: Having a diversified focus has<br />

helped ASB weather tough economic times. “When<br />

one industry or vertical market is down, we see<br />

growth in others,” Zavadil says. Overall, it adds up<br />

to a 12% increase in North American ad specialty<br />

revenues last year.<br />

✽ new in 2007: ASB launched the development<br />

phase of a new operating system, American People-<br />

Soft Solution. “This platform will give American the<br />

most robust fully-integrated system in the industry<br />

capable of handling everything electronically from<br />

end-user to vendor for inquiry, ordering, shipping<br />

and collection,” Zavadil says. ASB is scheduled to<br />

go live with the new system this month.<br />

✽ Personnel shifts: A reorganization plan at the<br />

MoviE stAr<br />

wAnnABE<br />

Larry Zavadil,<br />

American solutions<br />

for Business<br />

MOvie:<br />

Field of Dreams<br />

MOvie sTar:<br />

Kevin Coster as<br />

Larry Zavadil<br />

company’s Glenwood, MN, home office has created unified sales teams across operational departments<br />

and resulted in management shifts. Joining the sales support team as director of vendor relations is Justin<br />

Zavadil, Larry’s son. The younger Zavadil replaces Wayne Martin, who will continue as a vice president<br />

focusing on strategic and national accounts.<br />

✽ <strong>Top</strong> challenges: “Communication has been and always will be our most difficult challenge,” Zavadil says. “With the changing of generations<br />

in the work force, and preferences for technology changing almost daily, the ability to successfully communicate everything to everyone in<br />

real time is a significant challenge.”<br />

✽ Outlook for 2008: Bottom line profit is significantly ahead of budget, Zavadil reports. He expects implementation of the American People-<br />

Soft system to contribute significantly to growth this year and moving forward.<br />

MilliOns<br />

$88 $88 $88 $88 $88<br />

www.counselormag.com STATE OF THE INDUSTRY 2008 117

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

MilliOns<br />

MilliOns<br />

$65<br />

$143<br />

$85<br />

MoviE stAr<br />

wAnnABE<br />

Gregg Emmer,<br />

Kaeser & Blair<br />

$146<br />

$85<br />

MOvie:<br />

For A Few Dollars More<br />

MOvie sTar:<br />

Clint Eastwood<br />

$87 $87<br />

17<br />

120 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

Kaeser & Blair (19)<br />

(asi/238600)<br />

Kaeser & Blair increased its sales about 10% last<br />

year to move it up two spots on the <strong>Top</strong> <strong>40</strong> list.<br />

”We continue to be successful attracting top<br />

industry sellers to K&B,” says Chief Marketing<br />

Officer Gregg Emmer. “Their volume, along with<br />

$86<br />

the success of other K&B dealers provides the<br />

growth.”<br />

✽ 2007 results: Kaeser & Blair capitalized<br />

on continued upgrades to its operations and<br />

dealer outreach to achieve revenues of $85.6<br />

$76 $76<br />

$78<br />

million in 2007, an increase of 9.7% from 2006’s<br />

$78 million.<br />

✽ new in 2007: “We redesigned our recruiting<br />

Web site and the collateral materials that tell the<br />

K&B story,” Emmer says. “This helped our recruit-<br />

$70<br />

ing by providing the most current information in a very user-friendly way.”<br />

✽ <strong>Top</strong> challenges: Emmer identifies the top challenge as holding prices down in the face of rising oil costs.<br />

✽ Outlook for 2008: Kaeser & Blair revenue will likely be up 11% to 14% for 2008, Emmer estimates.<br />

$84 $84 $84<br />

summit Marketing Group (15)<br />

16 (asi/339116)<br />

After growth of 2.5% in 2006, Summit Marketing Group experienced a flat sales year<br />

in 2007. The company’s sales increased from $87.1 million in 2006 to $87.3 million in<br />

2007.<br />

✽ 2007 results: Summit’s less-than-one-percent sales increase in 2007 caused it to<br />

move down the <strong>Top</strong> <strong>40</strong> list one spot to number 16 this year. While Daniel Renz, the<br />

company’s CEO, predicted in last year’s State of the Industry report that his company<br />

would experience double-digit growth in 2007, he declined to comment on Summit’s<br />

2007 performance.<br />

✽ new in 2007: The distributor continued to expand its Arlington, VA-based<br />

Government Services Group and saw an increase of its business from government<br />

accounts as a result. Last year, Summit also acquired Drone Communications, an ad<br />

agency specializing in interactive marketing, and launched an interactive promotionson-demand<br />

program for its clients.<br />

18<br />

Myron (16)<br />

(asi/278980)<br />

MilliOns<br />

Counselor estimates put Myron’s 2007 revenues at $83.6 million for a third consecutive<br />

year. CEO Jim Adler declined to confirm the estimate.<br />

2007 results: The continued flat estimate moves Myron down the <strong>Top</strong> <strong>40</strong> list two spots<br />

to number 18. And while the estimate is based on a Dun & Bradstreet report gathered<br />

two years ago (Myron has since removed its revenue numbers from any public information<br />

reporting service), Myron contends that their revenues are actually significantly<br />

higher than the Counselor estimate and the Dun & Bradstreet report.<br />

Business background: Myron was formed in 1949 and claims to have serviced more<br />

than one million customers over its more than 50 years in business. The company has<br />

more than 1,000 employees and is based in Maywood, NJ.

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

MilliOns<br />

MoviE stAr<br />

wAnnABE<br />

Eric Belcher,<br />

innerworkings/<br />

Corporate Edge<br />

MOvie:<br />

To the Edge and Beyond<br />

MOvie sTar:<br />

Harrison Ford as Belcher<br />

$77<br />

$81 $81 $81 $81<br />

122 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

19 innerworkings/Corporate<br />

Edge (27)<br />

(asi/168860)<br />

The big news for perennial <strong>Top</strong> <strong>40</strong> distributor Corporate<br />

Edge was its purchase in December by<br />

Chicago-based managed print and promotional<br />

solutions provider InnerWorkings. The integration<br />

of Corporate Edge has opened up new revenue and<br />

growth potential in promotional products sales,<br />

according to InnerWorkings president and CEO<br />

Eric Belcher.<br />

✽ 2007 results: Corporate Edge enjoyed a great<br />

2007 leading up to and after its purchase by Inner-<br />

Workings, seeing a 41% increase in sales to $83 million. “Our promotional products revenue growth is due<br />

to both rapid organic growth – fueled by an increase in our e-commerce activities and our ability to continue<br />

to expand the percentage of our client’s spend that we manage – and the combination of InnerWorkings<br />

and Corporate Edge’s promotional product revenue,” Belcher says.<br />

✽ new in 2007: The purchase has facilitated cooperative sales strategies, with Corporate Edge CEO Scott<br />

Levy and President Stuart Weisenfeld continuing to manage operations of the promotional products business.<br />

“Promotional products have always been an important category for InnerWorkings, and the acquisition<br />

has made InnerWorkings a more powerful buyer in the marketplace,” Belcher says.<br />

✽ Outlook for 2008: For the overall InnerWorkings company, Belcher anticipates a continuation of last year’s healthy growth trends. He<br />

anticipates a “tremendous” 2008, with revenues projected to increase at least 50% to more than $450 million. “Promotional products is an<br />

important component of this revenue growth,” he says.<br />

EmbroidMe (24)<br />

21 (asi/38<strong>40</strong>00)<br />

EmbroidMe enjoyed strong growth in 2007, fueled by a continued aggressive franchising<br />

strategy that now encompasses more than 450 retail locations worldwide.<br />

✽ 2007 results: EmbroidMe North American sales were up 19% last year, to just over $75<br />

million. “Comparable store sales were up in ’07 in comparison to ’06 as a result of younger<br />

stores in our system growing into their second and third year and expanding their customer<br />

base,” says Tipton Shonkwiler, director of marketing.<br />

✽ new in 2007: A stronger emphasis on e-marketing campaigns for stores was an important<br />

part of the company’s strategy last year and has proven successful, he says.<br />

✽ Personnel shifts: Mark Johnson was appointed president of EmbroidMe. Former president<br />

Ray Titus has moved into the CEO position for parent company United Franchise Group.<br />

✽ Outlook for 2008: “We are tracking nicely with a strong global markets expansion,”<br />

Shonkwiler says.<br />

MilliOns<br />

$32<br />

Midwest trophy (17)<br />

20 (asi/270880)<br />

While MidWest declined to provide their revenues for 2007, Counselor estimated a<br />

flat year for the company, which resulted in $81 million in sales and a loss of three<br />

places on the <strong>Top</strong> <strong>40</strong> from 17 last year to number 20 this year.<br />

✽ new in 2007: The company’s incentives arm, MTM Recognition, was named the<br />

official awards program supplier for the National Collegiate Athletic Association in<br />

April 2007. This deal is in conjunction with MidWest’s Jostens division, the well-known<br />

class ring company that MidWest purchased in 2001.<br />

✽ Personnel: MidWest’s MTM Recognition division alone has about 800 employees in<br />

seven locations, and the division has about 70 recognition consultants in the U.S. and<br />

Canada that work directly with the company’s incentive and rewards clients.<br />

MilliOns<br />

$26<br />

$41<br />

$45<br />

$49<br />

$45.7<br />

$59<br />

$63<br />

$83<br />

$75

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

22<br />

Jack nadel international<br />

(20) (asi/279600)<br />

Jack Nadel International bills itself as an extension of a client’s existing marketing strategy, an approach<br />

the company believes is well-suited to an era when corporations are seeking a clarity of message amid<br />

brand clutter.<br />

MilliOns<br />

$74<br />

$86<br />

$86<br />

$76<br />

$75<br />

✽ 2007 results: Sales were essentially flat – down<br />

$1 million to $75 million in 2007 – even as profits<br />

rose slightly, according to Senior Vice President<br />

Craig Reese.<br />

✽ new in 2007: “We tried to strengthen our<br />

relationships with vendor partners over the last<br />

year,” Reese says. “We really focused on those<br />

relationships and tried to leverage them as best<br />

we can.”<br />

✽ Personnel shifts: The company announced a<br />

management change in September 2007, which<br />

was instituted in March of this year with the<br />

retirement of COO Robert Buckingham. President<br />

Craig Nadel and the rest of the senior management<br />

team remain in place.<br />

✽ <strong>Top</strong> challenges: Citing the economy as the<br />

MoviE stAr<br />

wAnnABE<br />

Craid nadel,<br />

Jack nadel<br />

international<br />

MOvie:<br />

Get Smart<br />

MOvie sTar:<br />

Steve Carell as Nadel<br />

number one issue for the industry right now, Reese says the main challenge is to help salespeople sell smarter as they adjust to the shifting<br />

needs of clients. “We see that a lot of our clients and potential clients are looking at condensing their promotional product suppliers and<br />

tightening up that supply chain,” he says. “They want to bring it down to a manageable level so they have more control over purchases, logos,<br />

and marketing – basically, to ensure that one voice is being spoken.”<br />

✽ Outlook for 2008: Reese reports that the company is tracking slightly upward for 2008. “We’re still concerned about the economy and<br />

how it will play out this year,” he says.<br />

23<br />

the vernon Company (21)<br />

(asi/351700)<br />

Like many distributors, The Vernon Company is looking to some strategic moves and new revenue streams to see it through a challenging<br />

economic environment.<br />

✽ 2007 results: Vernon’s North American sales last year were essentially flat, down<br />

$73<br />

$72<br />

less than 1%, from $72.6 million in 2006 to $72.1 million in 2007. Vice President of<br />

Sales Dave Regan chalks the results up to the loss of some major orders (though<br />

not whole accounts) from top clients cutting back on promotions, and a transitional<br />

period in sales, with many older reps gearing up for retirement and new reps being<br />

recruited and trained.<br />

$68<br />

✽ new in 2008: Vernon is putting a new focus on acquisitions and aggressive sales<br />

targets in order to reach a goal of $10 million in new annual business. Regan says<br />

the company seeks to generate at least half of this through added revenue from<br />

$66<br />

new acquisitions and half from increased sales in existing accounts.<br />

✽ Personnel shifts: The company is seeing some higher-level retirements, most<br />

$63<br />

noticeably national sales manager Harry Holmes, who has been replaced by Sharla<br />

Elscott, recently promoted to the position of business development manager.<br />

✽ <strong>Top</strong> challenges: “We need to bring in new revenue, and need to find the right<br />

balance between acquisitions and new individual hires added to the sales team,”<br />

Regan says. The third leg of the company’s growth strategy involves a focus on getting<br />

more business out of existing accounts. “Over the last two, three, four years our profitability has gone up substantially, and this has<br />

come through technology, manpower efficiency and streamlining management in the field,” he says. “We’re pretty darn efficient – now the<br />

increase in bottom line profit has to come from top line growth.”<br />

✽ Outlook for 2008: Regan summarizes this year’s outlook as “cautious optimism,” noting the company is up 2% to 3% from the year before<br />

as of the end of May.<br />

MilliOns<br />

www.counselormag.com STATE OF THE INDUSTRY 2008 125

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

$80<br />

126 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

24<br />

Evigna (22)<br />

(asi/155460)<br />

$71<br />

Evigna increased its sales $2 million in 2007, from $69 million to $71 million. The<br />

2.9% increased ended up dropping Evigna from 24 on the <strong>Top</strong> <strong>40</strong> last year to number<br />

22 this year.<br />

✽ new in 2007: With new CEO Marc Belanski at the helm of the company, Evigna<br />

began to expand through acquisition this year. It purchased Indiana-based Marc<br />

$68<br />

$69<br />

Promotions at the end of 2007, and most recently acquired Maestro Managed Print<br />

Solutions in May. Belanski says the deals help to expand the services it can offer<br />

to its clients. “We provide a managed solution for the procurement of promotional<br />

$65<br />

merchandise and this is really just another managed solution for the procurement<br />

of print,” he said of the distributor’s acquisition of Maestro in May.<br />

✽ Personnel shifts: Belanski took over in October 2007, succeeding Jeff Beckett,<br />

the Evigna co-chair who had served as interim CEO. Belanski’s promotion came<br />

after seven years at Evigna, where he was most recently the executive vice president<br />

of customer care. Also, Tom Donnellon, the founder of Maestro, became COO of Evigna following his company’s acquisition.<br />

MilliOns<br />

Brown & Bigelow (23)<br />

25 (asi/148500)<br />

Brown & Bigelow continues to enjoy success with its nationwide reach and decentralized<br />

sales structure. Strategic purchases last year allowed the company to increase<br />

revenues even as business slowed in some key promotional products sectors.<br />

✽ 2007 results: Sales were up over 3% last year, due primarily to the company’s purchase<br />

of Strong & Cutter in Boston and IPW Product Development in Cost Mesa, CA,<br />

according to Executive Vice President William D. Smith, Jr.<br />

✽ <strong>Top</strong> challenges: “We believe we offer the most lucrative compensation plan of any<br />

national distributor in the industry and that our decentralized office network combines<br />

the strength of a national distributor with the flexibility of a local distributor,” Smith<br />

says. “Our challenge is getting that message out to the salespeople in the industry.”<br />

✽ Outlook for 2008: “This is a challenging year for many of our salespeople who have<br />

been selling the construction, financial and pharma sectors,” Smith says.<br />

Artcraft Promotional Concepts (25)<br />

26 (asi/125050)<br />

✽ 2007 results: Artcraft enjoyed a 5% increase<br />

$64 in sales last year to $64.1 million. Company Vice<br />

President Howard Zimmerman chalks the increase<br />

$61<br />

up to clients’ purchasing more proprietary products<br />

and utilizing increased fulfillment services.<br />

✽ new in 2007: The company increased warehouse<br />

space last year by 16,000 square feet,<br />

$53<br />

enabling it to handle larger and more complex<br />

fulfillment projects, Zimmerman says. In addition,<br />

$49<br />

some of the company’s patented products were<br />

picked up by national retailers Brookstone and<br />

$45<br />

Williams Sonoma.<br />

✽ <strong>Top</strong> challenges: Pricing pressures mandate<br />

tighter cost controls and increased efficiencies,<br />

he says.<br />

MilliOns<br />

✽ Outlook for 2008: Zimmerman expects the<br />

company’s sales volume to drop this year due to a “perfect storm” in this country: the mortgage and<br />

credit crunch, high oil prices, and political uncertainty.<br />

MilliOns<br />

$62<br />

$63<br />

$65<br />

$67<br />

MoviE stAr<br />

wAnnABE<br />

MOvie:<br />

The African Queen<br />

$69<br />

Howard<br />

Zimmerman,<br />

Artcraft Promotional<br />

Concepts

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

27<br />

G & G outfitters inc. (28)<br />

(asi/199904)<br />

Sales were slightly down for G & G Outfitters last year, dropping from $58.3 million<br />

in 2006 to $56.6 million in 2007.<br />

✽ 2007 results: The 3% decrease is mostly due to changes in the marketplace,<br />

says Richard Gergar, executive vice president. “We have seen some challenges<br />

with one of the sectors in the financial institutions area,” Gergar says. “Consumer<br />

product companies continue to stay strong while financial institutions become<br />

weaker in their marketing efforts. But we had a lot of good things also in that<br />

number and we were happy with how we ended up.”<br />

✽ new in 2007: In 2007 G & G launched a beverage division, called Liquid Swag,<br />

which focuses solely on its core customers in the beverage industry.<br />

✽ <strong>Top</strong> challenges: Challenges last year are similar to ones that the company<br />

is still facing this year, Gergar says: managing internal costs including cost of<br />

goods, transportation, fuel, electric, benefits, etc.<br />

✽ Outlook for 2008: This year is looking good so far for G & G. “It’s very strong and we look to see sales continue to increase and beat<br />

expectations of last year,” he says. “G & G is better poised than most of our competitors because of our wide scope of our products and<br />

services that we manufacture and develop in-house.”<br />

The same high qualiTy meTal barreled<br />

producT ThaT you are used To buT<br />

from a four sTar supplier whom<br />

you already know.<br />

pen/highlighter combo with metal barrel<br />

Ballpoint pen with black ink at one end and yellow highlighter<br />

tip at the other end. Features steel barrel available in gold<br />

or silver finish and metal pocket clip. Double ended for dual<br />

purpose! Also available as Marker/Highlighter Combo with<br />

Metal Barrel; order XDM. Set up Charge to: 34.00 (c)<br />

XDP 200 Pcs. 500 Pcs. 1,000 Pcs. 2,500 Pcs. 5,000 Pcs.<br />

Silver 1.17/Pc. 1.15/Pc. 1.10/Pc. 1.08/Pc. 1.06/Pc.<br />

Gold 1.25/Pc. 1.22/Pc. 1.19/Pc. 1.17/Pc. 1.15/Pc.<br />

Discount code: 5C<br />

GOTHAM PEN<br />

asi/57860<br />

MilliOns<br />

N/A N/A<br />

$51<br />

$58<br />

$57<br />

Made in the USA<br />

Made in the USA<br />

www.counselormag.com STATE OF THE INDUSTRY 2008 129

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

28<br />

newton Manufacturing Co. (29)<br />

(asi/283300)<br />

$51 Revenues for Newton Manufacturing increased<br />

$50<br />

3% last year, jumping from $49.6 million in 2006<br />

to $51.1 million in 2007. The jump helped the com-<br />

$48<br />

pany move up one spot on the <strong>Top</strong> <strong>40</strong>.<br />

✽ 2007 results: Jerome Hoxton, Newton presi-<br />

$47<br />

dent, attributes 2007’s growth to the company’s<br />

commitment to supporting each salesperson.<br />

“We try to understand their unique selling styles,<br />

$45<br />

customers and markets,” he says. “We provide<br />

them customized, appropriate education, customer-centered<br />

marketing materials, presentations<br />

ready-to-present and support all of that<br />

with intelligent, rapid service responses.”<br />

✽ <strong>Top</strong> challenges: Along with increasing sales,<br />

the company’s top challenge in 2007 and 2008 is<br />

“understanding the rapidly changing expectations of customers and markets,” Hoxton says.<br />

✽ Outlook for 2008: Hoxton describes 2008 as “promising in many respects.” First quarter achievements<br />

include a number of new customers and important contracts.<br />

MilliOns<br />

29<br />

GMPC LLC (30)<br />

(asi/2603<strong>40</strong>)<br />

While GMPC continued to grow in 2007, it was up just 3%, compared with 7% in 2006<br />

and 15% in 2005.<br />

✽ 2007 results: GMPC’s sales increased from $48.1 million in 2006 to $49.8 million<br />

in 2007. It achieved this growth by emphasizing customer service, creativity, broad<br />

product categories and providing added value to customers, says Flash Mandel, vice<br />

president.<br />

✽ new in 2007: The company focused more on environmentally friendly products in<br />

2007, “on educating our customers about the importance and availability of using<br />

eco-conscious promotional products,” Mandel says.<br />

✽ Outlook for 2008: 2008 has been a success for GMPC so far, he says.<br />

130 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

MilliOns<br />

$31<br />

$39<br />

MoviE stAr<br />

wAnnABE<br />

Jerome Hoxton,<br />

newton<br />

Manufacturing Co.<br />

MOvie:<br />

Friendly Persuasion<br />

MOvie sTar:<br />

Clint Eastwood as Hoxton<br />

thomas Direct sales inc. (33)<br />

30 (asi/343878)<br />

After a flat year in 2006, Thomas Direct Sales saw 10% growth in 2007 and jumped up<br />

$44<br />

three spots on the <strong>Top</strong> <strong>40</strong>. The company garnered sales of $44.1 million in 2007, after<br />

its $<strong>40</strong> million result in 2006.<br />

✽ 2007 results: Last year’s growth can be mostly attributed to two additional preferred<br />

supplier contracts that Thomas Direct secured, says Nancy D’Andrea, president.<br />

$<strong>40</strong><br />

$<strong>40</strong><br />

✽ new in 2007: The company placed a greater emphasis on eco-friendly and green<br />

products in presentations to its clients, D’Andrea says.<br />

✽ <strong>Top</strong> challenges: Product safety was a challenge for the company in 2007, and<br />

D’Andrea expects it to continue. “We anticipate this to remain a challenge in 2008 as<br />

$35<br />

certain state laws regarding product safety are about to become stricter,” she says.<br />

✽ Outlook for 2008: With many current customers seeming to have smaller promotional<br />

budgets in 2008, Thomas Direct is working to secure new business to fuel growth.<br />

$33<br />

✽ Movie: The Incredibles. “Our staff has proven their commitment to customer service<br />

in heroic proportion,” D’Andrea says.<br />

MilliOns<br />

$45<br />

$48<br />

$50

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

31<br />

Accolade reaction Promotion Group<br />

(n/a) (asi/102905)<br />

The largest distributor in Canada makes its first appearance on the <strong>Top</strong> <strong>40</strong> this year<br />

after it acquired Merit Impressions last year to increase its revenues 62%.<br />

✽ 2007 results: Accolade increased revenues from $27 million 2006 to $43.95<br />

million in 2007, and while the Merit acquisition certainly helped the surge, CEO<br />

Mark Roy says the company also saw 16% organic growth last year.<br />

✽ new in 2007: Roy says the Merit deal “firmly positioned ARPG in the Western<br />

Canadian market as well as new sales offices in the Montreal and Quebec markets.”<br />

Also, this year, Accolade was purchased by Canadian retailer Golftown, which has<br />

now created a corporate merchandising division headed up by Roy. The companies<br />

together now have more than 75 salespeople across Canada, and Golftown plans to<br />

place a corporate merchandise rep in each of its 39 locations.<br />

$44<br />

✽ Personnel shifts: Neil Piitz, Accolade’s president retired after the company was<br />

acquired by Golftown.<br />

✽ <strong>Top</strong> challenges: “Integration was the number one challenge for us in ’07,” Roy<br />

N/A N/A N/A $27<br />

says. “Managing rapid growth was second and limited space in our distribution center was third.”<br />

✽ Outlook for 2008: Roy says that 2008 started off slow, but “spring sales have rebounded and we are presently showing 10% growth<br />

over last year.”<br />

✽ Movie: The Mighty Canucks.<br />

132 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

MilliOns

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

MilliOns<br />

MilliOns<br />

32<br />

N/A<br />

Merit industries inc. (31)<br />

(asi/268100)<br />

$31<br />

$39<br />

$42<br />

iPromoteU (n/a)<br />

33 (asi/232119)<br />

Sales growth of 45% between 2006 and 2007 has propelled iPromoteU into the <strong>Top</strong><br />

<strong>40</strong> for the first time.<br />

✽ 2007 results: Ross Silverstein, president and CEO of iPromoteU, says two factors<br />

contributed to the company’s growth last year: the fact that 157 new distributors<br />

affiliated with iPromoteU in calendar-year 2007 and the increased business from the<br />

company’s existing affiliates.<br />

✽ Personnel shifts: The company added Ken Purington as its director of affiliate relations<br />

and David Stolper as its director of operations.<br />

✽ <strong>Top</strong> challenges: “How to further accelerate the company’s growth so that we can<br />

achieve one of our goals of having an affiliate network of 1,000 experienced distributors<br />

as quickly as possible,” says Silverstein.<br />

✽ Outlook for 2008. Through the middle of May, iPromoteU was forecasting growth<br />

of about 30% and 2008 sales volume of more than $55 million.<br />

$44<br />

✽ Movie and actor: School of Ross, with Jack Black as Silverstein.<br />

34<br />

eCompanystore (37)<br />

(asi/185782)<br />

An industry company at the forefront of green product programs, Merit Industries’ growth<br />

in 2007 was mainly fueled by clients buying into its green way of doing business.<br />

✽ 2007 results: Sales grew 4% in 2007, up to $43.9 million from $42.2 million in 2006.<br />

Herbert Piller, president, says this was because Merit “concentrated on bigger companies<br />

and mainly on premium deals.” In addition it found a strong demand for green products<br />

such as trees, seeds and bamboo, he says.<br />

✽ new in 2007: Merit focused on more green items in 2007 and used sample mailings<br />

to larger accounts to draw more attention. “We’ve learned that green is the new red,<br />

white and blue,” Piller says.<br />

✽ Personnel shifts: More sales associates were added to handle the increased volume.<br />

✽ <strong>Top</strong> challenges: The biggest challenge for Merit is keeping the momentum going,<br />

Piller says. The company is going to continue to target large companies with its mailings<br />

to spark sales. “People like to see product samples rather than just pictures and<br />

some words in a catalog,” he says.<br />

✽ Outlook for 2008: So far, 2008 is up 15%-18% over 2007, Piller says.<br />

MilliOns<br />

N/A N/A<br />

2007 started out strong for eCompanyStore and helped the company grow an impressive 26% over<br />

2006’s numbers.<br />

$23<br />

$28<br />

$32<br />

$34<br />

$43<br />

✽ 2007 results: From 2006 to 2007, eCompany-<br />

Store jumped from $34 million to $42.9 million in<br />

sales. This was mainly attributed to four new Fortune<br />

500 accounts.<br />

✽ new in 2007: In 2007 the company built up its<br />

creative services team, which did “outstanding<br />

work in collateral, product and Web site design,”<br />

says Craig Callaway, CEO.<br />

✽ <strong>Top</strong> challenges: “Maintaining margins in an environment<br />

where procurement managers continue to<br />

try to commoditize our business,” he says.<br />

✽ Outlook for 2008: First quarter 2007 was a<br />

record setter, and it is down in 2008 so far. But, “we<br />

are on our business plan and looking forward to a<br />

rebounding economy,” Callaway says.<br />

$18.2<br />

$29.8<br />

MoviE stAr<br />

wAnnABE<br />

Craig Callaway,<br />

eCompanystore<br />

$43<br />

MOvie:<br />

David Amongst Goliaths<br />

MOvie sTar:<br />

Will Ferrell playing<br />

Callaway<br />

www.counselormag.com STATE OF THE INDUSTRY 2008 133

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

Goldman Promotions (39)<br />

35 (asi/209700)<br />

Goldman Promotions enjoyed a successful 2007, acquiring a couple of small distributors<br />

that added to its 20% growth. And the growth attracted the attention of Halo/Lee<br />

Wayne, which acquired Goldman this past May.<br />

✽ 2007 results: In addition to the small acquisitions, Goldman also added a new branch<br />

office in Orlando, FL, new people and some company store programs that contributed<br />

to its growth from $33.1 million in 2006 to $39.7 million in 2007.<br />

✽ Personnel shifts: Susan young was added as the vice president of the Orlando office.<br />

✽ <strong>Top</strong> challenges: Technology was the top challenge for Goldman in 2007. “Trying to<br />

upgrade our software, that was always a challenge for us,” says Ken Goldman, chairman.<br />

✽ Outlook for 2008: Commenting on Goldman’s recent acquisition by Halo/Lee<br />

Wayne, Goldman says, “We’re very happy to be a part of the Halo/Lee Wayne family<br />

and part of that is their technology. And they have a very similar culture to ours – we’re both Midwest companies and we’ve found there<br />

are a lot of similarities in how we operate.”<br />

MilliOns<br />

N/A N/A N/A<br />

MoviE stAr<br />

wAnnABE<br />

Chuck Fandos,<br />

Gateway CDi<br />

MOvie:<br />

Speed To Market<br />

MOvie sTar:<br />

Speed Racer as Fandos.<br />

$<strong>40</strong><br />

37<br />

134 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

$<strong>40</strong><br />

MilliOns<br />

Positive Promotions (34)<br />

36 (asi/297370)<br />

Counselor estimates that Positive Promotions garnered $39.5 million in revenues in<br />

2007, which resulted in a flat year for the company’s North American ad specialty<br />

sales. While Nelson Taxel, the company’s president, won’t confirm or deny this estimate,<br />

it drops Positive Promotions from number 34 last year to number 36 this year.<br />

✽ about the company: Positive has been in business since 1947. The company’s<br />

strategy is to break its offerings up into market specialties, by showing specific sections<br />

on its Web site for specific promotional events (like Breast Cancer Awareness<br />

and Black History Month).<br />

Gateway CDi (38)<br />

(asi/202515)<br />

Gateway CDI had a strong year in 2007 with 14%<br />

growth, which the company attributes to its<br />

increased focus on special orders. The results helped<br />

Gateway move up one place on the <strong>Top</strong> <strong>40</strong> list.<br />

✽ 2007 results: Change was the name of the game<br />

in 2007. Gateway doubled the size of its sales team,<br />

improved its marketing and training resources<br />

and upgraded its technology, which among many<br />

things, allowed it to better track its business more<br />

strategically.<br />

✽ new in 2007: The reorganization of its management<br />

team had a big affect on performance last<br />

year, says Chuck Fandos, president: “For the first time, we developed strategic plans for the entire company<br />

and each department. We also flattened out the decision making process and gave each area strategic<br />

control of their plans. We feel we went from a company to an organization.”<br />

✽ <strong>Top</strong> challenges: Making the decision to change was huge in 2007, but so will be the evolution of the company.<br />

This year will be about adjusting to the changes while also dealing with potentially strong growth.<br />

✽ Outlook for 2008: “We are optimistic for 2008 because we have become a better company with better vision and structure,” says Fandos.<br />

“We hope to see 5% growth, which is where we are tracking.”<br />

MilliOns<br />

$29<br />

$23<br />

$28<br />

$29<br />

$30<br />

$32<br />

$33<br />

$34<br />

$<strong>40</strong><br />

$<strong>40</strong>

SOI<br />

2008 To p <strong>40</strong> Di sT r i buTor s<br />

MilliOns<br />

38<br />

norscot Group (35)<br />

(asi/284520)<br />

Norscot posted another strong year of growth in 2007 with an increase of 9% for $37.9 million in sales.<br />

Caliendo-savio Enterprises-CsE (<strong>40</strong>)<br />

39 (asi/155807)<br />

2007 found Caliendo-Savio Enterprises with a solid 10% increase in sales, which stemmed<br />

partially from the company’s continuing strategy of setting itself up as a “true marketing<br />

partner, similar to an agency, versus a ‘vendor,’ ” says Mark Ziskind, COO.<br />

✽ 2007 results: The jump from 2006’s $32.8 million to 2007’s $36.2 million was mostly<br />

from new business, but also revenue from repeat customers, Ziskind says. In addition,<br />

“The combination of our creativity and full-service offering provides a one-stop shopping<br />

experience for our clients,” he says.<br />

✽ new in 2007: In 2007 CSE added online awards programs for timely recognition and<br />

employee motivation and online distributor imprint programs. It also emphasized selling<br />

the breadth of its products and services.<br />

<strong>40</strong><br />

Promo shop (n/a)<br />

(asi/300446)<br />

136 STATE OF THE INDUSTRY 2008 www.counselormag.com<br />

✽ new in 2007: Norscot added several new field staff to attract and service new<br />

accounts, as well as to build deeper relationships with existing accounts. They expanded<br />

their manufactured product lines and upgraded their online ordering capabilities to<br />

serve customers better and stepped up promotional efforts, including trade shows<br />

✽ <strong>Top</strong> challenges: “Cost containment was and continues to be a major focus here at<br />

Norscot,” says Scott Stern, president and CEO. “Because our product mix includes our<br />

own manufactured line, as well as the full array of promotional products, raw material<br />

prices can have a huge impact on our business. Add to this the increased cost of transportation,<br />

and it’s doubly clear why cost containment is critical.”<br />

✽ Outlook for 2008: “We’re tracking well ahead of last year for the first part of 2008,”<br />

says Stern. “Increases seem to be across all product areas. Some of the robustness has<br />

been driven by special events that several of our clients have had or will have in 2008,<br />

but a significant amount of the increase has been core business as well. We expect to<br />

finish well for the year.”<br />

✽ <strong>Top</strong> challenges: Attracting top sales talent continued to be a challenge for CSE in 2007,<br />

as well as finding high quality/low cost offshore manufacturing partners. It’s facing the same challenges so far in 2008, in addition to controlling<br />

the rising cost of freight.<br />

MilliOns<br />

N/A<br />

$24<br />

$31<br />

$35<br />

$38<br />

✽ Outlook for 2008: So far 2008 is looking very good for CSE, showing an increase over 2007, Ziskind says.<br />

N/A N/A<br />

$24<br />

$28<br />

$30<br />

MilliOns<br />

$30<br />

✽ 2007 results: Sales grew 10% – from $27.6 million<br />

in 2006 to $30.3 million in 2007.<br />

$31<br />

✽ <strong>Top</strong> challenges: Promo Shop started feeling<br />

pressure from the cost of oil in 2007 and into<br />

2008. Product compliance also started to develop<br />

as a factor in the market. “We do a lot of business<br />

with some very well known brands at which<br />

time we needed to make sure we had all of our<br />

paperwork and all of our compliance initiatives in<br />

order,” says Memo Kahan, president.<br />

✽ Outlook for 2008: Its revenues are up so far,<br />

compared with last year, Kahan says, and it’s also<br />

working with a new tech platform that is helping<br />

to streamline business processes.<br />

$32.5<br />

$33<br />

MoviE stAr<br />

wAnnABE<br />

Memo Kahan,<br />

Promoshop<br />

MOvie:<br />

300<br />

MOvie sTar:<br />

Andy Garcia<br />

as Kahan<br />

$36