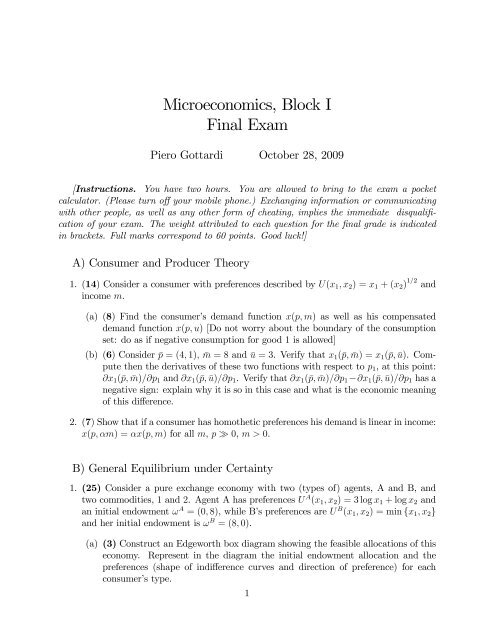

Microeconomics, Block I Final Exam

Microeconomics, Block I Final Exam

Microeconomics, Block I Final Exam

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Microeconomics</strong>, <strong>Block</strong> I<br />

<strong>Final</strong> <strong>Exam</strong><br />

Piero Gottardi October 28, 2009<br />

[Instructions. You have two hours. You are allowed to bring to the exam a pocket<br />

calculator. (Please turn off your mobile phone.) Exchanging information or communicating<br />

with other people, as well as any other form of cheating, implies the immediate disqualification<br />

of your exam. The weight attributed to each question for the final grade is indicated<br />

in brackets. Full marks correspond to 60 points. Good luck!]<br />

A) Consumer and Producer Theory<br />

1. (14) Consider a consumer with preferences described by U(x1, x2) = x1 + (x2) 1/2 and<br />

income m.<br />

(a) (8) Find the consumer’s demand function x(p, m) as well as his compensated<br />

demand function x(p, u) [Do not worry about the boundary of the consumption<br />

set: do as if negative consumption for good 1 is allowed]<br />

(b) (6) Consider ¯p = (4, 1), ¯m = 8 and ū = 3. Verify that x1(¯p, ¯m) = x1(¯p, ū). Compute<br />

then the derivatives of these two functions with respect to p1, at this point:<br />

∂x1(¯p, ¯m)/∂p1 and ∂x1(¯p, ū)/∂p1. Verify that ∂x1(¯p, ¯m)/∂p1−∂x1(¯p, ū)/∂p1 has a<br />

negative sign: explain why it is so in this case and what is the economic meaning<br />

of this difference.<br />

2. (7) Show that if a consumer has homothetic preferences his demand is linear in income:<br />

x(p, αm) = αx(p, m) for all m, p ≫ 0, m > 0.<br />

B) General Equilibrium under Certainty<br />

1. (25) Consider a pure exchange economy with two (types of) agents, A and B, and<br />

two commodities, 1 and 2. Agent A has preferences U A (x1, x2) = 3 log x1 + log x2 and<br />

an initial endowment ω A = (0, 8), while B’s preferences are U B (x1, x2) = min {x1, x2}<br />

and her initial endowment is ω B = (8, 0).<br />

(a) (3) Construct an Edgeworth box diagram showing the feasible allocations of this<br />

economy. Represent in the diagram the initial endowment allocation and the<br />

preferences (shape of indifference curves and direction of preference) for each<br />

consumer’s type.<br />

1

(b) (3) Consider the prices p1 = 1 = p2. Are these equilibrium prices? Explain why<br />

they are, or aren’t.<br />

(c) (8) Find the competitive equilibria (prices and allocation) of this economy (if<br />

they exist) and show them clearly on the diagram. Are they Pareto optimal?<br />

(d) (6) Consider the allocation where A gets (x A 1 , x A 2 ) = (4, 4) (and B gets the rest).<br />

Is this allocation Pareto optimal? If so, find the amount t ∈ R of the transfer of<br />

commodity 1 from B to A that yields this allocation as a competitive equilibrium.<br />

Compute the associated equilibrium prices.<br />

(e) (5) Suppose the equilibrium found in c. constitutes the autarky equilibrium of<br />

country I, populated by the agents of type A and B described above. There is<br />

then country II, populated by identical agents of another type, say C. Explain<br />

why, at the free trade equilibrium between countries I and II, either type A or<br />

type B gains with respect to the autarky equilibrium; it cannot be that they both<br />

loose nor that they both gain.<br />

2. (11) Consider an economy, populated by H consumers, each of them with utility<br />

function U h (xh 1, xh 2) = xh 1 + xh 1/2 h<br />

2 (as in Exercise A.1) and income m .<br />

(a) (6) Show that a representative consumer exist globally. That is, show that<br />

there exists a utility function U(x) and income level m such that the demand<br />

function x(p, m), obtained by maximizing U(x) subject to the budget constraint<br />

p · x ≤ m, equals the aggregate demand function of the economy, H h=1 xh (p, mh )<br />

for all p ≫ 0 and for all (mh ) H h=1 . [Again do not worry about the boundary of the<br />

consumption set: do as if negative consumption for good 1 is allowed]<br />

(b) (5) Suppose each consumer is endowed with an amount (ω h 1, ω h 2) of the two<br />

goods, thus his income is the market value of his endowment m h = p1ω h 1 + p2ω h 2.<br />

Explain why the economy described has a unique competitive equilibrium and<br />

how then the equilibrium prices can be found.<br />

C) General Equilibrium Under Uncertainty<br />

1. (9) Consider a pure exchange economy under uncertainty with two types of consumer<br />

(H = 2), a single commodity (L = 1) and S = 2 states of nature. The two consumers<br />

have the same preferences E log(x) = π(1) log x(1)+π(2) log x(2), with identical beliefs<br />

π(1) = 1/2. Type 1 consumer has then endowments equal to 10 units in state 1 and 4<br />

units in state 2 while type 2 has endowments equal to 2 in state 1 and to 4 in state 2.<br />

(a) (5) Find the Pareto effi cient allocations of this economy<br />

(b) [IGNORE THIS LAST QUESTION] (4) Discuss the relationship between the<br />

value of the prices (p(1), p(2)) which support any Pareto effi cient allocation as<br />

a competitive equilibrium with complete contingent markets and the probability<br />

is always greater, equal, or smaller<br />

beliefs (π(1), π(2)). Can you tell whether p(1)<br />

p(2)<br />

than π(1)<br />

? Explain.<br />

π(2)