The report is available in English with a Dutch summary - KCE

The report is available in English with a Dutch summary - KCE

The report is available in English with a Dutch summary - KCE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

32 Plasma <strong>KCE</strong> Reports 120<br />

NAT technology for viral DNA detection has dramatically reduced th<strong>is</strong> w<strong>in</strong>dow period.<br />

Negative results from the subsequent application of NAT technology to the plasma pool<br />

for a range of viruses (HCV, HIV, Parvo B19, HBV, etc.) provide assurance that the<br />

<strong>in</strong>itial viral load <strong>in</strong> the plasma pool <strong>is</strong> zero or very low.<br />

2.2.2 <strong>The</strong> worldwide supply of plasma products<br />

2.2.2.1 Corporate structure of the market of plasma products<br />

Restructur<strong>in</strong>g of the sector of plasma products<br />

Consider<strong>in</strong>g the <strong>in</strong>creas<strong>in</strong>g and vital needs of plasma products <strong>in</strong> most western<br />

countries, and simultaneously the uncerta<strong>in</strong> level of donation, purchasers of plasma<br />

products – ie hospitals, and more generally health care <strong>in</strong>stitutions – can feel <strong>in</strong> an<br />

<strong>in</strong>ferior position towards the plasma fractionation <strong>in</strong>dustry.<br />

<strong>The</strong> evolution of medical practices and also the political pressure of patient associations<br />

on health authorities do not leave them much room for manoeuvre. <strong>The</strong>refore it <strong>is</strong><br />

important to analyze the recent evolution of th<strong>is</strong> <strong>in</strong>dustry to have a clear idea on the<br />

purchasers’ actual negotiation power.<br />

MAIN SPECIFICITIES OF THIS INDUSTRY SINCE THE NINETIES: FUSIONS AND MARKET<br />

CONSOLIDATION<br />

In 1996, the number of global stakeholders <strong>in</strong> the n<strong>in</strong>eties was relatively high: almost 40<br />

companies (or non profit organ<strong>is</strong>ations) were identified worldwide <strong>in</strong> the plasma<br />

fractionation <strong>in</strong>dustry. Follow<strong>in</strong>g several merger waves, only 20 companies still ex<strong>is</strong>t<br />

today.<br />

Among these 20 companies some of them do not play a noticeable role on the global<br />

market because of their size or because of regulatory barriers that still <strong>is</strong>olate their<br />

domestic market from the <strong>in</strong>ternational market. Hence, only a very small number of<br />

companies can be considered as real “global players” <strong>in</strong> terms of economic weight: and<br />

market share.<br />

CURRENT SITUATION (2003-2005)<br />

Worldwide, only five private companies still play an important role (>5%) on the global<br />

market. Non profit organizations are also important stakeholders; however some of<br />

them enjoy a monopoly, based on a specific national regulation.<br />

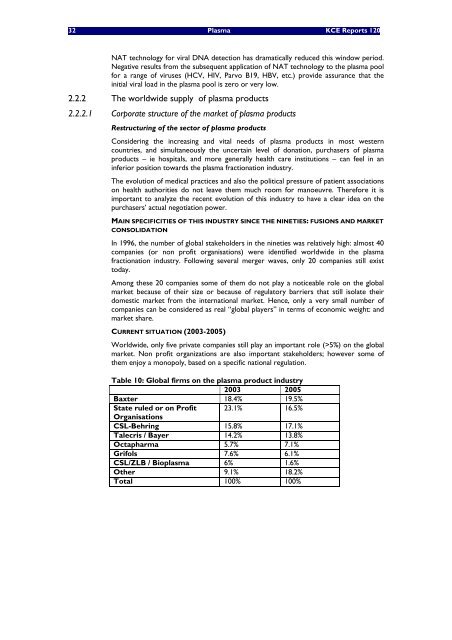

Table 10: Global firms on the plasma product <strong>in</strong>dustry<br />

2003 2005<br />

Baxter 18.4% 19.5%<br />

State ruled or on Profit 23.1% 16.5%<br />

Organ<strong>is</strong>ations<br />

CSL-Behr<strong>in</strong>g 15.8% 17.1%<br />

Talecr<strong>is</strong> / Bayer 14.2% 13.8%<br />

Octapharma 5.7% 7.1%<br />

Grifols 7.6% 6.1%<br />

CSL/ZLB / Bioplasma 6% 1.6%<br />

Other 9.1% 18.2%<br />

Total 100% 100%