The SAR Activity Review Issue 12 - FinCEN

The SAR Activity Review Issue 12 - FinCEN

The SAR Activity Review Issue 12 - FinCEN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Twenty-seven of the 78 (34.62%) depository institution <strong>SAR</strong> filings with narrative<br />

references to the credit union cooperatives involved transactions occurring at<br />

multiple shared-branching locations. Twenty-two of these 78 (28.21%) named<br />

members of participating credit unions as subjects. Fourteen <strong>SAR</strong>s involving<br />

multiple shared branches contained narrative references to money laundering or<br />

structuring. Thirteen filings involving multiple shared branches had narrative<br />

references to frauds or attempted frauds.<br />

Queries produced 23 depository institution <strong>SAR</strong>s filed from June 2, 2004 through<br />

March 6, 2007 by the credit union cooperatives covered in this study. <strong>The</strong> reports<br />

had a total of 16 unique filer-name variations, 10 unique FEINs, and 17 unique<br />

combinations of the two.<br />

At least 65.21 percent of <strong>SAR</strong>s filed by credit union cooperatives contained other<br />

potential data quality problems. Approximately 30.43 percent of the total filings<br />

had either blank or incomplete narrative fields. Some filers attempted to place<br />

narratives in the Violation Type Other field. Some reports contained the wrong<br />

Branch Address, wrong Total dollar amount involved in known or suspicious<br />

activity, or lacked FEINs. Other filers inserted “please see attached” in the <strong>SAR</strong><br />

narrative and listed Armed Robbery as the characterization of suspicious activity.<br />

As a reminder, when <strong>SAR</strong> forms are received at the Enterprise Computing Center-<br />

Detroit, only information that is in an explicit, narrative format is entered into the<br />

system; thus, tables, spreadsheets or other attachments are not entered into the<br />

<strong>SAR</strong> System database.<br />

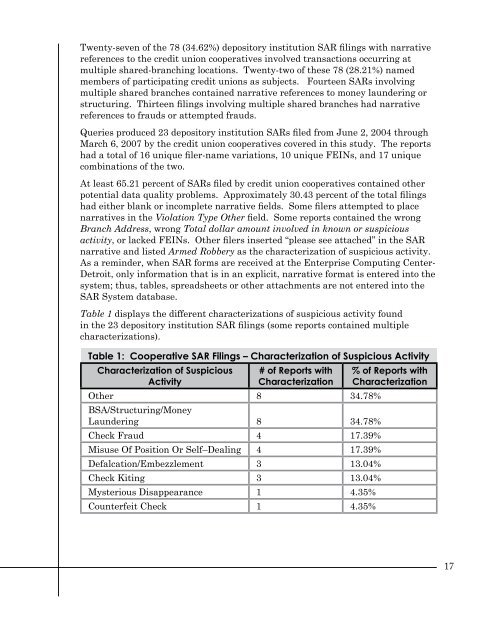

Table 1 displays the different characterizations of suspicious activity found<br />

in the 23 depository institution <strong>SAR</strong> filings (some reports contained multiple<br />

characterizations).<br />

Table 1: Cooperative <strong>SAR</strong> Filings – Characterization of Suspicious <strong>Activity</strong><br />

Characterization of Suspicious<br />

<strong>Activity</strong><br />

# of Reports with<br />

Characterization<br />

Other 8 34.78%<br />

BSA/Structuring/Money<br />

Laundering 8 34.78%<br />

Check Fraud 4 17.39%<br />

Misuse Of Position Or Self–Dealing 4 17.39%<br />

Defalcation/Embezzlement 3 13.04%<br />

Check Kiting 3 13.04%<br />

Mysterious Disappearance 1 4.35%<br />

Counterfeit Check 1 4.35%<br />

% of Reports with<br />

Characterization<br />

1