15. ,469 - Charity Blossom

15. ,469 - Charity Blossom

15. ,469 - Charity Blossom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

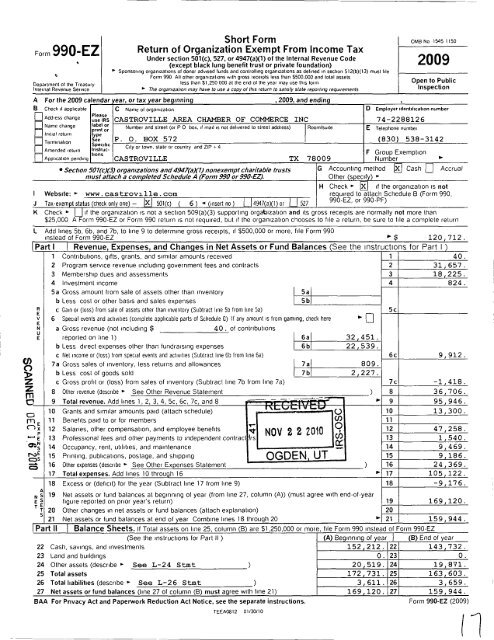

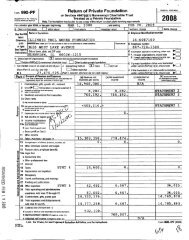

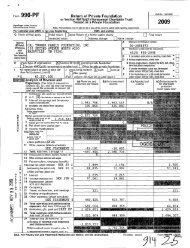

$11011 FOl*m oiviia no 15451150<br />

Form Return of Organization Exempt From Income Tax<br />

, Under section 501(c),<br />

(except black<br />

527,<br />

lung<br />

or<br />

benefit<br />

4947(a)(1)<br />

trust or private foundation)<br />

of the Internal Revenue Code<br />

* Sponsoring organizations ot donor advised funds and controlling organizations as defined in section 5l2(b)(13) must tile<br />

D f T L Form less than 990 All $1,250 other organizations 000 at the end with ot gross the receipts year may less than use $500,000 this form and Open total assets to ,Ub P lc ,.<br />

epartment o the reasury ,ns echo"<br />

li-iternal Revenue Service * The organrzafrori may have fo use a copy of this return to satisfy stale reporting requirements P<br />

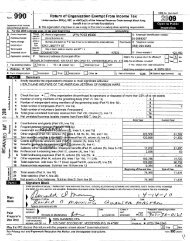

A For the 2009 calendar year, or tax year beginning , 2009, and ending ,<br />

B Check if applicable C Name of organization D Employer identification number<br />

Address change Please<br />

Name change<br />

Initial return<br />

Termination<br />

Amended return<br />

Application pending<br />

uselRs CASTROVILLE AREA CHAMBER OF COMMERCE INC 74-2288126<br />

.paxil<br />

,ms<br />

E: Number and<br />

F<br />

street (or<br />

Group<br />

P O box, if mail is not delivered to<br />

Exemption<br />

street address) Room/suite E Telephone number<br />

City or town. state or country and ZIP + 4<br />

t edi P. o. Box 572 (930) 539-3142<br />

CASTROVILLE TX 78009 Number *<br />

* Sect/on 50 7(c)(3) organrzat/ons and 4947(a)(I) nonexempt c/rar/"tab/e In/sts G ACCOUUUUQ 01911100 Cash E Accrual<br />

, must attach a comp/ered Schedule A (F orm 990 or 9.90-EZ). Other (specify) e<br />

H Check * if the organization is not<br />

I Website: * www,castrov111e . com required to attach Schedule B (Form 990,<br />

:I Tax-exempt status (check only one) - 50l(c) ( 6) * (insert no) U4947(a)(1)or U 527 990452* or 99O"PF)<br />

K Check * EI if the organization is not a section 509(a)(3) supporting orgabization and its gross receipts are normally not more than<br />

$25,000 A Form 990-EZ or Form 990 return is not required, but if the organization chooses to file a return, be sure to file a complete return<br />

instead of Form 990-EZ * S 120 712.<br />

I<br />

L Add lines 5b, 6b, and 7b, to line 9 to determine gross receipts, if $500,000 or more, file Form 990<br />

1PartI I Revenue, Expenses, and Changes in Net Assets or Fund Balances (See the instructions for Part I )<br />

1 Contributions, gifts, grants, and similar amounts received 1 40.<br />

2 Program service revenue including government fees and contracts -2* 31 , 657 .<br />

3 Membership dues and assessments 18 ,225.<br />

4 Investment income<br />

5a Gross amount from sale of assets other than inventory<br />

b Less cost or other basis and sales expenses<br />

5a<br />

-53..-*QF*<br />

c Gain or (loss) from sale of assets other than inventory (Subtract line 5b from line 5a)<br />

6 Special events and activities (complete applicable parts of Schedule G) ll any amount is from gaming, check here * E<br />

reported on line 1) 6a 32,451.<br />

a Gross revenue (not including $ 40. of contributions<br />

b Less direct expenses other than fundraising expenses 6b 22 , 539.<br />

c Net income or (loss) from special events and activities (Subtract line 6b from line 6a)<br />

7a Gross sales of inventory, less returns and allowances 7a 809 .<br />

b Less cost of goods sold 7b 2 ,227.<br />

c Gross profit or (loss) from sales of inventory (Subtract line 7b from line 7a)<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

Other revenue (describe * See Other Revenue Statement )<br />

Total revenue. Add lines 1, 2, 3, 4, 5c, 6c, 7c, and 8 "-*T - 7" 7""-"JC<br />

Grants and similar amounts paid (attach schedule) -f <br />

Benefits paid to or for members<br />

Salaries, other compensation, and employee benefits S- 2 2<br />

Professional fees and other payments to independent contract rs<br />

Occupancy, rent, utilities, and maintenance<br />

Printing, publications, postage, and shipping<br />

Other expenses (describe * See Other Expenses Statement )<br />

Total expenses. Add lines 10 through 16 *<br />

Excess or (deficit) for the year (Subtract line 17 from line 9)<br />

Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree with end-of-year<br />

figure reported on prior year"s return)<br />

Other changes in net assets or fund balances (attach explanation)<br />

21 Net assets or fund balances at end of year Combine lines 18 through 20 *<br />

lPat*l ll I BalanCe Sheets. If Total assets on line 25, column (B) are $1,250,000 or more. file Form 990 instead o<br />

(See the rnslructions lor Part ll ) (A) Beginning of ye<br />

22 Cash, savings, and investments 152 , 212<br />

23 Lana and buidings o .123<br />

25<br />

24 Other<br />

Total<br />

assets (describe<br />

assets<br />

* See<br />

172<br />

L-24 Stmt<br />

, 731.<br />

) 20 , 519.<br />

25<br />

24<br />

26 Total liabilities (describe * See L-26 Stmt ) 3 , 611 . 26<br />

27 Net assets or fund balances (line 27 of column (B) must agree with line 21) 1 69 , 120 . l27<br />

BAA For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.<br />

Teiirtoeiz oiraorio<br />

824 .<br />

-52??-#<br />

6c 9,912.<br />

-7C.<br />

8<br />

-1,418.<br />

36,705.<br />

r 9 95,946.<br />

Le.,-1<br />

1o 13,300.<br />

12 47,258.<br />

13 1 1,540.<br />

14. <strong>15.</strong> 9 <br />

,<strong>469</strong><br />

15<br />

117<br />

18<br />

19<br />

Am<br />

f<br />

arl<br />

.I22<br />

9,186<br />

24,369.<br />

105,122.<br />

-9,176.<br />

169,120.<br />

159,944.<br />

Forn1990-EZ<br />

(B) End ol year<br />

143,732.<br />

0.<br />

19,871.<br />

163,603.<br />

3,659.<br />

159,944.<br />

Forn1990-EZ(2O09)<br />

l 1

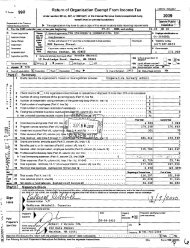

Form 990-EZ (2009) CASTROVILLE AREA CHAMBER OF COMMERCE INC 74-2288126 P3062<br />

IPart III I Statement of Program Service Accomplishments (See the instructions ) Expenses<br />

What is the organizations primary exempt purpose7 TO PROMOTE AREA BUSINESSES & TOURISM<br />

Describe whattwas achieved in carrying out the organizations exempt purposes In a clear and concise manner,<br />

describe the services provided, the number of persons benefited, or other relevant information for each<br />

program title<br />

(Re uired for section<br />

0l(2c)(3) and (4)<br />

orglanizations and section<br />

49 7(-a)(l) trusts, optional<br />

for ot ers)<br />

23 .PBQV.IPPlD. IIEPLOBMATE Q11 EQ .V.ISI.T9BS. .A1512 .PBQSPE QT.IYE. .NEW . . . . . . . . . .- <br />

1395131? 9<strong>15.</strong>35 -I.N. TFP- @1192? BQVI EEE. 355359 - P213-QCELY. P11113? F115 . . . . . . . . .- <br />

AREA BUSINESSES AND COMMUNITY MEMBERS.<br />

fel-ilig 5 ---------- - "fiini-S Efiolfn .Tie-iuEe2 for-@.Qn"gYaEiS, Enf,-el Eels " " " " " - - -- 1 -El 283 41,888.<br />

29 B-STS. 55 .CE1iT.R5& .OBQIENE 9153.1 Q11 F95 .CQELESTIPE .PLNP . . . . . . . . . . . . . .- <br />

DISBURSEMENTS OF CIVIC BETTERMENT FUNDS.<br />

(Grants S ) If this amount includes foreign grants, check here * lj 29a 13,300.<br />

30 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - --<br />

(Grants $ ) If this amount includes foreign grants, check here *U 30a<br />

31 Other program services (attach schedule)<br />

(Grants $ ) lf this amount includes foreign grants, check here * U 31 a<br />

32 Total program service expenses (add lines 28a through 3la) * 32 55 , 188.<br />

IPart IV I List of Officers, Directors, Trustees, and Key Employees. i.isi eacn one even if noi compensated (See the instrs)<br />

(b) Title and average hours (c) Compensation (lf (d) Contributions to (e) Expense account<br />

(a) Name and address per week devoted not paid, enter -0-.) employee benefit plans and and other allowances<br />

to position deferred compensation<br />

SALL IE HARBORTH<br />

292.14111 .99.V*L STE #1 . . . . .-<br />

CAS TROVI LLE TX 78009<br />

.G2EY. Q51-$92 - - - - <br />

.399 .Leia/eE*C.@. - - <br />

Castrovllle TX 78009<br />

.J 911811- 9@.d51e.r.2- - - <br />

29418. .FTE .421 .N. - - <br />

CASTROVILLE TX 78009<br />

F921. @2r.r9*l - - - - <br />

.11 Z .Rs iL@.r. tie-.-esiew. <br />

Castrovllle TX 78009<br />

.FB&N.K-12Pl*1N& - - - - <br />

.1 3 13. PET.EB$.B.UBC.5 .SE<br />

CASTROVILLE TX 78009<br />

.C5QC.K-I$1.EBQE. - - - <br />

.1141 YEE1-595 .P5211 <br />

CASTROVILLE TX 78009<br />

139229- Ii-1311121 - - - - <br />

.99-Z .H91 .99 .ML - - - <br />

CASTROVILLE TX 78009<br />

34:11:-2. Eelznseelelr- - <br />

118 FM 471 N<br />

Yzisw-R561-LLE - " I - TX 78009<br />

953.99359 .Zl1lSl*1E IBB.<br />

-P- -O-. - @O-X- J-5-35: - - <br />

CASTROVILLE TX 78009<br />

.Jesepb .W.121s1.e5- - <br />

.19f11. Brix 99 .W. - - <br />

CASTROVILLE TX 78009<br />

LFEQMBE .C.A1L4EB.ElJ: - <br />

.2151 PBIEPEH - - - - <br />

CASTROVILLE TX 78009<br />

Presldent<br />

5.00 0.<br />

Vlce Presldent<br />

3.00 0.<br />

SEC/TREAS<br />

3.00 0.<br />

Dlrector<br />

1.00 0 .<br />

DIRECTOR<br />

1 . O0 O.<br />

DIRECTOR<br />

1 . 00 0.<br />

DIRECTOR<br />

1 . 00 0.<br />

DIRECTOR<br />

1 . 00 0.<br />

DIRECTOR<br />

1 . O0 0.<br />

DIRECTOR<br />

1 . O0 0.<br />

DIRECTOR<br />

1 . 00 0.<br />

.SQEAFEUE .HE LEIQPEPLN.<br />

.1 9 51 .$919235 .BBE EEE.<br />

DIRECTOR<br />

CASTROVILLE TX 78009 1 . 00 O.<br />

BAA TEEAOBi2 Ol/30/10 Form 990-EZ (2009)

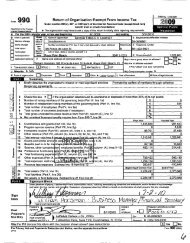

Form<br />

each<br />

990-EZ (2009) CASTROVILLE<br />

activity<br />

AREA CHAMBER OF COMMERCE<br />

33<br />

INC 74-2288126 Page 3<br />

lPart V I Other Information (Note the statement requirements in the instrs for Part V )<br />

1 Yes No<br />

33 Did the organization engage in any activity not previously reported to the IRS? lf "Yes," attach a detailed description of<br />

34 Were any changes made to the organizing or governing documents? lf "Yes," attach a conformed copy of the changes 34<br />

35 ll the organization had income from business activities, such as those reported on lines 2, 6a, and 7a (among others), but not reported on Form 990 T,<br />

attach a statement explaining why the organization did not report the income on Form 990 T See L-35 gtmt<br />

a Did the organization have unrelated business gross income of $1,000 or more or was it subiect to section 6033(e) notice,<br />

reporting, and proxy tax requirements?<br />

b lf "Yes," has it filed a tax return on Form 990-T for this year?<br />

36 Did the organization undergo a liquidation, dissolution, termination, or significant disposition of net assets during the<br />

year? lf "Yes," complete applicable parts of Schedule N<br />

37a Enter amount of political expenditures, direct or indirect, as described in the instructions *I 37al 0 .<br />

b Did the organization file Form 1120-POL for this year? 37b<br />

38a Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee or were<br />

any such loans made in a prior year and still outstanding at the end of the period covered by this return? 38a<br />

amount involved 38h<br />

b If "Yes," complete Schedule L, Part ll and enter the total<br />

39 a Initiation Section fees 50l(c)(7) and capital contributions organizations included on Enter line 9 39a.<br />

b Gross receipts, included on line 9, for public use of club facilities 39b<br />

40a Section 501(c)(3) organizations Enter amount of tax imposed on the organization during the year under<br />

section 4911 v , section 4912 * , section 4955 *<br />

b Section 501 (c)(3) and 501 (c)(4) organizations Did the organization engage in any section 4958 excess benefit<br />

transaction during the year or is it aware that it engaged in an excess benefit transaction with a disqualified person in a<br />

prior year, and that the transaction has not been reported on any of the organization"s prior Forms 990 or 990-EZ? lf<br />

"Yes," complete Schedule L, Part I 40b<br />

c Section 501 (c)(3) and 501 (c)(4) organizations Enter amount of tax imposed on organization<br />

managers or disqualified persons during the year under sections 4912, 4955, and 4958 *<br />

lL<br />

35b X<br />

by the *<br />

d Section 501(c)(3) and 501(c)(4) organizations Enter amount of tax on line 40c reimbursed<br />

e All organizations At any time during the tax year, was the organization a party to a prohibited tax<br />

shelter transaction? lf "Yes," complete Form 8886-T 40e Dali<br />

41 List the states with which a copy ol this return is filed *<br />

36<br />

LL<br />

L<br />

1-.DX<br />

L.<br />

iiooiisareincareof- OFFICE MANAGER Telentwiieiw * (830) 538-314<br />

L0cated at * -QKAITLPL - - - * - - - - - - - *- -QA-SEIEOI/ll?-L-E - - - - -- -Tl(- ZIP + 4 * -7QQO-9 - - * -- <br />

42a The organizations<br />

b At any time during the calendar year, did the organization have an interest in or a signature or other authority over a<br />

financial account in a foreign country (such as a bank account. securities account, or other financial accounl)? 2<br />

If "Yes," enter the name of the foreign country *<br />

2<br />

No<br />

X<br />

See the instructions for exceptions and filing requirements for Form TD F 90-22 1, Report of a Foreign Bank and Financial Accounts<br />

C At any time during the calendar year, did the organization maintain an office outside of the U S ? 42c<br />

ll "Yes," enter the name of the foreign country *<br />

l..-PL<br />

43 Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041 - Check here * EI<br />

and enter the amount of tax-exempt interest received or accrued during the tax year * I 43I<br />

No<br />

Bl<br />

44 Did Ot the Form organization 9 0-EZ maintain any donor advised funds? lf "Yes," Form 990 must be completed instead<br />

45 ls any related organization a controlled entity ot the organization within the meaning of section 512(b)(13)? If "Yes,"<br />

BAA TEEAosi2 oi/30/io Form 990-EZ (2009)<br />

45 X<br />

Form 990 must be completed instead of Form 990-EZ

Form 990-EZ (2009) CASTROVILLE AREA CHAMBER OF COMMERCE INC 74-2288126 Page4<br />

l Part VI I Section 501 (c)(3) organizations and section 4947(a)(1) nonexempt charitable trusts only. All section<br />

501 (c)(3) organizations and section 4947(a)(1) nonexempt charitable trusts must answer questions<br />

146-49b and complete the tables for lines 50 and 51.<br />

46 Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to candidates<br />

for public office? If "Yes," complete Schedule C, Part l<br />

47 Did the organization engage in lobbying activities? If "Yes," complete Schedule C, Part ll<br />

48 ls the organization a school as described in section 17O(b)(1)(A)(ii)? lf "Yes," complete Schedule E<br />

49a Did the organization make any transfers to an exempt non-charitable related organization?<br />

b If "Yes," was the related organization a section 527 organization?<br />

50 Complete this table for the organization"s five highest compensated employees (other than officers, directors, trustees and key<br />

employees) who each received more than $100,000 of compensation from the organization lf there is none, enter "None "<br />

(b) Title and average (c) Compensation (d) Contributions to employee (e) Expense<br />

(a) Name and address ol each employee paid hours per week benetit plans and accoiii-it and<br />

more than $100 000 devoted to position deferred compensation other allowances<br />

DOUG<br />

f Total number of other employees paid over $100,000 *<br />

51 Complete this table for the organization"s five highest compensated independent contractors who each received more than $100,000 of<br />

compensation from the organization If there is none, enter "None "<br />

H0119<br />

(a) Name and address ol each independent contractor paid more than $100 O00 (b) Type ol service (c) Compensation<br />

d Total number of other independent contractors each receiving over $100,000 *<br />

Under penalties of peritiry l declare that I have examined this return, including accompanying schedules and statements, and to the best ol my knowledge and beliel it is<br />

true correct and complete Declaration of preparer (other than ofiicei) is based on all information of which preparer has any knowledge<br />

gigrle , Sig/L:-Jiri( oioiiicei tx X& / * lbaill IJ<br />

MP7,, QQWQXWW Tr9rSvxftf<br />

l Pre-<br />

Preparei"s<br />

Slgnalme<br />

N ( Date<br />

1<br />

Sgfck<br />

1 /<br />

lf<br />

1<br />

?Srggai:ieSrtIrSugi?:riEilsf)ymg<br />

2 / 1 O employed *<br />

Number<br />

parer-S ifiimsiiiaiiliferoi O ISI Thomas L Tarrllllon, CIPA<br />

USC engployeilei, * PO BOX 722<br />

Only<br />

BAA<br />

3Fi5"fi?a"d<br />

Form<br />

Heloees Tx 7ao23-o722lpii0nen0-<br />

990 EZ<br />

(210)<br />

(2009)<br />

372-9212<br />

May the IRS discuss this return with the preparer shown above? See instructions *E Yes lj No<br />

TEEAosi2 or/30/io

CASTROVILLE AREA CHAMBER OF COMMERCE iNC 74-2288126<br />

Supporting Statement of:<br />

Continued<br />

Form 990-EZ/L1ne 14<br />

Description Amount<br />

Cap1tal Expendltures 229.<br />

Total 9,<strong>469</strong>.<br />

Supporting Statement of:<br />

Form 990-EZ/Llne 15<br />

Description Amount<br />

Dues Copler & lease pub 108. 823.<br />

Membershlp Postage dlrectory 1,707. 1,165.<br />

Vlsltors Newsletter gulde postage 4,516. 294.<br />

Tourlsm dues & sub 477.<br />

Total<br />

Postage - Tourlsm<br />

9,186.<br />

96.<br />

Supporting Statement of:<br />

Mlsc.<br />

Form 990-EZ/L1ne 16, Amount-1<br />

Description<br />

1,620.<br />

t Amount<br />

Total<br />

Tourlsm<br />

14,788.<br />

13,168.<br />

Supporting Statement of:

CASTROVILLE AREA CHAMBER OF COMMERCE INC 74-2288126<br />

Form 990-EZ, Part I, Lune 8<br />

Other Revenue Statement<br />

Other revenue (descnbe)<br />

MEMERSHIP<br />

Newsletter<br />

DIRECTORY<br />

Ads<br />

ADS<br />

790.<br />

2,870.<br />

Ads for V1s1tor Gulde 21,296.<br />

Total<br />

Scholarshlp donatlons<br />

36,706.<br />

rece1ved 11,750.<br />

Form 990-EZ, Part I, Lune I6<br />

Other Expenses Statement<br />

Other expenses (descnbe)<br />

ADVERTISING Llcenses and fees 14,788. 1,017.<br />

Meet1ng Mlleage relmb expense GA 809. 20.<br />

Mlscellaneous<br />

Offlce supplles<br />

expense<br />

3,093.<br />

1,537.<br />

New<br />

tourlsm<br />

Employee<br />

mlleage<br />

Lunch expenses<br />

823.<br />

1,465.<br />

m1sc tourlsm 670.<br />

workshops<br />

tourlsm offlce<br />

and<br />

supplles<br />

semlnars<br />

132.<br />

<strong>15.</strong><br />

TOQI 24,369.<br />

Explanatuon Statement<br />

Form/Lune Form 990-EZ, Part V Llne 35<br />

Expmnamwtd Not Report1ng Income on Form 990-T<br />

Income reported on Llnes 2, 6a, and 7a were frm act1v1t1es related<br />

to the Chamber*s operatlons and not unrelated buslness lncome.

schedule C (Form 990 or 990 Ez) 2009 CASTROVILLE AREA CHAMBER OE COMMERCE INC 74-2288126 Page 2<br />

lPart ll-A IComplete if the organization is exempt under section 501(c)(3) and filed Form 5768 (election under<br />

section 501(h)).<br />

A Check vu if the filing organization belongs to an affiliated group<br />

B Check v if the filing organization checked box A and "limited control" provisions apply<br />

Limits on Lobbying Expenditures - ta) Filifio tb) Affiliated<br />

(The term "expenditures" means amounts paid or incurred.) 0"9a"*Za"0"$ *Dials 910", *mais<br />

1a Total lobbying expenditures to influence public opinion (grass roots lobbying)<br />

b Total lobbying expenditures to influence a legislative body (direct lobbying)<br />

c Total lobbying expenditures (add lines 1a and lb)<br />

d Other exempt purpose expenditures<br />

e Total exempt purpose expenditures (add lines lc and 1d)<br />

f Lobbying nontaxable amount Enter the amount from the following table in<br />

both columns<br />

lf Not the amount over $500,000 on line le, column 20% (a) of or (b) the is amount ,The lobbying on nontaxable line amount is<br />

Over $1,000,000 $500,000 but but not not over $1,000,000 $1,500,000 I $100,000 $175,000 plus 10% 15% of ol the excess over $1,000,000 $500,000<br />

section 4911 tax for this year? lj Yes lj No<br />

4-Year Averaging Period Under Section 501(h)<br />

(Some organizations that made a section 501(h) election do not have to complete all of the five<br />

columns below. See the instructions for lines 2a through 21.)<br />

Over $1,500,000 but not over $17,000,000 I $225,000 plus 5% of the excess over $1,500,000<br />

ov@r$i7,ooo,oo0 I $1,000,000<br />

g Grassroots nontaxable amount (enter 25% of line lf)<br />

h Subtract line lg from line 1a If zero or less, enter -Oi<br />

Subtract line lf from line lc lf zero or less, enter -Oj<br />

ll there is an amount other than zero on either line 1h or line li, did the organization file Form 4720 reporting<br />

Lobbying Expenditures During 4-Year Averaging Period<br />

Calendar year (or fiscal<br />

year beginning in) (a) 2006 (b) 2007 (C) 2008 (d) 2009 (e) Total<br />

2 a Lobbying non-taxable<br />

amount<br />

b Lobbying ceiling<br />

amount (15O% of line<br />

2a, column (e))<br />

c Total lobbying<br />

expenditures<br />

d Grassroots nontaxable<br />

amount<br />

e Grassroots ceiling<br />

amount (15O% of line<br />

2d, column (e))<br />

f Grassroots lobbying<br />

expenditures<br />

BAA Schedule C (Form 990 or 990-EZ) 2009<br />

TEE/A3202 02/05/10

Schedule C (Form 990 or 990 EZ) 2009 CASTROVILLE AREA CHAMBER OF COMMERCE INC 74-2288126 Page 3<br />

IPart ll-B IComp-lete if the organization is exempt under section 501(c)(3) and has NOT filed Form 5768<br />

*(election under section 501(h)).<br />

(H) (b)<br />

Yes No Amount<br />

1 During the year, did the filing organization attempt to influence foreign, national, state or local<br />

legislation, including any attempt to influence public opinion on a legislative matter or referendum,<br />

through the use of<br />

a Volunteers?<br />

b Paid staff oi management (include compensation in expenses reported on lines 1c through li)?<br />

c Media advertisements?<br />

d Mailings to members, legislators, or the public?<br />

e Publications, or published or broadcast statements?<br />

f Grants to other organizations for lobbying purposes?<br />

g Direct contact with legislators, their staffs, government officials, or a legislative body?<br />

h Rallies, demonstrations, seminars, conventions, speeches, lectures, or any similar means?<br />

i Other activities? If "Yes," describe in Part IV<br />

j Total Add lines lc through li<br />

Za Did the activities in line 1 cause the organization to be not described in section 501(c)(3)?<br />

b ll "Yes," enter the amount of any tax incurred under section 4912<br />

c If "Yes," enter the amount of any tax incurred by organization managers under section 4912<br />

d If the filing organization incurred a section 4912 tax, did it file Form 4720 for this year?<br />

I Part Ill-A lComplete if the organization is exempt under section 501(c)(4), section 501(c)(5), or section 501(c)(6)<br />

1 Were substantially all (90% or more) dues received nondeductible by members?<br />

rg n ma e o y in ouse lobbying expenditures of $2,000 or less? 2<br />

2 Did the o anizatio k nl -h<br />

3 Did the organization agree to carryover lobbying and political expenditures from the prior year?<br />

Yes N<br />

lP a ri Ill-B IComplete if the organization is exempt under section 501(c)(4), section 501 (c)(5), or section 501 (c)(6)<br />

if BOTH Part Ill-A, questions 1 and 2 are answered "No" OR if Part lll-A, line 3 is answered "Yes"<br />

1 Dues, assessments and similar amounts from members<br />

2 Section 162(e) non-deductible lobbying and political expenditures (do not include amounts of political<br />

expenses for which the section 527(f) tax was paid).<br />

a Current year<br />

b Cairyover from last year<br />

c Total<br />

3 Aggregate amount reported in section 6033(e)(1)(A) notices of nondeductible section 162(e) dues<br />

4 If notices were sent and the amount on line 2c exceeds the amount on line 3 what portion of the excess<br />

does the organization agree to carryover to the reasonable estimate of nondeductible lobbying and political<br />

expenditure next year? 4<br />

5 Taxable amount of lobbying and political expenditures (see instructions) 5<br />

.lst<br />

-22<br />

I Part IV I Supplemental Information<br />

Complete this part to provide the descriptions required for Part I-A, line 1, Part I-B, line 4, Part I-C, line 5, and Part ll-B, line li<br />

Also, complete this part for any additional information<br />

Ll?-.1<br />

-2-C<br />

3<br />

BAA Schedule C (Form 990 or 990 EZ) 2009<br />

TEEA3203 02/05/10

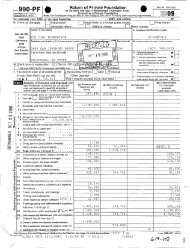

scheduieG(Form 990 or990-Ez)20o9 CASTROVILLE AREA CHAMBER oF COMMERCE INC 74-2288126 Pagez<br />

lpafl ll 1 Fundraising Events. Complete if the organization answered "Yes" to Form 990, Part IV, line 18, or<br />

reported more than $15,000 on Form 990-EZ, line 6a List events with gross receipts greater than $5,000<br />

(a) Event #1 (b) Event #2 (c) Other Events (d) Total Events<br />

* WINETASTING Did-Fashioned Ch... BANQUET (Add C0* , (?))*)hlO"9"<br />

CO<br />

(event type) (event type) (total number) C<br />

1 Gross receipts 12,000. 14,526. 5,925. 32,451.<br />

2 Less Charitable contributions<br />

3 Gross income (line 1 minus line 2) 12,000. 14,526. 5,925. 32,451.<br />

4 Cash prizes<br />

5 Noncash prizes<br />

6 Rent/facility costs<br />

78 Food<br />

Entertainment<br />

and beverages 1,155.<br />

248.<br />

17,298.<br />

248.<br />

18,453.<br />

9 Other direct expenses 549. 2,708. 581. 3,838.<br />

10 Direct expense summary Add lines 4- through 9 in column (d)<br />

11 Net income summary Combine lines 3, column (d) and line 10 * 9 , 912.<br />

lpaff "ll Gaming. Complete if the organization answered "Yes" to Form 990, Part IV, line 19, or reported more than<br />

$15,000 on Form 990-EZ, line 6a<br />

*<br />

1 Gross revenue<br />

2 Cash prizes<br />

3 Non-cash prizes<br />

4 Rent/facility costs<br />

bingo col (c))<br />

(d) Total gaming<br />

(a) Bingo (b) Pull tabs/Instant (c) Other gaming<br />

5 Other direct expenses<br />

Yes Yes Yes<br />

6 Volunteer labor<br />

bingo/progressive (Add col (a) through<br />

7 Direct expense summary Add lines 2 through 5 in column (d) *<br />

8 Net gaming income summary Combine lines 1, column (d) and line 7 *<br />

,-Eli<br />

9 Enter the stale(s) in which the organization operates gaming activities<br />

a ls the organization licensed to operate gaming activities in each of these states? 9a<br />

b lf "No," explain<br />

10a Were any of the organizations gaming licenses revoked, suspended or terminated during the tax year? 10a<br />

b If "Yes," explain<br />

11 Does the organization operate gaming activities with nonmembers7 11<br />

administer charitable gaming? 12<br />

12 ls the organization a grantor, beneficiary or trustee of a trust or a member of a partnership or other entity formed to<br />

BAA TEE/i37o2 oz/05/io Schedule G (Form 990 or 990-EZ) 2009

Schedule G (Form 990 or 990-EZ) 2009 CASTROVILLE AREA CHAMBER OF COMMERCE INC 74-2288126 Page 3<br />

EYEES-.Ni<br />

13 Indicate the percentage of gaming activity operated in<br />

a The organizations facility 13a %<br />

b*An outside facility 13b %<br />

14 Enter the name and address of the person who prepares the organizations gaming/special events books and records<br />

Name * - - - - - - - - - * * F - - - - - - - - - - - - - - - * - F - - - - - - - - - - - - - - - F * - - -- <br />

Address I -Q -, - - - - - - - - - - - - - * * - - - - - - - - - - - - - n - - - - - - w * - - * - * - - - - -- <br />

15a Does the organization have a contact with a third party from whorn the organization receives gaming revenue? *Lib<br />

tt "Yes," enter the amount of gaming revenue received by the organization S and the amount<br />

of gaming revenue retained by the third party S<br />

c If "Yes," enter name and address of the third party<br />

Name * - - - - - - - - - - - - - - - - - - - * * - - - - - - - - - - - - - - - - - * - - - - - - * - - - -- <br />

Address I - - - - - * - - - - - - - - - - - - * * - - - - - - - - - - - - - - - - - * - - - - - * - - - - -- <br />

16 Gaming manager information<br />

Name *<br />

Gaming manager compensation * $<br />

Description of services provided * - - - * * - - - - - - - - - - - - - - * - - - - - * - - - - - - - - - m -- <br />

E Director/officer D Employee E Independent contractor<br />

17 Mandatory<br />

state<br />

distributions<br />

gaming Iicense7 17a<br />

a Is the organization required under state taw to make charitable distributions from the gaming proceeds to retain the<br />

b Enter the amount of distributions required under state law to be distributed to other exempt organizations or spent in the<br />

organizations own exempt activities during the tax year * $<br />

BAA TEE/-i37o3 02/05/io Schedule G (Form 990 or 990-EZ) 2009

Form 990-EZ Other Assets and Liabilities 2009<br />

. Part ll<br />

Name as Shown on Return Employer Identification<br />

CASTROVILLE AREA CHAMER OF COMERCE INC 74-2288126<br />

Line 24 - Other Assets:<br />

Beginning<br />

of Year<br />

End of<br />

Year<br />

ACCOUNTS RECEIVABLE (DEFERRED REVENUE)<br />

INVENTORY HELD FOR RESALE 2,416. 2,012<br />

FURNITURE & EQUIPMENT 17,859. 17,859<br />

Deposlts & Undeposlted Funds 244. O<br />

Totals to Form 990-EZ, Part Il, line 24<br />

20,519. 19,871<br />

Line 26 - Total Liabilities:<br />

Beginning<br />

of Year<br />

End of<br />

Year<br />

DEFERRED REVENUE (SPONSORSHIPS) 700. 700<br />

Accounts Payable 58<br />

SCHOLARSHIPS PAYABLE 550. 550.<br />

Employment Taxes 2,361. 2,351<br />

Totals to Form 990-EZ, Part II, line 26<br />

3,611. 3,659.<br />

TEEWIBOT SCR O2/ll/IO

CASTROVILLE AREA CHAMBER OF COMMERCE INC 74-22881 26<br />

Supporting Statement of:<br />

Form 990-EZ/Llne 6b<br />

Description<br />

1 Amount<br />

Banquet Expenses 581.<br />

Old-Fashloned Chr1stmas 2,956.<br />

Wlnetastlng 1,704.<br />

Mlscellaneous Fundralser expenses 17,298.<br />

Total 22,539.<br />

Supporting Statement of:<br />

Form 990-EZ/L1ne 7b<br />

Description<br />

l Amount<br />

COGS estlmated 404.<br />

Sales Tax 69.<br />

Purchases 1,754.<br />

Total 2,227.<br />

Supporting Statement of:<br />

Form 990-EZ/L1ne 12<br />

Description<br />

i Amount<br />

employment taxes pald 1,209.<br />

Offlce salarles 33,709.<br />

employment taxes pald OT 451.<br />

Tourlsm salarles 9,958.<br />

employment taxes 1,931.<br />

Total 47,258.<br />

Supporting Statement of:<br />

Form 990-EZ/Llne 14<br />

Description<br />

Amount<br />

Insurance-property & l1ab1l1ty 3,025.<br />

R&M offlce equlp 245.<br />

GA - Stelnbach house offlce rent 1,292.<br />

storage rental 660.<br />

telephone 1,097.<br />

Tourlsm - Stelnbach house offlce rent 1,282.<br />

Slgn operatlon - R&M 552.<br />

Telephone - Tourlsm 1,097.