L.C. Development Ltd - FinanzNachrichten.de

L.C. Development Ltd - FinanzNachrichten.de

L.C. Development Ltd - FinanzNachrichten.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

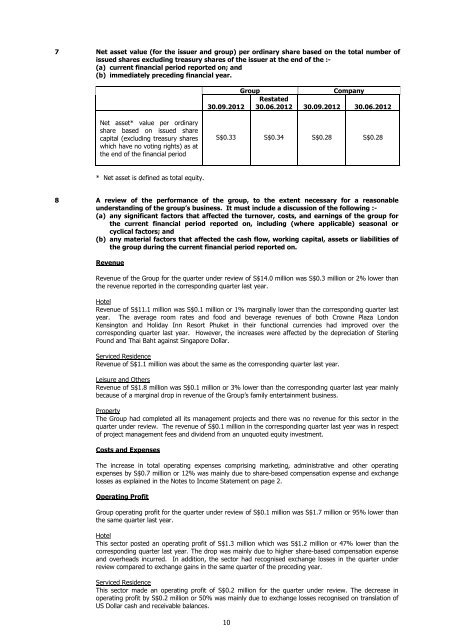

7 Net asset value (for the issuer and group) per ordinary share based on the total number of<br />

issued shares excluding treasury shares of the issuer at the end of the :-<br />

(a) current financial period reported on; and<br />

(b) immediately preceding financial year.<br />

Net asset* value per ordinary<br />

share based on issued share<br />

capital (excluding treasury shares<br />

which have no voting rights) as at<br />

the end of the financial period<br />

* Net asset is <strong>de</strong>fined as total equity.<br />

Group<br />

Restated<br />

Company<br />

30.09.2012 30.06.2012 30.09.2012 30.06.2012<br />

S$0.33<br />

10<br />

S$0.34<br />

S$0.28<br />

S$0.28<br />

8 A review of the performance of the group, to the extent necessary for a reasonable<br />

un<strong>de</strong>rstanding of the group’s business. It must inclu<strong>de</strong> a discussion of the following :-<br />

(a) any significant factors that affected the turnover, costs, and earnings of the group for<br />

the current financial period reported on, including (where applicable) seasonal or<br />

cyclical factors; and<br />

(b) any material factors that affected the cash flow, working capital, assets or liabilities of<br />

the group during the current financial period reported on.<br />

Revenue<br />

Revenue of the Group for the quarter un<strong>de</strong>r review of S$14.0 million was S$0.3 million or 2% lower than<br />

the revenue reported in the corresponding quarter last year.<br />

Hotel<br />

Revenue of S$11.1 million was S$0.1 million or 1% marginally lower than the corresponding quarter last<br />

year. The average room rates and food and beverage revenues of both Crowne Plaza London<br />

Kensington and Holiday Inn Resort Phuket in their functional currencies had improved over the<br />

corresponding quarter last year. However, the increases were affected by the <strong>de</strong>preciation of Sterling<br />

Pound and Thai Baht against Singapore Dollar.<br />

Serviced Resi<strong>de</strong>nce<br />

Revenue of S$1.1 million was about the same as the corresponding quarter last year.<br />

Leisure and Others<br />

Revenue of S$1.8 million was S$0.1 million or 3% lower than the corresponding quarter last year mainly<br />

because of a marginal drop in revenue of the Group’s family entertainment business.<br />

Property<br />

The Group had completed all its management projects and there was no revenue for this sector in the<br />

quarter un<strong>de</strong>r review. The revenue of S$0.1 million in the corresponding quarter last year was in respect<br />

of project management fees and divi<strong>de</strong>nd from an unquoted equity investment.<br />

Costs and Expenses<br />

The increase in total operating expenses comprising marketing, administrative and other operating<br />

expenses by S$0.7 million or 12% was mainly due to share-based compensation expense and exchange<br />

losses as explained in the Notes to Income Statement on page 2.<br />

Operating Profit<br />

Group operating profit for the quarter un<strong>de</strong>r review of S$0.1 million was S$1.7 million or 95% lower than<br />

the same quarter last year.<br />

Hotel<br />

This sector posted an operating profit of S$1.3 million which was S$1.2 million or 47% lower than the<br />

corresponding quarter last year. The drop was mainly due to higher share-based compensation expense<br />

and overheads incurred. In addition, the sector had recognised exchange losses in the quarter un<strong>de</strong>r<br />

review compared to exchange gains in the same quarter of the preceding year.<br />

Serviced Resi<strong>de</strong>nce<br />

This sector ma<strong>de</strong> an operating profit of S$0.2 million for the quarter un<strong>de</strong>r review. The <strong>de</strong>crease in<br />

operating profit by S$0.2 million or 50% was mainly due to exchange losses recognised on translation of<br />

US Dollar cash and receivable balances.