L.C. Development Ltd - FinanzNachrichten.de

L.C. Development Ltd - FinanzNachrichten.de

L.C. Development Ltd - FinanzNachrichten.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

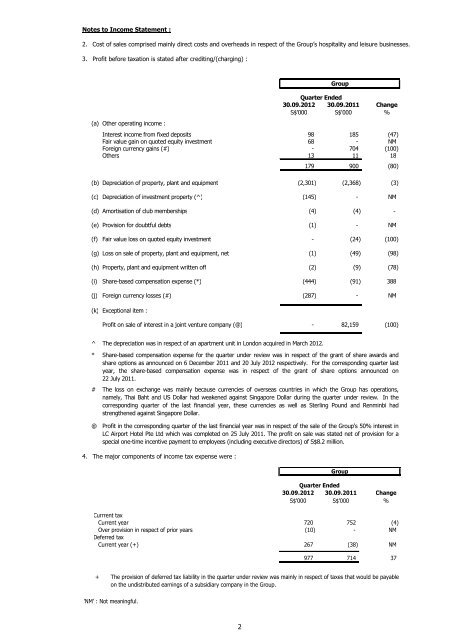

Notes to Income Statement :<br />

2. Cost of sales comprised mainly direct costs and overheads in respect of the Group’s hospitality and leisure businesses.<br />

3. Profit before taxation is stated after crediting/(charging) :<br />

(a) Other operating income :<br />

4. The major components of income tax expense were :<br />

Currrent tax<br />

Current year 720<br />

Over provision in respect of prior years (10)<br />

Deferred tax<br />

Current year (+) 267<br />

+<br />

'NM' : Not meaningful.<br />

2<br />

Quarter En<strong>de</strong>d<br />

30.09.2012 30.09.2011 Change<br />

S$'000 S$'000 %<br />

Interest income from fixed <strong>de</strong>posits 98<br />

185 (47)<br />

Fair value gain on quoted equity investment 68<br />

- NM<br />

Foreign currency gains (#) - 704 (100)<br />

Others 13<br />

11<br />

18<br />

(b) Depreciation of property, plant and equipment (2,301)<br />

(c) Depreciation of investment property (^) (145)<br />

(d) Amortisation of club memberships (4)<br />

(e) Provision for doubtful <strong>de</strong>bts (1)<br />

Quarter En<strong>de</strong>d<br />

30.09.2012 30.09.2011 Change<br />

S$'000 S$'000 %<br />

977<br />

Group<br />

752<br />

(4)<br />

- NM<br />

The provision of <strong>de</strong>ferred tax liability in the quarter un<strong>de</strong>r review was mainly in respect of taxes that would be payable<br />

on the undistributed earnings of a subsidiary company in the Group.<br />

179<br />

900<br />

(2,368)<br />

(f) Fair value loss on quoted equity investment - (24)<br />

(g) Loss on sale of property, plant and equipment, net (1)<br />

(h) Property, plant and equipment written off (2)<br />

(i) Share-based compensation expense (*) (444)<br />

(j) Foreign currency losses (#) (287)<br />

(k) Exceptional item :<br />

Profit on sale of interest in a joint venture company (@) - 82,159<br />

^ The <strong>de</strong>preciation was in respect of an apartment unit in London acquired in March 2012.<br />

*<br />

#<br />

@<br />

Group<br />

(38)<br />

714<br />

(80)<br />

(3)<br />

- NM<br />

(4)<br />

(49)<br />

-<br />

- NM<br />

(9)<br />

(91)<br />

(100)<br />

(98)<br />

(78)<br />

388<br />

- NM<br />

Share-based compensation expense for the quarter un<strong>de</strong>r review was in respect of the grant of share awards and<br />

share options as announced on 6 December 2011 and 20 July 2012 respectively. For the corresponding quarter last<br />

year, the share-based compensation expense was in respect of the grant of share options announced on<br />

22 July 2011.<br />

The loss on exchange was mainly because currencies of overseas countries in which the Group has operations,<br />

namely, Thai Baht and US Dollar had weakened against Singapore Dollar during the quarter un<strong>de</strong>r review. In the<br />

corresponding quarter of the last financial year, these currencies as well as Sterling Pound and Renminbi had<br />

strengthened against Singapore Dollar.<br />

Profit in the corresponding quarter of the last financial year was in respect of the sale of the Group's 50% interest in<br />

LC Airport Hotel Pte <strong>Ltd</strong> which was completed on 25 July 2011. The profit on sale was stated net of provision for a<br />

special one-time incentive payment to employees (including executive directors) of S$8.2 million.<br />

(100)<br />

NM<br />

37