THE ANNUAL REPORT 2002 - Oerlikon Barmag

THE ANNUAL REPORT 2002 - Oerlikon Barmag

THE ANNUAL REPORT 2002 - Oerlikon Barmag

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Index<br />

2 Financial highlights<br />

3 Introduction<br />

4 The <strong>2002</strong> financial year<br />

13 Financial report <strong>2002</strong><br />

21 Consolidated financial statements<br />

49 Financial report of Saurer Ltd.<br />

56 Corporate Governance<br />

67 Addresses<br />

71 Share statistics<br />

<strong>THE</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2002</strong>

FINANCIAL HIGHLIGHTS<br />

Key data<br />

(CHF 000) <strong>2002</strong> 2001<br />

Change<br />

in %<br />

Sales 2 490 391 2 405 919 3.5<br />

Operating profit before impairment charge 101 291 24 171 319.1<br />

% of sales 4.1% 1.0%<br />

Impairment charge – 76 786<br />

Operating profit (loss) 101 291 –52 615<br />

Net profit (loss) 48 643 –76 026<br />

% of sales 1.9% –3.2%<br />

Depreciation and amortization 116 860 127 081 –8.0<br />

% of sales 4.7% 5.3%<br />

EBITDA 218 151 151 252 44.2<br />

Cash flow (Net cash from operating activities) 212 728 176 097 20.8<br />

% of sales 8.5% 7.3%<br />

Capital expenditure 72 726 96 686 –24.8<br />

Employees (year end) 10 760 11 520 –6.6<br />

Total assets 1 909 906 2 065 251 –7.5<br />

Shareholders’ equity 643 671 625 212 3.0<br />

% equity financing 33.7% 30.3%<br />

Stock market capitalization (year end) 474 472 462 900 2.5<br />

Share summary (CHF)<br />

Nominal value 12.50 12.50<br />

Shareholders’ equity 45.81 44.02<br />

Earnings (loss) per share 3.45 –5.35<br />

Cash flow (Net cash from operating activities) 15.07 12.40<br />

Capital repayment1) 1.00 –<br />

1) Proposal of the Board of Directors to the General Meeting of Shareholders.<br />

2

LIKE THIS:<br />

76 PAGES, STAPLED, TWO-<br />

COLOUR PRINTING, 70 GRAM<br />

PAPER, OFFSET PRINTING<br />

AND WITHOUT LOADS OF<br />

WORDS.<br />

Dear Reader<br />

TEMPUS is the project with which we intend to gear Saurer business<br />

processes and Saurer culture consistently to the benefit of<br />

our customers. However, TEMPUS should be more than just a project<br />

– it should also be a new mental outlook of employees with a<br />

focus on customer benefit and efficiency, creativity and teamwork.<br />

This radical attitude does not, of course, completely bypass the<br />

annual report and we have conversed with “customers” of the<br />

annual report, namely our shareholders, business partners and<br />

media representatives, about what benefit they would wish to<br />

gain from the annual report. The desire for an honest, unadorned<br />

and comprehensible view of where the company stands in the<br />

market, financially and in terms of technology and how it is<br />

managed was clearly at the centre.<br />

The result lies before you. We hope we have met your wishes,<br />

too. We would be very pleased to receive your feedback to<br />

info@sgm.saurer.com. It will help us to satisfy our customers’<br />

requirements even better in the next annual report.<br />

3

<strong>THE</strong> <strong>2002</strong><br />

FINANCIAL<br />

YEAR<br />

DEAR SHAREHOLDERS<br />

The <strong>2002</strong> financial year developed in general positively for Saurer.<br />

Further significant measures to reduce costs in the textile sector<br />

in Germany, as well as in surface technology, enabled lowering of<br />

the targeted break-even point. Recovery in sales of textile machines<br />

in the second half of the year, in combination with lower<br />

annual costs, led to an improvement in operating results for this<br />

division. The reported result was, however, curtailed by additional<br />

restructuring expenditure in Germany. The transmission systems<br />

division continued its robust performance. Graziano Trasmissioni<br />

was able to increase sales and operating results, thanks to strict<br />

management of costs, new products in the automobile sector,<br />

and integration and consolidation of the acquisitions made last<br />

year. Integration of the complete textile business under a com-<br />

4<br />

mon management in the middle of <strong>2002</strong>, systematic re-engineering<br />

of all business processes and a dynamic corporate culture, will<br />

lead to further progress in Saurer’s profitability.<br />

The group’s order income increased by 21% to CHF 2 628 million<br />

(adjusted for acquisitions and currency 20%), and sales increased<br />

by 4% to CHF 2 490 million (adjusted for acquisitions and currency<br />

by 3%). The operative improvement is a consequence of<br />

systematic and sustained reduction in costs realized over past<br />

years. Earnings before interest and tax (EBIT) increased from CHF<br />

–53 million in the previous year to CHF 101 million. Restructuring<br />

costs of CHF 43 million (CHF 46 million restructuring costs and<br />

CHF 77 million goodwill impairment charge in the previous year),<br />

are included in this. The EBITDA (earnings before interest, tax,<br />

depreciation and amortization) increased from CHF 151 million to

amortisation) increased from CHF 151 million to CHF 219 million.<br />

Net profit improved from a loss of CHF 76 million in the previous<br />

year to a profit of CHF 49 million. The cash flow from operating<br />

activities amounted to CHF 213 million. Net debt was reduced by<br />

CHF 145 million to CHF 154 million. The degree of equity financing<br />

amounts to 34% (30% in the previous year).<br />

Strong capital investment was made in the transmission systems<br />

division – 41% of Saurer’s total investment, with 52% made in<br />

the textile division and 7% in surface technology.<br />

We regularly examine the value of capitalized goodwill using discounted<br />

cash flow analysis, to comply with the requirements of<br />

IFRS financial reporting rules. On the basis of our present mediumterm<br />

planning, there is no impairment of goodwill.<br />

FAVOURABLE DEVELOPMENT<br />

IN <strong>THE</strong> TEXTILE AND TRANS-<br />

MISSION SYSTEMS DIVISIONS.<br />

The increasingly cyclical nature of textile machine business made<br />

itself felt once more in the past year. Following a revival at the<br />

end of 2000 and the decline in the second half of 2001, business<br />

in the natural fiber sector revived again quicker than expected in<br />

the second quarter of <strong>2002</strong>. Order intake rose by 20% to CHF<br />

1’910 million and sales by 2% to CHF 1’777 million (adjusted for<br />

currency). Asian markets in particular, led by China and India and<br />

also Turkey, developed a strong demand for technically advanced<br />

products, more than expected. In contrast to this, demand in<br />

Europe and America persisted at the expected low level, apart<br />

from a few exceptions. The satisfactory volume of orders on hand<br />

at the end of the year as well as advanced negotiations for further<br />

projects, promise a good utilisation of production capacity for<br />

most plants until well after mid-2003. Business units in the natural<br />

fiber sector are in a position to cushion these short cycles with<br />

up to 30% fluctuation in utilisation of facilities from quarter to<br />

quarter and to adjust themselves correspondingly, thanks to a<br />

higher level of flexibility and discipline with costs, worked out<br />

over the past few years. First-class products with high customer<br />

benefit and after-sales service available world-wide, combined<br />

with continually reducing production costs, have allowed margins<br />

in most areas to improve further despite continuing pressure on<br />

prices.<br />

The order intake for synthetic fiber plants, at CHF 658 million was<br />

only slightly above the extremely low figure for the previous year,<br />

which with sales of CHF 642 million (CHF 693 million in the previous<br />

year) led to an increase in the volume of orders on hand at<br />

the close of the year.<br />

Developments in the business for synthetic fiber plants were not<br />

uniform. Neumag developed positively with machinery for production<br />

of carpet yarn and synthetic staple fiber, not only in<br />

respect of orders received and sales, but also in profit margins.<br />

On the other hand, <strong>Barmag</strong>’s business with filament spinning and<br />

texturing machines is still under enormous volume and price pressure.<br />

For this reason, additional restructuring measures were necessary,<br />

far beyond those introduced in the middle of 2001. They<br />

include a further reduction in structure costs as well as an accelerated<br />

re-orientation of production and logistical structures with<br />

an even stronger focus on the locations in China and the Czech<br />

Republic. Fortunately, demand in the synthetic fiber segment also<br />

revived significantly in the second half of the year. This was,<br />

however, by no means sufficient to compensate for the heavy losses<br />

suffered in the first half of the year. Even though the second<br />

half of the year produced an almost break even operating result<br />

in the synthetic fiber segment, still greater efforts lie ahead for<br />

<strong>Barmag</strong> to achieve sustained healthy results again.<br />

Despite the improved market conditions at present in the textile<br />

machine business, our structural adjustments in Germany are<br />

being pursued with greater intensity. Programs for outsourcing<br />

and for further lowering of fixed costs are at the fore in all business<br />

units. These measures are well advanced and the costs for<br />

the programs are provided for. In <strong>2002</strong>, capacity adjustment in<br />

the textile segment led to a cutback of 851 jobs as against the<br />

previous year (–12%).<br />

All of Saurer’s textile activities in the “Saurer Textile Solutions” division<br />

were combined under one management structure from<br />

June 1st , <strong>2002</strong>. “Saurer Textile Solutions” comprises nine strategic<br />

business units and the overlapping functions of Marketing &<br />

Sales, Technology, Administration and Human Resources. With<br />

the establishment of the new organisation, the joint “TEMPUS”<br />

program for systematic simplification and radical alignment to<br />

customer benefits of all business processes was initiated. The target<br />

is to reduce costs during the course of the next three years by<br />

a further CHF 50 million while simultaneously improving customer<br />

satisfaction. This ambitious program will have a lasting impact<br />

on Saurer’s corporate culture and will lead to more entrepreneurial<br />

spirit at all levels.<br />

Klaus Moll and Heinz Bachmann have retired from operational<br />

management of Saurer in the wake of this re-organisation. The<br />

Board of Directors and the Group management express their sincere<br />

thanks for their extensive commitment. The second stage of<br />

expansion of the new assembly and logistics centre in Suzhou<br />

(China) was put into operation in June <strong>2002</strong>, from where primarily<br />

the Chinese market is to be supplied in close contact with<br />

customers. It is also planned to use this location increasingly for<br />

the world-wide supply of components, in a later phase.<br />

The transmission systems division reports an increase in sales of<br />

31% (12% adjusted for currency and acquisitions) through new<br />

projects in the automotive sector and the integration of the Carr<br />

5

Magnetto’s transmission engineering, while maintaining operative<br />

profit performance and cash flow margins at a satisfactory<br />

level. It is a measure of Graziano’s strategically successful position<br />

in the market that this result has been achieved despite<br />

considerable integration costs, continuing low turnover in the<br />

traditional markets for agricultural and construction vehicles, as<br />

well as the flagging worldwide economic situation in the automobile<br />

industry.<br />

Surface Technology, with its main focus of operations in the USA,<br />

was again subjected to the weakness of the American economy<br />

and in particular, the consequences of strong decline in industrial<br />

production. Sales fell by a further 12% whereby the supply of<br />

plastification components (Xaloy) to plastic injection machine<br />

manufacturers was particularly badly hit. This led to a continuing<br />

low utilization of the already reduced capacity as well as a correspondingly<br />

lower absorption of fixed costs. The consolidations<br />

completed at the beginning of <strong>2002</strong> have led to a worldwide<br />

6<br />

Saurer Textile Solutions<br />

reduction of 240 jobs and the closing of factories in Switzerland<br />

and the USA.<br />

Both business units of the surface technology division (Xaloy and<br />

IonBond) are intended to be sold and accordingly are disclosed<br />

separately in this report as discontinuing operations.<br />

SAURER TEXTILE SOLUTIONS –<br />

INCREASE IN FLEXIBILITY AND<br />

COST REDUCTION WITH NO-<br />

TICEABLE MARKET RECOVERY<br />

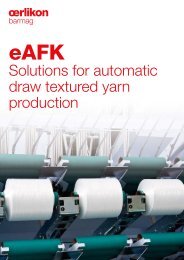

Saurer’s synthetic fiber plant operations (<strong>Barmag</strong>) were reorganized<br />

into the three strategic business units of Neumag, Texturing<br />

and Spinning during the course of consolidating Saurer’s activities<br />

in the textile sector, each of which addresses a specific product/

market segment. The developments in the three business units in<br />

<strong>2002</strong> were varied.<br />

Neumag: strong staple fiber business and entry into spunbond<br />

market Neumag showed a positive development not only<br />

in installations for the manufacture of synthetic staple fibers but<br />

also with carpet yarn plants. Sturdy demand as well as an increase<br />

in market share led to sales lying within the scope of<br />

expectations and a good intake of new orders. Neumag closed<br />

with a clearly positive result and started the new year with a high<br />

order backlog. The Asian markets, and China in particular, displayed<br />

considerable demand for new staple fiber capacity. Neumag has<br />

successfully established itself here in the past few years as a supplier<br />

of complete systems. In the carpet yarn business, where the<br />

integration of <strong>Barmag</strong> operations into Neumag has been successfully<br />

completed, the American market was well to the fore. A<br />

holding in the small American engineering company ASON, active<br />

in spunbond equipment business, was acquired in mid-<strong>2002</strong>.<br />

Patents and specialized know-how of ASON, combined with market<br />

access and wide experience in Neumag’s plant business,<br />

should allow Saurer a targeted and cost-efficient entry into the<br />

demanding segment of the spunbond plant market in the next<br />

three years, and thus bring about broader support of the volatile<br />

industrial plant business. The healthy order book at the end of<br />

the year, attractive products and services, as well as improved<br />

measures to optimize processes and costs further, will lead to a<br />

further positive development of business in 2003.<br />

First fruits from restructuring texturing business First fruits<br />

from <strong>Barmag</strong>’s restructuring efforts are recognizable in the texturing<br />

business. The re-engineering of processes aimed at a<br />

reduction in manufacturing costs, as well as the rapid relocation<br />

of production to China and the Czech Republic in order to increase<br />

flexibility and reduce costs, made it possible to exploit opportunities<br />

in the reviving markets in Asia and the Middle East during<br />

the second half of the year. Completion of relocation activities<br />

and further reduction of fixed costs in Germany will continue to<br />

have top priority. As a consequence of relocated production the<br />

factory in Bergisch-Born has been completely vacated and is available<br />

for sale. Development of a new highly flexible texturing machine,<br />

which is to be launched in the second half of 2003, is well<br />

advanced. The joint venture in China, with about 180 employees,<br />

which has existed since 1996, was dissolved in the mid-year and<br />

the business transferred to 100% subsidiaries of <strong>Barmag</strong> in Wuxi<br />

and Suzhou.<br />

Pressure on volumes and prices in the synthetic fiber spinning<br />

machine business The situation in <strong>Barmag</strong>’s spinning<br />

machine business remains very unsatisfactory. The continuing<br />

weak demand, which revived only slightly toward the end of the<br />

year, severe price competition for the few large-scale projects<br />

with corresponding squeeze on profit margins, keep eroding the<br />

improvement in costs which has been achieved through hard<br />

work and is running according to plan. A further acceleration in<br />

relocating production to China, introduced in the third quarter of<br />

<strong>2002</strong>, has scheduled the program completion for the fourth quarter<br />

of 2003, 15 months ahead of time. It includes all important<br />

spinning machine components. The joint venture in China with<br />

Shanghai Erfangji was terminated at the end of <strong>2002</strong> and transferred<br />

to the extended activities of Saurer in Suzhou. The first<br />

smaller plant design projects were acquired and delivered in the<br />

year under review not only in the technical yarn field but also in<br />

the textile field. The new spinning plant “VARIOFIL”, which because<br />

of its compact method of construction and modular form<br />

sets a new standard for small and medium-sized plants, also<br />

achieved first market success. The first orders for 10- and 12- fold<br />

spinning machines, which enable significantly increased productivity<br />

in a small space, were obtained and delivered according to<br />

plan in the year under review.<br />

ACO 312 – the standard for rotor spinning machines Business<br />

developed on the whole positively in the staple fiber segment.<br />

Business in rotor spinning machines moved slightly above<br />

the level of the previous year. The order intake in particular from<br />

China and Turkey increased again starting in the second quarter<br />

of the year and allowed a continuous increase in volumes in the<br />

second half of the year. The new ACO 312 rotor spinning machine<br />

introduced last year met our customers’ high expectations in<br />

respect of yarn quality, productivity and flexibility, and sets the<br />

global standard for rotor spinning machines.<br />

CompACT3 – for broader range of application Business also<br />

distinctly revived in the second half of the year in the ring spinning<br />

business unit. Profit margins were slightly increased thanks<br />

to continual improvement in costs. Markets particularly in Turkey,<br />

the Middle East and South East Asia regained something of their<br />

earlier dynamism in ringspinning. The American markets on the<br />

other hand continued at the low level of the previous year. Zinser<br />

Textile Systems Private Ltd. was established in India during <strong>2002</strong>,<br />

and is to manufacture and market the technically advanced Zinser<br />

roving frame for the Indian market. The introduction of Zinser<br />

CompACT3 compression spinning machines is proceeding according<br />

to schedule. In the year under review, the first machines in<br />

the long staple segment (wool) were sold in Italy and Japan, and<br />

the first large orders were obtained in the cotton segment. The<br />

CompACT3 system excels over the competition through its considerably<br />

wider range of application and its high degree of resistance<br />

to choking.<br />

Winding machines successful in Asia Business in winding<br />

machines profited from pressure on spinning mills in developing<br />

countries to renew their outdated winding machine capacity<br />

which can no longer meet quality expectations for export. In Asia,<br />

mainly China and India, but also other markets such as Pakistan,<br />

Bangladesh and Vietnam continue to be buoyant, so that in 2003<br />

a good level of business may again be expected. The continuing<br />

7

pressure on prices in China was successfully countered by the<br />

launch of a machine configuration specially tailored to the Chinese<br />

market. Two new types of modules with a new splicing unit<br />

for core yarns and with “ECOPACK”, an exact measuring of yarn<br />

length going down to thousandths resulting in a reduction of<br />

waste in subsequent processes, were launched during the past<br />

year; these demonstrate once again our role as technology leaders.<br />

Recovery in the twisted yarn market Business in twisting<br />

machines which collapsed at the end of 2000 recovered markedly<br />

in the most important markets. Carpet yarn and tyre cord machines<br />

in the American market, the Compact Twister in the staple<br />

fiber twisted threads in Europe and Asia, and the machines built<br />

in Suzhou (China) for the local market, all showed a positive<br />

development. Likewise well-received by the market was the Fashionator,<br />

a highly flexible machine for the manufacture of fancy<br />

yarns. Production of twisting machines by Hamel in Arbon was<br />

closed down and integrated into Volkmann in Krefeld at the end<br />

of <strong>2002</strong>. A project for further integration of the twisted yarn unit<br />

and increased co-operation between the factories of Allma in<br />

Kempten and Volkmann in Krefeld, with a corresponding reduction<br />

in costs, was commenced in the year under review and is<br />

expected to be completed in 2003.<br />

AMAYA – the embroidery machine which can be configured<br />

Business in large-scale embroidery machines was above the<br />

level of the previous year in terms of volumes. The price level<br />

improved somewhat during the course of the year but overall was<br />

still unsatisfactory. Melco, located in the USA, suffered from the<br />

continuing weak economic situation in the USA and in South<br />

America. In the year under review, Melco concentrated on completing<br />

the development and market introduction of AMAYA, the<br />

world’s first completely modular single and multi-head embroidery<br />

machine. Its ability to be configured in any manner within<br />

seconds makes highly flexible production concepts possible for<br />

embroidery for the first time. Following successful introduction to<br />

the market and test trials which were carried out extensively from<br />

the middle of <strong>2002</strong> in the USA, product launching is being prepared<br />

at present in the two large embroidery markets, namely<br />

Turkey and China.<br />

CONTINUALLY PROFITABLE<br />

GROWTH IN TRANSMISSION<br />

TECHNOLOGY<br />

Transmission Systems continued on a good level over the whole<br />

of <strong>2002</strong>. Orders received and sales increased by 31% (12% adjusted<br />

for acquisitions and currency). Integration of the Carr Hill<br />

factory in Doncaster (GB) taken over from CNH (Case New Holland)<br />

is proceeding according to schedule and has, in the main,<br />

newed decline in sales by reason of continuing weak industrial production<br />

in the USA since the middle of 2001. The effect was a halving<br />

in demand for machines for plastics in the USA, which, with the<br />

very modest recovery of demand among customers in Europe and<br />

Japan, led at Xaloy to 14% fewer sales of bimetallic plastification<br />

components such as screws and barrels. Another American subsidiary,<br />

IonBond, Inc., also suffered a clear decline in sales in the coatings<br />

business, whilst business in the European companies in<br />

Switzerland and UK appeared gratifyingly sturdy and was slightly<br />

above the figures for the previous year. Adjustment of capacity in<br />

the USA and Switzerland led to a reduction of 240 jobs as well as<br />

centralization or closing of three factories in the USA and<br />

Switzerland. For this reason the operational break-even point could<br />

again be brought under the present low sales level, in the second<br />

half of <strong>2002</strong>.<br />

SAURER STRATEGY – TWO<br />

FOOTHOLDS IN DIFFERENT<br />

BUSINESS CYCLES<br />

Saurer’s business will in future include the two strategic divisions<br />

of “Saurer Textile Solutions” and “Transmission Systems”. The<br />

preparatory work for the divestment of Surface Technology has<br />

been completed, so that a sale can be made quickly, following a<br />

revival in business prospects.<br />

The flexible supplier of transmission components in niche<br />

markets In Transmission Systems Saurer aims to exploit opportunities<br />

for growth in the three segments of agricultural vehicles,<br />

four-wheel drive vehicles and gears for sports cars, in collaboration<br />

with the new engineering partner PRODRIVE, and through<br />

complementary acquisitions. The continuing trend of vehicle<br />

manufacturers to outsource activities which do not belong to<br />

core business and the increasing specialization of component<br />

suppliers are continually opening up fresh opportunities. In developing<br />

countries such as India and China, additional opportunities<br />

are offered for robust technologies, and these will be exploited<br />

through the further development of the factory in New Delhi<br />

(India).<br />

The leading supplier of complete solutions for textile machine<br />

construction In the textile machine division, Saurer has<br />

a very strong market position with sound worldwide customer<br />

connections and innovative products. The problems of the past<br />

were predominantly a consequence of operational insufficiencies,<br />

low level of flexibility and high costs in the German production<br />

plants. The improvements in structural costs we have attained<br />

over the past few years will be consolidated further. Our ability to<br />

generate a significant cash flow will be further strengthened at<br />

the same time. The resulting funds will be channelled mainly to<br />

ally in spring, and in summer a presentation of a selected business<br />

unit at its location. In common with most European industrial<br />

companies, our interim reporting will focus on the half-yearly<br />

report as at June 30, as well as on details of orders received and<br />

sales for the first and third calendar quarters.<br />

OUTLOOK<br />

Overall, Saurer expects a further improvement in results for the<br />

year 2003. The outlook for a good course of business in the textile<br />

segment extending beyond the middle of the year exists by<br />

reason of the satisfactory order book at the end of the year. The<br />

continuing program to raise flexibility levels and reduce costs are<br />

showing results and will enable Saurer to react quickly to changes<br />

in the market. In the Transmission Systems division, we do not<br />

expect any organic growth (above that of the market level) for<br />

2003. Further improvements here will derive mainly from full integration<br />

of the recent acquisitions.<br />

SPECIAL THANKS TO OUR<br />

EMPLOYEES<br />

The <strong>2002</strong> financial year demanded from employees a high level of<br />

commitment and flexibility. The Board of Directors and Senior<br />

Management sincerely thank all employees for their contribution.<br />

Yours faithfully<br />

Prof. Dr. Giorgio Behr<br />

Chairman of the Board<br />

Heinrich Fischer<br />

CEO and Board Delegate<br />

12

FINANCIAL<br />

<strong>REPORT</strong> <strong>2002</strong><br />

15 Management’s discussion of results<br />

CONSOLIDATED FINANCIAL<br />

STATEMENTS<br />

23 Consolidated income statement<br />

24 Consolidated balance sheet<br />

25 Consolidated cash flow statement<br />

26 Consolidated statement of shareholders’ equity<br />

27 Accounting principles<br />

30 Notes to the consolidated financial statements<br />

44 Principal companies and investments<br />

46 Report of the group auditors<br />

47 Multiple year comparison<br />

FINANCIAL <strong>REPORT</strong><br />

OF SAURER LTD.<br />

51 Income statement<br />

52 Balance sheet<br />

53 Notes to the financial statements<br />

54 Proposal to the General Meeting<br />

55 Report of the statutory auditors<br />

13

Overview of the business year <strong>2002</strong><br />

Despite the unfavorable economic environment in the USA and<br />

Europe, the business year <strong>2002</strong> developed positively.<br />

The company had to face additional restructuring costs at<br />

Schlafhorst and <strong>Barmag</strong>, however, a significant reduction of<br />

the textile break even volume as well as a recovery in textile<br />

machinery sales in the second half of the year led to an<br />

improvement in operating results. In the important Asian markets<br />

a favorable trend towards high-end products could be<br />

observed. During the year the project TEMPUS, covering the<br />

whole textile segment, was started in order to reengineer all<br />

business processes. The aim of this project is to increase the<br />

customer value of Saurer products and services and at the<br />

same time to reduce fixed costs by another CHF 50 m by the<br />

year 2005.<br />

Order intake<br />

Management’s discussion of results<br />

Despite a partly sluggish demand, Transmission Systems,<br />

Saurer’s second major business area, further increased sales<br />

and profit in its traditional markets for agricultural and construction<br />

machines. The integration of the business areas<br />

acquired in 2001 was continued successfully and new projects<br />

were gained in the automotive sector.<br />

Further preparatory measures were taken concerning the sale<br />

of Surface Technology. The whole business, especially the plastification<br />

systems business (Xaloy), suffered from the continuing<br />

recessive climate in the US economy. The restructuring<br />

projects in this area were to a great extent finished in <strong>2002</strong><br />

and helped to bring the business to a good starting position<br />

for an expected market recovery.<br />

In <strong>2002</strong>, the restructuring projects initiated by the various<br />

Saurer business segments reduced the overall number of<br />

employees by 760.<br />

Change Adjusted Change<br />

(CHF 000) <strong>2002</strong> 2001 in % in % 1)<br />

Saurer Textile Solutions 1 909 989 1 574 329 21.3% 24.4%<br />

Natural Fibers 1 252 437 953 734 31.3% 25.8%<br />

Europe 248 781 232 752 6.9%<br />

North and South America 234 240 262 203 –10.7%<br />

Middle/Far East, Rest of World 769 416 458 779 67.7%<br />

Synthetic Fibers 657 552 620 595 6.0% 9.3%<br />

Europe 107 566 185 604 –42.0%<br />

North and South America 75 694 62 364 21.4%<br />

Middle/Far East, Rest of World 474 292 372 627 27.3%<br />

Transmission Systems 557 751 426 245 30.9% 11.5%<br />

Europe 438 286 344 333 27.3%<br />

North and South America 106 396 71 284 49.3%<br />

Middle/Far East, Rest of World 13 069 10 628 23.0%<br />

Discontinuing Operations (Surface Technology) 160 449 168 919 –5.0% –0.2%<br />

Europe 63 433 60 656 4.6%<br />

North and South America 84 781 94 573 –10.4%<br />

Middle/Far East, Rest of World 12 235 13 690 –10.6%<br />

Total Saurer 2 628 189 2 175 818 20.8% 19.8%<br />

Europe 858 066 829 670 3.4%<br />

North and South America 501 111 490 424 2.2%<br />

Middle/Far East, Rest of World 1 269 012 855 724 48.3%<br />

1) Adjusted for currency effects and acquisitions.<br />

Order intake during the business year <strong>2002</strong> closed CHF 452 m<br />

above prior year and, with a book-to-bill ratio of 1.06, well<br />

above the sales realized during the same period. An increase<br />

of CHF 99 m was caused by the first full year consolidation<br />

effect in <strong>2002</strong> of the acquisitions made in 2001 by Transmission<br />

Systems.<br />

Orders from Asia, Middle and Far East together rose by about<br />

47%, order intake from Europe and the USA was slightly<br />

above prior year’s order levels. Good order volumes were realized<br />

throughout the business year.<br />

In the staple fiber business a further shift of demand from<br />

Europe and the USA towards Asia and the Middle East was<br />

observed. The share of Asia and the Middle East was about<br />

61%. Adjusted for currency effects, order intake in the manmade<br />

fiber business was 9% above prior year, 66% of it coming<br />

from the Middle East.<br />

15

Management’s discussion of results<br />

Transmission Systems further increased its order volume.<br />

Adjusted for currency and acquisition effects, order income<br />

rose by 11% which is above the organic growth of the 2001<br />

financial year. 78% of all Transmission Systems orders came<br />

from European countries.<br />

Sales<br />

16<br />

Despite an already low starting position, in the Surface<br />

Technology business order income decreased by another 5%.<br />

Nevertheless, a book-to-bill ratio of 1.03 was realized for the<br />

whole year.<br />

Change Adjusted Change<br />

(CHF 000) <strong>2002</strong> 2001 in % in % 1)<br />

Saurer Textile Solutions 1 777 422 1 796 460 –1.1% 2.3%<br />

Natural Fibers 1 135 800 1 103 419 2.9% 6.3%<br />

Europe 221 161 262 113 –15.6%<br />

North and South America 238 425 299 318 –20.3%<br />

Middle/Far East, Rest of World 676 214 541 988 24.8%<br />

Synthetic Fibers 641 622 693 041 –7.4% –3.8%<br />

Europe 147 354 170 890 –13.8%<br />

North and South America 64 076 103 703 –38.2%<br />

Middle/Far East, Rest of World 430 192 418 448 2.8%<br />

Transmission Systems 557 751 426 245 30.9% 11.5%<br />

Europe 438 285 344 096 27.4%<br />

North and South America 106 396 71 519 48.8%<br />

Middle/Far East, Rest of World 13 070 10 630 23.0%<br />

Discontinuing Operations (Surface Technology) 155 218 176 889 –12.3% –7.8%<br />

Europe 58 058 61 728 –5.9%<br />

North and South America 84 798 98 592 –14.0%<br />

Middle/Far East, Rest of World 12 362 16 569 –25.4%<br />

Total Saurer 2 490 391 2 405 919 3.5% 3.2%<br />

Europe 864 858 845 152 2.3%<br />

North and South America 493 695 573 132 –13.9%<br />

Middle/Far East, Rest of World 1 131 838 987 635 14.6%<br />

1) Adjusted for currency effects and acquisitions.<br />

Supported by significant sales in China and Turkey, total sales<br />

in <strong>2002</strong> were increased by CHF 84 m. The shift of business<br />

activities towards Asia and Middle East which started in 1999<br />

is still continuing. The assembly and logistic center in Suzhou<br />

(P.R. China) was expanded to exploit this development.<br />

Order Backlog<br />

Throughput time in Transmission Systems usually is below one<br />

month. Sales in this segment developed according to the<br />

changes in order income described above.<br />

Change Adjusted Change<br />

(CHF 000) <strong>2002</strong> 2001 in % in % 1)<br />

Saurer Textile Solutions 656 483 545 763 20.3% 24.6%<br />

Natural Fibers 342 751 236 865 44.7% 49.3%<br />

Synthetic Fibers 313 732 308 898 1.6% 5.6%<br />

Transmission Systems – –<br />

Discontinued Operations (Surface Technology) 21 646 17 448 24.1% 30.3%<br />

Total 678 129 563 211 20.4% 24.8%<br />

1) Adjusted for currency effects and acquisitions.<br />

The positive development of Saurer’s order income led to an<br />

increase in order backlog of CHF 115 m. The majority of this<br />

increase originated in the staple fiber business. The synthetic<br />

fiber and surface technology businesses could only slightly<br />

raise their orders on hand.

Development of Operating Result (before impairment charge)<br />

Management’s discussion of results<br />

(CHF 000) Jan–Apr May–Aug Sep–Dec Total<br />

<strong>2002</strong> 3 186 37 866 60 239 101 291<br />

2001 38 968 12 012 –26 809 24 171<br />

In <strong>2002</strong>, the operating result before impairment charge was<br />

CHF 77 m above the prior year result. The cyclical business<br />

recovery in the market for textile machines, the reduction in<br />

fixed cost, as well as the improved flexibility of cost structures<br />

were the main factors responsible for this positive develop-<br />

Results Saurer Textile Solutions<br />

ment during the year. For the current reporting period, the<br />

regular analysis of reported goodwill positions did not lead to<br />

any impairments. The operating results as shown above also<br />

include exceptional operating income (such as proceeds from<br />

sale of property) and expense (such as restructuring cost).<br />

(CHF 000) <strong>2002</strong> % 2001 %<br />

Natural Fibers (continuing operations)<br />

Sales 1 121 541 100.0% 1 090 263 100.0%<br />

Operating profit (loss) before impairment charge1) 98 909 8.8% 57 575 5.3%<br />

Depreciation and amortization 33 362 3.0% 35 403 3.2%<br />

EBITDA 132 271 11.8% 92 978 8.5%<br />

Natural Fibers (discontinuing operations – Parsys)<br />

Sales (to third parties) 14 259 100.0% 13 156 100.0%<br />

Operating profit (loss) before impairment charge1) –7 800 –54.7% –20 904 –158.9%<br />

Depreciation and amortization 2 968 20.8% 2 673 20.3%<br />

EBITDA –4 832 –33.9% –18 231 –138.6%<br />

Synthetic Fibers<br />

Sales 641 622 100.0% 693 041 100.0%<br />

Operating profit (loss) before impairment charge1) –41 440 –6.5% –46 824 –6.8%<br />

Depreciation and amortization 25 421 4.0% 33 946 4.9%<br />

EBITDA –16 019 –2.5% –12 878 –1.9%<br />

Total Saurer Textile Solutions<br />

Sales 1 777 422 100.0% 1 796 460 100.0%<br />

Operating profit (loss) before impairment charge1) 49 669 2.8% –10 153 –0.6%<br />

Depreciation and amortization 61 751 3.5% 72 022 4.0%<br />

EBITDA 111 420 6.3% 61 869 3.4%<br />

Capital expenditure 38 408 2.2% 43 566 2.4%<br />

Employees (year end) 6 929 7 632<br />

1) Including non-recurring income and expense (e.g. restructuring).<br />

The natural fiber business (staple fiber machines) as a whole<br />

developed very well; especially Asian markets benefitted from<br />

a favorable business climate.<br />

In 2001, rotorspinning introduced the new ACO 312 machine<br />

to the market. It was well accepted by our customers and triggered<br />

a sales success in <strong>2002</strong>.<br />

The innovative ringspinning machine CompACT3 gained its<br />

first large projects.<br />

The quality and investment pressure which the spinning mills<br />

in the developing countries are currently facing had a positive<br />

impact on the winding business. Innovations at the module<br />

level as well as machine configurations specifically tailored to<br />

the needs of Asian customers helped Saurer to further consolidate<br />

its market leader position in this area.<br />

In <strong>2002</strong>, the twisting business was characterized by a significant<br />

market recovery. The first internal reorganizations were<br />

successfully finalized by integrating Hamel (Arbon) into<br />

Volkmann (Krefeld) and further measures were initiated.<br />

Low margins and sales volumes comparable to prior year characterized<br />

the business for large embroidery machines. The new<br />

fully modular single- and multihead machine AMAYA developed<br />

by Melco was successfully launched in the market.<br />

After several years of restructuring, the Parsys production<br />

plant will be shut down in 2003. Outsourcing of the compo-<br />

17

Management’s discussion of results<br />

nents produced there is being finalized. The <strong>2002</strong> operating<br />

result includes costs related to this shut down.<br />

The synthetic fiber business (<strong>Barmag</strong> & Neumag) showed<br />

continuing low order income and sales. Nevertheless, the different<br />

businesses developed very differently. Whereas<br />

machines for carpet yarns and synthetic staple fibers (Neumag)<br />

realized favorably high sales and margins, volume and price<br />

pressure continued unabated in the filament and texturing<br />

machines area (<strong>Barmag</strong>). Especially in the markets for large<br />

scale spinning plants, realized cost reductions were eroded by<br />

shrinking margins. As a result, further emphasis was placed on<br />

the structural cost reduction already initiated in the prior year<br />

as well as on the shift of production facilities to China and the<br />

Czech Republic. An investment in the American engineering<br />

company ASON by Neumag laid the foundations for accessing<br />

the highly attractive spunbond market and its future potential.<br />

Also in the spinning and texturing businesses a good number<br />

Results Transmission Systems<br />

18<br />

of innovative products were further developed and in some<br />

instances introduced to the market.<br />

Outlook<br />

Order backlog as of the end of <strong>2002</strong> as well as orders currently<br />

being negotiated raise expectations for a good business climate<br />

well into the second half of 2003. Outsourcing of production<br />

will be stepped up, fixed costs will be reduced further<br />

and Saurer’s ability to generate significant free cash flow will<br />

be strengthened. Systematic reengineering projects and a<br />

stronger focus on shared values, common directions and corporate<br />

culture will help to support this process among employees<br />

(TEMPUS project). In the future, Saurer Textile Solutions<br />

will continue to focus on activities in Asia and Eastern Europe,<br />

as the division seeks to position itself as unchallenged market<br />

leader for full service solutions.<br />

(CHF 000) <strong>2002</strong> % 2001 %<br />

Sales 557 751 100.0% 426 245 100.0%<br />

Operating profit1) 53 543 9.6% 46 587 10.9%<br />

Depreciation and amortization 37 871 6.8% 31 964 7.5%<br />

EBITDA 91 414 16.4% 78 551 18.4%<br />

Capital expenditure 29 219 5.2% 44 186 10.4%<br />

Employees (year end) 3 021 3 006<br />

1) Including non-recurring income and expense (e.g. restructuring).<br />

In <strong>2002</strong>, the transmission systems business again realized<br />

valuable organic growth and profits. The Carr Hill and<br />

Magnetto businesses, acquired in 2001, are shown with their<br />

full year consolidation effect for the first time, which led to a<br />

certain dilution of margins. On the other hand, the profitability<br />

of the traditional business was slightly improved.<br />

In the markets for agricultural and construction machines,<br />

especially for tractors, Graziano consolidated its market position.<br />

Tractor manufacturers increased their outsourcing of certain<br />

subassemblies.<br />

Demand for automotive transmission components also showed<br />

favorable development and continuing good margins. The<br />

increasing demand for four-wheel-drive vehicles as well as the<br />

increasing market for high-torque transmission systems for<br />

luxury sports cars resulted in new orders and projects. A synergistic<br />

cooperation with the anglo-american engineering<br />

company PRODRIVE was signed in <strong>2002</strong>.<br />

Outlook<br />

In the short term, for the next two years, we expect reduced<br />

organic growth. Nevertheless, in the tractor business of various<br />

developing countries there is significant potential that the<br />

technology level currently used there will lead to further<br />

organic growth for Graziano. An Indian plant already operating<br />

to high quality standards enables us to be close to our customers<br />

and to meet local demand. This plant will be further<br />

developed as a low cost production facility for global markets.<br />

The most important growth area for the transmission business<br />

will be the automotive sector. The integration of transmission<br />

activities acquired from the Magnetto Group will be continued<br />

in 2003. The target will be to raise productivity to Graziano<br />

standards.

Results Discontinuing Operations (Surface Technology)<br />

Management’s discussion of results<br />

(CHF 000) <strong>2002</strong> % 2001 %<br />

Sales 155 218 100.0% 176 889 100.0%<br />

Operating profit (loss) 1) –5 527 –3.6% –11 821 –6.7%<br />

Depreciation and amortization 16 394 10.6% 20 366 11.5%<br />

EBITDA 10 867 7.0% 8 545 4.8%<br />

Capital expenditure 5 014 3.2% 7 952 4.5%<br />

Employees (year end) 786 857<br />

1) Including non-recurring income and expense (e.g. restructuring).<br />

For the surface technology business in <strong>2002</strong> the continuing<br />

weak industrial production in the USA again caused an unsatisfactory<br />

low order income and sales volume. This had a negative<br />

impact on the results of the plastification systems (Xaloy)<br />

and coating (IonBond) businesses.<br />

Restructuring projects which were started in 2000 were completed<br />

in early <strong>2002</strong>, with a reduction of 240 jobs in total, 71 of<br />

them in <strong>2002</strong>. In <strong>2002</strong>, the closure of production facilities in the<br />

USA and in Switzerland was finalized as planned. Due to these<br />

programs, results were improved despite the lower sales volumes.<br />

Financial and Group Results<br />

Outlook<br />

During <strong>2002</strong>, Surface Technology’s break-even point was<br />

adjusted to the current market situation and the foundations<br />

for a profitable future were laid. Preparations to sell Surface<br />

Technology are at an advanced stage. As soon as a cyclical<br />

recovery occurs in the markets an early sale of the business<br />

can be expected.<br />

(CHF 000) <strong>2002</strong> 2001<br />

Operating result, before impairment charge 101 291 24 171<br />

Financial result –26 381 –29 744<br />

Income taxes –24 585 8 029<br />

Group profit before impairment charge and minority shares 50 325 2 456<br />

Financial expense was approximately at the same level as in<br />

the prior year. In accordance with IAS 32, interest expense<br />

amounting to CHF 8.1 m was charged to the income statement<br />

for the 21 ⁄4% convertible bond although only an amount<br />

of CHF 4.3 m is actually paid. Due to a continuous reduction<br />

in net debt, interest expenses were lowered, but the full effect<br />

of this reduction will occur in the year 2003.<br />

In comparison with last year, despite a significantly higher<br />

income before taxes, the current tax expense was reduced. On<br />

the other hand, the relief from deferred taxes was significantly<br />

lower than in the prior year. In the consolidated financial<br />

statements this resulted in an overall higher tax expense. Due<br />

to active measures taken, significant tax loss carryforwards<br />

were eliminated and transferred to asset positions available for<br />

tax deductible depreciation. This increased the value of tax<br />

assets.<br />

19

Management’s discussion of results<br />

Key Ratios<br />

(CHF 000) <strong>2002</strong> 2001<br />

Net Debt –153 877 –298 857<br />

Liquid assets 146 459 198 613<br />

Other financial assets – 9 438<br />

Short-term debt –65 062 –221 427<br />

Convertible bond –151 979 –194 875<br />

Other long-term debt –83 295 –90 606<br />

Net Tangible Worth (equity minus goodwill) 444 446 413 649<br />

Shareholders’ equity 643 671 625 212<br />

Goodwill –199 225 –211 563<br />

EBITDA 218 151 151 252<br />

Operating profit before impairment 101 291 24 171<br />

Depreciation and amortization 116 860 127 081<br />

Ratios<br />

Debt-Equity-Ratio 23.9% 47.8%<br />

Net Debt / Net Tangible Worth 34.6% 72.2%<br />

Equity in % of Total Assets 33.7% 30.3%<br />

Net Tangible Worth in % of Total Assets 23.3% 20.0%<br />

Net Debt / EBITDA 70.5% 197.6%<br />

Compared to last year, net debt was reduced by CHF 145 m.<br />

The cash flows generated during the year as well as short-term<br />

cash were predominantly used to pay back debt. Some debt<br />

reduction was realized by buying back part of the 21 ⁄4% convertible<br />

bond stock at an attractive rate.<br />

The sum of these measures as well as the increase in equity<br />

from the current period’s earnings resulted in a significant<br />

Cash Flow<br />

20<br />

increase in the equity financing ratio to 33.7% as well as in<br />

a reduction of the debt-equity-ratio to 23.9%. Without the<br />

impact of foreign currency translation in <strong>2002</strong> (strengthening<br />

of the Swiss Franc), these percentages would have been slightly<br />

improved.<br />

(CHF 000) <strong>2002</strong> 2001<br />

Cash flow from operating activities 212 728 176 097<br />

Capital expenditure for tangible fixed assets –72 726 –96 686<br />

Proceeds from sale of fixed assets 22 618 14 993<br />

Free Cash Flow 162 620 94 404<br />

Acquisition of investments and intangible assets –5 686 –37 186<br />

The CHF 213 m operating cash flow is a record breaking result<br />

for Saurer. This result also contains advance payments from<br />

customers which are about CHF 30 m above usual levels.<br />

However, even without this high level of advance payments<br />

still a record result would have been realized. Flexibility in<br />

component purchasing, which was improved in recent years,<br />

shows positive effects on the cash flow during the growth<br />

period <strong>2002</strong>. At the same time, fixed asset management was<br />

tightened.<br />

Distribution<br />

Due to the improved course of business in <strong>2002</strong>, at the annual<br />

General Meeting of Shareholders to be held in May 2003<br />

a distribution amounting to CHF 1.00 per share in the form<br />

of a capital repayment will be proposed by the Board of<br />

Directors. This proposal corresponds to a total payment of<br />

about CHF 14 m.

CONSOLIDATED<br />

FINANCIAL<br />

STATEMENTS

Consolidated income statement for the years ended December 31,<br />

(CHF 000) Note* <strong>2002</strong> % 2001 %<br />

Sales 1 2 490 391 100.0 2 405 919 100.0<br />

Cost of goods sold -1 904 509 –76.5 –1 858 478 –77.2<br />

Gross profit 585 882 23.5 547 441 22.8<br />

Selling and distribution –190 401 –7.6 –215 364 –9.0<br />

Research and development –113 365 –4.6 –120 069 –5.0<br />

Administration and other 3 –180 825 –7.2 –187 837 –7.8<br />

Operating expenses before impairment charge –484 591 –19.4 –523 270 –21.8<br />

Operating profit before impairment charge 4 101 291 4.1 24 171 1.0<br />

Impairment charge 12 – – –76 786 –3.2<br />

Operating profit (loss) 101 291 4.1 –52 615 –2.2<br />

Financial income (expense) 5 –26 381 –1.1 –29 744 –1.2<br />

Profit (loss) before taxes 74 910 3.0 –82 359 –3.4<br />

Income taxes 6 –24 585 –1.0 8 029 0.3<br />

Profit (loss) before minorities 50 325 2.0 –74 330 –3.1<br />

Minority interests 16 –1 682 –0.1 –1 696 –0.1<br />

Net profit (loss) 48 643 1.9 –76 026 –3.2<br />

* For details see the notes to the consolidated financial statements, pages 30–43. These are an integral part of the consolidated financial statements.<br />

Earnings per share (CHF)<br />

Basic earnings (loss) per share 3.45 –5.35<br />

Diluted earnings (loss) per share 3.44 –5.35<br />

See Note 7, page 34.<br />

23

Consolidated balance sheet as at December 31,<br />

(CHF 000) Note* <strong>2002</strong> % 2001** %<br />

Assets<br />

Cash 132 502 190 486<br />

Marketable securities 13 957 8 127<br />

Liquid assets 146 459 7.7 198 613 9.6<br />

Accounts receivable, trade 8 409 338 387 323<br />

Inventories 9 318 512 362 396<br />

Current income taxes 3 631 2 951<br />

Prepayments and accrued income 6 772 16 591<br />

Other receivables 90 943 61 690<br />

Current assets 975 655 51.1 1 029 564 49.9<br />

Financial assets 10 30 502 35 530<br />

Deferred income taxes 6 73 228 76 111<br />

Property, plant and equipment 11 626 073 709 103<br />

Intangible assets 12 204 448 214 943<br />

Non-current assets 934 251 48.9 1 035 687 50.1<br />

Total assets 1 909 906 100.0 2 065 251 100.0<br />

Liabilities and shareholders’ equity<br />

Short-term debt 13 26 625 189 529<br />

Short-term portion of long-term debt 13 38 437 31 898<br />

Accounts payable, trade 240 292 245 864<br />

Accruals and deferred income 127 205 108 510<br />

Current income taxes 13 493 15 435<br />

Short-term provisions 14 128 621 122 587<br />

Other current liabilities 129 545 95 292<br />

Current liabilities 704 218 36.9 809 115 39.2<br />

Long-term debt 13 235 274 285 481<br />

Long-term provisions 14 27 249 30 747<br />

Deferred income taxes 6 20 784 22 075<br />

Long-term employee benefits 15 254 686 264 438<br />

Other non-current liabilities 20 468 11 784<br />

Non-current liabilities 558 461 29.2 614 525 29.7<br />

Total liabilities 1 262 679 66.1 1 423 640 68.9<br />

Minority interests 16 3 556 0.2 16 399 0.8<br />

Share capital 17 192 875 192 875<br />

Group reserves 538 033 637 604<br />

Treasury shares –135 880 –129 241<br />

Net profit (loss) for the period 48 643 –76 026<br />

Shareholders’ equity 643 671 33.7 625 212 30.3<br />

Total liabilities and shareholders’ equity 1 909 906 100.0 2 065 251 100.0<br />

* For details see the notes to the consolidated financial statements pages 30–43. These are an integral part of the consolidated financial statements.<br />

** The balance sheet is presented in greater detail than in the prior year. The prior year’s figures have therefore been reclassified accordingly.<br />

24

Consolidated cash flow statement for the years ended December 31,<br />

(CHF 000)<br />

Cash flow from operating activities<br />

Note* <strong>2002</strong> 2001**<br />

Profit (loss) before taxes 74 910 –82 359<br />

Depreciation and amortization 116 860 127 081<br />

Impairment of assets – 76 786<br />

Interest (income) expense 25 349 25 786<br />

Other non-cash items and changes in net working capital 15 238 64 011<br />

Interest received 6 281 10 738<br />

Interest paid –18 368 –22 746<br />

Income taxes paid –7 542 –23 200<br />

Cash flow from operating activities 212 728 176 097<br />

Cash flow from investing activities<br />

Acquisition of investments (net) 18 –2 256 –37 001<br />

Loans (granted) repaid (net) 3 036 –271<br />

Capital expenditure for tangible fixed assets –72 726 –96 686<br />

Additions to intangible assets –3 430 –185<br />

Sale (purchase) of marketable securities –5 845 12 352<br />

Proceeds from the sale of fixed assets 22 618 14 993<br />

Cash flow from investing activities –58 603 –106 798<br />

Cash flow from financing activities<br />

Increase (decrease) in debt financing (net) –151 904 39 445<br />

Repurchase of 21 ⁄4% convertible bond 2000–2005 –42 906 –12 782<br />

Dividends and net capital repayments to minority shareholders –3 415 –1 653<br />

Sale (purchase) of treasury shares –7 202 656<br />

Capital repayment to the shareholders of Saurer Ltd. – –12 344<br />

Cash flow from financing activities –205 427 13 322<br />

Foreign exchange differences on cash –6 682 –3 132<br />

Net increase (decrease) in cash –57 984 79 489<br />

Cash as at January 1 190 486 110 997<br />

Cash as at December 31 132 502 190 486<br />

* For details see the notes to the consolidated financial statements pages 30–43. These are an integral part of the consolidated financial statements.<br />

** The cash flow statement is presented in greater detail than in the prior year. The prior year’s figures have therefore been reclassified accordingly.<br />

25

Consolidated statement of shareholders’ equity<br />

Foreign Retained<br />

Capital currency earnings and<br />

Share and legal translation Hedging Treasury net income<br />

(CHF 000) capital reserves reserve reserve shares for the period Total<br />

Balance as at 1.1.2001 205 219 210 494 –10 202 –999 –131 150 448 132 721 494<br />

Capital repayment –12 344 –12 344<br />

Net loss –76 026 –76 026<br />

21 ⁄4% convertible bond 2000–2005 –1 558 1 558 –<br />

Movements in cash flow hedges –1 079 –1 079<br />

Foreign currency translation –7 489 –7 489<br />

Change in treasury shares –1 600 1 909 347 656<br />

Balance as at 31.12.2001 192 875 207 336 –17 691 –2 078 –129 241 374 011 625 212<br />

Net profit 48 643 48 643<br />

21 ⁄4% convertible bond 2000–2005 –4 885 4 885 –<br />

Movements in cash flow hedges 4 409 4 409<br />

Foreign currency translation –27 391 –27 391<br />

Change in treasury shares 10 300 –6 639 –10 863 –7 202<br />

Balance as at 31.12.<strong>2002</strong> 192 875 212 751 –45 082 2 331 –135 880 416 676 643 671<br />

The presentation of shareholders’ equity has been adapted for<br />

greater clarity. Prior year figures have been reclassified; total<br />

equity is unchanged.<br />

The total amounts booked to equity in <strong>2002</strong> excluding capital<br />

transactions and profit (loss) for the period were CHF –30 184<br />

(2001: CHF –7 912).<br />

The capital and legal reserves may not be freely distributed.<br />

Distribution of the retained earnings is subject to certain restrictions,<br />

since the retained earnings of the subsidiaries have<br />

first to be distributed to Saurer Ltd. in accordance with statutory<br />

and fiscal regulations, before they are at the disposal of<br />

the shareholders’ meeting of Saurer Ltd.<br />

Foreign currency translation adjustments arise from changes in<br />

the exchange rates used to translate the opening equity and<br />

26<br />

net result of group companies that report in currencies other<br />

than the Swiss Franc, as well as foreign exchange differences<br />

on long-term intercompany loans of an investment nature.<br />

The cumulative foreign currency translation reserve represents<br />

the effect of the devaluation of the net worth of foreign subsidiaries<br />

due to the strengthening of the Swiss Franc.<br />

The proposal of the Board of Directors for the appropriation of<br />

the retained earnings of Saurer Ltd. is presented on page 54.<br />

Details of the movement in the hedging reserve are shown in<br />

Note 22.<br />

For share statistics see page 75.<br />

For details of treasury share transactions see Note 17.

Organization and business activity<br />

Saurer Ltd. is a corporation organized under the laws of Switzerland<br />

with legal domicile in Arbon. The main activities of Saurer Textile<br />

Solutions are the development, manufacture and sale of textile systems<br />

and of Transmission Systems the development, manufacture<br />

and sale of transmission systems. Surface Technology is to be divested<br />

in the near future and for that reason is shown as Discontinuing<br />

Operations. Saurer operates worldwide.<br />

Organizational changes within the scope of consolidation<br />

During the year under review the companies American <strong>Barmag</strong><br />

Corporation and Saurer Textile Systems Charlotte, Inc. were<br />

merged into Saurer, Inc. (formerly Schlafhorst, Inc.). In China,<br />

Shanghai <strong>Barmag</strong> Machinery Ltd. was liquidated and Wuxi<br />

<strong>Barmag</strong> Hongyuan Machinery Co. Ltd., formerly a joint venture,<br />

was bought out and is now fully owned by <strong>Barmag</strong> AG under<br />

the new name <strong>Barmag</strong> Textile Machinery (Wuxi) Co. Ltd. Two<br />

further <strong>Barmag</strong> subsidiaries were formed in China, <strong>Barmag</strong> Textile<br />

Machinery (Suzhou) Co. Ltd. and <strong>Barmag</strong> Beijing Machinery<br />

Co. Ltd.<br />

Principles for the consolidated financial statements<br />

General principles and accounting standards The consolidated<br />

financial statements are based on the financial statements of the<br />

individual group companies which have been drawn up in accordance<br />

with standardized accounting principles. The accounts are, in<br />

general, based on the historical cost convention. The consolidated<br />

financial statements and the individual financial statements of all<br />

companies are prepared in accordance with International Financial<br />

Reporting Standards, including International Accounting Standards<br />

and Interpretations issued by the International Accounting<br />

Standards Board (IASB).<br />

Change in accounting principles<br />

There has been no change in the accounting principles in <strong>2002</strong>.<br />

Principles of consolidation<br />

Scope of consolidation The consolidated financial statements of<br />

Saurer Ltd. include all subsidiaries in which Saurer Ltd. directly or<br />

indirectly controls more than 50% of the votes and the share capital.<br />

Companies acquired during the year under review are included<br />

in the consolidation as from the date of acquisition.<br />

Investments of between 20% and 50% (associated companies), in<br />

which the group exercises a significant influence, are included in the<br />

consolidated financial statements in accordance with the equity<br />

method.<br />

Intercompany receivables, payables, transactions and cash flows are<br />

eliminated.<br />

Full consolidation In the case of consolidated subsidiaries with<br />

minority interests, 100% of all balance sheet and income statement<br />

Accounting principles<br />

items are included in the consolidated financial statements. The<br />

interests of third-party minority shareholders are shown separately<br />

in the balance sheet and income statement.<br />

Capital consolidation The capital consolidation is based on the<br />

Anglo-Saxon purchase method. The assets and liabilities of newly<br />

acquired subsidiaries are included at their fair values in the consolidated<br />

financial statements as from the date of acquisition. In the<br />

case of companies acquired during the year, the income earned<br />

prior to the acquisition is not included in the consolidated income<br />

statement.<br />

Intercompany profits Profits resulting from intercompany sales are<br />

eliminated insofar as the products and services concerned were not<br />

delivered to third parties on the balance sheet date.<br />

Valuation and accounting principles<br />

Foreign currency translation Business transactions in foreign currencies<br />

are translated into the respective local currency at the<br />

exchange rate ruling on the day of transaction, and monetary<br />

assets and liabilities at the year-end balance sheet rate. The resulting<br />

profits and losses are included in the income statement, with the<br />

exception of exchange differences on intercompany loans of an<br />

investment nature, which are taken direct to shareholders’ equity. At<br />

year-end the balance sheets of foreign subsidiaries are translated into<br />

Swiss Francs at the year-end exchange rate, whilst the income statements<br />

and cash flow statements are translated into Swiss Francs at<br />

annual average rates. Any difference arising thereon is not included<br />

in the income statement, but taken direct to shareholders’ equity. In<br />

the event of divestment of a subsidiary, the relevant cumulative<br />

exchange rate differences from the sale are included in the income<br />

statement.<br />

Financial risk management Saurer’s international activities expose<br />

it to a variety of market risks, including currency risks. An overall risk<br />

management programme coordinated by central corporate treasury<br />

staff seeks to minimize the effects of unpredictable financial markets<br />

on the financial results of the group.<br />

Currency risks, which due to the group’s activities mainly arise in<br />

Euro and U.S. Dollar, are hedged by using forward contracts.<br />

Foreign currency risks which arise from the translation of income<br />

statement and balance sheet items of foreign consolidated companies<br />

are not hedged.<br />

Interest risks The group’s liquid assets are invested on a short-term<br />

basis. The group’s income and operating cash flows are substantially<br />

independent of changes in market interest, and interest exposures<br />

are not hedged.<br />

Credit risks Liquid assets are placed short-term with first-class<br />

banks only. The credit risk pertaining to accounts receivable is limited<br />

by the wide spread of customers, both geographically and by<br />

business activity. International accounts receivable, mainly in the<br />

textile business, are to a large extent secured by letters of credit and<br />

government export credit guarantees.<br />

27

Accounting principles<br />

Commodity price risks The price risks related to commodities used<br />

in Saurer products are low.<br />

Composition and valuation of balance sheet items<br />

Cash includes cash in hand, balances in postal and bank accounts,<br />

as well as short-term money market funds.<br />

Marketable securities are shown at year-end market value.<br />

Changes in value are included in the income statement.<br />

Accounts receivable, trade and other receivables are included at<br />

face value, less specific provisions where appropriate.<br />

Inventories Raw materials are valued at the lower of cost and<br />

market, using the FIFO or weighted average cost method. Finished<br />

goods and work in process are valued at production cost,<br />

reduced to net realizable value should this be lower than cost.<br />

Provisions are made for items of reduced salability and excess<br />

stocks. Customer payments on account are deducted from inventories.<br />

Financial assets are included at cost less provisions for permanent<br />

impairment of value.<br />

Financial Instruments Derivative financial instruments are recorded<br />

at cost and are subsequently adjusted to fair value. With the<br />

exception of financial instruments which hedge a forecasted transaction<br />

(cash flow hedges), all adjustments in fair values are included<br />

in income.<br />

The purpose of hedge accounting is to match the impact of the<br />

hedged item and the hedging instrument in the income statement.<br />

To qualify for hedge accounting, the hedging relationship must<br />

meet several strict conditions concerning documentation, hedge<br />

effectiveness and reliability of measurement. If these conditions are<br />

not met, the transaction does not qualify as a hedge for accounting<br />

purposes. In this event fair value adjustments to the value of the<br />

derivative and the hedged item are made through the income statement.<br />

Saurer uses hedge accounting exclusively for cash flow hedges.<br />

These are used to secure future cash flows which have a high<br />

probability of occurring. The hedge instrument is recorded on the<br />

balance sheet at fair value (replacement cost) and any subsequent<br />

adjustments are booked in the hedging reserve in shareholders’<br />

equity. If the hedge relates to a transaction which will subsequently<br />

be recorded on the balance sheet, the adjustments cumulated<br />

under shareholders’ equity at that time will be included in<br />

the initial book value of the asset or liability. In all other cases the<br />

cumulative changes in fair value of the hedging instrument that<br />

have been recorded in equity are included as a charge or credit to<br />

income when the forecasted transaction is recognized.<br />

Property, plant and equipment is carried at purchase or production<br />

cost less appropriate depreciation. In the case of an impairment<br />

loss the appropriate charge is made to income.<br />

Depreciation is charged on a straight-line basis over the following<br />

periods:<br />

28<br />

Furniture, fittings and equipment<br />

Years<br />

5–12<br />

IT, office equipment 3–7<br />

Vehicles, tools 4–6<br />

Machinery 6–10<br />

Buildings: – exterior constructions 30–60<br />

– interior constructions 12–25<br />

Repair and maintenance costs are expensed directly to the income<br />

statement. Costs which give rise to an increase in value are capitalized<br />

and depreciated over the remaining useful life of the<br />

assets.<br />

Financing costs incurred in respect of the construction of property,<br />

plant and equipment are taken directly to the income statement.<br />

Leased equipment Property, plant and equipment financed<br />

through long-term financial leasing contracts, and for which the<br />

company bears the major risks (financial leasing), is capitalized and<br />

depreciated like other fixed assets. The present value of the corresponding<br />

lease obligations is included as a liability under long-term<br />

liabilities.<br />

Rental costs for short-term operational leases are charged directly to<br />

the income statement. Operating leases are not included in the balance<br />

sheet; the corresponding obligations are fully reported in the<br />

notes.<br />

Goodwill is the excess of the acquisition price of investments over<br />

the related equity value at the date of acquisition and is amortized<br />

to the income statement over a maximum period of 20 years.<br />

Amortization periods in excess of 5 years are only used in the case<br />

of strategic acquisitions where a sustainable expansion of market<br />

share can be expected. In the case of the purchase of a foreign company,<br />

goodwill is converted and fixed in Swiss Francs at the time of<br />

acquisition. The amortization of goodwill is included in administration<br />

and other expenses.<br />

The carrying value of goodwill is reviewed at least annually for all<br />

investments and, if a risk of impairment is seen, a detailed valuation<br />

is performed using Discounted Cash Flow analysis over a five-year<br />

period. If required, adjustments are then made to reduce the carrying<br />

values of goodwill for the investments affected.<br />

Where an acquisition gives rise to negative goodwill this is released<br />

to income over a period calculated to match any related costs. The<br />

release to income is recorded together with goodwill amortization<br />

in administration and other expense.<br />

Patents, licenses and trademarks are capitalized at cost and are<br />

written off on a straight-line basis over their useful life, not exceeding<br />

10 years.<br />

Provisions are set up for current legal and actual liabilities which<br />

are attributable to events in the past. The amount of the provisions<br />

is based on the expected use of funds for covering the liabilities.<br />

Retirement benefits Saurer companies operate various plans for<br />

providing employees with retirement benefits, which conform to

local circumstances and practice in the countries concerned. These<br />

include defined benefit and defined contribution plans, under which<br />

benefits are provided through separate funds, insurance plans or<br />

unfunded arrangements. For defined benefit plans, the amount<br />

charged to the income statement consists of current service cost<br />

which includes the normal cost of financing benefits in respect of<br />

future years of service as well as net interest on the assets or obligations.<br />

Contributions to defined contribution pension schemes are<br />

charged to the income statement as incurred.<br />

For funded plans, plan assets are held separately from those of the<br />

group in independently administered funds. The group’s liability to<br />

pay future retirement benefits is determined using the “projected<br />

unit credit method” in accordance with IAS 19 (revised), and is provided<br />

in the group’s balance sheet. Actuarial gains and losses are<br />

amortized over the average remaining period of employment, insofar<br />

as they exceed 10 % of the higher amount of the present value<br />

of the benefits and of the plan assets.<br />

The additional costs for early retirement and reduced working hours<br />

are provided for at the time of the respective agreement.<br />

Employee stock options are issued with exercise prices equivalent<br />

to market prices at the date of issue and therefore no charge is<br />

made to income at the date of issue. On the exercise of the option,<br />

the difference between the exercise and market prices is offset by<br />

an equivalent gain on the sale of treasury shares.<br />

Convertible bond The convertible bond includes a liability and an<br />

equity component. At the time of issue the equity component is<br />

booked directly to shareholders’ equity. The difference between the<br />

Accounting principles<br />