The SAR Activity Review Issue 12 - FinCEN

The SAR Activity Review Issue 12 - FinCEN

The SAR Activity Review Issue 12 - FinCEN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

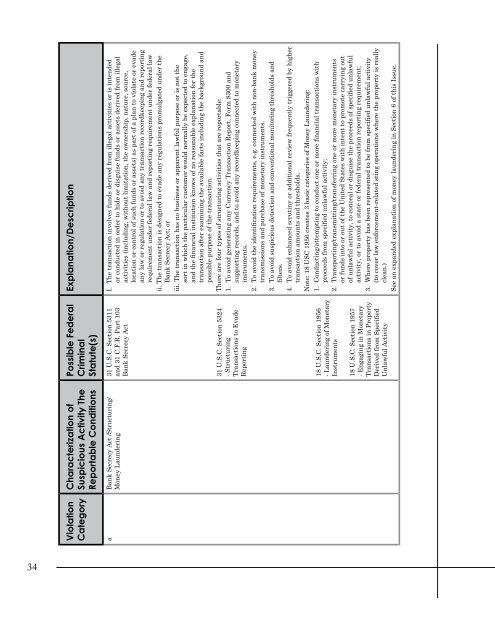

Explanation/Description<br />

Possible Federal<br />

Criminal<br />

Statute(s)<br />

Characterization of<br />

Suspicious <strong>Activity</strong> <strong>The</strong><br />

Reportable Conditions<br />

Violation<br />

Category<br />

I. <strong>The</strong> transaction involves funds derived from illegal activities or is intended<br />

or conducted in order to hide or disguise funds or assets derived from illegal<br />

activities (including, without limitation, the ownership, nature, source,<br />

location or control of such funds or assets) as part of a plan to violate or evade<br />

any law or regulation or to avoid any transaction recordkeeping and reporting<br />

requirement under federal law and reporting requirement under federal law<br />

31 U.S.C. Section 5311<br />

and 31 C.F.R. Part 103<br />

Bank Secrecy Act<br />

a Bank Secrecy Act /Structuring/<br />

Money Laundering<br />

ii. <strong>The</strong> transaction is designed to evade any regulations promulgated under the<br />

Bank Secrecy Act; or<br />

iii. <strong>The</strong> transaction has no business or apparent lawful purpose or is not the<br />

sort in which the particular customer would normally be expected to engage,<br />

and the financial institution knows of no reasonable explanation for the<br />

transaction after examining the available facts including the background and<br />

possible purpose of the transaction.<br />

<strong>The</strong>re are four types of structuring activities that are reportable:<br />

1. To avoid generating any Currency Transaction Report, Form 8300 and<br />

supporting records, and to avoid any recordkeeping connected to monetary<br />

instruments.<br />

2. To avoid the identification requirements, e.g. connected with non-bank money<br />

transmissions and purchase of monetary instruments.<br />

31 U.S.C. Section 5324<br />

- Structuring<br />

Transactions to Evade<br />

Reporting<br />

3. To avoid suspicious detection and conventional monitoring thresholds and<br />

filters.<br />

4. To avoid enhanced scrutiny or additional review frequently triggered by higher<br />

transaction amounts and thresholds.<br />

Note: 18 USC 1956 creates 3 basic categories of Money Laundering:<br />

1. Conducting/attempting to conduct one or more financial transactions with<br />

proceeds from specified unlawful activity;<br />

18 U.S.C. Section 1956<br />

- Laundering of Monetary<br />

Instruments<br />

2. Transporting/transmitting/transferring one or more monetary instruments<br />

or funds into or out of the United States with intent to promote carrying out<br />

of unlawful activity, to conceal or disguise the proceeds of specified unlawful<br />

activity, or to avoid a state or federal transaction reporting requirement;<br />

3. Where property has been represented to be from specified unlawful activity<br />

(to cover law enforcement-related sting operations where the property is really<br />

clean.)<br />

See an expanded explanation of money laundering in Section 6 of this <strong>Issue</strong>.<br />

18 U.S.C. Section 1957<br />

- Engaging in Monetary<br />

Transactions in Property<br />

Derived from Specified<br />

Unlawful <strong>Activity</strong>