Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

often a key priority, not least because the investors in those funds<br />

can be important public entities such as the World Bank. In many<br />

developing markets in particular, established PE investors from<br />

abroad can lead best practice in the area of sustainability. But with<br />

companies also increasingly concerned with how they manage their<br />

pension funds and financial assets, sustainability is also important for<br />

PE/VC investors in established markets.<br />

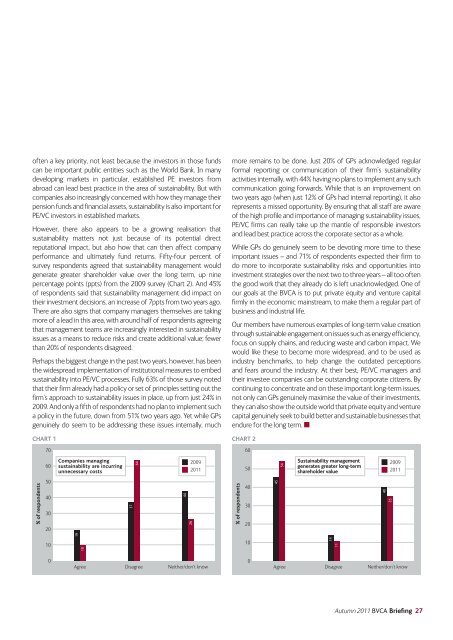

However, there also appears to be a growing realisation that<br />

sustainability matters not just because of its potential direct<br />

reputational impact, but also how that can then affect company<br />

performance and ultimately fund returns. Fifty-four percent of<br />

survey respondents agreed that sustainability management would<br />

generate greater shareholder value over the long term, up nine<br />

percentage points (ppts) from the 2009 survey (Chart 2). And 45%<br />

of respondents said that sustainability management did impact on<br />

their investment decisions, an increase of 7ppts from two years ago.<br />

There are also signs that company managers themselves are taking<br />

more of a lead in this area, with around half of respondents agreeing<br />

that management teams are increasingly interested in sustainability<br />

issues as a means to reduce risks and create additional value; fewer<br />

than 20% of respondents disagreed.<br />

Perhaps the biggest change in the past two years, however, has been<br />

the widespread implementation of institutional measures to embed<br />

sustainability into PE/VC processes. Fully 63% of those survey noted<br />

that their firm already had a policy or set of principles setting out the<br />

firm’s approach to sustainability issues in place, up from just 24% in<br />

2009. And only a fifth of respondents had no plan to implement such<br />

a policy in the future, down from 51% two years ago. Yet while GPs<br />

genuinely do seem to be addressing these issues internally, much<br />

ChArT 1 ChArT 2<br />

% of respondents<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Companies managing<br />

sustainability are incurring<br />

unnecessary costs<br />

19<br />

10<br />

37<br />

64<br />

Agree Disagree Neither/don’t know<br />

44<br />

2011<br />

26 2009<br />

more remains to be done. Just 20% of GPs acknowledged regular<br />

formal reporting or communication of their firm’s sustainability<br />

activities internally, with 44% having no plans to implement any such<br />

communication going forwards. While that is an improvement on<br />

two years ago (when just 12% of GPs had internal reporting), it also<br />

represents a missed opportunity. By ensuring that all staff are aware<br />

of the high profile and importance of managing sustainability issues,<br />

PE/VC firms can really take up the mantle of responsible investors<br />

and lead best practice across the corporate sector as a whole.<br />

While GPs do genuinely seem to be devoting more time to these<br />

important issues – and 71% of respondents expected their firm to<br />

do more to incorporate sustainability risks and opportunities into<br />

investment strategies over the next two to three years – all too often<br />

the good work that they already do is left unacknowledged. One of<br />

our goals at the <strong>BVCA</strong> is to put private equity and venture capital<br />

firmly in the economic mainstream, to make them a regular part of<br />

business and industrial life.<br />

Our members have numerous examples of long-term value creation<br />

through sustainable engagement on issues such as energy efficiency,<br />

focus on supply chains, and reducing waste and carbon impact. We<br />

would like these to become more widespread, and to be used as<br />

industry benchmarks, to help change the outdated perceptions<br />

and fears around the industry. At their best, PE/VC managers and<br />

their investee companies can be outstanding corporate citizens. By<br />

continuing to concentrate and on these important long-term issues,<br />

not only can GPs genuinely maximise the value of their investments,<br />

they can also show the outside world that private equity and venture<br />

capital genuinely seek to build better and sustainable businesses that<br />

endure for the long term. n<br />

% of respondents<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

45<br />

54<br />

Sustainability management<br />

generates greater long-term<br />

shareholder value<br />

14<br />

11<br />

Agree Disagree Neither/don’t know<br />

40<br />

2011<br />

35 2009<br />

Autumn 2011 <strong>BVCA</strong> <strong>Briefing</strong> 27