. . . . . O - Charity Blossom

. . . . . O - Charity Blossom

. . . . . O - Charity Blossom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

K<br />

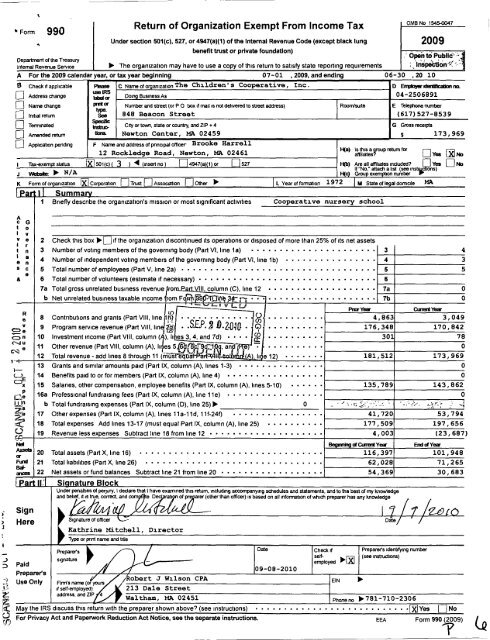

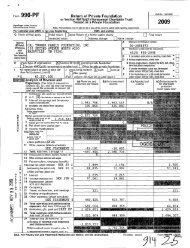

OMB N0 1545-0047<br />

. Fm 990 Return of Organization Exempt From Income Tax<br />

Q under section s01(e), 521, er 4s47(a)(1) ef me internal Revenue cede (except uiaeit iung 2009<br />

benefit trust or private foundatlon) 0 . .P H .<br />

Department of the Treasury I ,<br />

intemai Revenue seniiee P The organization may have to use a copy of this return to satisfy state reporting requirements IUSPWUOD *i 7<br />

A For the 2009 calendar year, or tax year beginning 07-01 , 2009, and ending 06-30 , 20 10<br />

B Check rt applicable<br />

Address change<br />

Name diange<br />

Ptmse<br />

isaIRS<br />

Hzidu<br />

Intex<br />

type.<br />

see<br />

spear:<br />

Doing Business/is 04""2506891<br />

Number and street (or P O box it mail is not delivered to street address) Roomlsuite E Telephone number<br />

848 Beacon Street (617) 527-8539<br />

C Nameotorganization "1"-T19 Chrl-drag" 5 C00P9r3tiT9/ IDE - - Y D E111tlyu*iitlliiimir1o.<br />

malretum<br />

ermmated<br />

*dnb City or town, state or country, and ZIP + 4 G Gross receipts<br />

Anundedremm film Newton Center, MA 02459 5 173,969<br />

, W, 1 N/A ite, on<br />

Application pending F Name and address 01 pnncipal otticer Br 00159 Har 17911<br />

12 Rockledge Road, Newton, MA 02461 Ha) E-rmgfsgmpmmmfu Eye, mm<br />

L Tax-exempt status XI501(c)( 3 ) 4 (insen ne) I I4947(e)(1)ef I I527 Htii) AreeiLemiia1eeindueee7 gljvee Ijm<br />

Fonnolorganization Bicorporation I-ITrustI IAssociation I IOther P L Yearofformation 1972 M Stateotlegaldomicile MA<br />

Summary<br />

1 Briefly describe the 0rganization"s mission or most signiticant activities Cooperat1ve nursery school<br />

Emil<br />

J<br />

3<br />

D2<br />

All<br />

E<br />

lei<br />

U w<br />

& 6<br />

7a<br />

b<br />

L3<br />

@E<br />

X<br />

Q2<br />

2<br />

U-L2<br />

22<br />

IZ<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16a<br />

17<br />

18<br />

19<br />

20<br />

21<br />

b<br />

Check this box PI-I if the organization discontinued its operations or disposed of more than 25% of its net assets<br />

Number ofvoting members ofthe governing body (Pait VI, line1a) - - - - - - - - - - - - - - - - - - - - - - 4<br />

Number ofindependent voting members ofthe governing body (Part Vl, line 1b) - - - - - - - - - - - -- - - - 3<br />

Totalnumberofempioyeeupargvuimega) . . . . . 5<br />

Total number ofvolunteers (estimate if necessary) - - - - - - - - - - - - - -- - - - - - - - - - - <br />

Total gross unrelated business revenue om.Ea VllI,column (C), line 12 - - - - - - - - - - - - - - - - - 7a 0<br />

Net unrelated business taxable income rom F031-F5915-*Ig,,Iiij1e jrm - - - - - - -- - - - - - - - - - - - - - 7b l 0<br />

U Ln * xi s.i t- xv-E I U<br />

Contributions and X grants . . .(Part .. PixrYea . VIII, . . U), line Ii) . CuruiYea* .-TI(-D . . . . 4 . 863 .. . 3 , 049 ,<br />

Program een/iee revenue (Penviii, iineIIl@) - -S-E-P-2 0-2-U-IU - IGPI - - - -- - 176,348 170,842<br />

Investment income<br />

Total oiiierrevenue(Penviii,eeiumn(A),ii mus<br />

(Part Vlll,<br />

q<br />

column(<br />

. ie. ),<br />

.<br />

l 7d) - - - - Q - - - - - - - 301 78<br />

ess safe* T9 je T "ITTIT<br />

.<br />

revenue-add linesBthrough 11 ( "5 VE U A I ,QQ 12) - - Q . - - -- e<br />

.<br />

- - O<br />

181,512 -.. - -. 173,969 - -<br />

0- Grants and similar amounts paid (Part IX, column (A), lines 1-3) <br />

135,789 143,862<br />

0 3 1 f - f- fri,-"Ng (3 1(<br />

Benefits paid to orfor members (Part IX, column (A), line 4) - - - - - - - -- - <br />

Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10) <br />

Professional fundraising fees (Part IX, column (A), line11e) - - - - - - - - - - - <br />

Total fundraising expenses (Part IX, column (D), line 25) P<br />

Otherexpenses (Pait IX, column (A), lines 11a-11d, 11f-24f) - - - - - - - - - - <br />

Total expenses Add lines13-17(must equal Part IX, column (A), line 25) - - - - - <br />

Revenue less expenses Subtract line 18from line 12 - - - - - - - - - - - - - - - <br />

Total assets (Part X, line 16) - - <br />

Total liabilities (Pan X, line 26) - - <br />

Net assets or fund balances Subtract<br />

E ffl Signature Block<br />

Sign<br />

Here<br />

Paid<br />

Preparefs<br />

Use Only<br />

- 41,720 53,794<br />

. . ..<br />

177,509<br />

4,003 (23,697)<br />

197,656<br />

.<br />

Begnti1gdOims1Yes* EnddYea*<br />

. .. ... .<br />

. .<br />

52,029<br />

. . .. 116,397<br />

71,265<br />

101,948<br />

line21fromline20-- - 54,369 30,683<br />

Under penalties et pequry. l declare that l have examined this retum, including accompanying schedules and statements, and to the best ot my knowledge<br />

Signature of oflicer Daz/ 7f<br />

and mer than officer) is based on all infomation which preparer has any knowledge<br />

Kathrine Mitchell , Dlrector<br />

Type or pnnt name and title<br />

Preparers Date Check I1 Preparers identifying number<br />

signature * 231,:-Jloyed<br />

W<br />

HE (see instructions)<br />

"I7<br />

0 9 - 0 8 - 2 0 1 0<br />

mms name (or Yours Robert J W:i.1son CPA EIN p<br />

itself-employed) 213 Dale Street<br />

ad*"e""a""Z"P 1 waltham, MA 02451 p,,,,,,,,,o p7a1-710-2305<br />

May the IRS discuss this return with the preparer shown above? (see instructions) - - - - - - - - - - - - -- - - - - - - - - - - - - -IiIYes I INo<br />

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. EEA Form 990 (2009)

K<br />

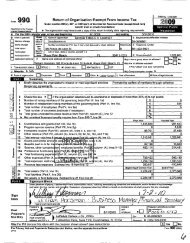

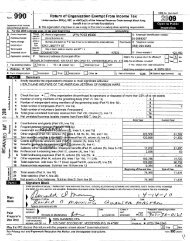

Form 990 (2009) The Chlldrenls Cooperatlve, Inc. 04-2506891 Page 2<br />

Statement of Program Service Accomplishments<br />

1 *Briefly describe the organization"s mission<br />

Cooperatlve nursery school<br />

2 Did the organization undertake any signitlcant program services during the year which were not listed on<br />

thepfl0rFofm990ofQ90-EZ7 -..--..--.----..o-.....- - . . - - . . Q . . . ..-. - - . . --.UYQS IENQ<br />

lf "Yes," descnbe these new services on Schedule O<br />

3 Did the organization cease conducting, or make significant changes in how it conducts, any program<br />

services? ......--..-...........--..--...... . . . . ..... . . - - . ........ljY9g @N0<br />

If "Yes," describe these changes on Schedule O<br />

4 Describe the exempt purpose achievements for each of the organization"s three largest program services by expenses<br />

Section 501(c)(3) and 501(c)(4) organizations and section 4947(a)(1) trusts are required to report the amount of grants and<br />

allocations to others, the total expenses, and revenue, if any, for each program service reported<br />

4a (Code )(Expenses $ 191,906 including grants of $ )(Revenue $ 170,842 )<br />

Cooperative nursery school for 30 children aged 3.9 to 5<br />

4b (Code" )(Expenses $ including grants of S )(Revenue S )<br />

4c (Code )(Expenses $ including grants of $ )(Revenue $ )<br />

(Expenses $ including grants of $ ) (Revenue $ )<br />

EEA Form 990 (2009)<br />

74d Other program servrces (Describe in Schedule O )<br />

740 Total program service expenses P 191 , 906

Fomi 990 (2009) The Chlldrenls Cooperative, Inc. 04-2506891 Page 3<br />

Checklistnof Required Schedules<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

12A<br />

13<br />

14a<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

ls the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)? lf "Yes,"<br />

con-1pleQeScheduleA . - - . - -a..--.--a---.-use--.-----1-..... . . . . - - . . -...-<br />

Is the organization required to complete Schedule B, Schedule ofContributors? - - - - - - - - - - - -- - - - - - - - <br />

Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to<br />

candidates for public office? lf"Yes," complete Schedule C, Partl - - - - - - - - - - - - - - - - - - - - - - <br />

Sectlon 501(c)(3) organizations. Did the organization engage in lobbying activities? If "Yes," complete<br />

Scheduleclpanllsaa-as-a - a a - a a a - aas-u--one-.season . o a - . aea.. 1 anno..<br />

Section 501(c)(-1), 501(c)(5), and 501(c)(6) organizations. Is the organization subiect to the section 6033(e)<br />

notice and reporting requirement and proxy tax? lf "Yes," complete Schedule C, Part lll - - - - -- - - - - - - - - - - - <br />

Did the organization maintain any donor advised funds or any similar funds or accounts where donors have<br />

the right to provide advice on the distribution or investment of amounts in such funds or accounts? If "Yes,"<br />

completescheduleolpanl.---.n.......------.-.-.-as--.aa--an-0. an us.. -<br />

Did the organization receive or hold a conservation easement, including easements to preserve open space,<br />

the environment, historic land areas, or historic structures? lf "Yes," complete Schedule D, Part ll - - - - <br />

Did the organization maintain collections of works of art, histoncal treasures, or other similar assets? If "Yes,"<br />

completescheduleovpanlll. . . . . . . ........---..........-...---...... .. . -.<br />

Did the organization report an amount in Part X, line 21, serve as a custodian for amounts not listed in Part<br />

X, or provide credit counseling, debt management, credit repair, or debt negotiation services? If "Yes,"<br />

C0mpIeteScheduleD,P3r1lV... . . . . . . ........-.................... ... . . ..<br />

Did the organization, directly or through a related organization, hold assets in term, permanent, or<br />

quasi-endowments? If "Yes," complete Schedule D, Part V - - - - - - - - - - - - - - - - - - - - - - <br />

ls the organization"s answer to any of the following questions "Yes"? If so, complete Schedule D, Parts Vl,<br />

VIIIVHIVlxlarxasappllcable-...-..........---....................<br />

Did the organization report an amount for land, buildings, and equipment in Part X, line 10? If "Yes," complete<br />

Schedule D, Part VI<br />

Did the organization report an amount for investments - other securities in Part X, line 12 that is 5% or more<br />

of its total assets reported in Part X, line 16? lf "Yes," complete Schedule D, Part VII<br />

Did the organization report an amount for investments - program related in Part X, line 13 that is 5% or more<br />

of its total assets reported in Part X, line 16? If "Yes," complete Schedule D, Part Vlll<br />

Did the organization report an amount for other assets in Part X, line 15 that is 5% or more of its total assets<br />

reported in Part X, line 16? If "Yes," complete Schedule D, Part IX.<br />

i ir<br />

Did the organization report an amount for other liabilities in Part X, line 25? If *Yes, complete Schedule D, Part X<br />

Did the organization"s separate or consolidated financial statements for the tax year include a footnote that addreSSGS<br />

the organization"s liability for uncertain tax positions under FIN 48? If "Yes," complete Schedule D, Part X<br />

Did the organization obtain separate, independent audited financial statements for the tax year? If "Yes," complete<br />

ScheduleD,PartsXl,Xll,andXlli......................... . . . . . . .<br />

Was the organization included in consolidated, independent audited financial statements for the tax year? ye, N0<br />

YesNo<br />

1 x<br />

2 x<br />

3 x<br />

4 x<br />

L?-.<br />

6 x<br />

1 x<br />

8 x<br />

9 x<br />

1o X<br />

11 X<br />

- -i . . . . . 13 X<br />

Is the organization a school described in section 170(b)(1)(A)(ii)? If "Yes, complete Schedule E - - - -- <br />

lf "Yes," completing Schedule D, Parts Xl,XlI, and Xlll is optional - - - . . . . . - - - - - - - - - - - -- - 12AI t X * -3<br />

Did the organization maintain an office, employees, or agents outside of the United States? - - - - - - - - - - - - - - <br />

Did the organization have aggregate revenues or expenses of more than $10,000 from grantmaking, fundraising,<br />

business, and program service activities outside the United States? If"Yes," complete Schedule F, Partl - - - - - - - - <br />

Did the organization report on Part IX, column (A), line 3, more than $5,000 of grants or assistance to any<br />

organization or entity located outside the United States? If "Yes," complete Schedule F, Part Il - - - - - - - - - - - - - <br />

Did the organization report on Part IX, column (A), line 3, more than $5,000 of aggregate grants or assistance<br />

to individuals located outside the United States? If "Yes," complete Schedule F, Part Ill - - - - - - - - - - -- - - - - - - - <br />

Did the organization report a total of more than $15,000 of expenses for professional fundraising services<br />

on Part IX, column (A), lines6and 11e? If "Yes," complete Schedule G, Partl - - - - - - - - - -- - - - - - - - - - <br />

Did the organization report more than $15,000 total of fundraising event gross income and contributions on<br />

Part Vlll, lines 1c and 8a? If"Yes," complete Schedule G, Part ll - - - - - - - - - - - - - - - - - -- - - - - - - - - - <br />

Did the organization report more than $15,000 of gross income from gaming activities on Part Vlll, line 9a?<br />

lf"Ye5I"cgmpletescheg-juIeG,Partlll......... . . . - - - . ........ . . . . . . . - ............<br />

Did the organization operate one or more hospitals? If "Yes," complete Schedule H - - - - - - - - -- <br />

EEA<br />

, , 4<br />

1<br />

i<br />

I ., $1. Y<br />

1 . fi-we 1<br />

" 1".-* e 1<br />

*.<br />

f 4-*<br />

12 X<br />

14a X<br />

14b X<br />

15 X<br />

is X<br />

11 X<br />

1s X<br />

zo<br />

19<br />

X<br />

Form seo (zoos)<br />

.

22 W22<br />

23<br />

* Yes No<br />

x<br />

Form 990 (2009) The Chlldren* s Cooperatlve, Inc. 04-25068 91 Page 4<br />

Q Checklis-t of Required Schedules (Continued)<br />

..21<br />

21 Did the organization report more than $5,000 of grants and other assistance to governments and organizations<br />

X<br />

in the United States on Part IX, column (A), line 1? lf"Yes," complete Schedule I, Parts I and ll - - - <br />

Did the organization report more than $5,000 of grants and other assistance to individuals in the<br />

United States on Part IX, column (A), line 2? If "Yes," complete Schedule I, Parts I and Ill - - - - -- <br />

X<br />

Did the organization answer "Yes" to Part VII, Section A, line 3, 4, or 5 about compensation of the<br />

26<br />

bC<br />

organization"s current and former officers, directors, trustees, key employees, and highest compensated<br />

emplQyee57 If "Yesl" Complete Schgdule J - . . - . . . . - - . -. . . . - . . Q . - - . . .. . . za X<br />

24a Did the organization have a tax-exempt bond issue with an outstanding principal amount of more than<br />

$100,000 as of the last day of the year, that was issued after December 31, 2002? lf "Yes," answer lines<br />

24b through 24d and complete Schedule K If "No," go to line 25 - - - - - - - - - - - -- - - - - <br />

Did the organization invest any proceeds of tax-exempt bonds beyond a temporary period exception? ..... ...24b<br />

24a X<br />

Did the organization maintain an escrow account other than a refunding escrow at any time during the ye<br />

todefeaseanygakexempgbondsv<br />

BY.. ..... . . . . ........................ . ..24c<br />

d Did the organization act as an "on behalf ot" issuer for bonds outstanding at any time during the year?<br />

24d<br />

25a Section 501(c)(3) and 501(c)(4) organizations. Did the organization engage in an excess benefit transaction<br />

with a disqualified person during the year? If "Yes," complete Schedule L, Part I - - - - - - - - -- zsa X<br />

in Is the organization aware that it engaged in an excess benefit transaction with a disqualified person in a<br />

prior year, and that the transaction has not been reported on any of the organization"s prior Forms 990 or<br />

990-EZ? If "Yes," complete Schedule L, Part I - - - - -- - - - - - - - - - - - - - - - - - - -- - zsb Was a loan to or by a current or former officer, director, trustee, key employee, highly compensated employee, o<br />

disqualified person outstanding as of the end of the organization"s tax year? If "Yes," complete<br />

rii.....25 Schedule L, Part X<br />

27 Did the organization provide a grant or other assistance to an officer, director, trustee, key employee,<br />

substantial contributor, or a grant selection committee member, or to a person related to such an individual?<br />

28<br />

29<br />

30<br />

31<br />

if-yes,--completeScheduleL,pam" . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . .<br />

Was the organization a party to a business transaction with one of the following parties (see Schedule L,<br />

Part IV instructions lor applicable filing thresholds, conditions, and exceptions)<br />

a A current or former officer, director, trustee, or key employee? If "Yes," complete Schedule L, Part IV <br />

b A family member of a current or fonner officer, director, trustee, or key employee? lf "Yes," complete<br />

C<br />

Scheduieimpanlv............. . . . . . . .<br />

An entity of which a current or former officer, director, trustee, or key employee of the organization (or a<br />

family member) was an officer, director, trustee, or direct or indirect owner? If "Yes," complete Schedule<br />

paniv . . . . . . . . . . . . . . . . .<br />

Did the organization receive more than $25,000 in non-cash contributions? If "Yes," complete Schedule M <br />

Did the organization receive contributions of an, historical treasures, or other similar assets, or qualified<br />

conservation contributions? If "Yes," complete Schedule M - - - - - - - - - - - - - - - - - - - - <br />

Partl.. . - . - - . - . -..-......--.-..-.-...---...-----..--.<br />

so<br />

Did the organization liquidate, terminate, or dissolve and cease operations? If "Yes," complete Schedule N.<br />

32 Did the organization sell, exchange, dispose of, or transfer more than 25% of its net assets? If "Yes," complete<br />

33<br />

5cheduieN.panH . . . . .<br />

Did the organization own 100% of an entity disregarded as separate from the organization under Regulations<br />

sections 301 7701-2 and 301 7701-3? If "Yes," complete Schedule R, Partl - - - - - -- - - - - - <br />

34 Was the organization related to any tax-exempt or taxable entity? lf "Yes," complete Schedule R, Parts II,<br />

as<br />

36<br />

37<br />

38<br />

iiiIiV.andV,t,ne1...... . . . . . . . . . . . . . . . . . . ...<br />

Is any related organization a controlled entity within the meaning of section 512(b)(13)? If "Yes," complete<br />

SCheduleR.PanV.Ime2 . . . . - . - . - . ...-........- . . . -..-.. . . . ...<br />

Section 501(c)(3) organizations. Did the organization make any transfers to an exempt non-charitable related<br />

i..<br />

21 X<br />

. . - . . . . ... 283 X<br />

zap X<br />

28c X<br />

29 X<br />

X<br />

31 X<br />

az X<br />

organization? lf"Yes," complete Schedule R, Part V, Iine2 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -- -, 36 X<br />

Did the organization conduct more than 5% of its activities through an entity that is not a related organization<br />

and that is treated as a partnership for federal income tax purposes? If "Yes," complete Schedule R,<br />

pargvi.. . . . . . . . . . . . . . . . . ...<br />

EEA Form 990 (2009)<br />

Did the organization complete Schedule O and provide explanations in Schedule O for Part VI, lines 11 and<br />

as X<br />

34 X<br />

as X<br />

. . . . . . ....37 X<br />

19? Note. All Form 990 filers are required to complete ScheduIeO - - - - - - - - - - - - - -- - 38 X

<br />

Form 990 (2009) The ChJ.1dren"s Cooperative, Inc. 04-2506891 Page5<br />

Yes MI<br />

1a Enter the number reported in Box 3 of Form 1096, Annual Summary and Transmittal of<br />

*if - .. 2 ,, f<br />

.T 7, J . .-. :V A<br />

US Information Returns Enter -0- if not applicable - - - - - - - - - - - - - - - ... -....13<br />

6 15* if 5..<br />

b Enter the number of Forms W-2G included in line 1a Enter -0- if not applicable - - . - - --un<br />

i<br />

0 -5* KVM.<br />

c<br />

- J ff<br />

Did the organization comply with backup withholding rules for reportable payments to vendors and reportable<br />

-3 " Q5, .T , L 1<br />

gaming (gambling) winnings to prize winners? - - - - - - - - - - - -- - - - - - -----1.--an ..--. .....1g,<br />

2a Enter the number of employees reported on Fom1 W-3, Transmittal of Wage and Tax<br />

* Statements-Regarding Other IRS Filings and Tax Compliance<br />

b<br />

3a<br />

b<br />

4a<br />

b<br />

5a<br />

b<br />

c<br />

6a<br />

b<br />

7<br />

a<br />

b<br />

c<br />

d<br />

e<br />

f<br />

9<br />

h<br />

Statements, filed forthe calendar year ending with or within the year covered by this return - - - - - Za t<br />

lf at least one is reported on line 2a, did the organization file all required<br />

,<br />

federal<br />

th<br />

employment tax returns? <br />

Note. lf the sum of lines 1a and 2a is greater than 250, you may be required to e-file this return (see<br />

instructions)<br />

Did the organization have unrelated business gross income of $1 OOO or more during e year covered by<br />

thIsreturn7-..--.. . . . --.s.ss...-.se..---.--..-...-.--..--.- as --<br />

lf "Yes," has it filed a Fonn 990-T for this year? lf "No," provide an explanation in Schedule O - - <br />

At any time during the calendar year, did the organization have an interest in, or a signature or other authority<br />

over, a financial account in a foreign country (such as a bank account, securities account, or other financial<br />

acc0unt)7-.............-.-..........-......---<br />

lf "Yes enter the name of the foreign country P<br />

See the instructions for exceptions and tiling requirements for Form TD F 90-22 1, Report of Foreign Bank<br />

and Financial Accounts<br />

Was the organization a party to a prohibited tax shelter transaction at any time during th<br />

Did any taxable party notify the organization that it was or is a party to a prohibited tax shelter transaction?<br />

If "Yes," to line 5a or 5b, did the organization tile Form 8886-T, Disclosure by Tax-Exempt Entity Regarding<br />

Prohibited Tax Shelter Transaction? - - - - - - - - - - - - - - - - - - - - - - <br />

Does the organization have annual gross receipts that are nonnally greater than $100,000, and did the<br />

organization solicit any contributions that were not tax deductible? - - - - - - - <br />

lf "Yes," did the organization include with every solicitation an express statement that such contributions or<br />

glftswefen0(taXdeducUble7 . . . . . . . . . .. . . . . - - . . . . - . . - . <br />

..3a<br />

ui. .Y<br />

, Y -1t<br />

tv 5<br />

..4a - .<br />

A-f<br />

6b<br />

Organizations that may receive deductible contributions under section 170(c).<br />

Did the organization receive a payment in excess of $75 made partly as a contribution and partly for goods<br />

,.1 L-,Lf-, -alyef--1<br />

andservicesprovidedtothepayor? - - - - - - - - - - - - - - - - - - - - - - 7a X<br />

If "Yes," did the organization notify the donor of the value of the goods or services provided? - - <br />

-7b<br />

Did the organization sell, exchange, or otherwise dispose of tangible personal property for which it was<br />

requ"-edtofjIeFQrm82827 ........--..--.---.--.-..-.<br />

7c<br />

lf"Yes." indicate the number of Forms 8282 filed during the year - - - - - - - - - <br />

Did the organization, during the year, receive any funds, directly or indirectly, to pay premiums on a personal<br />

benefifconffacf).-.---.-.....--.-.......--....-- ........... 19 u r<br />

-n-er-s. DL*-.L.<br />

Did the organization, during the year, pay premiums, directly or indirectly, on a personal<br />

benefit contract? . .. .. 7f<br />

For all contributions of qualified intellectual property, did the organization tile Form 8899 as required? - - .. ........ 7g<br />

For contnbutions of cars, boats, airplanes, and other vehicles, did the organization file a Form 1098-C as<br />

fequlred?.-...-......-....--..-...............<br />

etaxyealqasauoenan -.-.<br />

. . . . .......5b<br />

5 Wifi<br />

. . . . 2b X<br />

Sponsorlng organizations maintaining donor advised funds and section 509(a)(3) supporting<br />

organizations. Did the supporting organization, or a donor advised fund maintained byasponsoring ,,151 -gg .", -Y: J, -ll. * .<br />

organization, have excess business holdings at any time during the year? - - - - <br />

9<br />

,- .,,., , Sponsoring organizations maintaining donor advised funds.<br />

.-.I-,.e:.,,.,<br />

a Did the organization make any taxable distributions under section 4966? - - - - - . . . . . ...... 93<br />

b Did the organization make a distribution to a donor, donor advisor, or related person?<br />

10 Section 501(c)(7) organizations. Enter<br />

a Initiation fees and capital contnbutions included on Part VIII, line 12 - - - - - - - . . . . . ....10a 4- 1<br />

b Gross receipts. included on Form 990, Part Vlll, line 12, for public use of club facilities<br />

3 A ,<br />

11 Section 501 (c)(12) organizations. Enter<br />

a Gross income from members or shareholders - - - - - - - - - - - - - - - - - - .-..-....11<br />

.1<br />

....11b<br />

I.1<br />

1041?Iizbl<br />

A<br />

b Gross income from other sources (Do not net amounts due or paid to other sources against<br />

amountsdueorreceivedfromthem) - - - - - - - - - - - - - - - - - - - - - - <br />

12a Section 4947(a)(1) non-exempt charitable trusts. ls the organization tiling Form 990 in lieu of Form .. . . . . ...12a DQS-S<br />

.<br />

b lf "Yes," enter the amount of tax-exempt interest received or accmed during the year<br />

f i<br />

i EEA Form 990 (2009)<br />

, t<br />

J-ee , ,<br />

I 4,: V-I i<br />

.fxarq<br />

Iifitw<br />

17""<br />

.. 5,:<br />

5,2 1 , .<br />

3b<br />

,X<br />

:<br />

. VF,<br />

st-x<br />

X<br />

s J i<br />

4 1(<br />

1*.-PL<br />

..*-JL<br />

-.i-X.<br />

-6a<br />

. .........7h

x<br />

Form 990 (2009) The Chlldren " s Cooperatlve , Inc. 04-250 6891 Page 6<br />

I-Ea-all-gl-A Governance, Management, and Disclosure FOI* E8Ch "YES" f6Sp0f1S610 IIDES 2 through 7b bel0W, and<br />

* for a "No" response to line 8a, 8b, or 1Ob below, describe the circumstances, processes, or changes in<br />

Schedule O See instructions<br />

Section A. Governing Body and Management<br />

.ll<br />

Y Pb<br />

1a<br />

gp: "5" "<br />

1. <br />

is<br />

b<br />

xr...<br />

8, gf:<br />

5.<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7a<br />

b<br />

b<br />

Enter the number of voting members of the governing body - - - - - - - - - - - - - <br />

Enter the number of voting members that are independent - - - - - -- - - - - - - - - - -- - - - - - <br />

Did any officer, director, trustee, or key employee have a family relationship or a business relationship with<br />

any other officer, director, trustee, or key employee? - - - -- - - - - - - - - - - - -- - - - - - - - - - -- - <br />

Did the organization delegate control over management duties customarily perfom1ed by or under the direct<br />

supervision of officers, directors or trustees, or key employees to a management company or other person? - - - <br />

Did the organization make any significant changes to its organizational documents since the prior Form 990 was filed?<br />

Did the organization become aware during the year of a material diversion of the organization*s assets? - - - - - <br />

Does the organization have members or stockholders? - - - - - - - - - - - -- - - - - - - - - - - - -- - - - <br />

Does the organization have members, stockholders, or other persons who may elect one or more members<br />

ofthegoyel-mngbody7 . . . . . ...-. . . . . ....---.........-ss . . - . . ..-ss...<br />

Are any decisions of the governing body subject to approval by members, stockholders, or other persons? - - - - <br />

Did the organization contemporaneously document the meetings held or written actions undertaken during<br />

the year by the following<br />

1-hegovemmgb0dy7..... . . . . . . . . . . . . . . .<br />

form?<br />

Each committee with authority to act on behalf of the governing body? - - - - - - -- - - - - - - - -- - - - - <br />

ls there any officer, director, trustee, key employee listed in Part Vll, Section A, who cannot be reached<br />

at the organization*s mailing address? lf "Yes," provide the names and addresses in Schedule O - - - - - - - -- <br />

Does the organization have local chapters, branches, affiliates? - - - - - - - - - - -- - - - - - - -- - - <br />

If "Yes," does the organization have written policies and procedures governing the activities of such chapters,<br />

affiliates, and branches to ensure their operations are consistent with those of the organization? - - - - - - - - - <br />

Has the organization provided a copy of this Form 990 to all members of its governing body before filing the<br />

Describe in Schedule O the process, if any, used by the organization to review this Form 990<br />

Section B. Pgticies (This Section B requests infomiation about policies not required by the Internal<br />

Revenue Code )<br />

10a<br />

b<br />

11<br />

11a<br />

12a<br />

b<br />

13<br />

14<br />

15<br />

c<br />

b<br />

16a<br />

b<br />

r,set0conf1,Cg57 . . . .<br />

Does the organization haveawritten conflict of interest policy? lf "No," go to line 13 - - - - - - - - - - -- - - - <br />

Are officers, directors or trustees, and key employees required to disclose annually interests that could give<br />

Does the organization regularly and consistently monitor and enforce compliance with the policy? If "Yes,"<br />

describemscheduleohgwthlsisdgne .....--.......-......- . . . ...--.....-<br />

Does the organization haveawritten whistleblower policy? - - - - - - - - - - - - - - - - - - - - - - - - -- - <br />

Does the organization haveawritten document retention and destruction policy? - - - - - - - - - - - - -- - - <br />

Did the process for determining compensation of the following persons include a review and approval by<br />

independent persons, comparability data, and contemporaneous substantiation of the deliberation and decision?<br />

The organization"s CEO, Executive Director, or top management official - - - - - - - - - - - - - - - - - - - - - - - - - - <br />

Otherofficersorkeyemployeesoftheorganization - - - - - - - - - - - - - - - - - - - - - - - - - - - - - <br />

lf "Yes" to line 15a or 15b, describe the process in Schedule O (See instructions)<br />

Did the organization invest in, contribute assets to, or participate in a joint venture or similar arrangement<br />

with3fgxableenfltydufingtheyeaf).-.................................... . . . ....<br />

lf "Yes," has the organization adopted a written policy or procedure requiring the organization to evaluate<br />

its participation in joint venture arrangements under applicable federal tax law, and taken steps to safeguard<br />

the organization"s exempt status with respect to such arrangements? - - - - - - - - - - - - - - - - - - - - -- <br />

Section C. Disclogure<br />

17 List the states with which a copy of this Fom1 990 is required to be filed P MR<br />

18<br />

19<br />

20<br />

7a X<br />

vb X<br />

-*-.A-., M ,V111-iz.<br />

.f,g%. & "iss rs *<br />

8a X<br />

Bbx<br />

9<br />

X<br />

i...E9..<br />

.SX<br />

Y%<br />

10a<br />

1013<br />

11 X<br />

"*$"f*"f $5-1.1<br />

12a X<br />

12b X<br />

12c<br />

-M91<br />

X.<br />

*ZS<br />

X K<br />

-f .-4 r..<br />

? ,v 1*<br />

16a<br />

ja<br />

.fe-$2<br />

15a<br />

Lu 1 FE.:<br />

-4,*-L qqff<br />

1619<br />

Section 6104 requires an organization to make its Forms 1023 (or 1024 if applicable), 990, and 990-T (501(c)(3)s only)<br />

available for public inspection lndicate how you make these available Check all that apply<br />

D Own website EQ Anothers website lil Upon request<br />

Describe in Schedule O whether (and if so, how), the organization makes its governing documents, confiict of interest<br />

policy, and financial statements available to the public<br />

State the name, physical address, and telephone number of the person who possesses the books and records of the<br />

organization f SCOEC WSJJISI (617) 527-B539<br />

130 Carlisle St Newton Center, MA 02459<br />

EEA Form 990 (2009)

Form<br />

x<br />

990 (2009) The Cluldren* s Cooperatstve , Inc. 04-250 68 91 Page 7<br />

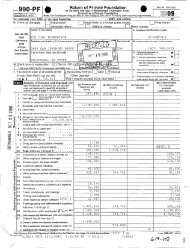

I-Efgtlljf "il Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated<br />

y * Employees-, and Independent Contractors<br />

Section A. Ofticers, Directors, Trustees, Key Employees, and Highest Compensated Employees<br />

1a Complete this table for all persons required to be listed Report compensation forthe calendar year ending with or within the<br />

organization*s tax year Use Schedule J-2 if additional space is needed<br />

g List all of the organization"s current officers, directors, trustees (whether individuals or organizations), regardless of amount<br />

of compensation Enter -0- in columns (D), (E), and (F) if no compensation was paid<br />

5 List all of the organization"s current key employees See instructions for definition of "key employee "<br />

g List the organization"s five current highest compensated employees (other than an officer, director, trustee, or key employee)<br />

who received reportable compensation (Box 5 of Form W-2 and/or Box 7 of Form 1099-MISC) of more than $100,000 from the<br />

organization and any related organizations.<br />

g List all of the organization*sfom1er officers, key employees, and highest compensated employees who received more than<br />

$100,000 of reportable compensation from the organization and any related organizations<br />

g List all of the organization"s former directors or trustees that received, in the capacity as a former director or trustee of<br />

the organization, more than $10,000 of reportable compensation from the organization and any related organizations<br />

List persons in the following order" individual trustees or directors, institutional trustees, officers, key employees, highest<br />

compensated employees, and former such persons<br />

(A) (B) (C) (D) (E)<br />

Name and Title Average Position (dieck all that apply) Reportable Reportable<br />

hours per K compensation compensation<br />

week from from related<br />

organizations<br />

organization (W-2/1099-MISC)<br />

(VV-2/1099-MISC)<br />

I-t Check this box if the organization did not compensate any current officer, director, or trustee<br />

(F)<br />

Estimated<br />

amount of<br />

other<br />

compensation<br />

from the<br />

organization<br />

and related<br />

organizations<br />

President 4 00 xl Secretary 2 . 00 xl q 0<br />

0<br />

0<br />

Brooke Harrell<br />

Maureen Oates<br />

Director<br />

Kathrine Mitchell<br />

40.00 X N 50,178 0<br />

0<br />

Treasurer 4 . 00 X1 q 0<br />

0<br />

Scott Welner<br />

EEA Form 990 (2009)

" (A) (B) (C) (D) (E)<br />

l Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)<br />

Name and Title Average Position (check all that apply) Reportable Reponable<br />

i<br />

Fonn 990 (2009) The Chzldrenl s Cooperative, Inc. 04-250 6891 Page 8<br />

week 9 from from related<br />

hours por K H compensation compensation<br />

the organizations<br />

organization (W-2/1099-MISC)<br />

(W-2/1099-MISC)<br />

(F)<br />

E$mmd<br />

amount of<br />

other<br />

compensation<br />

from the<br />

organization<br />

and related<br />

organizations<br />

1b Total . . . . . . . . 50,179 0 0<br />

2 Total number of individuals (including but not limited to those listed above) who received more than $100,000 in<br />

reportable compensation from the organization P 0<br />

3 Did the organization list any fomier officer, director or trustee, key employee, or highest compensated<br />

employee on line1a? If "Yes," complete ScheduleJfor such individual - - - - - - - - - - - - - - - - -- - - - - - - - -- <br />

Q 4 For any individual listed on line 1a, is the sum of reportable compensation and other compensation from<br />

I md,v,dual.......... . . . . . . . . . .. .. .<br />

N the organization and related organizations greater than $150,000? If "Yes," complete Schedule J for such<br />

Q 5<br />

Did any person listed on line 1a receive or accrue compensation from any unrelated organization for<br />

services rendered to the organization? If "Yes," complete ScheduleJfor such person - - - - - - - - - - - - - - - -- - - <br />

) Section B. Independent Contractors<br />

W, 1 Complete this table for your five highest compensated independent contractors that received more than $100,000 of<br />

compensation from the organization<br />

Yes No<br />

3 X<br />

r Is. je- ,<br />

, ie -.<br />

3 *ni-e iw<br />

.4/1, Jtlfvf :in<br />

.mi ,:.&iZa..mf..<br />

5 X<br />

early 1 <br />

L...-- i..1$$...z- *Y :.1 .z<br />

(A) (B) (C)<br />

Name and business address Description of services<br />

Compensation<br />

2 Total number of independent contractors (including but not limited to those listed above) who received<br />

more than $100,000 in compensation from the organization P<br />

EEA Form 990 (2009)<br />

,li

1a 1b ".<br />

Form<br />

1<br />

990 (2009) The Ch:i.1dren"s Cooparatlve, Inc. 04-2506891 Page9<br />

l-Bgftllll-ll Statement of Revenue<br />

9<br />

Total revenue Related or Unrelated Revenue<br />

* 1 exempt functi im (Bl ic) (Di<br />

business on revenue excluded under from sections tax<br />

revenue 512,<br />

I<br />

513,<br />

7<br />

or514<br />

.<br />

1c<br />

1d<br />

afnlh<br />

Progan<br />

Service<br />

Revdln<br />

1a Federated campaigns - <br />

b Membership dues - - - - -- - - <br />

c Fundraising events - - <br />

d Related organizations<br />

e Government grants (contributions) - 1ei 3,049<br />

.a i<br />

f All other contributions. gifts, grants,<br />

and similar amounts not included above 1f T<br />

9 Noncash contributions included in lines 1a-1f" $<br />

h Total. Add lines la-1f . . . . . . . . 3,04g<br />

23 Day care & education 624410<br />

170,342 79 73<br />

170,842-*MA 1-io,a42i<br />

J<br />

b<br />

C<br />

d<br />

e<br />

f All other program service revenueueeeuln<br />

- ,<br />

9 Total. Add lines 2a-2f <br />

Investment income (including dividends, interest, and<br />

other similar amounts) - <br />

* ,<br />

Income from investment of tax-exempt bond proceeds - - - P<br />

5 Royalties.......--.-.--..--..--..-.,<br />

(i) Real (ii) Personal ,<br />

6a Gross Rents - - - - -- <br />

,-<br />

.<br />

fi<br />

- ,--. 1<br />

.Lt,*<br />

"<br />

b Less rental expenses - - <br />

c Rental income or (loss) - <br />

d Net rental income or (loss)<br />

1a Gross amount from sales of<br />

(i)<br />

3,049<br />

Secunties<br />

-mi<br />

(ii)Other ",<br />

,X51<br />

1 - ,Lt I , L<br />

v. 4<br />

assets other than inventory<br />

b Less cost or other basis<br />

4<br />

and sales expenses - - <br />

iv" x r<br />

l<br />

1.<br />

c Gain or(loss) - - - - - <br />

d Net gain or (loss) - - - - . ..-..) MJ Y-*- Y I 4Y*<br />

Gross income from fundraising ,<br />

events (not including $<br />

of contributions<br />

ctivities ..-3b--?-<br />

fi.-in b<br />

reported<br />

Y K 4,<br />

on line<br />

3"* f<br />

1c)<br />

.3<br />

" j<br />

<br />

See Part IV, line1B - - - <br />

b Less direct expenses - <br />

c Net income or (loss) from fundraising events<br />

9a Gross income from gaming a<br />

.-......a See Part lV, line 19 - - - .. .<br />

. .<br />

P<br />

. ....b<br />

l<br />

.<br />

b Less direct expenses - - - - - - - - - - <br />

c Net income or (loss) from gaming activities <br />

10 Gross sales of inventory, less<br />

retums and allowances - <br />

b Less cost of goods sold <br />

c Net income or (loss) from salesofinventory - - - - - - - - - Miscellaneous Revenue msnw Code Y Y QI<br />

a<br />

b<br />

c<br />

d All other revenue - - - - <br />

e Total. Add lines 11a-11d<br />

12 Total revenue. See instructions . . . . ..<br />

EEA<br />

. . . . . ..<br />

Form<br />

. 5 173,969<br />

990<br />

170,942<br />

(2009)<br />

q -ia<br />

. I - ti,i

Form 990 (2009) The Chzldrenl s Cooperat-.:i.ve , Inc . 04-25068 91 Page 10<br />

. Lganjljq SUgemmntofFuncUonaIExpenses<br />

- Sectlon 501(c)(3) and 501(c)(4) organizations must complete all columns.<br />

All other organizations must complete column (A) but are not required to complete columns (B), (C), and (D).<br />

Do not Include amounts reported on lines 6b, W (B)<br />

Total expenses Program service<br />

7b, 8b, 9b, and 10b of Part VIII. expense,<br />

1 Grants and other assistance to governments and<br />

organizations in the U S See Part IV, line 21<br />

2 Grants and other assistance to individuals in<br />

ihetis seePanivimez2- -- -- --- -<br />

3 Grants and other assistance to governments,<br />

organizations, and individuals outside the<br />

US SeePartlV,lines15and16 - - - - - - - <br />

4 Benefits paid to orfor members - - - - - - - <br />

5 Compensation of current officers, directors,<br />

trustees. and key employees - - - - - - - - - <br />

6 Compensation not included above, to disqualified<br />

persons (as delined under section 4958(f)(1)) and<br />

persons described in section 4958(c)(3)(B)<br />

7 Other salaries and wages - - - - - - - - - <br />

8 Pension plan contributions (include section 401(k)<br />

and section 403(b) employer contributions)<br />

9 Otheremployeebenetits - - - - - - - - - - - - - - <br />

10 Payrolltaxes 4 6 . - . . - . -6 - 6 6 4 . - 6<br />

11 Fees for services (non-employees)<br />

aManagement-4.-6--1-----6.-6---.<br />

bl-egaI........ . . . . ----8<br />

C/Xccguntlng-8.... -1 6 . . . ..-6. 6.<br />

dLobby"-lg... - . . - . . ..-n..----<br />

e Professional fundraising services See Part IV,line 17 <br />

f Investment management fees - - - - - - - - - <br />

gOther.-.-6 . . . . .... . . . - . . -.4<br />

12 Advertising and promotion - - - - - - <br />

13 Office expenses - - - - -- - - - - <br />

14 Information technology - - - - - - - <br />

15 RoyaIhe56--...-- 4 5 6 6.. 6<br />

16 Occupancy.-...... 4 6 . - . ..-6 .6<br />

17 Travel.--8-.--.......--.-.<br />

18 Payments of travel or entertainment expenses<br />

for any federal, state, or local public officials<br />

19 Conferences, conventions, and meetings - - - - - <br />

20 Interest . . . . . . . . . . - . .. . . . . - .<br />

21 Payments to aftiliates - - - - - - - - - - - - <br />

22 Depreciation, depletion, and amortization - - - <br />

23 Insurance.--.....-........<br />

24 Other expenses Itemize expenses not<br />

covered above (Expenses grouped together<br />

N and labeled miscellaneous may not exceed<br />

5% of total expenses shown on line 25 below)<br />

i a Repalrs<br />

- -- 50,178 50,178<br />

83,411 83,411<br />

- 10,273 10,273<br />

.<br />

.<br />

.<br />

..<br />

. 2,453<br />

4,268 4,268<br />

(C) (D)<br />

Management and Fundraising<br />

general expenses expenses<br />

:L<br />

. in -1 -I "s.*,s : J. 1<br />

f . 4,,<br />

As.<br />

4<br />

1<br />

is<br />

4<br />

4<br />

x x7 x<br />

4<br />

s<br />

975 975<br />

1,071 1,071<br />

921 921<br />

17,696 17, 696<br />

y .<br />

. ,rt W<br />

.<br />

7 *i<br />

,,.<br />

r " I<br />

8,134 8,134<br />

2,453<br />

l b Bank charges 49 49<br />

c Groceries 2,852 2,852<br />

d Education consultants 5,504 5,504<br />

e St-.ate fees 330 330<br />

f All other expenses - - - - - - -- - - - - <br />

25 Total functional expenses. Add lines 1 through24<br />

-- 9,541 9,541<br />

26 Jolnt Costs. Check here pm if following<br />

SOP 98-2 Complete this line only if the<br />

organization reported in column (B) joint costs<br />

from a combined educational campaign and<br />

fundraising solicitation - - - - - - - - - -- <br />

. -in<br />

1<br />

i-4 leaf<br />

.431-,<br />

P" iff.<br />

1 .<br />

-.ff<br />

-1-.<br />

1<br />

.- H<br />

Lflf, - " ""<br />

f - - 197,656 191, 906 5,750 0<br />

EEA Form 990 (2009)

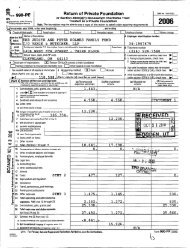

- (A) (Bl<br />

Form 990 (2009) The Ch:i.1dren" s Cooperatlve, Inc. 04-2506891 Page 11<br />

Uygjd 1 BamnceSheet<br />

Beginning of year<br />

End of year<br />

Cash-non-interest-bearing - - - - - - - - - - - - <br />

Savings and temporary cash investments - - - - - - - - - - - - - <br />

Pledges and grants receivable, net<br />

Accounts receivable, net<br />

Receivables from current and former officers. directors, t<br />

employees, and highest compensated employees Comp<br />

ScheduleL . . . ...-.......----...<br />

6 Receivables from other disqualified persons (as defined under section<br />

4958(f)(1)) and persons described in section 4958(c)(3)(B<br />

pan"of5CheduieL<br />

7 Notes and loans receivable, net - - - - - - - - - - <br />

8 lnventoriesforsaleoruse - - - - - - - - - - - - - <br />

9 Prepaid expenses and deferred charges - - - <br />

10a Land, buildings, and equipment cost or<br />

other basis Complete Part VI of ScheduleD - - - <br />

rustees, key , -, ,A "<br />

ieie Pan ii of 7 ,Y<br />

s<br />

) Complete 7 N1 4,, ,<br />

iob 27<br />

ioa 42,781 HM * 1<br />

b Less accumulated depreciation - - - - - - - - - ,218<br />

11 Investments-publicly traded securities - - - - - - - <br />

12 Investments - other securities See Pan IV, line 11<br />

13 Investments-program-related See Pan IV, line 11 - <br />

14 imangmie assets . . . . . . . . . . . . . .. . . . .<br />

15 Otherassets See Part IV, line 11 - - - - - - - - - - <br />

16 Total assets. Add lines 1 through 15 (must equal line 34)<br />

17 Accounts payable and accrued expenses - - - - - - <br />

13 (grant,-,payable............. .<br />

19 Deferredrevenue<br />

26,948 34,665<br />

69,619 51,720<br />

xi<br />

,, 5- .- 1 ,<br />

1,2<br />

f 2 -<br />

g<br />

*-*.4 -"3 -..-.<br />

,*<br />

*ad vu., ... -.- 4,335, .LIL-.,,<br />

12<br />

,J.<br />

19,830 10c 15,563<br />

11<br />

12<br />

13<br />

14<br />

15<br />

116,397 16 101,948<br />

950 17 975<br />

18<br />

61,078 19 70,290<br />

20 Tax-exempt bond liabilities - - - - - - - - - - - - - <br />

20<br />

21 Escrow or custodial account liability Complete Part lV of Schedule<br />

llfled<br />

D <br />

v-<br />

21<br />

22 Payables to current and former officers, directors, trustees, key<br />

.w, IC<br />

employees, highest compensated employees, and disqua 13,22<br />

persons Complete Partll of ScheduleL - - - - - - <br />

23 Secured mortgages and notes payable to unrelated third parties - - 23<br />

24 Unsecured notes and loans payable to unrelated third parties - - - <br />

24<br />

25 Other liabilities. Complete Part X of Schedule D - - - <br />

I 1.<br />

25<br />

26 Total liabilities. Add lines 17through 25 - - - - - - <br />

62,028 26 71,265<br />

Organizations that follow SFAS 117, check here P lxj and<br />

f<br />

complete lines 27 through 29, and lines 33 and 34.<br />

, , 7, gf,<br />

1<br />

-,<br />

.-11<br />

IC." . ,J va ."7<br />

".- "A<br />

"*,, ,r . 1<br />

1,1, jk- 8-1 ,:+.**f,".- fe, i,<br />

27<br />

2-fi 30,683<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

Unrestricted net assets - - - - - - - - - - -- - - - <br />

Temporanly restricted net assets - - - - - - - - <br />

Pemianently restncted net assets - - - - - - - -- - <br />

Organizations that do not follow SFAS 117, check here<br />

and complete lines 30 through 34.<br />

Capital stock or trust principal, or current funds - - - <br />

Paid-in or capital surplus, or land, building, or equipment<br />

Retained earnings, endowment, accumulated income, or other funds<br />

Total net assets or fund balances - - - - - - - - - - <br />

Total liabilities and netassets/fund balances - - - - <br />

... ... . . .. 54,359<br />

*lj<br />

fund ..........<br />

28<br />

29<br />

f<br />

,I<br />

#LL<br />

30<br />

31<br />

.,, - 4<br />

.1-, 1 ,<br />

. .<br />

-" * ,,"1. "L *<br />

*vm ,*,A4.<br />

"" .. ig<br />

i.<br />

-.,.f. A 1,, .<br />

-., 2.4-S4 AJ - . 3<br />

32<br />

54,369 33 30,683<br />

116,397 34 101, 948<br />

EEA Form 990 (2009)

Form 990 (2009) The Children* s Cooperat1ve, Inc. 04-2506891 Page 12<br />

I-E-QLLXLF Financial Statements ai1(LReporting<br />

1 Accounting method used to prepare the Form 990 CI Cash lil Accrual lj Other<br />

lfthe organization changed its methods of accounting from a prior year or checked "Other," explain in<br />

Schedule O<br />

2a Were the organization"s tlnancial statements compiled or reviewed by an independent accountant?<br />

b Were the organization"s llnancial statements audited by an independent accountant? - - - - - - - -- <br />

c If "Yes" to line 2a or 2b, does the organization have a committee that assumes responsibility for oversight of<br />

the audit, review, or compilation of its tlnancial statements and selection of an independent accountant? <br />

If the organization changed either its oversight process or selection process during the tax year, expla In In<br />

Schedule O<br />

d If "Yes" to line 2a or 2b, check a box below to indicate whether the llnancial statements for the year were<br />

issued on a consolidated basis, separate basis, or both<br />

III Separate basis lj Consolidated basis D Both consolidated and separate basis<br />

3a As a result of a federal award, was the organization required to undergo an audit or audits as set forth IPI<br />

the SingleAuditActand OMB CircularA-133? - - - - - -- - - - - - - - - - - - - - - - - - - <br />

b lf "Yes," did the organization undergo the required audit or audits? If the organization did not undergo the<br />

required audit or audits, explain why in Schedule O and describe any steps taken to undergo such audits<br />

Yes No<br />

nf"<br />

.,* 1<br />

*.5<br />

. . . . ..2,-, X<br />

zu X<br />

. --- . . . ...2c<br />

- i<br />

isit<br />

. . . . .......33 X<br />

.. .......3b<br />

EEA Form 990 (2009)

Public <strong>Charity</strong> Status and Public Support<br />

- Complete if the organization is a section 501(c)(3) organization or a section<br />

OMB NO 1545-0047<br />

Department of the Treasury - Q i<br />

4947(a)(1) nonexempt charitable trust. open to public-.-L<br />

(mama, Revenue sewn P Attach to Fonn 990 or Form 990-EZ. P See separate instructions. IHSPOQUO0- l<br />

Ngmdmgqggfngim nints<br />

The Children * s Cooperative , Inc. 04-2506891<br />

I-Ban-I. Reason for public <strong>Charity</strong> Status (All organizations must complete this part) See instructions<br />

The organization is not a private foundation because it is (For lines 1 through 11, check only one box)<br />

1 i A church, convention of churches, or association of churches described in section 170(b)(1)(A)(i).<br />

2 A school described in section 170(b)(1)(A)(li). (Attach Schedule E)<br />

in A hospital or a cooperative hospital service organization described in section 170(b)(1)(A)(iii).<br />

A medical research organization operated in conjunction with a hospital described in section 170(b)(1)(A)(iii). Enter the hospitals name,<br />

city, and state<br />

5 i An organization operated for the benefit of a college or university owned or operated by a governmental unit described in<br />

section 170(b)(1)(A)(iv). (Complete Part ll )<br />

6 - A federal, state, or local government or governmental unit described in section 170(b)(1)(A)(v).<br />

7 * An organization that normally receives a substantial part of its support from a governmental unit or from the general public<br />

described in section 170(b)(1)(A)(vi). (Complete Part ll )<br />

8 * A community trust described in section 170(b)(1)(A)(vi). (Complete Part ll )<br />

9 - An organization that normally receives (1) more than 33 1/3% of its support from contributions, membership fees, and gross<br />

receipts from activities related to its exempt functions - subject to certain exceptions, and (2) no more than 33 1/3% of its<br />

support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses<br />

acquired by the organization after June 30, 1975 See section 509(a)(2). (Complete Part Ill )<br />

10 E An organization organized and operated exclusively to test for public safety See section 509(a)(4).<br />

11 lj An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the<br />

purposes of one or more publicly supported organizations described in section 509(a)(1) or section 509(a)(2) See section<br />

509(a)(3). Check the box that describes the type of supporting organization and complete lines 11e through 11h<br />

a lj Type l b lj Type ll c lj Type lll-Functionally integrated d ij Type lll-Other<br />

e lj By checking this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified<br />

persons other than foundation managers and other than one or more publicly supported organizations described in section<br />

509(a)(1) or section 509(a)(2)<br />

f If the organization received a written determination from the IRS that it is a Type l, Type Il, or Type Ill supporting<br />

Qfgamzatlgnlcheckthlsbox ..................--...----ee . . - - ...-...e-. .-.. -0 --.lj<br />

g Since August 17, 2006, has the organization accepted any gift or contribution from any of the<br />

following persons?<br />

(i) A person who directly or indirectly controls, either alone or together with persons described in (ii)<br />

and (iii) below, the governing body of the supported organization? - - - - - - - - -- - - - - - - - - - - - - <br />

(ii) A family member of a person described in (i) above? - - - - - - -- <br />

(iii) A 35% controlled entity of a person described in (i) or (ii) above? - - - - - - - - - - - - - - - - - - - - - <br />

h Provide the following infomiation about the suppoited organization(s)<br />

(i) Name of supported (i) EIN (i) Type of organization (iii) ls the organization (v) Did you notify (vi) ls the (vi) Amount of<br />

Ofganllailfm (described on lines 1-9 in col (i) listed in your the organization in organization in col support<br />

above or IRC section goveming document? col (i) of your (D organized in the<br />

(see ieinniim) i , Support? U S 7<br />

Yes No Yes No Yes No<br />

Y J". 2-, r: 0-3*,-*t-9. *" P " -t<br />

,,,* 53")-s .j*f"",? , 1 - ,i c<br />

Total 1 - *-"f"-J-1*s#*1,**f:(*"3*f-i (Sl "A -PM l<br />

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for EEA 5d,ed,,,A(F,,,mg90,,ggH3)2gg9<br />

Form 990 or 990-EZ.

SCHEDULE D Supplemental Financial Statements GMM 1 7<br />

(Form 990) P Complete if the organization answered "Yes," to Form 990,<br />

i Part IV, Ilne 6, 7, 8, 9, 10,11, or 12.<br />

D<br />

Namarineugaiimim<br />

PBHTYB l0fth T . -""5 -" , "f.<br />

55* O-t0PubIIc<br />

Infernal Rgvmueesersgw P Attach to Form 990. P See separate Instructions. 4980" .A fp,-.ji<br />

The Childrenls Cooperative, Inc. O4-2506891<br />

i-Bairfflll Organizations Maintaining Donor Advised Funds or Other Similar Funds or Accounts. Complete If<br />

the organization answered "Yes" to Form 990, Part IV, line 6<br />

(E) Donor advised funds Q) Funds and other accounts<br />

Total number at end of year - - - - - - - - -- - <br />

Aggregate contributions to (during year) - - - <br />

Aggregate grants from (during year) - - - - -- <br />

Aggregate value at end of year - - - - - - - -- <br />

Did the organization infomi all donors and donor advisors in writing that the assets held in donor advised<br />

funds are the organization"s property, subject to the organization"s exclusive legal control? - - - - - - - - - - - - -- - - - - C1Yes El No<br />

6 Did the organization inform all grantees, donors, and donor advisors in writing that grant funds can be<br />

used only for charitable purposes and not for the benefit of the donor or donor advisor, or for any other<br />

purpose conferring impemtissible private benefit? - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - - - -- - I-lYes I-iNo<br />

Conservation Easementiq Complete if the organization answered "Yes" to Form 990, Part IV, line 7<br />

1 Purpose(s) of conservation easements held by the organization (check all that apply)<br />

lj Preservation of land for public use (e g , recreation or pleasure) CI Preservation of an historically important land area<br />

lj Protection of natural habitat lj Preservation of a certified historic structure<br />

lj Preservation of open space<br />

2 Complete lines 2a through 2d if the organization held a qualified conservation contribution in the form of a conservation<br />

easement on the last day of the tax year<br />

Held at the End of the Tax Year<br />

a Total number ofconservation easements - - - - - - - - - - - - - - -- - - - - - - - - - - - - - 2a<br />

b Total acreage restricted by conservation easements - - - - - - - - - - - - - - - - - -- - - - - - - - 2b<br />

c Number of conservation easements onacertified historic structure included in (a) - - - - - -- - - - - - 2c<br />

d Number of conservation easements included in (c) acquired after 8/17/06 - - - - - - - - - - - - - -- - 2d<br />

3 Number of conservation easements modified, transferred, released, extinguished, or terminated by the organization during<br />

the tax year P<br />

4 Number of states where property subject to conservation easement is located P<br />

5 Does the organization have a written policy regarding the periodic monitonng, inspection, handling of<br />

violations, and enforcement ofthe conservation easements it holds? - - - - - - - - - - - - - - - -- - - - - - - - - - - - DYes I::INo<br />

6 Staff and volunteer hours devoted to monitoring, inspecting, and enforcing conservation easements during the year<br />

P<br />

7 Amount of expenses incurred in monitoring, inspecting, and enforcing conservation easements during the year<br />

P $<br />

8 Does each conseniation easement reported on line 2(d) above satisfy the requirements of section<br />

170(h)(4)(B)(,)and5eci,on170(h)(4)(B)(,,)7 . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . Eyes DN()<br />

9 In Part XIV, describe how the organization reports conservation easements in its revenue and expense statement, and<br />

balance sheet, and include, if applicable, the text of the footnote to the organization*s financial statements that describes<br />

the organization"s accounting for conservation easements<br />

Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets.<br />

Complete if the organization answered "Yes" to Form 990, Part IV, line 8<br />

1a If the organization elected, as permitted under SFAS 116, not to report in its revenue statement and balance sheet works of<br />

art, historical treasures, or other similar assets held for public exhibition, education, or research in furtherance of public service,<br />

provide, in Part XIV, the text of the footnote to its financial statements that describes these items<br />

b If the organization elected, as pemiitted under SFAS 116, to report in its revenue statement and balance sheet works of art,<br />

historical treasures, or other similar assets held for public exhibition, education, or research in furtherance of public service,<br />

provide the following amounts relating to these items<br />

(i) RevenuesincludedinFonn990,PartVlll,line1 -- - - - - --- P$<br />

(ii)A55e(5mcludedmF0fm990,Par-1)(. . . . . ..... . . . . . ...... . . . ..............<br />

2 If the organization received or held works of art, historical treasures, or other similar assets for financial gain, provide the<br />

following amounts required to be reported urider SFAS 116 relating to these items<br />

a Revenues included in Form 990, Part Vlll, line 1 - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - -- - P S<br />

b Assets Included in Form Pan X . . . . . . . . . . . . . . . - . . . . . . . . - . . . . . . . . - . . . .. . , $<br />

For Privacy Act and Paperwork Reduction Act Notice, see tl1e Instructions for Fonn 990. EEA Sdmh D (pqmggg, gm

ScheduleD(Form990)2009 The Ch:.1dren*s Cooperatlve, Inc. o-1-2506891 Page 2<br />

I-Banhlljjl gh Organizations Maintaining Collections of Art, Historical Treasure-s,gor Other Similar Assets (Continued)<br />

3 -Using* the organization"s acquisition, accession, and other records, check any of the following that are a signiticant use of its<br />

collection items (check all that apply)<br />

a E Public exhibition d E Loan or exchange programs<br />

b lj Scholarly research e lj Other<br />

c Ei Preservation for future generations<br />

4 Provide a description of the organization"s collections and explain how they further the organization"s exempt purpose in<br />

Part XIV<br />

5 During the year, did the organization solicit or receive donations of an. historical treasures, or other similar<br />

assets to be sold to raise funds rather than to be maintained as part ofthe organization"s collection? I-iyes f-iN0<br />

I-Ban-il,i Escrow and Custodial Arrangements, Complete if organization answered "Yes" to Form 990,<br />

Pan IV, line 9, or reported an amount on Fomi 990, Part X, line 21<br />

1a ls the organization an agent, trustee, custodian or other intermediary for contributions or other assets not<br />

includedgi-iFQi1-ri99Q,Pai1)(7 . . . - . .-.-.--.---.--.--...-.--..--.-.<br />

1c<br />

.. . ...Eva<br />

W<br />

UNO<br />

b If "Yes," explain the arrangement in Part XIV and complete the following table"<br />

Amount<br />

cBegini*iirigbalanCe.-- . . - . . . - -... .-.. - . -.. . --..<br />

19 7<br />

f<br />

d Addiiionsduriiigtheyeaf .-.. - - - - . .--. - - - . .--. .. ----... 1d<br />

Disiiribuiigi-isdi-ifingihgyeaf ...--..--..-----.- - - - . . . . . . -.... ..<br />

Efidii-igbalance.------..---.----.--..--..- .- ..---..<br />

1f<br />

Did the organization include an amount on Form 990, Part X, line 217 - - - - - - - - - - - - - -- . . . . . . . . . ... i-iyes END<br />

If "Yes," explain the arrangement in Part XIV<br />

(Q Current year Q) Pnor year c Two years back Three years back e Four years back<br />

bConinbuiions................<br />

* vi " P<br />

c Netinvestmentearnings, gains, and losses<br />

d Grants or scholarships - - - - - - -- - - - 4 ,<br />

f<br />

-<br />

,<br />

,.<br />

- . 2 , f , -. 1 *<br />

it - r ..<br />

T ,<br />

9 Other expenditures for facilities<br />

ai<br />

I" " -F-e . 1. . <br />

1.<br />

and programs - - . . - . .- - - - ,t i" -* I-ttf.<br />

Administrative expenses - - - - - - - <br />

at i Q la* i<br />

g Endofyearbalance - - - - - - - - - - <br />

,ine <br />

f<br />

Provide the estimated percentage of the year end balance held as<br />

Board designated or quasi-endowment P %<br />

Permanent endowment P %<br />

Term endowment P %<br />

l-Eanll Endqwment Funds- Complete if the organization answered "Yes" to Fonn 990, Part IV, line 10<br />

1a Beginning ofyear balance - - - - - - - - 1<br />

2<br />

a<br />

b<br />

c<br />

3a<br />

Are there endowment funds not in the possession of the organization that are held and administered for the<br />

organization by<br />

(i)uni-elatedorganizaiigns-.- - - - - ---. .-.- .--.--.. . - - ----- .-... .<br />

(infelaiedoirgai-iizafigi-is--- - . . --..-----.---.--.---.... .- .-- - - - - . - . .-.-<br />

b If "Yes" to 3a(ii), are the related organizations listed as required on Schedule R7<br />

4 Describe in Part XIV the intended uses of the organization"s endowment funds<br />

LEQUMLI Investments - Land, Buildin s and Equipment. See Form 990-P2i1Xil"1@10<br />

Description of investment (a) Cost or other basis (b) Cost or other (c) Accumulated<br />

Y<br />

depreciation<br />

13 Lai-id..--.. - . - .<br />

EEA<br />

(investment) basis (other)<br />

- --.. . . - - - -.<br />

b Buildings - - . .. - . . . . - - - - . - - - -- .<br />

c Leasehold improvements - - - - - - - -- - - <br />

d Equipment -..--. . - - - . . . - . . - --<br />

(d) Book value<br />

9 other . - . - . . . - . . - . . . .- - SIQEIF, . 42,781 21,219 15,563<br />

Total. Add lines 1a through 1e (Column (d) must equal Form 990, Part X, column (B), line 10(c)) - - - - ...p 15,553<br />

SdlxihD("FtXmQJ)Z@

The Ch11dren"s Cooperat1ve, Inc.<br />

" See Form 990 Part X line 12<br />

schedule D (Form 990) 2009<br />

* Investments - Other Securities, - t<br />

* (a) Desc-iption of secunty or category (b) Book value (c) M v<br />

(including name of secunty)<br />

Financial derivatives - - - - -- - - - - - - - - - - - -- <br />

Closely-held equity interests - - - - - - - - - - - - - -- <br />

Other<br />

04-2506891 Page 3<br />

E1h0d0f all.lail0ft<br />

Cost or end-of-year market value<br />

Tod. (column . .<br />

(b) must equal Form 990 Pan x mi (ia) line 12) P .,<br />

l,Eaf1g)LllLl * - R lated Investments See Form Program 990, e , Part X, line 13<br />

(a) Description of investment type (b) Book value (c) Method of valuation<br />

Cost or end-of-year market value<br />

i<br />

i<br />

F "1<br />

Tdd. (Column (b) must equal Form 990, Part X, col (B) line 13) * K<br />

l Qlher Assets. See F0rm 990, Part X, llrle 15.<br />

(a) Description<br />

W, 4 - f:,a-...*"(<br />

(Q) Book value<br />

Total. (Column (b) must equal Form 990, Pr1X,Cgl(B)Ime15) a<br />

. .--. -0. . . . . . . ..--.......-)<br />

I-Bank( Qgher Liabilities, see Form 990, Pan x, Ime 25.<br />

1 (a) Desaipuon af ilabiiiiy (9) Amoum<br />

Federal income taxes<br />

.. 7<br />

, / . * x , 1,*v- 1<br />

1 f .1 ,v i *vi<br />

1<br />

i<br />

.. . , "Lt "Liles<br />

* .J J-e-.<br />

<br />

-1.. 49,1. ,-1. 2 - r 2,v.xf-.- f. 4. ,-4*<br />

1<br />

.- .r. ,M* vf - L., ,fi : ..i-55... ,<br />

Q# ivfiixi ia<br />

te<br />

a .<br />

.,.- *H<br />

1, *ku - V<br />

.. "1 -uv -.<br />

. 1.* 4 V<br />

-4.4.. -1<br />

- 1 uf -1<br />

,<br />

- L<br />

1, 1<br />

1<br />

Tata. (Column (b) must equal Fomi 990, Pan X, col (B) line 25 ) P<br />

2. FIN 48 Footnote ln Part XIV, provide the text of the footnote to the 0 rganization"s financial statements that reports the<br />

organization"s liability lor uncertain tax positions under FIN 48<br />

EEA Sdieiua D (Fam 990) 2009

Schedule D(F0i-m 990) 2009 The Children I s Cooperatlve , Inc . 04-25068 91 Page 4<br />

- Reconciliation of Change in Net Assets from-Form 9-90 to Financial Statemen s<br />

Total revenue (Form 990,I?art VIII, column (A), line 12) - - <br />

Total expenses (Form 990, Part IX, column (A), line 25) - - <br />

Excess or (deficit) for the year Subtract Iine2from Iine1 - <br />

Net unrealized gains (losses) on investments - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - <br />

Donatedse,-ylcesanduseoffacllmes....1111 111.1111111111111 ....111<br />

Investment expenses - - - - - - - - - -- - - <br />

Prrorperlodadlustmentg11111 1 1 1 111111 11 11111111 1 11111111111<br />

Othe,-(Desc,-,bempanXlV) . . . . . . . . . . . . . .<br />

Total adjustments (net) Add Iines4through8 - - - - - - - - - - - - - - - - - - - - - -- - - <br />

10 Excess or (deticit) for the year per audited financial statements Combine Iines3and9 - - - - <br />

l-Bgiixljgl Reconciliation of Revenue-pier Audited Financial Stgements With Revenue p-er Retum<br />

1 Total revenue, gains, and other support per audited financial statements <br />

2 Amounts included on line 1 but not on Form 990, Part VIII, line 12.<br />

. . . . . . . . 1<br />

Netunrealized gains on investments - - - - - -- - - - - - - - -- - - - - - 2a <br />

Donated services and use of facilities - - - - - - - -- - - - - - - E<br />

Recoveries ofprioryeargrants - - - - - - - - - - - - - - - E<br />

Other (Descrlbem Par( XIV) 1 1 1 1 1 1 1 1 1 1 1 11 1 1 1 1 1 1 11 1 1 1<br />

Addlines 23 through 2d 1 1 1 1 1 1 1 1 1 1 1 11 1 1 1 1 1 1 1 11 1 1 1<br />

3 Subtract line Zofrom Iine1 - - - - - - - - - - - -- - - - <br />

11 1 1 1 1 111111 1 1 1 111 29<br />

1 . . 1 111111. . 1 . .111 3<br />

4 Amounts included on Fomi 990, Part VIII, line 12, but not on line 1:<br />

a Investment expenses not included on Form 990, Part VIII, line 7b - - - - - - - - - 4a<br />

b other (oescrlbem Part 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 <br />

cAddIme$4aand4b 1111111 1 1 1 1 1 1 1 1111111 111 1 1 1 1 1 1 1 11111111 4g<br />

. . . . . . 1<br />

5 Total revenue Add lines3and 4c. (This must equal Form 990, Partl, line 12) - - - - - - - - -- - - - - - - - 5<br />

1 Total expenses and losses per audited financial statements - <br />

l,B3LLX1ll2I Recqgciliajion of Expenses per Audite Statements With Exgenses per Retum<br />

2 Amounts included on line 1 but not on Form 990, Part IX, line 25<br />

Donated services and use offacilities - - - - - - - - - - - - - - - -- - - - - - - 2a<br />

Prior yearadlustments 1 1 1 11 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 E<br />

Qihe,-ios5e5........... . . . . . . . . . . . . . . . ...<br />

Other(DescribeinPartXlV) .. . . . . . . . 2d L,-Q.<br />

-1,-.<br />

. . . . . . . . 3et?-.2-1<br />

Addlme52afhr0ugh 2d 1 1 1 1 1 1 1 1 1 1 1 1 1 11 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 11 1 1 1 1 1 1 1 1 1 1 23<br />

3 Subtract line 2efrom Iine1 - - - - - - - - - - - -- - - - - <br />

4 Amounts included on Form 990, Part IX, line 25, but not on line 1<br />

a Investment expenses not included on Form 990, Part VIII, line 7b<br />

b O(her(De5Crlbelr1PartXIV) 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 4b *<br />

cAddiines4aand4b............ . . . . . . . . . . . . . ... 4C<br />

5 Total expenses Add Iines3and 4c. (This must equal Form 990, Partl, line 18) - - - - - - - - - -- - - - - - 5<br />

E311 Xlyfl Supplemental information<br />

Complete this pan to provide the descriptions required for Part II, lines 3, 5, and 9, Part Ill, lines 1a and 4, Part IV, lines 1b<br />

and 2b, Part V, line 4, Part X, line 2, Part Xl, line 8, Part XII, lines 2d and 4b, and Part XIII, lines 2d and 4b Also complete<br />

this part to provide any additional information<br />

EEA Sd*BibD (Ftl"m&)&

X c<br />

l d<br />

*sci-iEoui.E E Schools<br />

OMB<br />

(Form 990 or 99052) p complete if me organization answered "Yes" so Form 99a, Pan iv, line 13,<br />

No 1545-0047<br />

2009<br />

Ol* FOI111 990-EZ, Part VI, "FIB 48. open to pubiic<br />

Department of the Treasury<br />

imemal Revenue service P Attach to Fonn 990 or Fonn 990-EZ. Inspection*<br />

Naimofineofganizauw The Children*s Cooperative, i ianpinyeruunimminnmr<br />

Inc. 04-2506891<br />

1 Does the organization have a racially nondiscriminatory policy toward students by statement in its charter,<br />

bylaws, other governing instrument, or inaresolution of its governing body? - - - - - - - - - - - - - - - - - - - - - <br />

2 Does the organization include a statement of its racially nondiscriminatory policy toward students in all its<br />

brochures, catalogues, and other written communications with the public dealing with student admissions,<br />

pi-ogramglandgct-i0laf5hip57..... . - . ....---...........---................ ..<br />