US GAAP vs. IFRS The basics - Financial Executives International

US GAAP vs. IFRS The basics - Financial Executives International

US GAAP vs. IFRS The basics - Financial Executives International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

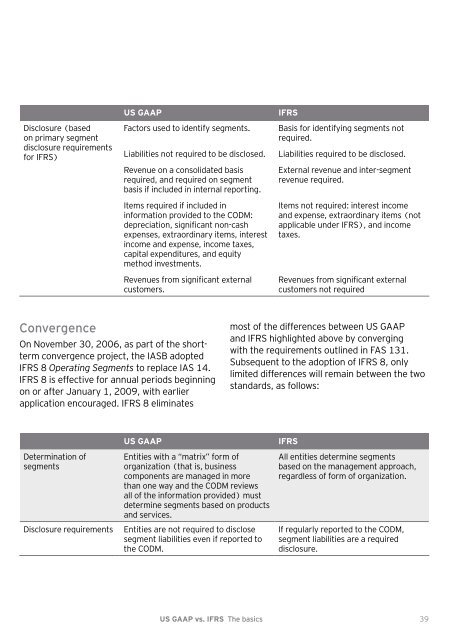

Disclosure (based<br />

on primary segment<br />

disclosure requirements<br />

for <strong>IFRS</strong>)<br />

Convergence<br />

<strong>US</strong> <strong>GAAP</strong> <strong>IFRS</strong><br />

Factors used to identify segments.<br />

Liabilities not required to be disclosed.<br />

Revenue on a consolidated basis<br />

required, and required on segment<br />

basis if included in internal reporting.<br />

Items required if included in<br />

information provided to the CODM:<br />

depreciation, significant non-cash<br />

expenses, extraordinary items, interest<br />

income and expense, income taxes,<br />

capital expenditures, and equity<br />

method investments.<br />

Revenues from significant external<br />

customers.<br />

On November 30, 200 , as part of the shortterm<br />

convergence project, the IASB adopted<br />

<strong>IFRS</strong> 8 Operating Segments to replace IAS 1 .<br />

<strong>IFRS</strong> 8 is effective for annual periods beginning<br />

on or after January 1, 2009, with earlier<br />

application encouraged. <strong>IFRS</strong> 8 eliminates<br />

Determination of<br />

segments<br />

<strong>US</strong> <strong>GAAP</strong> <strong>IFRS</strong><br />

Entities with a “matrix” form of<br />

organization (that is, business<br />

components are managed in more<br />

than one way and the CODM reviews<br />

all of the information provided) must<br />

determine segments based on products<br />

and services.<br />

Disclosure requirements Entities are not required to disclose<br />

segment liabilities even if reported to<br />

the CODM.<br />

<strong>US</strong> <strong>GAAP</strong> <strong>vs</strong>. <strong>IFRS</strong> <strong>The</strong> <strong>basics</strong><br />

Basis for identifying segments not<br />

required.<br />

Liabilities required to be disclosed.<br />

External revenue and inter-segment<br />

revenue required.<br />

Items not required: interest income<br />

and expense, extraordinary items (not<br />

applicable under <strong>IFRS</strong>), and income<br />

taxes.<br />

Revenues from significant external<br />

customers not required<br />

most of the differences between <strong>US</strong> <strong>GAAP</strong><br />

and <strong>IFRS</strong> highlighted above by converging<br />

with the requirements outlined in FAS 131.<br />

Subsequent to the adoption of <strong>IFRS</strong> 8, only<br />

limited differences will remain between the two<br />

standards, as follows:<br />

All entities determine segments<br />

based on the management approach,<br />

regardless of form of organization.<br />

If regularly reported to the CODM,<br />

segment liabilities are a required<br />

disclosure.<br />

39