Projection markovienne de processus stochastiques

Projection markovienne de processus stochastiques

Projection markovienne de processus stochastiques

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

tel-00766235, version 1 - 17 Dec 2012<br />

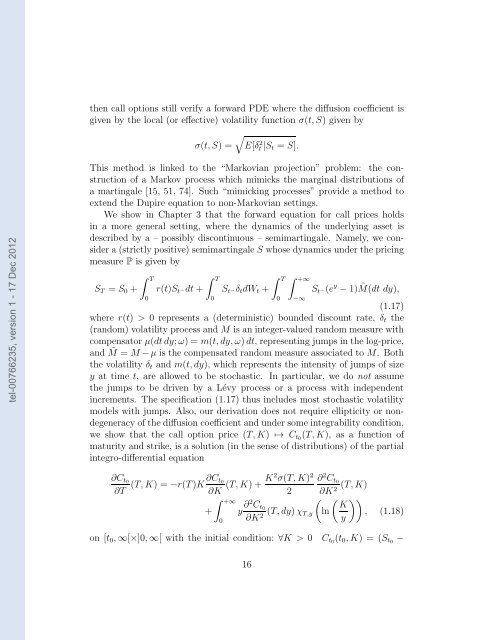

then call options still verify a forward PDE where the diffusion coefficient is<br />

given by the local (or effective) volatility function σ(t,S) given by<br />

<br />

σ(t,S) = E[δ2 t|St = S].<br />

This method is linked to the “Markovian projection” problem: the construction<br />

of a Markov process which mimicks the marginal distributions of<br />

a martingale [15, 51, 74]. Such “mimicking processes” provi<strong>de</strong> a method to<br />

extend the Dupire equation to non-Markovian settings.<br />

We show in Chapter 3 that the forward equation for call prices holds<br />

in a more general setting, where the dynamics of the un<strong>de</strong>rlying asset is<br />

<strong>de</strong>scribed by a – possibly discontinuous – semimartingale. Namely, we consi<strong>de</strong>r<br />

a (strictlypositive) semimartingale S whose dynamics un<strong>de</strong>r thepricing<br />

measure P is given by<br />

T<br />

ST = S0 +<br />

0<br />

r(t)St −dt+<br />

T<br />

0<br />

St −δtdWt +<br />

T +∞<br />

0<br />

−∞<br />

St −(ey −1) ˜ M(dt dy),<br />

(1.17)<br />

where r(t) > 0 represents a (<strong>de</strong>terministic) boun<strong>de</strong>d discount rate, δt the<br />

(random) volatility process and M is an integer-valued random measure with<br />

compensator µ(dtdy;ω)= m(t,dy,ω)dt, representing jumps in the log-price,<br />

and ˜ M = M−µ is the compensated random measure associated to M. Both<br />

the volatility δt and m(t,dy), which represents the intensity of jumps of size<br />

y at time t, are allowed to be stochastic. In particular, we do not assume<br />

the jumps to be driven by a Lévy process or a process with in<strong>de</strong>pen<strong>de</strong>nt<br />

increments. The specification (1.17) thus inclu<strong>de</strong>s most stochastic volatility<br />

mo<strong>de</strong>ls with jumps. Also, our <strong>de</strong>rivation does not require ellipticity or non<strong>de</strong>generacy<br />

ofthediffusion coefficient andun<strong>de</strong>r someintegrability condition,<br />

we show that the call option price (T,K) ↦→ Ct0(T,K), as a function of<br />

maturity and strike, is a solution (in the sense of distributions) of the partial<br />

integro-differential equation<br />

∂Ct0<br />

∂T<br />

0<br />

∂ 2 Ct0<br />

(T,K) = −r(T)K∂Ct0<br />

∂K (T,K)+ K2σ(T,K) 2<br />

2<br />

+∞<br />

+ y ∂2 <br />

Ct0 K<br />

(T,dy)χT,y ln<br />

∂K2 y<br />

(T,K)<br />

∂K2 <br />

, (1.18)<br />

on [t0,∞[×]0,∞[ with the initial condition: ∀K > 0 Ct0(t0,K) = (St0 −<br />

16

![[tel-00433556, v1] Relation entre Stress Oxydant et Homéostasie ...](https://img.yumpu.com/19233319/1/184x260/tel-00433556-v1-relation-entre-stress-oxydant-et-homeostasie-.jpg?quality=85)