O 0 O 0 - Charity Blossom

O 0 O 0 - Charity Blossom

O 0 O 0 - Charity Blossom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

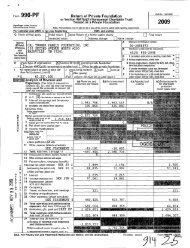

oepanm ni rin 1 ,<br />

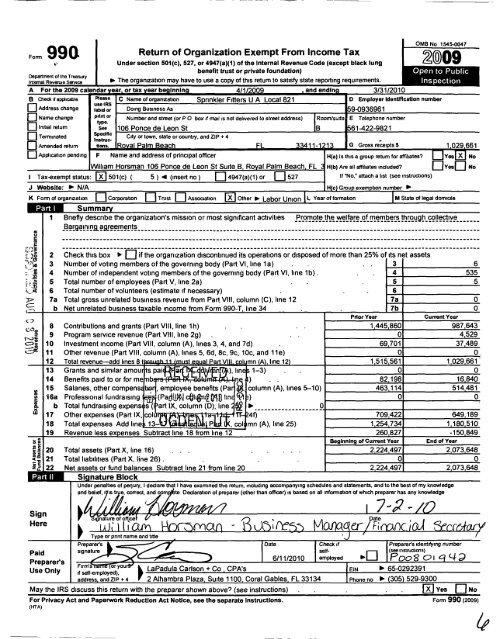

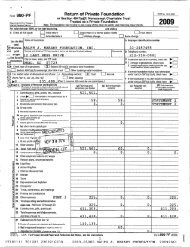

OMB N0 1545-0047<br />

Form v Under Return section 501(c), of 527, Organization or 4947(a)(1) of the Internal Exempt Revenue Code (except From black lung Income Tax<br />

benefit trust or private foundation) Open to Public<br />

,memal sevgmeesglain D The organization may have to use a copy of this retum to satisfy state reporting requirements. Ins pection<br />

A For the 2009 calendar ear or tax ear b 1 innin 4/ / I I * and endin 3/31/2010<br />

B Check iiappiicabie "el" C Name of organization Sprinkler Fittei-5 U A Local 821 D Ernpioyer Identification number<br />

use IRS<br />

EI Address Cheese me or Dome Business AS - 9-0936961<br />

U El Name Initial change " pxsear Number retum and street see (or P O box 106 if mail is not Ponce delivered to street de address) Leon IRoom/surte- B Qsi<br />

E Telephone 61-422-9821 number g<br />

D Terminated Insfruo spednc City or town, state or country, end ZIP + 4 -I<br />

EI/xmenuea retum aim o a * Im eac , 3 - 11-1 G Gross reoeipiw 1 029 661<br />

El Avvlicafivn Pending F Name and address of principal officer His) is this 8 group feium for afriiaiesv I vas N6<br />

William Horsman 106 Ponce de Leon St Suite B, Royal Palm Beach, FL - Hin) Are aii affiliates inauaeav I:IYeaI:I no<br />

I Tax-exempt status: 501(c) ( 5 ) 4 (insert no) E 4947(a)(1) or U 527 ""N0-"H920" 3 "SI (Seeing-*"****0"S)<br />

J Website: V N/A H c Group exemption number P<br />

Summary<br />

K Fomi oforganization CI Corporation EI Trust Q Association IX I Other D Labor Union IL Year of formation IM State of legal domicile<br />

Q05<br />

me<br />

722 Lf/<br />

L 1..<br />

I*N<br />

(D<br />

U-90<br />

E<br />

Es<br />

L-:lr<br />

1 Bnetly describe the organization"s mission or most signiticant activities -l2r.qmp-te)-I1-e yyel-fare-of-mcem-ber-s. through-ggi-legtiye ----- -<br />

.5@E9eLf1lD9.?9I99.l99El3E .................................................................................................. -<br />

. . 3 6<br />

Check this box D I3 if the organization discontinued its operations or disposed of more than 25% of its net assets<br />

Number of voting members of the governing body (Part VI, line 1a) . .<br />

Number of independent voting members of the goveming body (Part VI, line 1b)<br />

Total number of employees (Part V, line 2a) . .<br />

Total number of volunteers (estimate if necessary) .<br />

Total gross unrelated business revenue from Part VIII, column (C), line 12<br />

Net unrelated business taxable income from Form 990-T, line 34 .<br />

8 Contributions and grants (Part VIII, line 1h) . .<br />

9 Program service revenue (Part VIII, line 2g) .<br />

10 Investment income (Part Vlll, column (A), lines 3, 4, and 7d) .<br />

11<br />

15<br />

Other revenue (Part<br />

-<br />

VIII, column<br />

,<br />

(A), lines 5, 6d, 8c, 9c, 10c, and 11e)<br />

12 Total revenue-add lines 8 t -<br />

I<br />

:- ii<br />

- - -<br />

I<br />

* ii I<br />

mn<br />

)<br />

Qi), line 12)<br />

4 5 535 5<br />

67a 7b O<br />

0 O 4,529 0<br />

1,445,860 N<br />

Prior Year Cunrent Year<br />

987,643<br />

I 1<br />

069,701 37,489<br />

, 0<br />

1,515,561 1,029,661<br />

13 14 Grants Benetitspaidtoorforme and similar amou b ts - pai - - f - db( . . 1 - 82,198 ), lin 1-3) . . O 0 16,840<br />

514,481<br />

16a Professional Salaries, other fundraising compens t employee *I* (Pa5tiy*N benefits lin (Pa rgcolumn (A), lines 5-10) 1 463,114.<br />

b Total fundraising expens s( art IX, column (D), line Q P ------------------ -Q 7<br />

709,422 649,189<br />

17 Other expenses (Part IX, col Tf" 41)<br />

18 Total expenses Add line 13- If , col mn (A), line 25)<br />

1,254,734 1,180,510<br />

19 Revenue less expenses Subtract line 18 from line 12 . . 7 260,827<br />

-150,849<br />

s.<br />

20 Total assets (Part X, line 16) . . .<br />

21 Total liabilities (Part X, line 26) . . .<br />

22 Net assets or fund balances Subtract line 21 from line 20 O 0<br />

Beginning of Current Year End of Year<br />

2,224,497 2,073,648<br />

2,224,497 2,073,648<br />

Here<br />

Under penalties of penury, I dedare that I have examined this retum, including accompanying schedules and statements, and to the best of my knowledge<br />

and belief, i is e, correct, and com te Dedaration of preparer (other than ofiicer) is based on all iniorrnation of which preparer has any knowledge<br />

. U I<br />

* .. I I &/I<br />

Slgn , ignature of office I ate i 7"?-L0 ,<br />

Signature Block<br />

uoromen E00 065: i/imager/fnunai may<br />

Paid signature self- ($69 IHSINCIIUISI<br />

1 preparefs -i Date Check if Preperefs identifying number<br />

I Ein v 65-0292391<br />

use only $*gg,femp,oy:$)I"" LaPadula Carlson + Co , CPA"s<br />

address, and zip + 4 2 Alhambra Plaza, Suite 1100, Coral Gables, FL 33134 Phone no P (305) 529-9300<br />

Preparers -tx* I 6/11/2010 employed *EI P008 Oi 61 Ll 9<br />

May the IRS discuss this return with the preparer shown above7 (see instructions) . . . . . Yes I:I No<br />

For Privacy Act and Paperwork Reduction Act Notice, see the separate Instnictions. Form 990 (2009)<br />

(HTA)<br />

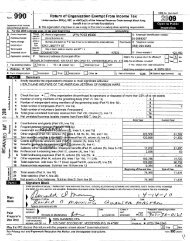

44

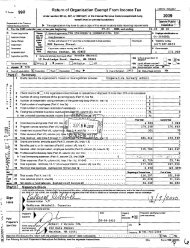

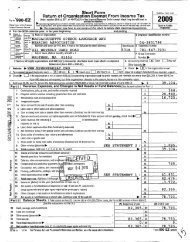

Form 990 (2009) Spnnkler Fitters U A. Local 821 59-0936961 Page 2<br />

* Statement of Program Service Accomplishments<br />

1 Bnefiy descnbe the organization"s mission.<br />

PIQIUQEG $99. Yi*-Elf? EQ 9.f.fI1.e.fI1P.e.f.5.tI1f.0H9*J .QQ*1Q9f.lY9-l2@E9@ LQIDS. ?9.f 99.119915 .................................................. - <br />

2 Did the organization undertake any significant program services dunng the year which were not listed on<br />

the pnor Form 990 or 990-Ez? . . . . . . . . . . . lj Yes No<br />

services?<br />

If "Yes," describe these new services on Schedule<br />

.<br />

O<br />

. . . . lj Yes No<br />

3 Did the organization cease conducting, or make significant changes in how it conducts, any program<br />

If "Yes," descnbe these changes on Schedule O<br />

4 Describe the exempt purpose achievements for each of the organization"s three largest program services by expenses.<br />

Section 501(c)(3) and 501(c)(4) organizations and section 4947(a)(1) trusts are required to report the amount of grants and<br />

allocations to others, the total expenses, and revenue, if any, for each program service reported<br />

4a (Code ,,,,,,,,,,,, n ) (Expenses $ ------ - 912. .1211 including grants of $ ------------ "Q ) (Revenue $ -------------- "Q )<br />

F.f9J/ji-Lflfl 9.f.S1%D0995.ED9.99D9.5.f9.f9. 919019955 .ai Y*L%ll?.S. U19 RLQFDPELQQ .0.f.99D9.f9l ........................................... -welfareef.m.ein.Qefs.ans1.ti19u.femiILes----------<br />

......... ....... ....... ....... .........<br />

4b (Code ------------ U )(Expenses $ ------ -2-1-Q.-3,51 including grants of$ ------------ "Q ) (Revenue $ -------------- "Q )<br />

Mac*sstB.e99y9ry.easements99ll99$99.tf9nJ-n1.i-linker?-.QIl.Q.Q21us9mQ.f9aBe .............................................. -<br />

L1DJ9D.9QDLf.2.Qf9.f5.E0.Qf.9.995399149/251 $b9.Q9D1fI1.e.f.CJ@l. LTl@EKQf.9y.$u951QI.21Q9 ........................................<br />

L%l29E.02&*?<br />

4c (Code. ------------ n ) (Expenses $ ------------ "Q including grants of $ ------------ "Q ) (Revenue $ -------------- "Q )<br />

4d Other program services (Descnbe in Schedule O )<br />

(Expenses $ 0 including-grants of $ 0 )-(Revenue $ 0)<br />

4e Total program service expenses P 1,180,510<br />

Form 990 (zoos)

Form 990 (2009) sprinkler Filters u A. Local 821 59-0936061 Page 3<br />

Pan IV Checklist of Required Schedules<br />

.-G-2-Z Yes No<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

16<br />

17<br />

18<br />

19<br />

20<br />

o<br />

Q<br />

0<br />

O<br />

complete Schedule A . . . .<br />

Is the organization required to complete Schedule B, Schedule of Contributors? .<br />

Is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)? lf "Yes, "<br />

Part ll . . . . .<br />

Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to<br />

candidates for public office? lf "Yes, " complete Schedule C, Part/ . . .<br />

Section 501(c)(3) organizations. Did the organization engage in lobbying activities? If "Yes, " complete Schedule<br />

C,<br />

Section 501(c)(4), 501(c)(5), and 501(c)(6) organizations. ls the organization subject to the section 6033(e) notice<br />

and reporting requirement and proxy tax? lf "Yes, "complete Schedule C, Part ll/ .<br />

Did the organization maintain any donor advised funds or any similar funds or accounts where donors have<br />

the right to provide advice on the distnbution or investment of amounts in such funds or accounts? lf "Yes, "<br />

complete Schedule D, Partl . . . . . . .<br />

Did the organization receive or hold a conservation easement, including easements to preserve open space,<br />

the environment, historic land areas, or historic structures? If "Yes, " complete Schedule D, Part ll<br />

Did the organization maintain collections of works of art, histoncal treasures, or other similar assets? lf "Yes, "<br />

complete Schedule D, Part Ill . . . . . . . . . . .<br />

Did the organization report an amount in Part X, line 21, serve as a custodian for amounts not listed in Part<br />

X, or provide credit counseling, debt management, credit repair, or debt negotiation services? lf "Yes, "<br />

complete Schedule D, Part IV . . . . . . .<br />

Did the organization, directly or through a related organization, hold assets in term, permanent, or<br />

quasi-endowments? If "Yes, " complete Schedule D, Part V . . . . . . .<br />

Is the organizations answer to any of the following questions "Yes"? lf so, complete Schedule D, Parts Vl,<br />

VII, Vlll, IX, orX as applicable . . .<br />

Did the organization report an amount for land, buildings, and equipment in Part X, line 10? lf "Yes, "complete<br />

Schedule D, Part V/<br />

Did the organization repoit an amount for investments-other securities in Part X, line 12 that is 5% or more<br />

of its total assets reported in Part X, line 16? lf "Yes, " complete Schedule D, Pan Vl/<br />

Did the organization repoit an amount for investments-program related in Part X, line 13 that is 5% or more<br />

of its total assets reported in Part X, line 16? lf "Yes, " complete Schedule D, Part Vlll<br />

Did the organization report an amount for other assets in Pait X, line 15 that is 5% or more of its total assets<br />

reported in Part X, line 16? If "Yes, "complete Schedule D, Part /X<br />

Did the organization report an amount for other liabilities in Part X, line 25? lf "Yes, " complete Schedule D, PartX<br />

Did the organization*s separate or consolidated financial statements for the tax year include a footnote that<br />

addresses the organizations liability for uncertain tax positions under FIN 48? lf "Yes, " complete Schedule D, Part X<br />

12 Did the organization obtain separate, independent audited financial statements for the tax year? If "Yes, " compI6f6<br />

Schedule D, Parts Xl, Xll, and Xlll .<br />

12X<br />

12A<br />

I N0X , 2<br />

Was the organization included in consolidated, independent audited Hnancial statements for the tax<br />

.-.il<br />

Y88<br />

year? lf "Yes, " completing Schedule D, Parts Xl, X//, and Xlll is optional . 12A<br />

-*l<br />

13 Is the organization a school described in section 170(b)(1)(A)(ii)? lf "Yes, " complete Schedule E .<br />

I 13<br />

14a Did the organization maintain an oflice, employees, or agents outside of the United States?<br />

14a<br />

b<br />

9.<br />

-...-.L<br />

14b<br />

15<br />

Did the organization have aggregate revenues or expenses of more than $10,000 from grantmaking, fundraisin<br />

business, and program service activities outside the United States? If "Yes, " complete Schedule F, Part/<br />

Did the organization report on Part IX, column (A), line 3, more than $5,000 of grants or assistance to any<br />

organization or entity located outside the United States? lf "Yes, " complete Schedule F, Pan ll . . .<br />

Did the organization report on Pait IX, column (A), line 3, more than $5,000 of aggregate grants or assistance<br />

to individuals located outside the United States? lf "Yes, " complete Schedule F, Part /ll<br />

Did the organization report a total of more than $15,000 of expenses for professional fundraising services<br />

on Part IX, column (A), lines 6 and 11e? If "Yes, " complete Schedule G, Part/ . .<br />

Did the organization report more than $15,000 total of fundraising event gross income and contnbutions on<br />

Part VIII, lines 1c and 8a? If "Yes, "complete Schedule G, Part ll . .<br />

Did the organization report more than $15,000 of gross income from gaming activities on Part VIII, line 9a?<br />

lf "Yes," complete Schedule G, Part Ill . . . . .<br />

Did the organization operate one or more hospitals? lf "Yes, " complete Schedule H .<br />

1 X<br />

2 X<br />

Li?<br />

5 x<br />

6 X<br />

7 X<br />

8 X<br />

9 X<br />

10 X<br />

11 X<br />

15 x<br />

16 x<br />

11 x<br />

18 x<br />

19 zo x<br />

Form 990 (zoos)

Form 990 (2009) I Sprinkler Fitters U.A Local 821 59-0936961 Page 4<br />

Checklist of Required Schedules (cont/nued)<br />

Did the organization report more than $5,000 of grants and other assistance to govemments and organizations<br />

in the United States on Part IX, column (A), line 1? If "Yes, "complete Schedule l, Parts l and ll . .<br />

Did the organization report more than $5,000 of grants and other assistance to individuals in the<br />

United States on Part IX, column (A), line 2? If "Yes," complete Schedule l, Parts I and /ll .<br />

Did the organization answer "Yes" to Part VII, Section A, line 3, 4, or 5 about compensation of the<br />

organization"s current and former officers, directors, tnistees, key employees, and highest compensated<br />

employees? lf "Yes, " complete Schedule J . . . . . . . .<br />

Did the organization have a tax-exempt bond issue with an outstanding principal amount of more than<br />

$100,000 as of the last day of the year, that was issued after December 31, 2002? lf "Yes, " answer lines<br />

24b through 24d and complete Schedule K lf Wo, " go to line 25 . .<br />

Did the organization invest any proceeds of tax-exempt bonds beyond a temporary period exception? .<br />

Did the organization maintain an escrow account other than a refunding escrow at any time during the year<br />

to defease any tax-exempt bonds? . . . . . .<br />

Did the organization act as an "on behalf of* issuer for bonds outstanding at any time during the year?<br />

Section 501(c)(3) and 501(c)(4) organizations. Did the organization engage in an excess benefit transaction<br />

with a disqualified person dunng the year? lf "Yes, " complete Schedule L, Part/ . .<br />

ls the organization aware that it engaged in an excess benefit transaction with a disqualified person in a<br />

pnor year, and that the transaction has not been reported on any of the organization"s pnor Forms 990 or<br />

990-EZ? lf "Yes, " complete Schedule L, Part/ .<br />

Was a loan to or by a current or former officer, director, trustee, key employee, highly compensated employee, or<br />

disqualified person outstanding as of the end of the organization"s tax year? lf "Yes,"complete Schedule L, Part ll .<br />

Did the organization provide a grant or other assistance to an officer, director, trustee, key employee,<br />

substantial contributor, or a grant selection committee member, or to a person related to such an individual?<br />

lf "Yes, " complete Schedule L, Part lll . . . . .<br />

Was the organization a party to a business transaction with one of the following parties (see Schedule L,<br />

Part IV instructions for applicable tiling thresholds, conditions, and exceptions)<br />

A current or former oficer, director, trustee, or key employee? lf "Yes, " complete Schedule L, Part IV .<br />

A family member of a current or former officer, director, trustee, or key employee? If "Yes, " complete<br />

Schedule<br />

Part IV<br />

L, Part<br />

. .<br />

/V<br />

.<br />

.<br />

.<br />

An entity of which a current or former officer, director, trustee, or key employee of the organization (or a<br />

family member) was an ofhcer, director, tnistee, or direct or indirect owner? If "Yes," complete Schedule L,<br />

Part<br />

Did the organization receive more<br />

l<br />

than $25,000<br />

.<br />

in<br />

.<br />

non-cash<br />

.<br />

contributions?<br />

. .<br />

lf "Yes,<br />

.<br />

"complete<br />

.<br />

Schedule<br />

.<br />

M .<br />

Did the organization receive contnbutions of art, historical treasures, or other similar assets, or qualified<br />

conservation contnbutions? lf "Yes, " complete Schedule M . . . .<br />

Did the organization liquidate, terminate, or dissolve and cease operations? lf "Yes, " cc, dule N,<br />

Did the organization sell, exchange, dispose of, or transfer more than 25% of its net assets?<br />

If "Yes, "complete Schedule N, Part ll . , . . . .<br />

Did the organization own 100% of an entity disregarded as separate from the organization under Regulations<br />

sections 301 7701-2 and 301 7701-3? If "Yes, " complete Schedule R, Part/ . . .<br />

Was the organization related to any tax-exempt or taxable entity? lf "Yes, " complete Schedule R, Parts ll,<br />

lll, ll/, and V, line 1 . . .<br />

Is any related organization a controlled entity within the meaning of section 512(b)(13)? lf "Yes, " complete<br />

Schedule R, Part V, line 2 . . . .<br />

V/ . . . . . . . .<br />

Section 501(c)(3) organizations. Did the organization make any transfers to an exempt non-charitable related<br />

organization? lf "Yes, " complete Schedule R, Part V, line 2 . . .<br />

Did the organization conduct more than 5% of its activities through an entity that is not a related organization<br />

and that is treated as a partnership for federal income tax purposes? If "Yes, " complete Schedule R, Part<br />

Did the organization complete Schedule O and provide explanations in Schedule O for Part VI, lines 11 and<br />

19? Note. All Form 990 filers are required to complete Schedule O . . . .<br />

21<br />

22<br />

23<br />

24a<br />

24b<br />

. 24c<br />

24d<br />

25a<br />

25b<br />

26<br />

27<br />

28a<br />

28b<br />

286<br />

29<br />

so<br />

31<br />

sz<br />

:ia<br />

-PLZ?<br />

as<br />

36<br />

38<br />

FOYITI

Form 990 (2009) , Sprinkler F itters U A Local 821 59-0936961 Pa<br />

Statements Regarding Other IRS Filings and Tax Compliance<br />

1a<br />

b<br />

c<br />

2a<br />

b<br />

3a<br />

b<br />

4a<br />

b<br />

5a<br />

b<br />

c<br />

6a<br />

b<br />

7<br />

a<br />

b<br />

c<br />

d<br />

e<br />

f<br />

9<br />

h<br />

9<br />

a<br />

b<br />

10<br />

a<br />

b<br />

11<br />

a<br />

b<br />

12a<br />

b<br />

Enter the number reported in Box 3 of Form 1096, Annual Summary and Transmittal of<br />

U S Information Returns Enter -0- if not applicable . . . 1a<br />

Enter the number of Forms W-2G included in line 1a Enter -0- if not applicable . . . m<br />

Did the organization comply with backup withholding rules for reportable payments to vendors and reportable<br />

gaming (gambling) winnings to pnze winners? . . . . .<br />

Enter the number of employees reported on Form W-3, Transmittal of Wage and Tax<br />

Statements, filed for the calendar year ending with or within the year covered by this retum 2a 5<br />

If at least one is reported on line 2a, did the organization file all required federal employment tax returns? .<br />

Note. lf the sum of lines 1a and 2a is greater than 250, you may be required to e-fi/e this retum (see<br />

instructions)<br />

Did the organization have unrelated business gross income of $1,000 or more during the year covered by<br />

account)?<br />

If "Yes," has it filed a Form 990-T for this year? If "No,<br />

.<br />

" provide<br />

. .<br />

an explanation<br />

. .<br />

in<br />

.<br />

Schedule<br />

.<br />

O .<br />

At any time during the calendar year, did the organization have an interest in, or a signature or other authority<br />

over, a financial account in a foreign country (such as a bank account, secunties account, or other financial<br />

If "Yes," enter the name of the foreign country v --------------------------------------------------------- U<br />

See the instructions for exceptions and filing requirements for Form TD F 90-22.1, Report of Foreign Bank<br />

and Financial Accounts<br />

Was the organization a party to a prohibited tax shelter transaction at any time dunng the tax year? . .<br />

this retum? . . . . . 055*<br />

Did any taxable party notify the organization that it was or is a party to a prohibited tax shelter transaction? .<br />

lf "Yes" to line 5a or 5b, did the organization ile Fomi 8886-T, Disclosure by Tax-Exempt Entity Regarding<br />

Prohibited Tax Shelter Transaction? . .<br />

Does the organization have annual gross receipts that are normally greater than $100,000, and did the<br />

organization solicit any contnbutions that were not tax deductible? . . .<br />

lf "Yes," did the organization include with every solicitation an express statement that such contnbutions or<br />

gifts were not tax deductible? . . . . . . .<br />

Organizations that may receive deductible contributions under section 170(c).<br />

Did the organization receive a payment in excess of $75 made partly as a contnbution and partly for goods<br />

7<br />

0<br />

985<br />

Y98 N0<br />

1c x<br />

iii" ff<br />

3b<br />

4a X<br />

and services provided to the payof7 . . . . M73.-. ,<br />

lf "Yes," did the organization notify the donor of the value of the goods or services provided? .<br />

Did the organization sell, exchange, or othenivise dispose of tangible personal property for which it was<br />

required to ile Form 8282? . . . . . .<br />

beneit contract? . . . . . .<br />

lf"Yes," indicate the number of Forms 8282 filed during the year . . . I 7d I<br />

Did the organization dunng the year. receive any funds, directly or indirectly, to pay premiums on a personal<br />

required? . . . . .<br />

Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract? .<br />

For all contnbutions of qualified intellectual property, did the organization file Form 8899 as required?<br />

For contnbutions of cars, boats, airplanes, and other vehicles, did the organization file a Fom1 1098-C as<br />

Sponsoring organizations maintaining donor advised funds and section 509(a)(3) supporting<br />

organizations. Did the supporting organization, or a donor advised fund maintained by a sponsoring<br />

organization, have excess business holdings at any time dunng the year? . . .<br />

" , . . I 10 I<br />

Initiation fees and capital contnbutions included on Pait Vlll line 12 a<br />

Gross receipts, included on Form 990, Part Vlll, line 12, for public use of club facilities . . m<br />

Section 501(c)(12) organizations. Enter.<br />

Sponsoring organizations maintaining donor advised funds.<br />

Did the organization make any taxable distnbutions under section 4966? . .<br />

Did the organization make a distnbution to a donor, donor advisor, or related person? . .<br />

Section 501(c)(7) organizations. Enter<br />

Gross income from members or shareholders . . . . 1 1a<br />

l aga Gross income nst amounts from other sources due (Do or not received net amounts from due or paid them to other ) . sources . . . EH<br />

Section 4947(a)(1) non-exempt charitable trusts. ls the organization tiling Form 990 in lieu of Form 1041?<br />

lf "Yes," enter the amount of tax-exempt interest received or accrued dunng the year I 12b I<br />

i<br />

i<br />

,vu<br />

X<br />

saw A<br />

5h X<br />

,ig<br />

5c<br />

6a X<br />

Gb<br />

7b<br />

7c<br />

7e I<br />

7f<br />

.ZLE<br />

1h<br />

9a<br />

9b<br />

Fomi<br />

12a<br />

990 (2cue)<br />

i<br />

l<br />

i<br />

l<br />

,- ,l<br />

i<br />

l<br />

l

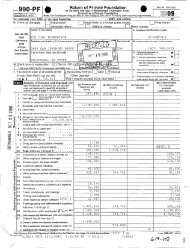

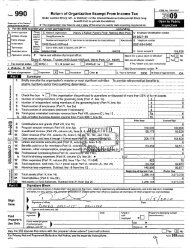

Form 990 (2009) sprinkler Finers u A Local 821 59-0936961 page 6<br />

Part VI Governance, Management, and Disclosure For each "Yes" response to lines 2 through 7b below, and<br />

for a "No" response to line 8a, 8b, or 10b be/ow, describe the circumstances, processes, or changes in<br />

Schedule O. See instructions.<br />

Section A. Governing Body and Management<br />

1a<br />

b<br />

2<br />

3<br />

7a<br />

b<br />

8<br />

a<br />

b<br />

9<br />

p . . .<br />

Did any oflicer, director, trustee, or key employee have a family relationship or a business relationship with<br />

Enter the number of voting members of the goveming body . . 1a 6<br />

Enter the number of voting members that are inde endent m 535 p<br />

any other oflicer, director, trustee, or key employee? . . . . .<br />

Did the organization delegate control over management duties customanly performed by or under the direct<br />

supervision of officers, directors or trustees, or key employees to a management company or other person?<br />

Did the organization make any signiticant changes to its organizational documents since the pnor Form 990 was filed?<br />

Did the organization become aware dunng the year of a matenal diversion of the organizatlon"s assets? .<br />

Does the organization have members or stockholders? . . . . . .<br />

Does the organization have members, stockholders, or other persons who may elect one or more members<br />

of the governing body? . . . .<br />

Are any decisions of the goveming body subject to approval by members, stockholders, or other persons?<br />

Did the organization contemporaneously document the meetings held or written actions undertaken during<br />

the year by the following<br />

The goveming body? . . . . . . . .<br />

Each committee with authority to act on behalf of the goveming body? . .<br />

Is there any officer, director, trustee, or key employee listed in Part VII, Section A, who cannot be reached<br />

at the organlzation"s mailing address? lf "Yes, "provide the names and addresses in Schedule O<br />

Section<br />

form?<br />

B. Policies (This Section B requests information about policies not<br />

.<br />

required by<br />

.<br />

the Intemal<br />

Revenue Code )<br />

10a Does the organization have local chapters, branches, or afillates? . .<br />

b If "Yes," does the organization have written policies and procedures goveming the activities of such chapters,<br />

affiliates, and branches to ensure their operations are consistent with those of the organization?<br />

11 Has the organization provided a copy of this Form 990 to all members of its governing body before tiling the<br />

11A Descnbe in Schedule O the process, if any, used by the organization to review this Form 990 .<br />

nse<br />

12a Does the organization<br />

to<br />

have<br />

conlilcts?<br />

a wntten contiict of interest policy? If "No,"<br />

.<br />

go<br />

.<br />

to /ine<br />

.<br />

13<br />

.<br />

. .<br />

b Are officers, directors or trustees, and key employees required to disclose annually interests that could give<br />

c Does the organization regularly and consistently monitor and enforce compliance with the policy? If "Yes,"<br />

13<br />

14<br />

15<br />

a<br />

b<br />

16a<br />

b<br />

descnbe in Schedule O how this is done . . .<br />

Does the organization have a wntten whistleblower policy? . . .<br />

Does the organization have a written document retention and destruction policy? .<br />

Did the process for determining compensation of the following persons include a review and approval by<br />

independent persons, comparability data, and contemporaneous substantiation of the deliberation and decision?<br />

The organlzatlon"s CEO, Executive Director, or top management official . . .<br />

Other ofiicers or key employees of the organization . . .<br />

If "Yes" to line 15a or 15b, descnbe the process in Schedule O. (See instructions )<br />

Did the organization invest in, contnbute assets to, or participate in a ioint venture or similar arrangement<br />

with a taxable entity during the year? .<br />

If "Yes," has the organization adopted a written policy or procedure requinng the organization to evaluate<br />

its participation in ioint venture arrangements under applicable federal tax law, and taken steps to safeguard<br />

*il Y98i<br />

.1-,S-.-l 2,.,, .x,<br />

.-..-.L .-.-.-L ill .-..L..<br />

73 X<br />

7b X<br />

8aX<br />

the organlzatlon"s exempt status with respect to such arrangements? . .<br />

16b<br />

Section C. Disclosure<br />

17 List the states with which a copy of this Form 990 is required to be filed vital-cz-ne --------------------- -<br />

18 section 6104 requires an organization to make its Forms 1023 (or 1024 if applicable), 990, and 990-T (5o1(cf("3-)2,-Shih" ----------- -I<br />

available for public inspection Indicate how you make these available Check all that apply.<br />

19<br />

20<br />

CI Own website lj Another*s website Upon request<br />

9a<br />

X<br />

-l.L<br />

Yea N0<br />

10a<br />

1-iii--ll<br />

10b<br />

11 X<br />

OL-.<br />

ll<br />

12a<br />

12b x<br />

12c x<br />

I 13 I I X<br />

14X<br />

S-Si<br />

774 *Y*<br />

15b X<br />

16a in<br />

Describe in Schedule O whether (and if so, how), the organization makes its goveming documents, conliict of interest<br />

policy, and financial statements available to the public.<br />

State the name, physical address, and telephone number of the person who possesses the books and records of the<br />

0f9af1I2afl0fi P ,,,,,,,, ,yV,iILlga,rq,lgI9rs5i1ar,l ,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,, ,,i5$3,1,-12,2,-9,621 ,,,,,,, U<br />

106 Ponce de Leon St Suite B, Royal Palm Beach, FL 33411-1213<br />

Form 990 (zoos)

Form 990 (2009) , Sprinkler Fitters U A Local 821 59-0936961 Page 7<br />

Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated<br />

Employees, and Independent Contractors<br />

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees<br />

1a Complete this table for all persons required to be listed. Report compensation for the calendar year ending with or within the<br />

organization"s tax year Use Schedule J-2 if additional space is needed<br />

0 List all of the organization"s current officers, directors, trustees (whether individuals or organizations), regardless of amount<br />

of compensation Enter -0- in columns (D), (E), and (F) if no compensation was paid<br />

* List all of the organization"s current key employees See instructions for definition of "key employee "<br />

0 List the organization"s five current highest compensated employees (other than an officer, director, trustee, or key employee)<br />

who received reportable compensation (Box 5 of Form W-2 and/or Box 7 of Form 1099-MISC) of more than $100,000 from the<br />

organization and any related organizations<br />

0 List all of the organization"s former officers, key employees, and highest compensated employees who received more than<br />

$100,000 of reportable compensation from the organization and any related organizations<br />

0 List all of the organizations former directors or trustees that received, in the capacity as a former director or trustee of the<br />

organization, more than $10,000 of reportable compensation from the organization and any related organizations<br />

List persons in the following order individual trustees or directors, institutional trustees, officers, key employees, highest<br />

compensated employees, and former such persons<br />

(A) (B)<br />

Name and Title Average<br />

El Check this box if the organization did not compensate any current officer, director, or trustee<br />

(C)<br />

- (E<br />

..- 8 -" <br />

QI -5353 5."<br />

Position (check all that apply)<br />

5::<br />

3..<br />

(D) (E)<br />

Reportable Reportable<br />

compensation compensation<br />

from from related<br />

the organizations<br />

organization (W-2/1099-MISC)<br />

(W-2/1099-MISC)<br />

(F)<br />

Estimated<br />

amount of<br />

other<br />

compensation<br />

from the<br />

organization<br />

and related<br />

organizations<br />

.)Mll*?.fU-*Il9I?D".@D ..................... -<br />

Business Mgr ------- 40 X 86,825 o 0<br />

.VY1lll.a."J.99.fD.a.f9.S .............................. --<br />

President X 66,785 0 0o 0<br />

3999.". HQEQQU99? ............................. - - L<br />

Wce President X 0<br />

.U19U1@5.l:E@Ef1*P9. ............................. --<br />

O Recording Sec X<br />

llllll<br />

x<br />

lQfI1D.21lPJL@.f ..................................<br />

Executive Board 0<br />

.E.Inq9-@.2.w .................................... --l<br />

Executive Board<br />

192". KQQUGDPEQKQL ........................... --<br />

Executive Board X O<br />

.Qeyiq 9.999 ...................................<br />

Executive Board X 0<br />

39995 f.Q5.t9Il ................................ --<br />

Finance Committee X 0<br />

.C599f99.By.i1uf19 ...............................<br />

Finance Committee X 0<br />

.J.e.f9.my.Smi.fb .................................. -.<br />

Finance Committee X 0<br />

x 0<br />

0 O<br />

0<br />

0<br />

O<br />

0<br />

O<br />

0<br />

0<br />

0<br />

O<br />

0<br />

0<br />

O<br />

0<br />

Form 990 (2009)

Form 990 (2009) , Spnnkier Fiiiers U A Local 821 59-0936961 Page 8<br />

Part Vll Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)<br />

(A) (B) (C) (D) (E) (F)<br />

Name and title Average Posmon (check an mm apply)<br />

week - ... from from related<br />

(D23<br />

hours per - - Q co<br />

3<br />

I - (W-2/1099-MISC)<br />

Reportable Reportable<br />

compensation compensation<br />

" - the organizations<br />

" organization (W-2/1099-MISC)<br />

-f<br />

Estimated<br />

amount ot<br />

other<br />

compensation<br />

from the<br />

organization<br />

and related<br />

organizations<br />

ll X<br />

3 Did the organization list any former ofticer, director or tnistee, key employee, or highest compensated M g<br />

employee<br />

individual<br />

on line 1a7 If "Yes, complete Schedule J<br />

.<br />

for such<br />

.<br />

individual<br />

. . . .<br />

. . .<br />

.<br />

4 For any individual listed on line 1a, is the sum of reportable compensation and other compensation from<br />

the organization and related organizations greater than $150,000? If "Yes, " complete Schedule J for such gg* <br />

5 X<br />

5 Did any person listed on line 1a receive or accrue compensation from any unrelated organization for Y 7 g 0 g g<br />

services rendered to the organization? lf "Yes, " complete Schedule J for such person .<br />

Section B. Independent Contractors<br />

1 Complete this table for your tive highest compensated independent contractors that received more than $100,000 of<br />

compensation from the organization(A) (B) (C)<br />

Name and business address Descnption of services Compensation<br />

1b Tomi . . v 153,610 0 0<br />

- 2 Total number of individuals (including but not limited to those listed above) who received more than $100,000 in<br />

reportable compensation from the organization D 0<br />

No<br />

2 Total number of independent contractors (including but not limited to those listed above) who received<br />

more than $100,000 in compensation from the organization P 0<br />

Form 990 (zoos)

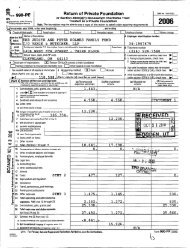

Form 990 (2009) .Sprinkler Fitters U.A. Local 821 59-0936961 Page 9<br />

Part Vlllf Statement of Revenue<br />

Federated campaigns 1a<br />

Membership dues 1b<br />

Fundraising events . . 1c<br />

Related organizations . 1d l<br />

Government grants (contnbutions) 1e<br />

... All other contributions, gifts, grants, and<br />

similar amounts not included above . 1f i<br />

g Noncash contributions included in lines 1a-1f $<br />

h Total. Add lines 1a-1f .<br />

0<br />

987 643<br />

O<br />

O<br />

0<br />

(A)<br />

Total revenue<br />

0<br />

.......... -9. -nf -- 9<br />

b 987,643<br />

Buslness Code<br />

22 E.Xp.eus9-B9imQ9Ls9m.9f1LSl.B9fun9s .......... -. 4,529<br />

ll other program service revenue .<br />

Total. Add lines 2a-2f . .<br />

3 Investment income (including dividends, interest, and<br />

P<br />

O<br />

4,529<br />

37,469<br />

0<br />

other similar amounts) . . .<br />

4 Income from investment of tax-exempt bond proceeds<br />

5 Royalties . . .<br />

Ga Gross Rents<br />

b Less rental expenses<br />

(i) Real (ii) Personal<br />

d Net rental income or (loss) . . . P 0<br />

. P PP<br />

0<br />

O<br />

(B)<br />

Related or<br />

exempt<br />

function<br />

revenue<br />

(C) (D)<br />

Unrelated Revenue<br />

business exd uded from<br />

revenue tax under sedions<br />

512, 513, or 514<br />

c Rentalincomeor(loss) 0 0- g -M g VV- - "Avg M A H g ,<br />

O 0<br />

O 0<br />

7a Gross amount from sales of (I) Securities (ii) Other<br />

assets other than inventory<br />

b Less" cost or other basis<br />

and sales expenses<br />

c Gainor(loss) Ot 0Ww,m",g M A- YM" AM, A/ U U<br />

d Net gain or (loss) .<br />

c Net income or (loss) from fundraising events<br />

9a Gross income from gaming activities<br />

, P<br />

l l i<br />

l<br />

Gross income from fundraising<br />

i<br />

events (not including $ ------------- --Q.<br />

of contnbutions reported on line 1c)<br />

See Part IV, line 18 . . a<br />

b Less. direct expenses . b-ilo<br />

ll, Mwvfj* A AMW 9 9 "WM" " *"9 " "<br />

See Part IV, line 19 . . a<br />

i<br />

b Less direct expenses . bll()o<br />

c Net income or (loss) from gaming activities<br />

10a Gross sales of inventory, less<br />

o<br />

, P 0<br />

ill,<br />

retums and allowances . a .120<br />

b Less cost of goods sold . b<br />

Y c Net income or (loss) from sales of inventory<br />

Miscellaneous Revenue<br />

11a ------------------------------------------- -I<br />

b "U"-"U --------- --U --------- --"U ---- -<br />

C . - - - - - - - . . - - - - - - - - - - . - - - - . - - . - - - - - . . . . - - - - - --.<br />

All other revenue . .<br />

Total. Add lines 11a-11d .<br />

12 Total revenue. See instructions<br />

, P 0<br />

Buslness Code<br />

.P .P 1,029,661 0<br />

0 0<br />

Form 990 (zoos)<br />

i<br />

l<br />

I<br />

i<br />

i<br />

i<br />

i

Form 99012009) - Sprinkler Fmers u.A Local 621 590936961 Page 10<br />

Part IX- Statement of Functional Expenses<br />

Section 501(c)(3) and 501(c)(4) organizations must complete all columns.<br />

All other organizations must complete column (A) but are not required to complete columns (B), (C), and (Q).<br />

Do not include amounts reported on lines 6b,<br />

7b, 8b, 9b, and 10b of Part VIII.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

8<br />

f<br />

9<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

49 lv<br />

1 9<br />

20<br />

21<br />

22<br />

23<br />

24<br />

a<br />

b<br />

c<br />

d<br />

e<br />

f<br />

25<br />

26<br />

Grants and other assistance to governments and<br />

organizations in the U S See Part IV, line 21 .<br />

Grants and other assistance to individuals in<br />

the U S See Part IV, line 22<br />

Grants and other assistance to governments,<br />

organizations, and individuals outside the<br />

U S See Part IV, lines 15 and 16<br />

Benefits paid to or for members<br />

Compensation of current officers, directors,<br />

trustees, and key employees<br />

Compensation not included above, to disqualified<br />

persons (as deined under section 4958(f)(1)) and<br />

persons described in section 4958(c)(3)(B) .<br />

Other salaries and wages . . .<br />

Pension plan contributions (include section 401(k)<br />

and section 403(b) employer contributions)<br />

Other employee benefits . .<br />

Payroll taxes .<br />

Fees for services (non-employees)<br />

Management<br />

Legal .<br />

ccounting . .<br />

Lobbying .<br />

Professional fundraising services See Part IV, line 17<br />

Investment management fees<br />

Other<br />

Advertising and promotion<br />

Office expenses . .<br />

information technology<br />

Royalties .<br />

Occupancy .<br />

Travel . .<br />

Payments of travel or entertainment expenses<br />

for any federal, state, or local public officials<br />

Conferences, conventions, and meetings<br />

Interest .<br />

Payments to affiliates . .<br />

Insurance . .<br />

Other expenses ltemize expenses not<br />

Depreciation, depletion, and amortization<br />

covered above (Expenses grouped together<br />

and labeled miscellaneous may not exceed<br />

5% of total expenses shown on line 25 below )<br />

.T.e.l9P.h.QfJ9 ...................................... -.<br />

MQEKQQ B.e.E9Y9.fY ................................ -.<br />

F.Qf.9.a.E*$@ ...................................... -.<br />

.DH95.a.E9.$9P.$.C.fLEt19D5 ......................... -<br />

Qtnentexes .................................... -<br />

All other expenses --------------------------- -<br />

Total functional expenses. Add lines 1 through 24f<br />

Joint costs. Check here PEI if following<br />

SOP 98-2 Complete this line only if the organization<br />

reported in column (B) ioint costs from a combined<br />

educational campaign and fundraising<br />

solicitation . .<br />

(A) (BI (C) (D)<br />

Total expenses Program service Management and Fundraising<br />

expenses general expenses expenses<br />

O<br />

0<br />

0<br />

16,640 16,640<br />

153,610 153,610<br />

O<br />

137,634 137,634<br />

135,364 135,364<br />

61,260<br />

61,280<br />

26,393 26,393<br />

0<br />

7,056<br />

7,056<br />

26,669 26,669<br />

0<br />

0<br />

O<br />

O<br />

12,712 12,712<br />

50,041<br />

50,041<br />

8,296<br />

0<br />

8,296<br />

25,560 25,560<br />

0<br />

0<br />

63,264 63,264<br />

0<br />

0<br />

36,709 36,709<br />

7,931 7,931<br />

17,369 17,369<br />

210,357 210,357<br />

170,436 170,436<br />

245<br />

324<br />

245<br />

324<br />

10,000 10,000<br />

1,160,510 1,160,510<br />

O<br />

0 0<br />

Form 990 (2009)

F0fm 990 (2009) . Sprinkler Fitters U A Local 821 59-0936961 Page 11<br />

Balance Sheet (A) (B)<br />

Beginning of year End of year<br />

Cash-non-interest-beanng 811,946 750,174<br />

Savings and temporary cash investments . 1,291,428 1,237,060<br />

Pledges and grants receivable, net . .<br />

Accounts receivable, net . . .<br />

Receivables from current and former officers, directors, trustees, key<br />

employees, and highest compensated employees Complete Part ll of<br />

0 O<br />

Schedule L . ,-2 ,2-.,,*,- -2 .-0 -.5 2 --24-.2 *.2 YW. <br />

6 Receivables from other disqualified persons (as delined under section<br />

4958(f)(1)) and persons described in section 4958(c)(3)(B) Complete<br />

Part ll of Schedule L .<br />

Notes and loans receivable, net . .<br />

lnventones for sale or use .<br />

Prepaid expenses and deferred charges .<br />

Land, buildings, and equipment cost or 10a 193 542<br />

other basis Complete Part VI of Schedule D<br />

to 11 0<br />

b Less accumulated depreciation 10b 111,128 7 7" 7121,125 -100 A M" 82,414<br />

11 Investments-publicly traded securities . .<br />

12 Investments-other secunties See Part IV, line 11<br />

13 Investments-program-related See Part IV, line 11 .<br />

14 Intangible assets . .<br />

15 Other assets See Part IV, line 11 0 15 4,000<br />

16 Total assets. Add lines 1 through 15 (must equal line 34) 2,224,497 I 16 2,073,648<br />

017<br />

Grants<br />

Deferred<br />

payable<br />

revenue<br />

.<br />

. . . .<br />

20 Tax-exempt bond liabilities . . .<br />

17 Accounts payable and accrued expenses<br />

18<br />

19<br />

21<br />

22<br />

Escrow or custodial account liability Complete Part lV of Schedule D<br />

Payables to current and former ofhcers, directors, trustees, key<br />

employees, highest compensated employees, and disqualitied<br />

persons Complete Part Il of Schedule L .<br />

23 Secured mortgages and notes payable to unrelated third parties<br />

24 Unsecured notes and loans payable to unrelated third partres .<br />

25 Other liabilities Complete Part X of Schedule D . .<br />

26 Total liabilities. Add lines 17 through 25 . .<br />

Organizations that follow SFAS 117, check here b and<br />

complete lines 27 through 29, and lines 33 and 34.<br />

Unrestricted net assets .<br />

1 0 zo21<br />

,182<br />

19*<br />

-27<br />

28 Temporanly restncted net assets . 28<br />

l<br />

I<br />

l I<br />

l<br />

I1<br />

2,224,497 21 2,073,848<br />

29 Permanently restricted net assets . . . . .<br />

Organizations that do not follow SFAS 117, check here PEI<br />

29,<br />

and complete lines 30 through 34.<br />

22-2*2.,w,, ",256 -2#-2-,-?.-<br />

30 Capital stock or trust pnncipal, or current funds .<br />

31 Paid-in or capital surplus, or land, building, or equipment fund<br />

32 Retained earnings. endowment, accumulated income, or other funds<br />

2.*-he- -- ./.O7 -- A--.. - 4--L Y.--L ..---4-- - I<br />

33 Total net assets or fund balances . . . 2,224,497 33 2,013,848<br />

34 Total liabilities and net assets/fund balances 2,224,497, 34 2,078,848<br />

Form 990 (2009)<br />

31<br />

32<br />

I

l<br />

l<br />

Form 990 (2009) sprinkler Fruers u.A. Local 821 5941936961 Page 12<br />

Part Xl Financial Statements and Reporting<br />

1<br />

2a<br />

3a<br />

Accounting method used to prepare the Form 990: Cash EI Accrual El Other<br />

lf the organization changed its method of accounting from a prior year or checked "Other," explain in<br />

Schedule O.<br />

Were the organization"s financial statements compiled or reviewed by an independent accountant? . .<br />

Were the organizations financial statements audited by an independent accountant? . . . . . . . . .<br />

If "Yes" to line 2a or 2b, does the organization have a committee that assumes responsibility for oversight of<br />

the audit, review, or compilation of its hnancial statements and selection of an independent accountant? . .<br />

lf the organization changed either its oversight process or selection process during the tax year, explain in<br />

Schedule O.<br />

lf "Yes" to line 2a or 2b, check a box below to indicate whether the financial statements for the year were<br />

issued on a consolidated basis, separate basis, or both: . . . . . . . . . . . . . . . . . . . .<br />

Separate basis lj Consolidated basis E Both consolidated and separate basis<br />

As a result of a federal award, was the organization required to undergo an audit or audits as set forth in<br />

theSingleAuditActand OMBCircularA-133?. . . . . . . . . . . . . . . . . . . . . . . .<br />

If "Yes," did the organization undergo the required audit or audits? lf the organization did not undergo the<br />

reguired audit or audits, explain why in Schedule O and describe any steps taken to undergo such audits.<br />

2a X<br />

2b X<br />

2c X<br />

Yes No<br />

F-- -W -1-l<br />

3a<br />

3b<br />

Form 990 (2009)<br />

l

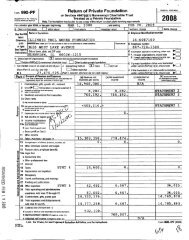

SCHEDULE D oivira No 1545-oo-11<br />

(Form 990) Supplemental V Complete If the organization answered Financial "Yes," to Form 990, Statements<br />

Depmmem onheneawy Part IV, llne 6, 7, 8,9,10,11, or 12. Open to Public<br />

Name of the organization Employer Identification number<br />

S rinkler Fitters U A. Local 821 59-0936961<br />

,,,,,,,,a, Reveme Sem, P Attach to Form 990. P See separate Instructions. I Inspection<br />

@ Organizations Maintaining Donor Advised Funds or Other Similar Funds or Accounts. Complete if<br />

the organization answered "Yes" to Form 990, Part IV, line 6.<br />

(a) Donor advised funds (b) Funds and other accounts<br />

Total number at end of year<br />

Aggregate contributions to (during year)<br />

Aggregate grants from (dunng year)<br />

Aggregate value at end of year<br />

Did the organization inform all donors and donor advisors in wnting that the assets held in donor advised<br />

funds are the organization"s property, subject to the organization"s exclusive legal control? EI Yes lj No<br />

6 Did the organization inform all grantees, donors, and donor advisors in writing that grant funds can be<br />

used only for charitable purposes and not for the benefit of the donor or donor advisor, or for any other<br />

purpose confernng impermissible private benefit? . . . . . lj Yes EI No<br />

Conservation Easements. Complete if the organization answered "Yes" to Fomi 990, Part IV, line 7.<br />

1 Purpose(s) of conservation easements held by the organization (check all that apply)<br />

El Preservation of land for public use (e g , recreation or pleasure) El Preservation of an histoncally important land area<br />

lj Protection of natural habitat El Preservation of a certitied historic structure<br />

E Preservation of open space<br />

2 Complete lines 2a through 2d if the organization held a qualified conservation contnbution in the form of a conservation<br />

easement on the last day of the tax year<br />

Held at the End of the Tax Year<br />

Total number of conservation easements . . 2a<br />

Total acreage restricted by conservation easements 2b<br />

Number of conservation easements on a certified historic structure included in (a) 2c<br />

Number of conservation easements included in (c) acquired after 8/17/06 2d<br />

3 Number of conservation easements modified, transferred, released, extinguished, or terminated by the organization<br />

during the tax year F ---------- U<br />

4 Number of states where property subject to conservation easement is located P ------------ -<br />

5 Does the organization have a wntten policy regarding the periodic monitonng, inspection, handling of<br />

violations, and enforcement ofthe conservation easements it holds? . . . El Yes D No<br />

6 Staff and volunteer hours devoted to monitoring, inspecting, and enforcing conservation easements during the year<br />

b<br />

7 Amount-of expenses incurred in monitonng, inspecting, and enforcing conservation easements during the year<br />

P $<br />

8 Does each conservation easement reported on line 2(d) above satisfy the requirements of section<br />

17O(h)(4)(B)(i) and section 170(h)(4)(B)(ii)? . . . El Yes lj No<br />

9 In Part XIV, describe how the organization reports conservation easements in its revenue and expense statement, and<br />

balance sheet, and include, if applicable, the text of the footnote to the organization"s financial statements that descnbes<br />

the organizations accounting for conservation easements<br />

Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets.<br />

Complete if the organization answered "Yes" to Form 990, Part IV, line 8<br />

1a If the organization elected, as permitted under SFAS 116, not to report in its revenue statement and balance sheet works of<br />

art, histoncal treasures, or other similar assets held for public exhibition, education, or research in furtherance of public<br />

service, provide, in Part XIV, the text of the footnote to its financial statements that describes these items<br />

b If the organization elected, as pemiitted under SFAS 116, to report in its revenue statement and balance sheet works of art,<br />

histoncal treasures, or other similar assets held for public exhibition, education, or research in furtherance of public<br />

service, provide the following amounts relating to these items<br />

(i) Revenues included in Form 990, Part VIII, line 1 . . . . . P $ ------------------- U<br />

(ii)Assets included in Form 990, PartX . . . P $ ------------------- U<br />

2 If the organization received or held works of art, histoncal treasures, or other similar assets for financial gain, provide the<br />

following amounts required to be reported under SFAS 116 relating to these items<br />

a Revenues included in Form 990, Part VIII, line 1 . .<br />

b Assets included in Form 990, PartX . . . . . .<br />

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Fonri 990. Schedule D (Form 990) 2009<br />

(HTA)

- Sprinkler Fitters U A Local 821 59-0936961<br />

SCh6dUl& D (FOITI1 990) 2009 Page 2<br />

Part Ill Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets (cont/nued)<br />

3<br />

4<br />

5<br />

a<br />

b<br />

c<br />

Using the organizations acquisition, accession, and other records, check any of the following that are a significant<br />

use of its collection items (check all that apply)<br />

E Public exhibition d EI Loan or exchange programs<br />

CI Scholarly research e El Other ------------------------------------------- -<br />

III Preservation for future generations<br />

Provide a descnption of the organizations collections and explain how they further the organizations exempt purpose in<br />

Part XIV<br />

During the year, did the organization solicit or receive donations of art, historical treasures, or other similar<br />

assets to be sold to raise funds rather than to be maintained as part ofthe organization"s collection? El Yes lj No<br />

Escrow and Custodial Arrangements. Complete if the organization answered "Yes" to Form 990, Part<br />

IV, line 9, or reported an amount on Form 990, Part X, line 21.<br />

1a<br />

b<br />

2a<br />

b<br />

Endowment Funds. Com lete if the organization answered "Yes" to Form 990, Part IV, line 10.<br />

1a<br />

b<br />

c<br />

d<br />

e<br />

f<br />

9<br />

2<br />

a<br />

b<br />

c<br />

3a<br />

ls the organization an agent, trustee, custodian or other intermediary for contributions or other assets not<br />

included on Form 990, Pan xv . . . . III Yes III Na<br />

Beginning balance . . 1c<br />

If "Yes," explain the arrangement in Part XIV and complete the following table<br />

Amount<br />

Additions Distnbutions Ending<br />

during dunng balance<br />

the the year year . 1d 1e . 1f 0<br />

Did the organization include an amount on Form 990, Part X, line 21? . :I Yes lj No<br />

lf "Yes " explain the arrangement in Part XIV<br />

Beginning of year balance . O<br />

Contnbutions<br />

Net investment eamings, gains,<br />

and losses .<br />

Grants or scholarships<br />

Other expenditures for facilities<br />

and programs . .<br />

Administrative expenses .<br />

End of year balance . 0 0<br />

(a) Current year (b) Prior year (c) Two years back (d) Three years back (e) Four years back<br />

Provide the estimated percentage of the year end balance held as<br />

Board designated or quasi-endowment P ------------ --2/1<br />

Permanent endowment P ------------ -f/i<br />

Term endowment P ----------- "Q/1<br />

Are there endowment funds not in the possession of the organization that are held and administered for the<br />

organization by<br />

(i) unrelated organizations . . . .<br />

(ii) related organizations . . . . .<br />

lf "Yes" to 3a(ii), are the related organizations listed as required on Schedule R? . .<br />

Descnbe in Part XIV the intended uses of the organization"s endowment funds<br />

Land . . 0 0<br />

b<br />

4<br />

Investments-Land,<br />

Buildings<br />

Buildin s and Equipment. See Form 990, Part X,<br />

0<br />

line 10.<br />

0 0<br />

Descnption of investment (a) Cost or other basis (b) Cost or other (c) Accumulated (d) Book value<br />

(investment) basis (other) depreciation<br />

1a<br />

b<br />

c<br />

d<br />

e<br />

Other Leasehold Equipment improvements . . . 173,628 2,072 17,842 101,739 1 8,491 71 9,351<br />

898 174 ,sae .<br />

Total. Add lines 1a through 1e (Column (Q) must equal Form 990, Part X, column (E), line 10(2) P 82,414<br />

Schedule D (Form 990) 2009

. Spnnkler Fitters U A Local 821 59-0936961<br />

schedule o (Form seo) zoos page 3<br />

Investments-Other Securities. See Form 990, Part X, line 12.<br />

(a) Descrrptron of secunty or category (5) Book value (c) Method of valuatron<br />

(rndudrng name of secunty) Cost or end-of-year market value<br />

Frnancral derrvatrves<br />

Closely-held equrty interests<br />

Other ------------------------------------- - <br />

Total. (Column (b) must equal Form 990, PanX, col (B) llne 12) P<br />

Part VIII Investments-Program Related. See Form 990, Part Xi line 13.<br />

(a) Descnptron of investment type (b) Book value<br />

(c) Method of valuation<br />

Cost or end-of-year market value<br />

Total. (Column (D) musl equal Fomr 990, Part X, cd (B) lme 13) P<br />

other Assets. see Form 990, Pan x, une 15.<br />

(a) Descnptron (b) Book value<br />

Total. Column (Q) must equal Form 990, Part X, col (Q) //ne 15)<br />

Other Liabilities. See Fomr 990, Part X, line 25<br />

1, (a) Descnptron of lrabrlrty (b) Amount<br />

Federal Income taxes<br />

mar. (column fb) musr equal Form 990, Panx. ml (B) rms 25 I P O<br />

2. FIN 48 Footnote ln Part XIV, provrde the text of the footnote to the organrzatron"s Hnancial statements that reports the<br />

organrzatron"s Irabrlrty for uncertarn tax posrtrons under FIN 48<br />

P<br />

Schedule D (Form 990) 2009

- Sprinkler Fitters U A Local 821 59-0936961<br />

seneeuie D (Form 990) zoos paw, 4<br />

Reconciliation of Change in Net Assets from Fonn 990 to Audited Financial Statements<br />

1 Total revenue (Form 990, Part VIII, column (A), line 12) 1 1 029 661<br />

Total expenses (Form 990, Part IX, column (A), line 25) . 1 180 510<br />

Excess or (deicit) for the year. Subtract line 2 from line 1 . -150 849<br />

Net unrealized gains (losses) on investments .<br />

Donated services and use of facilities .<br />

Investment expenses<br />

Prior penod adjustments<br />

Other (Describe in Part XIV) . . .<br />

Total adjustments (net) Add lines 4 through 8 . . O<br />

Excess or (deicit) for the year per audited financial statements. Combine lines 3 and 9 . -150,849<br />

Reconciliation of Revenue per Audited Financial Statements With Revenue per Return<br />

Total revenue, gains, and other support per audited financial statements . 1<br />

Amounts included on line 1 but not on Form 990, Part VIII, line 12<br />

Net unrealized gains on investments<br />

Donated services and use of facilities<br />

Recoveries of pnor year grants<br />

Other (Descnbe in Part XIV) ij A<br />

Add lines 2a through 2d . . 2e 0<br />

3 Subtract line 2e from line 1 .<br />

4 Amounts included on Form 990, Part VIII, line 12, but not on line 1<br />

a Investment expenses not included on Form 990, Part VIII, line 7b 4a<br />

b Other (Describe in Part XIV ) . . m M *<br />

c Add lines 4a and 4b . . . . 4c 0<br />

5 Total revenue Add lines 3 and 4c. (This must equal Form 990, Pan I, /ine 12 ) 5 0<br />

Reconciliation of Expenses per Audited Financial Statements With Expenses per Return<br />

1 Total expenses and losses per audited financial statements . . . 1<br />

2 Amounts included on line 1 but not on Form 990, Part IX, line 25<br />

Donated services and use of facilities<br />

Other<br />

Pnor year<br />

losses<br />

adjustments<br />

.<br />

. .<br />

Other Add lines (Descnbe 2a in through Part XIV 2d ) U . A3<br />

0 . . 2e 0<br />

3 Subtract line 2e from line 1<br />

b Other (Describe in Part XIV ) m k Q<br />

c Add lines 4a and 4b . . 4c 0<br />

4 Amounts included on Form 990, Part IX, line 25, but not on line 1: i<br />

a investment expenses not included on Form 990, Part VIII, line 7b . 4a<br />

3 0<br />

5 Total expenses Add lines 3 and 4c. (This must equal Form 990, Part /, /ine 18.) . 5 0<br />

Supplemental information<br />

Complete this part to provide the descriptions required for Part II, lines 3, 5, and 9, Part Ill, lines 1a and 4, Part IV, lines 1b<br />

and 2b, Part V, line 4, Part X, line 2, Part XI, line 8, Part XII, lines 2d and 4b, and Part XIII, lines 2d and 4b Also complete<br />

IPF: P912 .*9.EiQY*9.e. ?DY.?S*9JE*99?.UUf9EfI*?.fLQE ............................................................................... -.<br />

Schedule D (Fonn 990) 2009

scheme o (Form seo) zoos Page 5<br />

. Spnnkler Fltters U A Local 821<br />

59-0936961<br />

Part XIV Sugplemental Information (continued)<br />

schedule o (Form seo) zoos

panm 1 T .<br />

Nm<br />

?,CHE%g:*,":E 0 Complete Supplemental to provlde lnfonnatlon Information for responses to speclflc to Form questlons 990 on OENEQBQ47<br />

Form 990 or to provlde any addltlonal lnfonnatlon. Open to Public<br />

:xmalsglgnflesgzlacfy P At1achtoForm990. Inspection<br />

Name of the organlzatlon Employer ldentlflcatlon number<br />

jpnnkler Fitters U A Local 821 59-0936961<br />

.F.QUI*.999. P95 1 l.l.$99f"9.". 5. LLQQ P. P.f9.V.* ELOJE 9.f.91*-ED/1995.? D9.t29U.e.".t5.f9. D141-*Ull?E EE .ai Mill 9.5. U1? ................................ - <br />

.Rf9."J 9I*.0.f1 9.f.99U9I@l. Y*L@If@ EQ 9.f.fP.e.*PP.e.f.5. Q99. U19 Lf.f?."JLI Lei: ................................................................. - <br />

.F.QE"J.999. 5.3.3.4 .I U.$99I*9.". 9. U11? .Q MQEKQE E@99Y.eIY.@$595Ef1@Dl$: 9.01 l.e.Qt.e.d. ff.Q*P.f.".%*I1.QQf.5L 9f.l4.-*.521 -Q E91 ......................... - <br />

.*-1.5.5211 .t9.fP.3.*$@ .llf1*9.f1 999553 9t.Qfi U19 EQ 9.QfPP.%tLtlY9 ."J.tI1.e. 99.fUL".@EQ*.al .@9591 RY. 59.b.$9LZ.*DH.l*1@*.f.l?P.Qf ........................... - <br />

.QQSAS ................................................................................................................... -<br />

.F.Qm1.999. Elan MI. $9.C.fI.Qf1 .B .L1 09. 1591.0./e 99.5. tw. @lLf9P. m@0@s.e.m.e.f1f.@ Le .dlstefsq by. 20919991 .u.f1I9.0."s ........................... - <br />

.bx4.@mS.whI9b.@I9xQf9.Q9n9y.@U.1b9.m9mQ9t& ............................................................................ -<br />

.F.Qf.m.999. Part MLS9.C.fI.Qf1 .Ei 1-.I n9.15b.Ih:e. 99.51092*-.m21u@99f.he slbs. @y.fb9r-.w.f9. Qstem n9.eeLaues.Qf. ......................... - <br />

.fb9.S.e. n9$.0.Qve@Q.Qx 9. 991199304-1: P.@.fs.a.Imf19 .asceement .................................................................... -<br />

For Prlvacy Act and Paperwork Reduction Act Notlce, see the Instructions for Form 990. schedule 0(Fom1 990) 2009<br />

(HTA)