ECJ VAT Cases MAY/JUNE 2007 - empcom.gov.in

ECJ VAT Cases MAY/JUNE 2007 - empcom.gov.in

ECJ VAT Cases MAY/JUNE 2007 - empcom.gov.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Judgments<br />

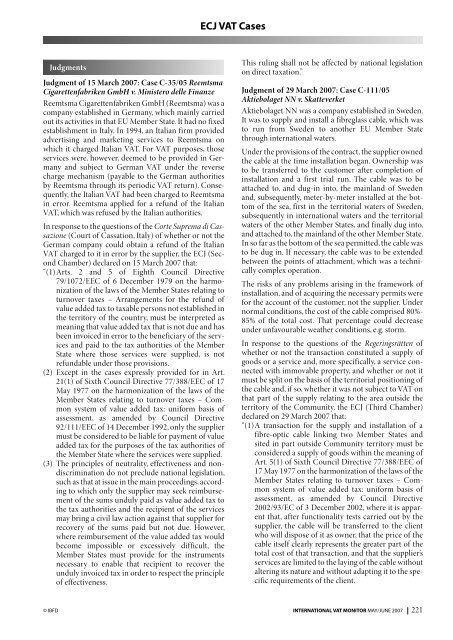

Judgment of 15 March <strong>2007</strong>: Case C-35/05 Reemtsma<br />

Cigarettenfabriken GmbH v. M<strong>in</strong>istero delle F<strong>in</strong>anze<br />

Reemtsma Cigarettenfabriken GmbH (Reemtsma) was a<br />

company established <strong>in</strong> Germany, which ma<strong>in</strong>ly carried<br />

out its activities <strong>in</strong> that EU Member State. It had no fixed<br />

establishment <strong>in</strong> Italy. In 1994, an Italian firm provided<br />

advertis<strong>in</strong>g and market<strong>in</strong>g services to Reemtsma on<br />

which it charged Italian <strong>VAT</strong>. For <strong>VAT</strong> purposes, those<br />

services were, however, deemed to be provided <strong>in</strong> Germany<br />

and subject to German <strong>VAT</strong> under the reverse<br />

charge mechanism (payable to the German authorities<br />

by Reemtsma through its periodic <strong>VAT</strong> return). Consequently,<br />

the Italian <strong>VAT</strong> had been charged to Reemtsma<br />

<strong>in</strong> error. Reemtsma applied for a refund of the Italian<br />

<strong>VAT</strong>, which was refused by the Italian authorities.<br />

In response to the questions of the Corte Suprema di Cassazione<br />

(Court of Cassation, Italy) of whether or not the<br />

German company could obta<strong>in</strong> a refund of the Italian<br />

<strong>VAT</strong> charged to it <strong>in</strong> error by the supplier, the <strong>ECJ</strong> (Second<br />

Chamber) declared on 15 March <strong>2007</strong> that:<br />

“(1)Arts. 2 and 5 of Eighth Council Directive<br />

79/1072/EEC of 6 December 1979 on the harmonization<br />

of the laws of the Member States relat<strong>in</strong>g to<br />

turnover taxes – Arrangements for the refund of<br />

value added tax to taxable persons not established <strong>in</strong><br />

the territory of the country, must be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that value added tax that is not due and has<br />

been <strong>in</strong>voiced <strong>in</strong> error to the beneficiary of the services<br />

and paid to the tax authorities of the Member<br />

State where those services were supplied, is not<br />

refundable under those provisions.<br />

(2) Except <strong>in</strong> the cases expressly provided for <strong>in</strong> Art.<br />

21(1) of Sixth Council Directive 77/388/EEC of 17<br />

May 1977 on the harmonization of the laws of the<br />

Member States relat<strong>in</strong>g to turnover taxes – Common<br />

system of value added tax: uniform basis of<br />

assessment, as amended by Council Directive<br />

92/111/EEC of 14 December 1992, only the supplier<br />

must be considered to be liable for payment of value<br />

added tax for the purposes of the tax authorities of<br />

the Member State where the services were supplied.<br />

(3) The pr<strong>in</strong>ciples of neutrality, effectiveness and nondiscrim<strong>in</strong>ation<br />

do not preclude national legislation,<br />

such as that at issue <strong>in</strong> the ma<strong>in</strong> proceed<strong>in</strong>gs, accord<strong>in</strong>g<br />

to which only the supplier may seek reimbursement<br />

of the sums unduly paid as value added tax to<br />

the tax authorities and the recipient of the services<br />

may br<strong>in</strong>g a civil law action aga<strong>in</strong>st that supplier for<br />

recovery of the sums paid but not due. However,<br />

where reimbursement of the value added tax would<br />

become impossible or excessively difficult, the<br />

Member States must provide for the <strong>in</strong>struments<br />

necessary to enable that recipient to recover the<br />

unduly <strong>in</strong>voiced tax <strong>in</strong> order to respect the pr<strong>in</strong>ciple<br />

of effectiveness.<br />

<strong>ECJ</strong> <strong>VAT</strong> <strong>Cases</strong><br />

This rul<strong>in</strong>g shall not be affected by national legislation<br />

on direct taxation.”<br />

Judgment of 29 March <strong>2007</strong>: Case C-111/05<br />

Aktiebolaget NN v. Skatteverket<br />

Aktiebolaget NN was a company established <strong>in</strong> Sweden.<br />

It was to supply and <strong>in</strong>stall a fibreglass cable, which was<br />

to run from Sweden to another EU Member State<br />

through <strong>in</strong>ternational waters.<br />

Under the provisions of the contract, the supplier owned<br />

the cable at the time <strong>in</strong>stallation began. Ownership was<br />

to be transferred to the customer after completion of<br />

<strong>in</strong>stallation and a first trial run. The cable was to be<br />

attached to, and dug-<strong>in</strong> <strong>in</strong>to, the ma<strong>in</strong>land of Sweden<br />

and, subsequently, meter-by-meter <strong>in</strong>stalled at the bottom<br />

of the sea, first <strong>in</strong> the territorial waters of Sweden,<br />

subsequently <strong>in</strong> <strong>in</strong>ternational waters and the territorial<br />

waters of the other Member States, and f<strong>in</strong>ally dug <strong>in</strong>to,<br />

and attached to, the ma<strong>in</strong>land of the other Member State.<br />

In so far as the bottom of the sea permitted, the cable was<br />

to be dug <strong>in</strong>. If necessary, the cable was to be extended<br />

between the po<strong>in</strong>ts of attachment, which was a technically<br />

complex operation.<br />

The risks of any problems aris<strong>in</strong>g <strong>in</strong> the framework of<br />

<strong>in</strong>stallation, and of acquir<strong>in</strong>g the necessary permits were<br />

for the account of the customer, not the supplier. Under<br />

normal conditions, the cost of the cable comprised 80%-<br />

85% of the total cost. That percentage could decrease<br />

under unfavourable weather conditions, e.g. storm.<br />

In response to the questions of the Reger<strong>in</strong>gsrätten of<br />

whether or not the transaction constituted a supply of<br />

goods or a service and, more specifically, a service connected<br />

with immovable property, and whether or not it<br />

must be split on the basis of the territorial position<strong>in</strong>g of<br />

the cable and, if so, whether it was not subject to <strong>VAT</strong> on<br />

that part of the supply relat<strong>in</strong>g to the area outside the<br />

territory of the Community, the <strong>ECJ</strong> (Third Chamber)<br />

declared on 29 March <strong>2007</strong> that:<br />

“(1)A transaction for the supply and <strong>in</strong>stallation of a<br />

fibre-optic cable l<strong>in</strong>k<strong>in</strong>g two Member States and<br />

sited <strong>in</strong> part outside Community territory must be<br />

considered a supply of goods with<strong>in</strong> the mean<strong>in</strong>g of<br />

Art. 5(1) of Sixth Council Directive 77/388/EEC of<br />

17 May 1977 on the harmonization of the laws of the<br />

Member States relat<strong>in</strong>g to turnover taxes – Common<br />

system of value added tax: uniform basis of<br />

assessment, as amended by Council Directive<br />

2002/93/EC of 3 December 2002, where it is apparent<br />

that, after functionality tests carried out by the<br />

supplier, the cable will be transferred to the client<br />

who will dispose of it as owner, that the price of the<br />

cable itself clearly represents the greater part of the<br />

total cost of that transaction, and that the supplier’s<br />

services are limited to the lay<strong>in</strong>g of the cable without<br />

alter<strong>in</strong>g its nature and without adapt<strong>in</strong>g it to the specific<br />

requirements of the client.<br />

© IBFD INTERNATIONAL <strong>VAT</strong> MONITOR <strong>MAY</strong>/<strong>JUNE</strong> <strong>2007</strong> 221

<strong>ECJ</strong> <strong>VAT</strong> <strong>Cases</strong><br />

(2) Art. 8(1)(a) of Sixth Directive 77/388 must be <strong>in</strong>terpreted<br />

as mean<strong>in</strong>g that the right to tax the supply<br />

and lay<strong>in</strong>g of a fibre-optic cable l<strong>in</strong>k<strong>in</strong>g two Member<br />

States and sited <strong>in</strong> part outside the territory of the<br />

Community is held by each Member State pro rata<br />

accord<strong>in</strong>g to the length of cable <strong>in</strong> its territory with<br />

regard both to the price of the cable itself and the<br />

rest of the materials and to the cost of the services<br />

relat<strong>in</strong>g to the lay<strong>in</strong>g of the cable.<br />

(3) Art. 8(1)(a) of Sixth Directive 77/388, read <strong>in</strong> conjunction<br />

with Arts. 2(1) and 3 of that Directive, must<br />

be <strong>in</strong>terpreted as mean<strong>in</strong>g that the supply and lay<strong>in</strong>g<br />

of a fibre-optic cable l<strong>in</strong>k<strong>in</strong>g two Member States is<br />

not subject to <strong>VAT</strong> for that part of the transaction<br />

which is carried out <strong>in</strong> the exclusive economic zone,<br />

on the cont<strong>in</strong>ental shelf and at sea.”<br />

Judgment of 19 April <strong>2007</strong>: Case C-455/05 Velvet &<br />

Steel Immobilien und Handels GmbH v. F<strong>in</strong>anzamt<br />

Hamburg-Eimsbüttel<br />

In September 1998, Burmeister Immobilien GmbH sold<br />

a plot of land with a rented apartment build<strong>in</strong>g. In July<br />

1999, two <strong>in</strong>dividuals together undertook a similar<br />

transaction. In the two sale contracts, the suppliers<br />

undertook to carry out the renovation work needed on<br />

the build<strong>in</strong>gs concerned. The two <strong>in</strong>dividuals also<br />

assumed a rent guarantee.<br />

After the sales, the suppliers concluded, on 25 September<br />

1998 and 12 July 1999 respectively, contracts with<br />

Velvet & Steel entitled “assignment of a part of the purchase<br />

price <strong>in</strong> return for assumption of obligations”. By<br />

those contracts, Velvet & Steel assumed responsibility<br />

for the suppliers’ obligation to renovate the build<strong>in</strong>gs as<br />

well as for the rent guarantee <strong>in</strong> return for a part of the<br />

purchase price of those build<strong>in</strong>gs. The two purchasers of<br />

the build<strong>in</strong>gs subsequently agreed to release Velvet &<br />

Steel from its obligations <strong>in</strong> return for payment to them<br />

of part of that fraction of the purchase price ceded to it.<br />

The profit result<strong>in</strong>g from that transaction, with regard to<br />

the contracts concluded with Burmeister and with the<br />

two <strong>in</strong>dividuals concerned, rema<strong>in</strong>ed with Velvet & Steel<br />

as “payment or lump-sum compensation/<strong>in</strong>demnity <strong>in</strong><br />

respect of any loss of profit”. Velvet & Steel declared only<br />

that profit as consideration for the services rendered, for<br />

<strong>VAT</strong> purposes.<br />

The tax adm<strong>in</strong>istration took the view that the assumption<br />

by Velvet & Steel of the obligation to renovate the<br />

build<strong>in</strong>gs was a service, which was subject to <strong>VAT</strong>. Velvet<br />

& Steel appealed aga<strong>in</strong>st that decision argu<strong>in</strong>g that neither<br />

of the two obligations which it had assumed had<br />

actually been carried out.<br />

In response to the question of the F<strong>in</strong>anzgericht Hamburg<br />

(Germany) of whether the concept of the assumption<br />

of obligations <strong>in</strong>cludes only pecuniary obligations<br />

or also the assumption of other obligations, such as service<br />

obligations, the <strong>ECJ</strong> (Third Chamber) declared on 19<br />

April <strong>2007</strong> that:<br />

“Art. 13(B)(d)(2) of Sixth Council Directive 77/388/EEC<br />

of 17 May 1977 on the harmonization of the laws of the<br />

Member States relat<strong>in</strong>g to turnover taxes – Common<br />

system of value added tax: uniform basis of assessment<br />

must be <strong>in</strong>terpreted as mean<strong>in</strong>g that the concept of<br />

assumption of obligations excludes from the scope of<br />

that provision obligations which are non-pecuniary,<br />

such as the obligation to renovate a property.”<br />

Court’s Orders<br />

Court’s Order of 6 March <strong>2007</strong>: Case C-168/06<br />

Ceramika Paradyż sp. z oo v. Dyrektor Izby Skarbowej<br />

w Łodzi<br />

In its monthly <strong>VAT</strong> return for September 2003,<br />

Ceramika Paradyż had reported the sale of a build<strong>in</strong>g for<br />

a net price of PLN 168,578 and PLN 36,427 <strong>in</strong> <strong>VAT</strong>. Due<br />

to a mistake <strong>in</strong> its <strong>VAT</strong> report<strong>in</strong>g system, the company<br />

declared the same transaction aga<strong>in</strong> <strong>in</strong> its <strong>VAT</strong> return for<br />

October 2003. After discovery of that mistake, the company<br />

decreased the turnover reported <strong>in</strong> its <strong>VAT</strong> return<br />

for November 2003 by PLN 168,578 and – as a result –<br />

<strong>in</strong>creased its excess <strong>in</strong>put tax claim by PLN 36,427.<br />

On discovery of the company’s mistake, the tax authorities<br />

reversed its corrections and imposed an additional<br />

tax liability of PLN 10,928 (30% of PLN 36,427). The tax<br />

authorities did not deny that Ceramika Paradyż was<br />

entitled to reclaim the amount paid through its return<br />

for October but took the view that it should have corrected<br />

its <strong>VAT</strong> return for October, not decreased its <strong>VAT</strong><br />

liability for November. Under the Polish <strong>VAT</strong> Law, the<br />

30% additional tax liability is imposed on taxable persons<br />

who have understated their output <strong>VAT</strong> liability or<br />

overstated their <strong>in</strong>put <strong>VAT</strong> claim <strong>in</strong> their <strong>VAT</strong> return.<br />

For a description of the legal background of the case, see<br />

the case note at pp. 227 of this issue.<br />

Ceramika Paradyż disputed the imposition of the additional<br />

tax liability and, <strong>in</strong> the course of the subsequent<br />

proceed<strong>in</strong>gs before the Wojewódzki Sąd Adm<strong>in</strong>istracyjny<br />

(the Regional Adm<strong>in</strong>istrative Court) <strong>in</strong> Łódź, that<br />

regional court referred two questions to the <strong>ECJ</strong> on the<br />

conformity of the national provision with Community<br />

law.<br />

Under Art. 104(3) of the <strong>ECJ</strong>’s Rules of Procedure, where<br />

the answer to a question referred to the <strong>ECJ</strong> for a prelim<strong>in</strong>ary<br />

rul<strong>in</strong>g may be clearly deduced from exist<strong>in</strong>g case<br />

law, the <strong>ECJ</strong> may, after hear<strong>in</strong>g the Advocate General, at<br />

any time give its decision by reasoned order <strong>in</strong> which<br />

reference is made to its previous judgment or to the relevant<br />

case law.<br />

In this context, the <strong>ECJ</strong> observed that, accord<strong>in</strong>g to the<br />

order for reference, the national court wished to know<br />

how the provisions of the First and Sixth Directives<br />

must be <strong>in</strong>terpreted for the purposes of its assessment of<br />

whether or not the provision of national law under<br />

which the additional tax liability is imposed is compatible<br />

with Community law. In the case at hand, that liability<br />

had been imposed by reason of an alleged <strong>in</strong>correct<br />

<strong>VAT</strong> return for a period (October 2003) prior to Poland’s<br />

accession to the European Union (1 May 2004). S<strong>in</strong>ce<br />

222 INTERNATIONAL <strong>VAT</strong> MONITOR <strong>MAY</strong>/<strong>JUNE</strong> <strong>2007</strong> © IBFD

the <strong>ECJ</strong> is solely competent to <strong>in</strong>terpret Community law<br />

applicable <strong>in</strong> a new Member State from the date of its<br />

accession and regardless of whether the additional tax<br />

liability constitutes a tax or a penalty, by its order of 6<br />

March <strong>2007</strong>, the <strong>ECJ</strong> declared that it was not competent<br />

to answer the questions referred to it by the national<br />

court.<br />

[Unofficial translation]<br />

Op<strong>in</strong>ions<br />

Op<strong>in</strong>ion of 8 March <strong>2007</strong>: Case C-434/05 Sticht<strong>in</strong>g<br />

Regionaal Opleid<strong>in</strong>gen Centrum Noord-<br />

Kennemerland/West-Friesland (Horizon College) v.<br />

Staatssecretaris van F<strong>in</strong>anciën and C-445/05 Werner<br />

Haderer v. F<strong>in</strong>anzamt Wilmersdorf<br />

Case C-434/05<br />

Sticht<strong>in</strong>g Regionaal Opleid<strong>in</strong>gen Centrum Noord-Kennemerland/West<br />

Friesland (Horizon College) was a<br />

teach<strong>in</strong>g establishment at Alkmaar <strong>in</strong> the Netherlands.<br />

For the purposes of Art. 13(A)(1)(i) of the Sixth <strong>VAT</strong><br />

Directive, it was an organization def<strong>in</strong>ed by the Member<br />

State as hav<strong>in</strong>g educational objects. It pr<strong>in</strong>cipally provided<br />

secondary level and vocational education, but also<br />

seconded teachers to other establishments to meet temporary<br />

shortages of teach<strong>in</strong>g staff. Under the secondment<br />

contract, the teacher was assigned work by the<br />

other establishment, which also paid for liability <strong>in</strong>surance.<br />

The teacher’s salary cont<strong>in</strong>ued to be paid by Horizon<br />

College, which claimed the bare cost back from the<br />

other establishment, without tak<strong>in</strong>g any profit or charg<strong>in</strong>g<br />

<strong>VAT</strong>.<br />

Case C-445/05<br />

Mr Haderer worked for a number of years for the Land<br />

of Berl<strong>in</strong> as a teacher <strong>in</strong> a freelance capacity. In 1990, he<br />

worked at various adult education centres for a total of<br />

often more than 30 hours per week, provid<strong>in</strong>g “help with<br />

schoolwork” and runn<strong>in</strong>g a ceramics and pottery course.<br />

His status was covered by regularly renewed contracts,<br />

which expressly stipulated that they did not create an<br />

employment relationship. Mr Haderer received an<br />

hourly fee for work actually done. If a course was cancelled<br />

for any reason, or if he was prevented from work<strong>in</strong>g<br />

by sickness or any other cause, he was not entitled to<br />

a fee. He did, however, receive a contribution to the costs<br />

of his health <strong>in</strong>surance and pension scheme and a “leave<br />

allowance” calculated as a percentage of his fees. Mr<br />

Haderer did not file a <strong>VAT</strong> return <strong>in</strong> respect of his services.<br />

On 8 March <strong>2007</strong>, Advocate General Sharpston delivered<br />

her op<strong>in</strong>ion <strong>in</strong> cases C-434/05 and C-445/05. As<br />

regards the question of whether or not the secondment,<br />

for consideration, of a teacher by Horizon College to<br />

another educational <strong>in</strong>stitution was exempt from <strong>VAT</strong><br />

under the exemption for educational services, she proposed<br />

that the <strong>ECJ</strong> should answer the questions referred<br />

to it by the Hoge Raad <strong>in</strong> Case C-434/05 as follows:<br />

<strong>ECJ</strong> <strong>VAT</strong> <strong>Cases</strong><br />

“– On a proper construction of Art. 13(A)(1)(i) of Sixth<br />

Council Directive 77/388/EEC, the temporary supply<br />

of a teacher to an educational establishment, <strong>in</strong><br />

order to provide teach<strong>in</strong>g services under the responsibility<br />

of that establishment, does not constitute<br />

provision of education or vocational tra<strong>in</strong><strong>in</strong>g or<br />

retra<strong>in</strong><strong>in</strong>g, but does <strong>in</strong> pr<strong>in</strong>ciple constitute the supply<br />

of a service closely related thereto.<br />

– In order to qualify for exemption from <strong>VAT</strong> under<br />

that provision, the supply <strong>in</strong> question must be made<br />

by a body or organization as referred to there<strong>in</strong>, and<br />

must comply with the requirements of Art.<br />

13(A)(2)(b) of the same directive, as clarified by the<br />

Court <strong>in</strong> its judgment <strong>in</strong> Case C-415/04 Sticht<strong>in</strong>g<br />

K<strong>in</strong>deropvang Enschede, and, where applicable, with<br />

those of Art. 13(A)(2)(a).”<br />

As regards the question of whether or not Mr Haderer’s<br />

services were exempt from <strong>VAT</strong>, she proposed that the<br />

<strong>ECJ</strong> should answer the questions referred to it by the<br />

Bundesf<strong>in</strong>anzhof <strong>in</strong> Case C-445/05 as follows:<br />

“– On a proper construction of Art. 13(A)(1)(j) of Directive<br />

77/388, the concept of tuition given privately<br />

by teachers does not <strong>in</strong>clude a situation <strong>in</strong> which a<br />

self-employed teacher contracts with an educational<br />

establishment to provide tuition to students <strong>in</strong><br />

courses organized by that establishment on its<br />

premises and under its responsibility, for which the<br />

establishment and not the teacher receives payment<br />

from the students.”<br />

Case note<br />

In Horizon College, the basic question was whether or<br />

not the secondment of teachers by and educational <strong>in</strong>stitution<br />

to another educational <strong>in</strong>stitution was exempt<br />

from <strong>VAT</strong>.<br />

In her Op<strong>in</strong>ion of 8 March <strong>2007</strong>, Advocate General<br />

Sharpston sighed that <strong>VAT</strong> is an unusual tax because,<br />

unlike exemptions under other taxes, exemptions under<br />

<strong>VAT</strong> may have an adverse effect on the taxable person<br />

<strong>in</strong>volved, <strong>in</strong> the sense that he is not entitled to deduct (as<br />

<strong>in</strong>put tax) any <strong>VAT</strong> charged to him by other suppliers of<br />

goods and services purchased for the purpose of carry<strong>in</strong>g<br />

out the exempt transactions.<br />

Accord<strong>in</strong>g to the Advocate General, the Sixth Directive<br />

does not directly provide an answer to the question of<br />

whether or not the secondment of teachers is exempt<br />

from <strong>VAT</strong>. In this framework, she mentioned the legal<br />

exemption for educational services, which she rejected<br />

on the ground that the secondment of teachers is not the<br />

provision of education, 1 and that for the services of private<br />

tutors, 2 which she also rejected. Instead of exam<strong>in</strong>-<br />

1. Under Art. 13(A)(1)(i) of the Sixth Directive (Art. 132(1)(i) of Directive<br />

2006/112), Member States must exempt children’s or young people’s education,<br />

school or university education, vocational tra<strong>in</strong><strong>in</strong>g or retra<strong>in</strong><strong>in</strong>g, <strong>in</strong>clud<strong>in</strong>g<br />

the supply of services and of goods closely related thereto, provided by bodies<br />

<strong>gov</strong>erned by public law hav<strong>in</strong>g such as their aim or by other organizations<br />

def<strong>in</strong>ed by the Member States concerned as hav<strong>in</strong>g similar objects.<br />

2. Under Art. 13(A)(1)(j) of the Sixth Directive (Art. 132(1)(j) of Directive<br />

2006/112), Member States must exempt tuition given privately by teachers<br />

and cover<strong>in</strong>g school or university education.<br />

© IBFD INTERNATIONAL <strong>VAT</strong> MONITOR <strong>MAY</strong>/<strong>JUNE</strong> <strong>2007</strong> 223

<strong>ECJ</strong> <strong>VAT</strong> <strong>Cases</strong><br />

<strong>in</strong>g the relevance of the third exemption mentioned<br />

under “legal background”, i.e. the exemption laid down<br />

by Art. 13(A)(1)(k) of the Sixth Directive, she focused on<br />

services “closely related to education”, which are exempt<br />

under the exemption for educational services. 3<br />

One of the basic pr<strong>in</strong>ciples of <strong>VAT</strong> is that all supplies<br />

made by taxable persons are subject to <strong>VAT</strong>, unless the<br />

legislation specifically provides otherwise and, if the<br />

<strong>VAT</strong> legislation provides for an exemption, it must be<br />

<strong>in</strong>terpreted strictly because it is an exception to the rule<br />

that all supplies are subject to <strong>VAT</strong>. Another basic pr<strong>in</strong>ciple<br />

is that, unless the legislation specifically provides<br />

otherwise, <strong>VAT</strong> exemptions and special regimes apply to<br />

certa<strong>in</strong> supplies of goods and services, regardless of the<br />

status of the service provider, for example, the exemption<br />

for <strong>in</strong>surance transactions may apply to supplies<br />

made by an <strong>in</strong>stitution not authorized as an “<strong>in</strong>surance<br />

company”, the exemption for f<strong>in</strong>ancial services may<br />

apply to <strong>in</strong>stitutions other than banks, the marg<strong>in</strong><br />

scheme applicable to the services of travel agents may<br />

apply to hotels, etc.<br />

On the basis of those pr<strong>in</strong>ciples and follow<strong>in</strong>g the Advocate<br />

General’s plausible view that the secondment of<br />

teachers is not the provision of education, the results are<br />

as follows. Horizon College undoubtedly qualified as a<br />

taxable person for <strong>VAT</strong> purposes, which means that, <strong>in</strong><br />

pr<strong>in</strong>ciple, all its supplies were subject to <strong>VAT</strong>. However,<br />

its educational services were exempt from <strong>VAT</strong>. Secondment<br />

of staff however could only be exempt if that<br />

transaction is covered by another exemption.<br />

Under the Sixth Directive, a specific exemption applied<br />

to the secondment of staff. Under Art. 13(A)(1)(k), 4 certa<strong>in</strong><br />

supplies of staff by religious or philosophical <strong>in</strong>stitutions<br />

for the purpose of, <strong>in</strong>ter alia, exempt educational<br />

services and with a view to spiritual welfare, were<br />

exempt from <strong>VAT</strong>. 5 That provision clearly implies that<br />

other supplies (secondment) of staff cannot possibly be<br />

exempt from <strong>VAT</strong>. It is undoubtedly true that the secondment<br />

of staff by Horizon College was made for the<br />

purposes of the educational services provided by the<br />

hir<strong>in</strong>g-<strong>in</strong> <strong>in</strong>stitutions but it cannot reasonably be ma<strong>in</strong>ta<strong>in</strong>ed<br />

that Horizon College was a religious or philosophical<br />

<strong>in</strong>stitution and that the secondment of staff<br />

took place with a view to spiritual welfare. Non-fulfilment<br />

of those conditions should have led to the conclusion<br />

that Horizon College’s secondment of staff was subject<br />

to <strong>VAT</strong>.<br />

Instead of draw<strong>in</strong>g that straightforward conclusion, the<br />

Advocate General exam<strong>in</strong>ed whether or not Horizon<br />

College’s secondment of staff could be exempt on the<br />

ground that it is a supply of goods and services “closely<br />

related” to the educational services rendered by Horizon<br />

College. 6<br />

Subsequently, the Advocate General exam<strong>in</strong>ed the<br />

restrictions applicable to the exemption for educational<br />

services rendered by bodies other than those <strong>gov</strong>erned<br />

by public law. Apart from the optional restrictions to be<br />

set by the <strong>in</strong>dividual Member States7 , those restrictions<br />

are that the exemption for, <strong>in</strong> this case, educational services<br />

and closely related supplies does not apply to private<br />

entities, firstly, where the supply of goods and service is<br />

not essential to the exempt transactions8 and, secondly,<br />

where its basic purpose is to obta<strong>in</strong> additional <strong>in</strong>come9 for the organization by carry<strong>in</strong>g out transactions which<br />

are <strong>in</strong> direct competition with those of commercial<br />

enterprises liable for <strong>VAT</strong>. Although it is obvious that, <strong>in</strong><br />

order to qualify as “closely related”, the supply must be<br />

made by the person who makes the pr<strong>in</strong>cipal exempt<br />

supply and that also the above restrictions must apply to<br />

the “closely related” supplies made by the supplier of the<br />

exempt educational services (Horizon College), the<br />

Advocate General made the remarkable manoeuvre of<br />

<strong>in</strong>terpret<strong>in</strong>g the concept of closely related supplies and<br />

the first restriction as apply<strong>in</strong>g to the transactions carried<br />

out by Horizon College’s customers. 10 In other<br />

words, Horizon College is supposed to determ<strong>in</strong>e<br />

whether or not its supply (secondment of staff) is<br />

exempt from <strong>VAT</strong> on the basis of an assessment of<br />

whether or not that secondment is essential to its customers’<br />

educational services. It is logical that Horizon<br />

College took that view because it had no other plausible<br />

arguments <strong>in</strong> support of its claim that the secondment of<br />

staff was exempt from <strong>VAT</strong> but it is, to say the least,<br />

remarkable that the Commission supported it.<br />

If the new11 policy becomes that taxable persons must<br />

apply exemptions on the basis of criteria that are beyond<br />

their horizon, <strong>VAT</strong> has truly become a highly complex<br />

tax.<br />

3. See note 1, phrase highlighted <strong>in</strong> italics. The “closely related” supplies<br />

<strong>in</strong>clude, for example, provision of educational materials or field trips, for consideration.<br />

4. Art. 132(1)(k) of Directive 2006/112.<br />

5. That exemption cont<strong>in</strong>ues to apply under Art. 132(1)(k) of Directive<br />

2006/112.<br />

6. The expression “thereto” <strong>in</strong> “closely related thereto” clearly refers to the<br />

service provider’s exempt educational services.<br />

7. Those conditions are laid down by Art. 13(A)(2)(a) of the Sixth Directive<br />

(Art. 133 of Directive 2006/112) and <strong>in</strong>clude non-profit-mak<strong>in</strong>g aims,<br />

voluntary management, approved maximum prices, and not result<strong>in</strong>g <strong>in</strong> distortion<br />

of competition.<br />

8. It is highly doubtful that it can reasonably be ma<strong>in</strong>ta<strong>in</strong>ed that the<br />

secondment of teachers by Horizon College was essential to its educational<br />

services.<br />

9. The relationship between that restriction (see Art. 134(b)) and<br />

Art. 13(A)(1)(o) of the Sixth Directive (Art. 132(1)(o) of Directive 2006/112),<br />

which provides for a separate exemption for fund-rais<strong>in</strong>g events organized by<br />

<strong>in</strong>stitutions, <strong>in</strong>clud<strong>in</strong>g educational <strong>in</strong>stitutions whose supplies are covered by<br />

specific exemptions, is not entirely clear.<br />

10. The Advocate General noted that, if students are receiv<strong>in</strong>g education or<br />

vocational tra<strong>in</strong><strong>in</strong>g from an educational <strong>in</strong>stitution, and that <strong>in</strong>stitution suffers<br />

a temporary shortage of qualified teachers or <strong>in</strong>structors, then the benefit<br />

of the education or tra<strong>in</strong><strong>in</strong>g received will be greatly enhanced by the secondment<br />

of qualified staff from another such <strong>in</strong>stitution. It is true that that view is<br />

obviously correct, as a matter of common sense, but it is equally obvious that<br />

the benefit derived by the customer from a certa<strong>in</strong> supply has noth<strong>in</strong>g to do<br />

with the relationship between that supply and the supplier’s other supplies.<br />

11. That policy would not be entirely new because <strong>in</strong> its judgment of 9 February<br />

2006 <strong>in</strong> Sticht<strong>in</strong>g K<strong>in</strong>deropvang Enschede v. Staatssecretaris van F<strong>in</strong>anciën,<br />

Case C-415/04, [2006] ECR I-1385, the <strong>ECJ</strong> followed a similar approach.<br />

Regardless of the results, that l<strong>in</strong>e of reason<strong>in</strong>g should not have been adopted.<br />

224 INTERNATIONAL <strong>VAT</strong> MONITOR <strong>MAY</strong>/<strong>JUNE</strong> <strong>2007</strong> © IBFD

In addition, educational <strong>in</strong>stitutions hir<strong>in</strong>g out teachers<br />

can easily manipulate the applicable <strong>VAT</strong> regime:<br />

depend<strong>in</strong>g on the tax regime applicable to their customers’<br />

services, the hir<strong>in</strong>g-out <strong>in</strong>stitutions will claim<br />

that the secondment is or is not essential to their customers’<br />

educational services. That claim cannot possibly<br />

be verified on the basis of objective evidence held by the<br />

hir<strong>in</strong>g-out <strong>in</strong>stitution.<br />

F<strong>in</strong>ally, the Advocate General’s approach throws a peculiar<br />

light on the statement made by the Commission a<br />

couple of years ago <strong>in</strong> order to justify its <strong>in</strong>tention to<br />

“modernize” the exemptions for social, educational, cultural<br />

and other activities. 12 If the adverse consequences<br />

of the outsourc<strong>in</strong>g of activities and hir<strong>in</strong>g-<strong>in</strong> of staff by<br />

<strong>in</strong>stitutions engaged <strong>in</strong> those exempt transactions are to<br />

be mitigated by a broad and flexible <strong>in</strong>terpretation of the<br />

exist<strong>in</strong>g exemptions, the “modernization” of the <strong>VAT</strong> legislation<br />

has become an autonomous and cont<strong>in</strong>uous<br />

process beyond the control of the European legislature.<br />

The Advocate General’s l<strong>in</strong>e of reason<strong>in</strong>g does not<br />

directly lead to a conclusion as regards the <strong>VAT</strong> regime<br />

applicable to the secondment of teachers by Horizon<br />

College. In order for the exemption to apply, several<br />

other hurdles must be taken: firstly, Horizon College’s<br />

customers must use the hired-<strong>in</strong> teachers for the purpose<br />

of provid<strong>in</strong>g education with<strong>in</strong> the mean<strong>in</strong>g of Art.<br />

13(A)(1)(i); secondly, the supply of staff must be essential<br />

to the exempt transactions, i.e. it must be of such a<br />

nature or quality that the customers could not be<br />

assured of obta<strong>in</strong><strong>in</strong>g a service of the same value without<br />

the secondment of teach<strong>in</strong>g staff from Horizon College;<br />

thirdly, the basic purpose must not be to obta<strong>in</strong> additional<br />

<strong>in</strong>come, which <strong>in</strong>cludes reduction of Horizon<br />

College’s loss aris<strong>in</strong>g from the situation that it would<br />

have to pay the seconded teachers’ salary without hav<strong>in</strong>g<br />

sufficient employment for them; fourthly, Horizon College<br />

must comply with the conditions the Member States<br />

are entitled to impose under Art. 13(A)(2)(a) 13 of the<br />

Sixth Directive; and f<strong>in</strong>ally, Horizon College must have<br />

the status of a body or organization referred to <strong>in</strong> Art.<br />

13(A)(1)(i) of that Directive. It must reasonably be<br />

assumed that, <strong>in</strong> particular the second and third conditions,<br />

as formulated by the Advocate General, are prohibitive<br />

for application of the exemption.<br />

Walter van der Corput<br />

Op<strong>in</strong>ion of 19 April <strong>2007</strong>: Case C-73/06 Planzer<br />

Luxembourg Sàrl v. Bundeszentralamt für Steuern<br />

The transport company Planzer Luxembourg Sàrl<br />

(Planzer) had its seat <strong>in</strong> Luxembourg. Its sole shareholder<br />

was Planzer Transport AG, which had its seat <strong>in</strong><br />

Switzerland.<br />

At the place where Planzer Luxembourg had its seat, Mr<br />

Deltgen ran the company Helvetica House from which<br />

Planzer had rented office space. As representative of its<br />

sole shareholder, Mr Deltgen had assumed the task of<br />

undertak<strong>in</strong>g whatever was necessary to establish Planzer<br />

Luxembourg. The managers of Planzer Luxembourg<br />

were two employees of Planzer Transport AG. One of<br />

<strong>ECJ</strong> <strong>VAT</strong> <strong>Cases</strong><br />

them was resident <strong>in</strong> Switzerland and the other <strong>in</strong> Italy.<br />

Thirteen other bus<strong>in</strong>esses, three of which were subsidiaries<br />

of Swiss transport companies, had their address<br />

at Planzer Luxembourg.<br />

Planzer requested a <strong>VAT</strong> refund from the German tax<br />

authorities for <strong>VAT</strong> paid on fuel purchased <strong>in</strong> Germany.<br />

When fil<strong>in</strong>g the refund request, Planzer attached a certificate<br />

based on Annex B to the Eighth Directive<br />

(79/1072/EEC), which stated that Planzer was subject to<br />

<strong>VAT</strong> <strong>in</strong> Luxembourg and had a Luxembourg <strong>VAT</strong> identification<br />

number.<br />

On the ground that Planzer did not have a telephone<br />

connection at its address <strong>in</strong> Luxembourg, the German<br />

authorities refused to grant the refund argu<strong>in</strong>g that<br />

Planzer was established not <strong>in</strong> Luxembourg, but outside<br />

the European Union.<br />

As regards the questions of whether or not a certificate<br />

based on Annex B to the Eighth Directive constituted an<br />

irrefutable assumption that the taxable person was<br />

established <strong>in</strong> the Member State issu<strong>in</strong>g the certificate,<br />

and if not, whether the term “bus<strong>in</strong>ess” refers to the place<br />

where the company has its registered office or where<br />

management decisions or decisions vital to normal<br />

every-day operations are taken, Advocate General Verica<br />

Trstenjak delivered her op<strong>in</strong>ion on 19 April <strong>2007</strong>. She<br />

proposed that the <strong>ECJ</strong> should answer the questions<br />

referred to it by the F<strong>in</strong>anzgericht Köln (Germany) as follows:<br />

(1) An undertak<strong>in</strong>g’s certificate drawn up <strong>in</strong> accordance<br />

with the specimen form <strong>in</strong> Annex B to the Eighth<br />

Council Directive 79/1072/EEC of 6 December<br />

1979, merely <strong>in</strong>dicates that an undertak<strong>in</strong>g is subject<br />

to <strong>VAT</strong> and, therefore, does not create an irrefutable<br />

assumption that the undertak<strong>in</strong>g is established <strong>in</strong><br />

the state that issued the certificate.<br />

(2) The term “bus<strong>in</strong>ess” <strong>in</strong> Art. 1(1) of the Thirteenth<br />

Directive is identical to that used to determ<strong>in</strong>e the<br />

place of supply of services and, <strong>in</strong> view of the <strong>ECJ</strong>’s<br />

case law on the taxable person’s place of bus<strong>in</strong>ess and<br />

fixed establishment, must be construed as mean<strong>in</strong>g<br />

the place where the undertak<strong>in</strong>g’s economic activity<br />

is actually carried out and is characterized by a comb<strong>in</strong>ation<br />

of human and technical resources necessary<br />

for the purpose of carry<strong>in</strong>g out that activity<br />

<strong>in</strong>dependently. In view of possible schemes set up<br />

for the purpose of manipulat<strong>in</strong>g the tax regime, she<br />

added that, unless proven otherwise, that place is the<br />

undertak<strong>in</strong>g’s statutory seat.<br />

[Unofficial translation]<br />

12. Communication from the Commission to the Council and the European<br />

Parliament: A strategy to improve the operation of the <strong>VAT</strong> system<br />

with<strong>in</strong> the context of the <strong>in</strong>ternal market, COM(2000) 348 f<strong>in</strong>al, Annex,<br />

po<strong>in</strong>t 2.1.<br />

13. See Art. 133 of Directive 2006/112.<br />

© IBFD INTERNATIONAL <strong>VAT</strong> MONITOR <strong>MAY</strong>/<strong>JUNE</strong> <strong>2007</strong> 225

<strong>ECJ</strong> <strong>VAT</strong> <strong>Cases</strong><br />

Op<strong>in</strong>ion of 29 March <strong>2007</strong>: Case C-97/06 Navicon SA<br />

v. Adm<strong>in</strong>istración del Estado<br />

Navicon and the company Compañía Transatlántica<br />

Española SA had entered <strong>in</strong>to a partial charter<strong>in</strong>g agreement<br />

under which the former provided the latter, aga<strong>in</strong>st<br />

payment of a sum, with part of the space on its vessels to<br />

transport conta<strong>in</strong>ers between various ports on the Iberian<br />

pen<strong>in</strong>sula and a place outside the EU <strong>VAT</strong> territory<br />

(the Canary Islands).<br />

Navicon had not charged <strong>VAT</strong> to its customer reason<strong>in</strong>g<br />

that the transaction was zero rated or, <strong>in</strong> the term<strong>in</strong>ology<br />

of the Sixth Directive, exempt from <strong>VAT</strong> with the right<br />

to deduct <strong>in</strong>put tax. The Spanish tax authorities had not<br />

accepted the zero rate because, under Spanish law, only<br />

full charter<strong>in</strong>g, not partial charter<strong>in</strong>g, is zero rated.<br />

As regards the Tribunal Superior de Justicia de Madrid<br />

(Spa<strong>in</strong>) questions of whether the term “charter<strong>in</strong>g” <strong>in</strong><br />

Art. 15(5) of the Sixth Directive must be <strong>in</strong>terpreted as<br />

cover<strong>in</strong>g only charter<strong>in</strong>g of the entire capacity of a vessel<br />

(full charter<strong>in</strong>g) or also <strong>in</strong>cludes charter<strong>in</strong>g of a part or<br />

percentage of a vessel’s capacity (partial charter<strong>in</strong>g), and<br />

whether or not the Sixth Directive precludes that only<br />

full charter<strong>in</strong>g is zero rated under national law, Advocate<br />

General Mazák delivered his op<strong>in</strong>ion on 29 March <strong>2007</strong>.<br />

He proposed that the <strong>ECJ</strong> should answer the questions<br />

referred to it as follows:<br />

“(1)The term ‘charter<strong>in</strong>g’ <strong>in</strong> the exemption provided for<br />

<strong>in</strong> Art. 15(5) of Sixth Council Directive 77/388/EEC<br />

of 17 May 1977 on the harmonization of the laws of<br />

the Member States relat<strong>in</strong>g to turnover taxes – Common<br />

system of value added tax: uniform basis of<br />

assessment, as amended by Council Directive<br />

92/111/EEC of 14 December 1992, is to be <strong>in</strong>terpreted<br />

as <strong>in</strong>clud<strong>in</strong>g both charter<strong>in</strong>g of the entire<br />

capacity of the vessel (full charter<strong>in</strong>g) and charter<strong>in</strong>g<br />

relat<strong>in</strong>g to a part or percentage of the vessel’s capacity<br />

(partial charter<strong>in</strong>g).<br />

(2) The Sixth Directive precludes a national law which<br />

allows exemption only for full charter<strong>in</strong>g.”<br />

President’s Orders<br />

President’s Order of 23 March <strong>2007</strong>: C-368/06<br />

Cedilac SA v. M<strong>in</strong>istère de l’Économie, des F<strong>in</strong>ances et<br />

de l’Industrie<br />

In the course of the proceed<strong>in</strong>g between Cedilac SA and<br />

the French M<strong>in</strong>istry of Economy, F<strong>in</strong>ance and Industry,<br />

the Adm<strong>in</strong>istrative Court Lyon had referred prelim<strong>in</strong>ary<br />

questions to the <strong>ECJ</strong> on the <strong>in</strong>terpretation of the Arts. 17<br />

and 18(4) of the Sixth Directive as regards Cedilac’s<br />

claim for damages from the French state on the ground<br />

that the national provisions accompany<strong>in</strong>g the repeal of<br />

the one-month delay rule for refunds of <strong>VAT</strong> were compatible<br />

with Community law.<br />

By its request of 26 February <strong>2007</strong>, a third party, the<br />

company SAS Fromagerie des Chaumes, requested to be<br />

admitted to the proceed<strong>in</strong>gs as <strong>in</strong>tervener for the purpose<br />

of submitt<strong>in</strong>g its observations as regards the conformity<br />

of the disputed French provisions with<br />

Community law. In that framework, the third party<br />

claimed that it was <strong>in</strong> the same position as Cedilac and,<br />

just like the latter company, that it had started an action<br />

for damages before the Adm<strong>in</strong>istrative Court Pau. That<br />

court had also raised questions on the <strong>in</strong>terpretation of<br />

Community law identical to those that were the subject<br />

of the present case. However, that court had observed<br />

that, <strong>in</strong> view of the fact that the case of Cedilac was<br />

pend<strong>in</strong>g before the <strong>ECJ</strong>, referral of prejudicial questions<br />

to the <strong>ECJ</strong> was not necessary.<br />

As regards Fromagerie des Chaumes’ request, the President<br />

of the <strong>ECJ</strong> observed that it is settled <strong>ECJ</strong> case law<br />

that the procedure to jo<strong>in</strong> the proceed<strong>in</strong>gs <strong>in</strong> the case of<br />

prelim<strong>in</strong>ary questions, is <strong>gov</strong>erned by Art. 23(1) and (2)<br />

of the Statute of the <strong>ECJ</strong>, which provides that the right to<br />

submit observations is limited to “the parties”, the Member<br />

States and the Commission, as well as, where appropriate,<br />

the Council, the European Parliament and the<br />

European Central Bank. In that context, the expression<br />

“parties” only refers to those that have that status <strong>in</strong> the<br />

proceed<strong>in</strong>gs before the national court. Consequently,<br />

persons who have not requested to be admitted to the<br />

proceed<strong>in</strong>gs before the national court and have not been<br />

admitted to those proceed<strong>in</strong>gs are not entitled to submit<br />

their observations to the <strong>ECJ</strong>.<br />

On those grounds, by its order of 23 March <strong>2007</strong>, the<br />

President of the <strong>ECJ</strong> declared Fromagerie des Chaumes’<br />

request <strong>in</strong>admissible.<br />

[Unofficial translation]<br />

New <strong>Cases</strong><br />

Prelim<strong>in</strong>ary rul<strong>in</strong>g: Case C-25/07 Alicja Sosnowska v.<br />

Izba Skarbowa we Wrocławiu Ośrodek Zamiejscowy w<br />

Wałbrzychu<br />

Reference has been made to the Court of Justice of the<br />

European Communities by order of the Wojewódzki Sąd<br />

Adm<strong>in</strong>istracyjny we Wrocławiu (Poland) of 25 January<br />

<strong>2007</strong>, for a prelim<strong>in</strong>ary rul<strong>in</strong>g on the follow<strong>in</strong>g questions:<br />

“(1)Does the third paragraph of Art. 5 EC, <strong>in</strong> conjunction<br />

with Art. 2 of First Council Directive<br />

67/227/EEC 14 of 11 April 1967 on the harmonization<br />

of legislation of Member States concern<strong>in</strong>g<br />

turnover taxes and Art. 18(4) of Sixth Council Directive<br />

77/388/EEC of 17 May 1977 on the harmonization<br />

of the laws of the Member States relat<strong>in</strong>g to<br />

turnover taxes – Common system of value added<br />

tax: uniform basis of assessment, confer on a Member<br />

State the right to <strong>in</strong>corporate <strong>in</strong>to national provisions<br />

on the tax on goods and services the rules<br />

laid down <strong>in</strong> Arts. 97(5) and (7) of the Ustawa o<br />

podatku od towarów i usług (Law on the tax on goods<br />

and services) of 11 March 2004 …?<br />

14. OJ L 71, 1967, p. 1301.<br />

226 INTERNATIONAL <strong>VAT</strong> MONITOR <strong>MAY</strong>/<strong>JUNE</strong> <strong>2007</strong> © IBFD

(2) Do the rules laid down <strong>in</strong> Arts. 97(5) and (7) of the<br />

Ustawa o podatku od towarów i usług of 11 March<br />

2004 … constitute special measures to prevent certa<strong>in</strong><br />

types of tax evasion and avoidance with<strong>in</strong> the<br />

mean<strong>in</strong>g of Art. 27(1) of the Sixth Directive?”<br />

Case note<br />

Under Art. 97(1) of the <strong>VAT</strong> Law, 15 taxable persons are<br />

obliged to <strong>in</strong>form the tax authorities about their <strong>in</strong>tent<br />

to make <strong>in</strong>tra-Community supplies or effect <strong>in</strong>tra-<br />

Community acquisitions of goods, no later than the day<br />

before those events occur for the first time.<br />

Under Art. 97(5) of the <strong>VAT</strong> Law, taxable persons who<br />

commence their bus<strong>in</strong>ess activities <strong>in</strong> the framework of<br />

which they carry out transactions subject to <strong>VAT</strong>, and<br />

those who have commenced those activities less than 12<br />

months before provid<strong>in</strong>g the <strong>in</strong>formation required<br />

under Art. 97(1), are generally entitled to a refund of<br />

excess <strong>in</strong>put tax with<strong>in</strong> 180 days from the date of fil<strong>in</strong>g<br />

the <strong>VAT</strong> return. Other taxable persons are generally entitled<br />

to a refund with<strong>in</strong> a period of 60 days (Art. 87(2) of<br />

the <strong>VAT</strong> Law). The extended refund period set by Art.<br />

97(5) does, however, not apply where the taxable person<br />

has made a deposit (kaucja) of an amount of PLN<br />

250,000 (EUR 65,000) with the tax authorities (Art.<br />

97(7) of the <strong>VAT</strong> Law). That deposit may take the form<br />

of either a f<strong>in</strong>ancial security (zabezpieczenie majątkowe)<br />

or bank guarantee (gwarancja bankowa). Taxable persons<br />

may apply to the tax authorities for release of the<br />

deposit after 12 months, on the condition that they have<br />

filed their <strong>VAT</strong> returns on a timely basis and remitted<br />

the <strong>VAT</strong> due, as well as other taxes payable to the state.<br />

Under Art. 87(5) of the <strong>VAT</strong> Law, on reasoned application,<br />

taxable persons who supply goods dest<strong>in</strong>ed to leave<br />

the Polish territory, or supply goods or services outside<br />

Poland, and do not carry out any transactions subject to<br />

Polish <strong>VAT</strong>, are entitled to a refund of <strong>in</strong>put tax with<strong>in</strong> 60<br />

days from the date of fil<strong>in</strong>g the return. Depend<strong>in</strong>g on the<br />

circumstances, the tax authorities must repay the <strong>in</strong>put<br />

tax with<strong>in</strong> 25 or 60 days, if the <strong>in</strong>put tax shown on the<br />

<strong>VAT</strong> return relates to, <strong>in</strong>ter alia, <strong>in</strong>tra-Community supplies<br />

of goods (Art. 87(6) of the <strong>VAT</strong> Law).<br />

Alicja Sosnowska (trad<strong>in</strong>g as Cztery Pory Roku) had<br />

been runn<strong>in</strong>g a bus<strong>in</strong>ess s<strong>in</strong>ce 31 September 2005. On<br />

22 February 2006, this taxable person filed a <strong>VAT</strong> return<br />

for January 2006, which <strong>in</strong>cluded <strong>in</strong>tra-Community<br />

supplies of goods with a value of PLN 261,427 and<br />

acquisitions with a value of PLN 57,897. The <strong>VAT</strong> return<br />

resulted <strong>in</strong> a net claim of PLN 44,782, which, accord<strong>in</strong>g<br />

to the taxable person, was to be refunded with<strong>in</strong> 60 days.<br />

In that respect, the taxable person relied on, <strong>in</strong>ter alia,<br />

Art. 18(4) of the Sixth Directive, 16 as well as the provisions<br />

of the Constitution. 17<br />

By their decision of 21 April 2006, the tax authorities<br />

refused to repay the <strong>in</strong>put <strong>VAT</strong> with<strong>in</strong> the 60-day period<br />

on the ground that the applicant had not made the<br />

required deposit.<br />

<strong>ECJ</strong> <strong>VAT</strong> <strong>Cases</strong><br />

On appeal before the Director of the Izba Skarbowa<br />

(regional tax office) <strong>in</strong> Wrocław, the taxable person<br />

claimed that the tax authorities’ refusal to repay the <strong>VAT</strong><br />

with<strong>in</strong> 60 days was <strong>in</strong> violation of Arts. 2 (pr<strong>in</strong>ciple of<br />

democracy) and 32 (pr<strong>in</strong>ciples of equality and proportionality)<br />

of the Constitution, Art. 87(5) and (6) of the<br />

<strong>VAT</strong> Law, and Art. 18(4) of the Sixth Directive. Furthermore,<br />

the taxable person contested that the Polish<br />

refund procedure discrim<strong>in</strong>ated aga<strong>in</strong>st start-up bus<strong>in</strong>esses,<br />

limit<strong>in</strong>g their chances of survival <strong>in</strong> a competitive<br />

market.<br />

The Director upheld the <strong>in</strong>itial decision of the tax<br />

authorities contend<strong>in</strong>g that, under Art. 97(5) of the <strong>VAT</strong><br />

Law, the refund was to be made with<strong>in</strong> a 180-day period.<br />

Furthermore, s<strong>in</strong>ce they do not provide for a maximum<br />

refund period, the provisions of the Sixth Directive<br />

could not possibly have been violated. He also po<strong>in</strong>ted<br />

out that the refund application had not been rejected<br />

and, therefore, the pr<strong>in</strong>ciple of <strong>VAT</strong>’s neutrality had not<br />

been <strong>in</strong>fr<strong>in</strong>ged.<br />

In the course of the subsequent proceed<strong>in</strong>gs, the<br />

Wojewódzki Sąd Adm<strong>in</strong>istracyjny (regional adm<strong>in</strong>istrative<br />

court) <strong>in</strong> Wrocław referred prelim<strong>in</strong>ary questions to<br />

the <strong>ECJ</strong> on 25 January <strong>2007</strong>. 18 The national court asked<br />

the <strong>ECJ</strong> whether or not the third paragraph of Art. 5 EC,<br />

<strong>in</strong> conjunction with Art. 2 of the First and Art. 18(4) of<br />

the Sixth Directives, confer on a Member State the right<br />

to <strong>in</strong>corporate <strong>in</strong>to its national legislation the rules laid<br />

down by Art. 97(5) and (7) of the <strong>VAT</strong> Law. The court<br />

also asked the <strong>ECJ</strong> whether or not the rules laid down by<br />

Art. 97(5) and (7) of the <strong>VAT</strong> Law constitute a special<br />

measure aimed at prevent<strong>in</strong>g certa<strong>in</strong> types of tax evasion<br />

and avoidance with<strong>in</strong> the mean<strong>in</strong>g of Art. 27(1) of the<br />

Sixth Directive. 19<br />

Adam Biegalski, University of Warmia and Mazury,<br />

Olsztyn, and Krzysztof Lasiński-Sulecki<br />

Nicholas Copernicus University, Toruń.<br />

Prelim<strong>in</strong>ary rul<strong>in</strong>g: <strong>Cases</strong> C-95/07 and C-96/07<br />

Ecotrade SpA v. Agenzia Entrate Ufficio Genova 3<br />

Reference has been made to the Court of Justice by<br />

orders of the Commissione Tributaria Prov<strong>in</strong>ciale di Ge-<br />

15. Ustawa z dnia 11 marca 2004 r. o podatku od towarów i usług, Journal of<br />

Laws 2004, No. 54, item 535, as amended.<br />

16. With effect from 1 January <strong>2007</strong>, Art. 18(4) of the Sixth Directive has<br />

been replaced by Art. 183 of Directive 2006/112/EC of 28 November 2006, OJ<br />

L 347 of 11 December 2006.<br />

17. Konstytucja Rzeczypospolitej Polskiej z dnia 2 kwietnia 1997 r., Journal of<br />

Laws 1997, No. 78, item 483, as amended.<br />

18. Reference for a prelim<strong>in</strong>ary rul<strong>in</strong>g <strong>in</strong> Alicja Sosnowska v. Dyrektor Izby<br />

Skarbowej we Wrocławiu – Ośrodek Zamiejscowy w Wałbrzychu, Case C-25/07.<br />

19. Art. 27(1) of the Sixth Directive, which corresponded to Art. 395(1) of<br />

Directive 2006/112, provided that the Council, act<strong>in</strong>g unanimously on a proposal<br />

from the Commission, may authorize any Member State to <strong>in</strong>troduce<br />

special measures for derogation from the provisions of this Directive, <strong>in</strong> order<br />

to simplify the procedure for charg<strong>in</strong>g the tax or to prevent certa<strong>in</strong> types of<br />

tax evasion or avoidance. Measures <strong>in</strong>tended to simplify the procedure for<br />

charg<strong>in</strong>g the tax, except to a negligible extent, may not affect the overall<br />

amount of the tax revenue of the Member State collected at the stage of f<strong>in</strong>al<br />

consumption.<br />

© IBFD INTERNATIONAL <strong>VAT</strong> MONITOR <strong>MAY</strong>/<strong>JUNE</strong> <strong>2007</strong> 227

<strong>ECJ</strong> <strong>VAT</strong> <strong>Cases</strong><br />

nova (Italy) of 20 February <strong>2007</strong>, for prelim<strong>in</strong>ary rul<strong>in</strong>gs<br />

on the follow<strong>in</strong>g questions:<br />

“Does a correct <strong>in</strong>terpretation of Arts. 17, 21(1) and 22<br />

of the Sixth Council Directive 77/388/EEC of 17 May<br />

1977 on the harmonization of the laws of the Member<br />

States relat<strong>in</strong>g to turnover taxes preclude national legislation<br />

(<strong>in</strong> particular Art. 19 of DPR 633 of 26/10/72) that<br />

makes the exercise of the right to deduct value added tax,<br />

payable by a taxable person <strong>in</strong> the pursuit of his bus<strong>in</strong>ess<br />

activities, dependent on compliance with a (two-year)<br />

time limit and penalizes non-compliance with annulment<br />

of that right? That question is asked with reference,<br />

<strong>in</strong> particular, to cases where the liability to <strong>VAT</strong> on the<br />

purchase of the goods or service stems from the application<br />

of the reverse charge procedure, which allows the<br />

authorities a longer period (of four years under Art. 57<br />

of DPR 633/72) <strong>in</strong> which to demand payment of the<br />

duty than the period allowed to the trader for deduction<br />

of the duty, on expiry of which the trader’s right to such<br />

deduction lapses.<br />

Does it follow from a correct <strong>in</strong>terpretation of Art.<br />

18(1)(d) of the Sixth Council Directive 77/388/EEC of<br />

17 May 1977 that national legislation may not, <strong>in</strong> regulat<strong>in</strong>g<br />

the ‘formalities’ referred to <strong>in</strong> that provision by<br />

means of the reverse charge procedure <strong>gov</strong>erned by the<br />

comb<strong>in</strong>ed provisions of Arts. 17(3), 23 and 25 of DPR<br />

633/72, make (solely to the detriment of the taxpayer)<br />

the exercise of the right to deduct permitted by Art. 17 of<br />

the Directive conditional upon compliance with a time<br />

limit such as that laid down <strong>in</strong> Art. 19 of DPR 633/72?”<br />

Prelim<strong>in</strong>ary rul<strong>in</strong>g: Case C-98/07 Nordania F<strong>in</strong>ans<br />

A/S and BG Factor<strong>in</strong>g A/S v. Skattem<strong>in</strong>isteriet<br />

Reference has been made to the Court of Justice of the<br />

European Communities by order of the Højesteret (Denmark)<br />

of 22 February <strong>2007</strong>, for a prelim<strong>in</strong>ary rul<strong>in</strong>g on<br />

the follow<strong>in</strong>g question:<br />

“Is the expression ‘capital goods used by the taxable person<br />

for the purposes of his bus<strong>in</strong>ess’ conta<strong>in</strong>ed <strong>in</strong> Art.<br />

19(2) of Sixth Council Directive 77/388/EEC of 17 May<br />

1977 on the harmonization of the laws of the Member<br />

States relat<strong>in</strong>g to turnover taxes – Common system of<br />

value added tax: uniform basis of assessment, to be <strong>in</strong>terpreted<br />

as cover<strong>in</strong>g goods which a leas<strong>in</strong>g undertak<strong>in</strong>g<br />

purchases with a view both to leas<strong>in</strong>g and resale upon<br />

term<strong>in</strong>ation of the leas<strong>in</strong>g contract?”<br />

Prelim<strong>in</strong>ary rul<strong>in</strong>g: Case C-124/07 J.C.M. Beheer B.V.<br />

v. Staatssecretaris van F<strong>in</strong>anciën<br />

Reference has been made to the Court of Justice of the<br />

European Communities by order of the Hoge Raad der<br />

Nederlanden of 2 March <strong>2007</strong>, for a prelim<strong>in</strong>ary rul<strong>in</strong>g<br />

on the follow<strong>in</strong>g question:<br />

“Do the provisions of Art. 13(B)(a) of the Sixth Directive<br />

extend to activities of a (legal) person which performs<br />

characteristic and essential activities of an <strong>in</strong>surance<br />

broker and <strong>in</strong>surance agent, whereby negotiations are<br />

carried out <strong>in</strong> the name of another <strong>in</strong>surance broker or<br />

<strong>in</strong>surance agent <strong>in</strong> connection with the br<strong>in</strong>g<strong>in</strong>g about<br />

of <strong>in</strong>surance transactions?”<br />

Removals<br />

Removal: Case C-42/05 Belgium State v. R<strong>in</strong>g<br />

Occasions SA, <strong>in</strong> liquidation, Fortis Bank SA<br />

By order of 14 September 2006, the President of the<br />

Court of Justice of the European Communities has<br />

ordered the removal from the register of Case C-42/05<br />

Belgium State v. R<strong>in</strong>g Occasions SA, <strong>in</strong> liquidation, Fortis<br />

Bank SA.<br />

Removal: Case C-118/06 Diagram APS Applicazioni<br />

Prodotti Software v. Agenzia Entrate Ufficio Roma 6<br />

By order of 29 November 2006, the President of the<br />

Court of Justice of the European Communities has<br />

ordered the removal from the register of Case C-118/06:<br />

Diagram APS Applicazioni Prodotti Software v. Agenzia<br />

Entrate Ufficio Roma 6.<br />

228 INTERNATIONAL <strong>VAT</strong> MONITOR <strong>MAY</strong>/<strong>JUNE</strong> <strong>2007</strong> © IBFD