EZRA HOLDINGS LIMITED - FinanzNachrichten.de

EZRA HOLDINGS LIMITED - FinanzNachrichten.de

EZRA HOLDINGS LIMITED - FinanzNachrichten.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

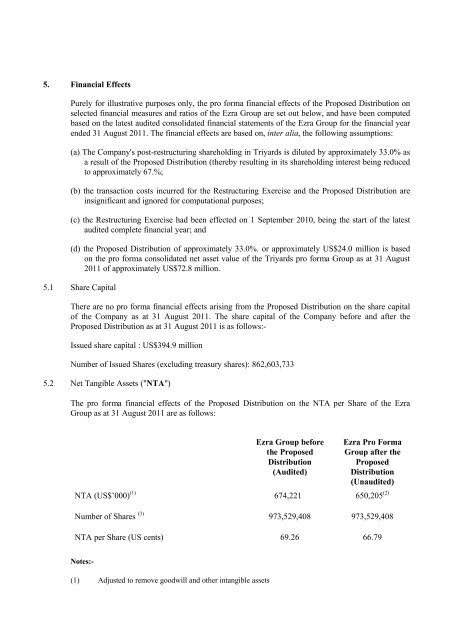

5. Financial Effects<br />

Purely for illustrative purposes only, the pro forma financial effects of the Proposed Distribution on<br />

selected financial measures and ratios of the Ezra Group are set out below, and have been computed<br />

based on the latest audited consolidated financial statements of the Ezra Group for the financial year<br />

en<strong>de</strong>d 31 August 2011. The financial effects are based on, inter alia, the following assumptions:<br />

(a) The Company's post-restructuring shareholding in Triyards is diluted by approximately 33.0% as<br />

a result of the Proposed Distribution (thereby resulting in its shareholding interest being reduced<br />

to approximately 67.%;<br />

(b) the transaction costs incurred for the Restructuring Exercise and the Proposed Distribution are<br />

insignificant and ignored for computational purposes;<br />

(c) the Restructuring Exercise had been effected on 1 September 2010, being the start of the latest<br />

audited complete financial year; and<br />

(d) the Proposed Distribution of approximately 33.0%. or approximately US$24.0 million is based<br />

on the pro forma consolidated net asset value of the Triyards pro forma Group as at 31 August<br />

2011 of approximately US$72.8 million.<br />

5.1 Share Capital<br />

There are no pro forma financial effects arising from the Proposed Distribution on the share capital<br />

of the Company as at 31 August 2011. The share capital of the Company before and after the<br />

Proposed Distribution as at 31 August 2011 is as follows:-<br />

Issued share capital : US$394.9 million<br />

Number of Issued Shares (excluding treasury shares): 862,603,733<br />

5.2 Net Tangible Assets ("NTA")<br />

The pro forma financial effects of the Proposed Distribution on the NTA per Share of the Ezra<br />

Group as at 31 August 2011 are as follows:<br />

NTA (US$’000) (1)<br />

Number of Shares (3)<br />

0102236-0000004 SN:5301031.6 6<br />

Ezra Group before<br />

the Proposed<br />

Distribution<br />

(Audited)<br />

Ezra Pro Forma<br />

Group after the<br />

Proposed<br />

Distribution<br />

(Unaudited)<br />

674,221 650,205 (2)<br />

973,529,408 973,529,408<br />

NTA per Share (US cents) 69.26 66.79<br />

Notes:-<br />

(1) Adjusted to remove goodwill and other intangible assets