L.C. Development Ltd - FinanzNachrichten.de

L.C. Development Ltd - FinanzNachrichten.de

L.C. Development Ltd - FinanzNachrichten.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3 Where the figures have been audited or reviewed, the auditors’ report (including any<br />

qualifications or emphasis of a matter).<br />

Not applicable.<br />

4 Whether the same accounting policies and methods of computation as in the issuer’s most<br />

recently audited annual financial statements have been applied.<br />

Except as disclosed in paragraph 5 below, the financial statements have been prepared based on the<br />

accounting policies and methods of computation consistent with those adopted in the most recent audited<br />

financial statements for the year en<strong>de</strong>d 30 June 2012.<br />

The adoption of the new and revised Financial Reporting Standards (“FRS”) and Interpretations of FRS<br />

that are relevant to the Group’s operations from 1 July 2012 is not expected to have a material impact on<br />

the financial statements.<br />

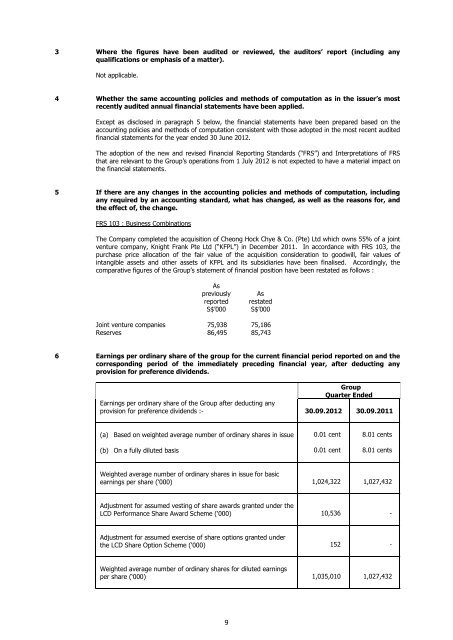

5 If there are any changes in the accounting policies and methods of computation, including<br />

any required by an accounting standard, what has changed, as well as the reasons for, and<br />

the effect of, the change.<br />

FRS 103 : Business Combinations<br />

The Company completed the acquisition of Cheong Hock Chye & Co. (Pte) <strong>Ltd</strong> which owns 55% of a joint<br />

venture company, Knight Frank Pte <strong>Ltd</strong> (“KFPL”) in December 2011. In accordance with FRS 103, the<br />

purchase price allocation of the fair value of the acquisition consi<strong>de</strong>ration to goodwill, fair values of<br />

intangible assets and other assets of KFPL and its subsidiaries have been finalised. Accordingly, the<br />

comparative figures of the Group’s statement of financial position have been restated as follows :<br />

As<br />

previously<br />

reported<br />

S$’000<br />

9<br />

As<br />

restated<br />

S$’000<br />

Joint venture companies<br />

75,938 75,186<br />

Reserves 86,495 85,743<br />

6 Earnings per ordinary share of the group for the current financial period reported on and the<br />

corresponding period of the immediately preceding financial year, after <strong>de</strong>ducting any<br />

provision for preference divi<strong>de</strong>nds.<br />

Earnings per ordinary share of the Group after <strong>de</strong>ducting any<br />

provision for preference divi<strong>de</strong>nds :-<br />

(a) Based on weighted average number of ordinary shares in issue<br />

(b) On a fully diluted basis<br />

Weighted average number of ordinary shares in issue for basic<br />

earnings per share (‘000)<br />

Adjustment for assumed vesting of share awards granted un<strong>de</strong>r the<br />

LCD Performance Share Award Scheme (‘000)<br />

Adjustment for assumed exercise of share options granted un<strong>de</strong>r<br />

the LCD Share Option Scheme (‘000)<br />

Weighted average number of ordinary shares for diluted earnings<br />

per share (‘000)<br />

30.09.2012<br />

Group<br />

Quarter En<strong>de</strong>d<br />

0.01 cent<br />

0.01 cent<br />

1,024,322<br />

10,536<br />

152<br />

1,035,010<br />

30.09.2011<br />

8.01 cents<br />

8.01 cents<br />

1,027,432<br />

-<br />

-<br />

1,027,432