The Rise of VAT in Africa – Impact and Challenges - empcom.gov.in

The Rise of VAT in Africa – Impact and Challenges - empcom.gov.in

The Rise of VAT in Africa – Impact and Challenges - empcom.gov.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Like a vast majority <strong>of</strong> countries <strong>in</strong> the world,<br />

<strong>Africa</strong>n countries have not been able to resist<br />

the attraction <strong>of</strong> <strong>VAT</strong> <strong>in</strong> the past 20 years. In this<br />

article, the authors focus on the adm<strong>in</strong>istrative<br />

aspects <strong>of</strong> the <strong>VAT</strong> <strong>in</strong> <strong>Africa</strong>, <strong>in</strong>clud<strong>in</strong>g<br />

implementation issues, the conditions for the<br />

successful <strong>in</strong>troduction <strong>and</strong> operation <strong>of</strong> <strong>VAT</strong><br />

<strong>and</strong> the challenges <strong>of</strong> the reform <strong>of</strong> the tax<br />

adm<strong>in</strong>istration.<br />

1. Introduction<br />

Like a vast majority <strong>of</strong> countries <strong>in</strong> the world, <strong>Africa</strong>n<br />

countries have not been able to resist the attraction <strong>of</strong><br />

<strong>VAT</strong> <strong>in</strong> the past 20 years. Adopted by only 1 countries<br />

<strong>in</strong> 1990, <strong>VAT</strong> has now been <strong>in</strong>troduced <strong>in</strong> 1 1 countries,<br />

<strong>in</strong>clud<strong>in</strong>g 8 <strong>in</strong> <strong>Africa</strong> (Tables 1 <strong>and</strong> 2). 1 S<strong>in</strong>ce the release<br />

<strong>of</strong> <strong>The</strong> Modern <strong>VAT</strong> <strong>in</strong> 2001, the literature on <strong>VAT</strong> <strong>and</strong> its<br />

impact on the tax systems <strong>of</strong> develop<strong>in</strong>g countries has<br />

exp<strong>and</strong>ed, 2 <strong>in</strong>clud<strong>in</strong>g articles that raise a number <strong>of</strong><br />

questions regard<strong>in</strong>g the suitability <strong>of</strong> <strong>VAT</strong> for develop<strong>in</strong>g<br />

countries, but do not suggest credible alternatives.<br />

In <strong>Africa</strong>, as <strong>in</strong> other regions, the <strong>in</strong>troduction <strong>of</strong> <strong>VAT</strong><br />

has been accompanied by major changes <strong>in</strong> the tax system,<br />

<strong>in</strong>clud<strong>in</strong>g improvements <strong>in</strong> the taxation <strong>of</strong> imports<br />

<strong>and</strong> domestic supplies <strong>of</strong> goods <strong>and</strong> services, <strong>and</strong> modernization<br />

<strong>of</strong> the organization <strong>and</strong> procedures <strong>of</strong> the tax<br />

adm<strong>in</strong>istration. Indeed, while further efforts are still<br />

needed to improve tax compliance <strong>in</strong> several <strong>Africa</strong>n<br />

countries, <strong>VAT</strong> has been a platform to launch major tax<br />

adm<strong>in</strong>istration reforms <strong>in</strong> the entire region.<br />

Given the lack <strong>of</strong> adequate adm<strong>in</strong>istrative capacity <strong>in</strong><br />

many <strong>Africa</strong>n countries, tax policy <strong>and</strong> tax adm<strong>in</strong>istration<br />

aspects are more closely l<strong>in</strong>ked than usual. In these<br />

countries, sound tax policy options are critical to the<br />

success <strong>of</strong> the tax. S<strong>in</strong>ce the tax policy options have been<br />

extensively discussed <strong>in</strong> <strong>The</strong> Modern <strong>VAT</strong> <strong>and</strong> the subse-<br />

Articles<br />

<strong>The</strong> <strong>Rise</strong> <strong>of</strong> <strong>VAT</strong> <strong>in</strong> <strong>Africa</strong> <strong>–</strong> <strong>Impact</strong> <strong>and</strong><br />

<strong>Challenges</strong><br />

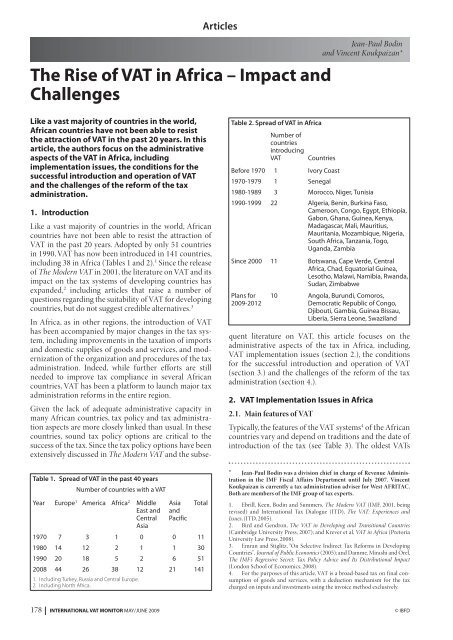

Table 1. Spread <strong>of</strong> <strong>VAT</strong> <strong>in</strong> the past 40 years<br />

Number <strong>of</strong> countries with a <strong>VAT</strong><br />

Year Europe 1 America <strong>Africa</strong> 2 Middle<br />

East <strong>and</strong><br />

Central<br />

Asia<br />

Asia<br />

<strong>and</strong><br />

Pacific<br />

Total<br />

1970 7 3 1 0 0 11<br />

1980 14 12 2 1 1 30<br />

1990 20 18 5 2 6 51<br />

2008 44 26 38 12 21 141<br />

1. Includ<strong>in</strong>g Turkey, Russia <strong>and</strong> Central Europe.<br />

2. Includ<strong>in</strong>g North <strong>Africa</strong>.<br />

Table 2. Spread <strong>of</strong> <strong>VAT</strong> <strong>in</strong> <strong>Africa</strong><br />

Number <strong>of</strong><br />

countries<br />

<strong>in</strong>troduc<strong>in</strong>g<br />

<strong>VAT</strong> Countries<br />

Jean-Paul Bod<strong>in</strong><br />

<strong>and</strong> V<strong>in</strong>cent Koukpaizan*<br />

Before 1970 1 Ivory Coast<br />

1970-1979 1 Senegal<br />

1980-1989 3 Morocco, Niger, Tunisia<br />

1990-1999 22 Algeria, Ben<strong>in</strong>, Burk<strong>in</strong>a Faso,<br />

Cameroon, Congo, Egypt, Ethiopia,<br />

Gabon, Ghana, Gu<strong>in</strong>ea, Kenya,<br />

Madagascar, Mali, Mauritius,<br />

Mauritania, Mozambique, Nigeria,<br />

South <strong>Africa</strong>, Tanzania, Togo,<br />

Ug<strong>and</strong>a, Zambia<br />

S<strong>in</strong>ce 2000 11 Botswana, Cape Verde, Central<br />

<strong>Africa</strong>, Chad, Equatorial Gu<strong>in</strong>ea,<br />

Lesotho, Malawi, Namibia, Rw<strong>and</strong>a,<br />

Sudan, Zimbabwe<br />

Plans for<br />

2009-2012<br />

10 Angola, Burundi, Comoros,<br />

Democratic Republic <strong>of</strong> Congo,<br />

Djibouti, Gambia, Gu<strong>in</strong>ea Bissau,<br />

Liberia, Sierra Leone, Swazil<strong>and</strong><br />

quent literature on <strong>VAT</strong>, this article focuses on the<br />

adm<strong>in</strong>istrative aspects <strong>of</strong> the tax <strong>in</strong> <strong>Africa</strong>, <strong>in</strong>clud<strong>in</strong>g,<br />

<strong>VAT</strong> implementation issues (section 2.), the conditions<br />

for the successful <strong>in</strong>troduction <strong>and</strong> operation <strong>of</strong> <strong>VAT</strong><br />

(section .) <strong>and</strong> the challenges <strong>of</strong> the reform <strong>of</strong> the tax<br />

adm<strong>in</strong>istration (section .).<br />

2. <strong>VAT</strong> Implementation Issues <strong>in</strong> <strong>Africa</strong><br />

2.1. Ma<strong>in</strong> features <strong>of</strong> <strong>VAT</strong><br />

Typically, the features <strong>of</strong> the <strong>VAT</strong> systems <strong>of</strong> the <strong>Africa</strong>n<br />

countries vary <strong>and</strong> depend on traditions <strong>and</strong> the date <strong>of</strong><br />

<strong>in</strong>troduction <strong>of</strong> the tax (see Table ). <strong>The</strong> oldest <strong>VAT</strong>s<br />

* Jean-Paul Bod<strong>in</strong> was a division chief <strong>in</strong> charge <strong>of</strong> Revenue Adm<strong>in</strong>istration<br />

<strong>in</strong> the IMF Fiscal Affairs Department until July 2007. V<strong>in</strong>cent<br />

Koukpaizan is currently a tax adm<strong>in</strong>istration adviser for West AFRITAC.<br />

Both are members <strong>of</strong> the IMF group <strong>of</strong> tax experts.<br />

1. Ebrill, Keen, Bod<strong>in</strong> <strong>and</strong> Summers, <strong>The</strong> Modern <strong>VAT</strong> (IMF, 2001, be<strong>in</strong>g<br />

revised) <strong>and</strong> International Tax Dialogue (ITD), <strong>The</strong> <strong>VAT</strong>: Experiences <strong>and</strong><br />

Issues, (ITD, 200 ).<br />

2. Bird <strong>and</strong> Gendron, <strong>The</strong> <strong>VAT</strong> <strong>in</strong> Develop<strong>in</strong>g <strong>and</strong> Transitional Countries<br />

(Cambridge University Press, 2007); <strong>and</strong> Krever et al, <strong>VAT</strong> <strong>in</strong> <strong>Africa</strong> (Pretoria<br />

University Law Press, 2008).<br />

. Emran <strong>and</strong> Stiglitz, “On Selective Indirect Tax Reforms <strong>in</strong> Develop<strong>in</strong>g<br />

Countries”, Journal <strong>of</strong> Public Economics (200 ); <strong>and</strong> Damme, Mirashi <strong>and</strong> Orel,<br />

<strong>The</strong> IMF’s Regressive Secret: Tax Policy Advice <strong>and</strong> Its Distributional <strong>Impact</strong><br />

(London School <strong>of</strong> Economics, 2008).<br />

. For the purposes <strong>of</strong> this article, <strong>VAT</strong> is a broad-based tax on f<strong>in</strong>al consumption<br />

<strong>of</strong> goods <strong>and</strong> services, with a deduction mechanism for the tax<br />

charged on <strong>in</strong>puts <strong>and</strong> <strong>in</strong>vestments us<strong>in</strong>g the <strong>in</strong>voice method exclusively.<br />

178 INTERNATIONAL <strong>VAT</strong> MONITOR MAY/JUNE 2009 © IBFD

Table 3. <strong>VAT</strong> <strong>in</strong> <strong>Africa</strong> <strong>–</strong> ma<strong>in</strong> characteristics (2008)<br />

Country Year <strong>of</strong> adoption Rate(s) Registration threshold<br />

(<strong>in</strong> USD)<br />

Anglophone countries<br />

Botswana 2002 10 40,000 0.45<br />

Egypt 1992 10, 5, 20, 30 27,000 0.34<br />

Ethiopia 2003 15 54,000 0.32<br />

Ghana 1998 12.5 11,000 0.45<br />

Kenya 1990 16 75,000 0.32<br />

Lesotho 2003 14, 5, 15 80,000 0.37<br />

Malawi 2001 17.5 15,000 0.36<br />

Mauritius 1998 15 96,000 0.45<br />

Namibia 2000 15 28,000 0.33<br />

Nigeria 1994 5 0 0.33<br />

Rw<strong>and</strong>a 2001 18 38,000 0.27<br />

South <strong>Africa</strong> 1991 14 42,000 0.46<br />

Sudan 2000 10 50,000 0.13<br />

Tanzania 1998 20 32,000 0.26<br />

Ug<strong>and</strong>a 1996 18 20,000 0.23<br />

Zambia 1995 17.5 50,000 0.38<br />

Zimbabwe 2004 15 2,500 0.64<br />

Hispano/lusophone countries<br />

Cape Verde 2004 15 2,300 0.53<br />

Equatorial Gu<strong>in</strong>ea 2005 15 0 0.25<br />

Mozambique 1999 17 4,000 0.27<br />

Francophone countries<br />

Algeria 1992 17, 7 43,000 0.19<br />

Ben<strong>in</strong> 1991 18 80,000 2 0.35<br />

Burk<strong>in</strong>a Faso 1993 18 60,000 2 0.26<br />

Cameroon 1999 19.3 94,000 0.21<br />

Central <strong>Africa</strong> 2001 18 100,000 2 0.12<br />

Chad 2000 18 56,000 2 0.06<br />

Congo 1997 18.9, 5 36,000 2 0.18<br />

Gabon 1995 18, 10 150,000 2 0.12<br />

Gu<strong>in</strong>ea 1996 18 30,000 2 0.17<br />

Ivory Coast 1960 18 100,000 2 0.25<br />

Madagascar 1994 18 100,000 0.27<br />

Mali 1991 15, 10 60,000 0.45<br />

Mauritania 1995 14 24,000 2 0.38<br />

Morocco 1986 20, 7, 10, 14 200,000 2 0.33<br />

Niger 1986 19 60,000 2 0.09<br />

Senegal 1979 18 100,000 2 0.44<br />

Togo 1995 18 60,000 2 0.09<br />

Tunisia 1988 18, 6, 10, 29 78,000 2 0.34<br />

Efficiency ratio 1<br />

1. <strong>The</strong> ratio <strong>of</strong> <strong>VAT</strong> revenues to GDP divided by the st<strong>and</strong>ard rate <strong>of</strong> <strong>VAT</strong>. A different criterion to assess the efficiency <strong>of</strong> <strong>VAT</strong> is the “C-Efficiency ratio”, which is def<strong>in</strong>ed<br />

≈≈as the ratio <strong>of</strong> the share <strong>of</strong> <strong>VAT</strong> revenues <strong>in</strong> consumption, rather than GDP: see <strong>The</strong> Modern <strong>VAT</strong> (note 1), Chapter IV.<br />

2. Threshold applicable to supplies <strong>of</strong> goods. A different threshold applies to supplies <strong>of</strong> services.<br />

© IBFD INTERNATIONAL <strong>VAT</strong> MONITOR MAY/JUNE 2009<br />

Articles<br />

179

Articles<br />

were adopted <strong>in</strong> the francophone countries, <strong>in</strong>clud<strong>in</strong>g<br />

Ivory Coast, Morocco, Senegal <strong>and</strong> Tunisia. <strong>The</strong>y have a<br />

complex rate structure (three to four rates), different registration<br />

thresholds depend<strong>in</strong>g on activity (for example,<br />

supplies <strong>of</strong> goods <strong>and</strong> provision <strong>of</strong> services), a large<br />

number <strong>of</strong> exemptions (<strong>in</strong>clud<strong>in</strong>g exemption for supplies<br />

to exporters 5 , the achats en franchise), <strong>and</strong> a withhold<strong>in</strong>g<br />

mechanism for supplies to the <strong>gov</strong>ernment <strong>and</strong><br />

state-owned enterprises 6 (see below). S<strong>in</strong>ce the early<br />

1990s, new approaches have been developed to improve<br />

the design <strong>of</strong> <strong>VAT</strong> <strong>in</strong> <strong>Africa</strong>, <strong>in</strong>clud<strong>in</strong>g the adoption <strong>of</strong> a<br />

s<strong>in</strong>gle positive rate for domestic supplies, fewer exemptions,<br />

<strong>and</strong> higher registration thresholds. Such an<br />

approach was <strong>in</strong>itiated <strong>in</strong> Ben<strong>in</strong> <strong>in</strong> 1991 <strong>and</strong>, thereafter,<br />

adopted by the majority <strong>of</strong> <strong>Africa</strong>n countries where <strong>VAT</strong><br />

has been adopted.<br />

As <strong>in</strong> many develop<strong>in</strong>g countries where technical assistance<br />

has been provided, the features <strong>of</strong> the <strong>VAT</strong> have<br />

<strong>of</strong>ten been <strong>in</strong>fluenced by foreign experts. In several<br />

cases, these experts’ advice simply replicated practices<br />

that had been developed <strong>in</strong> their own country. This<br />

expla<strong>in</strong>s, for example, the complex rate <strong>and</strong> threshold<br />

structures, <strong>and</strong> widespread exemptions <strong>in</strong> the “first generation”<br />

<strong>VAT</strong>s that were <strong>in</strong>troduced <strong>in</strong> francophone<br />

countries until the end <strong>of</strong> the 1980s, as well as the very<br />

low registration thresholds <strong>in</strong> hispano <strong>and</strong> lusophone<br />

countries (for example Cape Verde <strong>and</strong> Mozambique),<br />

<strong>and</strong> the uncerta<strong>in</strong>ty regard<strong>in</strong>g the most suitable organization<br />

for <strong>VAT</strong> adm<strong>in</strong>istration <strong>in</strong> most anglophone<br />

countries (for example <strong>in</strong> Malawi, where <strong>VAT</strong> was <strong>in</strong>itially<br />

adm<strong>in</strong>istered by customs <strong>and</strong>, subsequently, by a<br />

<strong>VAT</strong> directorate that was eventually merged with the<br />

<strong>in</strong>come tax adm<strong>in</strong>istration).<br />

In recent years, several countries, for example Algeria,<br />

Ivory Coast <strong>and</strong> Senegal, where old <strong>VAT</strong> systems had<br />

been <strong>in</strong>troduced, have successfully modernized these<br />

systems. However, experience <strong>of</strong> other countries, <strong>in</strong>clud<strong>in</strong>g<br />

Egypt, Morocco <strong>and</strong> Tunisia, shows that moderniz<strong>in</strong>g<br />

a “first generation” <strong>VAT</strong> may politically be more difficult<br />

than adopt<strong>in</strong>g a new <strong>VAT</strong> <strong>in</strong> l<strong>in</strong>e with best practices.<br />

In the second half <strong>of</strong> the 1990s, the <strong>in</strong>itiatives <strong>of</strong> the West<br />

<strong>Africa</strong>n Economic <strong>and</strong> Monetary Union (WAEMU) <strong>and</strong><br />

Central <strong>Africa</strong>n Economic <strong>and</strong> Monetary Community<br />

(CAEMC) to harmonize the <strong>in</strong>direct tax systems <strong>of</strong> their<br />

member countries on the basis <strong>of</strong> recognized best practices<br />

<strong>–</strong> <strong>in</strong>clud<strong>in</strong>g drastic simplification <strong>of</strong> the rate structure,<br />

elim<strong>in</strong>ation <strong>of</strong> several exemptions, an <strong>in</strong>crease <strong>in</strong><br />

the registration threshold, <strong>and</strong> a simplified tax regime for<br />

small bus<strong>in</strong>esses below this threshold <strong>–</strong> have contributed<br />

to the modernization <strong>of</strong> <strong>VAT</strong> <strong>in</strong> West <strong>Africa</strong>. In the com<strong>in</strong>g<br />

years, similar improvements can be expected <strong>in</strong> other<br />

<strong>Africa</strong>n countries, where similar <strong>in</strong>itiatives are be<strong>in</strong>g<br />

taken by the East <strong>Africa</strong>n Community (EAC) or are<br />

be<strong>in</strong>g considered by the Economic Community <strong>of</strong> West<br />

<strong>Africa</strong>n States (ECOWAS) <strong>and</strong> the Southern <strong>Africa</strong>n<br />

Development Community (SADC).<br />

2.2. Ma<strong>in</strong> reasons for the spread <strong>of</strong> <strong>VAT</strong> <strong>in</strong> <strong>Africa</strong><br />

As <strong>in</strong> many other countries, the ma<strong>in</strong> reason for the<br />

spread <strong>of</strong> <strong>VAT</strong> <strong>in</strong> <strong>Africa</strong> was the search for an effective,<br />

neutral tax <strong>in</strong>strument capable <strong>of</strong> meet<strong>in</strong>g revenue<br />

requirements that could not be satisfied by <strong>in</strong>come tax<br />

<strong>and</strong> the traditional turnover tax. In most <strong>Africa</strong>n countries,<br />

<strong>VAT</strong> has replaced complex turnover taxes that were<br />

<strong>in</strong>herited from the colonial era. With a narrow base, multiple<br />

rates <strong>and</strong> complex mechanisms to mitigate their<br />

cascad<strong>in</strong>g effect, these taxes were particularly difficult to<br />

adm<strong>in</strong>ister. 7<br />

<strong>VAT</strong> has also played an important role <strong>in</strong> facilitat<strong>in</strong>g<br />

trade liberalization <strong>and</strong> customs tariff reforms <strong>in</strong><br />

<strong>Africa</strong>n countries that form part <strong>of</strong> regional economic<br />

<strong>and</strong> customs unions (WAEMU <strong>and</strong> CAEMC <strong>in</strong>itially),<br />

<strong>and</strong> those that concluded trade agreements with the<br />

European Union (particularly Morocco <strong>and</strong> Tunisia).<br />

<strong>The</strong> measures adopted to support these <strong>in</strong>itiatives have<br />

contributed to more effective <strong>VAT</strong> <strong>and</strong> excise tax systems<br />

that were capable <strong>of</strong> compensat<strong>in</strong>g the expected<br />

decrease <strong>in</strong> the collection <strong>of</strong> customs duties, <strong>and</strong> cop<strong>in</strong>g<br />

with the challenges <strong>of</strong> the transition from the old tax<br />

regimes. 8<br />

In most <strong>Africa</strong>n countries, the <strong>in</strong>troduction <strong>and</strong> operation<br />

<strong>of</strong> a modern <strong>VAT</strong> <strong>in</strong> l<strong>in</strong>e with best practices has also<br />

provided a better environment for modernization <strong>of</strong> the<br />

entire tax system, beg<strong>in</strong>n<strong>in</strong>g with its adm<strong>in</strong>istration. <strong>The</strong><br />

<strong>in</strong>troduction <strong>of</strong> <strong>VAT</strong> has provided a platform for major<br />

improvements <strong>of</strong> the old tax adm<strong>in</strong>istration systems,<br />

which were <strong>in</strong>herited from the colonial era <strong>and</strong> were<br />

<strong>of</strong>ten characterized by unnecessarily complex <strong>and</strong> outdated<br />

organizational <strong>and</strong> procedural models. 9<br />

2.3. <strong>VAT</strong> adm<strong>in</strong>istration <strong>–</strong> Ma<strong>in</strong> challenges<br />

Contrary to the concerns that were expressed <strong>in</strong> the early<br />

1990s, experience has shown that the <strong>in</strong>troduction <strong>of</strong><br />

<strong>VAT</strong> <strong>in</strong> <strong>Africa</strong> has not resulted <strong>in</strong> major problems, provided<br />

however that the design <strong>of</strong> the tax was <strong>in</strong> l<strong>in</strong>e with<br />

best practices <strong>and</strong> that its <strong>in</strong>troduction was carefully prepared.<br />

10 Except <strong>in</strong> Ghana <strong>and</strong> Ug<strong>and</strong>a (see below), the<br />

<strong>in</strong>troduction <strong>of</strong> <strong>VAT</strong> was generally seen as successful by<br />

. In the francophone countries where the system <strong>of</strong> “achats en franchise”<br />

has been adopted, exports <strong>and</strong> supplies to exporters are usually “exempt” with<br />

a possibility to claim a refund <strong>of</strong> the related <strong>in</strong>put <strong>VAT</strong>, which is equivalent to<br />

a zero rate.<br />

6. Under this system, suppliers <strong>of</strong> goods <strong>and</strong> services charge the full<br />

amount <strong>of</strong> the <strong>VAT</strong> to their customers but, <strong>in</strong>stead <strong>of</strong> pay<strong>in</strong>g the amount <strong>of</strong> the<br />

tax to their suppliers, the customer (“withhold<strong>in</strong>g agent”) withholds this<br />

amount <strong>and</strong> remits it directly to the tax <strong>of</strong>fice (note 12).<br />

7. <strong>The</strong> Modern <strong>VAT</strong> (note 1) provides an analysis <strong>of</strong> the turnover taxes that<br />

were replaced by a <strong>VAT</strong> <strong>in</strong> Ben<strong>in</strong>, Burk<strong>in</strong>a Faso, Gabon, Gu<strong>in</strong>ea, Kenya,<br />

Malawi, Mauritania, Togo, Ug<strong>and</strong>a <strong>and</strong> Zambia.<br />

8. Chambas, “TVA et transition fiscale en Afrique: les nouveaux enjeux”,<br />

Afrique contempora<strong>in</strong>e (200 ).<br />

9. Such models <strong>in</strong>cluded separation <strong>of</strong> the tax assessment <strong>and</strong> collection<br />

functions, which were assigned to two separate directorates <strong>in</strong> the francophone<br />

countries, <strong>and</strong> separation <strong>of</strong> the adm<strong>in</strong>istration <strong>of</strong> direct <strong>and</strong> <strong>in</strong>direct<br />

taxes <strong>in</strong> the anglophone countries.<br />

10. <strong>VAT</strong> preparations have been discussed <strong>in</strong> various documents <strong>in</strong> the early<br />

1990s, <strong>in</strong>clud<strong>in</strong>g the guide that was published <strong>in</strong> 1991, <strong>VAT</strong>: Adm<strong>in</strong>istrative <strong>and</strong><br />

Policy Issues (IMF Occasional Paper).<br />

180 INTERNATIONAL <strong>VAT</strong> MONITOR MAY/JUNE 2009 © IBFD

the bus<strong>in</strong>ess community <strong>and</strong> the tax authorities, who<br />

immediately understood the merits <strong>of</strong> an effective revenue-rais<strong>in</strong>g<br />

<strong>in</strong>strument, which is neutral for economic<br />

activities. In most <strong>Africa</strong>n countries, the <strong>in</strong>troduction <strong>of</strong><br />

<strong>VAT</strong> resulted <strong>in</strong> a quick <strong>in</strong>crease <strong>in</strong> <strong>in</strong>direct tax revenues.<br />

11<br />

Modernization <strong>of</strong> first-generation <strong>VAT</strong>s<br />

Modernization <strong>of</strong> the old <strong>VAT</strong>s to improve their efficiency<br />

is a major challenge <strong>in</strong> several countries (especially<br />

North <strong>Africa</strong>n countries, see Table ). With complex<br />

rate structures, multiple registration thresholds,<br />

pervasive exemptions (<strong>in</strong>clud<strong>in</strong>g those for supplies made<br />

to exporters), <strong>and</strong> withhold<strong>in</strong>g schemes for supplies<br />

made to the <strong>gov</strong>ernment <strong>and</strong> public enterprises (the précompte),<br />

12 these <strong>VAT</strong>s were particularly difficult to<br />

adm<strong>in</strong>ister. <strong>The</strong>se problems have frequently been amplified<br />

by the <strong>in</strong>ability <strong>of</strong> policymakers to resist pressure<br />

from various lobbies request<strong>in</strong>g an extension <strong>of</strong> special<br />

rates or exemptions that were <strong>in</strong>itially reserved for a limited<br />

number <strong>of</strong> cases.<br />

Broaden<strong>in</strong>g the <strong>VAT</strong> base<br />

Broaden<strong>in</strong>g the <strong>VAT</strong> base is a recurrent challenge <strong>in</strong><br />

<strong>Africa</strong>, where a large share (more than half <strong>in</strong> most countries)<br />

<strong>of</strong> the gross <strong>VAT</strong> receipts is collected on imports.<br />

Important sectors, such as the agricultural sector <strong>and</strong><br />

supplies <strong>of</strong> unprocessed foodstuffs, <strong>and</strong> aid-funded projects,<br />

are commonly outside the scope <strong>of</strong> <strong>VAT</strong>. Several<br />

factors contribute to this situation <strong>in</strong> less-advanced<br />

countries, <strong>in</strong>clud<strong>in</strong>g the degree <strong>of</strong> poverty that prevents<br />

taxation <strong>of</strong> unprocessed foodstuffs, the structure <strong>of</strong> economic<br />

activities <strong>and</strong> the small number <strong>of</strong> bus<strong>in</strong>esses<br />

whose turnover is above an adequate <strong>VAT</strong> registration<br />

threshold (a few hundred only <strong>in</strong> the smallest countries).<br />

In this context, broaden<strong>in</strong>g the <strong>VAT</strong> base requires the<br />

development <strong>of</strong> a more effective approach to deal with<br />

the <strong>in</strong>formal sector, keep<strong>in</strong>g <strong>in</strong> m<strong>in</strong>d that, contrary to<br />

some experts’ views, a well-designed <strong>VAT</strong> is capable <strong>of</strong><br />

collect<strong>in</strong>g some tax from this sector (see below).<br />

Improvement <strong>of</strong> <strong>VAT</strong> efficiency<br />

Although, despite a decrease <strong>of</strong> customs duties, the<br />

<strong>in</strong>troduction <strong>of</strong> <strong>VAT</strong> usually results <strong>in</strong> higher <strong>in</strong>direct tax<br />

revenues, it must be recognized that the revenue productivity<br />

<strong>of</strong> <strong>VAT</strong> <strong>in</strong> <strong>Africa</strong> is generally below its potential.<br />

Improvement <strong>of</strong> the <strong>VAT</strong> revenue efficiency is certa<strong>in</strong>ly<br />

a major challenge for several <strong>Africa</strong>n countries where the<br />

tax has been adopted.<br />

<strong>The</strong> ma<strong>in</strong> difficulties <strong>in</strong> the area <strong>of</strong> <strong>VAT</strong> adm<strong>in</strong>istration<br />

typically materialize several years after the <strong>in</strong>troduction<br />

<strong>of</strong> the tax. In <strong>Africa</strong>, as <strong>in</strong> many other develop<strong>in</strong>g countries,<br />

the <strong>VAT</strong> revenue efficiency commonly deteriorates<br />

<strong>in</strong> the medium to long term, if the adm<strong>in</strong>istrative capacity<br />

is <strong>in</strong>sufficient to effectively control claims for refund<br />

<strong>of</strong> excess <strong>in</strong>put <strong>VAT</strong>, <strong>and</strong> to process the exporters’ refund<br />

claims effectively <strong>and</strong> <strong>in</strong> good time. This situation leads<br />

to abusive practices <strong>and</strong> evasion, <strong>and</strong> pressure to exclude<br />

more activities from the <strong>VAT</strong> base. In several <strong>Africa</strong>n<br />

Articles<br />

countries, these difficulties impede the neutrality <strong>of</strong> <strong>VAT</strong><br />

<strong>and</strong> contribute to the low efficiency ratios mentioned<br />

above (Table ), as compared to the ratios <strong>in</strong> other<br />

regions. 1<br />

3. Conditions for Successful Operation <strong>of</strong> <strong>VAT</strong><br />

<strong>The</strong> challenges <strong>of</strong> operat<strong>in</strong>g the <strong>VAT</strong> system have led<br />

several experts to question the wisdom <strong>of</strong> <strong>in</strong>troduc<strong>in</strong>g<br />

<strong>VAT</strong> <strong>in</strong> develop<strong>in</strong>g countries. 1 <strong>The</strong> ma<strong>in</strong> criticism on<br />

the adoption <strong>of</strong> <strong>VAT</strong> <strong>in</strong> <strong>Africa</strong> is based on the follow<strong>in</strong>g:<br />

<strong>–</strong> <strong>VAT</strong> is difficult to adm<strong>in</strong>ister <strong>in</strong> these countries <strong>in</strong><br />

view <strong>of</strong> their <strong>in</strong>adequate adm<strong>in</strong>istrative capacity. For<br />

example, the refund system is too complex for small<br />

entrepreneurs, who are more easily exposed to<br />

<strong>–</strong><br />

harassment by corrupt tax <strong>of</strong>ficers than large bus<strong>in</strong>esses;<br />

record-keep<strong>in</strong>g requirements are too complex <strong>and</strong><br />

tax compliance costs are too high for small bus<strong>in</strong>esses;<br />

<strong>–</strong> due to the high <strong>VAT</strong> compliance costs, many bus<strong>in</strong>ess<br />

owners choose to operate <strong>in</strong> the <strong>in</strong>formal sector;<br />

<strong>and</strong><br />

<strong>–</strong> <strong>VAT</strong> is regressive, especially if a s<strong>in</strong>gle rate is<br />

adopted, as is recommended for a modern <strong>VAT</strong>.<br />

<strong>The</strong>se problems have led some experts 1 to take the view<br />

that <strong>VAT</strong> is not suitable for <strong>Africa</strong>n countries <strong>and</strong> that<br />

trade liberalization measures carried out <strong>in</strong> these countries<br />

s<strong>in</strong>ce the early 1990s were not appropriate. <strong>The</strong>se<br />

experts claim that, as compared to <strong>VAT</strong>, customs duties<br />

are easier to adm<strong>in</strong>ister <strong>and</strong> better deal with the <strong>in</strong>formal<br />

sector. As discussed <strong>in</strong> this section <strong>and</strong> the follow<strong>in</strong>g,<br />

these conclusions are <strong>in</strong> fact a criticism on the <strong>VAT</strong>s that<br />

have been <strong>in</strong>troduced <strong>in</strong> a few <strong>Africa</strong>n countries without<br />

tak<strong>in</strong>g <strong>in</strong>to account the best practices recommended for<br />

successful operation <strong>of</strong> <strong>VAT</strong>. <strong>The</strong> critics also underestimate<br />

the need to modernize the tax <strong>and</strong> customs adm<strong>in</strong>istrations<br />

<strong>in</strong> these countries <strong>and</strong> the changes required to<br />

establish more effective compliance programmes <strong>and</strong><br />

provide better services to taxpayers.<br />

11. <strong>The</strong> Modern <strong>VAT</strong> (note 1). As previously mentioned, <strong>VAT</strong> implementation<br />

has usually been accompanied by measures aimed at simplify<strong>in</strong>g the <strong>in</strong>direct<br />

tax system, <strong>in</strong>clud<strong>in</strong>g repeal<strong>in</strong>g the former consumption taxes, <strong>and</strong><br />

streaml<strong>in</strong><strong>in</strong>g excise taxes (i.e. reduc<strong>in</strong>g the number <strong>of</strong> excisable items) <strong>and</strong> the<br />

customs tariff (i.e. typically, reduc<strong>in</strong>g the number <strong>of</strong> tariff b<strong>and</strong>s <strong>and</strong> the level<br />

<strong>of</strong> the rates). Given that a large share <strong>of</strong> <strong>VAT</strong> revenues is collected on imports,<br />

the revenue impact <strong>of</strong> the adoption <strong>of</strong> a <strong>VAT</strong> must be assessed not only <strong>in</strong> the<br />

light <strong>of</strong> <strong>VAT</strong> efficiency (Table ), but also <strong>in</strong> the light <strong>of</strong> the <strong>in</strong>crease or<br />

decrease <strong>in</strong> the total <strong>in</strong>direct tax collections.<br />

12. In several francophone countries for example, Cameroon, Ivory Coast<br />

<strong>and</strong> Senegal, the amount <strong>of</strong> the <strong>VAT</strong> to be paid on sales to the central <strong>and</strong> local<br />

<strong>gov</strong>ernments is withheld by the Treasury. In other countries, for example,<br />

Kenya <strong>in</strong> <strong>Africa</strong> <strong>and</strong> many countries <strong>in</strong> Lat<strong>in</strong> America, this scheme also applies<br />

to sales to large bus<strong>in</strong>esses that are required to withhold the <strong>VAT</strong> on their purchases<br />

<strong>and</strong> remit it to the tax adm<strong>in</strong>istration. As discussed by Bird <strong>and</strong> Gendron<br />

(note 2), <strong>and</strong> Bod<strong>in</strong> <strong>and</strong> Koukpaizan <strong>in</strong> “Taxation <strong>of</strong> Small Enterprises:<br />

Recent Developments”, International <strong>VAT</strong> Monitor 2 (2008), p. 121, these<br />

schemes have significant drawbacks that underm<strong>in</strong>e the function<strong>in</strong>g <strong>of</strong> the<br />

<strong>VAT</strong>.<br />

1 . <strong>The</strong> average efficiency ratio <strong>in</strong> <strong>Africa</strong> (<strong>in</strong>clud<strong>in</strong>g the North <strong>Africa</strong>n<br />

countries <strong>and</strong> South <strong>Africa</strong>) is 0. 0 aga<strong>in</strong>st 0. 8 <strong>in</strong> Asia (exclud<strong>in</strong>g Australia,<br />

Japan <strong>and</strong> New Zeal<strong>and</strong>) <strong>and</strong> 0. <strong>in</strong> Lat<strong>in</strong> America.<br />

1 . See Damme, Mirashi <strong>and</strong> Orel (note ) <strong>and</strong> Emran <strong>and</strong> Stiglitz (note ).<br />

1 . In particular, Emran <strong>and</strong> Stiglitz (note ).<br />

© IBFD INTERNATIONAL <strong>VAT</strong> MONITOR MAY/JUNE 2009<br />

181

Articles<br />

3.1. Fundamental legislative <strong>and</strong> policy issues<br />

S<strong>in</strong>gle or multiple <strong>VAT</strong> rates<br />

<strong>The</strong> choice <strong>of</strong> the rate structure for domestic supplies 16 is<br />

probably one <strong>of</strong> the most controversial issues s<strong>in</strong>ce the<br />

<strong>in</strong>troduction <strong>of</strong> <strong>VAT</strong> <strong>in</strong> develop<strong>in</strong>g countries. Adoption<br />

<strong>of</strong> a complex rate structure with three, four, or even five<br />

rates was a predom<strong>in</strong>ant feature <strong>of</strong> the first-generation<br />

<strong>VAT</strong>s that were <strong>in</strong>troduced <strong>in</strong> France (19 8-68) <strong>and</strong> <strong>in</strong><br />

several other Member States <strong>of</strong> the European Union (at<br />

the end <strong>of</strong> the 1960s <strong>and</strong> the beg<strong>in</strong>n<strong>in</strong>g <strong>of</strong> the 1970s).<br />

However, s<strong>in</strong>ce the expansion <strong>of</strong> <strong>VAT</strong> to other regions,<br />

<strong>in</strong>clud<strong>in</strong>g <strong>Africa</strong> from the early 1990s, an <strong>in</strong>creas<strong>in</strong>g<br />

number <strong>of</strong> countries have adopted a s<strong>in</strong>gle rate. From the<br />

tax adm<strong>in</strong>istration’s <strong>and</strong> bus<strong>in</strong>ess owners’ perspectives, a<br />

s<strong>in</strong>gle rate is an important factor <strong>in</strong> simplify<strong>in</strong>g the management<br />

<strong>of</strong> <strong>VAT</strong> on the grounds that a s<strong>in</strong>gle rate:<br />

<strong>–</strong> facilitates record keep<strong>in</strong>g <strong>and</strong> <strong>in</strong>voic<strong>in</strong>g. Contrary to<br />

the situation <strong>in</strong> countries with a multiple-rate <strong>VAT</strong>,<br />

there is no need to categorize purchases <strong>and</strong> supplies<br />

<strong>of</strong> goods <strong>and</strong> services <strong>in</strong> accordance with the applicable<br />

rate;<br />

<strong>–</strong> helps simplify the <strong>VAT</strong> declaration form, which can<br />

be limited to a s<strong>in</strong>gle page <strong>and</strong> is easier to complete<br />

by the bus<strong>in</strong>esses <strong>and</strong> to process by the tax adm<strong>in</strong>istration<br />

than a form conta<strong>in</strong><strong>in</strong>g multiple rates;<br />

<strong>–</strong> facilitates “desk verifications“ (for example, reconciliation<br />

<strong>of</strong> <strong>in</strong>formation derived from the <strong>in</strong>come tax<br />

<strong>and</strong> <strong>VAT</strong> returns) <strong>and</strong> <strong>VAT</strong> audits (because the auditors<br />

can focus on check<strong>in</strong>g the accuracy <strong>of</strong> the<br />

reported total supplies <strong>and</strong> expenses, <strong>in</strong>stead <strong>of</strong><br />

check<strong>in</strong>g the distribution <strong>of</strong> these supplies <strong>and</strong><br />

<strong>–</strong><br />

expenses <strong>in</strong> accordance with the applicable rates). A<br />

s<strong>in</strong>gle rate therefore helps reduce the duration <strong>of</strong><br />

audits;<br />

helps avoid the situation <strong>of</strong> permanent excess <strong>in</strong>put<br />

<strong>VAT</strong> for bus<strong>in</strong>esses whose <strong>in</strong>puts are subject to a<br />

higher rate than their outputs. Refund claims can<br />

thus be restricted to exporters <strong>and</strong> <strong>in</strong>vestors.<br />

<strong>The</strong> advantages <strong>of</strong> a s<strong>in</strong>gle rate expla<strong>in</strong> why most countries<br />

where <strong>VAT</strong> was <strong>in</strong>troduced <strong>in</strong> the past 20 years have<br />

opted for a s<strong>in</strong>gle rate. Experience shows that the application<br />

<strong>of</strong> reduced <strong>VAT</strong> rates has no real impact on the<br />

distributional effect <strong>of</strong> the tax system. Recent studies<br />

show that revenue losses due to the adoption <strong>of</strong> reduced<br />

rates benefit ma<strong>in</strong>ly the wealthiest persons, whose consumption,<br />

<strong>in</strong> absolute terms, <strong>of</strong> food <strong>and</strong> other items that<br />

are subject to a reduced rate (such as water <strong>and</strong> electricity)<br />

is higher than that <strong>of</strong> the poor. 17<br />

Despite the obvious benefits <strong>of</strong> a s<strong>in</strong>gle rate, its adoption<br />

is <strong>of</strong>ten difficult for policymakers, who are under pressure<br />

to apply concessions to specific types <strong>of</strong> transactions<br />

or specific sectors. 18 For example, a temporary<br />

<strong>in</strong>crease <strong>in</strong> the price <strong>of</strong> basic foodstuffs <strong>and</strong> raw materials<br />

<strong>in</strong> 2008 has led some countries <strong>in</strong> the WAEMU to<br />

question the rules set by the Commission <strong>of</strong> the<br />

WAEMU <strong>in</strong> the 1990s regard<strong>in</strong>g the m<strong>and</strong>atory adoption<br />

<strong>of</strong> a s<strong>in</strong>gle <strong>VAT</strong> rate. <strong>The</strong> rules have now been<br />

relaxed authoriz<strong>in</strong>g these countries to apply a reduced<br />

rate to specific items. 19 Whatever the legitimate concerns<br />

<strong>of</strong> the supporters <strong>of</strong> multiple rates may be, it is clear that<br />

their approach can significantly <strong>in</strong>crease the complexity<br />

<strong>of</strong> <strong>VAT</strong> <strong>and</strong> may have negative consequences that need to<br />

be carefully assessed <strong>in</strong> countries with a weak adm<strong>in</strong>istrative<br />

capacity. Frequently, these supporters are <strong>of</strong>ten<br />

those who also emphasize the unsuitability <strong>of</strong> <strong>VAT</strong> for<br />

develop<strong>in</strong>g countries, without giv<strong>in</strong>g sufficient thought<br />

to the proper balance between the pros <strong>and</strong> cons <strong>of</strong> their<br />

position.<br />

Broaden<strong>in</strong>g the <strong>VAT</strong> base<br />

Like multiple <strong>VAT</strong> rates, exemptions give rise to complexities.<br />

Exemptions <strong>in</strong>crease the risk <strong>of</strong> cascad<strong>in</strong>g <strong>and</strong><br />

jeopardize the neutrality <strong>of</strong> the <strong>VAT</strong>, which can be particularly<br />

harmful to exports. Exemptions can also give<br />

comparative advantage to imports. Paradoxically, this is<br />

frequently the case for the supply <strong>of</strong> domestically produced<br />

food items, especially <strong>in</strong> less-advanced countries.<br />

20 Another major drawback <strong>of</strong> exemptions is the<br />

risk <strong>of</strong> proliferation (i.e. extension <strong>of</strong> the scope <strong>of</strong> the<br />

exemption to similar items <strong>and</strong> to <strong>in</strong>puts used for the<br />

purposes <strong>of</strong> produc<strong>in</strong>g exempt items). For example,<br />

where supplies <strong>in</strong> the agricultural sector are exempt from<br />

<strong>VAT</strong>, there will be pressure to extend the exemption to<br />

fertilizers. Moreover, as with multiple rates, purchases<br />

<strong>and</strong> supplies <strong>of</strong> exempt goods <strong>and</strong> services must be<br />

recorded separately <strong>and</strong> give rise to complex allocation<br />

rules regard<strong>in</strong>g equipment used for mak<strong>in</strong>g both taxed<br />

<strong>and</strong> exempt supplies. Those complexities can significantly<br />

complicate the bookkeep<strong>in</strong>g <strong>and</strong> fil<strong>in</strong>g obligations<br />

for bus<strong>in</strong>esses. Given their negative impact on the function<strong>in</strong>g<br />

<strong>of</strong> the <strong>VAT</strong>, it is not surpris<strong>in</strong>g that the elim<strong>in</strong>ation<br />

<strong>of</strong> exemptions has become an important issue <strong>in</strong><br />

most <strong>VAT</strong> reforms carried out over the past 20 years. 21<br />

In <strong>Africa</strong>, apart from the traditional exemptions for<br />

social reasons (such as health care <strong>and</strong> education) or<br />

technical reasons (such as f<strong>in</strong>ancial <strong>and</strong> <strong>in</strong>surance transactions,<br />

which may be subject to special schemes), the<br />

ma<strong>in</strong> categories <strong>of</strong> exemptions are the follow<strong>in</strong>g:<br />

16. Only exports be<strong>in</strong>g subject to the zero rate.<br />

17. Bird <strong>and</strong> Gendron (note 2) emphasize the need to take a global approach<br />

<strong>in</strong> assess<strong>in</strong>g the distributional consequences <strong>of</strong> the tax system, Moreover, the<br />

impact <strong>of</strong> the <strong>VAT</strong> threshold must be taken <strong>in</strong>to account. Exempt<strong>in</strong>g small<br />

traders from <strong>VAT</strong> re<strong>in</strong>forces the progressivity <strong>of</strong> the tax system, see Keen,<br />

“What Do (<strong>and</strong> Don’t) We Know about the <strong>VAT</strong>”, International Tax <strong>and</strong> Public<br />

F<strong>in</strong>ance (2008). <strong>The</strong> impact <strong>of</strong> the registration threshold on progressivity is<br />

particularly important if the threshold is set <strong>in</strong> l<strong>in</strong>e with best practices (see<br />

below).<br />

18. <strong>The</strong>se sectors <strong>and</strong> transactions vary, depend<strong>in</strong>g on the circumstances,<br />

from supplies <strong>of</strong> unprocessed foodstuffs to services <strong>in</strong> the tourism sector,<br />

<strong>in</strong>clud<strong>in</strong>g hotel accommodation <strong>and</strong> restaurant transactions, small cars, construction<br />

services, etc.<br />

19. To some extent, the difficulties faced by the WAEMU countries may<br />

have been amplified by the relatively high <strong>VAT</strong> rates <strong>in</strong> francophone <strong>Africa</strong><br />

(<strong>of</strong>ten rang<strong>in</strong>g from 18%-20%, as compared to 12%-1 % <strong>in</strong> many other<br />

<strong>Africa</strong>n countries, see Table ).<br />

20. Another frequent example <strong>in</strong> <strong>Africa</strong> relates to local supplies <strong>of</strong> school<br />

books that bear <strong>VAT</strong> on their <strong>in</strong>puts, while imported books are exempt.<br />

21. <strong>The</strong> ITD (note 1) <strong>and</strong> Chambas (note 8) provide an analysis <strong>of</strong> the drawbacks<br />

<strong>of</strong> exemptions for unprocessed foodstuff <strong>and</strong> their negative impact on<br />

the efficiency <strong>of</strong> <strong>VAT</strong> <strong>in</strong> <strong>Africa</strong>.<br />

182 INTERNATIONAL <strong>VAT</strong> MONITOR MAY/JUNE 2009 © IBFD

<strong>–</strong> agricultural sector <strong>and</strong> supplies <strong>of</strong> unprocessed food<br />

items;<br />

<strong>–</strong> support <strong>of</strong> <strong>in</strong>vestments <strong>and</strong> exports (for example,<br />

exemptions for supplies made to exporters); <strong>and</strong><br />

<strong>–</strong> aid-funded projects.<br />

Despite a few attempts to obta<strong>in</strong> some <strong>VAT</strong> revenue from<br />

the agricultural sector, for example, by elim<strong>in</strong>at<strong>in</strong>g<br />

exemptions for specific agricultural <strong>in</strong>puts, broaden<strong>in</strong>g<br />

the <strong>VAT</strong> base to this sector is likely to be particularly difficult<br />

for a number <strong>of</strong> years. However, depend<strong>in</strong>g on<br />

improvements <strong>in</strong> check<strong>in</strong>g <strong>and</strong> process<strong>in</strong>g claims for<br />

refund <strong>of</strong> excess <strong>in</strong>put <strong>VAT</strong> 22 (see below), a more aggressive<br />

approach should be adopted to elim<strong>in</strong>ate exemptions<br />

relat<strong>in</strong>g to capital goods <strong>and</strong> supplies made to<br />

exporters <strong>and</strong> bus<strong>in</strong>esses <strong>in</strong> export process<strong>in</strong>g zones<br />

(EPZs), as well as supplies relat<strong>in</strong>g to the exploitation <strong>of</strong><br />

natural resources, for example, timber, oil, m<strong>in</strong>erals, etc.<br />

Recent developments regard<strong>in</strong>g the tax treatment <strong>of</strong> aid<br />

could also lead to a gradual elim<strong>in</strong>ation <strong>of</strong> exemptions <strong>in</strong><br />

this area <strong>in</strong> the com<strong>in</strong>g years.<br />

Exemption <strong>of</strong> aid has significant drawbacks, especially,<br />

by def<strong>in</strong>ition, <strong>in</strong> the poorest countries where the adm<strong>in</strong>istrative<br />

capacity is <strong>in</strong>adequate. Special schemes adopted<br />

to control these exemptions, <strong>in</strong>clud<strong>in</strong>g the vouchers systems<br />

developed <strong>in</strong> francophone <strong>Africa</strong>, are complex <strong>and</strong><br />

<strong>in</strong>effective. This is especially true for large aid-funded<br />

projects (such as construction <strong>of</strong> roads, hospitals, etc.),<br />

where <strong>VAT</strong> exemptions on a range <strong>of</strong> goods <strong>and</strong> services<br />

(such as cement, fuel, electricity, cars, equipment, labour<br />

services, etc.), which are imported or purchased on the<br />

local market by various contractors <strong>and</strong> subcontractors,<br />

cannot be effectively controlled by the tax adm<strong>in</strong>istration.<br />

This expla<strong>in</strong>s why the World Bank <strong>and</strong> other<br />

donors, such as the Inter-American Development Bank<br />

<strong>and</strong> the Asian Development Bank, have recently<br />

reviewed their approach <strong>and</strong> accepted that aid-funded<br />

projects should <strong>in</strong> pr<strong>in</strong>ciple be subject to <strong>VAT</strong>. 2<br />

Modernization <strong>and</strong> simplification <strong>of</strong> the tax law, <strong>in</strong>clud<strong>in</strong>g<br />

broaden<strong>in</strong>g the <strong>VAT</strong> base <strong>and</strong> elim<strong>in</strong>at<strong>in</strong>g exemptions<br />

<strong>and</strong> reduced rates, are <strong>of</strong>ten tough decisions for<br />

policymakers. To facilitate these decisions, several countries<br />

have developed tax expenditure analyses to help<br />

underst<strong>and</strong> the negative consequences <strong>of</strong> exemptions<br />

<strong>and</strong> reduced rates. Initially, these systems were <strong>in</strong>troduced<br />

<strong>in</strong> OECD countries. In recent years, they have also<br />

been used by a few other countries <strong>in</strong> <strong>Africa</strong> (for example<br />

Morocco s<strong>in</strong>ce 2006 <strong>and</strong>, more recently, Algeria). <strong>The</strong><br />

<strong>in</strong>itial results <strong>of</strong> this approach are encourag<strong>in</strong>g. 2<br />

3.2. <strong>VAT</strong> registration threshold <strong>and</strong> treatment <strong>of</strong> small<br />

bus<strong>in</strong>esses<br />

Adoption <strong>of</strong> a sufficiently high threshold is a critical prerequisite<br />

for successful operation <strong>of</strong> <strong>VAT</strong> <strong>in</strong> countries<br />

with an <strong>in</strong>adequate adm<strong>in</strong>istrative capacity. 2 In the<br />

absence <strong>of</strong> a clear picture <strong>of</strong> the distribution <strong>of</strong> bus<strong>in</strong>esses<br />

by level <strong>of</strong> turnover, <strong>and</strong> a good underst<strong>and</strong><strong>in</strong>g <strong>of</strong><br />

the distribution <strong>of</strong> the value added among the various<br />

sectors <strong>of</strong> the economy based on the size <strong>of</strong> the bus<strong>in</strong>esses,<br />

policymakers <strong>and</strong> experts, who have ignored this<br />

Articles<br />

basic prerequisite, have encountered problems when<br />

<strong>VAT</strong> was <strong>in</strong>troduced <strong>in</strong> some countries.<br />

<strong>The</strong> need for a sufficiently high registration threshold<br />

<strong>The</strong> cases <strong>of</strong> Ghana <strong>and</strong> Ug<strong>and</strong>a, where the <strong>in</strong>troduction<br />

<strong>of</strong> <strong>VAT</strong> <strong>in</strong> 199 <strong>and</strong> 1996 resulted <strong>in</strong> serious problems,<br />

<strong>in</strong>clud<strong>in</strong>g demonstrations <strong>and</strong> riots, are still remembered<br />

by a number <strong>of</strong> tax specialists <strong>in</strong> <strong>Africa</strong>. <strong>The</strong> lack <strong>of</strong><br />

a sufficiently high registration threshold was identified<br />

as the ma<strong>in</strong> reason for these difficulties <strong>in</strong> both countries.<br />

Despite their weak adm<strong>in</strong>istrative capacity, the tax<br />

<strong>of</strong>fices attempted to register a large number <strong>of</strong> small<br />

bus<strong>in</strong>esses, who had very little underst<strong>and</strong><strong>in</strong>g <strong>of</strong> the<br />

requirements for, <strong>and</strong> function<strong>in</strong>g <strong>of</strong>, the <strong>VAT</strong> system. In<br />

Ug<strong>and</strong>a, the decision <strong>of</strong> the authorities to immediately<br />

<strong>in</strong>crease the registration threshold was sufficient to<br />

ensure that <strong>VAT</strong> was quickly on track. However, <strong>in</strong><br />

Ghana, the magnitude <strong>of</strong> the resistance aga<strong>in</strong>st <strong>VAT</strong> led<br />

the <strong>gov</strong>ernment to abolish the <strong>VAT</strong> law, which was re<strong>in</strong>troduced<br />

<strong>in</strong> 1999, with a significantly higher threshold. 26<br />

Until the second half <strong>of</strong> the 1990s, contrary to the francophone<br />

countries with a tradition <strong>of</strong> high registration<br />

thresholds that were regularly adapted to <strong>in</strong>flation, <strong>VAT</strong><br />

was <strong>in</strong>troduced <strong>in</strong> most other <strong>Africa</strong>n countries with relatively<br />

low thresholds. Except for the well-known case <strong>of</strong><br />

the lusophone countries, most <strong>Africa</strong>n countries 27 have<br />

learned the lessons from the experience <strong>of</strong> Ghana <strong>and</strong><br />

Ug<strong>and</strong>a.<br />

<strong>The</strong> lusophone countries have been used as an example<br />

by the experts who question the wisdom <strong>of</strong> <strong>in</strong>troduc<strong>in</strong>g<br />

<strong>VAT</strong> <strong>in</strong> <strong>Africa</strong>. <strong>The</strong>ir criticism is ma<strong>in</strong>ly based on the difficulties<br />

faced by small bus<strong>in</strong>esses <strong>in</strong> comply<strong>in</strong>g with the<br />

<strong>VAT</strong> requirements, <strong>in</strong>clud<strong>in</strong>g:<br />

<strong>–</strong> high tax compliance costs <strong>and</strong> the difficulties for,<br />

sometimes illiterate, small bus<strong>in</strong>ess owners <strong>in</strong> ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g<br />

proper books <strong>and</strong> records;<br />

<strong>–</strong> risks <strong>of</strong> harassment <strong>of</strong> these small taxpayers by tax<br />

<strong>of</strong>ficials; <strong>and</strong><br />

<strong>–</strong> eventually, the <strong>in</strong>centive for small bus<strong>in</strong>esses to<br />

operate <strong>in</strong> the <strong>in</strong>formal sector. 28<br />

Introduction <strong>of</strong> <strong>VAT</strong> <strong>in</strong> a country with a large <strong>in</strong>formal<br />

sector undoubtedly requires comprehensive <strong>and</strong> careful<br />

22. In many develop<strong>in</strong>g countries, the difficulties faced by <strong>in</strong>vestors <strong>and</strong><br />

exporters <strong>in</strong> obta<strong>in</strong><strong>in</strong>g their <strong>VAT</strong> refunds are among the ma<strong>in</strong> reasons why<br />

<strong>VAT</strong> exemptions are <strong>of</strong>ten widespread.<br />

2 . <strong>The</strong>se issues <strong>and</strong> their consequences for donors <strong>and</strong> develop<strong>in</strong>g countries<br />

have been discussed by the International Tax Dialogue: Tax Treatment <strong>of</strong><br />

Donor-F<strong>in</strong>anced Projects (ITD, 2006).<br />

2 . S<strong>in</strong>ce the release <strong>of</strong> the first tax expenditure analysis <strong>in</strong> Morocco, several<br />

<strong>VAT</strong> exemptions have been repealed <strong>and</strong> a step-by-step approach to phase out<br />

reduced <strong>VAT</strong> rates has been developed.<br />

2 . <strong>The</strong> Modern <strong>VAT</strong> (note 1), <strong>and</strong> Keen <strong>and</strong> M<strong>in</strong>tz, “<strong>The</strong> optimal threshold<br />

for a <strong>VAT</strong>”, Journal <strong>of</strong> Public Economics (200 ).<br />

26. Terkper,“<strong>VAT</strong> <strong>in</strong> Ghana: Why it Failed”, Tax Notes International (1996).<br />

27. Includ<strong>in</strong>g those where <strong>VAT</strong> was <strong>in</strong>troduced <strong>in</strong> the mid-1990s (such<br />

as Lesotho <strong>and</strong> Mauritius) <strong>and</strong> the countries where the threshold was significantly<br />

<strong>in</strong>creased <strong>in</strong> recent years (such as Kenya).<br />

28. See Damme, Mirashi, <strong>and</strong> Orel (note ) <strong>and</strong> the problems faced by small<br />

bus<strong>in</strong>esses <strong>in</strong> Mozambique <strong>in</strong> comply<strong>in</strong>g with their <strong>VAT</strong> obligations. In an<br />

attempt to address these problems, a simplified <strong>VAT</strong> scheme was adopted <strong>in</strong><br />

that country, <strong>in</strong> addition to another simplified system for <strong>in</strong>come tax.<br />

© IBFD INTERNATIONAL <strong>VAT</strong> MONITOR MAY/JUNE 2009<br />

18

Articles<br />

preparation. A key issue to be addressed dur<strong>in</strong>g these<br />

preparations is the establishment <strong>of</strong> a sufficiently high<br />

registration threshold to address the difficulties mentioned<br />

above. Box 1 provides a brief analysis <strong>of</strong> the consequences<br />

<strong>of</strong> <strong>VAT</strong> <strong>in</strong> an economy with a large <strong>in</strong>formal<br />

sector. 29<br />

Box 1. <strong>VAT</strong> <strong>and</strong> the <strong>in</strong>formal sector<br />

Experience shows that a modern <strong>VAT</strong> is a tool that is at least<br />

equivalent, if not superior, to customs duties <strong>and</strong> traditional<br />

turnover taxes <strong>in</strong> countries with a large <strong>in</strong>formal sector. If<br />

appropriately designed, <strong>VAT</strong> helps creat<strong>in</strong>g an environment<br />

that takes <strong>in</strong>to account the needs <strong>of</strong> small bus<strong>in</strong>esses <strong>and</strong><br />

encourages other bus<strong>in</strong>esses to operate <strong>in</strong> the formal sector,<br />

while ensur<strong>in</strong>g that operators <strong>in</strong> the <strong>in</strong>formal sector contribute,<br />

to some extent, to the tax revenues.<br />

Small bus<strong>in</strong>esses<br />

Adopt<strong>in</strong>g a high <strong>VAT</strong> registration threshold is a significant<br />

first step towards simplify<strong>in</strong>g the tax <strong>and</strong> account<strong>in</strong>g requirements<br />

for small <strong>and</strong> micro bus<strong>in</strong>esses <strong>and</strong> reduc<strong>in</strong>g their<br />

<strong>in</strong>centive to operate <strong>in</strong> the <strong>in</strong>formal sector. Application <strong>of</strong> a<br />

high registration threshold has very little impact on total <strong>VAT</strong><br />

revenues because the loss <strong>of</strong> tax revenue is limited to the tax<br />

on the marg<strong>in</strong> <strong>of</strong> small retailers. 30 Conversely, adoption <strong>of</strong> a<br />

high registration threshold is not possible <strong>in</strong> a traditional<br />

turnover tax system (especially a retail sales tax) because <strong>of</strong><br />

the obvious risks <strong>of</strong> revenue losses.<br />

Bus<strong>in</strong>esses <strong>in</strong> the formal sector<br />

<strong>The</strong> credit mechanism is an <strong>in</strong>centive for the bus<strong>in</strong>esses <strong>in</strong><br />

the formal sector to select suppliers who are registered for<br />

<strong>VAT</strong>. That mechanism may also be an encouragement for<br />

small bus<strong>in</strong>esses, whose turnover is below the registration<br />

threshold, to register on a voluntary basis <strong>in</strong> order to <strong>in</strong>crease<br />

their supplies to registered bus<strong>in</strong>esses. 31<br />

Informal operators<br />

Contrary to the conclusions <strong>of</strong> those who criticize the simplification<br />

<strong>and</strong> decrease <strong>of</strong> customs duties <strong>and</strong> the repeal <strong>of</strong> the<br />

old turnover taxes, experience shows that <strong>VAT</strong> is a more<br />

appropriate tool <strong>in</strong> an environment with a large <strong>in</strong>formal sector.<br />

<strong>VAT</strong> is just as effective as customs duties as a means to tax<br />

imports <strong>of</strong> goods <strong>and</strong> capital equipment. Moreover, import<br />

<strong>VAT</strong> is deductible from the <strong>VAT</strong> due on the supplies <strong>of</strong> registered<br />

importers, but is a cost for importers operat<strong>in</strong>g <strong>in</strong> the<br />

<strong>in</strong>formal sector. <strong>VAT</strong> is therefore an effective means <strong>of</strong> collect<strong>in</strong>g<br />

at least some tax from <strong>in</strong>formal operators, beg<strong>in</strong>n<strong>in</strong>g with<br />

<strong>VAT</strong> on their imports. 32 In the same manner, these operators<br />

also contribute to the tax revenue because they cannot<br />

deduct the <strong>VAT</strong> <strong>in</strong>curred on their domestic purchases <strong>of</strong><br />

goods <strong>and</strong> services (such as electricity, water, telephone<br />

services, cars, gas, cement, etc.).<br />

<strong>VAT</strong> registration threshold <strong>–</strong> best practices<br />

In <strong>Africa</strong>, depend<strong>in</strong>g on the country’s history, three ma<strong>in</strong><br />

trends can be identified regard<strong>in</strong>g the <strong>VAT</strong> registration<br />

thresholds:<br />

<strong>–</strong> very low thresholds <strong>in</strong> hispano <strong>and</strong> lusophone countries;<br />

<strong>–</strong> moderate thresholds <strong>in</strong> anglophone countries; <strong>and</strong><br />

<strong>–</strong> high thresholds for supplies <strong>of</strong> goods <strong>and</strong> lower<br />

thresholds for services <strong>in</strong> the francophone countries<br />

(see Table ).<br />

In most <strong>of</strong> these countries, the <strong>VAT</strong> registration threshold<br />

is the predom<strong>in</strong>ant criterion to def<strong>in</strong>e small bus<strong>in</strong>esses.<br />

By structur<strong>in</strong>g the total population <strong>of</strong> bus<strong>in</strong>esses<br />

on the basis <strong>of</strong> turnover <strong>–</strong> whether the level is set below<br />

or above the threshold <strong>–</strong> the <strong>VAT</strong> provides a good framework<br />

to develop important tax adm<strong>in</strong>istration concepts,<br />

<strong>in</strong>clud<strong>in</strong>g the exemption <strong>of</strong> small bus<strong>in</strong>esses <strong>and</strong> a simplified<br />

tax regime for these bus<strong>in</strong>esses.<br />

Based on a recent comparative study, the best practice<br />

regard<strong>in</strong>g the adoption <strong>of</strong> a <strong>VAT</strong> threshold would be the<br />

follow<strong>in</strong>g:<br />

<strong>–</strong> adoption <strong>of</strong> a sufficiently high threshold, for example<br />

<strong>in</strong> the range <strong>of</strong> the equivalent <strong>of</strong> USD 60,000 to<br />

100,000;<br />

<strong>–</strong> harmonization <strong>of</strong> the taxation pr<strong>in</strong>ciples applicable<br />

to small bus<strong>in</strong>esses for <strong>VAT</strong> <strong>and</strong> <strong>in</strong>come tax;<br />

<strong>–</strong> adoption <strong>of</strong> a s<strong>in</strong>gle threshold for supplies <strong>of</strong> goods<br />

<strong>and</strong> the provision <strong>of</strong> services (because dist<strong>in</strong>guish<strong>in</strong>g<br />

supplies <strong>of</strong> goods from services is <strong>of</strong>ten difficult<br />

for small bus<strong>in</strong>esses <strong>and</strong> leads to complex <strong>and</strong> arbitrary<br />

regulations); <strong>and</strong><br />

<strong>–</strong> elim<strong>in</strong>ation <strong>of</strong> discrim<strong>in</strong>ation based on corporate<br />

structure by also apply<strong>in</strong>g the <strong>VAT</strong> threshold to<br />

small corporate bus<strong>in</strong>esses (because this type <strong>of</strong> discrim<strong>in</strong>ation<br />

is now history for a grow<strong>in</strong>g number <strong>of</strong><br />

bus<strong>in</strong>esses).<br />

Taxation <strong>of</strong> small <strong>and</strong> micro bus<strong>in</strong>esses<br />

Although discussion <strong>of</strong> the need to establish special tax<br />

regimes for small <strong>and</strong> micro bus<strong>in</strong>esses is certa<strong>in</strong>ly not<br />

new, this topic has received greater attention <strong>in</strong> recent<br />

years from tax adm<strong>in</strong>istrators <strong>and</strong> policymakers <strong>in</strong> many<br />

countries, <strong>in</strong>clud<strong>in</strong>g those <strong>of</strong> the OECD <strong>and</strong> a number <strong>of</strong><br />

develop<strong>in</strong>g countries. To a large extent, the relatively<br />

high costs born by small <strong>and</strong> micro bus<strong>in</strong>esses to comply<br />

with the st<strong>and</strong>ard requirements <strong>of</strong> the tax system <strong>and</strong> the<br />

costs <strong>of</strong> the tax adm<strong>in</strong>istration to enforce these requirements<br />

for this large group <strong>of</strong> taxpayers expla<strong>in</strong> the grow<strong>in</strong>g<br />

<strong>in</strong>terest <strong>in</strong> this topic. Taxation <strong>of</strong> small bus<strong>in</strong>esses has<br />

become an important component <strong>of</strong> the tax reform pro-<br />

29. On these issues <strong>and</strong> the response to the criticism <strong>of</strong> Emran <strong>and</strong> Stiglitz<br />

(note ), see Keen, “<strong>VAT</strong> Attacks! Second Best Perspectives on <strong>VAT</strong>”, International<br />

Tax <strong>and</strong> Public F<strong>in</strong>ance (2007).<br />

0. In fact, experience shows that an <strong>in</strong>crease <strong>in</strong> the threshold most <strong>of</strong>ten<br />

helps <strong>in</strong>crease the effectiveness <strong>of</strong> the tax adm<strong>in</strong>istration <strong>and</strong> the revenue performance<br />

<strong>of</strong> the <strong>VAT</strong>.<br />

1. In most <strong>VAT</strong> systems, the option for voluntary registration is open to<br />

small bus<strong>in</strong>esses that are able to keep proper books <strong>and</strong> records, issue <strong>in</strong>voices,<br />

<strong>and</strong> have a good tax compliance history.<br />

2. See Keen (notes 17 <strong>and</strong> 29). To <strong>in</strong>crease the contribution <strong>of</strong> <strong>in</strong>formal<br />

operators to the tax revenues, several <strong>Africa</strong>n countries also apply an advance<br />

<strong>in</strong>come tax that is collected by customs on imports. This advance payment is<br />

creditable aga<strong>in</strong>st the f<strong>in</strong>al <strong>in</strong>come tax liabilities <strong>of</strong> the bus<strong>in</strong>esses <strong>in</strong> the formal<br />

sector. It is therefore a cost for the bus<strong>in</strong>esses <strong>in</strong> the <strong>in</strong>formal economy <strong>and</strong><br />

those who do not comply with their tax obligations.<br />

. Bod<strong>in</strong> <strong>and</strong> Koukpaizan (note 12).<br />

. Similarly, harmonized pr<strong>in</strong>ciples also apply to small bus<strong>in</strong>esses that voluntarily<br />

register for <strong>VAT</strong>. <strong>The</strong>se small bus<strong>in</strong>esses must also opt for the normal<br />

tax <strong>and</strong> account<strong>in</strong>g regimes for <strong>in</strong>come tax.<br />

. After the first conference on <strong>VAT</strong> <strong>in</strong> March 200 , the organizations promot<strong>in</strong>g<br />

the International Tax Dialogue (ITD) have naturally focused their<br />

work on small-bus<strong>in</strong>ess taxation dur<strong>in</strong>g the second conference that was held<br />

<strong>in</strong> October 2007, (www.itdweb.org/SMEconference).<br />

18 INTERNATIONAL <strong>VAT</strong> MONITOR MAY/JUNE 2009 © IBFD

grammes developed <strong>in</strong> <strong>Africa</strong>: design<strong>in</strong>g an appropriate<br />

tax regime for small <strong>and</strong> micro bus<strong>in</strong>esses is a necessary<br />

step towards facilitat<strong>in</strong>g the modernization <strong>of</strong> the <strong>VAT</strong><br />

system <strong>and</strong> the adoption <strong>of</strong> a high registration threshold.<br />

<strong>The</strong> comparative study <strong>of</strong> the tax systems for small bus<strong>in</strong>esses<br />

shows a great diversity <strong>of</strong> the exist<strong>in</strong>g regimes,<br />

<strong>in</strong>clud<strong>in</strong>g: turnover taxes, patents, systems based on<br />

physical <strong>in</strong>dicators, taxes based on the bus<strong>in</strong>ess’ rental<br />

value, etc. 6 Discussion <strong>and</strong> the exchange <strong>of</strong> views on this<br />

topic are relatively new. <strong>The</strong> discussions dur<strong>in</strong>g the ITD<br />

conference confirm that there is not yet a credible guide<br />

to best practices. While an <strong>in</strong>-depth evaluation <strong>of</strong> the<br />

exist<strong>in</strong>g regimes is needed, those recently developed <strong>in</strong><br />

some countries should be given particular attention, for<br />

example, the tax regime for small bus<strong>in</strong>esses that was<br />

<strong>in</strong>troduced <strong>in</strong> Madagascar <strong>in</strong> 2008. 7<br />

4. Reform <strong>of</strong> Tax Adm<strong>in</strong>istration <strong>–</strong> Progress <strong>and</strong><br />

<strong>Challenges</strong><br />

4.1. <strong>Impact</strong> <strong>of</strong> <strong>VAT</strong> on tax adm<strong>in</strong>istration<br />

<strong>VAT</strong> is certa<strong>in</strong>ly the most important tax reform that has<br />

taken place <strong>in</strong> <strong>Africa</strong> <strong>in</strong> the past 20 years <strong>and</strong> it is not surpris<strong>in</strong>g<br />

that its <strong>in</strong>troduction has resulted <strong>in</strong> significant<br />

changes for most tax adm<strong>in</strong>istrations <strong>in</strong> this region. <strong>The</strong><br />

experts who question the appropriateness <strong>of</strong> <strong>VAT</strong> for<br />

develop<strong>in</strong>g countries sometimes claim that similar<br />

changes could have been made under the previous tax<br />

systems, <strong>in</strong>clud<strong>in</strong>g the old turnover taxes. To a large<br />

extent, these views reflect a lack <strong>of</strong> experience with the<br />

actual situation <strong>of</strong> the tax <strong>and</strong> customs adm<strong>in</strong>istrations<br />

<strong>in</strong> <strong>Africa</strong>.<br />

<strong>The</strong> collection procedures for <strong>in</strong>come tax that were <strong>in</strong><br />

place prior to the <strong>in</strong>troduction <strong>of</strong> <strong>VAT</strong> were primarily<br />

based on negotiations between tax <strong>of</strong>ficers <strong>and</strong> taxpayers.<br />

8 <strong>The</strong>se procedures were particularly <strong>in</strong>effective <strong>and</strong><br />

time consum<strong>in</strong>g. <strong>The</strong>y also provided significant opportunities<br />

for corruption. Similarly, the old turnover taxes<br />

were particularly complex <strong>and</strong> difficult to adm<strong>in</strong>ister. In<br />

several countries, they were supplemented by specific<br />

excise taxes on numerous items (sometimes more than<br />

20, such as gold, tea, sugar, cement, soap, etc). <strong>The</strong> adm<strong>in</strong>istration<br />

<strong>of</strong> these taxes was commonly based on physical<br />

controls similar to those used by the customs adm<strong>in</strong>istration.<br />

<strong>The</strong>se controls provided opportunities for multiple<br />

visits to the taxpayer’s premises, which were frequently<br />

accompanied by harassment <strong>and</strong> corruption. All<br />

tax adm<strong>in</strong>istration specialists who have provided technical<br />

assistance <strong>in</strong> <strong>Africa</strong>n countries before the <strong>in</strong>troduction<br />

<strong>of</strong> <strong>VAT</strong> can confirm that it was impossible to<br />

develop a sound tax adm<strong>in</strong>istration modernization<br />

strategy <strong>in</strong> such a context.<br />

Modernization <strong>of</strong> the tax adm<strong>in</strong>istration has <strong>of</strong>ten<br />

started with develop<strong>in</strong>g more effective <strong>and</strong> transparent<br />

collection methods for <strong>VAT</strong>. It has also frequently<br />

<strong>in</strong>volved a fundamental change <strong>in</strong> the organizational<br />

structure <strong>of</strong> the tax adm<strong>in</strong>istration, especially <strong>in</strong>tegration<br />

<strong>of</strong> functions that were previously fragmented<br />

among several agencies. Another component <strong>of</strong> the<br />

Articles<br />

modernization, which has also been significantly <strong>in</strong>fluenced<br />

by the “structur<strong>in</strong>g effect” <strong>of</strong> <strong>VAT</strong>, is the development<br />

<strong>of</strong> the concept <strong>of</strong> “segmentation” <strong>of</strong> taxpayers. This<br />

concept takes <strong>in</strong>to account the characteristics <strong>of</strong> the various<br />

categories <strong>of</strong> taxpayers, <strong>in</strong> order to adapt the compliance<br />

programmes <strong>and</strong> the network <strong>of</strong> local <strong>of</strong>fices to<br />

the need <strong>of</strong> the taxpayers for specific services, <strong>and</strong> to the<br />