L.C. Development Ltd - FinanzNachrichten.de

L.C. Development Ltd - FinanzNachrichten.de

L.C. Development Ltd - FinanzNachrichten.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

L.C. <strong>Development</strong> <strong>Ltd</strong><br />

Company Registration No.197301118N<br />

(Incorporated in the Republic of Singapore)<br />

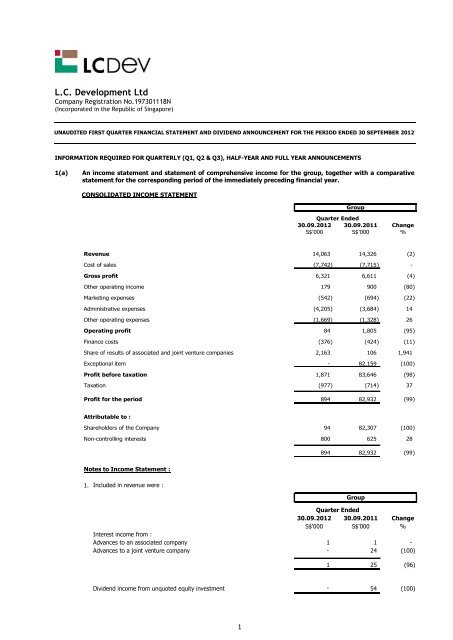

UNAUDITED FIRST QUARTER FINANCIAL STATEMENT AND DIVIDEND ANNOUNCEMENT FOR THE PERIOD ENDED 30 SEPTEMBER 2012<br />

INFORMATION REQUIRED FOR QUARTERLY (Q1, Q2 & Q3), HALF-YEAR AND FULL YEAR ANNOUNCEMENTS<br />

1(a) An income statement and statement of comprehensive income for the group, together with a comparative<br />

statement for the corresponding period of the immediately preceding financial year.<br />

CONSOLIDATED INCOME STATEMENT<br />

Revenue 14,063<br />

Cost of sales (7,742)<br />

Gross profit 6,321<br />

Other operating income 179<br />

Marketing expenses (542)<br />

Administrative expenses (4,205)<br />

Other operating expenses (1,669)<br />

Operating profit 84<br />

Finance costs (376)<br />

Share of results of associated and joint venture companies 2,163<br />

1<br />

Quarter En<strong>de</strong>d<br />

30.09.2012 30.09.2011 Change<br />

S$'000 S$'000 %<br />

14,326<br />

(7,715)<br />

6,611<br />

900<br />

(694)<br />

(3,684)<br />

(1,328)<br />

Exceptional item - 82,159<br />

Profit before taxation 1,871<br />

Taxation (977)<br />

Profit for the period 894<br />

Attributable to :<br />

Sharehol<strong>de</strong>rs of the Company 94<br />

Non-controlling interests 800<br />

Notes to Income Statement :<br />

1. Inclu<strong>de</strong>d in revenue were :<br />

894<br />

Group<br />

1,805<br />

(424)<br />

106<br />

83,646<br />

(714)<br />

82,932<br />

82,307<br />

625<br />

82,932<br />

Quarter En<strong>de</strong>d<br />

30.09.2012 30.09.2011 Change<br />

S$'000 S$'000 %<br />

Interest income from :<br />

Advances to an associated company 1<br />

1<br />

-<br />

Advances to a joint venture company - 24 (100)<br />

1<br />

Group<br />

Divi<strong>de</strong>nd income from unquoted equity investment - 54<br />

25<br />

(2)<br />

-<br />

(4)<br />

(80)<br />

(22)<br />

14<br />

26<br />

(95)<br />

(11)<br />

1,941<br />

(100)<br />

(98)<br />

37<br />

(99)<br />

(100)<br />

28<br />

(99)<br />

(96)<br />

(100)

Notes to Income Statement :<br />

2. Cost of sales comprised mainly direct costs and overheads in respect of the Group’s hospitality and leisure businesses.<br />

3. Profit before taxation is stated after crediting/(charging) :<br />

(a) Other operating income :<br />

4. The major components of income tax expense were :<br />

Currrent tax<br />

Current year 720<br />

Over provision in respect of prior years (10)<br />

Deferred tax<br />

Current year (+) 267<br />

+<br />

'NM' : Not meaningful.<br />

2<br />

Quarter En<strong>de</strong>d<br />

30.09.2012 30.09.2011 Change<br />

S$'000 S$'000 %<br />

Interest income from fixed <strong>de</strong>posits 98<br />

185 (47)<br />

Fair value gain on quoted equity investment 68<br />

- NM<br />

Foreign currency gains (#) - 704 (100)<br />

Others 13<br />

11<br />

18<br />

(b) Depreciation of property, plant and equipment (2,301)<br />

(c) Depreciation of investment property (^) (145)<br />

(d) Amortisation of club memberships (4)<br />

(e) Provision for doubtful <strong>de</strong>bts (1)<br />

Quarter En<strong>de</strong>d<br />

30.09.2012 30.09.2011 Change<br />

S$'000 S$'000 %<br />

977<br />

Group<br />

752<br />

(4)<br />

- NM<br />

The provision of <strong>de</strong>ferred tax liability in the quarter un<strong>de</strong>r review was mainly in respect of taxes that would be payable<br />

on the undistributed earnings of a subsidiary company in the Group.<br />

179<br />

900<br />

(2,368)<br />

(f) Fair value loss on quoted equity investment - (24)<br />

(g) Loss on sale of property, plant and equipment, net (1)<br />

(h) Property, plant and equipment written off (2)<br />

(i) Share-based compensation expense (*) (444)<br />

(j) Foreign currency losses (#) (287)<br />

(k) Exceptional item :<br />

Profit on sale of interest in a joint venture company (@) - 82,159<br />

^ The <strong>de</strong>preciation was in respect of an apartment unit in London acquired in March 2012.<br />

*<br />

#<br />

@<br />

Group<br />

(38)<br />

714<br />

(80)<br />

(3)<br />

- NM<br />

(4)<br />

(49)<br />

-<br />

- NM<br />

(9)<br />

(91)<br />

(100)<br />

(98)<br />

(78)<br />

388<br />

- NM<br />

Share-based compensation expense for the quarter un<strong>de</strong>r review was in respect of the grant of share awards and<br />

share options as announced on 6 December 2011 and 20 July 2012 respectively. For the corresponding quarter last<br />

year, the share-based compensation expense was in respect of the grant of share options announced on<br />

22 July 2011.<br />

The loss on exchange was mainly because currencies of overseas countries in which the Group has operations,<br />

namely, Thai Baht and US Dollar had weakened against Singapore Dollar during the quarter un<strong>de</strong>r review. In the<br />

corresponding quarter of the last financial year, these currencies as well as Sterling Pound and Renminbi had<br />

strengthened against Singapore Dollar.<br />

Profit in the corresponding quarter of the last financial year was in respect of the sale of the Group's 50% interest in<br />

LC Airport Hotel Pte <strong>Ltd</strong> which was completed on 25 July 2011. The profit on sale was stated net of provision for a<br />

special one-time incentive payment to employees (including executive directors) of S$8.2 million.<br />

(100)<br />

NM<br />

37

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME<br />

Profit for the period 894<br />

Other comprehensive (expense)/income :<br />

Foreign currency translation (loss)/gain (2,496)<br />

Fair value gain on quoted equity investment 99<br />

Transfer from foreign currency translation reserve to income statement 126<br />

3<br />

Quarter En<strong>de</strong>d<br />

30.09.2012 30.09.2011 Change<br />

S$'000 S$'000 %<br />

(2,271)<br />

Total comprehensive (expense)/income for the period (1,377)<br />

Attributable to :<br />

Sharehol<strong>de</strong>rs of the Company (1,455)<br />

Non-controlling interests 78<br />

'NM' : Not meaningful.<br />

Note to Statement of Comprehensive Income :<br />

(1,377)<br />

Group<br />

82,932<br />

(99)<br />

6,240<br />

NM<br />

- NM<br />

232<br />

(46)<br />

6,472<br />

89,404<br />

86,517<br />

2,887<br />

89,404<br />

Foreign currency translation (loss)/gain arose from the translation of the financial statements of foreign operations whose functional<br />

currencies are different from that of the Group's presentation currency (Singapore Dollar). The functional currencies in Thai Baht and<br />

US Dollar had weakened during the quarter un<strong>de</strong>r review. In comparison, these currencies as well as Sterling Pound and Hong Kong<br />

Dollar had strengthened during the corresponding quarter last year.<br />

NM<br />

NM<br />

NM<br />

(97)<br />

NM

1(b)(i) A statement of financial position (for the issuer and group), together with a comparative statement as at the<br />

end of the immediately preceding financial year.<br />

30.09.2012<br />

Restated<br />

30.06.2012 30.09.2012 30.06.2012<br />

S$'000 S$'000 S$'000 S$'000<br />

Non-current assets<br />

Property, plant and equipment 281,598 285,778<br />

- -<br />

Investment property 9,538 9,684<br />

- -<br />

Intangible assets 190<br />

197<br />

133<br />

137<br />

Subsidiary companies - - 282,977 283,750<br />

Associated companies 1,626 1,576<br />

- -<br />

Joint venture companies 74,090 75,186<br />

- -<br />

Long-term investment 1,000 1,000<br />

- -<br />

Property un<strong>de</strong>r <strong>de</strong>velopment 3,821 3,875<br />

- -<br />

Deferred tax assets 11<br />

11<br />

- -<br />

4<br />

371,874<br />

Current assets<br />

Investment securities 278<br />

Inventories 679<br />

Tra<strong>de</strong> receivables 2,022<br />

Other receivables 3,326<br />

Tax recoverable 306<br />

Prepayments 1,204<br />

Cash and short-term <strong>de</strong>posits 50,139<br />

57,954<br />

Current liabilities<br />

Provision 101<br />

Tra<strong>de</strong> payables 2,657<br />

Other payables and accruals 8,025<br />

Provision for taxation 2,219<br />

Hire purchase creditors 183<br />

Term loans 39,263<br />

52,448<br />

Net current assets 5,506<br />

Non-current liabilities<br />

Provision 134<br />

Hire purchase creditors 538<br />

Term loans 9,771<br />

Deferred tax liabilities 24,027<br />

34,470<br />

Net assets 342,910<br />

Equity attributable to<br />

sharehol<strong>de</strong>rs of the Company<br />

Share capital 206,587<br />

Treasury shares (2,233)<br />

Reserves 84,905<br />

289,259<br />

Non-controlling interests 53,651<br />

Total equity 342,910<br />

Group Company<br />

377,307<br />

204<br />

678<br />

2,049<br />

1,704<br />

392<br />

698<br />

50,371<br />

56,096<br />

101<br />

3,334<br />

8,944<br />

1,805<br />

198<br />

39,912<br />

54,294<br />

1,802<br />

134<br />

578<br />

9,894<br />

24,018<br />

34,624<br />

344,485<br />

206,587<br />

(2,233)<br />

85,743<br />

290,097<br />

54,388<br />

344,485<br />

283,110<br />

283,887<br />

128<br />

60<br />

- -<br />

- -<br />

99<br />

92<br />

- -<br />

54<br />

9<br />

8,751 7,166<br />

9,032<br />

7,327<br />

- -<br />

- -<br />

543<br />

517<br />

- -<br />

- -<br />

- -<br />

543<br />

8,489<br />

291,599<br />

206,587<br />

(2,233)<br />

87,245<br />

517<br />

6,810<br />

- -<br />

- -<br />

- -<br />

- -<br />

- -<br />

290,697<br />

206,587<br />

(2,233)<br />

86,343<br />

291,599 290,697<br />

- -<br />

291,599<br />

290,697

Notes to Statement of Financial Position :<br />

Group<br />

1. Apart from <strong>de</strong>preciation, the Group’s property, plant and equipment balances <strong>de</strong>nominated in Thai Baht and<br />

US Dollar were lower on translation at 30 September 2012 when compared to that at 30 June 2012 as these<br />

foreign currencies had weakened against Singapore Dollar.<br />

2. The movement in joint venture companies had taken into account the share of results of joint<br />

venture companies, a divi<strong>de</strong>nd <strong>de</strong>clared by a joint venture company and the <strong>de</strong>preciation/amortisation of the<br />

fair value adjustments to tangible assets and intangible assets (with finite lives) of Knight Frank Pte <strong>Ltd</strong><br />

(“KFPL”) and its subsidiaries, arising from the purchase price allocation exercise carried out for the acquisition<br />

of Cheong Hock Chye & Co. (Pte) <strong>Ltd</strong> (“CHC”) which owns 55% of KFPL.<br />

3. Other receivables and prepayments were higher mainly because of a divi<strong>de</strong>nd receivable from an associated<br />

company, Holiday Inn City Centre Guangzhou Co., <strong>Ltd</strong> and prepaid insurance for the Group’s hotel properties<br />

at Phuket, Thailand respectively.<br />

4. Tra<strong>de</strong> payables were lower mainly because <strong>de</strong>posits received from hotel guests at the end of the last financial<br />

year had been used for hotel stay and reversed to room revenue in the quarter un<strong>de</strong>r review.<br />

5. The <strong>de</strong>crease in other payables and accruals was mainly attributable to the payment of expenses accrued at<br />

the end of the last financial year.<br />

Company<br />

6. The increase in cash and short-term <strong>de</strong>posits was mainly because of a divi<strong>de</strong>nd received from a subsidiary<br />

company, CHC during the quarter un<strong>de</strong>r review.<br />

1(b)(ii) Aggregate amount of group's borrowings and <strong>de</strong>bt securities.<br />

Amount repayable in one year or less, or on <strong>de</strong>mand<br />

As at 30.09.2012 As at 30.06.2012<br />

Secured Unsecured Secured Unsecured<br />

S$’000 S$’000 S$’000 S$’000<br />

39,263 - 39,912 -<br />

Amount repayable after one year<br />

As at 30.09.2012 As at 30.06.2012<br />

Secured Unsecured Secured Unsecured<br />

S$’000 S$’000 S$’000 S$’000<br />

9,771 - 9,894 -<br />

Details of any collaterals<br />

The Group's borrowings are secured as follows :<br />

1. 2 term loans of S$27.4 million :<br />

- a mortgage on the freehold land and building owned by a company in the Group.<br />

- a fixed and floating charge over the assets of a company in the Group.<br />

- a corporate guarantee from a company in the Group.<br />

2. 2 term loans of S$12.7 million :<br />

- a mortgage on the freehold land and buildings owned by a company in the Group.<br />

3. A revolving credit facility of S$8.9 million :<br />

- a pledge of fixed <strong>de</strong>posit by a company in the Group.<br />

5

1(c) A statement of cash flows (for the group), together with a comparative statement for the corresponding<br />

period of the immediately preceding financial year.<br />

6<br />

Group<br />

Quarter En<strong>de</strong>d<br />

30.09.2012 30.09.2011<br />

S$'000 S$'000<br />

Cash flows from operating activities :<br />

Profit before taxation<br />

Adjustments for :<br />

1,871 83,646<br />

Depreciation of property, plant and equipment 2,301<br />

2,368<br />

Depreciation of investment property 145<br />

-<br />

Loss on sale of property, plant and equipment 1<br />

49<br />

Property, plant and equipment written off 2<br />

9<br />

Fair value (gain)/loss on quoted equity investment (68)<br />

24<br />

Share of results of associated and joint venture companies (2,163)<br />

(106)<br />

Amortisation of club memberships 4<br />

4<br />

Share-based compensation expense 444<br />

91<br />

Divi<strong>de</strong>nd income from unquoted equity investment - (54)<br />

Interest income (99)<br />

(210)<br />

Finance costs 376<br />

424<br />

Exceptional item - (82,159)<br />

Currency realignment 330<br />

(537)<br />

Operating profit before reinvestment in working capital 3,144<br />

Increase in inventories (1)<br />

Increase in receivables and prepayments (363)<br />

(Decrease)/increase in payables (1,600)<br />

Cash flows generated from operations 1,180<br />

Interest received 85<br />

Interest paid (373)<br />

Income taxes paid (277)<br />

Net cash flows from operating activities 615<br />

3,549<br />

(22)<br />

(730)<br />

724<br />

3,521<br />

193<br />

(423)<br />

(30)<br />

Cash flows from investing activities :<br />

Divi<strong>de</strong>nds received 1,925<br />

1,819<br />

Proceeds from sale of property, plant and equipment 2<br />

8<br />

Purchase of property, plant and equipment (806)<br />

(752)<br />

Investment in a joint venture company - (311)<br />

Divi<strong>de</strong>nds paid to non-controlling sharehol<strong>de</strong>rs (858)<br />

-<br />

Sale of interest in a joint venture company - 114,991<br />

Net cash flows from investing activities 263<br />

3,261<br />

115,755<br />

Cash flows from financing activities :<br />

Repayment of bank loans (697) (5,707)<br />

Repayment from a joint venture company - 6,000<br />

Decrease in hire purchase creditors (55)<br />

(20)<br />

Net cash flows (used in)/from financing activities (752)<br />

Net increase in cash and cash equivalents 126<br />

Effects of exchange rate changes on opening cash and cash equivalents (357)<br />

Cash and cash equivalents at beginning of period 40,277<br />

Cash and cash equivalents at end of period 40,046<br />

Note to Cash Flow Statement :<br />

Cash and cash equivalents comprised the following amounts :<br />

273<br />

119,289<br />

1,278<br />

32,696<br />

153,263<br />

30.09.2012 30.09.2011<br />

S$'000 S$'000<br />

Fixed <strong>de</strong>posits 41,315 136,007<br />

Cash and bank balances 8,824 17,256<br />

Cash and short-term <strong>de</strong>posits per Consolidated Statement of Financial Position 50,139<br />

Less : Fixed <strong>de</strong>posits pledged (10,093)<br />

Cash and cash equivalents per Consolidated Statement of Cash Flows 40,046<br />

Group<br />

153,263<br />

-<br />

153,263

1(d)(i) A statement (for the issuer and group) showing either (i) all changes in equity or (ii) changes in equity other than those arising from capitalisation issues and distributions to sharehol<strong>de</strong>rs,<br />

together with a comparative statement for the corresponding period of the immediately preceding financial year.<br />

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE PERIOD ENDED 30 SEPTEMBER 2012<br />

7<br />

Non-controlling Total<br />

interests equity<br />

Foreign<br />

Total currency Asset Share-based Fair value<br />

2013 Share Treasury other Legal translation revaluation compensation adjustment Revenue Total<br />

Group capital shares reserves reserve reserve reserve reserve reserve reserve reserves<br />

S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000<br />

As at 1 July 2012<br />

- as previously reported 206,587<br />

(2,233)<br />

25,153<br />

30<br />

(19,970)<br />

- Effects of purchase price allocation - - - - - - - - (752)<br />

- as restated 206,587<br />

(2,233)<br />

25,153<br />

Total comprehensive (expense)/income for the period - - (1,549)<br />

Share-based compensation expense - - 444<br />

30<br />

(19,970)<br />

- (1,629)<br />

43,481<br />

43,481<br />

1,392<br />

1,392<br />

220<br />

220<br />

- - 80<br />

- - - 444<br />

61,342<br />

60,590<br />

94<br />

86,495<br />

(752)<br />

85,743<br />

(1,455)<br />

- - 444<br />

Divi<strong>de</strong>nds paid to non-controlling sharehol<strong>de</strong>rs - - - - - - - - - - (858)<br />

Increase in net assets of a joint venture company - - - - - - - - 173<br />

As at 30 September 2012 206,587<br />

(2,233)<br />

24,048<br />

30<br />

(21,599)<br />

43,481<br />

1,836<br />

300<br />

60,857<br />

173<br />

84,905<br />

54,388<br />

54,388<br />

78<br />

43<br />

53,651<br />

345,237<br />

- (752)<br />

344,485<br />

(1,377)<br />

- 444<br />

(858)<br />

216<br />

342,910<br />

Non-controlling Total<br />

interests equity<br />

Foreign<br />

Total currency Asset Share-based Fair value<br />

2012 Share Treasury other Legal translation revaluation compensation adjustment Revenue Total<br />

Group capital shares reserves reserve reserve reserve reserve reserve reserve reserves<br />

S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000 S$'000<br />

As at 1 July 2011 206,587<br />

(1,772)<br />

15,142<br />

Total comprehensive income for the period - - 4,210<br />

Transfer from asset revaluation reserve to<br />

revenue reserve - - (16,543)<br />

Share-based compensation expense - - 91<br />

Lapsing of share options - - (2)<br />

As at 30 September 2011 206,587<br />

------------------------------------------------------------------Attributable to sharehol<strong>de</strong>rs of the Company-------------------------------------------------------------------<br />

------------------------------------------------------------------Attributable to sharehol<strong>de</strong>rs of the Company-------------------------------------------------------------------<br />

(1,772)<br />

2,898<br />

30<br />

30<br />

(26,088)<br />

- 4,210<br />

41,025<br />

- - (16,543)<br />

175<br />

- - - 91<br />

- - - (2)<br />

(21,878)<br />

24,482<br />

- (18,650)<br />

- - - 82,307<br />

264<br />

- - 16,543<br />

(3,508)<br />

86,517<br />

- - 91<br />

- 2<br />

- 80,202<br />

83,100<br />

39,749<br />

2,887<br />

241,056<br />

89,404<br />

- - -<br />

- 91<br />

- - -<br />

42,636<br />

330,551

Share-based<br />

2013 Share Treasury compensation Revenue Total Total<br />

Company capital shares reserve reserve reserves equity<br />

S$'000 S$'000 S$'000 S$'000 S$'000 S$'000<br />

As at 1 July 2012 206,587<br />

8<br />

(2,233)<br />

1,392<br />

84,951<br />

Total comprehensive income for the period - - - 458<br />

Share-based compensation expense - - 444<br />

As at 30 September 2012 206,587<br />

(2,233)<br />

1,836<br />

85,409<br />

86,343<br />

458<br />

- 444<br />

87,245<br />

290,697<br />

458<br />

444<br />

291,599<br />

Share-based<br />

2012 Share Treasury compensation Revenue Total Total<br />

Company capital shares reserve reserve reserves equity<br />

S$'000 S$'000 S$'000 S$'000 S$'000 S$'000<br />

As at 1 July 2011 206,587<br />

(1,772)<br />

175<br />

6,254<br />

Total comprehensive income for the period - - - 56,925<br />

Share-based compensation expense - - 91<br />

Lapsing of share options - - (2)<br />

As at 30 September 2011 206,587<br />

(1,772)<br />

264<br />

6,429<br />

56,925<br />

- 91<br />

2<br />

63,181<br />

63,445<br />

211,244<br />

56,925<br />

91<br />

- -<br />

268,260<br />

1(d)(ii) Details of any changes in the company’s share capital arising from rights issue, bonus issue,<br />

share buy-backs, exercise of share options or warrants, conversion of other issues of equity<br />

securities, issue of shares for cash or as consi<strong>de</strong>ration for acquisition or for any other<br />

purpose since the end of the previous period reported on. State also the number of shares<br />

that may be issued on conversion of all the outstanding convertibles, as well as the number<br />

of shares held as treasury shares, if any, against the total number of issued shares excluding<br />

treasury shares of the issuer, as at the end of the current financial period reported on and as<br />

at the end of the corresponding period of the immediately preceding financial year.<br />

There was no change in the Company’s share capital since the end of the previous period<br />

reported on. The Company’s issued and fully paid-up shares as at 30 September 2012 comprised<br />

1,024,322,464 (30 September 2011 : 1,027,432,464) ordinary shares with voting rights and 14,454,000<br />

(30 September 2011 : 11,344,000) ordinary shares (treasury shares) with no voting rights.<br />

Un<strong>de</strong>r the LCD Share Option Scheme (“Option Scheme”), the number of shares that may be issued on<br />

conversion of all the outstanding share options un<strong>de</strong>r the Option Scheme as at 30 September 2012 was<br />

21,022,800 (30 September 2011 : 8,010,800) shares.<br />

Un<strong>de</strong>r the LCD Performance Share Award Scheme (“Award Scheme”), the number of shares that may be<br />

issued on vesting of all the outstanding share awards un<strong>de</strong>r the Award Scheme as at 30 September 2012<br />

was 14,340,000 (30 September 2011 : Nil) shares.<br />

1(d)(iii) To show the total number of issued shares excluding treasury shares as at the end of the<br />

current financial period and as at the end of the immediately preceding year.<br />

Total number of ordinary shares excluding treasury shares<br />

30.09.2012<br />

1,024,322,464<br />

30.06.2012<br />

1,024,322,464<br />

1(d)(iv) A statement showing all sales, transfers, disposal, cancellation and/or use of treasury shares<br />

as at the end of the current financial period reported on.<br />

No treasury shares were sold, transferred, disposed, cancelled and/or used as at the end of the current<br />

financial period reported on.<br />

2 Whether the figures have been audited or reviewed and in accordance with which auditing<br />

standard or practice.<br />

The figures in this announcement have not been audited or reviewed by the auditors.

3 Where the figures have been audited or reviewed, the auditors’ report (including any<br />

qualifications or emphasis of a matter).<br />

Not applicable.<br />

4 Whether the same accounting policies and methods of computation as in the issuer’s most<br />

recently audited annual financial statements have been applied.<br />

Except as disclosed in paragraph 5 below, the financial statements have been prepared based on the<br />

accounting policies and methods of computation consistent with those adopted in the most recent audited<br />

financial statements for the year en<strong>de</strong>d 30 June 2012.<br />

The adoption of the new and revised Financial Reporting Standards (“FRS”) and Interpretations of FRS<br />

that are relevant to the Group’s operations from 1 July 2012 is not expected to have a material impact on<br />

the financial statements.<br />

5 If there are any changes in the accounting policies and methods of computation, including<br />

any required by an accounting standard, what has changed, as well as the reasons for, and<br />

the effect of, the change.<br />

FRS 103 : Business Combinations<br />

The Company completed the acquisition of Cheong Hock Chye & Co. (Pte) <strong>Ltd</strong> which owns 55% of a joint<br />

venture company, Knight Frank Pte <strong>Ltd</strong> (“KFPL”) in December 2011. In accordance with FRS 103, the<br />

purchase price allocation of the fair value of the acquisition consi<strong>de</strong>ration to goodwill, fair values of<br />

intangible assets and other assets of KFPL and its subsidiaries have been finalised. Accordingly, the<br />

comparative figures of the Group’s statement of financial position have been restated as follows :<br />

As<br />

previously<br />

reported<br />

S$’000<br />

9<br />

As<br />

restated<br />

S$’000<br />

Joint venture companies<br />

75,938 75,186<br />

Reserves 86,495 85,743<br />

6 Earnings per ordinary share of the group for the current financial period reported on and the<br />

corresponding period of the immediately preceding financial year, after <strong>de</strong>ducting any<br />

provision for preference divi<strong>de</strong>nds.<br />

Earnings per ordinary share of the Group after <strong>de</strong>ducting any<br />

provision for preference divi<strong>de</strong>nds :-<br />

(a) Based on weighted average number of ordinary shares in issue<br />

(b) On a fully diluted basis<br />

Weighted average number of ordinary shares in issue for basic<br />

earnings per share (‘000)<br />

Adjustment for assumed vesting of share awards granted un<strong>de</strong>r the<br />

LCD Performance Share Award Scheme (‘000)<br />

Adjustment for assumed exercise of share options granted un<strong>de</strong>r<br />

the LCD Share Option Scheme (‘000)<br />

Weighted average number of ordinary shares for diluted earnings<br />

per share (‘000)<br />

30.09.2012<br />

Group<br />

Quarter En<strong>de</strong>d<br />

0.01 cent<br />

0.01 cent<br />

1,024,322<br />

10,536<br />

152<br />

1,035,010<br />

30.09.2011<br />

8.01 cents<br />

8.01 cents<br />

1,027,432<br />

-<br />

-<br />

1,027,432

7 Net asset value (for the issuer and group) per ordinary share based on the total number of<br />

issued shares excluding treasury shares of the issuer at the end of the :-<br />

(a) current financial period reported on; and<br />

(b) immediately preceding financial year.<br />

Net asset* value per ordinary<br />

share based on issued share<br />

capital (excluding treasury shares<br />

which have no voting rights) as at<br />

the end of the financial period<br />

* Net asset is <strong>de</strong>fined as total equity.<br />

Group<br />

Restated<br />

Company<br />

30.09.2012 30.06.2012 30.09.2012 30.06.2012<br />

S$0.33<br />

10<br />

S$0.34<br />

S$0.28<br />

S$0.28<br />

8 A review of the performance of the group, to the extent necessary for a reasonable<br />

un<strong>de</strong>rstanding of the group’s business. It must inclu<strong>de</strong> a discussion of the following :-<br />

(a) any significant factors that affected the turnover, costs, and earnings of the group for<br />

the current financial period reported on, including (where applicable) seasonal or<br />

cyclical factors; and<br />

(b) any material factors that affected the cash flow, working capital, assets or liabilities of<br />

the group during the current financial period reported on.<br />

Revenue<br />

Revenue of the Group for the quarter un<strong>de</strong>r review of S$14.0 million was S$0.3 million or 2% lower than<br />

the revenue reported in the corresponding quarter last year.<br />

Hotel<br />

Revenue of S$11.1 million was S$0.1 million or 1% marginally lower than the corresponding quarter last<br />

year. The average room rates and food and beverage revenues of both Crowne Plaza London<br />

Kensington and Holiday Inn Resort Phuket in their functional currencies had improved over the<br />

corresponding quarter last year. However, the increases were affected by the <strong>de</strong>preciation of Sterling<br />

Pound and Thai Baht against Singapore Dollar.<br />

Serviced Resi<strong>de</strong>nce<br />

Revenue of S$1.1 million was about the same as the corresponding quarter last year.<br />

Leisure and Others<br />

Revenue of S$1.8 million was S$0.1 million or 3% lower than the corresponding quarter last year mainly<br />

because of a marginal drop in revenue of the Group’s family entertainment business.<br />

Property<br />

The Group had completed all its management projects and there was no revenue for this sector in the<br />

quarter un<strong>de</strong>r review. The revenue of S$0.1 million in the corresponding quarter last year was in respect<br />

of project management fees and divi<strong>de</strong>nd from an unquoted equity investment.<br />

Costs and Expenses<br />

The increase in total operating expenses comprising marketing, administrative and other operating<br />

expenses by S$0.7 million or 12% was mainly due to share-based compensation expense and exchange<br />

losses as explained in the Notes to Income Statement on page 2.<br />

Operating Profit<br />

Group operating profit for the quarter un<strong>de</strong>r review of S$0.1 million was S$1.7 million or 95% lower than<br />

the same quarter last year.<br />

Hotel<br />

This sector posted an operating profit of S$1.3 million which was S$1.2 million or 47% lower than the<br />

corresponding quarter last year. The drop was mainly due to higher share-based compensation expense<br />

and overheads incurred. In addition, the sector had recognised exchange losses in the quarter un<strong>de</strong>r<br />

review compared to exchange gains in the same quarter of the preceding year.<br />

Serviced Resi<strong>de</strong>nce<br />

This sector ma<strong>de</strong> an operating profit of S$0.2 million for the quarter un<strong>de</strong>r review. The <strong>de</strong>crease in<br />

operating profit by S$0.2 million or 50% was mainly due to exchange losses recognised on translation of<br />

US Dollar cash and receivable balances.

Leisure and Others<br />

This sector incurred an operating loss of S$0.9 million which was S$0.2 million or 28% higher than the<br />

operating loss of the corresponding quarter last year mainly because of lower revenue of the Group’s<br />

family entertainment business and higher share-based compensation expense.<br />

Property<br />

This sector’s operating loss of S$0.5 million was S$0.1 million or 34% higher than the corresponding<br />

quarter last year. It was mainly because of the lower revenue as explained in the fifth paragraph un<strong>de</strong>r<br />

“Revenue” above.<br />

Results of Associated and Joint Venture Companies<br />

The Group’s share of the results of its associated and joint venture companies for the quarter un<strong>de</strong>r<br />

review was a profit of S$2.2 million compared to a profit of S$0.1 million in the corresponding quarter<br />

last year. This was mainly because Holiday Inn City Centre Guangzhou had contributed a higher profit<br />

and Knight Frank Pte <strong>Ltd</strong>, which was acquired in December 2011, had also contributed positively to the<br />

results.<br />

9 Where a forecast, or a prospect statement, has been previously disclosed to sharehol<strong>de</strong>rs,<br />

any variance between it and the actual results.<br />

Not applicable.<br />

10 A commentary at the date of the announcement of the significant trends and competitive<br />

conditions of the industry in which the group operates and any known factors or events that<br />

may affect the group in the next reporting period and the next 12 months.<br />

11 Divi<strong>de</strong>nd.<br />

Works to re<strong>de</strong>velop and upgra<strong>de</strong> the Group’s newly acquired property at Rawai, Phuket into a luxury<br />

resort are in progress. Key consultants have been appointed and are working towards finalising the<br />

conceptual plans for the first phase of the project. We are targeting to complete the first phase of the<br />

re<strong>de</strong>velopment and for the hotel to be operational in 2014.<br />

Holiday Inn Resort Phuket has commenced on the refurbishment of its Main Wing starting with the public<br />

areas which inclu<strong>de</strong> enhancement works to the lobby as well as Food and Beverage outlets.<br />

Improvement works to the rooms as well as other public areas will be carried out next year. With these<br />

works in progress, there will inevitably be disruptions to the business but this will be minimised through<br />

careful planning as well as phasing of the works with the hotel operator. The performance of the hotel is<br />

expected to be affected to some extent during this period.<br />

Although the restrictions imposed by the Chinese government on property purchases have affected the<br />

pace of the sale of our resi<strong>de</strong>ntial apartment units in Xuzhou, China, we continue to see units being<br />

progressively taken up. To-date, we have sold approximately 40% of 576 units launched for sale.<br />

Holiday Inn City Centre Guangzhou, in which the Group has a 50% interest, will no longer contribute to<br />

the Group’s results after December 2012 when the ownership of this hotel is returned to the Chinese<br />

partner.<br />

The outlook for the global economy remains uncertain with concerns over the fragile economic situation<br />

in Europe and the United States. Whilst maintaining a cautious and pru<strong>de</strong>nt approach in managing the<br />

Group's businesses, we will also continually seek and evaluate sound investment opportunities for growth<br />

in Singapore and regionally.<br />

(a) Current Financial Period Reported On.<br />

Any divi<strong>de</strong>nd <strong>de</strong>clared for the current financial period reported on?<br />

None.<br />

11

(b) Corresponding Period of the Immediately Preceding Financial Year.<br />

Any divi<strong>de</strong>nd <strong>de</strong>clared for the corresponding period of the immediately preceding financial year?<br />

The Group had recognised an exceptional profit on the sale of its 50% interest in LC Airport Hotel<br />

Pte <strong>Ltd</strong> in the first quarter of financial year 2012 and the Company had <strong>de</strong>clared a special interim<br />

divi<strong>de</strong>nd as follows :<br />

Name of Divi<strong>de</strong>nd : Special Interim Divi<strong>de</strong>nd<br />

Divi<strong>de</strong>nd Type : Cash<br />

Divi<strong>de</strong>nd per share : 0.50 cent per ordinary share<br />

Tax Rate : Tax exempt (one-tier)<br />

(c) Date payable.<br />

Not applicable.<br />

(d) Books closure date.<br />

Not applicable.<br />

12 If no divi<strong>de</strong>nd has been <strong>de</strong>clared/recommen<strong>de</strong>d, a statement to that effect.<br />

No divi<strong>de</strong>nd has been <strong>de</strong>clared or recommen<strong>de</strong>d for the current financial period reported on.<br />

13 Confirmation pursuant to Rule 920(1)(a)(ii) of the Listing Manual.<br />

The Company does not have a general mandate from sharehol<strong>de</strong>rs for interested person transactions.<br />

14 Confirmation by the Board pursuant to Rule 705(5) of the Listing Manual<br />

The Directors of the Company hereby confirm to the best of their knowledge that nothing has come to<br />

the attention of the Board of Directors which may ren<strong>de</strong>r the unaudited financial statements for the<br />

first quarter en<strong>de</strong>d 30 September 2012 to be false or misleading in any material respect.<br />

On behalf of the Board of Directors<br />

David Lum Kok Seng Kelvin Lum Wen Sum<br />

Director Director<br />

BY ORDER OF THE BOARD<br />

Iris Wu Hwee Tan<br />

Lee Kin Meng<br />

Company Secretaries<br />

9 November 2012<br />

12