Medicare Monthly Review Bulletin July 2012 - National Government ...

Medicare Monthly Review Bulletin July 2012 - National Government ...

Medicare Monthly Review Bulletin July 2012 - National Government ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A CMS Contracted Agent<br />

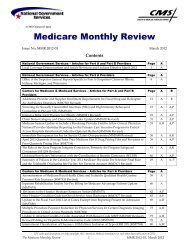

<strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong><br />

Issue No. MMR <strong>2012</strong>-07 <strong>July</strong> <strong>2012</strong><br />

Contents<br />

<strong>National</strong> <strong>Government</strong> Services – Articles for Part A and Part B Providers Page A B<br />

Local Coverage Determinations and Article Revisions and Updates Effective <strong>July</strong> <strong>2012</strong> 3 A A,P<br />

<strong>National</strong> <strong>Government</strong> Services – Articles for Part A Providers Page A<br />

Inpatient Rehabilitation Facilities – Payment Is Affected by the Patient Discharge Status<br />

Codes Reported on <strong>Medicare</strong> Claims<br />

7 A<br />

Centers for <strong>Medicare</strong> & Medicaid Services – Articles for Part A and Part B<br />

Providers<br />

Page A B<br />

Clarification of <strong>Medicare</strong> Conditional Payment Policy and Billing Procedures for<br />

Liability, No-Fault and Workers’ Compensation <strong>Medicare</strong> Secondary Payer Claims<br />

(MM7355 Revised)<br />

10 H,M P<br />

Revisions of the Financial Limitation for Outpatient Therapy Services – Section 3005 of<br />

the Middle Class Tax Relief and Job Creation Act of <strong>2012</strong> (MM7785)<br />

18 A A,P<br />

Contractor and Common Working File Additional Instructions Related to Change<br />

Request 7633 - Screening and Behavioral Counseling Interventions in Primary Care to<br />

Reduce Alcohol Misuse (MM7791 Revised)<br />

23 A A<br />

Extracorporeal Photopheresis (ICD-10) (MM7806) 26 A A,P<br />

Advance Beneficiary Notice of Noncoverage, Form CMS-R-131, Updated Manual<br />

Instructions (MM7821)<br />

31 A,M A,P<br />

Modifying the Timely Filing Exceptions on Retroactive <strong>Medicare</strong> Entitlement and<br />

Retroactive <strong>Medicare</strong> Entitlement Involving State Medicaid Agencies (MM7834)<br />

40 A,M A,P<br />

<strong>July</strong> Update to the CY <strong>2012</strong> <strong>Medicare</strong> Physician Fee Schedule Database (MM7844) 43 A P,N<br />

<strong>July</strong> <strong>2012</strong> Update of the Ambulatory Surgical Center (ASC) Payment System (MM7854) 46 A A,P<br />

Edits on the Ordering/Referring Providers in <strong>Medicare</strong> Part B, DME and Part A HHA<br />

Claims (Change Requests 6417, 6421, 6696, and 6856) (SE1011 Revised)<br />

52 A P,N<br />

Important Reminders about HIPAA 5010 & D.0 Implementation (SE1106 Revised) 61 A A,P<br />

Important Update Regarding 5010/D.0 Implementation – Action Needed Now (SE1131<br />

Revised)<br />

69 A,M A,P<br />

Questionable Billing By Suppliers of Lower Limb Prostheses (SE1213 Revised) 73 A A,P<br />

Phase 2 of Ordering and Referring Requirement (SE1221) 79 A,M P,N<br />

Appeals for Denied Claims Submitted by an Ordering and Referring Optout<br />

Physician/Nonphysician Practitioners Who Are Excluded by the Office of Inspector<br />

General (SE1223)<br />

85 A P,N<br />

Centers for <strong>Medicare</strong> & Medicaid Services – Articles for Part A Providers Page A<br />

New Occurrence Code to Report Date of Death (MM7792 Revised) 89 A,M<br />

Changes to the Hospice Aggregate Cap Calculation Method (MM7838) 91 A,M<br />

CPT codes and descriptors are only copyright <strong>2012</strong> American Medical Association (or such other date publication of CPT)<br />

The <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 1 MMR <strong>2012</strong>-07, <strong>July</strong> <strong>2012</strong>

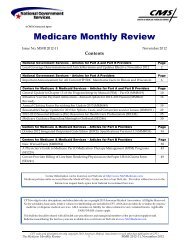

Centers for <strong>Medicare</strong> & Medicaid Services – Articles for Part A Providers Page A<br />

<strong>July</strong> <strong>2012</strong> Update of the Hospital Outpatient Prospective Payment System (MM7847) 99 A,M<br />

Attending Provider Identifiers on Religious Nonmedical Health Care Institution Claims<br />

(MM7862)<br />

109 A<br />

<strong>Medicare</strong> Contractor Annual Update of the International Classification of Diseases,<br />

Ninth Revision, Clinical Modification (ICD-9-CM) (MM7863)<br />

111 A<br />

Centers for <strong>Medicare</strong> & Medicaid Services – Articles for Part B Providers Page B<br />

October Quarterly Update to <strong>2012</strong> Annual Update of HCPCS Codes Used for<br />

Skilled Nursing Facility (SNF) Consolidated Billing (CB) Enforcement (MM7856)<br />

115 A,P<br />

5010 Requirement for Ambulance Suppliers (SE1029 Revised) 117 A,B<br />

This key is provided as a convenience to alert providers/suppliers to articles with topics that may pertain to their particular field.<br />

This key is not a guarantee that information in other articles will not also apply. It is each provider’s/supplier’s responsibility to<br />

become familiar with the contents of each newsletter:<br />

Part A Key: A-All Providers, C-Community Mental Health Centers (CMHC), E-Renal Dialysis (ESRD) Providers, F-Federally<br />

Qualified Health Centers (FQHC), H-Hospitals, M-Home Health Providers, O-Comprehensive Outpatient Rehabilitation<br />

Facilities (CORF) and Outpatient Physical Therapy Providers, P-Hospice Providers, R-Rural Health Center (RHC), S-Skilled<br />

Nursing Facilities (SNF), NA-Not Applicable<br />

Part B Key: A-All Providers, B-Ambulance, C-Cardiovascular, D-DMEPOS, E-Drugs & Biologicals, F-ASC, G-Anesthesia, H-<br />

Physical & Occupational Therapy, I-Beneficiaries, J-Insurers, K-Home Health Care, L-Laboratory, M-Medicine, N-Non-Physician<br />

Practitioner, O-Nuclear Medicine, P-Physicians, Q-Mental Health R-Radiology, S-Surgery, T-Nephrology, U-Urology, V-<br />

Chiropractor, W-Ophthalmology & Optometry, X-Podiatry, Y-Radiation Z-Oncology, NA-Not Applicable.<br />

Contact Information can be found on our Web site at: http://www.NGS<strong>Medicare</strong>.com.<br />

<strong>Medicare</strong> policies can be accessed from the Medical Policy Center section of our Web site. Providers without access to the<br />

Internet can request hard copies from <strong>National</strong> <strong>Government</strong> Services.<br />

CPT five-digit codes, descriptions, and other data only are copyright 2011 American Medical Association. All Rights Reserved.<br />

No fee schedules, basic units, relative values or related listings are included in CPT. AMA does not directly or indirectly practice<br />

medicine or dispense medical services. AMA assumes no liability for data contained or not contained herein. Applicable<br />

FARS/DFARS clauses apply.<br />

This bulletin should be shared with all health care practitioners and managerial members of the providers/suppliers staff.<br />

<strong>Bulletin</strong>s issued during the last two years are available at no cost from our Web site at www.NGS<strong>Medicare</strong>.com.<br />

CPT codes and descriptors are only copyright <strong>2012</strong> American Medical Association (or such other date publication of CPT)<br />

The <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 2 MMR <strong>2012</strong>-07, <strong>July</strong> <strong>2012</strong>

<strong>National</strong> <strong>Government</strong> Services Articles for Part A & B Providers<br />

Local Coverage Determinations and Article Revisions and Updates<br />

Effective <strong>July</strong> <strong>2012</strong><br />

<strong>July</strong> <strong>2012</strong> Revisions<br />

Coverage and Billing FDG Positron Emission Tomography (PET) Scans - Medical Policy Article<br />

(A51614)<br />

Article published <strong>July</strong> <strong>2012</strong>: Template language regarding the limitation of liability information was<br />

corrected to remove the statement that claims with modifier GA would be automatically denied by fiscal<br />

intermediaries or Part A <strong>Medicare</strong> Administrative Contractors (MACs).<br />

Denosumab (Prolia , Xgeva ) - Related to Local Coverage Determination (LCD) L25820 (A50361)<br />

(A50361)<br />

Article published <strong>July</strong> <strong>2012</strong>: The “ICD-9 Codes that are Covered” section has been corrected to indicate<br />

that International Classification of Diseases, Clinical Modification, 9th Revision (ICD-9-CM) code 733.01<br />

should be reported for the treatment of postmenopausal women with osteoporosis at high risk for<br />

fracture or ICD-9-CM code 733.01 and a secondary diagnosis should be reported for postmenopausal<br />

women with osteoporosis who have failed or are intolerant to other available osteoporosis therapy<br />

ICD-9-CM codes 733.00, 733.01, 733.09 and 185 have been added as payable diagnoses when reported to<br />

increase bone mass in men at high risk for fracture receiving androgen deprivation therapy for<br />

nonmetastatic prostate cancer effective for dates of service on or after 02/01/<strong>2012</strong>.<br />

ICD-9-CM codes 733.00, 733.01, 733.09, 174.0, 174.1, 174.2, 174.3, 174.5, 174.6, 174.8 and 174.9 have been<br />

added as payable diagnoses when reported to increase bone mass in women at high risk for fracture<br />

receiving adjuvant aromatase inhibitor therapy for breast cancer effective for dates of service on or after<br />

02/01/<strong>2012</strong>.<br />

Erythropoiesis Stimulating Agents (ESA) (L25211)<br />

R19 (effective 07/01/<strong>2012</strong>): The following reference was added to the “CMS <strong>National</strong> Coverage Policy”<br />

section:<br />

The Centers for <strong>Medicare</strong> & Medicaid Services (CMS) Internet-Only Manual (IOM) Publication 100-04,<br />

<strong>Medicare</strong> Claims Processing Manual, Transmittal No 2450, Change Request (CR) 7831, April 26, <strong>2012</strong>,<br />

Quarterly Healthcare Common Procedure Coding System (HCPCS) Drug/Biological Code Changes – <strong>July</strong><br />

<strong>2012</strong> Update.<br />

Based on the aforementioned Change Request, Healthcare Common Procedure Coding System (HCPCS)<br />

code Q2047 was added to the “Current Procedural Terminology (CPT)/HCPCS Codes” section for<br />

OMONTYS ® (peginesatide) Injection.<br />

Based on the Food & Drug Administration (FDA) approval for OMONTYS (peginesatide) Injection,<br />

HCPCS code C9399 or J3490 should be reported dates of service March 27, <strong>2012</strong> through June 30, <strong>2012</strong><br />

which were added to the “CPT/HCPCS Codes” section.<br />

The prescribing information for OMONTYS (peginesatide) Injection was added to the “Sources of<br />

Information and Basis for Decision” section.<br />

No comment or notice periods required.<br />

CPT codes and descriptors are only copyright <strong>2012</strong> American Medical Association (or such other date publication of CPT)<br />

The <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 3 MMR <strong>2012</strong>-07, <strong>July</strong> <strong>2012</strong>

Erythropoiesis Stimulating Agents (ESA) Supplemental Instructions Article (SIA) (A44399)<br />

Article published <strong>July</strong> <strong>2012</strong>: Based on CMS IOM Publication 100-04, <strong>Medicare</strong> Claims Processing Manual,<br />

Transmittal No 2450, CR 7831, April 26, <strong>2012</strong>, Quarterly Healthcare Common Procedure Coding System<br />

(HCPCS) Drug/Biological Code Changes – <strong>July</strong> <strong>2012</strong> Update, HCPCS code Q2047 was added to the<br />

“CPT/HCPCS Codes” section.<br />

Based on the FDA approval for OMONTYS (peginesatide) Injection, HCPCS code C9399 or J3490 should<br />

be reported dates of service March 27, <strong>2012</strong> through June 30, <strong>2012</strong> which were added to the “CPT/HCPCS<br />

Codes” section.<br />

The following coding guidelines were added:<br />

For dates of service March 27, <strong>2012</strong> through June 30, <strong>2012</strong>, HCPCS code J3490 should be reported on<br />

claims submitted to the carrier or Part B MAC for OMONTYS (peginesatide) Injection along with the<br />

name of the drug and the dosage in Item 19 of the CMS-1500 claim form or the electronic equivalent.<br />

For dates of service March 27, <strong>2012</strong> through June 30, <strong>2012</strong>, HCPCS code C9399 should be reported on<br />

hospital outpatient perspective payment system (OPPS) claims submitted to the FI or Part A MAC for<br />

OMONTYS (peginesatide) Injection along with the <strong>National</strong> Drug Code (NDC), the quantity of the<br />

drug that was administered (milligrams) and the date the drug was administered in FL 80, remarks<br />

for the CMS-1450 or the electronic equivalent.<br />

Filgrastim, Pegfilgrastim (e.g., Neupogen ® , Neulasta TM ) - Related to LCD L25820 (A48208)<br />

Article published <strong>July</strong> <strong>2012</strong>: Based on a reconsideration request, dose dense chemotherapy<br />

administration guidelines have been added to the paragraph for pegfilgrastim in the “General Guidelines<br />

for claims submitted to carriers or intermediaries or Part A or Part B MAC” section. Additional sources<br />

have been added to the “Sources of Information” section of the article.<br />

Implantable Miniature Telescope (IMT)(L32454)<br />

R1 (effective 07/01/<strong>2012</strong>): The following references were added to the “CMS <strong>National</strong> Coverage Policy”<br />

section:<br />

CMS IOM Publication 100-04, <strong>Medicare</strong> Claims Processing Manual, Transmittal No. 2479, CR 7854, May 25,<br />

<strong>2012</strong>, provides billing instructions for HCPCS codes C1840 and 0308T and the deletion of HCPCS code<br />

C9732 under the Ambulatory Surgery Center (ASC) Payment System.<br />

CMS IOM Publication 100-04, <strong>Medicare</strong> Claims Processing Manual, Transmittal No. 2481, CR 7844, June 1,<br />

<strong>2012</strong> includes CPT code 0308T for an insertion of an ocular telescope prosthesis including removal of<br />

crystalline lens which is effective for service performed on or after <strong>July</strong> 1, <strong>2012</strong>.<br />

CMS IOM Publication 100-04, <strong>Medicare</strong> Claims Processing Manual, Transmittal No. 2483, CR 7847, June 8,<br />

<strong>2012</strong>, provides billing instructions for HCPCS codes C1840 and 0308T and the deletion of HCPCS code<br />

C9732 under the Hospital Outpatient Prospective Payment System (OPPS).<br />

Based on CR 7844, CPT code 0308T was added to the “CPT/HCPCS Codes” section for dates of service on<br />

or after <strong>July</strong> 1, <strong>2012</strong>. Based on CR 7847 and CR 7854, HCPCS code C9732 was deleted from this section.<br />

No comment or notice periods required and none given.<br />

Implantable Miniature Telescope (IMT) Supplemental Instructions Article (A51615)<br />

Article published <strong>July</strong> <strong>2012</strong>: Based on CMS IOM Publication 100-04, <strong>Medicare</strong> Claims Processing Manual,<br />

Transmittal No. 2481, CR 7844, June 1, <strong>2012</strong>, CPT code 0308T was added to the “CPT/HCPCS Codes”<br />

CPT codes and descriptors are only copyright <strong>2012</strong> American Medical Association (or such other date publication of CPT)<br />

The <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 4 MMR <strong>2012</strong>-07, <strong>July</strong> <strong>2012</strong>

section for dates of service on or after <strong>July</strong> 1, <strong>2012</strong>. Based on CMS IOM Publication 100-04, <strong>Medicare</strong> Claims<br />

Processing Manual, Transmittal No. 2479, CR 7854, May 25, <strong>2012</strong> and CMS IOM Publication 100-04,<br />

<strong>Medicare</strong> Claims Processing Manual, Transmittal No. 2483, CR 7847, June 8, <strong>2012</strong>, HCPCS code C9732 was<br />

deleted from this section.<br />

The following coding guidelines were added:<br />

Effective <strong>July</strong> 1, <strong>2012</strong>, claims submitted by Part A providers and ambulatory surgical centers for<br />

device pass-through category C1840 must be billed with CPT code 0308T (Insertion of ocular<br />

telescope prosthesis including removal of crystalline lens) to receive pass-through payment. HCPCS<br />

code C9732 was deleted June 30, <strong>2012</strong> and replaced with CPT code 0308T.<br />

For dates of service on or after <strong>July</strong> 1, <strong>2012</strong>, CPT code 0308T should be reported for an insertion of<br />

ocular telescope prosthesis including removal of crystalline lens. CPT code 0308T should not be<br />

reported in conjunction with codes 65800-65815, 66020, 66030, 66600-66635, 66761, 66825, 66982-66986<br />

and 69990.<br />

The following coding guidelines were revised:<br />

Effective January 1, <strong>2012</strong> through June 30, <strong>2012</strong>, claims submitted by Part A providers and<br />

ambulatory surgical centers for device pass-through category C1840 must be billed with HCPCS code<br />

C9732 (insertion of ocular telescope prosthesis including removal of crystalline lens) to receive passthrough<br />

payment.<br />

For dates of services from June 1 through June 30, <strong>2012</strong>, claims for the physician’s professional service<br />

should be submitted to the carrier or Part B MAC under CPT code 66999 (unlisted procedure, anterior<br />

segment of eye) with the terminology “implantable miniature telescope” reported in Item 19 of the<br />

CMS-1500 claim form or the electronic equivalent.<br />

Claims for implantable miniature telescope services (CPT code 66999 for dates of service June 1<br />

through June 30, <strong>2012</strong> and CPT code 0308T for dates of service on or after <strong>July</strong> 1 ,<strong>2012</strong>) are payable<br />

under <strong>Medicare</strong> Part B in the following places of service: inpatient hospital (21), outpatient hospital<br />

(22) and ambulatory surgical center (24).<br />

Template language regarding the limitation of liability information was corrected to remove the<br />

statement that claims with modifier GA would be automatically denied by fiscal intermediaries or<br />

Part A MACs.<br />

Polysomnography and Sleep Studies (L26428)<br />

R10 (effective 07/01/<strong>2012</strong>):The following paragraphs in the “Other Comments” section have been revised<br />

to add the Accreditation Commission for Health Care’s sleep lab accreditation credential:<br />

An active staff member of a sleep center or laboratory accredited by the American Academy of Sleep<br />

Medicine (AASM), the Accreditation Commission for Health Care, Inc. or The Joint Commission<br />

(formerly the Joint Commission on Accreditation of Healthcare Organizations (JCAHO).<br />

HST scoring must be performed by an individual certified by the Board of Registered<br />

Polysomnographic Technologists as a Registered Polysomnographic Technologist (RPSGT), or<br />

equivalent, or by a polysomnographic technician under the supervision of a RPSGT, or equivalent.<br />

RPSGTs and polysomnographic technicians must meet the standards for such individuals<br />

promulgated by the American Academy of Sleep Medicine Standards for Accreditation of<br />

Laboratories for Sleep Related Breathing Disorders, or by the Accreditation Commission for Health<br />

Care, Inc. Standards for Accreditation for Sleep Programs and be licensed or certified by the state in<br />

which they practice, if such licensure or certification exists. The laboratory physician must review the<br />

entire raw data recording for every patient studied.<br />

No comment and notice periods required and none given.<br />

CPT codes and descriptors are only copyright <strong>2012</strong> American Medical Association (or such other date publication of CPT)<br />

The <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 5 MMR <strong>2012</strong>-07, <strong>July</strong> <strong>2012</strong>

Ranibizumab (e.g., Lucentis) and Aflibercept (e.g., Eylea) - Related to LCD L25820 (A46091)<br />

Article published <strong>July</strong> <strong>2012</strong>: The article has been revised to include aflibercept (Eylea) HCPCS code<br />

Q2046, effective for dates of service on or after 07/01/<strong>2012</strong>.<br />

Rituximab (Rituxan®) (effective 2010) - Related to LCD L25820 (A49636)<br />

Article published <strong>July</strong> <strong>2012</strong>: ICD-9-CM code V49.83 has been added to the “ICD-9 Codes that are<br />

Covered” section of the article effective for dates of service on or after 07/01/<strong>2012</strong>.<br />

Transthoracic Echocardiography (TTE) (L27360)<br />

R9 (effective 07/01/<strong>2012</strong>): The list of ICD-9-CM codes applicable to codes 93350, 93351, 93352, and C8930<br />

was corrected to include HCPCS code C8928 for outpatient prospective payment system (OPPS) billing.<br />

HCPCS codes C8928 and C8930 were added to the list of codes for which stress agents apply. Minor<br />

formatting changes made. No comment or notice periods required and none given.<br />

Transthoracic Echocardiography Transthoracic Echocardiography (TTE) Transthoracic<br />

Echocardiography (A48397)<br />

Article published <strong>July</strong> <strong>2012</strong>: the list of codes for which stress agents apply was updated to include OPPS<br />

codes C8928 and C8930. Minor formatting changes made including the deletion of obsolete coding<br />

instructions. Template language regarding the Limitation of liability information was corrected to remove<br />

the statement that claims with modifier GA would be automatically denied by fiscal intermediaries or<br />

Part A MACs.<br />

Self-Administered Drug (SAD) Annual <strong>Review</strong><br />

Self-Administered Drug Exclusion List - Medical Policy Article (R4) CT and NY A/B MAC<br />

(A47846)<br />

Article published 07/01/<strong>2012</strong> (R4): An annual review was completed on this article. Content<br />

reviewed, and no changes required other than for minor formatting.<br />

Self-Administered Drug Exclusion List - Medical Policy Article (R23) IL (A2311)<br />

Article published 07/01/<strong>2012</strong> (R23): An annual review was completed on this article. Content<br />

reviewed, and no changes required other than for minor formatting.<br />

Self-Administered Drug Exclusion List - Medical Policy Article (R9) IN (A906)<br />

Article published 07/01/<strong>2012</strong> (R9): An annual review was completed on this article. Content<br />

reviewed, and no changes required other than for minor formatting.<br />

Self-Administered Drug Exclusion List - Medical Policy Article (R18) IN (A2310)<br />

Article published 07/01/<strong>2012</strong> (R18): An annual review was completed on this article. Content<br />

reviewed, and no changes required other than for minor formatting.<br />

Self-Administered Drug Exclusion List - Medical Policy Article (R5) MI (A47527)<br />

Article published 07/01/<strong>2012</strong> (R5): An annual review was completed on this article. Content<br />

reviewed, and no changes required other than for minor formatting.<br />

Self-Administered Drug Exclusion List - Medical Policy Article (R5) WI (A47525)<br />

Article published 07/01/<strong>2012</strong> (R5): An annual review was completed on this article. Content<br />

reviewed, and no changes required other than for minor formatting.<br />

June <strong>2012</strong> Revisions<br />

Category III CPT ® Codes (L25275)<br />

R13 (effective 06/14/<strong>2012</strong>): Article for Percutaneous Laminotomy/Laminectomy (Intralaminar Approach)<br />

(0275T) (A51849) has been added. No comment period required and none given.<br />

CPT codes and descriptors are only copyright <strong>2012</strong> American Medical Association (or such other date publication of CPT)<br />

The <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 6 MMR <strong>2012</strong>-07, <strong>July</strong> <strong>2012</strong>

June <strong>2012</strong> New LCD/Articles<br />

Percutaneous Laminotomy/Laminectomy (Intralaminar Approach) (0275T) – Related to LCD L25275<br />

(A51849)<br />

Minimally invasive lumbar decompression has been proposed as a treatment for symptomatic lumbar<br />

spinal stenosis (LSS) unresponsive to conservative therapy. One technique is the mild ® procedure in<br />

which small portions of the laminae are removed and debulking of the ligamentum flavum (LF) is<br />

performed under imaging guidance without endoscopy or an open procedure. Reconsideration requests<br />

of the noncoverage policy for mild have been received. An article is being published to explain the<br />

rationale for noncoverage.<br />

Retired <strong>National</strong> <strong>Government</strong> Services LCDs and Articles<br />

As part of the continuing review and assessment of <strong>National</strong> <strong>Government</strong> Services LCDs, the following<br />

LCD will be retired for all <strong>National</strong> <strong>Government</strong> Services jurisdictions, effective for dates of service on or<br />

after <strong>July</strong> 1, <strong>2012</strong>:<br />

LCD Title LCD ID Article ID Date Retired<br />

Prostate Specific Antigen (PSA) L27357 A47389 07/01/<strong>2012</strong><br />

All local policy rules, requirements, and limitations within this policy will no longer be applied on a<br />

prepay basis, effective on <strong>July</strong> 1, <strong>2012</strong>, but as with any billed service, claims will be subject to postpay<br />

review. All CMS national policy rules, requirements, and limitations remain in effect.<br />

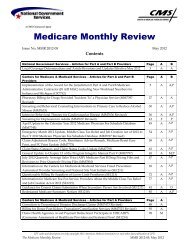

<strong>National</strong> <strong>Government</strong> Services Articles for Part A Providers<br />

Inpatient Rehabilitation Facilities – Payment Is Affected by the Patient<br />

Discharge Status Codes Reported on <strong>Medicare</strong> Claims<br />

It is important that inpatient rehabilitation facilities (IRFs) assign and report the most appropriate patient<br />

discharge status codes on their <strong>Medicare</strong> claims. Submitting claims with incorrect patient discharge status<br />

codes is a claim billing error and could result in the claims being rejected or in the claims being canceled<br />

and payments being taken back. In addition, submitting claims with incorrect patient discharge status<br />

codes can result in IRFs receiving inappropriate <strong>Medicare</strong> payments due to the transfer payment policy<br />

that exists under the IRF prospective payment system (IRF PPS).<br />

Under the IRF PPS, an IRF receives a full case-mix group (CMG) payment from <strong>Medicare</strong> when it<br />

discharges/transfers a beneficiary to home or to an institution that does not fall under the IRF PPS<br />

transfer payment policy. However, for a transfer case, <strong>Medicare</strong> pays a lesser amount, based on a perdiem<br />

rate and the number of days the beneficiary spent in the IRF. A transfer case is one in which the<br />

beneficiary’s IRF stay is shorter than the average stay for the non-transfer cases in the specific CMG and<br />

the beneficiary is discharged or transferred to an acute care hospital for inpatient care, a hospital-based<br />

approved swing bed (within the institution), another IRF, a long-term care hospital, or a nursing home<br />

that accepts payment under <strong>Medicare</strong> or under Medicaid.<br />

The patient discharge status code is a required two-digit code that identifies where the patient is at the<br />

conclusion of a health care facility encounter or at the end time of a billing cycle (the through date of the<br />

claim). It is reported in form locator 17 on a Uniform Billing (UB)-04 Claim Form or its electronic<br />

equivalent in the Health Insurance Portability and Accountability Act (HIPAA)-compliant 837 format.<br />

UB-04 form locators and descriptions can be found in the Centers for <strong>Medicare</strong> & Medicaid Services<br />

CPT codes and descriptors are only copyright <strong>2012</strong> American Medical Association (or such other date publication of CPT)<br />

The <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 7 MMR <strong>2012</strong>-07, <strong>July</strong> <strong>2012</strong>

(CMS) Internet-Only Manual (IOM), Publication 100-04, <strong>Medicare</strong> Claims Processing Manual, Chapter 25,<br />

Section 75 (see Section 75.2, form locator 17 for patient discharge status). Billing codes and descriptions<br />

are available from the <strong>National</strong> Uniform Billing Committee (NUBC) Web site, www.nubc.org via the<br />

NUBC’s Official UB-04 Data Specifications Manual.<br />

The patient discharge status code is the primary way in which <strong>Medicare</strong> can identify the claim as a<br />

transfer case under IRF PPS. We have provided the patient discharge status codes and definitions related<br />

specifically to the facility types that fall under the IRF PPS transfer payment policy.<br />

PATIENT DISCHARGE<br />

STATUS CODE<br />

FACILITY TYPE<br />

02 Short-term general hospital for inpatient care<br />

61 Hospital-based approved swing bed (within the institution)<br />

62 Inpatient rehabilitation facility<br />

63 Long-term care hospital<br />

03 Nursing home that accepts payment under <strong>Medicare</strong><br />

64 Nursing home that accepts payment under Medicaid<br />

Identifying the appropriate patient discharge status code can be challenging; in cases in which two or<br />

more patient discharge status codes apply, providers should code the highest level of care known.<br />

For more information regarding patient discharge status codes, refer to the <strong>Medicare</strong> Learning Network<br />

(MLN) Matters Special Edition article SE0801 “Clarification of Patient Discharge Status Codes and Hospital<br />

Transfer Policies” (http://www.cms.gov/Outreach-and-Education/<strong>Medicare</strong>-Learning-Network-<br />

MLN/MLNMattersArticles/downloads//SE0801.pdf).<br />

CPT codes and descriptors are only copyright <strong>2012</strong> American Medical Association (or such other date publication of CPT)<br />

The <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 8 MMR <strong>2012</strong>-07, <strong>July</strong> <strong>2012</strong>

Centers for <strong>Medicare</strong> &<br />

Medicaid Services<br />

Articles for Part A&B<br />

Providers

DEPARTMENT OF HEALTH AND HUMAN SERVICES<br />

Centers for <strong>Medicare</strong> & Medicaid Services<br />

News Flash – <strong>Medicare</strong> is denying an increasing number of claims, because providers are not<br />

identifying, nor sending claims to, the correct primary payer prior to claims submission.<br />

<strong>Medicare</strong> would like to remind providers, physicians, and suppliers that they have the<br />

responsibility to bill correctly and to ensure claims are submitted to the appropriate primary<br />

payer. Please refer to the “<strong>Medicare</strong> Secondary Payer (MSP) Manual,” Chapters 1, 3, and 5 and<br />

MLN Matters® Article SE1217 for additional guidance.<br />

MLN Matters® Number: MM7355 Revised Related Change Request (CR) #: 7355<br />

Related CR Release Date: May 25, <strong>2012</strong><br />

Related CR Transmittal #: R86MSP<br />

Effective Date: October 1, <strong>2012</strong> for Professional Claims and DME<br />

Supplier Claims; January 1, 2013 for Institutional Claims<br />

Implementation Date: January 7, 2013 for Professional and DME<br />

Supplier Claims; January 7, 2013 for Institutional Claims<br />

Clarification of <strong>Medicare</strong> Conditional Payment Policy and Billing Procedures for<br />

Liability, No-Fault and Workers’ Compensation (WC) <strong>Medicare</strong> Secondary Payer<br />

(MSP) Claims<br />

Note: This article was revised on May 30, <strong>2012</strong>, to reflect the revised CR7355 issued on May 25. In the<br />

article, the CR release date, transmittal number, effective and implementation dates (see above), and<br />

the Web address for accessing CR7355 were revised. All other information is the same.<br />

Provider Types Affected<br />

This MLN Matters ® article is intended for physicians, hospitals, Home Health Agencies, and other<br />

providers who bill <strong>Medicare</strong> Carriers, Fiscal Intermediaries (FIs) or <strong>Medicare</strong> Administrative<br />

Contractors (A/B/MACs); and suppliers who bill Durable Medical Equipment MACs (DME MACs) for<br />

<strong>Medicare</strong> beneficiary liability insurance (including self insurance), no-fault insurance, and WC<br />

<strong>Medicare</strong> Second Payer (MSP) claims.<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to<br />

statutes, regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of<br />

either the written law or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and<br />

accurate statement of their contents. CPT only copyright 2010 American Medical Association.<br />

10<br />

Page 1 of 8

MLN Matters ® Number: MM7355 Related Change Request Number: 7355<br />

Provider Action Needed<br />

This article provides clarifications in the procedures for processing liability insurance (including selfinsurance),<br />

no-fault insurance and WC <strong>Medicare</strong> Secondary Payer (MSP) claims. Not following the<br />

procedures identified in this article may impact your reimbursement. Change Request (CR) 7355, from<br />

which this article is taken, clarifies the procedures you are to follow when billing <strong>Medicare</strong> for liability<br />

insurance (including self-insurance), no-fault insurance, or WC claims, when the liability insurance<br />

(including self-insurance), no-fault insurance, or WC carrier does not make prompt payment. It also<br />

includes definitions of the promptly payment rules and how contractors will identify conditional<br />

payment requests on MSP claims received from you. You should make sure that your billing staffs are<br />

aware of these <strong>Medicare</strong> instructions.<br />

Background<br />

Key Points<br />

CR7355, from which this article is taken: 1) Clarifies the procedures to follow when submitting liability<br />

insurance (including self-insurance), no-fault insurance and WC claims when the liability insurer<br />

(including self-insurance), no-fault insurer and WC carrier does not make prompt payment or cannot<br />

reasonably be expected to make prompt payment; 2) Defines the promptly payment rules; and 3)<br />

Instructs you how to submit liability insurance (including self-insurance), no-fault insurance and WC<br />

claims to your <strong>Medicare</strong> contractors when requesting <strong>Medicare</strong> conditional payments on these types<br />

of MSP claims.<br />

The term Group Health Plan (GHP) as related to this MLN article means health insurance coverage<br />

that is provided by an employer to a <strong>Medicare</strong> beneficiary based on a beneficiary’s own, or family<br />

member’s, current employment status. The term Non-GHP means coverage provided by a liability<br />

insurer (including self-insurance), no-fault insurer and WC carrier where the insurer covers for<br />

services related to the applicable accident or injury.<br />

Conditional <strong>Medicare</strong> Payment Procedures<br />

<strong>Medicare</strong> may not make payment on a MSP claim where payment has been made or can reasonably<br />

be expected to be made by GHPs, a WC law or plan, liability insurance (including self-insurance), or<br />

no-fault insurance.<br />

<strong>Medicare</strong> can make conditional payments for both Part A and Part B WC, or no-fault, or liability<br />

insurance (including self insurance) claims if payment has not been made or cannot be reasonably<br />

expected to be made by the WC, or no-fault, or liability insurance claims (including self insurance) and<br />

the promptly period has expired. Note: If there is a primary GHP, <strong>Medicare</strong> may not pay<br />

conditionally on the liability, no-fault, or WC claim if the claim is not billed to the GHP first. The<br />

GHP insurer must be billed first and the primary payer payment information must appear on<br />

the claim submitted to <strong>Medicare</strong>.<br />

These payments are made “on condition” that the trust fund will be reimbursed if it is demonstrated<br />

that WC, no-fault, or liability insurance is (or was) responsible for making primary payment (as<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to statutes,<br />

regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of either the written law<br />

or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement of their contents.<br />

CPT only copyright 2010 American Medical Association.<br />

11<br />

Page 2 of 8

MLN Matters ® Number: MM7355 Related Change Request Number: 7355<br />

demonstrated by a judgment; a payment conditioned upon the recipient’s compromise, waiver, or<br />

release [whether or not there is a determination or admission of liability for payment for items or<br />

services included in a claim against the primary payer or the primary payer’s insured]; or by other<br />

means).<br />

“Promptly” Definition<br />

No-fault Insurance and WC “Promptly” Definition<br />

For no-fault insurance and WC, promptly means payment within 120 days after receipt of the claim<br />

(for specific items and services) by the no-fault insurance or WC carrier. In the absence of evidence to<br />

the contrary, the date of service for specific items and service must be treated as the claim date when<br />

determining the promptly period. Further with respect to inpatient services, in the absence of evidence<br />

to the contrary, the date of discharge must be treated as the date of service when determining the<br />

promptly period.<br />

Liability Insurance “Promptly” Definition<br />

For liability insurance (including self-insurance), promptly means payment within 120 days after the<br />

earlier of the following:<br />

• The date a general liability claim is filed with an insurer or a lien is filed against a potential liability<br />

settlement; or<br />

• The date the service was furnished or, in the case of inpatient hospital services, the date of<br />

discharge.<br />

The "<strong>Medicare</strong> Secondary Payer (MSP) Manual"<br />

(http://www.cms.gov/manuals/downloads/msp105c01.pdf), Chapter 1 (Background and Overview),<br />

Section 20 (Definitions), provides the definition of promptly (with respect to liability, no-fault, and WC)<br />

which all <strong>Medicare</strong> contractors must follow.<br />

Note: For the liability situation, the MSP auxiliary record is usually posted to the <strong>Medicare</strong>’s Common<br />

Working File (CWF) after the beneficiary files a claim against the alleged tortfeasor (the one who<br />

committed the tort (civil wrong)) and the associated liability insurance (including self-insurance). In the<br />

absence of evidence to the contrary, the date the general liability claim is filed against the liability<br />

insurance (including self-insurance) is no later than the date that the record was posted on <strong>Medicare</strong>’s<br />

CWF. Therefore, for the purposes of determining the promptly period, <strong>Medicare</strong> contractors consider<br />

the date the Liability record was created on <strong>Medicare</strong>’s CWF to be the date the general liability claim<br />

was filed.<br />

How to Request a Conditional Payment<br />

The following summarizes the technical procedures that Part A, and Part B and supplier contractors<br />

will use to identify providers' conditional payment requests on MSP claims.<br />

Part A Conditional Payment Requests<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to statutes,<br />

regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of either the written law<br />

or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement of their contents.<br />

CPT only copyright 2010 American Medical Association.<br />

12<br />

Page 3 of 8

MLN Matters ® Number: MM7355 Related Change Request Number: 7355<br />

Type of<br />

Insurance<br />

No-<br />

Fault/Liability<br />

WC<br />

Providers of Part A services can request conditional non-GHP payments from Part A contractors on<br />

the hardcopy Form CMS-1450, if you have permission from <strong>Medicare</strong> to bill hardcopy claims, or the<br />

837 Institutional Electronic Claim, using the appropriate insurance value code (i.e., value code 14, 15<br />

or 47) and zero as the value amount. Again, you must bill the non-GHP insurer, and the GHP insurer,<br />

if the beneficiary belongs to an employer group health plan, first before billing <strong>Medicare</strong>.<br />

For hardcopy (CMS-1450) claims, Providers must identify the other payer’s identity on line A of Form<br />

Locator (FL) 50, the identifying information about the insured is shown on line A of FL 58-65, and the<br />

address of the insured is shown in FL38 or Remarks (FL 80). All primary payer amounts and<br />

appropriate codes must appear on your claim submitted to <strong>Medicare</strong>.<br />

For 837 Institutional Claims, Providers must provide the primary payer’s zero value code paid<br />

amount and occurrence code in the 2300 HI. (The appropriate Occurrence code (2300 HI), coupled<br />

with the zeroed paid amount and MSP value code (2300 HI), must be used in billing situations where<br />

you attempted to bill a primary payer in non-GHP (i.e., Liability, no-fault and Workers’ Compensation)<br />

situations, but the primary payer did not make a payment in the promptly period). Note: Beginning <strong>July</strong><br />

1, <strong>2012</strong> <strong>Medicare</strong> contractors will no longer be accepting 4010 claims; Providers must submit claims in<br />

the 5010 format beginning on this date.<br />

Table 1 displays the required information of the electronic claim in which a Part A provider is<br />

requesting conditional payments.<br />

Table 1<br />

Data Requirements for Conditional Payment for Part A Electronic Claims<br />

CAS<br />

Part A Value<br />

Code (2300 HI)<br />

Value<br />

Amount<br />

(2300 HI)<br />

Occurrence Code<br />

(2300 HI)<br />

2320 - valid 01-Auto Accident &<br />

information why<br />

Date<br />

NGHP or GHP did<br />

not make payment 14 or 47 $0<br />

02-No-fault<br />

Insurance Involved &<br />

Date<br />

24 – Date Insurance<br />

Denied<br />

2320 - valid<br />

04-Accident/Tort<br />

information why<br />

NGHP or GHP did<br />

15 $0<br />

Liability & Date<br />

24 – Date Insurance<br />

not make payment Denied<br />

Part B Conditional Payment Requests (Table 2)<br />

Condition Code<br />

(2300 HI)<br />

02-Condition is<br />

Employment<br />

Related<br />

Since the electronic Part B claim (837 4010 professional claim) does not contain Value Codes or<br />

Condition Codes, the physician or supplier must complete the: 1) 2320AMT02 = $0 if the entire claim<br />

is a non-GHP claim and conditional payment is being requested for the entire claim; or 2) 2430 SVD02<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to statutes,<br />

regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of either the written law<br />

or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement of their contents.<br />

CPT only copyright 2010 American Medical Association.<br />

13<br />

Page 4 of 8

MLN Matters ® Number: MM7355 Related Change Request Number: 7355<br />

Type of<br />

Insurance<br />

No-<br />

Fault/Liability<br />

for line level conditional payment requests if the claim also contains other service line activity not<br />

related to the accident or injury, so that the contractor can determine if conditional payment should be<br />

granted for Part B services related to the accident or injury.<br />

For Version 4010, Physicians and other suppliers may include CP- <strong>Medicare</strong> Conditionally Primary,<br />

AP-auto insurance policy, or OT- other in the 2320 SBR05 field. The 2320 SBR09 may contain the<br />

claim filing indicator code of AM - automobile medical, LI - Liability, LM - Liability Medical or WC -<br />

Workers’ Compensation Health Claim. Any one of these claim filing indicators are acceptable for the<br />

non-GHP MSP claim types.<br />

The 2300 DTP identifies the date of the accident with appropriate value. The “accident related causes<br />

code” is found in 2300 CLM 11-1 through CLM 11-3. Note: Beginning <strong>July</strong> 1, <strong>2012</strong> <strong>Medicare</strong><br />

contractors will no longer accept 4010 claims; Providers must submit claims in the 5010 format<br />

beginning on this date.<br />

Table 2 displays the required information for a MSP 4010 Professional in which a<br />

physician/supplier is requesting conditional payments.<br />

Table 2<br />

Data Requirements for Conditional Payments for MSP 4010 Professional Claims<br />

CAS Insurance<br />

Type Code<br />

(2320<br />

SBR05)<br />

2320 or 2430<br />

valid<br />

information why<br />

NGHP or GHP<br />

did not make<br />

payment<br />

WC 2320 or 2430<br />

valid<br />

information why<br />

NGHP or GHP<br />

did not make<br />

payment<br />

Claim Filing<br />

Indicator<br />

(2320<br />

SBR09)<br />

AP or CP AM, LI, or<br />

LM<br />

Paid Amount<br />

(2320 AMT or<br />

2430 SVD02)<br />

Insurance<br />

Type<br />

Code<br />

(2000B<br />

SBR05)<br />

Date of Accident<br />

$0.00 14 2300 DTP 01 through 03<br />

and 2300 CLM 11-1<br />

through 11-3 with value<br />

AA, AP or OA<br />

OT WC $0.00 15 2300 DTP 01 through 03<br />

and 2300 CLM 11-1<br />

through or 11-3 with value<br />

EM<br />

Please note that for 837 5010 Professional claims, the insurance codes changed and the acceptable<br />

information for <strong>Medicare</strong> conditional payment request is modified as displayed in Table 3.<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to statutes,<br />

regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of either the written law<br />

or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement of their contents.<br />

CPT only copyright 2010 American Medical Association.<br />

14<br />

Page 5 of 8

MLN Matters ® Number: MM7355 Related Change Request Number: 7355<br />

Type of<br />

Insurance<br />

No-<br />

Fault/Liability<br />

Table 3<br />

Data Requirements for Conditional Payment for 837 5010 Professional Claims<br />

CAS Insurance<br />

Type Code<br />

2320 SBR05<br />

from previous<br />

2320 or 2430 –<br />

valid<br />

information<br />

why NGHP or<br />

GHP did not<br />

make payment<br />

WC 2320 or 2430 –<br />

valid<br />

information<br />

why NGHP or<br />

GHP did not<br />

make payment<br />

payer(s)<br />

Claim Filing<br />

Indicator (2320<br />

SBR09)<br />

Paid Amount<br />

(2320 AMT or<br />

2430 SVD02)<br />

Condition Code<br />

(2300 HI)<br />

Date of<br />

Accident<br />

14 / 47 AM or LM $0.00 2300 DTP 01<br />

through 03 and<br />

2300 CLM 11-1<br />

through 11-3<br />

with value AA<br />

or OA<br />

15 WC $0.00 02-Condition is<br />

Employment<br />

Related<br />

2300 DTP 01<br />

through 03 and<br />

2300 CLM 11-1<br />

through or 11-3<br />

with value EM<br />

Note: <strong>Medicare</strong> beneficiaries are not required to file a claim with a liability insurer or required to<br />

cooperate with a provider in filing such a claim, but they are required to cooperate in the filing of nofault<br />

claims. If the beneficiary refuses to cooperate in filing of no-fault claims <strong>Medicare</strong> does not pay.<br />

Situations Where a Conditional Payment Can be Made for No-Fault and WC<br />

Claims<br />

Conditional payments for claims for specific items and service may be paid by <strong>Medicare</strong> where the<br />

following conditions are met:<br />

• There is information on the claim or information on <strong>Medicare</strong>’s CWF that indicates the no-fault<br />

insurance or WC is involved for that specific item or service;<br />

• There is/was no open GHP record on the <strong>Medicare</strong> CWF MSP file as of the date of service;<br />

• There is information on the claim that indicates the physician, provider or other supplier sent the<br />

claim to the no-fault insurer or WC entity first; and<br />

• There is information on the claim that indicates the no-fault insurer or WC entity did not pay the<br />

claim during the promptly period.<br />

Note: When a conditional payment is made to you, <strong>Medicare</strong> contractors will use Remittance Advice<br />

Remark Code M32 to indicate a conditional payment is being made.<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to statutes,<br />

regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of either the written law<br />

or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement of their contents.<br />

CPT only copyright 2010 American Medical Association.<br />

15<br />

Page 6 of 8

MLN Matters ® Number: MM7355 Related Change Request Number: 7355<br />

Situations Where a Conditional Payment Can be Made for Liability (including<br />

Self Insurance) Claims<br />

Conditional payments for claims for specific items and service may be paid by <strong>Medicare</strong> where the<br />

following conditions are met:<br />

• There is information on the claim or information on <strong>Medicare</strong>’s CWF that indicates liability<br />

insurance (including self-insurance) is involved for that specific item or service;<br />

• There is/was no open GHP record on the <strong>Medicare</strong>’s CWF MSP file as of the date of service;<br />

• There is information on the claim that indicates the physician, provider or other supplier sent the<br />

claim to the liability insurer (including the self-insurer) first, and<br />

• There is information on the claim that indicates the liability insurer (including the self insurer) did<br />

not make payment on the claim during the promptly period.<br />

Conditional Primary <strong>Medicare</strong> Benefits Paid When a GHP is a Primary Payer to<br />

<strong>Medicare</strong><br />

Conditional primary <strong>Medicare</strong> benefits may be paid if the beneficiary has GHP coverage primary to<br />

<strong>Medicare</strong> and the following conditions are NOT present:<br />

• It is alleged that the GHP is secondary to <strong>Medicare</strong>;<br />

• The GHP limits its payment when the individual is entitled to <strong>Medicare</strong>;<br />

• The services are covered by the GHP for younger employees and spouses but not for employees<br />

and spouses age 65 or over;<br />

• If the GHP asserts it is secondary to the liability (including self insurance), no-fault or workers’<br />

compensation insurer.<br />

Situations Where Conditional Payment is Denied<br />

Liability, No-Fault, or WC Claims Denied<br />

1. <strong>Medicare</strong> will deny claims when:<br />

• There is an employer GHP that is primary to <strong>Medicare</strong>; and<br />

• You did not send the claim to the employer GHP first; and<br />

• You sent the claim to the liability insurer (including the self-insurer), no-fault, or WC entity, but<br />

the insurer entity did not pay the claim.<br />

2. <strong>Medicare</strong> will deny claims when:<br />

• There is an employer GHP that is primary to <strong>Medicare</strong>; and<br />

• The employer GHP denied the claim because the GHP asserted that the liability insurer<br />

(including the self-insurer), no-fault insurer or WC entity should pay first; and<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to statutes,<br />

regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of either the written law<br />

or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement of their contents.<br />

CPT only copyright 2010 American Medical Association.<br />

16<br />

Page 7 of 8

MLN Matters ® Number: MM7355 Related Change Request Number: 7355<br />

• You sent the claim to the liability insurer (including the self-insurer), no-fault, insurer or WC<br />

entity, but the insurer entity did not pay the claim.<br />

Denial Codes<br />

To indicate that claims were denied by <strong>Medicare</strong> because the claim was not submitted to the<br />

appropriate primary GHP for payment, <strong>Medicare</strong> contractors will use the following codes on the<br />

remittance advice sent to you:<br />

• Claim Adjustment Reason Code 22 - "This care may be covered by another payer per<br />

coordination of benefits" and<br />

• Remittance Advice Remark Code MA04 -Secondary payment cannot be considered without the<br />

identity of or payment information from the primary payer. The information was either not<br />

reported or was illegible.”<br />

Additional Information<br />

You can find official instruction, CR7355, issued to your carrier, FI, RHHI, A/B MAC, or DME MAC by<br />

visiting http://www.cms.hhs.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R86MSP.pdf on<br />

the CMS website.<br />

You will find the following revised Chapters of the "<strong>Medicare</strong> Secondary Payer Manual," as an attachment<br />

to that CR:<br />

Chapter 1 (Background and Overview):<br />

• Section 10.7 (Conditional Primary <strong>Medicare</strong> Benefits),<br />

• Section 10.7.1 (When Conditional Primary <strong>Medicare</strong> Benefits May Be Paid When a GHP is a Primary<br />

Payer to <strong>Medicare</strong>), and<br />

• Section 10.7.2 (When Conditional Primary <strong>Medicare</strong> Benefits May Not Be Paid When a GHP is a<br />

Primary Payer to <strong>Medicare</strong>).<br />

Chapter 3 (MSP Provider, Physician, and Other Supplier Billing Requirements):<br />

• Section 30.2.1.1 (No-Fault Insurance Does Not Pay), and<br />

• Section 30.2.2 (Responsibility of Provider Where Benefits May Be Payable Under Workers'<br />

Compensation).<br />

Chapter 5 (Contractor Prepayment Processing Requirements):<br />

• Section 40.6 (Conditional Primary <strong>Medicare</strong> Benefits),<br />

• Section 40.6.1 (Conditional <strong>Medicare</strong> Payment), and<br />

• Section 40.6.2 (When Primary Benefits and Conditional Primary <strong>Medicare</strong> Benefits Are Not Payable).<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to statutes,<br />

regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of either the written law<br />

or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement of their contents.<br />

CPT only copyright 2010 American Medical Association.<br />

17<br />

Page 8 of 8

DEPARTMENT OF HEALTH AND HUMAN SERVICES<br />

Centers for <strong>Medicare</strong> & Medicaid Services<br />

News Flash – Looking for the latest new and revised MLN Matters ® articles? Subscribe to the<br />

MLN Matters ® electronic mailing list! For more information about MLN Matters ® and how to<br />

register for this service, go to http://www.cms.gov/Outreach-and-Education/<strong>Medicare</strong>-Learning-<br />

Network-MLN/MLNProducts/downloads/What_Is_MLNMatters.pdf and start receiving updates<br />

immediately!<br />

MLN Matters® Number: MM7785 Related Change Request (CR) #: CR 7785<br />

Related CR Release Date: April 27, <strong>2012</strong> Effective Date: October 1, <strong>2012</strong><br />

Related CR Transmittal #: R2457CP Implementation Date: October 1, <strong>2012</strong><br />

Revisions of the Financial Limitation for Outpatient Therapy Services – Section<br />

3005 of the Middle Class Tax Relief and Job Creation Act of <strong>2012</strong><br />

Provider Types Affected<br />

This MLN Matters ® article is intended for physicians, other suppliers and providers who submit claims<br />

to <strong>Medicare</strong> contractors (carriers, Fiscal Intermediaries (FIs), A/B <strong>Medicare</strong> Administrative Contractors<br />

(A/B MACs), and/or Regional Home Health Intermediaries (RHHIs)) for therapy services provided to<br />

<strong>Medicare</strong> beneficiaries.<br />

Provider Action Needed<br />

STOP – Impact to You<br />

This article is based on Change Request (CR) 7785, which extends the therapy cap exceptions<br />

process through December 31, <strong>2012</strong>, adds therapy services provided in outpatient hospital settings<br />

other than Critical Access Hospitals (CAHs) to the therapy cap effective October 1, <strong>2012</strong>, requires the<br />

<strong>National</strong> Provider Identifier (NPI) of the physician certifying therapy plan of care on the claim, and<br />

addresses new thresholds for mandatory medical review.<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to<br />

statutes, regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of<br />

either the written law or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and<br />

accurate statement of their contents. CPT only copyright 2011 American Medical Association.<br />

18<br />

Page 1 of 5

MLN Matters® Number: MM7785 Related Change Request Number: CR 7785<br />

CAUTION – What You Need to Know<br />

The therapy cap amounts for <strong>2012</strong> are $1880 for occupational therapy services, and $1880 for the<br />

combined services for physical therapy and speech-language pathology. Suppliers and providers will<br />

continue to use the KX modifier to request an exception to the therapy caps on claims that are over<br />

these amounts. The use of the KX modifier indicates that the services are reasonable and necessary,<br />

and there is documentation of medical necessity in the patient’s medical record. For services provided<br />

on or after October 1, <strong>2012</strong> and before January 1, 2013, there will be two new therapy services<br />

thresholds of $3700 per year: one annual threshold each for 1) Occupational Therapy (OT) services,<br />

and 2) Physical Therapy (PT) services and Speech-Language Pathology (SLP) services combined.<br />

Per-beneficiary services above these thresholds will require mandatory medical review .<br />

GO – What You Need to Do<br />

See the Background and Additional Information Sections of this article for further details regarding<br />

these changes.<br />

Background<br />

The Balanced Budget Act of 1997 (see http://www.gpo.gov/fdsys/pkg/PLAW-<br />

105publ33/pdf/PLAW-105publ33.pdf on the Internet) enacted financial limitations on outpatient PT,<br />

OT, and SLP services in all settings except outpatient hospital. Exceptions to the limits were enacted<br />

by the Deficit Reduction Act (see http://www.gpo.gov/fdsys/pkg/PLAW-109publ171/pdf/PLAW-<br />

109publ171.pdf on the Internet), and have been extended by legislation several times.<br />

The Middle Class Tax Relief and Job Creation Act of <strong>2012</strong> (MCTRJCA, Section 3005; see<br />

http://www.gpo.gov/fdsys/pkg/BILLS-112hr3630enr/pdf/BILLS-112hr3630enr.pdf on the Internet)<br />

extended the therapy caps exceptions process through December 31, <strong>2012</strong>, and made several<br />

changes affecting the processing of claims for therapy services.<br />

The therapy cap amounts for <strong>2012</strong> are:<br />

• $1880 for OT services, and<br />

• $1880 for the combined services for PT and SL P.<br />

Change Request (CR) 7785 instructs <strong>Medicare</strong> suppliers and providers to continue to use the KX<br />

modifier to request an exception to the therapy cap on claims that are over these amounts. Note that<br />

use of the KX modifier is an attestation from the provider or supplier that:<br />

1. The services are reasonable and necessary, and<br />

2. There is documentation of medical necessity in the patient’s medical record.<br />

Therapy services furnished in an outpatient hospital setting have been exempt from the application of<br />

the therapy caps. However, MCTRJCA requires Original <strong>Medicare</strong> to temporarily apply the therapy<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to statutes,<br />

regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of either the written law<br />

or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement of their contents.<br />

CPT only copyright 2011 American Medical Association.<br />

19<br />

Page 2 of 5

MLN Matters® Number: MM7785 Related Change Request Number: CR 7785<br />

caps (and related provisions) to the therapy services furnished in an outpatient hospital between<br />

October 1, <strong>2012</strong>, and December 31, <strong>2012</strong>.<br />

Although the therapy caps are only applicable to hospitals for services provided on or after October 1,<br />

<strong>2012</strong>, in applying the caps after October 1, <strong>2012</strong>, claims paid for outpatient therapy services since<br />

January 1, <strong>2012</strong>, will be included in the caps accrual totals.<br />

In addition, MCTRJCA contains two requirements that become effective on October 1, <strong>2012</strong>.<br />

• The first of these requires that suppliers and providers report on the beneficiary’s claim for<br />

therapy services the <strong>National</strong> Provider Identifier (NPI) of the physician (or Non-Physician<br />

Practitioner (NPP) where applicable) who is responsible for reviewing the therapy plan of<br />

care. For implementation purposes, the physician (or NPP as applicable) certifying the<br />

therapy plan of care is reported. NPPs who can certify the therapy plan of care include nurse<br />

practitioners, physician assistants and clinical nurse specialists.<br />

• The second requires a manual medical review process for those exceptions where the<br />

beneficiary therapy services for the year reach a threshold of $3,700. The two separate<br />

thresholds triggering manual medical reviews build upon the separate therapy caps as<br />

follows:<br />

o One for OT services, and<br />

o One for PT and SLP services combined.<br />

Although PT and SLP services are combined for triggering the threshold, medical review is<br />

conducted separately by discipline.<br />

Claims with the KX modifier requesting exceptions for services above either threshold are subject to a<br />

manual medical review process. The count of services to which these thresholds apply begins on<br />

January 1, <strong>2012</strong>. Absent Congressional action, manual medical review expires when the exceptions<br />

process expires on December 31, <strong>2012</strong>.<br />

Claims for services at or above the therapy caps or thresholds for which an exception is not granted<br />

will be denied as a benefit category denial, and the beneficiary will be liable. Although <strong>Medicare</strong><br />

suppliers and providers are not required to issue an Advance Beneficiary Notice (ABN) for these<br />

benefit category denials, they are encouraged to issue the voluntary ABN as a courtesy to their<br />

patients requiring services over the therapy cap amounts ($1,880 for each cap in CY <strong>2012</strong>) to alert<br />

them of their possible financial liability.<br />

Key Billing Points<br />

Remember the caps will apply to outpatient hospitals as detected via:<br />

• Types of Bill (TOB) 12X (excluding CAHs with CMS Certification Numbers (CCNs) in the<br />

range of 1300-1399) or 13X;<br />

• A revenue code of 042X, 043X, or 044X;<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to statutes,<br />

regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of either the written law<br />

or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement of their contents.<br />

CPT only copyright 2011 American Medical Association.<br />

20<br />

Page 3 of 5

MLN Matters® Number: MM7785 Related Change Request Number: CR 7785<br />

• Modifier GN, GO, or GP; and<br />

• Date of service on or after October 1, <strong>2012</strong>.<br />

Other important points are as follows:<br />

• The new thresholds will accrue for claims with dates of service from January 1, <strong>2012</strong>,<br />

through December 31, <strong>2012</strong>. <strong>Medicare</strong> will display the total amount applied toward the<br />

therapy caps and thresholds on all applicable inquiry screens and mechanisms.<br />

• Providers should report the NPI of the physician/NPP certifying the therapy plan of care in<br />

the Attending Physician field on institutional claims for outpatient therapy services, for<br />

dates of service on or after October 1, <strong>2012</strong>.<br />

• In cases where different physicians/NPPs certify the OT, PT, or SLP plan of care, report<br />

the additional NPI in the Referring Physician field (loop 2310F) on institutional claims for<br />

outpatient therapy services for dates of service on or after October 1, <strong>2012</strong>.<br />

• On professional claims, providers are to report the physician/NPP certifying the therapy<br />

plan of care, including his/her NPI, for outpatient therapy services on or after October 1,<br />

<strong>2012</strong>.<br />

• For claims processing purposes, the certifying physician/NPP is considered a referring<br />

provider and such providers must follow the instructions in Chapter 15, Section 220.1.1 of<br />

the "<strong>Medicare</strong> Benefit Policy Manual" (http://www.cms.gov/Regulations-and-<br />

Guidance/Guidance/Manuals/Downloads/bp102c15.pdf) for reporting the referring<br />

provider on a claim.<br />

• On electronic professional claims, report the referring provider, including NPI, per the<br />

instructions in the appropriate ASC X12 837 Technical Report 3 (TR3).<br />

• For paper claims, report the referring provider, including NPI, per the instructions in<br />

Chapter 26, Section 10 of the "<strong>Medicare</strong> Claims Processing Manual" at<br />

http://www.cms.gov/Regulations-and-<br />

Guidance/Guidance/Manuals/Downloads/clm104c26.pdf on the Centers for <strong>Medicare</strong> &<br />

Medicaid services (CMS) website.<br />

Claims without at least one referring provider, including his/her NPI, will be returned as unprocessable<br />

with the following codes:<br />

• Claim Adjustment Reason Code 165 (Referral absent or exceeded).<br />

• Remittance Advice Remark Code of N285 (Missing/incomplete/invalid referring provider<br />

name) and/or N286 (Missing/incomplete/invalid referring provider number).<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to statutes,<br />

regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of either the written law<br />

or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement of their contents.<br />

CPT only copyright 2011 American Medical Association.<br />

21<br />

Page 4 of 5

MLN Matters® Number: MM7785 Related Change Request Number: CR 7785<br />

Additional Information<br />

The official instruction, CR7785, issued to your carriers, FIs, A/B MACs, and RHHIs regarding this<br />

change may be viewed at http://www.cms.hhs.gov/Regulations-and-<br />

Guidance/Guidance/Transmittals/Downloads/R2457CP.pdf on the CMS website.<br />

If you have any questions, please contact your carriers, FIs, A/B MACs, or RHHIs at their toll-free<br />

number, which may be found at http://www.cms.hhs.gov/Outreach-and-Education/<strong>Medicare</strong>-<br />

Learning-Network-MLN/MLNProducts/downloads/CallCenterTollNumDirectory.zip on the CMS<br />

website.<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to statutes,<br />

regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of either the written law<br />

or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement of their contents.<br />

CPT only copyright 2011 American Medical Association.<br />

22<br />

Page 5 of 5

DEPARTMENT OF HEALTH AND HUMAN SERVICES<br />

Centers for <strong>Medicare</strong> & Medicaid Services<br />

News Flash – <strong>Medicare</strong> is denying an increasing number of claims, because providers are not<br />

identifying the correct primary payer prior to claims submission. <strong>Medicare</strong> would like to remind providers,<br />

physicians, and suppliers that they have the responsibility to bill correctly and to ensure claims are<br />

submitted to the appropriate primary payer. Please refer to the “<strong>Medicare</strong> Secondary Payer (MSP)<br />

Manual,” Chapter 3, and MLN Matters® Article SE1217 for additional guidance.<br />

MLN Matters® Number: MM7791 Revised Related Change Request (CR) #: 7791<br />

Related CR Release Date: June 21, <strong>2012</strong> Effective Date: October 1, <strong>2012</strong><br />

Related CR Transmittal #: R2488CP Implementation Date: October 1, <strong>2012</strong><br />

Contractor and Common Working File (CWF) Additional Instructions Related to<br />

Change Request (CR) 7633 - Screening and Behavioral Counseling<br />

Interventions in Primary Care to Reduce Alcohol Misuse<br />

Note: This article was revised on June 22, <strong>2012</strong>, to reflect a revised CR7791 issued on June 21. The CR<br />

transmittal number, release date, and the Web address for accessing the CR have been changed. Also,<br />

a second sentence was added to the very last paragraph of the "Background" section (first paragraph<br />

on page 3). All other information is the same.<br />

Provider Types Affected<br />

This MLN Matters ® Article is intended for physicians, providers and suppliers submitting claims to<br />

Fiscal Intermediaries (FI), carriers and A/B <strong>Medicare</strong> Administrative Contractors (A/B MAC) for<br />

screening and behavioral counseling services provided to <strong>Medicare</strong> beneficiaries.<br />

What You Need to Know<br />

If a claim is submitted by a provider for G0443 (Brief face-to-face behavioral counseling for alcohol<br />

misuse, 15 minutes) when there are no claims for G0442 (Annual alcohol misuse screening, 15<br />

minutes) in <strong>Medicare</strong>'s claims history within a prior 12 month period, CR 7791 requires contractors to<br />

deny these claims. Be sure to inform your staff of these changes.<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to<br />

statutes, regulations, or other policy materials. The information provided is only intended to be a general summary. It is not intended to take the place of<br />

either the written law or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and<br />