On the Optimal Taxation of Capital Income

On the Optimal Taxation of Capital Income

On the Optimal Taxation of Capital Income

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

106 JONES, MANUELLI, AND ROSSI<br />

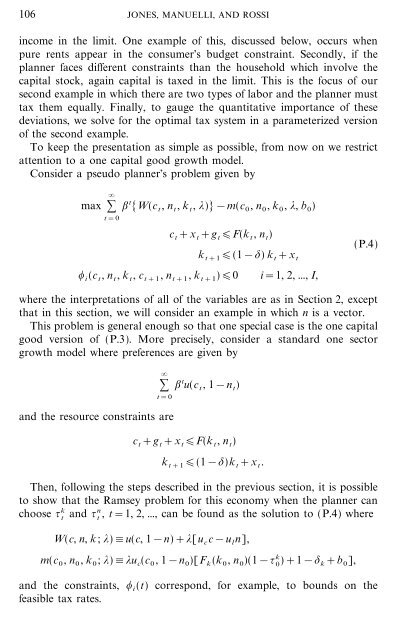

income in <strong>the</strong> limit. <strong>On</strong>e example <strong>of</strong> this, discussed below, occurs when<br />

pure rents appear in <strong>the</strong> consumer's budget constraint. Secondly, if <strong>the</strong><br />

planner faces different constraints than <strong>the</strong> household which involve <strong>the</strong><br />

capital stock, again capital is taxed in <strong>the</strong> limit. This is <strong>the</strong> focus <strong>of</strong> our<br />

second example in which <strong>the</strong>re are two types <strong>of</strong> labor and <strong>the</strong> planner must<br />

tax <strong>the</strong>m equally. Finally, to gauge <strong>the</strong> quantitative importance <strong>of</strong> <strong>the</strong>se<br />

deviations, we solve for <strong>the</strong> optimal tax system in a parameterized version<br />

<strong>of</strong> <strong>the</strong> second example.<br />

To keep <strong>the</strong> presentation as simple as possible, from now on we restrict<br />

attention to a one capital good growth model.<br />

Consider a pseudo planner's problem given by<br />

max :<br />

t=0<br />

; t [W(c t, n t, k t, *)]&m(c 0, n 0, k 0, *, b 0)<br />

c t+x t+g t<br />

k t+1<br />

F(k t, n t)<br />

(1&$) k t+x t<br />

, i(c t, n t, k t, c t+1, n t+1, k t+1) 0 i=1, 2, ..., I,<br />

(P.4)<br />

where <strong>the</strong> interpretations <strong>of</strong> all <strong>of</strong> <strong>the</strong> variables are as in Section 2, except<br />

that in this section, we will consider an example in which n is a vector.<br />

This problem is general enough so that one special case is <strong>the</strong> one capital<br />

good version <strong>of</strong> (P.3). More precisely, consider a standard one sector<br />

growth model where preferences are given by<br />

:<br />

t=0<br />

and <strong>the</strong> resource constraints are<br />

c t+g t+x t<br />

k t+1<br />

; t u(c t,1&n t)<br />

F(k t, n t)<br />

(1&$)k t+x t.<br />

Then, following <strong>the</strong> steps described in <strong>the</strong> previous section, it is possible<br />

to show that <strong>the</strong> Ramsey problem for this economy when <strong>the</strong> planner can<br />

choose { k<br />

t and {n<br />

t , t=1, 2, ..., can be found as <strong>the</strong> solution to (P.4) where<br />

W(c, n, k; *)#u(c, 1&n)+*[u cc&u ln],<br />

m(c 0, n 0, k 0; *)#*u c(c 0,1&n 0)[F k(k 0, n 0)(1&{ k<br />

0 )+1&$ k+b 0],<br />

and <strong>the</strong> constraints, , i(t) correspond, for example, to bounds on <strong>the</strong><br />

feasible tax rates.